Crypto License in Estonia 2026

Today, Estonia is the unqualified leader among European countries in the number of cryptocurrency licenses issued.

In Estonia, the regulator for cryptocurrency licensing is the National Financial Intelligence Unit, also known as Rahapesu Andmebüroo or RAB, for such transactions that have now been combined under one license of a virtual currency service provider.

According to the Law on Prevention of Money Laundering and Financing of Terrorism, one cryptocurrency licence is required. There are two kinds of services included in this category: as a virtual currency purse service provider and as a virtual currency exchanger. Until March 10, 2020-two separate licenses were issued in Estonia:

Cryptocurrency exchange services for fictitious money or vice versa, or cryptocurrency for another cryptocurrency.

Managing Crypto Wallets and Caste Services

Estonia crypto license

|

«Company & MiCA license application in Estonia» |

55,000 EUR |

- Preparation of necessary documents for registration of a new company in Estonia

- Translation of a certificate of no criminal record into Estonian through a sworn translator

- Payment of state fees related to company registration

- Payment of notary fees related to company registration

- Preparation of compliance documents for MiCA application

- Preparation of a business plan

- Submission of the necessary documents to Financial Supervisory

- Authority (Finantsinspektsioon, FSA)

- Recruitment of local MLRO/Compliance officer

- Recruitment of a local director

| Legal Services for Crypto Projects | 1,500 EUR |

General Provisions

Virtual currency wallets are offline and online methods depending on a public key crypto license to permit users to securely upload and get cryptocurrencies over the Internet.

It may be cold — that is, offline storage, for example, hardware wallet, paper wallet for cryptocurrency — and hot (online) storage. They differ in that the first type keeps digital coins offline, not using internet connection. Hot wallets are intended for small-scale storage or for everyday use. There are regular and multi-currency wallets that provide for storing different cryptocurrencies.

The Crypto license in Estonia will permit the provision of cryptocurrency wallet services; be it cold or hot.

The crypto license in Estonia also allows for cryptocurrency exchange for the FIAT and crypto for crypto.

LICENSING PROCESS

An application for a crypto permit in Estonia may be submitted by someone from the company’s board. On the condition of visiting a notary in Tallinn, in case of an electronic resident card, the license application should be filed via the Internet. A license application fee is 10,000 euros and should be paid to the Estonian Ministry of Finance. The Money Laundering Data Office, as a separate structural unit of the Police and Border Police Department, shall decide on the issue of a licence within 60 working days from the date of receipt of the application. The licence on crypto currency is issued for an indefinite period.

To obtain a license you must provide the next info:

- Business contacts (telephone number, e-mail and postal address), resume.

- The place where the services are offered, including the website address.

- Name and details of the one who made the proposal.

- Name, personal code (or if impossible date of birth), place of birth and address of residence of the true beneficiary of the company.

- Rules of procedure and internal controls established in sections 29 and 30 of the Prevention of Money Laundering and Terrorist Financing Act and, in the case of persons with particular responsibilities listed in section 6 of the International Sanctions Act, procedural rules, procedure, Section 13 of Part 6 of the International Sanctions Act and monitoring of its implementation.

- Name, personal code (if not possible date of birth), place of birth, national address, position and data on the contact person referred to in article 29, paragraph 3 or paragraph 4, of the Law on Prevention of Money Laundering and Financing of Terrorism.

- Name, personal code (if not possible date of birth), place of birth, nationality, address of residence, position and details of the person who is applying the international financial sanctions imposed by the employer in accordance with article 13.9.

- If the entrepreneur, board member, trustee, actual beneficiary or owner is a foreign citizen, in the case of the businessman being an alien, a certificate from the register of penalties of the country of origin or an other similar document, decision of a judicial or administrative authority stating that there is no punishment for a crime against public authority; Money-laundering offences or other intentional offences committed within three months from the date of their publication; which have been approved by a notary or other equivalent and have been legalized or signed by a new legalization certificate (apostille), unless otherwise provided by the contract.

Crypto regulation in Estonia

| Period for consideration |

up to 6 months | Annual fee for supervision | No |

| State fee for application |

10,000 € | Local staff member | Required |

| Required share capital | from 100,000 € | Physical office | Required |

| Corporate income tax | 0% | Accounting audit | Required |

Estonian Cryptocurrency Companies: Requirements, 2026

In 2026, Estonia remains one of the frontline countries in regulating cryptocurrency. Licensing for cryptocurrency companies is taken care of by the National Financial Intelligence Unit, commonly known as Rahapesu Andmebüroo or, in short form, RAB.

Among many of the requirements for a cryptocurrency license in Estonia include:

- Increasing Equity: A company should possess equity of 350,000 euros in cash or in low-risk securities.

- The company needs at least two people, and this management-shareholder, director cannot use the position of KYC/ AML officer since conflicts of interest should not occur.

- Safer IT systems, using cash investments instead of refinancing clients’ funds.

- Companies shall follow the AML and CTF laws.

- Physical Presence: The firm should be registered in Estonia, and it needs to have an office in the country.

- Staffing: The firm shall be staffed with at least full-time employees, of which there should be a minimum of two directors who shall be fit and proper, an AML Officer.

- Internal Controls:Have internal AML/CFT policies, Data protection legislation, procedures in place to ensure the safety of client funds.

Once the implementation of the Markets in Crypto-Assets regulation starts in July 2026, the Financial Supervision Authority is expected to take over the regulatory oversight from the beginning of 202 for the crypto service providers. It will surely challenge the companies operating in this market to adapt to a new regulated environment that gives much priority to AML and KYC policies.

Advantages

0% tax on undistributed company profits

No annual license fee

Availability of legislation for accounting declaration of crypto assets

Highest number of licenses issued

Estonia

Capital |

Population |

Currency |

GDP |

| Tallinn | 1,357,739 | EUR | $29,344 |

Requirements for new crypto companies in Estonia for the year 2025

1. Authorized capital is higher:

- Digital Currency Exchange Service – at minimum EUR 100 000

- Digital Currency Transfer Service – at minimum EUR 250 000

2. Customer Identification and Verification:

- Customer verification shall be done appropriately by using technology which provides real identification and eradicates all further possibilities regarding the alteration, sending, publication, and misuse of the data.

- Digital Identification or other electronic means approved by the Authority shall be used by the customers.

- Biometric data can be referred to for verifying the identity.

3. Supervision by the FSA

- Starting 2025, crypto companies would be under the FSA to comply with EU regulations.

- The AMl fine has been raised to EUR 5 million, meaning full compliance

4. New Legislation:

- The Estonian government has signed a new law to give a legal status to the crypto service provider.

- New law is oriented to bring more regulation into the market and make it more reliable

- Companies would be required to switch to FSA license in 2025 to meet EU laws.

These updates contribute to making Estonian cryptocurrency companies work under stricter regulations, ensuring the industry acquires much-needed security and also becomes more transparent.

Plan of Action for Virtual Currency Providers

Business plans at least for two years are submitted by the virtual currency provider.

The funds of a virtual currency provider have to be owned

Virtual Currency Providers have to maintain at any time funds which are equal to one of the following:

- Amount of authorized capital

- Own funds according to the calculation method, are calculated as:

The own funds of a virtual currency provider shall be at least an amount resulting from the sum of the following components of the volume, if the provider provides the service stipulated in paragraphs 101 and 102 of Part 3 of this Law:

- 4% of the volume of the transactions performed within the provision of services exceeding or amounting to 5 million euros;

- Above 5 million euros of transactions in the service sector, but not more than 10 million euros;

- Above 10 million euros of operations conducted in the provision of services but not surpassing 100 million euros;

- More than 100 million euros of transactions for the provision of the service but not exceeding 250 million euros; 0.5% of that amount;

- This represents 0.25% of the transactions of more than 250 million euros executed within the service.

The share of the transactions, to the part determined as services, shall be 1/12th of the total volume of the transactions determined as services in Parts 100 and 101 of this Article. In case the venture capital firm had been in operation for a period of less than 12 months in the previous year, the total of the remittances and foreign exchange transactions in the previous year, shall be divided by the number of months in the previous year in which the venture capital firm was in operation.

It is crucial that a virtual foreign exchange provider shall make all the required provisions to ensure at all times its own funds are correctly ascertained.

According to this law and the legal acts issued on the basis of it, the Financial Intelligence Unit may determine the term during which the virtual foreign exchange service provider is obliged to comply with the requirements established by the Law. Audit of cryptocurrencies providers The virtual foreign exchange service providers are obliged to audit the annual report. Applications for licensing should point auditor data.

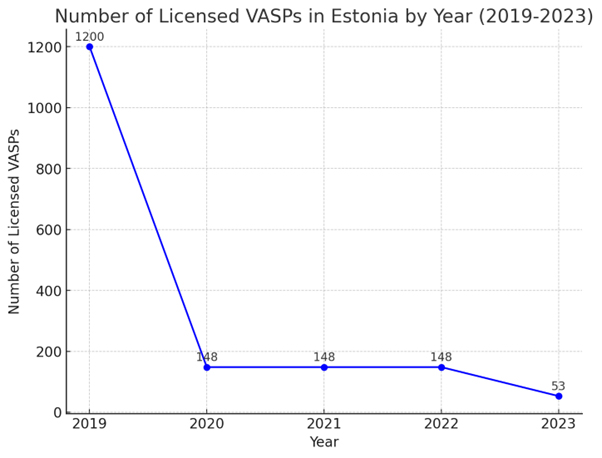

Number of virtual currency service providers (VASPs) in Estonia with an operating licence

IMPORTANT INFO AND REQUIREMENTS FOR LOCATION, LOCATION, BOARD MEMBERS, AND CONTACT PERSON

Applicants must have at least two years’ professional experience and higher education as board members of virtual currency service providers.

It is forbidden for a member of the board of a virtual foreign exchange service provider to serve on the board of more than two of these services.

The fee when applying for a license in cryptocurrency increased from 3,300 euros to 10,000 euros.

Also, lawyers from Regulated United Europe provide legal support for crypto projects and help with adaptation to MICA regulations.

Estonia’s Crypto Frontier: Unlocking Opportunities with a Crypto License, 2025

The Estonian government, known for its forward-thinking approach to digital governance, has been at the cutting edge in regulating cryptocurrency. The details required for a crypto exchange license in Estonia, and the necessary roadmap, will be provided here for potential investors and entrepreneurs looking to join Estonia’s vibrant crypto market.

The Regulatory Landscape of Crypto in Estonia

The crypto regulation in Estonia is one of breadth and friendliness, and it is under the management of the Financial Intelligence Unit. Among the first countries in the world that have created a clear legal framework for cryptocurrencies, the Estonian crypto licenses include but are not limited to the following:

- Crypto exchange license in Estonia: This license provides firms with the right to conduct exchange activities between digital assets and fiat currencies.

- Crypto broker license in Estonia: It grants the right to firms to act as intermediaries in crypto transactions.

- Crypto trading license in Estonia: It is intended for those participants who are directly involved in trading digital assets.

- VASP crypto license in Estonia: Such a license is targeted at service providers dealing with virtual assets.

Application of Crypto License in Estonia

The application procedure requires serious preparation and adherence to regulator demands, such as the implementation of extensive anti-money laundering mechanisms and policies against terrorist financing. Companies have to disclose information on their operational structure and the soundness of their financial situation.

Financial Consequences of Licensing

The cost of the crypto exchange license in Estonia is considered competitive in the European Union and, as such, becomes a financially valid option for many startups and established companies. It cannot be overemphasized that performing planning for such costs is itself a guarantor of success in such an application and, thus, continued operation.

Advantages of Holding an Estonian Crypto License

Getting a crypto license in Estonia creates a lot of opportunities for increased credibility, reaching the greater European market, and meeting all international financial norms. This strategic positioning will go a long way toward assisting the business to scale and tap the global markets.

Upscale and Expansion Opportunities

The very low barriers to entry, apart from being the cheapest crypto license, make it fertile ground for startups. Estonia supportive ecosystem provides ample opportunities for growth especially in Fintech and technology services.

Buying an Existing License

Those in a hurry can also buy an already existing crypto exchange license for sale in Estonia. It is important to consider that extensive due diligence is required to ensure the license will meet all the regulatory requirements in place at this time.

Conclusion: While this digital and regulatory landscape keeps on changing, Estonia remains a hotbed of cryptocurrency entrepreneurs from around the world. Getting a crypto exchange license in Estonia is just not about allowing legitimate and secure operation, but putting businesses at the forefront of the digital finance revolution. Ensuring compliance and monitoring the change in regulations can give a room for manoeuvring in the dynamic market environment of Estonia.

Crypto License in Estonia 2025

Being one of the most innovative countries in Europe in terms of digitalisation of public services, Estonia has also taken an active part in the regulation of the cryptocurrency market. Furthermore, the country is famous for its progressive approach to licensing activities related to cryptocurrencies, which, of course, is appealing for cryptocurrency companies. Herein, we examine the most important features of obtaining a cryptocurrency licence in Estonia in 2025.

Legal basis

Since the beginning of 2020, Estonia has significantly raised the bar for cryptocurrency market operators by introducing strict AML/CFT requirements. Such measures were undertaken with the purpose of enhancement of financial security and strengthening supervision over the VC market.

Licensing requirements

In 2025, for a cryptocurrency platform to be licensed to conduct the activity of virtual currency in Estonia, it should meet the following threshold conditions:

Full Compliance Review: The company shall undergo the AML and CFT regulatory compliance review process. Establishment of a Company in Estonia: The result of the legality of a company is to be established in Estonia. Office in Estonia: According to the law, the company is supposed to maintain a physical office in the state of Estonia. Management qualified at executive and key employee levels is expected; executives and key employees must have an impeccable reputation and relevant knowledge related to the crypto industry.

Capital and financial guarantees: The minimum statutory capital for cryptocurrency-related activities is 12,000 euros.

Procedure for obtaining licence

The overall process of obtaining a license consists of several stages, namely:

Preparation of Documents

Preparation and filing of documents to be filed by an applicant, like a business plan, AML and CFT policies, and information on beneficial ownership.

Submitting to the Register of Economic Activities

This must be done via the online environment.

Verification of compliance

Verification follows the application filing, whereby a governmental body inspects the company for its observance.

Licensing

Upon a successful inspection, the company is granted a license to operate cryptocurrency activities.

Crypto License in Estonia 2025

Pursuant to the regulation of the Minister of Finance, from 1 January 2025, all Virtual Currency Service Providers operating in Estonia must submit quarterly reports with detailed information to the Bank of Estonia and to the Money Laundering Office, RAB. These reports include data about current activities, measures of verification of customers, given services, and financial position, including assets and liabilities.

First-quarter reporting, due by 20 May for the period ending 20 April 2025, saw all 49 active VASPs report by 6 May, 39 of those within the deadline.

Current Trends in the Regulation of VASPs

The Estonian virtual currency service market is much more regulated compared to several years ago, thanks to the government’s stricter regulatory approach. If in 2019 there were more than 1,200 licensed VASPs in the country, at the beginning of 2022 that number was reduced to 148. Already by the end of 2023, the number of licensed operators decreased to 53.

Despite a decrease in the number of operators, in 2023, the turnover of services provided by companies holding an Estonian cryptocurrency license reached EUR 20 billion. Beginning next year, regular reporting will help regulators assess the risks of the sector even better, adding to the market’s transparency.

Status of reporting and notifications

In 2023, VCs collectively submitted fewer notifications to the RAB compared to previous years, partly because of the reduced number of licensed operators. Only 44 companies out of the 49 active VASPs for the year submitted notifications, and only 24 of these reported, or 44 per cent, down from 47 per cent last year.

Since 2020, the volume of VASP notifications has continued to decline. In 2020, there were 530 notifications; these increased to 1,865 in 2021 and reached a peak of 4,331 notifications in 2022. The volume in 2023 declined to 3,430 notifications. It is important to note that 29% of all notifications to the RAB emanated from VASPs.

Reporting quality and issues identified

While the overall quality of notifications is better than in previous years, significant gaps in reporting activity remain. The majority of notifications relate to suspected document fraud, identity theft, or customer non-cooperation following law enforcement interest. This would indicate that existing systems for monitoring business relationships are ineffective and the risk of money laundering is underestimated.

While some VASPs go to the extent of in-depth analysis and risk assessments to provide meaningful and detailed reports, many firms still rely exclusively on the systems for transaction monitoring developed by third-party software providers with no consideration for individual risk linked to their customers.

The new reporting and regulatory requirements coming online in 2025 will continue to drive transparency in the market for virtual currency services and better identify risk. Yet, despite the developments, many virtual asset service providers still struggle with monitoring and adequate systems for regulatory compliance.

The procedure for obtaining a cryptocurrency license in Estonia in 2025 will need careful preparation and strict adherence to its course. Estonia still remains one of the most advanced countries in regulating cryptocurrencies, maintains a clear and transparent legal environment, and is an attractive country for investment and further development in cryptocurrency startups.

“As a seasoned legal professional well-versed in the intricacies of crypto licensing in Estonia, I am dedicated to furnishing you with comprehensive and current insights to bolster your initiatives. My commitment extends to ensuring that you receive accessible and pertinent information to navigate the regulatory landscape and successfully advance your crypto-related projects in Estonia.”

FREQUENTLY ASKED QUESTIONS

Does Estonia grant a license for crypto activities?

Until recently, companies that handle financial operations related to crypto currencies in Estonia could apply for two types of crypto licenses:

- Crypto exchange license

- Crypto wallet license

However, following recent changes, the two license types were merged into one, officially known as the Virtual Currency Service Provider license. It allows crypto companies to offer cryptocurrency exchange services (exchanging one cryptocurrency for another, exchanging fiat currency to crypto and vice versa) and cryptocurrency wallet services (enabling users to send and receive cryptocurrencies as means of payment and trade).

How do I get a crypto license in Estonia?

The first step of the process entails establishing a company in Estonia. Once this process is complete, the applicant needs to provide the following information:

- Company information: phone, e-mail, website address

- Information of individuals who will be responsible for managing and providing crypto-related services

- Information on shareholders and the legal representative of the company: names, dates and places of birth, contact information

- Internal strategy for the implementation of regulations when dealing with cryptocurrencies and information about the individual who will hold responsibility for compliance with the regulatory network

- Reports proving the non-criminal background of shareholders and board members

The entire application process may be completed either in person or completely remotely, with the help of a legal representative.

Is it necessary to contact the local tax authority in crypto activities on behalf of an Estonian company?

Yes. However, the tax system in Estonia has two major benefits:

- Undistributed profits are tax-free. That means that profits which are reinvested in the business are tax-exempt.

- The tax system is territorial, meaning that all foreign-sourced income is tax-free.

What are the activities of the crypto license in Estonia?

The Virtual Currency Service Provider license permits license holders to provide the following services:

- Issue and host e-wallets

- Provide crypto exchange services for a fee

- Establish and run a crypto payment system

- Alternative payment system provision

- Wholesale purchase of precious metals and stones, and articles related to them

How long does it take to get a license?

The average period of time required to complete the application and receive a conclusive decision from the regulator is around 13 weeks. It can be prolonged in case if documents are missing in the application or if the regulator requests a physical meeting with the applicant.

Can non-residents of Estonia own a crypto company?

Yes. However, in order to complete a preceding step of establishing a company in Estonia, the founder must register an Estonian address as an official office location.

Can non-residents of Estonia be part of the board of an Estonian crypto company?

The minimum amount of board members for a crypto company in Estonia is 1. There must be at least one Estonian resident on the board, and the board must be located in Estonia. However, there are no statutory requirements stating that all members of a crypto company in Estonia must be Estonian residents – as long as there is more than one person on the board.

Is it necessary to have a banking account to obtain a license?

Yes. It’s a necessary preparatory step for obtaining a license.

What is the minimum authorized capital for a virtual currency service provider?

To carry out operations with cryptocurrencies, Estonian crypto companies must present an authorized capital of 100,000 Euros. This amount must be deposited on the official bank account of the crypto company in question.

For how long is a crypto-license issued?

Crypto licenses in Estonia are issued for an indefinite amount of time.

Is it possible to deposit authorized capital in cryptocurrency?

No, this option is not possible at the moment.

How is the charter capital of a crypto company paid in?

Payment of the share capital is made using a fiat contribution (in cash or by bank transfer).

What happens next with the money investment in the corporate account of an Estonian crypto company?

Once the total amount of 100,000 euros is deposited to the bank account of the crypto company in question, it will not be frozen. The applicant will be free to use this amount for financing various commercial activities of the company.

When do you need to deposit capital to open a company and obtain a crypto-license in Estonia?

Full payment of the minimum authorized capital is a necessary preparatory step in the application process. It must be completed before submitting application documents.

Why you should get a crypto license in Estonia?

There are a few good reasons for obtaining a cryptocurrency license in Estonia. Firstly, Estonia is one of the pioneers in blockchain technology. It was one of the first EU countries to jump onboard the crypto train and offer official crypto licenses. Furthermore, Estonia offers a simple licensing environment with one license for a broad spectrum of crypto-related services. It’s easy to apply on a remote basis and the licensing process itself takes a relatively short amount of time.

Are Estonian cryptocurrency companies audited?

Yes. The physical office of a crypto company in Estonia can be visited by the regulator at any time. The regulator may check the documentation to confirm the firm’s activities and request further reports or documentation in case doubts arise.

Can the director of a crypto company be a non-resident of Estonia?

Directors of crypto companies in Estonia can only be individuals. The minimum number of directors is 1. In case there is more than one director, half of the directors must be residents of EEA (European Economic Area) countries. In case more than half of the directors reside outside Estonia, the company must provide the Commercial Register with a contact in Estonia where necessary documents can be sent. All foreign directors will be requested to provide their residential addresses and email addresses.

What measures to prevent money-laundering and the financing of terrorism are in place in Estonia?

Measures are instated in the Money Laundering and Terrorist Financing Prevention Act. It was first introduced in 2017 and amended in 2020 – this amendment was designed to also cover virtual asset service providers. In 2022, the Government of Estonia approved a new package of changes affecting Estonian cryptocurrency companies. Officially, they are treated similarly to other financial institutions in Estonia. Here are the main AML requirements that crypto companies in Estonia face today:

- Revising internal anti-money laundering procedures

- Appointing a compliance officer

- Conducting a ‘fit and proper test’ (this is a responsibility of the managers)

- Establishing an office based in Estonia

- Setting up a payment account with an institution registered in Estonia or the EU

What difficulties may arise in obtaining a crypto license in Estonia?

Crypto companies in Estonia are witnessing a time of change. Regulations are becoming tighter and, in practice, it has resulted to a great number of revoked licenses for providers who no longer match the new requirements. To successfully establish and run a crypto company in Estonia, one must carefully follow all the requirements and upcoming changes, showing a flexible attitude and ability to adapt to regulatory changes as they come.

Where can I open a bank account for an Estonian crypto company?

According to local regulation, crypto companies in Estonia, are not required to have a bank account in traditional banking institutions. Alternatively, crypto companies can collaborate with European Fintech companies that provide accounts with an IBAN. Having an IBAN is necessary for establishing a crypto company in Estonia.

Additional services for Estonia

RUE customer support team

RUE (Regulated United Europe) customer support team complies with high standards and requirements of the clients. Customer support is the most complex field of coverage within any business industry and operations, that is why depending on how the customer support completes their job, depends not only on the result of the back office, but of the whole project itself. Considering the feedback received from the high number of clients of RUE from all across the world, we constantly work on and improve the provided feedback and the customer support service on a daily basis.

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

Registration number:

14153440

Anno: 16.11.2016

Phone: +372 56 966 260

Email: [email protected]

Address: Laeva 2, Tallinn, 10111, Estonia

Registration number: 304377400

Anno: 30.08.2016

Phone: +370 6949 5456

Email: [email protected]

Address: Lvovo g. 25 – 702, 7th floor, Vilnius, 09320, Lithuania

Registration number:

08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00, Prague

Registration number: 38421992700000

Anno: 28.08.2019

Email: [email protected]

Address: Twarda 18, 15th floor, Warsaw, 00-824, Poland

Please leave your request

The RUE team understands the importance of continuous assessment and professional advice from experienced legal experts, as the success and final outcome of your project and business largely depend on informed legal strategy and timely decisions. Please complete the contact form on our website, and we guarantee that a qualified specialist will provide you with professional feedback and initial guidance within 24 hours.