Obtaining a Virtual Asset Service Provider (VASP) license is essential for operating legally and securely in Europe’s rapidly evolving cryptocurrency market. Our agency specializes in guiding businesses through the process, ensuring compliance and efficiency in top jurisdictions like Lithuania and the Czech Republic.

Choose the country

for obtaining VASP license

Advantages

of Taking the VASP Licence

Need a VASP License?

Comparison of VASP License Requirements by Country

The table below highlights VASP license price the key conditions for obtaining a VASP license in popular countries, including processing time, taxes, capital requirements, and more.

| Czech | Lithuania | Poland | Estonia | Switzerland | Malta | |

|---|---|---|---|---|---|---|

| Period for consideration | up to 1 month | up to 1 month | up to 2 months | up to 6 months | from 8 months | up to 9 months |

| State fee for application | 250 € | No | 133 € | 10,000 € | from 1,750 € | 24,000 € |

| Required share capital | from 0,04 € | 125,000 € | 1,077 € | from 100,000 € | from 300,000 € | up to 730,000 € |

| Corporate income tax | 19% | 5 – 15% | 15% | 0% | 11% – 24% | 35% |

| Annual fee for supervision | No | No | No | No | No | from 3,500 € |

| Local staff member | No | Required | No | No | No | At least 3 |

| Physical office | No | Required | No | No | No | Required |

| Accounting audit | No | Required | No | No | No | Required |

Exploring Sub-Topics

About VASP license

In conjunction with the fast-moving development of the cryptocurrency market and the enhanced regulative scrutiny of the industry, this license is turning into a must to operate legally. The VASP license will grant a legal basis for the company to operate in various countries by exchanging, transferring, and storing cryptocurrencies. The most promising jurisdictions where to obtain a VASP license in 2025 are Lithuania and the Czech Republic. The following article will outline the main opportunities opened by the VASP license and analyze the benefits of its acquisition in these states.

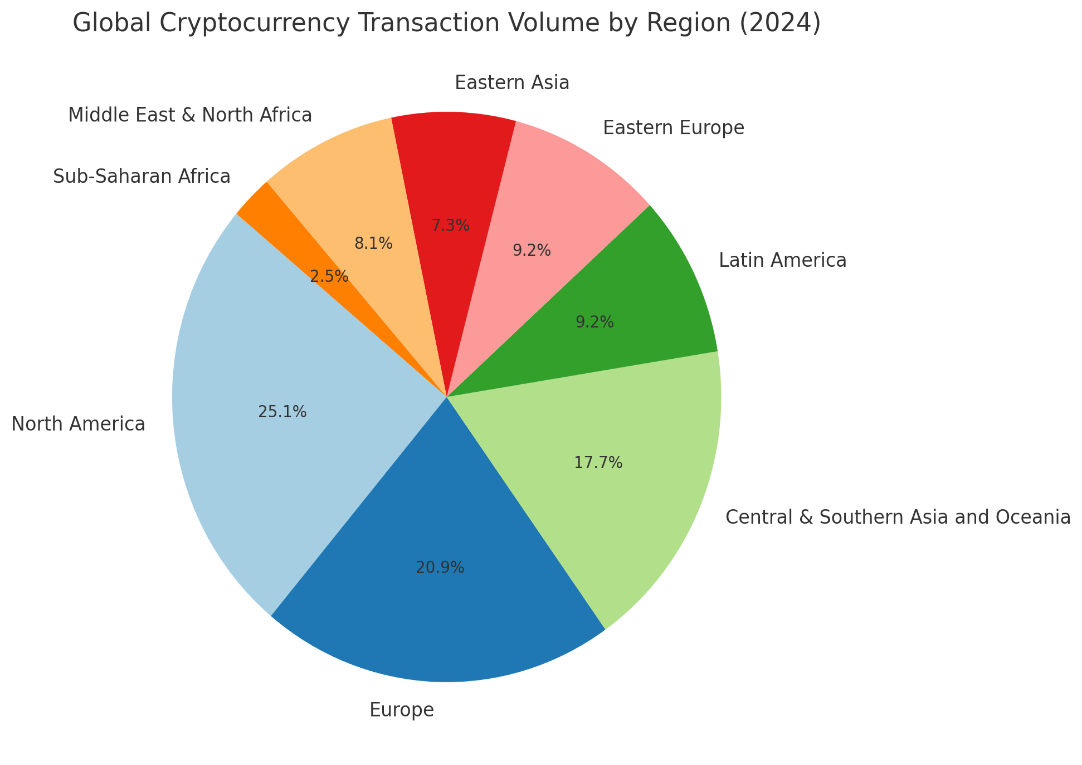

With just over 750 million people, the European population belongs to one of the most prosperous economies; more than 17% of them use digital assets, which makes the continent the world’s largest cryptocurrency market, accounting for about 25% of all crypto activities globally. In this context, you can certainly find vast opportunities to build a lucrative cryptocurrency business of your own.

First, get acquainted with the crypto regulatory framework of Europe, which has set the bar high for the rest of the world so far. Further, it’s worth exploring various European jurisdictions that currently have different levels of crypto regulations-meaning while some countries require meeting very strict crypto licensing requirements, others still don’t treat crypto business as a separately regulated area, which makes it relatively easy to obtain a crypto license.

What is a VASP license?

A VASP license or Virtual Asset Service Provider License is basically regulated under the guidelines of FATF or International Money Laundering Task Force. It provides transparency for cryptocurrencies. After getting licensure, a firm shall be authorized to perform the following activities:

A VASP license or Virtual Asset Service Provider License is basically regulated under the guidelines of FATF or International Money Laundering Task Force. It provides transparency for cryptocurrencies. After getting licensure, a firm shall be authorized to perform the following activities:

- Cryptocurrency Exchange: trading of cryptocurrency for Fiat money or any other digital asset.

- Crypto Storage: Custody or safekeeping services with regards to crypto assets of third-party owners.

- Crypto Transfer: Crypto transfer from one user to another.

VASP licence in the Czech Republic

The Czech Republic has positioned itself in recent times as one of the friendliest and most approachable jurisdictions to start a cryptocurrency business among European Union countries. Its loyal regulatory norms, minimal documentation burden, and possibility to establish a company remotely attract the attention of crypto-entrepreneurs from all over the world.

Advantages of the Czech regulatory environment

- Low cost and minimal barriers to entry: Minimum financial and administrative barriers to opening a crypto business are ensured in the Czech Republic. This, especially, makes the country very attractive for startups and individual entrepreneurs in search of opportunities to develop their projects in a stable and innovation-supportive jurisdiction.

- Fast and remote registration process: It allows the Czech Republic to provide fast and fully remote company registration, making life much easier for foreign investors. This is an excellent opportunity in today’s world of digitalisation and pandemic, where there may be limited personal visits to the country.

- Loyalty of regulatory authorities: It means that given the flexibility and openness of the Czech regulators when it comes to regulating cryptocurrency transactions, they essentially create an environment which is really good in terms of growth and development in the context of a cryptocurrency market.

Obtaining a VASP license in the Czech Republic

Application process:

Obtaining a license for the performance of virtual asset services is based upon the fulfillment of regulatory imperatives by filing the required documentation. However, it is less burdensome, the requirements being less stringent, as compared to other EU countries, and thus facilitates simpler and faster licensing. This includes:

- Document preparation: Including corporate documents, AML policy, and proof of identification of key persons.

- Application Submission to the Regulator: The application, at this stage, comes along with attachments of all required documentation, is then sent to the relevant government agency for approval.

- Licensing: After verification of the submitted data and documents, the company gets a VASP license that will permit the conduct of its activities legally in the field of cryptocurrencies in the Czech Republic.

The Czech Republic probably offers the most loyal and accessible environment for launching cryptocurrency projects within the European Union. Minimum required documentation, the possibility of remote registration, and the loyal attitude of regulators turn this country into a real paradise for crypto-entrepreneurs in 2025. That is the kind of environment where innovations are welcomed and where capital is attracted to the country for its economic and technological development.

Advantages for Crypto Firms in the Czech Republic

- Stable economic environment: The Czech Republic has a high level of economic stability and a developed financial system.

- Support for innovation: The Ministry of Finance generally supports innovation and the development of new technologies, including cryptocurrencies.

- Access to European markets: As a member of the European Union, a license obtained in the Czech Republic provides access to the vast European market.

The choice of country to obtain a VASP licence depends on many factors, including the regulatory environment, tax policy and business climate. Lithuania and the Czech Republic have a number of advantages for crypto companies which are going to expand their operation in Europe. Obtaining a VASP licence in these countries will not only legalise the activity of exchanging, transferring and storing cryptocurrencies but also provide the company with a reputational advantage on the international arena.

VASP license Lithuania

Such a progressive and friendly approach to the regulation of virtual assets turns Lithuania into the most attractive region within Europe concerning areas like turnovers of cryptocurrencies. More than 500 companies benefited from a license to conduct cryptocurrency turnover as early as 2025, which once again speaks to the leadership position of Lithuania in this sphere.

Virtual Asset Service Provider Licence The permission for Lithuania’s VASP was issued by FCIS-meaning the Financial Commission for Combating Money Laundering. Such a license will mean quite a lot for those companies that are going to deal with the legal processing of cryptocurrencies and other virtual assets.

Lithuanian VASP License Advantages

- Lingual accessibility: The FCIS provides all relevant information in English, making it easier for foreign investors to understand expectations and the entire process.

- Transparency: Each license number is unique, and public access to information about licensed companies enhances industry confidence and transparency.

- Support from the regulator: The Lithuanian regulator is open to business needs, facilitating the adaptation process and compliance with regulatory requirements.

Licensing in Lithuania is a rather complex process; good preparation is required in addition to proper knowledge of the local legislation. The whole process of application involves company documentation, sources of funds, and transparency, together with AML/CFT programs.

Stages of the Application Process

- Preparation of Documentation: Compile corporate documents, AML and CFT policies, and an extended executive summary.

- Application: Submit the application to FCIS, followed by a verification period.

- Control and Approval: FCIS conducts thorough due diligence on the provided information, including financial flows and management structure.

In the context of ever-growing popularity, cryptocurrencies and virtual assets make Lithuania one of the strongest supporters of operating legally and effectively within this dynamically developing area. A VASP license opens wide opportunities for companies involved in this sphere of international cooperation and at the same time enhances their legal protection from both European and global perspectives.

From being crypto-friendly right from the very top, this country is also creating an investment-friendly atmosphere, putting it as one of the best jurisdictions to start and grow a virtual asset business in 2025.

VASP license cost

From the growing interest in cryptocurrencies to the need for regulation, this issue seems to face many companies: obtaining a license of a Virtual Asset Service Provider. Such a license costs differently depending on a country, complexity of the procedure, and requirements to licensees. In the given article, we touch upon the issue of the cost and requirements for obtaining a VASP license in two European countries-the Czech Republic and Lithuania-and analyze which factors influence the cost of a license.

Cost of VASP license in the Czech Republic

Obtaining a VASP license is relatively inexpensive in the Czech Republic. Its cost starts from €3,400, making this license one of the most appealing in Europe in terms of initial investment. Major work stages:

Filing is about the preparation of documentation and a formal application to the regulators. It includes:

- Advisory services on law issues: To make the activities of the firm conform to the Letter and Spirit of Czech Law, attention shall be given to its implementation based on or upon it.

- Compliance Review: Compliance to FATF requirements and respective local Anti-Money Laundering requirements.

In some scenarios, such as when a business needs more legal training or highly technical, security-related integrations, these costs can be much higher.

Lithuania VASP License Cost

The Lithuanian license is much more expensive, its initial fee starts from 9900 euros. It is justified by more strict requirements for compliance and, hence, more complicated licensing procedure. The main components of cost are the following:

- Preparation of documentation: Much more extensive than in the Czech Republic, needs to be very detailed, describing absolutely everything about the activity.

- Compliance and technical audits: Lithuania provides for very serious audits of management systems and data security.

- Legal and advisory services: This would involve the need for further, deepened legal support and consultation on adjusting to Lithuanian legislation.

Requirements and cost analyses

Licensing usually depends not only on the cost of a license but also on the goals of business of a company, market peculiarities, and strategic plans for the future. In this respect, the Czech Republic generally offers a lower level of barrier to entry and less complexity in its setup, probably more suitable for a start-up or an enterprise with meager resources. Contrasting the above, Lithuania is a jurisdiction that has a more expensive set-up undertaking and therefore provides a more restrictive yet better-protected regulatory regime for bigger companies or companies that need a better regulatory environment.

In choosing between the Czech Republic and Lithuania, especially regarding an application for a VASP license, detailed financial capability analysis, business strategy, and special cryptocurrency operation requirements have to be considered. That being said, both countries do provide huge opportunities, but the secret to successful operation is understanding and implementing regulatory requirements that would eventually make all the difference in the value of general business performance.

VASP licence in Estonia

Being one of the first regulators of cryptocurrencies back in 2017, Estonia has forthwith become one of the leading countries in the issue of virtual asset licenses, having issued more than 2,000 licenses. However, in the course of just a couple of years, this concept changed so much regarding the regulation of this fast-growing industry that the idea hit at Estonia’s status as a cryptocurrency hub really painfully. I mostly agree with this statement.

Historical context

It was one of the first countries in the world that adopted legislation, which allowed companies to operate legally in the field of cryptocurrency. That very liberal policy attracted a lot of international firms seeking to get a Virtual Asset Services Provider license from the country. That’s where the things started to go wrong.

Growth and fame

As it was founded very early, the crypto market in Estonia then developed at a very high speed with relevant technology and investment. The number of licensed companies broke through the bar of 2,000, which began to play a certain role in the national economy.

Regulatory changes

Eventually, the Estonian government began to close ways through which money laundering and terrorist financing can be run because the holders of cryptocurrency licences started coming with stringent requirements. Two great waves of license revocation have caused most companies to lose the right to conduct the activity in the country as a result of this.

Current situation in the Estonian market In 2025, only a few remain in Estonia with a valid VASP license. The politics on new ones got very serious in this country and managed to set the tone for the general view of Estonia as a crypto-friendly place.

Reasons for tightening regulatory measures

| Czech | Lithuania | Poland | Estonia | Switzerland | Malta | |

|---|---|---|---|---|---|---|

| Period for consideration | up to 1 month | up to 1 month | up to 2 months | up to 6 months | from 8 months | up to 9 months |

| State fee for application | 250 € | No | 133 € | 10,000 € | from 1,750 € | 24,000 € |

| Required share capital | from 0,04 € | 125,000 € | 1,077 € | from 100,000 € | from 300,000 € | up to 730,000 € |

| Corporate income tax | 19% | 5 – 15% | 15% | 0% | 11% – 24% | 35% |

| Annual fee for supervision | No | No | No | No | No | from 3,500 € |

| Local staff member | No | Required | No | No | No | At least 3 |

| Physical office | No | Required | No | No | No | Required |

| Accounting audit | No | Required | No | No | No | Required |

Changes in Estonian regulative policy influence the situation in the whole cryptocurrency market of the country. More intensive demands and a reduction in the number of licensed companies have lowered the attractiveness of Estonia as a jurisdiction for crypto-business. Thus, Estonia keeps high regulatory requirements, gives a certain focus on security and transparency, which may help to get confidence back in the longer term and lure responsible players into the market. With newly imposed restrictions and complications, Estonia still enjoys a very good position in the European map of cryptocurrency jurisdictions.

VASP-licence in Malta

Literally, Malta is called the ‘Blockchain Island’ because of its really innovative regulative approach to the crypto industry and blockchain technology in general. The country was the first in the European Union to come up with a far-reaching regulative proposal concerning VASP licensing. Though such a proposal looked appealing enough, oncoming startups of the crypto world find Malta less achievable because of the high requirements for the authorized capital.

Regulatory environment in Malta

In 2018, the government of Malta adopted three laws controlling DLT technology in such a way that one of them clearly outlined the legal framework regarding the process of cryptocurrency transactions and blockchain platforms. It was decided to do so with the purpose of attracting crypto investors and startups, involving them in strengthening the country’s economy by means of innovative technologies.

Key requirements for obtaining a VASP licence:

- Authorized capital: The minimum amount of €730,000 is rather high compared to most other jurisdictions.

- Adherence to AML/CFT policy: Very stringent AML/CFT.

- Validation of management competency: All key persons of the company need to show relevant experience and qualifications.

It is an obstacle of high authorized capital for new companies and startups. In other words, such demand from the authorities indicates that Malta wants companies involved in cryptocurrency trading to be the financially sound and serious players. The policy contradicts this one, which excludes the opportunities for SME-players that might make a great contribution to innovation and market development.

Impact on Crypto-entrepreneurs

That means many crypto entrepreneurs and startups avoid Malta in search of jurisdictions where one could more conveniently launch projects with relatively less initial capital invested, such as Estonia or Lithuania. Despite the advantages, Malta is losing out on innovators who would add value to the island if they actually placed an investment in Malta. With the high standards and requirements, Malta is actually considered one of the best-protected and most secure jurisdictions for cryptocurrency transactions within the European Union. The adapting requirements to Malta may mean opening up to a wide range of investors and entrepreneurship who would want to innovate and develop the market on the blockchain island, keeping Malta at that position within the crypto industry.

VASP licence Poland

Poland has joined those few European Union countries which give the opportunity to legally obtain a virtual asset transaction licence – VASP. Already today, more than a thousand private individuals and legal entities have received a cryptocurrency licence in Poland, which shows quite a big interest in this jurisdiction on the part of crypto-entrepreneurs. However, for all the advantages, Polish cryptocurrency market also has some peculiarities that can complicate a process of licensing, especially for those people who do not plan to stay in this country for a long period of time.

Advantages of the Polish VASP licence

- Recognition and legitimacy: A VASP license in Poland allows businesses to operate within a legally set framework, which itself is a prerequisite for investors and the confidence of clients. It serves as an indicator of a certain level of legitimacy and safety against possible legal risks.

- Flexibility and variety of options: On the whole, Poland opens wide perspectives for cryptocurrency business regarding exchange, asset management, and other services concerning virtual assets. That is why the country is very attractive to entrepreneurs willing to diversify their business models.

- Complexities and bureaucratic procedures: Despite the many advantages, the Polish regulatory environment is far from easy for those not planning to stay permanently. For example, project realization can be influenced by bureaucratic procedures and formal requirements, especially for foreign investors.

Strong points of challenge include:

- Requirements for local presence: Poland requires a local office or representative, which is not ideal for companies planning on working remotely.

- Bureaucratic procedures: The procedure for obtaining a license is very complicated, with a lot of formalities involved, such as filing documents in Polish and compliance with local regulatory requirements.

- Regulatory pressure: In recent times, Poland has been clamping down on the trading of cryptocurrencies, which might mean even more challenges for such companies.

On the other hand, the only thing that may hamper the plans of someone who wants to live in Poland and manage his own business could be these enhanced bureaucracy procedures, which include necessary elements of local presence; the Polish license of a VASP gives the opportunity to realize a legal activity within the world of cryptocurrencies, including recognition, flexibility, and the possibility of various businesses.

Accordingly, it is seen that in order to take any license and conduct smooth business, one should be well equipped against bureaucracy and stand on all the regulatory norms of Poland. Here, Poland may become your reliable base of operation for your cryptocurrency projects in 2025.

VASP licence Bulgaria

Over the past years, active development of cryptocurrencies technologies was widely noticed, and many European countries try to adapt their legislations to new realities of a financial world. Bulgaria, though having the biggest number of companies with a VASP license, has a number of difficulties reducing its attractiveness for foreign investors willing to start a cryptocurrency project. The following paper will outline the main trends of VASP licensing in Bulgaria and the main obstacles that foreign entrepreneurs face in this jurisdiction.

VASP-licensing in Bulgaria

The status of a VASP operator in Bulgaria is certified by the Financial Supervision Commission that exercises regulation and supervision over all the virtual asset market players. For one company to get a licence it has to meet lots of criteria, such as having a real office in Bulgaria, certain capital and professional and financial management. It takes several months and even up to a year for a company to receive its licence, since one has to submit voluminous documentation and pass multilevel verification.

Challenges for foreign investors

In spite of the existence of a formal licensing mechanism, there are several aspects that may deter foreign investors from entering the Bulgarian jurisdiction:

- Bureaucracy and administration delays: Processes for obtaining a VASP licence are often surrounded with bureaucratic difficulties and indefinite length administrative procedures, which may delay the deployment of a project indefinitely.

- Lack of Special Conditions for Foreign Investors: Bulgaria does not provide special conditions or stimuli for foreign entrepreneurs, and that is why it is less interesting for them in comparison with other countries which actively develop the cryptocurrency infrastructure.

In this respect, Bulgaria really can be a very good virtual currency hub, but noticeable bureaucratic and administrative barriers reduce its attractiveness for foreign investors. Actually, it urgently needs serious simplification of the licensing procedure and acceleration of the administrative processes, with more favorable conditions for foreign entrepreneurs who are ready to work with virtual assets.

VASP licence Switzerland

Owing to well-established jurisprudence, Switzerland has long positioned itself as one of the most progressive countries in terms of cryptocurrency legislation. But as friendly as the country is, getting a license for VASPs involves so many complexities and requirements that an international entrepreneur may easily get deterred from pursuing these matters. During this paper, we have pointed out some key themes concerning the regime of Licensing under VASP in Switzerland, part of the various requirements by applicants, and part of the possible limitations to foreign investors.

Licensing of VASP in Switzerland

VASP licensing in Switzerland is done by the Financial Market Supervisory Authority of Switzerland, FINMA. The licensing process extends to a comprehensive review of the business model, funding sources, management structures, and internal control systems. To name a few of the most important pre-conditions for getting a license, it shall be necessary that:

- Authorized capital: The minimum authorized capital should be at least EUR 300,000. The same should be fully paid up and available for use.

- Local workers: It needs to establish at least three people residing and working in Switzerland.

- Local office: Having an office in Switzerland is one of the conditions it needs to face to show that the firm is present in Switzerland.

- Transparency and compliance: Companies will have to show absolute transparency and full compliance with relevant local and international laws, such as anti-money laundering and counter-terrorist financing laws.

Considering the obvious advantages of conducting a cryptocurrency business in Switzerland, there are several limitations such as, but not limited to the fact that:

- High barrier to entry: High minimum authorized capital and the requirement for local employees is highly discouraging for start-ups and small businesses.

- Long review process: The whole licensing application process may take as much as 8 months to complete, implying huge consumptions of time and resources.

- Regulatory requirements: FINMA’s demanding governance and internal control requirements can go beyond the additional investment in systems and processes to drive up the overall cost of the project.

With its stable economic and political conditions combined with the highly sophisticated regulatory environment provided by Switzerland, it remains one of the most attractive regions for entrepreneurs in cryptocurrency businesses. It is more oriented to big and medium enterprises that are in a position to afford the high financial and administrative demands. Smaller and start-up organizations are those that have to bear with more difficulties as their structure demands acute adherence to all the requirements which may be elaborated with much attention and probably require alternative routes of entry into this market.

VASP licence in Dubai

The United Arab Emirates, and especially Dubai, have been actively establishing themselves as one of the world leaders for cryptocurrency and blockchain projects over the past years. Large international companies head to the region with great conditions for innovative virtual asset startups. In this article, we’ll describe how the VASP licensing system works in Dubai, which prospects it opens for business, and what kind of difficulties foreign entrepreneurs can face.

VASP licensing in Dubai

In order to establish a crypto-related business, you need to get a VASP license in Dubai. The procedure for obtaining it is regulated by UAE regulators who enforce compliance standards, internationally recognized, which makes the process of licensing quite strict but transparent.

Key Milestones of Getting a VASP License

- Application Filing: Firms must file an application form with the relevant regulatory body, such as the DFSA or other competent authorities in free economic zones.

- Compliance Check: Firms must demonstrate compliance with local and international anti-money laundering and counter-terrorist financing standards.

- Financial Strength: Proof of financial strength and effective management control is required to obtain the license.

- Local Infrastructure: The company must maintain an office in the UAE and preferably hire local experts specializing in cryptocurrency and blockchain.

Advantages of Dubai for Cryptocurrency Companies

- Strategic Location: Dubai is situated at the center between East and West, facilitating access to several markets and acting as a connecting point for both regions.

- Tax Incentives: The UAE offers attractive tax incentives, including exemptions from income and value-added tax for specific transactions.

- Innovation Ecosystem: Dubai is actively investing in technology and innovation infrastructure, creating a friendly environment for the growth and development of cryptocurrency projects.

Possible difficulties

However, for companies, there are also a few things to consider regarding the complications of it all:

- Regulatory complexity: High demands for compliance create greater administrative and financial burdens.

- Competition: The strong appeal of the market attracts numerous competitors which may make it hard for new companies to gain a foothold in the market.

Dubai, or the UAE for that matter, offers a great platform for crypto businesses with their openness to innovation, progressive regulation, and attractive tax environment. An application for a VASP licence is thus an important step towards commencing operations in the region, although complex, the benefits of doing business in the UAE can far outweigh the initial cost and effort.

VASP licence Cayman Islands

While being an attractive financial and tax jurisdiction, the Cayman Islands have taken a serious step toward regulation in the field of cryptocurrency through the adoption of the Virtual Assets Law 2020 hereinafter referred to as “the VASP Law”. The said Act provided the groundwork regarding structuring and licensing of activities associated with cryptocurrency and blockchain. Hence, it set the rules of the game quite clearly for all market players. In this article, we take a closer look at the main provisions of the VASP Law and what they mean for any cryptocurrency company that wishes to operate in the Cayman Islands.

Key Provisions of the VASP Act

The VASP Act was devised to enhance transparency and security of virtual asset services and prevent money laundering and financing of terrorism using cryptocurrency platforms. Following are the main areas it regulates in detail:

- Licensing and registration: The VASPs of the Cayman Islands shall apply for the respective license with, and registration in, the Cayman Islands Monetary Authority. This covers not only custodial services but also trading platforms and any other type of service dealing in virtual assets.

- Supervision and oversight: CIMA periodically supervises the activities of the licensed companies with a view to their observance of the legal requirements and standards.

- AML/KYC compliance: Virtual asset businesses must correspond strictly to international and local requirements on anti-money laundering and customer authentication.

The business benefits from the VASP Act

The VASP Law clarifies a legal regime in the Cayman Islands and, for that reason, has become a catalyst of the following business advantages of cryptocurrency companies:

- Gaining greater investor confidence: Clear regulation increases confidence in Cayman-based cryptocurrency platforms, which are attracting international investors.

- The Code primarily protects the rights of the users by ensuring that the companies are highly transparent and responsible.

- A stable regime attracts innovation and the development of blockchain and cryptocurrencies.

Possible Challenges

On the other hand, however, the VASP Act will also present the following obligations and challenges to businesses:

- Stringent licensing and regulatory requirements may serve as one of the barriers to new and small businesses.

- Administrative and financial costs: Maintaining compliance with regulatory standards means huge resources, and especially for startups, it could turn into a financial headache.

The VASP Law of the Cayman Islands in 2020 represents a very important step toward a sustainable and secure crypto-currency ecosystem. It performs such a function with proper legal provisions to help not only secure the market participants but ensure growth in the blockchain and crypto-currency industry. At the same time, companies should be ready to cope with high standards and take responsibility for compliance to keep the opportunity to operate in this jurisdiction.

VASP licence Hong Kong

Hong Kong is one of the most important global financial centers, and active work is underway to find a balance in its policy with regard to cryptocurrencies. The balance between supporting innovation on one hand and assuring consumer protection on the other has become a key challenge for Hong Kong regulators. The regulatory framework includes the Securities and Futures Ordinance and the Anti-Money Laundering and Countering the Financing of Terrorism Ordinance, which establish strict control and supervision over the activities of cryptocurrencies. The central role in this process is taken by the Securities and Futures Commission – SFC. Below are some key discussions regarding the question of regulation of cryptocurrency in Hong Kong and the process for obtaining a VASP license in the country.

Elements of Cryptocurrency Regulation in Hong Kong

- Securities and Futures Ordinance: This ordinance regulates investment products and services, including those related to cryptocurrency, if they qualify as a security or a futures contract.

- The Anti-Money Laundering and Countering the Financing of Terrorism Ordinance (AMLO): This law imposes strict customer identification and reporting obligations on all cryptocurrency operators.

- SFC Oversight: The Securities and Futures Commission regulates companies interacting with cryptocurrencies, requiring Virtual Asset Trading Platforms to obtain the relevant VASP license.

Licensing Procedure for Virtual Asset Companies in Hong Kong

- Application Filing: The company must submit an application to the SFC detailing its business model, measures for AML/CFT compliance, and management and ownership structure.

- Compliance Review: The SFC will review how comprehensively the company addresses compliance issues, including risk management and customer protection.

- Licence Issuance: Once the company meets all requirements, it will be granted the VASP licence and authorized to operate a cryptocurrency business in Hong Kong.

In this sense, the VASP license in Hong Kong creates tremendous business potential by offering an environment that is much more transparent and regulated, thereby attracting investment and building trust in virtual asset platforms. However, for companies, the main challenges are connected with strict adhesion to regulatory standards and high demands regarding internal control and risk management.

Hong Kong is still at the forefront of cryptocurrency regulation in the interest of investors and high standards in the sector. The VASP licensing system is, therefore, a determinant for any cryptocurrency business in effectively conducting work in this fast pace.

BVI VASP licence

The legal framework is designed to bring Virtual Asset Service Providers into a legally regulated framework within the British Virgin Islands. This would create an environment for the regulation of activities that either protect consumers or create market stability while fostering innovation and making the jurisdiction appealing to cryptocurrency companies. The paper will discuss the main provisions of the VASP law in the British Virgin Islands, providing at the same time a description of how the process of obtaining the relevant license will go about.

VASP Law in the British Virgin Islands

The VASP Law was brought into place with the motive of regulating those organizations that were involved in providing the following services related to virtual assets:

- Providing Virtual Asset Services: virtual asset exchanges, transfers, and mediation and advice services concerning those.

- Virtual Asset Custody Services: Any form of custodial services related to storing and managing cryptocurrency and other digital assets for clients.

VASP Licensing Procedure

The procedure of getting a VASP license within the British Virgin Islands is strictly bound by the regulatory requirements, taking a course through a number of critical steps:

- Application: Legal entities apply for a license with the BVI regulatory agency, providing full details of their business-including a business plan, proof of AML/CFT policy observance, and information about the composition of ownership and management.

- Verification and assessment: The regulator checks the completeness of the given information and assesses the applicant’s competencies in safely managing virtual assets and complying with the rule of law.

- Licensing: Upon the applicant’s successful passing of inspection and found to comply with all requirements, a license is issued, and that applicant is allowed to operate freely and legally within the virtual asset space of the BVI.

Pros and Cons

Pros:

- Regulatory Clarity: In the BVI, the clear regulation of this operation boosts transparency of operations and instills confidence in customers and investors alike.

- Consumer protection: Stringent licensing requirements aim at protecting rights and funds of users. It means that an investment will be much safer.

- International recognition: the license obtained in such a respected and renowned jurisdiction as the BVI may add to the prestige and competitiveness of companies on the international market.

Challenges:

- Complexity of the process: getting a license requires serious investments of time and money in order to prepare and comply with all necessary requirements.

- Technical training: Companies need to ensure a high level of technical and safety training to meet the regulator’s standards.

VASP licensing in the British Virgin Islands provides companies with the opportunity to operate in a legally clearly regulated environment, facilitating the growth and development of the cryptocurrency industry. This not only improves the investment climate and provides investor protection, but also supports international standards in cryptocurrencies and blockchain.

EU Crypto Regulations

Although the EU hasn’t recognized cryptocurrencies as legal tender, it has been working tirelessly to turn this crypto industry into a stable and reliable market by introducing and elaborating a variety of regulations. Although some EU crypto regulations apply directly across the member states, others have to be transposed into the national legislation of every EU member and hence it is relevant to look properly at the general crypto regulatory framework of the EU, before dealing with the peculiarities of one specific country, let alone applying for a crypto license.

The anti-money laundering directives of the EU have also been tightening anti-money laundering and counter-terrorist financing regulations that include greater and more transparent requirements for crypto businesses. In 2020, the Sixth Anti-Money Laundering Directive (6AMLD) came into force to enhance the rules and clarify definitions laid down in the Fifth Anti-Money Laundering Directive, 5AMLD. New changes should finally enhance corporate responsibility for crypto businesses acting from within the EU. Notably, 6AMLD addresses the lack of supervision by company leadership, which is sure to have legal consequences.

The MiCA was passed in 2022 by the Economic and Monetary Affairs Committee of the European Commission for a vote by the Full European Parliament and member states whereby, within the EU, a wide crypto regulatory framework is targeted to foster innovation and fair competition by way of legal certainty but also further reinforce consumer protection to make the crypto industry a safer and more stable area of business.

When this law takes effect, it would apply directly throughout the EU, and virtual asset service providers will be authorized to offer their products and services in the union provided that they register with national authorities for the relevant legal provisions. However, MiCA also has its limitations in that it currently excludes decentralised finance and non-fungible tokens, which, on the other hand, should be duly included in the near future.

The latest MiCA updates include:

- Large CASPs would, among other things, be required to disclose energy consumption on their website and to provide the data to the relevant authorities in order to help reduce cryptocurrencies’ high carbon footprint. ESMA is mandated to prepare regulatory technical standards.

- MiCA will not duplicate anti-money-laundering regulations because these are set by the anti-money laundering and counter-terrorist financing legislations.

- On the other hand, EBA will subject maintenance of a public register and enhanced AML checks for those non-compliant CASPs whose parent company is registered in countries identified by the EU as third countries considered high-risk for anti-money laundering activities and b) non-cooperative jurisdictions for tax purposes.

- Stablecoins will be regulated by the European Banking Authority: stablecoin providers must be present in the EU, and they will be obliged to establish an adequate liquid reserve at a ratio of 1:1.

Other regulations aside, the explanation or adaptation of the fiscal framework currently is at the infant stage but some things have already been defined. For instance, under EU law, there isn’t any VAT levied on conversions between fiat money and cryptocurrencies, although it may fall on a variety of other crypto-related products and services.

With all these novel and rapidly developing laws and regulations, the EU should already easily shape a leading crypto market, where crypto and generally blockchain entrepreneurs could further develop their products and investors could entrust their money freely. A second important point is standing out from other countries: one-sixth of the whole international economy, which offers unprecedented success. Of course, you should not undervalue non-EU countries, such as Switzerland, which offers really attractive conditions for crypto-entrepreneurs.

Advantages of the EU Crypto Regulations

While much has been done, the authorities of the block are still gradually developing a comprehensive single legal framework for cryptocurrency businesses that will be applied across the EU. The two guiding principles of these constantly improved regulations are the encouragement of the development and usage of blockchain-based technologies by means of updated legislation and different kinds of support, and the protection of consumers and investors by fighting against market manipulation and financial crime.

You can consider these principles highly welcome on a number of reasons. First, as a crypto entrepreneur, you will be supported in your endeavor by the ever-growing number of government and non-governmental national and transnational initiatives that will help you grow and navigate the market. Secondly, your crypto company will be considered trustworthy by investors and clients due to the in-depth regulations designed to protect market integrity.

Other undeniable advantages of the single regulatory framework include rules that are clear, consistent, and transparent for your crypto company, thus gaining access to the whole single market of the EU. When the regulations become harmonized across the block, you will be able to navigate the market with ease without trying to adapt to the wide variations in requirements in different countries.

As for the latest enhancements of MiCA, it was referred to as a continent’s success by Stefan Berger (EPP, DE), the rapporteur, because Europe is the first whole continent that has introduced crypto regulations and therefore can become a global standard setter. According to the MEP, MiCA is going to harmonise this market where cryptoasset issuers and crypto service providers will have legal certainty, and customers will be protected at the highest standards.

If building up a crypto business under the auspices of a European regulatory framework is your goal, then proceed with reading this article, as further on our trusted lawyers team here at Regulated United Europe will show you the most progressive European countries using cryptocurrencies in everyday life and doing everything possible to provide a friendly and safe environment for both crypto entrepreneurs and their consumers.

Crypto License in Lithuania

In 2018, Lithuania was among those few forward-looking European states that introduced Initial Coin Offering regulations, and it is considered by many to be the most blockchain-friendly country in Europe. So far, Lithuanian blockchain startups have attracted more than 1 billion EUR, which is a very distinct evidence of success for a country with less than three million people.

Moreover, Lithuania is ranked among countries offering the world’s fastest and most reliable internet connection, which is important for the smooth and safe operations of a crypto company. On top of that, Lithuania is recognized as a safe business environment among global investors and ranks 9th among the lowest-risk jurisdictions. These are clear signals that you have no further need to look elsewhere when you are hunting for a safe and modern jurisdiction to place your innovative cryptocurrency project in.

In Lithuania, virtual currency is considered an instrument with a digital value, yet it is not taken as legal tender and, therefore, is neither authorized nor guaranteed by any national institution. Provided the virtual currency is accepted by natural and legal persons as a means of exchange, it can, without any obstacles, be legally transferred, stored, sold, exchanged, invested, and used for paying for purchases electronically.

The Bank of Lithuania is the Lithuanian financial market regulator that issues crypto licenses, in addition to its other regulatory activities. It has also developed a blockchain-based technological sand box strong LBChain with the goal of serving Fintech market participants by offering all the regulatory and technological infrastructure necessary for testing innovative business solutions in controlled conditions. All businesses – start-ups and more mature companies alike – are allowed to carry out blockchain-related research, experiment with novel solutions, and provide their new products and services to consumers.

In Lithuania, you may receive one of the following crypto licenses:

- A Crypto Wallet Licence allows crypto businesses to provide crypto wallets to customers and to manage the same on behalf of their clients.

- A Crypto Exchange Licence permits crypto companies to offer services of cryptocurrency-to-fiat-money exchange and vice versa as well as cryptocurrency-to-cryptocurrency exchange services.

The main advantages of the Lithuanian crypto license:

- A crypto license can be issued within a month.

- You won’t have to pay any application and annual supervision fees.

- You’ll be subject to relatively low Corporate Income Tax (5–15%).

- Your company name will appear in the public registry of all virtual currency license holders in Lithuania, available to everyone free of charge, whose key objective is the introduction of more transparency to instill confidence in the market by way of verification of crypto licenses.

- You will have at your disposal a pool of disciplined, multilingual, driven, and highly qualified talents that can be instrumental in growing your crypto company.

- Small businesses with certain conditions are audit exempt.

Key Requirements:

- A senior manager who is a permanent resident of Lithuania.

- Registered authorized capital of at least 125,000 EUR in the case of a Private Limited Liability Company (UAB) or a Public Limited Liability Company (AB).

- The main activity of a crypto company should be executed in Lithuania, and its fundamental services should be provided to customers in Lithuania.

For such a license, it is possible to either establish a new Lithuanian company and apply for a license or purchase a fully licensed ready-made crypto company. Both variants have their advantages and if you are in doubt which is more suitable to satisfy your needs, don’t hesitate to contact our team who will be more than happy to provide a personalized consultation.

The Lithuanian taxation system is doubtlessly one of the most favorable ones in Europe, since the Lithuanian economy ranks 6th in the EU regarding ease of paying taxes. Taxes in Lithuania are regulated by The State Tax Inspectorate, which hasn’t introduced any crypto-specific taxes yet, and all cryptocurrency companies must therefore pay general taxes. Moreover, Lithuanian crypto businesses can enjoy such tax reliefs as a 200% allowance on qualifying R&D expenses.

Crypto License in Estonia

Estonia was the first European country that provided clear rules and guidelines for virtual currencies. Today, it is known as the jurisdiction that has issued the biggest number of crypto licenses in Europe, and it has more than 200 blockchain solution providers. So far, Estonian blockchain companies have raised 285 mill. EUR, which is rather remarkable for a nation of fewer than 1.5 million people.

In Estonia, one can obtain just one kind of crypto license called Virtual Currency Service Provider Licence. It is issued by The National Financial Intelligence Unit and may allow you to render cryptocurrency exchange services and crypto wallet services. Mind that one can either apply for it opening a new Estonian company or buy together with a ready crypto company. Contact us today for further insights into this solution.

Main requirements to consider before getting an Estonian crypto license:

- Application fee is 10,000 EUR, no annual supervision fee will be required

- Authorized share capital – starting from 100,000 EUR

- You will be obliged to open a local physical office and hire local staff, though it might be changed to an advantage given the pool of highly qualified, multilingual talents.

- Company audit is a must.

Under national law, virtual currencies are values in digital form, and they can be transferred, stored, or traded in digital form, and people can accept them as a means of payment. However, they are not considered legal tender. Having said that, Estonia continues to be a proponent of such blockchain projects in the form of cryptocurrencies at both the national and European levels.

Countless applications of blockchains are being implemented in the public domain. It hosts one of the most highly scalable and privacy-focused, keyless signature blockchain infrastructures in use, from health, property, business, and inheritance registries to even the country’s state newspaper and digital court system. The widespread use of such innovation only shows you that Estonia is dead serious about the adoption of blockchain-based solutions, and you certainly could benefit from conducting a business from inside the country for Estonian consumers.

Among the most notable initiatives you could take advantage of is an e-Residency program that enables crypto and other blockchain entrepreneurs to establish and operate a company in the EU completely online. It is one of the reasons why Estonia has many companies offering blockchain-based solutions, among which are the trading of cryptocurrencies and crypto wallets.

The Estonian taxation system is regulated by the Estonian Tax and Customs Board (ETCB), which has not yet established any business taxes in relation to cryptocurrencies, meaning that your Estonian crypto company would be liable to pay regular taxes. The good news is that, with low tax burdens on business investment and an effective level of neutrality enabled by a well-structured framework of tax codes, Estonia has ranked first in the International Tax Competitiveness Index several times, and Estonian tax policy currently ranks among the most competitive in the world.

For tax purposes, the treatment of virtual currencies is viewed as. The standard rate of Corporate Income Tax is 20%, but all undistributed corporate profits are exempt from tax. Regarding the payment of VAT, the exchange of cryptocurrencies is not subject to VAT.

Crypto License in Switzerland

Switzerland is one of those countries that belong to the group of non-EU members that are almost unbeatable in the creation of a stable and reputable crypto regulatory framework, aiming to attract the largest industry players. Its famous Crypto Valley was home to 14 blockchain unicorns – that is, companies with a valuation above 1 bill USD ≈ 912 mill. CHF or 949 mill. EUR – right at the beginning of 2022. The last year has been a bumpy ride for crypto businesses, but in the meantime, the concrete application of blockchain-based solutions has been slowly spreading across various Swiss industries.

For example, the fintech and insurtech sectors are increasingly adopting blockchain-based smart contracts, and crypto-related services such as exchange, custodian wallets, and asset management continue to be developed and offered within Switzerland. So, basically, if you are looking for the most prosperous, prestigious, and friendliest jurisdiction to implement your crypto project, this might be it.

But before you actually do anything, take your time to become aware of the crypto regulatory framework of Switzerland in general and the different types of Swiss crypto license that were implemented in the year 2021 and are issued by the Swiss Financial Market Supervisory Authority – FINMA, which also secures the protection and integrity of the Swiss crypto sector.

FINMA specified and adopted the following type of virtual currencies:

- Payment tokens are a means of digital payment that can be used for the transfer of monetary value, for example in the form of Ether or Bitcoin.

- Asset-backed tokens are backed by tangible assets and are very often issued during the Security Token Offering, or STO stage to raise funds. They can further be divided into debt tokens, equity tokens, and participation tokens.

- Utility tokens grant access to a digital system or service, they’re normally available on a particular DLT platform and may be considered securities.

In Switzerland, the following licenses are available:

- Fintech License (or Financial Intermediary License) – the most popular license, which entitles crypto companies to accept public deposits of up to 100 million CHF (approx. 96 million EUR) or store and trade crypto assets.

- Banking License – allows receiving and holding an unlimited number of deposits from natural or legal persons.

- Investment Funds License – allows fund managers to administer a collective fund’s assets on behalf of clients.

- DLT Trading Facility License – enables multilateral trading of DLT securities.

In the event that your crypto-related economic activities do not fall within any of the categories of regulated cryptoassets and, therefore, cannot be licensed in any of the above ways, you will be obliged to register your crypto business as a Self-Regulated Organisation that will be required to meet certain requirements.

The main piece of legislation elaborating the rules for Swiss crypto businesses is the Federal Act on the Adaptation of Federal Law to Developments in Distributed Ledger Technology-the so-called DLT Act. There, you will find detailed descriptions of the financial market infrastructure for trading cryptocurrencies, anti-money laundering procedures, bankruptcy proceedings, liability for any damage made to the investors, and, of course, licensing. These focus areas support the ultimate goal of the DLT Act-to protect the integrity and stability of the prestigious Swiss financial market.

While Swiss crypto regulations are getting tighter, Switzerland still remains one of the most welcoming countries for crypto entrepreneurs and blockchain innovators. National authorities have already adopted blockchain-based solutions to issue digital sovereign identities and vote at the regional level. This allows taxpayers in Canton Zug to pay their taxes in virtual currencies. Of most relevance is the Crypto Valley Association in Zug, whose purpose is to accelerate innovation through the development of an ecosystem that brings together entrepreneurs with national authorities through networking and education events, working groups, and publication of topics of interest. Companies such as the Swiss Crypto Investor Association and Bitcoin Association also create impact by bringing the most forward-looking minds together.

Several taxation laws exist in Switzerland, both at the national and regional levels, depending on a given canton. Switzerland is a multi-layer tax administration system; it has three layers: the Federal Tax Administration (FTA), the cantons, and the municipalities. Although the federal tax rates remain stable, the cantonal tax rates are put under review yearly, whereby all the rates are published on each canton’s official website.

For the Wealth Tax, virtual currencies would normally be regarded as foreign currencies, whose exchange value is regularly fixed by the Federal Tax Administration at the end of each year. Persons do not have to pay Personal Income Tax on gains made in digital currencies; equally, a gain in virtual currency is not subject to VAT.

Crypto License in the Czech Republic

The Czech Republic has lately seen rapid growth in cryptocurrency trading, though the country does not yet have a comprehensive or at least maturing legal framework to regulate such businesses. This means that in relation to crypto-related economic activities in the Czech Republic, your company shall have to act within the general regulatory framework. That being said, certain EU rules will still apply given that the Czech Republic is an EU member.

For instance, the Financial Analytics Office of the Czech Republic regulates crypto firms to combat money laundering and terrorist financing in line with EU recommendations. In this respect, it defines any virtual currency as an electronically stored unit that is not included within the definition of Fiat money but may be used as payment means by individuals other than the issuer.

The absence of any crypto-specific regulatory framework does not stand in the way of the adoption of crypto-related products and services, and in the Czech Republic, you are free to find Bitcoin ATMs, invest in Initial Coin Offerings, and trade in cryptocurrencies for a living. The government of the Czech Republic has so far proposed to put all types of cryptocurrencies into one category regardless of the purpose or function of a cryptocurrency and to keep detailed records of any type of cryptocurrency. At this stage, however, cryptocurrencies are not recognized as legal tender by The Czech National Bank (CNB), the supervising authority of the Czech financial market.

To commence practicing crypto-related economic activities in the Czech Republic, you need to apply for a standard trade license issued by the Trade Licensing Register. You can do this by submitting your electronic application with respect to your crypto company and its founders in one of the general Trade Offices in the Czech language and paying the provided state application fee of 6,000 CZK (approximately 243 EUR) to finalize your registration.

Also, the crypto business can be licensed in the following types of trade:

- Classic – allows performing an exchange between cryptocurrencies for a commission;

- Fiat – allows performing an exchange between cryptocurrencies and fiat money for a commission;

- Traditional – provides with the right of intermediation in the exchange of any type of currencies;

- Specialized license – issued in respect of specific crypto-related products and services, such as crypto wallet, encrypted client keys, etc.

Key requirements for crypto businesses:

- It needs a registered physical office in the Czech Republic, which should employ at least full-time staff, including a director who does not necessarily have to be resident in the country, plus at least one AML Officer – one and the same person would do. For its internal purposes, the company should develop AML/CFT policies. Internal data protection procedures are something that a crypto company is supposed to provide in any case; it must show compliance with GDPR. Policies ensuring client funds safety – just impossible to operate without.

While complying with all the statutory obligations, grab all the supporting opportunities given under the following initiatives at the local level:

- CzechInvest – korporacia supported by the government offering a seven-month incubator program CzechStarter under which the beginning companies apply for funding besides taking part in workshops and expert advisories.

- Blockchain Connect Association / Czech Alliance: a non-profit organisation aimed at the development and promotion of blockchain technology in the country, which, according to the founders, should also help to combat fraud and corruption in the financial sector.

- The Institute of Cryptoanarchy: a platform that tries to create conditions for the creation of a decentralized economy, the main vectors of development of which are the free flow of information and widespread use of blockchain-based products and services.

- CNB’s FinTech contact point – a single line of communication with the established contact form launched with the aim of making the innovative financial market participants function better.

In the Czech Republic, taxes are administered by the Tax Offices and all crypto companies are regular taxpayers regardless of the type of trade licence. Generally, standard tax rates apply (e.g., a 19% Corporate Income Tax and 24.8% Social Security Insurance). Still, there are such exceptions as VAT exemption, since the Court of Justice of the European Union has ruled out that cryptocurrencies are treated as fiat money for VAT purposes, which means crypto exchange services are exempt from VAT.

In case you have decided to apply for one of these crypto-licenses or you are in doubt which of the European crypto licenses will suit your unique crypto project best, do not hesitate to contact us now for an appointment for a personal consultation where our experienced lawyers will introduce actionable insights to help you kick off your project. We would be delighted to provide you with customized, value-added crypto license support, like document preparation and translation, certification, and filing, among other things. From the very beginning of the process, you will receive expert assistance in the dynamic European crypto legislation, crypto licensing, corporate reporting, and taxation.

VASP crypto license

In the digital economic era, while cryptocurrency assets are finding their place within the global financial system, the regulation and licensing of VASPs become a critical issue. It is not only a question of ensuring security and transparency for users and investors but also a key aspect that provides legitimacy and sustainability to the cryptocurrency industry itself. In this article, we will take a closer look at the main aspects of VASP licensing, its importance to businesses, and the main challenges on the way.

Why Do You Need VASP Licensing?

A license is a tool for regulators to ensure that virtual asset service providers adhere to predetermined rules and standards concerning transparency, anti-money laundering, financing terrorism, and protection of clients’ rights and funds. For cryptocurrency companies, obtaining a VASP license serves as confirmation of their reliability and commitment to high operational standards.

Licensing Process

The VASP licensing process varies widely depending on the jurisdiction but often involves:

- Filing

- In-depth business model review

- Verification of funding sources

- Implementation of AML/CFT processes

- Assessment of management and employee qualifications

Companies will also be required to demonstrate technical and physical security measures for safeguarding customer assets and information.

Licensing as a Strategic Imperative to Business

Obtaining a VASP license is not just about access to markets in regulated jurisdictions; it also serves as an important tool for gaining trust among customers and partners. Moreover, it opens new avenues for cooperation with traditional financial institutions and allows entry into new business segments.

Challenges on the Road to Licensing

The path to obtaining a VASP license can be complicated and demanding. Key challenges include:

- In-depth knowledge of local legislation

- Implementation of complex internal procedures and systems

- Adapting to fast-changing regulatory requirements

All these challenges may require significant effort and continuous updates to policies and procedures.

The entire concept of VASP licensing was designed to be at the heart of regulating the crypto market for the protection of interests of all participants in that market, hence contributing to building a healthy and sustainable digital asset ecosystem. To companies that want to take leading positions in the cryptocurrency industry, the possibility of understanding and managing such processes often turns out to be one of the main enablers of growth and innovation.

Distribution of crypto transactions by world regions

VASP licence in the EU

Generally speaking, the European Licence for Virtual Asset Service Providers allows the relevant licence holder to operate their business freely in the European Union. On the other hand, the licence significantly enhances the transparency of VASPs’ businesses and builds trust with customers and in general business partners and government regulators. It is definitely a promising direction for virtual asset entrepreneurs.

The European Parliament adopted the Markets in Cryptoassets Regulation on 20 April 2023, a landmark act in global regulatory practice setting a precedent for other jurisdictions. MICA is a regulatory regime designed by the European Commission with the express aim of regulating markets of virtual assets and related services that have not been covered so far by Union law.

Before its adoption, the regulation was in the making since 2018 and would mean the establishment of one licensing regime for all EU Member States with a view to harmonizing the rules on the creation and circulation of virtual assets-a provision in the European Digital Finance Strategy. MiCA is expected to be in force by mid-2025/early 2025.

MiCA, upon its implementation, will immediately alter the regulatory conditions of whatever firm seeks to operate in the EU, including sourcing in customers outside the EU. However, MiCA will not affect the various national regulatory frameworks put in place already in some countries of the EU that might supplement the MiCA requirements with more stringent ones companies and virtual asset service providers will be expected to adhere to. Thus, any enterprise operating in this area will be obliged to obtain a licence as a VASP licence holder.

Before the adoption of MiCA, even the legislation of European countries already provided for uniform requirements in line with EU regulations; in practice, however, the differences were striking, especially in regard to business models related to virtual assets.

Therefore, a decision on the jurisdiction of choice for VASP activities should be made in consideration of specific rules and conditions, together with various benefits that regulation applicable in different EU countries provides. In the majority of the cases, holding a VASP license would be prerequisites. Whatever the choice of jurisdiction may be, each regulator has a certain requirement that an applicant needs to go through to successfully acquire a VASP license.

How to get a VASP license in the European Union

Under the European Union regulation, the VASP license is intended for those offering transfers of virtual assets, providing a service related to an exchange, management, or provision of financial services between virtual and fiat currencies. According to the Financial Action Task Force, persons and entities facilitating transactions, managing virtual assets, or offering financial services related to virtual assets fall within the category of VASPs. The European Fifth Anti-Money Laundering Directive, 5AMLD, brought the requirements for VASPs into the EU legal framework by setting common rules at the level of Member States.

In particular, VASP registration through FIN-FSA prescribes the compulsory basis of business operation with virtual assets in the EU to be in compliance with the law while minimising legal risks. The determination process involves ascertaining whether the VASP registration is required when the verification of a business meeting set criteria for a virtual asset service provider is sought and considers possible exemptions that could also be supported by expert legal support with a view to verifying accuracy and legality of regulatory requirements.

History of licensing of firms in the EU by VASP

Europe’s VASP licensing regime was structured in consonance with global AML requirements and recommendations, particularly by FATF. The framework is very much centered around the establishment of transparency and accountability amongst virtual asset market participants, an area that is essentially similar to international standards. Key aspects will be discussed thereafter.

According to the FATF, a VASP is defined as any business that offers one or more of the following transactions on behalf of or in the name of a customer: exchange between virtual assets and fiat currencies; exchange between one or more forms of virtual assets; transfer virtual assets; storage and/or administration of virtual assets; and any type of financial services related to the offer and sale of virtual assets. It has taken over these definitions and used them to build its own regulatory framework on.

The European system has ensured that all VASPs are registered or licensed depending on the level of their operation. This puts a guarantee on the service providers being appropriately supervised, much as the FATF recommendations for VASPs to either be licensed or registered in jurisdictions where the businesses operate.

The FATF mandated that the VASPs implement Anti-Money Laundering programmes, including customers’ identification policies and procedures, also known as Know Your Customer, or KYC, transactions monitoring policies and procedures, and internal controls and compliance policies and procedures. In a similar way, European regulators have applied a strict AML/CFT standard by requiring VASPS to perform due diligence and ongoing monitoring of customers, and reporting suspicious transactions.

In addition, the FATF Recommendations provide a major focus on international cooperation-sharing of information among regulators being an effective fight against crime. The EU cooperates with third countries and international organisations for coherence of regulation and data sharing.

For this reason, taken altogether, the European VASP licensing system is well aligned with FATF global standards and thus in a better position to strengthen international efforts towards preventing financial systems from being used for anti-money laundering and terrorist financing. More importantly, this positioning gives full assurance of protection for both the consumer and the integrity of financial markets against the prospect of virtual assets’ growing popularity.

Advantages of Taking the VASP Licence in the European Union

Obtaining a Virtual Asset Service Provider license in Europe gives several serious advantages to the company acting in this field. First of all, licensure strongly increases the trust of clients and partners, and it promotes wider integration of the company into the global financial system. The main features and advantages are discussed below:

- Legal legitimacy: A license obtained will be proof of the legality of the company’s activities within the virtual asset market in the applicable jurisdiction. In other words, it meets all regulatory requirements that ensure low risk of legal claims or violations.

- Access to banking and financial services: Banks and other financial service providers will only work with licensed virtual asset operators due to the very high level of risk in this sector. The VASP license empowers companies to facilitate access to banking services and other financial instruments.

- Transparency and reporting: Licensing provides high levels of transparency, such as regular reporting to regulators. This helps to engender confidence among customers and investors.

- Improved market perception: The licensed company would then be perceived as more trustworthy and safe to deal with. This attracts new customers, retains old customers, and simultaneously improves the relationships with investors and other stakeholders.

- Compliance with regulatory requirements: Through such regulatory compliance, avoidance of fines and penalties, perhaps imposed due to non-compliance with AML/CFT standards, is ensured. The procedure also enforces compliance with international standards and advances the position of the company internationally.

- Access to new markets: A license can help penetrate new markets but especially those countries that require an appropriate level of regulation with respect to virtual asset transactions.

- Protection against reputational risks: Compliance and a license will help mitigate reputational risks associated with the potential use of the platform for money laundering or other illegal activities.

Obtaining a VASP license in Europe is hugely credible for a company and further extends the probability of accessing the single market of the European Union. Key aspects of how the VASP license contributes to this include the following:

Increased credibility and trust

Legal legitimation: the license confirms that a company follows all the regulatory standards of the EU, which definitely enhances its reputation. It is perceived by clients, partners, and investors as a reliable and trusted participant of the market.

Transparency of activities: under the license, companies shall operate in accordance with publicity of reporting and auditing. Increasing trust, it makes the company preferred among clients and partners, requiring high accountability.

High standards mean that AML/CFT underpin the responsible approach of a company to its activity, which will have a positive effect on strengthening its reputation in the market.

More extensive access to the EU single market

- Standardisation of the regulatory regime: The Union aspires to have a “harmonized regulatory regime” within the bloc so that every company holding a VASP license can extend the operation in all member states. There is no longer a need to obtain a separate license for every country, and hence bureaucratic and financial costs are reduced.

- Easier cooperation with banks and financial institutions: EU banks and other financial institutions are more eager to cooperate with licensed companies because of the reduced regulatory risks. The license opens access to banking services, better conditions for credits, and a broad range of financial instruments.

- International expansion: With a European VASP license, entering new markets outside the EU is much easier because many countries outside Europe acknowledge European regulatory standards.

- Investment attraction: The license helps to increase the attractiveness of the firm towards investors, especially those looking for stable and regulated markets where they can invest. This can help in raising capital and finance for expansion.

For that reason, a VASP licence is more than just a means of legal compliance; it is, in fact, an important differentiator with substantial competitive advantage, which fundamentally enhances one’s position as an actor in the virtual asset market. It provides legal protection, unlocks business growth opportunities, and boosts confidence with clients and partners alike.

Characteristics of the Virtual Asset Service Provider License within the European Union

Obtaining a Virtual Asset Service Provider License in Europe offers a number of great benefits to companies and is an important step toward legalization and sustainability in this fast-growing sector. Let’s elaborate on the main features of and advantages provided by this license.

Features of VASP License

- Legality and legitimacy: The VASP license is a kind of assurance that the company fulfills the rigid European legislation regarding the security of finance, AML (Anti-Money Laundering), and CFT (Combating Financing of Terrorism). Such compliance would enhance the company’s credibility before regulators and clients.

- Financial market access: The ability to easily access banking and payment systems is crucial to the success of any virtual asset businesses. It provides an opportunity for greater operation and expansion of business.

- Enhanced transparency: There is increased transparency by the nature of the requirement to have detailed records and auditing of activities by licensed VASPs; this becomes important in building customer confidence.

Benefits of obtaining a VASP licence

- Increased trust: A VASP license increases the trust in a company on the part of clients and partners, as it serves to illustrate that the company is serious about compliance with legislations and regulations.