Crypto license Czech Republic 2025

The Czech Republic has rapidly emerged as a highly attractive jurisdiction for obtaining a Crypto license in Czech Republic. In fact, many industry sources refer to this same license as a CASP license in Czech Republic or a VASP license in Czech Republic. Although these terms are used interchangeably, they stem from different regulatory or legal traditions. Regardless of the terminology, all these licenses ensure that companies comply with rigorous AML/KYC standards and benefit from a transparent regulatory framework. This integrated approach provides businesses with the opportunity to operate confidently in the European market while maintaining high security and credibility.

According to the legislation of the Czech Republic, the Czech National Bank is the body responsible for the general supervision of the financial market in the Czech Republic. According to the relevant authorities, cryptocurrencies cannot be considered as legal tender. Furthermore, crypto data kept on a blockchain cannot be treated as a claim denominated in any traditional national currency, whether the currency was issued by a central bank, a credit institution, or another payment service provider. More than that, according to Article 4(1) of the Payment System Act, crypto assets are excluded from the concept of electronic money. With respect to Article 2(1)(c) of the Law on the Payment System, they cannot be treated as funds. Otherwise, in all other cases, crypto assets are considered commodities.

Before engaging in crypto activity in the Czech Republic, it is worth seeking help from local initiatives. Many startups and incubators provide valuable added services such as product development, marketing, and sales. Examples of such initiatives are: CzechInvest is a government agency operating programs supporting businesses, including the seven-month incubator program CzechStarter, offering funding to start-ups, along with seminars and consultations with experts.

Blockchain Connect Association/Czech Alliance was established in 2018 with the goal of accelerating the development and use of blockchain across the country. The Association is dedicated to fraud eradication and the rooting out of corruption in order to create trust in innovative financial solutions.

Cryptoanarchy Institute is Paralelní Polis – a non-profit civic association that was established to support a decentralized economy through unobstructed information dissemination to the mass introduction of products and services utilizing blockchain, such as cryptocurrencies.

All new and existing “crypto companies” have at their disposal the FinTech CNB contact point-an optimized communication channel by which the functioning of financial market participants is to be improved with an emphasis on innovation. This is usually done through a contact form in which the crypto companies need to explain, for example, why their product or service is financial innovation. That said, such regulatory advice should in no way replace your professional lawyers. Should you want to receive more specific legal counseling, please don’t hesitate to contact us, and we’ll be more than happy to help you out.

Cryptocurrency Licence in Czech Republic

Cost of cryptocurrency license

|

PACKAGE «COMPANY & CRYPTO LICENSE IN Czech Republic» |

- Preparation of necessary documents for registration of a new company in the Czech Republic

- Acquisition of a legal address for the company

- Translation of a certificate of no criminal record into Czech through a sworn translator

- Payment of state fees related to company registration

- Payment of notary fees related to company registration

- Registration of the Company in accordance with the law

- Obtaining the licence for the provision of services related to virtual assets in the Czech Republic

Additional services

| from 290 EUR | |

| from 300 EUR | |

| 400 EUR | |

| 1,300 EUR | |

| 1,500 EUR | |

| 1,500 EUR | |

| 1,500 EUR | |

| 2,000 EUR | |

| 2,000 EUR | |

| 16,900 EUR |

CRYPTO LEGISLATION IN THE CZECH REPUBLIC

Of course, despite the lack of one comprehensive national crypto regulatory framework that could protect investors by all means, the Czech crypto businesses are obliged to adhere to EU legislation. This is documented in the 2018 CNB publication, “Security of Internet Payments and Cryptocurrency.”

The country brought its laws into compliance with the EU Fourth Anti-Money Laundering Directive (4AMLD) and the Fifth Anti-Money Laundering Directive (5AMLD). These regulations impose an obligation on virtual money exchanges and virtual wallets to establish an internal AML/CFT policy, which includes KYC. In addition, the new concept of Czech legislation contains a broader range of crypto-related economic activities-the businesses involved in exchanging, storing, managing, or brokering the purchase or sale of virtual currencies or providing other services related to cryptography.

Under the AML/CFT regime, digital currency is defined to be any digital unit of value that does not constitute fiat currency but has nevertheless been accepted as a means of payment in exchange for goods and services with persons other than the issuers of that unit.

Every Czech company engaged in cryptography-related economic activities is subject to the following laws concerning AML/CFT:

- Law on Combating Money Laundering (Law No 253/2008 Coll.), which sets out measures to combat money laundering/terrorist financing

- Criminal Code (Law No. 40/2009 Coll.), which defines criminal acts

- Law on International Sanctions (Law No. 69/2006 Coll. ), which defines the rules for the imposition of international sanctions

The Financial Analysis Authority (FAU) is the main AML/CTF oversight body, while the CBN is responsible for enforcing other financial market legislation. At present, the authorities have not introduced any complex registration process for companies involved in cryptography-related economic activities, making it relatively easy to enter the market.

Companies engaged in activities related to cryptography should consider the following general laws governing financial services:

- Trade Licensing Act (Act No. 455/1991 Coll.)

- Law on Banks (No. 21/1992 Coll.)

- Act on Obligations on the Capital Market (No. 256/2004 Coll.)

- Law on Management Companies and Investment Funds (Law No. 240/2013 Coll.)

- Law on Insurance (No. 277/2009 Coll.)

- General legislation can help crypto companies to understand where their activities should be located within the current regulatory framework of the financial market.

The general legislation requires permission from the NSC for the following kinds of economic activities related to cryptography:

- Trading with crypto derivatives is they have features of investment instruments, so trading with them requires a license from an investment firm.

- Custody of the assets of investor funds investing in cryptocurrencies, whether the funds are offered to the general public or to a selected group of investors.

- The transfer of funds in the course of organizing transaction with cryptocurrencies, for instance, within cryptoexchange activity, when a person transfers non-cash money or electronic money, and such transfers have the signs of provision of payment services, in particular, the transfer of funds from accounts of clients of such exchange to the payment accounts specified by them.

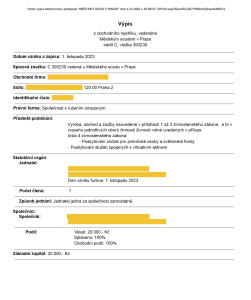

Example of a Czech Republic crypto company certificate

Field of activity – Poskytování služeb spojených s virtuálním aktivem

What is a CASP / VASP License in Czech Republic?

A CASP license in Czech Republic and VASP license in Czech Republic are essentially two terms used for the same regulatory license granted to providers of crypto asset services. These licenses ensure that cryptocurrency companies adhere to strict security protocols, AML/KYC procedures, and maintain transparency in financial operations. While the term ‘CASP’ (Crypto Asset Service Provider) is sometimes used in certain regulatory documents, ‘VASP’ (Virtual Asset Service Provider) appears in others, reflecting historical and regional differences. However, the underlying requirements and benefits remain consistent, offering legal certainty and a competitive edge in the European crypto market.

TYPES OF CRYPTO LICENSES IN THE CZECH REPUBLIC

Currently, the majority of crypto companies that would like to start economic activity in the Czech Republic need to register one of the ordinary trade licenses in the Trade Licensing Register. That is enough for a company to be allowed to operate within the EU-all it needs to do is open offices in any member country without extreme bureaucracy, bar notification of local authorities according to local legislation.

Classification of activities:

- Transactions that are subject to notification can be concluded immediately upon notification.

- Licensed activities can be pursued only after the concession has been provided based on that commercial license, insofar as special conditions must be met as a requirement therein, such as relevant professional experience or education.

Based on the purpose of use of the cryptocurrency, the company can request one of the following licenses:

- The Classic — Sharing Among Cryptocurrencies for a Fee

- Fiat-exchange of cryptocurrencies for fiat money on commission;

- Traditional-intermediation in a currency exchange of all types;

- Specialized-certain products and services associated with cryptography-crypto-wallets, encrypted client keys, etc.

In case of failure to obtain the relevant license by crypto company, one might face the status of fraudster with fine up to 500,000 CZK (approximately 20,204 EUR) and enforced termination.

Advantages

Fast project implementation time

Possibility to purchase an off-the-shelf solution

No share capital requirement

No obligatory local staff member

Additional Benefits of CASP/VASP Licenses:

Having a CASP license in Czech Republic or VASP license in Czech Republic not only aligns with the core requirements of a Crypto license in Czech Republic but also signals to investors and partners that your company operates under a robust regulatory framework. This can lead to enhanced market credibility, improved investor confidence, and greater access to European financial markets.

HOW TO SET UP A CRYPTO COMPANY IN THE CZECH REPUBLIC

To obtain one of these four licenses, the crypto company must be registered in the Czech Republic. One of the most popular legal types of businesses in the Czech Republic is the Limited Liability Company-SRO, which has some advantages, such as low minimum equity, few founders, and it can be exempt from financial audits. It can be registered in three weeks with the condition of submitting all required documentation on time.

The main requirements for a crypto company:

Business plan reflecting the complexities and business model for business continuity and details of the financial statements

Registered physical office in the Czech Republic

Development of domestic anti-money-laundering/counter-financing of terrorism policy to ensure detection and reporting of fraudulent activities

Recruitment of an anti-money laundering officer to be trained in accordance with the company’s operating model and reporting requirements

Description of any hardware and software used for the proposed economic activity

Development of data protection procedures in accordance with GDPR and other relevant legislation, which at the same time should allow the exchange of data with authorities

Develop policies and procedures that can ensure the security of client funds

Main steps for opening SRO for crypto operations include but are not limited to:

- Verification of the name of the new company

- Receipt of a criminal record statement issued by the competent authority, proving that there are no impediments to engagement in crypto-related economic activities

- Obtaining a legal address for at least one year

- Opening of a corporate bank account

- Transfer of minimum share capital, which is only 1 CZK (approx. 0,04 EUR)

- Obtaining a compulsory trade license from the Trade license Registry

- Preparation and notarization of the founding contract

- Paying the state fees related to the registration – 6000 CZK (ca. 243 EUR)

- Registration of the firm in the Register of Enterprises and Tax Authorities

- Registration of a company with the FAA for AML/CFT reporting purposes

All necessary documentation must be submitted in the Czech language. If you need a certified translator, our team here in Regulated United Europe (RUE) will be more than happy to help.

You can also opt for a remote company formation, in which case you need to sign a power of attorney that allows your representative to act on your behalf throughout the process of creating your crypto company.

CRYPTO LICENSING PROCESS IN THE CZECH REPUBLIC

Since there is no crypto-specific license within the Czech Republic, the companies that plan to operate in crypto-based economic activities must apply general authorisation procedures through the Trade Licensing Register. In total, the whole crypto licensing process can take as long as four months, including company formation.

Generally speaking, a crypto company needs to apply to one of the general Trade Offices in the Czech language, containing all the essential information about the company and its founders. That should be accompanied by a business plan (including strategy and operations) and various background documentation.

Applications can be submitted online using a secure electronic signature, and dispatched to the central Electronic Filing Room of the Trade Register. Submissions will then be processed by the competent Trade Licensing Office specified by the applicant.

The review of an application may involve disclosure of information to foreign regulatory bodies. In the event of approval, a license is granted, though limited to specific crypto activities. It is also important to note that sometimes the license might be conditional, meaning a new licensee would have other conditions to meet before he can start his operation in the Czech Republic.

The second point, once a crypto company receives a license within the Czech Republic, the licensee will be obliged to disclose the needed reports, for example, about the clients, to the State authorities CNB and FAU. This license might be suspended in cases of errors or refusals, and then it would not be possible to obtain a new license since such a company will be deemed fraudulent.

Crypto regulation in Czech Republic

| Period for consideration |

up to 1 month | Annual fee for supervision | No |

| State fee for application |

250 € | Local staff member | No |

| Required share capital | from 0,04 € | Physical office | No |

| Corporate income tax | 21% | Accounting audit | No |

TAXATION OF CRYPTO IN THE CZECH REPUBLIC

No matter what license of trading your crypto company will apply for, it automatically will become an ordinary taxpayer in the Czech Republic. Taxation is carried out by the tax authorities. The tax year coincides with the calendar year, but companies can choose the accounting year as the tax year.

Depending on the purpose of cryptography activity, there are different tax regimes for crypto companies. Nevertheless, it differs from other businesses only in the case if specific legislation is enacted by the EU. Thus, for example, the CJEU has ruled out that for VAT purposes, cryptocurrencies like Bitcoin are traditional currency and therefore crypto exchange services-cryptocurrencies for fiat money and vice versa and a cryptocurrency for another cryptocurrency-are exempt from VAT.

Companies operating with crypto-products and related services are required to be registered as a VAT payer. The tax period for newly registered VAT payers is one calendar month.

Czech Republic standard tax rates:

- Corporate Income Tax – 19%

- Tax on branch – 19%

- Capital Gains Tax – 0 -19%

- Value Added Tax – 21%

- Social Insurance – 24.8%

- Medical insurance – 9%

Taxes are paid by resident companies based on their income, and non-resident companies have an obligation to pay the tax only for the income made within the Czech Republic. In a case when the company’s headquarters are in the Czech Republic, it is said to be a resident taxpayer. The taxable income is determined as accounting profit based on the Czech accounting rules.

Cryptocurrency licensees and their counterparts need to ensure that they will be in a position to operate within the existing tax system despite the novelty of their activities. For example, the following rules have to be taken into consideration:

- If employees are being paid in cryptocurrency, they and their employer shall pay the general taxes.

- While there might be no VAT charged on cryptocurrency firms, due to a lack of relationship between a vendor and a customer, revenues derived from operation fees are usually subject to the standard corporate income tax. As long as common product and service providers are paid in cryptocurrencies, they are taxed just like anyone else who is getting paid in fiat money.

Although crypto-related economic activity in the Czech Republic is mainly unregulated, the utilization of cryptocurrencies for tax evasion or unconscious disregard of the rules of taxation will surely bring about prosecutions because the Czech government has made it its priority to eradicate tax evasion through the anonymity of cryptocurrency owners. If you want a clear idea of your crypto company’s tax liability, our tax experts will be happy to advise you.

The good news is that licensees of crypto also can enjoy existing tax benefits and incentives. For example, qualified Czech crypto companies may be entitled to an R&D tax credit, where in general, up to 100% of the respective R&D expenditure incurred during the tax year is deducted from the tax base as a tax credit. That means that the costs are deducted twice for tax purposes-once as average tax-free expenses and once as a tax credit for R&D. To top it all, if the qualifying costs of the current tax year exceed those from the previous year, an additional 10% can be applied as a supplement.

Czech Republic

Capital |

Population |

Currency |

GDP |

| Prague | 10,516,707 | CZK | $28,095 |

REPORTING REQUIREMENTS

Crypto licensees should note that they are always under stringent corporate reporting requirements, closely aligned to the International Financial Reporting Standards.

The annual financial statements shall comprise a balance sheet, an income statement and notes. The companies for whom auditing of annual financial statements is obligatory shall also provide a statement of cash flows and a statement of changes in equity. The annual financial statements are published in the Business Register and shall be submitted with the tax return.

Auditing is obligatory for companies meeting at least two of the following criteria:

- Turnover above 80 mills. CZK approx. 3,234,413 EUR)

- Total assets above 40 mills. CZK approx. 1,617,206 EUR)

- Average number of employees above 50 persons

If you’ve decided to obtain a crypto license in the Czech Republic, our highly experienced and dynamic team of Regulated United Europe (RUE) is here to guide you through the process. We offer assistance in crypto company formation and licensing, as well as accounting services. Furthermore, we’ll be delighted to advise on taxation and corporate reporting. Rest assured, we guarantee efficiency, confidentiality as well as meticulous attention to every detail that impacts your business success. Contact us now to book a personalised consultation.

Acquiring a company in the Czech Republic which already has permission for such a license to operate a crypto currency exchange is the strategic step by entrepreneurs wishing to be part of this market as soon as possible. The process requires detailed planning, knowledge of the local legislation, and paying much attention to the legal aspect of the transaction itself. In this article, we will review the main stages of buying such a company, the requirements for buyers, and the estimated timeframe for realising such a project.

Step 1: Preliminary analysis and selection of the target company

First of all, the necessary market analysis should be done in order to reveal potential companies that already have permits to operate a cryptocurrency exchange in the Czech Republic. It would be needed to check the financial condition, reputation and history of the operations, the efficiency of the current management. The preliminary analysis should also include a review of all licences and permits, their correspondence to current legislation.

Step 2: Legal and financial audit

Following the selection of the target company, due diligence should be properly conducted. The purpose of this phase is to reveal potential risks which may be associated with the acquisition, such as debts, liabilities, disputes, and other issues. Due diligence should also confirm that all licenses are valid and up-to-date.

Step 3: Terms of Transaction negotiation

This stage involves the discussion between the buyer and seller on the transaction terms, particularly the purchase price, terms of transfer of assets and liabilities, and other vital aspects. Among the most crucial aspects which will have to be paid special attention to in view of the terms of transfer of licences and permits is the continuity of operations after change of ownership.

Step 4: Legalization of the Transaction and Transfer of Rights

After the transaction terms and conditions have been agreed on, the purchase is legalized by preparing and signing the sale and purchase agreement with the transfer of ownership rights and subsequent discharge of all the required registration procedures at applicable Czech authorities. Notarization services may be relevant in this respect and recording of changes in the Commercial Register, where proper.

Step 5: Integration and start-up

When the legal formalisation of the transaction is done, the new owner begins to integrate the firm to be acquired and begin operations. This can be internal procedure modifications, retraining human resources, and even a shift in development strategy.

Requirements of buyer

- Financial soundness: Adequate funds for buying a firm and for sustaining its operations.

- Goodwill: Clear business goodwill, no bad history in corporate dealings.

- The ability to comply with all local statutory and regulatory requirements.

Timing of company incorporation

The timing may be different for different transactions depending on the complexity of the transaction, audit time, and speed of the incorporation/registration process. Typically, the purchase and re-registration of the company takes several months to six months.

Each step of the purchase of a company in the Czech Republic with licences to operate a cryptocurrency exchange is work that demands an extremely considered approach. The described purchase is a rare opportunity for fast entry into the cryptocurrency market but requires buyers with deep financial, legal, and cryptocurrency expertise.

Navigating Crypto Compliance: The Path to a Crypto Exchange License in the Czech Republic in 2025

The cryptocurrency sector is experiencing rapid expansion, and the Czech Republic is emerging as a strategic entry point for businesses seeking to access the European market. This article provides a comprehensive guide to obtaining a crypto exchange license in the Czech Republic, outlining the regulatory landscape, the application process, and the benefits of becoming a licensed operator.

Regulatory Framework for Crypto Licensing in the Czech Republic

In the Czech Republic, cryptocurrencies are regulated by the Czech National Bank (CNB) and fall under the broader EU regulations concerning financial technology. Businesses seeking to operate legally must comply with regulatory requirements, including anti-money laundering (AML) directives and the recently implemented EU frameworks for crypto assets.

Several different licenses are available for crypto businesses in the Czech Republic.

- A licence to operate a crypto exchange in the Czech Republic permits businesses to facilitate the buying and selling of cryptocurrencies.

- A licence to operate as a crypto broker in the Czech Republic: This license permits the brokering of deals on behalf of clients.

- A licence to trade cryptocurrencies in the Czech Republic is specifically for trading activities.

VASP crypto license in the Czech Republic: The licence covers a range of services, including exchange services and custody solutions.

To obtain a crypto license in the Czech Republic, applicants must provide comprehensive documentation, including business plans, anti-money laundering (AML) policies, and proof of economic capabilities. Furthermore, rigorous assessments of operational security and compliance are essential to safeguard against cyber threats and financial crimes.

The financial implications of crypto licensing

The cost of a crypto exchange licence in the Czech Republic depends on the type of licence and the intended scope of operations. While the fees are significant, they are competitive with those of other EU jurisdictions, making the Czech Republic an attractive option for crypto businesses from a financial perspective.

The benefits of holding a crypto license in the Czech Republic

A licence raises a company’s profile, improves global financial interactions and paves the way for growth in the Czech market. The Czech crypto market offers a variety of investment opportunities. The Czech market presents several opportunities for crypto businesses, especially given the competitive pricing of crypto licenses in the Czech Republic. New entrants can leverage favourable economic policies and a dynamic tech community.

Purchasing an existing crypto exchange licence for sale in the Czech Republic may be a viable option for those wishing to enter the market more expediently. However, this route requires a thorough legal examination.

In conclusion, as the Czech Republic continues to refine its cryptocurrency regulations, obtaining a crypto exchange licence in the Czech Republic represents a crucial step for businesses aiming to establish a legitimate presence in the European crypto market. To leverage the opportunities presented by this dynamic sector, businesses must ensure compliance, prepare thoroughly, and understand the legal landscape.

Crypto License in Czech Republic 2025

Indeed, MiCA is among the most important legislative amendments that have changed the world of cryptocurrencies this year. For instance, it makes cryptocurrency financial service providers record users’ information and identification. In that respect, it promises greater security for those people who would buy or sell cryptocurrencies. Even though most of the regulation will not come into force in 2025, some parts of the regulation—like the regulation of stablecoins—are already in effect.

Another important regulation is the DORA regulation, which is focused on IT security and digital resilience and assumes new procedures in risk management and customer protection. Further, the obligation prescribed by the DAC8 directive to report all crypto transactions to financial authorities will introduce greater transparency and comparability with traditional paper currencies.

This virtual asset legislation also can be expected to be dynamic in the near future in the Czech Republic, as MiCA is not expected to come into force in the Czech Republic until 2026. Regulation MiCA was approved by the European Parliament with a view to improving consumer protection—funds and personal data against fraud and risk thereof—and adding to overall market stability. The major advantages of the directive are better transparency and security.

MiCA will put numerous demands on cryptocurrency entrepreneurs, such as have hitherto been imposed on traditional financial institutions, like banks and investment funds. For instance, companies operating in this field need to obtain a new license from state authorities which, for its part, will require conformity to high standards of IT security.

Naturally, regulation is a great opportunity for cryptocurrency financial service providers. For many companies, this is some sort of bureaucratic barrier, but MiCA is going to stabilize the world of cryptocurrencies and make it predictable, which will result in the long-term development of financial services in this field.

Taxation of cryptocurrencies in the Czech Republic In 2025

Therefore, crypto-assets are considered intangible assets, which are not classified as securities. In the case of a direct sale—or, in general, any type of exchange—cryptocurrencies should be taxed at least 15% provided that this owner is a natural person and a tax resident of the Czech Republic, and he or she makes a profit.

It is in a kind of paradox situation in view of Czech law. Because the bitcoin-ETF was approved on 10 January 2025, investors could invest in shares of this fund whose underlying asset was bitcoin, and since it was a stock, one could apply the time and value test to it. This means not to its underlying asset of bitcoins.

Amendment to the law on cryptocurrencies in the Czech Republic 2025

The politicians of the House of Representatives of the Czech Republic have in front of them the very amendment to House Press Bill No. 964, which is supposed to exempt holders of cryptocurrencies from paying income tax at all, starting from 2025. In fact, this proposal has already passed first and second readings since May and is expecting a third and final reading:

- What can be added is that the amendment proposal to the Parliamentary Press No. 694, namely clause A4, has been brought in by MPs from all over the political spectrum.

- Representatives of all the parliamentary parties are present. The competent manager is the Ministry of Finance, Minister Zbyněk Stanyura, which gave a favourable opinion on this amendment. The Budget Committee is the steering committee, which, by its resolution No. 386 of 4 September 2025, recommends that the Chamber of Deputies express its approval of the bill—with amendments. At its meeting of 8 October 2025, the Standing Committee of the Chamber of Deputies for the Control of the Financial Analysis Department also recommended that the Chamber of Deputies approve the Government’s bill—Parliamentary Seal No. 694—in wording, among others, of the above-mentioned amendment.

The proposal, therefore, complements the regulation of MiCA, which the Member States of the European Union shall apply in their legislation. It is a complete regulatory regime concerning crypto-assets, known by the acronym MiCA—Markets in Crypto-assets. To some experts, it is the most comprehensive regulatory package in the world, containing EU crypto-asset market rules with legal certainty for cryptocurrencies, stablecoins, and tokens. It pursues the protection of investors and users, by such means as making all entities in charge of crypto assets subject to a licence obligation, and the general dissemination of blockchain technology.

Seminar of the Czech National Bank on cryptocurrencies

On 11 October 2025, the Czech National Bank hosted an expert seminar on the new regulation of crypto-asset markets—MiCA—at the CNB Congress Hall.

In the introductory part of the seminar, the participants’ attention was concentrated on the new EU regulatory framework for crypto-assets. The present status of the discussion with regard to the Financial Market Digitalisation Act—an overview of the key provisions—could also be brought to the fore.

The second part of the seminar is fully devoted to selected interpretative issues arising from the MiCA regulation. In doing so, special attention was given to four topics: which activities do not fall within the MiCA regulation, the relationship between notifications and authorization requests under the MiCA, the permissibility of certain distribution schemes, and setting the boundary between crypto assets and financial instruments in relation to the forthcoming guidelines of the European Security and Markets Authority.

The third section introduced participants to the procedural and technical requirements for an applicant for a license or notification under MiCA, which are not expressly addressed under the DORA regulation. More specifically, this section addressed essentially the technical aspects related to managing and storing crypto-assets, as well as transaction and reporting process requirements.

The final part of the seminar covered MiCA licensing procedure-related issues. The presentation of license requirements was supplemented by a number of practical recommendations addressed to applicants, underlining that particular attention should be paid to the thorough preparation and completeness of the application.

Time was left at the end for questions, and several dozen were asked. Those whose questions could not be fitted in were later offered the opportunity to have an informal discussion with the speakers, which many participants took up.

Analysing crypto-asset regulation under MiCA in the Czech Republic

During the last period, active work on the preparation of the legal framework for crypto-asset regulation has been conducted within the European Union. One of the most important acts is the Markets in Crypto-assets Regulation 2023/1114 (MiCA), which provided the legislative framework for crypto-asset activities. The following article will provide analysis regarding the licensing and supervisory regime of crypto-assets as performed in the Czech Republic, in light of Regulation MiCA.

Definition and legal regime of crypto-asset activity

The MiCA Regulation classifies CASPs, ARTs, and EMTs as subjects of special regulation. Specific requirements include their authorisation, management, control, organization, and governance.

Licensing and notification procedures

CASPs are bound to start their activity after previous regulatory authorisation. The process involves a filing of the application, completeness check and a substantive one. It shall be accompanied by information on activities, prudential requirements, security of ICT, management and internal control system and mechanisms for segregation of crypto assets and customer funds.

Role of the Czech National Bank

The main body for regulation and supervision of the crypto-asset market is the Czech National Bank. The Czech National Bank is in charge of providing methodological support, licence application assessment, and supervision according to the MiCA regime and national legislation.

Regulatory framework and sources of information

Main sources of information and regulatory framework include the website of the Czech National Bank where legislation, methodologies, and opinions on financial market regulation can be found. This covers general guidance from the European Banking Authority (EBA) and European Securities and Markets Authority (ESMA) including questions and answers on regulation.

Final recommendations to applicants

Efficient and effective licensing may be best achieved by applicant preparation, the use of qualified drafting resources for the license application, and active applicant involvement in the administrative process. Development of an applicant checklist is also recommended to ensure the completeness of the application.

The actual implementation of MiCA represents a serious step toward structuring and strengthening the legal framework for dealing with crypto-assets within the European Union. The CNB actively participates in the implementation process of this regulation by creating the respective methodological and regulatory support.

Regulation of the crypto-asset market in the Czech Republic under the MiCA Regulation

Over the past years, the crypto-asset market has been a hot topic in terms of European Union regulators. The so-called MiCA Regulation—Cryptoasset Markets Regulation, which was adopted on 31 May 2023 by the European Parliament and the Council, is the very first comprehensive way to regulate this dynamic sector.

General provisions under the MiCA Regulation

The main goal of MiCA is to create a unified regime for crypto-assets throughout all EU member states. The regulation primarily intends to bring clarity over the rules to be followed by the crypto-asset issuers and service providers concerned, with a view to the protection of investors, maintenance of order in the markets, and prevention of criminal activity in the markets.

Role of the Czech National Bank

Under the MiCA Regulation, the Czech National Bank is the competent authority to regulate crypto-asset markets. It is to monitor observance of the rules and obligations laid down by the national law and the European legislation.

Transitional provisions

Transitional provisions are given to the already existing crypto-asset service providers to ease the transition. The transitional provisions allow these activities to continue up until a new license has been granted by virtue of Article 63 of MiCA, but no later than 1 July 2026.

The cornerstones of far-reaching regulation of crypto-assets in the EU and, simultaneously, in the Czech Republic are created by the MiCA Regulation and the national law represented by the ZDFT. Increased transparency, security, and stability of such markets are the natural consequences of these measures; such represents important protection of interests of all market participants.

Specific Requirements for Crypto-Asset Management under MiCA Regulation

The MiCA regulation is an ambitious European Union regulation focused on developing a standardized approach towards the crypto-asset markets. The scope of the document pertains to requirements that differ from the DORA, or Digital Operational Resilience Act regulation, in that they extend towards technological and operational aspects of managing and holding crypto-assets.

Key Technology Requirements of the MiCA Regulation

- Distributed Ledger Technology (DLT): The MiCA regulation emphasized measures concerning the use of DLT technology for the security, transparency, and safety of crypto assets.

- Crypto-Asset Management/Custody: The service provider should keep clients’ crypto assets separate from the corporate assets to reduce risks and preserve owner interests. Service providers shall safely manage the crypto asset access keys, including backup and restoration of access keys after incidents.

- Cybersecurity and Digital Resilience: Advanced cybersecurity mechanisms shall protect information and systems from attack. Periodic tests of vulnerability and swift responses to cyber threats on the systems.

- Transparency of Operations: Full transparency of transactions by service providers shall ensure that data are available for auditing and monitoring purposes.

- Transactional Processes: To develop and implement technology solutions to support speedy and efficient transaction processing, interoperability of systems shall be ensured across different blockchain platforms and technologies.

Application and Compliance

The MiCA Regulation will introduce a relevant obligation for all market participants to adhere to the technology standards, regularly review them, and audit them to confirm compliance, including independent assessment and reports on regulatory compliance.

The MiCA Regulation lays down, under a quite strict regime, the specific managerial modus vivendi to be exerted in the field of crypto asset management, due to its high technical expertise and responsibility. These limits were brought in as one of the very key steps necessary to regain stronger user confidence and more security in crypto-asset investments across the EU.

Unregulated Aspects of the Crypto-Asset Market and Their Impact on the Regulatory Space

Although the Markets in Crypto-assets Regulation has come into place, there are certain activities related to crypto-assets that remain unregulated. Due to this, significant legal uncertainties arise, and debate pertaining to whether these activities should be regulated or not is ongoing. This article discusses the main aspects of crypto-asset-related activities that remain unregulated and their impact on the market.

Unregulated Crypto-Asset Activities

- Crypto-asset lending and staking: Generally speaking, these activities are outside the scope of MiCA regulation. Crypto-asset staking and lending is the activity whereby holders of crypto-assets can earn interest or other forms of rewards for participating in blockchain transactions.

- Decentralized Finance (DeFi): DeFi refers to an ecosystem of financial applications built on blockchain with no intermediaries involved. The majority of its aspects—such as smart contracts and decentralized exchange platforms—are outside the scope of MiCA regulation.

- Crypto-asset mining: Cryptocurrency mining as such is still not within the scope of the MiCA Regulation, as the process itself does not include any financial services or issuance of tokens as defined by the Regulation.

- Manufacturing and supplying hardware: Designing, making, and selling hardware and software to mine cryptocurrencies does not fall within the ambit of MiCA either.

Legal Risks and Challenges

It is precisely the lack of regulation that results in legal uncertainty, which has the potential to affect consumer protection and generally influences the stability of the entire financial market. For example, if a DeFi platform has crashed or there is some loss of crypto-assets via fraud, it may be quite difficult for market participants to seek compensation on grounds that such transactions are not covered by traditional financial regulations.

In particular, unregulated crypto-asset activities should be of interest to regulators in a bid to address legal lacunas and afford further protection to the market participants. The extra regulation will add to the safety and stability of the market environment for all participants.

Whether you refer to it as a Crypto license, CASP license, or VASP license in Czech Republic, the unified regulatory framework ensures that your business is well-positioned for success in the European crypto market.

“Establishing a business in the Czech Republic is a streamlined process, indicative of its welcoming business environment. As a specialist in this field, I am well-equipped to assist you. Feel free to reach out for more information or guidance.”

FREQUENTLY ASKED QUESTIONS

Does Czech Republic grant a licence for crypto activities?

Yes. In Czech Republic, crypto companies may apply for 4 different types of crypto licence. The type of licence depends on the activities that a crypto company is looking to provide.

How do I get a crypto license in Czech Republic?

In order to obtain a crypto license in Czech Republic, crypto companies must go through the application process with the Financial Analytical Office (FAU)

What are the activities of the crypto license in Czech Republic?

As briefly noted above, there are 4 types of crypto licence in Czech Republic:

- Classic

Holders of a classic crypto licence may offer exchange between virtual currencies for a fee.

- Fiat

Holders of a fiat crypto licence may offer exchange between cryptocurrencies and fiat money for a fee.

- Traditional

This licence type combines types 1 and 2. Holders of a traditional crypto licence may offer intermediation in the exchange of cryptocurrency for fiat money and one cryptocurrency for another.

- Specialized

This licence type authorizes crypto business work. It is necessary for crypto companies that want to offer crypto wallet services or create and store encrypted client keys.

How long does it take to get a license?

Due to a straightforward process of establishing a company and applying for a crypto licence in Czech Republic, the process of obtaining a licence may last as little as 3-4 weeks.

Can non-residents of Czech Republic own a crypto company?

Yes. Czech Republic crypto companies can be established by any natural person or physical entity. No specific residence restrictions apply.

Can non-residents of Czech Republic be part of the board of a Czech Republic crypto company?

Yes. A crypto company in Czech Republic must have 1 director. No specific residential requirements apply.

What is the minimum authorized capital for a virtual currency service provider?

In order to apply for a crypto license in Czech Republic, it is necessary to first incorporate a crypto company. Minimum authorized capital for limited liability companies (S.R.O.) in Czech Republic is 1 CZK (around 0,04 EUR).

For how long is a crypto-license issued?

In Czech Republic, crypto licenses are issues for an indefinite period.

How is the charter capital of a crypto company paid in?

Charter capital must be paid in to either the bank account of a crypto company, or its cash desk.

When do you need to deposit capital to open a company and obtain a crypto-license in Czech Republic?

This step is subject to a flexible deadline. Companies can complete it either before the time of incorporation, during the registration process, or even shortly after. When it comes to applying for a crypto licence, however, this step must be completed for the application to go through.

What does a crypto company need to apply for a cryptographic license in Czech Republic?

In order to successfully apply for a crypto license in Czech Republic, crypto companies must complete the following steps:

- Open a corporate bank account

- Pay the authorized capital

- Employ a Czech Republic AML officer with experience in anti-money laundering and terrorism financing compliance.

- Apply for a licence with the Financial Analytical Office (FAU)

Why you should get a crypto license in Czech Republic?

Amongst many other EU member states who offer crypto licenses, Czech Republic stands out due to its loyalty to EU regulation. The country does not apply any additional restrictions on its own. Together with low corporate taxes and an generally good conditions for business development in the country, Czech Republic is a very appealing place for establishing and running a crypto business.

Are Czech Republic cryptocurrency companies audited?

Yes. Crypto companies in Czech republic are audited if they meet two or more of the following conditions:

- Turnover exceeds 80 mill. CZK (approx. 3,234,413 EUR)

- Total assets exceed 40 mill. CZK (approx. 1,617,206 EUR)

- Average number of employees is over 50

Can the director of a crypto company be a non-resident of Czech Republic?

Yes. Crypto companies in Czech Republic must have 1 director. No residential restrictions apply.

When are measures to prevent money-laundering and the financing of terrorism applied in Czech Republic?

In order to internally ensure anti-money laundering and terrorism financing compliance, crypto companies must hire a Czech Republic AML officer who will check the organization for exposure of criminal risk and financial crime. In addition (subject to certain criteria indicated above) companies may be subject to an external audit.

Where can I open a bank account for a Czech Republic crypto company?

Crypto businesses in Czech Republic must open a corporate account in any European payment system.

Purchase of Ready Made Licensed VASP in Czech Republic

The acquisition of a turnkey, licensed VASP company in the Czech Republic represents a strategically advantageous step for entrepreneurs wishing to enter the European cryptocurrency market. This approach allows you to avoid lengthy and complex procedures for obtaining a new license and immediately begin operations, relying on an already established regulatory and operational framework.

Firstly, the process of licensing a new VASP company can be slow and requires significant effort and additional checks by a notary in the Czech Republic. Purchasing a ready-made licensed company eliminates the need to go through all stages of inspections and approvals, which is especially important in the context of constantly changing legislation and regulatory requirements, such as the upcoming introduction of MiCA regulation.

The acquisition of a ready-made licensed VASP company in the Czech Republic is an effective way to quickly start and confidently conduct a cryptocurrency business in the European market, minimizing initial risks and costs.

VASP license in Czech Republic 2025

The VASP (Virtual Asset Service Provider) license in the Czech Republic has several significant advantages over similar licenses in other European countries, making it an attractive option for companies operating in the cryptocurrency space.

One of the main advantages is the relative ease and speed of obtaining a license in the Czech Republic compared to other EU countries, where procedures can be longer and more expensive due to strict regulatory requirements. Czech regulators are offering a clearer licensing process, which reduces administrative barriers to entry into the market.

In addition, the regulatory environment in the Czech Republic is characterized by a high degree of stability and predictability. The government actively supports the development of fintech and blockchain technologies, which creates favorable conditions for investment and business development. This contrasts with some other jurisdictions (such as Estonia and Lithuania), where frequent changes in legislation can create additional costs and uncertainty for businesses.

The Czech Republic also offers favorable tax conditions for technology companies, including low corporate tax rates and incentives for innovative projects. These factors make the Czech Republic attractive to cryptocurrency companies looking to maximize their profits and minimize costs.

In addition, the Czech Republic has a developed financial infrastructure and qualified specialists in the field of IT and finance, which provides companies with access to high-quality resources to develop and support their products.

The combination of these factors makes the Czech Republic one of the most preferred places to obtain a VASP license in Europe. The relative ease of doing business, government support, favorable tax conditions and qualified resources create strong incentives to choose the Czech Republic as a jurisdiction for registering and operating a cryptocurrency business.

Crypto trading company in Czech Republic

Opening a cryptocurrency trading company in the Czech Republic begins with determining the legal form of the business, the most commonly used form is a closed joint stock company (s.r.o.). This choice is due to a convenient corporate structure, relatively low requirements for authorized capital and clearly defined responsibilities of the founders.

To register a company, it is necessary to prepare constituent documents, including the charter and articles of association, which must be certified by a notary - all these procedures could be done completely remotely. Then you should register the company in the Trade Register of the Czech Republic, the process takes several days and is also possible without visiting the Czech Republic.

It is also necessary to take into account the tax aspects of doing business. The Czech Republic offers relatively low corporate tax rates, but potential tax liabilities associated with cryptocurrency transactions, such as VAT and income tax, should be carefully considered.

For the company's operating activities, it is important to establish payment systems and technological infrastructure. A high level of transaction security and customer data protection should be ensured. In addition, our company recommends investing in reliable IT solutions and compliance with international security standards.

In addition to core activities, it is important to pay attention to marketing and customer acquisition. An effective advertising strategy and quality customer service will increase the company's competitiveness in the market.

Opening a cryptocurrency trading company in the Czech Republic requires careful planning and consideration of many factors, from corporate structure to technological infrastructure and tax planning. A comprehensive study of the market and legislation will help minimize risks and speed up the launch of a business.

Additional services for Czech Republic

RUE customer support team

“Hi, if you are looking to start your project, or you still have some concerns, you can definitely reach out to me for comprehensive assistance. Contact me and let’s start your business venture.”

“Hello, I’m Sheyla, ready to help with your business ventures in Europe and beyond. Whether in international markets or exploring opportunities abroad, I offer guidance and support. Feel free to contact me!”

“Hello, my name is Diana and I specialise in assisting clients in many questions. Contact me and I will be able to provide you efficient support in your request.”

“Hello, my name is Polina. I will be happy to provide you with the necessary information to launch your project in the chosen jurisdiction – contact me for more information!”

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

Registration number: 08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00 Prague

Registration number: 304377400

Anno: 30.08.2016

Phone: +370 6949 5456

Email: [email protected]

Address: Lvovo g. 25 – 702, 7th floor, Vilnius,

09320, Lithuania

Sp. z o.o

Registration number: 38421992700000

Anno: 28.08.2019

Email: [email protected]

Address: Twarda 18, 15th floor, Warsaw, 00-824, Poland

Europe OÜ

Registration number: 14153440

Anno: 16.11.2016

Phone: +372 56 966 260

Email: [email protected]

Address: Laeva 2, Tallinn, 10111, Estonia