Crypto Regulation in Czech Republic 2025

For AML/CFT purposes, the following subjects are supervised by the Financial Analytics Office – FAU. The authority closely cooperates with the Czech National Bank (CNB) responsible for the general supervision of the financial market in the Czech Republic. Other national regulatory authorities include the Czech Inspection Authority and the Ministry of Finance.

CNB does not consider cryptocurrencies to be a legal tender but rather classifies them as commodities. It has its legal basis in the already standing legislation that led to the very conclusion that crypto data stored on blockchain does not constitute claims denominated in traditional national currency issued by a central bank, credit institutions, or other payment service providers. Article 4(1) of the Payment System Act states that cryptocurrencies are not viewed as electronic money. According to Article 2(1)(c) of the Payment System Act, they also do not represent funds.

Cryptocurrency Licence in Czech Republic in 2025

AML/CFT LEGISLATION IN CZECH REPUBLIC

The most significant legislation regarding crypto firms in the Czech Republic has been from the EU. According to the security summary of Internet payments and cryptocurrency, published in 2018 by CNB, all such firms operating in the Czech Republic are obliged to adhere to EU legislation.

Although crypto activities in the Czech Republic are largely unregulated, the authorities have maintained transparency as a key operational principle by transposing the 4AMLD, the Fifth Anti-Money Laundering Directive (5AMLD), and the Sixth Anti-Money Laundering Directive (6AMLD), which obliges cryptocurrency exchanges and crypto purse providers to apply strict internal AML/CFT procedures. These directives address standard due diligence, information gathering, recording and retention, AML/CFT risk assessment, ultimate beneficial ownership, and reporting of suspicious transactions; perform customer transactions and apply enhanced customer due diligence for customers resident in high-risk countries.

In fact, national authorities have gone even further, covering a wider range of economic activities related to cryptography. It follows that the businesses to which AML/CFT applies are those trading, storing, managing, or mediating the purchase or sale of virtual currencies, or offering other cryptography-related services. In this context, virtual currency is defined as a digital unit that does not fall into the category of fiat money but is still accepted as a means of payment for products and services by persons who are not issuers of the unit.

The following anti-money laundering/terrorist financing laws apply to companies involved in crypto-related economic activities in the Czech Republic:

- AML Act (Act 253/2008 Coll.) sets the principles of the AML/CFT.

- Money Laundering Ordinance (Decree No 281/2008 Coll.) sets requirements for corporate policy and procedures in the area of combating money laundering/terrorist financing.

- Criminal Code (Law No. 40/2009 Coll.) defines criminal acts.

- Act on International Sanctions (Act No. 69/2006 Coll.), which stipulates the conditions under which international sanctions are imposed.

To comply with the AML/CFT regulations, crypto companies shall undertake the following:

- Gathering and processing disclosure of ultimate beneficiaries (owners DOE) of the companies/institutions who are originators of transactions.

- Reporting of suspicious transactions and customers.

- Drawing up reports, if necessary, at the request of authorities.

- Be ready to share information with regard to cross-border transfers.

Following the Directives of the EU, their transposition into the law system of the Czech Republic requires that every crypto company collects at least the following information from their customers to conduct the procedures of KYC:

- Natural persons – name, number of birth certificate, date and place of birth, address of residence, nationality, and in case of a person with business, name of the company, business address, and information on corporate identity.

- Companies: company name, address of headquarters, identification data, including data of beneficiaries.

- Institutions without legal personality: denomination, identity of the administrator or equivalent.

Failure to comply with AML/CFT obligations/requirements is therefore a crime and hence punishable with such measures as the termination of activity, expropriation of property, fine, and publication of judgment. The measure required in law would depend upon the particular prudent consideration of the nature of the violation and the type of person responsible.

Advantages

Fast project implementation time

Possibility to purchase an off-the-shelf solution

No share capital requirement

No obligatory local staff member

OTHER CRYPTO-RELATED LEGISLATION IN CZECH REPUBLIC

Czech crypto companies should also make sure that they are aware of where their activities should fall within the current regulatory framework of the financial market and follow relevant rules. Depending on the nature of the economic activity, the following laws may apply:

- The Trade Licensing Act (Act No. 455/1991 Coll.)

- The Act on Banks (Act No. 21/1992 Coll.)

- Act on Capital Market Undertakings (Act No. 256/2004 Coll.)

- Act on Management Companies and Investment Funds (Act No. 240/2013 Coll.)

- Act on Insurance (Act No. 277/2009 Coll.)

The following are crypto-related economic activities, with a basis in general legislation, dependent on authorization by the NSC, such as:

- Trading in crypto-derivatives, inasmuch as they possess the attributes of investment instruments, requires an investment firm license;

- Custody of assets of investor funds invested in cryptocurrency, whether such funds are publicly offered or offered only to a limited group of investors.

- The transfer of money in the body of a deal with cryptocurrencies, for example in cryptoexchange activity, in case of a transfer by a person of non-cash money or electronic means and provided that such transfer has features of provision of payment services, namely transfer of funds from accounts of clients of such exchange to the payment accounts specified by such clients.

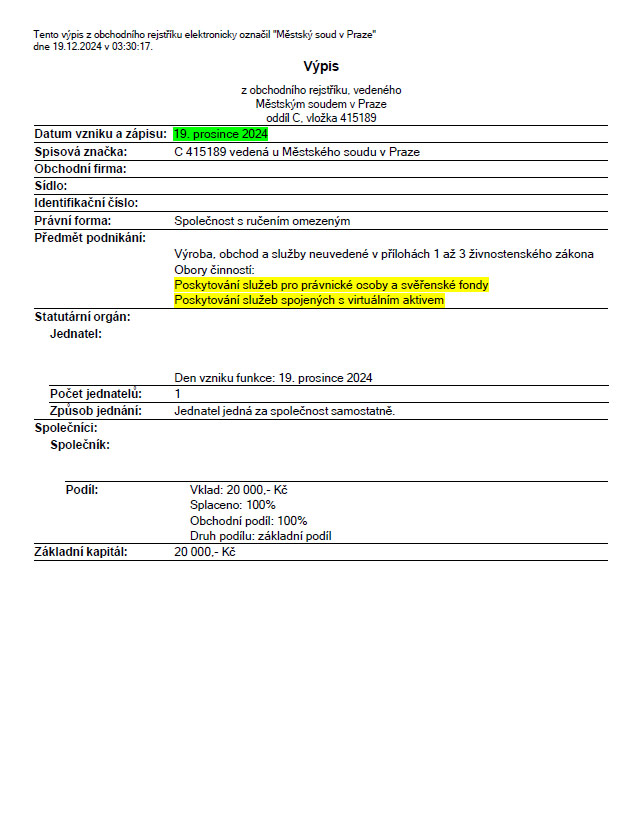

CRYPTO COMPANY FORMATION IN CZECH REPUBLIC in 2025

First, of course, a license requires a company to be established in the Czech Republic. One of the most common forms of a legal business structure is the Limited Liability Company-SRO, which can generally be established within three weeks by one or more shareholders. Its advantages include very low minimum required share capital, possible exemption from auditing, and fewer rules compared to other legal entities.

Documents to be presented for the purpose of a crypto company establishment:

- Memorandum of association

- Business plan with detailed financial reporting and business continuity business model

- Documents related to the biography of founders and directors of companies, like a police record, education, etc.

- Description of the hardware and software to be used in conducting the licensed crypto activities

- A letter from the bank, which authorizes depositing equity

- Copy of a relevant trading license

All the documentation required should be in the Czech language. In the case of any certified translator, we at RUE are happy to assist.

Following steps are must for any Crypto Company willing to operate either in or from the Czech Republic:

| Requirement |

|---|

| Registered premises in the Czech Republic for at least one year; |

| Recruitment of staff in the Czech Republic; |

| Appoint at least one resident or non-resident director with healthy and suitable relevant educational and professional experience, and no criminal record; |

| Create clear internal AML/CFT policies for identifying and reporting suspicious activities and customers; |

| Appoint an anti-money-laundering officer who would be capable of being properly trained and prepared for reporting to the relevant authorities; |

| Establish procedures for exchanging data and protection under national and EU legislation; |

| Safeguarding of Client Funds: Policy Development; |

Registration Process of a New Crypto Company, in brief:

- Verification of the name of the new company

- Opening a corporate bank account

- Transfer of the minimum share capital, which is only 1 CZK (approx. 04 EUR)

- Payment of state fees related to registration – 6000 CZK (ca. 243 EUR)

- Obtaining a compulsory trade licence from the trade licence register

- Registration of a company in the Business Register

- Registration with the Social Security Office, selected insurance companies and tax authorities

- Company registration in the FAA for AML/CFT reporting purposes

To incorporate a company remotely, you will have to sign a power of attorney which will enable your representative to act on your behalf in the process of incorporating your crypto company. If that works for you best, we can assist you with it.

Crypto regulation in Czech Republic

| Period for consideration |

up to 1 month | Annual fee for supervision | No |

| State fee for application |

250 € | Local staff member | No |

| Required share capital | from 0,04 € | Physical office | No |

| Corporate income tax | 21% | Accounting audit | No |

HOW TO OBTAIN A CRYPTO LICENSE IN CZECH REPUBLIC

Although the Czech authorities have not developed any complicated process of licensing cryptocurrencies, this does not exempt companies from the obligation to obtain a license prior to their operations in the Czech Republic.

Currently, most of them are forced to get one of the standard trade licenses from the Trade License Register. The application is relatively easy, and it opens the door to operations in other EU countries, too, including opening branches without needing to go through interminable bureaucratic procedures if they notify local authorities in conformity with local regulations.

Activities fall into the following categories:

Trade subject to notification may be carried out immediately upon notification, while permitted trade may be carried out upon the concession granted in light of a special commercial license if this serves to meet certain conditions, such as relevant professional experience or education.

Licenses available for crypto companies come in several forms, and some of them are the following:

- The Classic — Sharing Among Cryptocurrencies for a Fee

- Fiat-commission-based exchange between cryptocurrencies and fiat money

- Traditional-intermediation services in the exchange of currencies of all types

- Specialized-particular products and related services with cryptography, crypto-wallets, encrypted customer keys, etc.

By virtue of the principle of possible access, EU/EEA crypto licensees are not obliged to obtain a Czech license but are deemed satisfied by the formality of a notification to the Czech authorities, accompanied by a passport.

This may take as long as four months and also covers the incorporation of any new company. All applicants will be subject to general permitting procedures under the Trade Licence Register.

Applications shall be addressed to the central electronic register electronic filing cabinet, signed with the secure electronic signature by the managing director(s). Applications are processed by the competent Trade Licensing Authority of the applicant’s choice.

The following documents and information shall be attached to the application:

- Legal documents and detailed information concerning the qualification company

- Identification documents of the founders, the directors, and the shareholders

- Certificates confirming no criminal record, unpaid taxes, and debts were issued

- Business plan which included strategy and operational policies and procedures

It is expected that all the information furnished would, in all probability, be forwarded to the concerned international supervisory authorities so that an assessment regarding the suitability of the applicant can be made for engaging in licensed crypto activities. Applicants who succeed with their application are granted a license to undertake activities only as authorized by the Trade Licensing Authority. In cases where conditions are attached to the license granted, the licensee can commence the crypto activities only upon complying with conditions so laid down by the authority.

The law binds all licensees upon request to make reports to any regulatory body, and failures to do so may mean suspension of the license on grounds of fraudulent activity.

Please note that the criminal offense consists in initiating a licensed crypto activity without permission. A crypto company with unauthorized operations might be treated as fraudulent and/or receive a fine up to 500,000 CZK (ca. 20,204 EUR) and be forced to stop its activities.

CRYPTO COMPANIES SUPPORT IN CZECH REPUBLIC

Despite the fact that the government has a very liberal approach to crypto business, Czech crypto startups and maturing companies are given a chance to request support from the government, related and non-governmental initiatives. Startup accelerators and incubators support crypto product development, marketing, and sales.

The contact point FinTech CNB first serves all crypto companies in the Czech Republic, provided they can explain how their product or service fits within the definition of financial innovation. The contact point shall also provide a communication channel optimized to improve the functioning of innovative financial market participants. Qualified companies can get regulatory advice via a contact form. Nonetheless, it in no way replaces professional legal advice, and we encourage you to address yourself to our group of experts with specific legal advice.

For financing and other substantial business issues, you may use the following programs:

- CzechInvest, a state agency, offers a seven-month incubator program of CzechStarter with financing to startups, including attendant seminars and expert consulting.

- Blockchain Connect Association/ Czech Alliance, which aims to accelerate the development and promotion of blockchain technology throughout the country to combat fraud and corruption – this should build confidence in innovative financial solutions.

- Cryptoanarchy Institute for Promotion of a Decentralized Economy with Unlimited Dissemination of Information and Widespread Introduction of Such Cryptchain-Based Products and Services.

TAXES ON CRYPTOCURRENCIES IN CZECH REPUBLIC

They should be able to make crypto firms conduct their activities seamlessly under the current tax system, which is being taxed accordingly based on the nature of activities that might fall under different sets of common law. They shall not be treated any different from other enterprises unless certain rules get repealed by EU legislation.

The tax authorities collect and collect taxes on behalf of the Czech government. Though the tax year is concurrent with the calendar year, companies are at liberty to apply the accounting year regarding taxes as their tax year.

Generally, crypto companies are obliged to pay the following taxes:

| Tax Type | Rate |

|---|---|

| Corporate Income Tax (CIT) | 21% |

| Branch Tax (BT) | 19% |

| Capital Gains Tax (CGT) | 0%-19% |

| Value Added Tax (VAT) | 21% |

| Social Security Insurance (SSI) | 24.8% |

| Health Insurance (HI) | 9% |

On the other hand, the Court of Justice of the European Union stated in a judgement that for VAT purposes, cryptocurrencies such as Bitcoin need to be regarded as traditional currency, and therefore crypto exchange services are outside the scope of VAT. All other types of crypto products and services shall be obliged to be registered as a VAT payer. The tax period for newly registered VAT payers is one calendar month.

Whereas the resident companies are taxed on their income around the world, the non-resident companies are taxed in respect of income earned in the Czech Republic alone. A company shall also be considered a resident taxpayer when its head office is in the state or in case of ultimate management and control by shareholders. It is possible for tax residents to shield their tax revenues in two states by means of about 80 international double taxation elimination agreements.

AUDITING REQUIREMENTS

Currently, general rules of audit apply to crypto companies. The approach depends on the purpose for which they were held – since there is no universally accepted definition, they may be held as financial assets, reserves, or even derivatives. Once the management of the company has reached a decision on cryptocurrencies classification, they are to make sure this consistently reflects in the financial statements disclosed.

Auditing is, under the conditions stipulated by law, obligatory for companies that at the same time meet at least two of the following criteria:

- Turnover higher than 80 mill. CZK approx. 3,234,413 EUR

- The total assets higher than 40 mill. CZK approx. 1,617,206 EUR

- Average number of employees higher than 50

Those companies that have the obligation to file audited financial statements should also lodge a cash flow statement and a statement of changes in equity. The annual financial statements are to be published in the Business Register and filed together with the tax declaration.

If you think that the Czech regulatory framework could help you reach success in this innovative and profitable market, then our experienced and dynamic team RUE will help orient you according to the rules. We are perfectly prepared for advice on company formation, licensing, taxation, and reporting. We provide detailed accounting services, tailored to your needs. Efficiency, privacy, and awareness of each detail which may affect the success of your business are assured by each member of our team. Never be afraid to contact us and set an appointment for consultation.

ESTABLISH A CRYPTO COMPANY IN THE CZECH REPUBLIC

Located almost in the heart of Europe, the Czech Republic was famous for its strategic position and for the well-developed and open economy, where foreign entrepreneurs enjoyed equal rights as a Czech citizen. Now, the process of forming a crypto company is almost identical to the formation of any other type of business, except for the additional level of compliance related to AML/CFT.

The following advantages distinguish the Czech business environment:

- Powerful and rapidly growing economy; the economy grew by 3.5% in 2021.

- The Czech Republic is a part of the EU, meaning you will have access to the EU Single Market.

- Supportive government-endorsed investment incentives for innovative startups, for instance, through the Entrepreneurship and Innovation Operational Programme.

- Well-educated and skilled but affordable labor force.

- The Czech Republic ranked 41st among 190 countries in the World Bank’s Ease of Doing Business 2019 ranking, which gives evidence of a quite friendly business climate (based on the easiness of opening and financing an enterprise and eventually conducting economic activity).

All business companies based in the Czech Republic fall under the scope of the Commercial Corporations Act 2012 and address a wide scope of issues concerning the incorporation and activities of the following six types of business entities.

The State Business Register of Czech Companies is kept by the Registration Court and is managed by the Ministry of Justice according to Law 304/2013.

In terms of AML/CFT supervision, financial market participants are overseen by the FAU, which closely cooperates with the CNB responsible for general supervision of the financial market of the Czech Republic. Other national regulators include the Czech Inspectorate and the Ministry of Finance.

Types of business entities

If one is about to establish a fully licensed crypto business in the Czech Republic, one of the first things that come into consideration will be an appropriate business structure. Several business structures are at disposal, but the most common ones include a Limited Liability Company, S.R.O., and Joint Stock Company, A.S.

Regardless of the type of business structure, each crypto company has to meet the requirements in relation to the following:

- Develop internal AML/CFT policies, providing the identification of customers and reporting to the relevant authorities fraudulent activities.

- Detection and acquisition of an office in the Czech Republic.

- Recruitment of full-time staff in the Czech Republic.

- Appoint an anti-money laundering officer who will undergo training according to the needs determined by the Company’s operating model and reporting.

- Development of data protection procedure on the basis of GDPR and other applicable legislation which should provide unhindered safe data exchange with authorities.

- The establishment of policy and procedures on the security of the clients’ funds.

- All accounts records to be in Czech.

Requirements for Directors:

- A company director can be either a natural person or another company.

- In case of a foreign citizen company director, he/she does not need a residence visa in the Czech Republic for his/her registration as a Company Director.

- Criminal record.

- Full legal capacity.

- No statutory bars to prevent a person from trading under trade licensing.

Any document that may be required for the formation of the company should be presented in the Czech language. In case you need a certified translator, our team here in Regulated United Europe (RUE) will be more than glad to assist.

Limited Liability Company – S.R.O.

The most popular form of legal business type is the Limited Liability Company – S.R.O., which can be typically set up within three weeks. Its advantages are very low minimum share capital, possibility of exemption from audit, and less regulation than comparing with other legal types.

| Section | Details |

|---|---|

| Basic characteristics of Limited Liability Company – S.R.O. | The name of the company shall include “Společnost s Ručením Omezeným”, or its abbreviation Spol. s r.o. or S.R.O. Minimum share capital – 1 CZK (approx. 0.04 EUR) per shareholder. A different type of share may have another amount of contribution. At least one shareholder who may be a natural person or a legal person, and in case of a foreigner, the residence permit is needed. Class shares for shareholders. The liability of the shareholders is limited up to the amount with which they haven’t paid their contribution obligation considering the records of the Business Register at the date in which a creditor demands the satisfaction of his claim. At least two resident or non-resident directors, fit and proper: appropriate education and work experience in the financial market; no criminal convictions. |

| Documents filed for the incorporation of an S.R.O. | Memorandum of Association. Business plan-sketch, financial statements, and operational structure. Proof of identity for shareholders and statutory directors of the firm. Proof of lack of criminal records for every shareholder and director issued by a competent authority proving that there are no obstacles to engage in crypto-related economic activities, education diplomas of shareholders and directors. Hardware and software description to be used for performing licensable crypto activity/ies. Bank document allowing depositing of the share capital. Copy of relevant trade licence. |

| Memorandum of Association shall include: | Trade name of the company. Description of the company’s economic activities. Information on the shareholders: identification, residential address or head office address. Type of shares held by each member and particular rights and responsibilities relating to those shares, in cases when several types of business shares have been defined. Amounts of contributions related to the business shares, including obligations of each shareholder and relevant deadlines. Contribution administrator details. The amount of authorized capital. Number and identification details of the company’s directors and a description of their roles. Non-monetary contributions – description, valuation, amount applied towards the issue price. Details of the person appointed as an expert to evaluate the non-monetary contributions. |

| Statutory Audit Requirements | A Limited Liability Company – S.R.O. is required to perform a statutory audit, subject to at least two of the following amounts having been exceeded during both the current and preceding year: The net turnover – CZK 80 million (approx. 3 million EUR). Total assets – CZK 40 million (approx. 1.6 million EUR). Average number of employees – 50 persons. |

What to Do

Either you visit the Czech Republic or you select a distance education company; in that case, you will have to sign the power of attorney, which will enable your representative to act on your behalf during the whole process of crypto company establishment. If you decide to do that, then contact our legal experts and learn what to do next.

With this, a crypto company can be established in as quick as four months with an obtained trading license.

The steps for the process of establishing a licensed cryptocurrency company in the Czech Republic are as follows:

- Checking the name of the company, reserving it.

- Obtaining a legal address for at least one year.

- Preparation and notarization of constituent documents.

- Opening of a corporate bank account in the Czech Republic.

- Transfer of basic share capital to the new bank account.

- Pay the registration fee with the state – 6000 CZK (ca. 243 EUR).

- Registration of the company in the Business Register.

- Application for mandatory trade license from the Trade License Registry.

- Registration of a firm with fiscal authorities.

- Registration of your company with FAU due to AML/CFT reporting.

A reliable regulatory framework for business cryptocurrency has not yet been established in the Czech Republic. However, each crypto company is obliged to obtain a usual trading license from the Trade Licensing Register before the beginning of a business.

Depending on the purpose of using cryptocurrency, the company may apply for any of the following licenses:

- The Classic – Sharing Among Cryptocurrencies for a Fee.

- Fiat – exchange between cryptocurrencies and fiat money on commission.

- Traditional: it intermediates the exchange of currency of any type.

- Specialized: specific products and services regarding cryptography, crypto-wallets, encrypted client keys, etc.

Czech Republic

Capital |

Population |

Currency |

GDP |

| Prague | 10,516,707 | CZK | $28,095 |

Taxation of Crypto Companies in the Czech Republic

Taxes in the Czech Republic are levied and collected by the Tax Offices. Whereas the tax year in principle coincides with the calendar year, companies can adopt an accounting year as the basis for a tax year.

Czech Crypto companies are subject to paying the following general taxes:

| Tax Type | Rate |

|---|---|

| Corporate Income Tax (CIT) | 21% |

| Branch Tax (BT) | 19% |

| Capital Gains Tax (CGT) | 0%-19% |

| Withholding Tax (WHT) | 15% |

| Value Added Tax (VAT) | 21% |

| Social Security Insurance (SSI) | 24.8% |

| Health Insurance (HI) | 9% |

Since cryptocurrencies are not viewed as legal tender, therefore it will be advisable to classify it under other inventory. The revenues generated from cryptocurrencies shall be presented as other revenues.

Resident tax companies pay the tax on income received both in the Czech Republic and abroad. Non-resident companies have to pay taxes only from the income obtained in the Czech Republic. If a company is registered or its head office is located in the Czech Republic, then it is a resident taxpayer.

Our team of dedicated highly qualified lawyers will be happy to provide individual, additional support in creating a fully authorized cryptocurrency company in the Czech Republic. From the very beginning of the process, you will receive the support of experts on the creation of companies, the rapid development of legislation on AML/CFT and taxation. Moreover, we will be very happy if we can help you with financial accounting services. Contact us today to get a personal offer.

Crypto Regulation in the Czech Republic 2025

Cryptocurrency business is legal in the Czech Republic, and its activity falls under the general legislative framework, which includes The Trade Licensing Act, The Act on Capital Market Undertakings, and other laws of the Czech Republic. Still, with new EU regulations in place, it is necessary to turn one’s attention to what will change for all member states in due time.

| Topic | Details |

|---|---|

| New EU Rules Applicable to the Czech Republic | The Government of the Czech Republic is obliged to comply with all EU regulations improving crypto regulations. The Markets in Crypto-Assets (MiCA) regulation has been cleared in 2022 and will be implemented by the end of 2025, aiming to establish legal certainty while excluding decentralized finance and non-fungible tokens. |

| Environmental Responsibilities | New rules will require major crypto-asset service providers to disclose energy consumption on their websites and report it to national authorities. ESMA will adopt necessary regulatory technical standards. |

| Regulation of Stablecoins | Stablecoins will be overseen by the European Banking Authority (EBA), requiring issuers to maintain an adequate liquid reserve at a 1:1 ratio, partially in deposits, ensuring stablecoin holders can claim their assets at any time. |

| Anti-Money Laundering Checks | MiCA does not replicate AML requirements, but the EBA will maintain a public register and conduct enhanced AML checks on noncompliant CASPs, especially those with parent companies in high-risk jurisdictions. |

| Innovative Projects Support | The DLT Market Infrastructure Regulation-Pilot Regime (PDMIR) allows a single legal system for trading cryptoassets qualified as financial instruments under MiFID 2, enabling safe testing of new technologies until 2026. |

| Crypto-Friendly Environment | The Czech Republic remains friendly to cryptocurrency companies, researchers, and enthusiasts, hosting events like the European Bitcoin Conference to foster networking and business partnerships. |

You should also note that the support is offered beyond the events by the following local initiatives:

- CzechStarter – a seven-month incubator programme offered by CzechInvest, a government-backed agency, where startups can break through the Czech market and grow beyond the borders by receiving funding, as well as participating in workshops and receiving advice from experts.

- Technology Incubation project – another CzechInvest’s project, backed by the Ministry for Science, which over the next five years should support up to 250 innovative startups by providing funding of 850 mill. CZK (approx. 35,4 mill. EUR) in seven key areas.

- FinTech contact point by the Czech National Bank (CNB) – a streamlined communication platform with a dedicated contact form, designed to improve the functioning of the innovative financial market startups.

- The Blockchain Connect Association/Czech Alliance – an organisation promoting the development and use of blockchain technology across the country, as well as combating fraud and corruption in the financial industry.

- The Institute of Cryptoanarchy – an organisation that aims to promote the growth of the decentralised economy by focusing on unrestricted dissemination of information and large-scale adoption of blockchain-based products and services.

Cryptocurrency Licence in the Czech Republic in 2025

An application for a Czech cryptocurrency licence in 2025 will also be submitted for a standard trade licence issued by the Trade Licensing Register. It involves filling out, online, the state application form in Czech with the name of the crypto company and founders. Following this, the application is enriched with a state application fee of 6,000 CZK, about 240 EUR, for consideration by the general Trade Office.

The following types of trade licenses are provided in 2025:

- Classic-with exchange of cryptocurrencies for a commission

- Fiat-for exchanging cryptocurrencies and fiat money for commission

- Traditional-for intermediation in the exchange of currencies of all types

- Specialised-For specific crypto-related products and services, crypto wallets, encrypted client keys, etc.

The sine qua non would be the opening of a company in the Czech Republic. Due to its advantages, such as low minimum share capital, a low number of founders, and an exemption from a financial audit, SRO is a very usual legal business structure in the Czech Republic. The crypto company must be registered and actually domiciled in the Czech Republic, it must employ at least two employees on a full-time basis, and it must provide at least two fit and proper directors, an AML Officer. Also, the Company shall prove the adoption of the internal AML/CFT policy, compliance with the data protection legislation, and the measures to provide for clients’ assets safety.

Cryptocurrency Taxes in the Czech Republic 2025

The Czech Republic has been among the top positions of the International Tax Competitiveness Index for the last few years and will not be expected to raise any tax rates in 2025. It will be one of the friendliest countries for companies operating in cryptocurrencies. However, you are recommended to get yourself acquainted with those changes introduced by the Organization for Economic Cooperation and Development and applying to the Czech Republic.

In 2023, OECD introduced Crypto-Asset Reporting Framework, CARF, which allowed the automation of tax reporting and information-sharing on crypto assets across international tax administrations. A crypto-asset reporting framework covers organizations and individuals offering services in crypto exchanges and transfers of crypto, including those that involve retail payments. Crypto assets not used as a means of payment or as an investment, plus those related to centralized stablecoins, are also exempt under this framework.

Recent Changes: One example of recent national changes is to Social Security and Health Insurance. Beginning in February 2025, employers pay the lowered rate of 5% for those employees who qualify as members of eligible social groups—for example, persons taking care of a child under ten years old or persons with a disability—and that work part-time. All other tax rates and allowances remain the same.

MiCA regulations in Czech Republic

Act 31/2025 Coll. on Digitalisation of the Financial Market came into force in the Czech Republic on 15 February 2025, which gives the Czech National Bank (CNB) regulatory authority over cryptoassets. The Act has been in force since its enactment, and companies subject to it must immediately begin the process of complying with the new requirements.

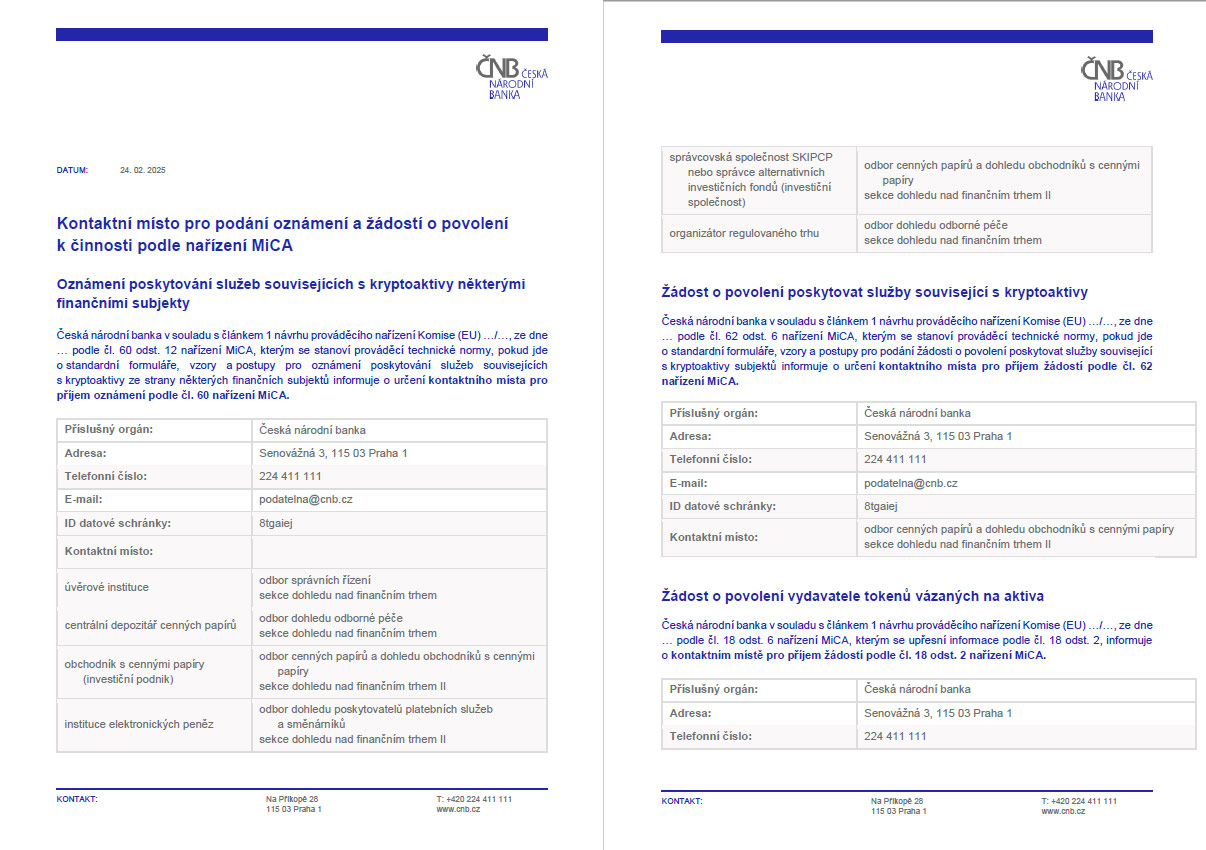

Submitting an application for a MiCA licence in the Czech Republic to the Czech National Bank in 2025 requires cryptoasset service provider authorisation in accordance with Article 62 of MiCAR. The Czech National Bank accepts applications via data mailbox (Datova Schranka) or by email to [email protected], but the application must be digitally signed. The Czech National Bank (CNB) is currently preparing to become the competent authority for the regulation of cryptoassets under the EU’s Markets in Cryptoassets Regulation (MiCA). This status will be consolidated following the adoption of the Act on Digitalisation of the Financial Market, which is currently under consideration in the Czech Republic’s legislature.

Legislative changes and the status of the CNB

Based on the draft Financial Market Digitalisation Act, the CNB will be empowered to regulate virtual currencies in the Czech Republic. According to Article 9 of the draft law, the CNB will be granted the status of the main MiCA regulator in the Czech Republic.

The bill is currently being debated in the Parliament of the Czech Republic. It was approved by the Chamber of Deputies on 6 December 2024 and passed to the Senate on 30 December 2024. After its adoption and publication, the law will enter into force the next day. Until then, the CNB does not have administrative powers to deal with applications and notifications under MiCA.

Procedures and requirements after the law comes into force (15 February 2025)

Once the Financial Market Digitalisation Act is formally enacted, the CNB will begin to accept and process:

- Technical documentation notifications for cryptoassets other than asset-backed tokens (ARTs) and electronic money tokens (EMTs)

- Licence applications for non-bank ART issuers

- White label approval requests for ART issuers if they are banks

- Notices to EMT issuers of intent to publicly offer or list tokens, and white paper filings by those issuers

- Applications for a cryptoasset related service provider (CASP) licence

- Notifications from entities already authorised by the CNB of their intention to provide cryptoasset-related services.

Transition period for existing service providers

Companies that already provide virtual asset-related services and operate under a trade licence (activity code 81 under Schedule 4 of the Trade Licensing Act) will be able to continue to operate provided they apply for CASP licensing until 31 July 2025. They will be able to provide their services until the final decision on their application, but no later than 1 July 2026. In this way, the Czech National Bank becomes a key authority in the regulation of the crypto market in the Czech Republic, ensuring compliance of local legislation with MiCA regulations and creating conditions for the efficient functioning of the digital asset market.

Applying for authorisation to provide services related to cryptocurrency assets to the Czech National Bank (CNB)

Czech National Bank in accordance with Article 1 of the Commission’s Draft Executive Regulation (EU) MiCA Regulation setting technical implementation standards for standard forms, templates and procedures for applying for authorisation to provide cryptoasset services:

| Field | Details |

|---|---|

| Competent Authority | Czech National Bank |

| Address | Senovážná 3, 115 03 Praha 1 |

| Phone Number | +420 224 411 111 |

| [email protected] | |

| Data Box Identifier | 8tgaiej |

| Contact Person | Department of Securities and Supervision of Securities Dealers, Financial Market Supervision II |

MiCA capital requirements for virtual asset related service providers in the Czech Republic

| Service Provider | Type of Services Related to Crypto Assets | Minimum Capital Requirements (Article 67) |

|---|---|---|

| Class 1 | Provider authorized to offer the following services related to crypto assets:

|

€50,000 |

| Class 2 | Provider authorized to offer all Class 1 services, as well as:

|

€150,000 |

| Class 3 | Provider authorized to offer all Class 2 services, as well as:

|

€150,000 |

FAU requirements for VASP companies in the Czech Republic

In view of the increasing number of foreign-owned commercial companies providing services related to virtual assets, the Financial Analysis Unit (FAU) draws attention to a number of regulatory aspects. These companies often do not fully comply with the requirements related to anti-money laundering and countering the financing of terrorism (AML/CFT) measures, which requires increased regulatory scrutiny. The following is a list of requirements for VASP companies in the Czech Republic.

Language of administrative procedures

According to Section 16 of Act No. 500/2004 Coll. (Code of Administrative Procedure), all official communications and documentation in administrative processes must be conducted in the Czech language. It is permissible to use Slovak for filing applications and communicating with the FAU. Thus, all documents, including suspicious transaction reports, designation of contact persons, provision of information and development of internal rules, must be in one of these languages.

VASP terminology and regulation

Pursuant to Section 2(1)(b) 15 of Act No. 253/2008 Coll. (‘AML Act’), virtual asset service providers (VASPs) are categorised as so-called ‘obliged entities’ and are treated as financial institutions. Their activities are subject to strict AML/CFT compliance requirements.

The key definitions relating to virtual assets and their providers are set out in the following provisions of the AML Law:

- Section 4(8) – defines the term ‘virtual asset’;

- Section 4(9) – articulates the concept of ‘service related to a virtual asset’;

- Section 4(10) – provides the definition of ‘VASP’;

- Section 4(11) – discloses the term ‘unallocated address’.

Companies operating in this area must consider these legislative requirements and comply with the regulations to ensure the legality of their activities and minimise the risks associated with money laundering and terrorist financing.

Risk assessment and its regular updating

Virtual Asset Service Providers (VASPs) are required to develop and maintain a written Anti-Money Laundering and Counter-Terrorist Financing (AML/CFT) Risk Assessment. This document must be created within 60 days of becoming an obligated entity and updated regularly in accordance with the AML Act (Section 21a (2) and (3)). The risk assessment must be drawn up in the Czech language.

Internal system of rules

Based on the Risk Assessment, the VASP is obliged to develop and implement an Internal Rule System – a document that describes measures, procedures and internal policies for AML/CFT compliance. This document must be prepared no later than 60 days after becoming an obligated entity and must be updated regularly.

Suspicious Transaction Reporting (STR)

One of VASP’s key responsibilities under AML/CFT measures is to identify suspicious transactions and report them to the Financial Analysis Unit (FAU) in a timely manner. This process is governed by Section 18 (1) of the AML Act. The form for filing a report is available on the official website of FAU. Suspicious transactions must be reported to the FAU without undue delay and exclusively in the Czech language. All information about STRs and FAU actions is subject to strict confidentiality.

Additional duties of the VASP

In addition to the above requirements, a VASP must comply with other provisions of the AML/CFT Law, including:

- Mandatory identification of customers;

- conducting customer due diligence;

- maintaining appropriate records and reports;

- training employees and monitoring compliance with AML/CFT requirements.

New obligations under MiCA regulations – what Czech VASP firms need to be prepared for

Previously, cryptocurrencies and other crypto-assets were hardly subject to specialised regulation and were treated as commodities. Although their general legal status remains unchanged, from 30 December 2024 they are subject to the MiCA (Markets in Crypto-Assets) regulation. This regulation introduces comprehensive rules for the regulation of crypto-assets at the European Union level and significantly affects the activities of companies involved in their issuance and circulation.

Key requirements for issuers of cryptoassets

Under MiCA and the new Czech legislation, issuers of cryptoassets are required to comply with a number of new requirements, including:

- EU registration – companies issuing cryptoassets must be legal entities registered in the European Union. Previously, many companies circumvented this requirement by registering offshore or in third countries.

- White Paper preparation – issuers are required to develop and publish a detailed whitepaper containing full information about the crypto asset or crypto project.

- Adherence to principles of professional conduct – issuers’ activities must meet high standards of honesty, transparency and professionalism in the interests of crypto-asset holders.

- Transparency of communication – information provided to users and investors must be accurate, understandable and not misleading.

- Conflict of interest management – issuers are required to identify, prevent, manage and disclose potential conflicts of interest.

Given the new requirements, cryptoasset companies are advised to adapt to the regulatory changes as soon as possible to avoid potential future sanctions and restrictions.

Cryptoassets not subject to MiCA regulation

Not all cryptoassets are within the scope of MiCA Regulation. Certain categories of tokens are exempt from its requirements, but exemptions may apply in some cases.

1. Non-Futurable Tokens (NFTs)

NFTs, being unique and non-interchangeable tokens, are in most cases not subject to MiCA regulation. However, if a collection of NFTs has features of interchangeability or mass issuance, such assets may be subject to regulation and each such case should be considered separately.

2. Financial cryptoassets

This category includes tokens that are already subject to existing EU regulations, such as financial instruments and structured deposits under the MiFID II Directive. If your project involves such assets, a MiFID II authorisation process will be required.

Financial instruments within the meaning of MiFID II include:

- Transferable securities – shares, bonds and derivative contracts linked to financial instruments.

- Money market instruments – options, futures, swaps, forwards and other derivative financial contracts.

- Collective investment fund units.

- Derivatives – contracts relating to credit risk transfer, financial contracts for difference, and CO₂ emission allowances.

General characteristics of financial instruments excluded from MiCA:

- Transferability – they can be transferred to other owners.

- Standardisation – assets have a degree of standardisation, which ensures their interchangeability.

- Tradability – they are suitable for organised trading in financial markets.

3. Other cryptoassets exempted from MiCA

Some crypto-assets are partially exempt from MiCA regulation. For example, Sections II, III and IV of the regulation do not apply to tokens without an identifiable issuer. Also exempted:

- Utility tokens, if they fulfil the conditions set out.

- Airdrop tokens, mining rewards, liquidity pools and staking, if certain requirements are met.

- Tokens used in a limited merchant network – if they are only used to purchase goods and services from a limited number of partners who have a contractual relationship with the issuer.

Need for individualised valuation

Whilst certain assets are formally excluded from the scope of MiCA, there are instances where they may fall within the scope of regulation. A detailed legal analysis is recommended to avoid potential infringements.

Different regulatory regimes for cryptoasset issuers and service providers (CASPs) in the Czech Republic

With the adoption of the Act on Digitalisation of the Financial Market by the Czech Senate, the Czech National Bank (CNB) is empowered to review applications and notifications from cryptocurrency market participants. This law will come into force shortly and the regulator will start accepting:

- White paper notifications of an asset-backed cryptoasset (excluding tokens) or electronic money token (EMT).

- Authorisation applications for ART (asset-backed token) issuers if they are not banks.

- White paper authorisation applications for ART issuers if they are banks.

- Notices of an EMT issuer’s intention to offer e-money tokens publicly or allow them to be traded, and the relevant white papers.

- Applications for licensing of cryptoasset related service providers (CASPs) and notifications from entities already licensed by the CNB to operate in this field.

Activities requiring a CASP licence

Crypto Asset Service Providers (CASPs) must obtain a CNB licence to conduct the following activities:

- Storing and managing cryptoassets on behalf of clients.

- Operating a cryptocurrency exchange (trading platform for cryptoassets).

- Exchange of crypto-assets into fiat currencies.

- Exchange of crypto-assets among themselves.

- Execution of clients’ orders related to cryptoassets.

- Placement of cryptoassets.

- Receiving and transmitting orders related to cryptoassets.

- Counselling services related to crypto-assets.

Responsibilities of cryptoasset issuers

Issuing tokens does not fall under the definition of CASP services. However, cryptoasset issuers are required to comply with a number of requirements under the MiCA regulations, including:

- Developing and publishing a detailed white paper (technical documentation) in accordance with MiCA.

- Notifying the Czech National Bank of the issuance of a cryptoasset.

- Obtaining authorisation to issue certain types of tokens, such as Asset-Related Tokens (ART) and Electronic Money Tokens (EMT).

Thus, different regulatory regimes apply depending on a company’s role in the crypto market – whether it is a cryptoasset issuer or a connected service provider. This requires careful attention to licensing and compliance with the new MiCA requirements.

Contact point for a VASP company in the Czech Republic

Due to the growing number of commercial companies with a foreign presence in their ownership and organisational structure, established for the purpose of providing virtual asset services, which often fail to comply flawlessly with their legal obligations in the field of anti-money laundering and countering the financing of terrorism (hereinafter – AML/CFT) measures, the Financial Analysis Unit (hereinafter – FAU) draws the attention of entrepreneurs to the following:

- The language of the procedure. According to Section 16 of Law No. 500/2004 Coll. of the Code of Administrative Procedure: “Communication within the procedure shall be carried out and documents shall be drawn up in the Czech language. The parties to the procedure may also communicate and submit applications in Slovak’. In other words, all applications to the FAU must be in Czech (or Slovak) language (e.g. suspicious transaction report, appointment of a contact person, fulfilment of the duty to provide information or the Internal Rule System).

- Licence of the Czech National Bank (CNB) – CNB is a competent authority under the EU Cryptoasset Markets Regulation (MiCA) on the basis of the Financial Market Digitalisation Act. The CNB is authorised to accept applications during February 2025 (after the legislative process is completed and the relevant law comes into force).

- Appointment of a contact person. Pursuant to Regulation 22 of the AML Act, the VASP is required to appoint a specific employee or statutory body member to fulfil the reporting obligation under Section 18 of the AML Act and to ensure ongoing contact with the FAU (the so-called Contact Person). The VASP shall inform the FAU of the appointment of the Contact Person and any subsequent changes within 30 days from the day it became an obligated entity or within 15 days from the day the change occurred. С 1. 2.2025, regulation no. 420/2024 Coll. of the Ministry of Finance is mandatory for the notification of the FAU contact person , which establishes the prescribed format (xml) and structure (form). In addition, the notification of the contact person is exclusively required via the data field of the obliged person in accordance with Section 22 (2) of the AML Act. The interactive form is available from the home page of the FAU website ‘Formulář pro oznámení kontaktní osoby. This new extended obligation must be met by all current obliged entities by 10 March 2025. A breach of the obligation to provide information in relation to a Contact Person constitutes the commission of an offence within the meaning of Article 46 (2) of the AML/CFT Act, for which an administrative penalty of a fine of up to CZK 1,000,000 may be imposed. A contact person who is a specific employee or member of the statutory body of the VASP must be able to communicate with the FAU in Czech (or Slovak) language.

- Creation and regular updating of the Risk Assessment. A VASP must create, no later than 60 days from the date on which it became an obligated entity, a written assessment of the risks of money laundering and terrorist financing (the so-called Risk Assessment) for the types of business and business relationships provided, to the extent that it conducts controlled activities under the AML Law (cf. Section 21a (2) of the AML Law), while continuously updating the relevant assessment (cf. Section 21a (3) of the AML Law). If the VASP has not created a written Risk Assessment or has not regularly updated it, it would have committed an offence within the meaning of Section 48 (4) of the AML Act, for which an administrative penalty of a fine of up to CZK 1,000,000 may be imposed. The risk assessment must be created in the Czech language.

- Creation and regular updating of the Internal Rule System. A VASP must establish (and regularly update) a written system of internal policies, procedures and controls to fulfil the obligations set out in the AML Law no later than sixty 60 days from the date on which it became an obligated entity on the basis of the Risk Assessment (the so-called Internal Rule System). If VASP had not established a written Internal Rule System, it would have committed an offence within the meaning of Section 48 (2) of the AML Act, for which an administrative penalty of a fine of up to CZK 1,000,000 may be imposed. The internal system of rules shall be established in the Czech language.

- Suspicious Transaction Report (STR). The VASP, as an obliged person, subsequently has a variety of other obligations arising from the AML/CFT Law, whether these are obligations related to the customer and its transactions (e.g. identification obligation, customer due diligence) or general obligations (e.g. record keeping, employee training, etc.).

Finally, the FAU notes that failure to comply with AML/CFT obligations may entail not only administrative penalties (see examples above), but also, given the nature of the offence, may lead to possible criminal prosecution for the offence of money laundering (cf. Articles 216 and 217 of the Criminal Code).

Lawyers from the Regulated United Europe also provide legal services on getting the Czech Republic crypto license.

“Hi, I’m happy to guide you on the perfect jurisdiction for your crypto business. The Czech Republic is only starting to regulate this field, and has minimal requirements to fulfil, which is very convenient for early-stage crypto companies.”

FREQUENTLY ASKED QUESTIONS

Who is required to designate and notify a contact person?

The obligation to designate and notify a contact person under section 22 of the AML/CFT Law applies to all obliged persons referred to in section 2(1). 1 or in Section 2(2) letter d) of the AML/CFT Act, except for lawyers and notaries, i.e. obliged persons under Section 2(1) letter g) of the AML/CFT Act who are only obliged to designate a contact person but are not obliged to notify it, except for obliged persons to whom Section 28, Section 29a or Section 29b of the AML/CFT Act applies, who are not even obliged to designate a contact person.

Companies that provide the following services are obliged to notify a contact person in accordance with section 22 of the AML Act:

- § 2 paragraph 1 letter b) point 15 - person providing services related to a virtual asset (covered by Regulation (EU) 2023/1114 of the European Parliament and of the Council of 31 May 2023 on markets in cryptoassets and amending Regulations (EU) No 1093/2010 and (EU) No 1095/2010 and Directives 2013/36/EC and (EU) 2019/1937)

- § 2 paragraph 1 letter b) point 15 - a person providing services related to a virtual asset (not covered by Regulation (EU) 2023/1114 of the European Parliament and of the Council of 31 May 2023 of 31 May 2023 on markets in cryptoassets and amending Regulations (EU) No 1093/2010 and (EU) No 1095/2010 and Directives 2013/36/EC and (EU) 2019/1937)

Who should be designated as the contact person?

The requirements for a contact person are as follows: to be an employee or board member of the obligated entity. This obligation cannot be transferred to external parties, e.g. a law firm.

What is the role of the contact person?

Liaison with the FAU, both for reporting suspicious transactions under section 18 of the AML/CFT Law, and to ensure ongoing contact with the FAU, particularly in relation to fulfilling the obligation to provide information under section 24 of the AML/CFT Law and complying with FAU instructions.

Can an obligated entity have more than one contact person?

Yes, the new notification form (effective from 1 February 2025) also allows this. Each contact person must fulfil the conditions set out in section 22 of the AML Law. Generally, the number of contact persons will be appropriate to the scale and nature of the obligated entity's activities.

To whom does the contact person report?

Financial Analysis Office of the Czech Republic (FAU)

What is the content of the notification to the contact person?

According to section 22, paragraph 2 of the AML/CFT Law, the following data must be filled in the form prepared on the basis of the order of the Ministry of Finance:

- name and surname of the contact person

- the position of the contact person

- contact details, including telephone number and e-mail (must be in working order)

- the time when this person can be contacted (the time when the obliged person performs transactions or services)

- What type of obligated person is meant by Article 2.1(2) indicating the type of obligated person.

When does the obligation to designate and notify a contact person arise?

Within the statutory period of 30 days from the date on which you became the owner of a VASP company in the Czech Republic or within 15 days from the date on which a change occurs, e.g. the designated contact person is replaced by another person, the contact telephone number or e-mail address is changed.

Do I have to notify my FAU contact person under the new rules and using the form, even if I have already reported on or before January 2025?

Yes, you must do so. The reason for this is that from 1 February 2025, the amount of information you must report and the way you must report it (via the form and data field) has changed.

Do I have to inform the FAU of the cessation of my activities, i.e. notify the contact person of the change?

Yes. By doing so, the obliged person is fulfilling their obligation to notify the change and must do so within 15 days of the date on which the obliged person ceases to carry on business (e.g. suspension or revocation of the relevant trade, cancellation of licence, registration). If they fail to do so, they are still considered obliged persons who must fulfil all obligations under the AML Law.

How to notify the FAU contact person?

As of 1 February 2025, the notification of the contact person is governed by a regulation of the Ministry of Finance ( Regulation No. 420/2024 Coll. "On the format and structure for the submission of information containing the contact person's details to the Financial Analysis Unit ’), which sets out the prescribed format and structure (form). of the contact person shall be carried out exclusively through the data mailbox of the obliged person in accordance with section 22(1). 2 of the AML Act. This will be made possible (from 1 February 2025) by simply clicking on the ‘send’ button on the online form and then logging into the data box of the obliged entity whose contact person is being notified.

How would you describe the industry in general?

Cryptocurrency businesses in the Czech Republic are yet to be governed by a comprehensive set of rules. Currently, crypto activities are not regulated separately and cryptocurrencies are not considered legal tender. The Czech financial market regulates most crypto companies engaged in crypto-related economic activities. In such a liberal environment, innovation and experimentation with fast-evolving products and services are allowed, provided that all EU rules are followed.

What is the Czech Republic's regulatory framework for crypto businesses?

All financial market participants are overseen by the Financial Analytics Office (FAU) for anti-money laundering and counter-terrorist financing purposes. A close relationship exists between the authority and the Czech National Bank (CNB), which is responsible for overseeing the financial market in the Czech Republic. The Ministry of Finance and the Czech Inspection Authority are also national regulatory authorities.

Is the Czech Republic a good place to start a cryptocurrency business?

Tax laws specific to crypto have not yet been introduced in the Czech Republic. Depending on the purpose of crypto-related economic activities, crypto companies are taxed in accordance with EU legislation and general law.

The status of cryptocurrencies as legal tender is not established. As a result, it is categorized as a commodity. In accordance with current legislation, crypto data stored on a blockchain does not constitute claims denominated in the national currency issued by a central bank, credit institution, or another payment service provider.

Czech Republic company formation: how to get started?

Obtaining a license requires establishing a company in the Czech Republic. The Limited Liability Company (SRO) is one of the most common legal business structures, which can usually be established within three weeks by one or more shareholders. As opposed to other legal entities, it has fewer rules and requires a very small share capital.

A cryptographic company must have the following documents:

- Incorporation memorandum

- A detailed financial plan and a business continuity plan should be included in your business plan

- Biographical information about founders and directors of companies (criminal records, education, etc.);

- Cryptographic activities require the use of hardware and software that can be described in detail

- Deposit authorization from the bank

- Licence copy for relevant trading

In what ways does the Czech crypto license process differ from other countries?

Despite the lack of a complicated licensing process for cryptocurrencies in the Czech Republic, companies are still obligated to acquire a license before they can operate there.

The Trade Licence Register currently requires most of them to obtain one of the normal trade licenses. By notifying local authorities in accordance with local regulations, it is possible to open branches in other EU countries without having to go through endless bureaucratic procedures.

There are several types of activities:

- Notification-based trade may commence immediately after notification

- In certain cases (such as if relevant professional experience or education is required) authorized trade can take place after a concession has been granted based on a special commercial licence.

Is there more than one type of license?

For cryptographic companies, the following license types are available:

- Sharing cryptocurrencies for a fee - the classic

- Fiat – exchange between cryptocurrencies and fiat money on commission

- Traditional - all forms of currency exchange intermediation

- Cryptography-specific products and services (crypto-wallets, encrypted client keys, etc.)

In order to obtain a license, what information do I need to provide?

In the central electronic registry electronic room, applications can be submitted online by managing directors using secure electronic signatures. Each application is handled by the competent Trade Licensing Authority selected by the applicant.

Along with the application, please provide the following information:

- An overview of the company's qualifications and corporate documents

- Shareholders, directors, and founders' identity documents

- A certificate confirming that you do not have a criminal record, debts or taxes owed

- A business plan that incorporates strategies, policies, and procedures related to operations

Is there any support available for my business?

The following initiatives can help you with funding and other important aspects of your business:

- An incubator program offered by CzechInvest offers startups funding, seminars, and expert advice for seven months

- The Blockchain Connect Association / Czech Alliance was founded to advance blockchain technology in the country, eliminate fraud and corruption, and boost confidence in innovative financial solutions.

- Creating a Decentralized Economy with Unlimited Information Dissemination and Widespread Implementation of Cryptocurrency-Based Products and Services is the objective of Cryptoanarchy Institute.

What are the tax rates in the Czech Republic?

Generally, Czech crypto companies are required to pay the following taxes:

- Corporate Income Tax (CIT) – 19%

- Branch Tax (BT) – 19%

- Capital Gains Tax (CGT) – 0%-19%

- Withholding Tax (WHT) – 15%

- Value Added Tax (VAT) – 21%

- Social Security Insurance (SSI) – 24,8%

- Health Insurance (HI) – 9%

Do innovative businesses have access to any support?

Pilot DLT Market Infrastructure Regulation (PDMIR) was approved by the EU in 2022. Using the pilot, traders and investors will be able to trade and settle transactions in crypto assets, which under MiFID 2 are classified as financial instruments.

As with a sandbox approach, the pilot will provide a safe environment for experimentation with new technologies and gather evidence to support a potential permanent framework. 2026 is the expected review date for the pilot. In the meantime, the European Securities and Markets Authority (ESMA) is consulting on draft guidelines to develop standards and templates for the implementation of DLT, and is currently engaging in Q&A sessions.

Additional information

Additional services for Czech Republic

RUE customer support team

“Hi, if you are looking to start your project, or you still have some concerns, you can definitely reach out to me for comprehensive assistance. Contact me and let’s start your business venture.”

“Hello, I’m Sheyla, ready to help with your business ventures in Europe and beyond. Whether in international markets or exploring opportunities abroad, I offer guidance and support. Feel free to contact me!”

“Hello, my name is Diana and I specialise in assisting clients in many questions. Contact me and I will be able to provide you efficient support in your request.”

“Hello, my name is Polina. I will be happy to provide you with the necessary information to launch your project in the chosen jurisdiction – contact me for more information!”

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

Registration number: 08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00 Prague

Registration number: 304377400

Anno: 30.08.2016

Phone: +370 6949 5456

Email: [email protected]

Address: Lvovo g. 25 – 702, 7th floor, Vilnius,

09320, Lithuania

Sp. z o.o

Registration number: 38421992700000

Anno: 28.08.2019

Email: [email protected]

Address: Twarda 18, 15th floor, Warsaw, 00-824, Poland

Europe OÜ

Registration number: 14153440

Anno: 16.11.2016

Phone: +372 56 966 260

Email: [email protected]

Address: Laeva 2, Tallinn, 10111, Estonia