| Country | Details |

|---|---|

| Corporate income tax is 10% and income tax is 10%. | |

| Ireland’s corporate tax rate of 12.5% is attractive to international businesses. Its incentives have helped make Ireland a European headquarters destination for many. | |

| Corporate income tax is 12.5%. Tax incentives for foreign investors, including non-residents and investors. | |

| The tax system is unique in that corporate tax is only payable when profits are distributed. Income tax is levied at a fixed rate of 20%. |

Things to Consider While Establishing a Company in Europe

One has to consider the overall tax burden that is other than corporate tax, which includes VAT, labour taxes, and social contributions.

Double Taxation: You have to see the double taxation treaties between your country and the country in which you plan to invest and start a business.

Country reputation: Some of the low-tax countries are considered – though this is a misconception – as “tax havens”, which affects reputation and consequently follow-on business behaviour.

You should, therefore, always carry out the proper analysis and, when required and relevant, consult professional tax and legal advisors prior to decisions about registering a business or investing in any jurisdiction.

European countries with highest % of foreign ownership of firms

Data relating to foreign firm ownership in European countries fluctuate over time and depend on a set of factors such as economic policies, investment climate, and global trends. However, according to historical data and economic reports, some European countries have traditionally reported high percentages of foreign firm ownership. Examples include:

1. Luxembourg

Luxembourg is a large financial centre with a friendly tax policy and pronounced international orientation; accordingly, the proportion of foreign-owned companies in the country is very significant.

2. Netherlands

Thanks to a stable economic position, convenient location, and encouraging investment climate, the country has gained for many years a long-standing reputation as a recipient of foreign investment.

3. Switzerland

Switzerland offers a stable political environment, along with a tax-friendly climate and in addition provides complete confidentiality to foreign companies.

![]()

UK

UK, London is a global financial hub and has historical exposure to foreign investments.

Ireland

Ireland

Ireland remains one of the favourite destinations for global headquarters and foreign firms; mainly it is because of the tax rate of.

Estonia

The Estonian e-Residency program, for example, has been a real magnet for foreign investments, more than 15% of the companies created by foreign non-Estonians and more than 200 mln euros in taxes received last year.

What to consider for non-dom status persons

- Foreign ownership of companies’ shares may increase or decrease as political and economic events will appear, among which may be Brexit, any new changes to tax legislation and international agreements.

- Market dynamics: Global economic trends, such as trade wars, pandemics, and financial crises, can also impact a country’s attractiveness for foreign investment.

- Please refer to recent economic reports, statistics, and analyses for the most up-to-date information and a more detailed understanding.

Lowest corporate tax in Europe

Taxes in Europe are paid by all individuals and legal entities earning money in one of the countries on its territory. Foreigners who have been given tax residency status pay their contributions on all the income that has been received both in and outside of the EU state: it is assigned to immigrants that have spent at least 183 days in the jurisdiction during the year, with other mandatory conditions being met. The quirk in the EU law is that, within the bloc, each state has a right to set the amount of rates as it sees fit. Citizens of European countries can take advantage of a double taxation treaty if the jurisdictions of one’s citizenship and residence have concluded a double taxation treaty.

The EU itself does not have any single law regulating the payment of fees as an organization but, instead, this area is under the control of separate narrowly focused directives and conventions. This article describes the types of taxes in the EU states, differences between the fees for individuals and legal entities, and the requirements for applicants who want to get tax residency status in Europe in 2023.

Types of Taxes in European Nations

Europe uses myriad taxes that are different and dependent on the government of each jurisdiction. Sometimes, the minimum rate is normally imposed by the EU legislation, for example, excise duties. Tax obligations depend on the status of a person and where their income originates.

- Corporate Taxes: Every company has to pay its taxes directly to the regulatory authority of their own country where the business is being carried out. However, individual payments are allowed, but in most cases employers take the responsibility for the payment of taxes of employees.

- Tax Structures: The countries may have either a progressive or stable tax system.

Critical Types of Taxes in the EU

Both citizens and foreign residents are subject to various types of taxes in European countries, including:

Income Taxes for Individuals

The income tax can be imposed by a country where an individual obtains an income or holds a tax residency. This encompasses wages, pensions, allowances, profits from property, and capital gains. A foreigner employed in an EU state who has a salary and does not obtain tax residency will only be required to pay the local income tax on a salary that was obtained within that particular country but not that earned outside. Tax residents, however, pay on worldwide income.

Corporate Taxes

All businesses will need to pay a tax in the state in which they are both registered and operate. The rules of taxation differ depending on the jurisdiction, as there are resident companies which get taxed both on national and international level while foreign businesses are to be taxed only based on local activities.

VAT

EU law provides a minimum standard VAT rate of 15%, a minimum reduced rate of 5%. The appropriate rate of VAT, which is incorporated into the price, is decided by the individual states and businesses can deduct pre-paid VAT on sales.

Harmonized Excise Duties

Excise duties are indirect taxes by consumers of certain products, such as spirits, tobacco, and electricity. The EU sets minimum rates, but member states can set higher rates.

Social Levies

Social taxes by employees, employers, and the self-employed pay for benefits such as pensions and sickness allowances. Even though there is no uniform amount in Europe for social levies, usually a person is subject to social security contributions in the country where he or she works. EU citizens who have acquired benefits may continue to receive them even after re-domiciling to another member state.

Please note that additional fees may apply.

In some countries, residents are liable to pay additional fees, such as environmental or transport taxes, which are typically the responsibility of vehicle owners. Furthermore, citizens in countries such as Austria, Germany, and Finland may be required to pay church taxes if they are registered members of a religious institution.

Taxation of Individuals

Residency will be considered if a person has remained in the jurisdiction for at least six months in the previous year. Or residency may be held based upon permanent address or the situs of their interests. Many EU and non-EU jurisdictions have double taxation treaties to prevent income from being taxed in a large number of countries.

The following classes of income are liable to taxation:

By EU law, individuals are required to pay tax on the following classes of income, including:

- Salary: In the majority of the EU member states, income tax on wages is progressive. The lowest rate – 10% – is levied in Bulgaria and Romania, while in Finland, the highest rate can be as much as 56.5%. Payment is normally by deduction at source, responsibility usually lying with the employer.

- Taxation on property, inheritance, and gifts: Taxes could be levied on nearly any form of asset, such as animals and cryptocurrency to vehicles. This is not a practice used by every country in the world, and even among the ones using it, progressive rates are often set. Bulgaria is at a minimum of 0.4%, while Spain goes up to 87.6% depending on the region.

- Dividends: The minimum is Greece, going to a maximum of 42% in Denmark. The dividend tax is payable by the individual.

- Capital Gains: The taxation rate of capital gains varies in each country. The lowest ones are 15%, recorded in Greece and Hungary, up to a maximum of 42% in Denmark.

A foreign company registered in a European country has an obligation to pay taxes both on domestic and international profits. On the other hand, companies of foreign origin are liable to pay taxes only on local income. Fees payable by legal entities include:

Corporate Income Taxes:

These vary from the lowest 9% in Hungary to the highest 25% in France. In addition is the VAT ranging from country to country. The lowest is Luxembourg with a rate of 16% while the highest is Hungary with 27%. Lithuania has the lowest employer contribution rate, 1.77%, while Slovakia has the highest rate, 35.2%.

Customs Duties:

Companies in customs unions are exempted from customs duties, but businesses importing goods from outside the country are required to pay customs tariffs depending on the origin and value of the merchandise moved into their country.

Taxation of income produced by foreign branches

Most usually, such a foreign company branch, operating in Europe, is subject to corporate tax and VAT. For the dependent branches, one is allowed to consolidate their financial activity reporting, while independent branches have to create a separate report.

Cheapest corporation tax in Europe in 2025

When choosing a country to move to or start a company, foreigners often tend to choose jurisdictions with the most favourable taxation. The lowest income taxes in the EU states are presented in the table below:

| Tax | Rate in % | Countries |

| Income | 10 | Bulgaria, Romania |

| Corporate | 9 | Hungary |

| Standard VAT | 16 | Luxembourg |

How to become a tax resident in an EU country

Tax residency in a European country can be granted to persons permanently residing in the territory of that country. In this respect, for such purposes, the applicant needs to obtain a residence permit or passport of such jurisdiction. This can be accomplished through one of the available migration programmes.

Lowest corporate tax in Europe

The people pay the most tax in Denmark, France and Austria; the lowest income tax rates in Europe are imposed in Hungary, Estonia and the Czech Republic.

Payment of taxes

Most European countries have introduced a progressive tax payment structure, i.e. the levies increase with the growth of wages. The rates and the number of categories vary greatly from country to country.

Income tax rates in Europe

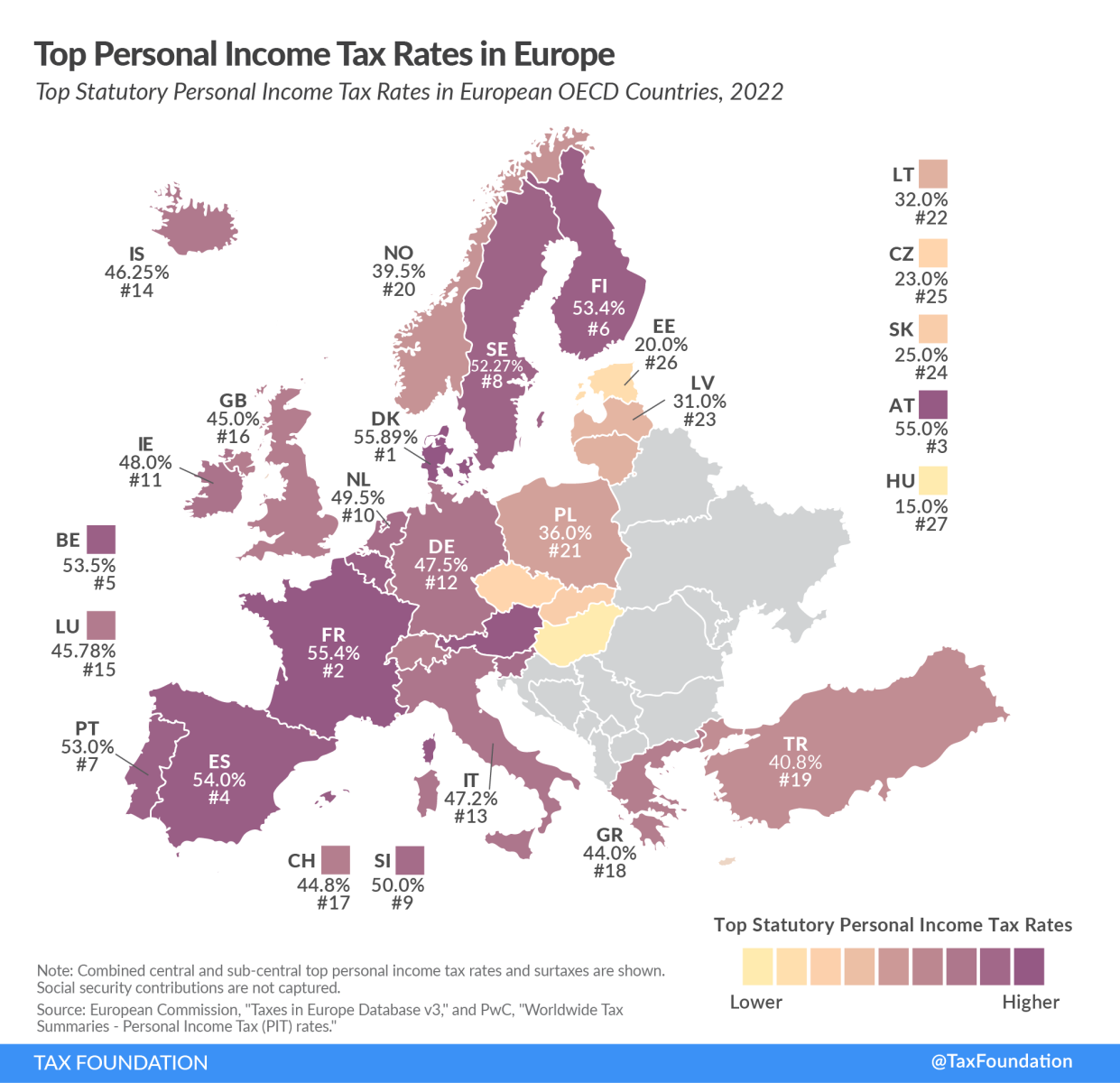

The highest personal income tax rates among the Organisation for Economic Co-operation and Development (OECD) countries are imposed in Denmark – 55.9%, France – 55.4% and Austria – 55%.

In Spain this indicator is 54%, in Belgium – 53.5%. The maximum rates are very high in Finland, Portugal and Sweden.

| Country | Tax Rate |

| 55.9% | |

| 55.4% | |

| 55% | |

| 54% | |

| 53.5% | |

| 53.4% | |

| 53% | |

| 52% | |

| 50% | |

| 49.5% | |

| 48% | |

| 47.5% | |

| 47.2% | |

| 46.3% | |

| 45.8% | |

| 45% | |

| 44.8% | |

| 44% | |

| 40.8% | |

| 39.5% | |

| 36% | |

| 32% | |

| 31% | |

| 25% | |

| 23% | |

| 20% | |

| 15% | |

| 10% |

Countries with low taxes Europe

Hungary has the lowest income tax rate in Europe—15%, Estonia has 20%, and the Czech Republic has 23%. Each country sets its own levies, but common standards must be fulfilled throughout the European Union. Social tax is a direct tax. Its purpose is to ensure that a socially insured person is entitled to receive certain services from the state.

Services may include the following:

- old-age pension

- a disability pension

- a survivor’s pension

- sick pay

- maternity benefits

- unemployment benefits

- funeral allowance

Therefore, accordingly, in social tax, the following payments for different purposes include: payment for accumulation of pensions, maternity benefits, sickness, disability, incapacity for work and unemployment benefits (insurance).

The taxpayers are employers, employees, self-employed persons, and persons who pay social tax at their own wish.

Wages will be the object of tax in view of the legislation, both for employees and employers, while a certain amount will present the object of tax for self-employed persons. Normally, the employer withholds a part of the tax—the part that the employee pays—from the wages and pays another part of the tax for the employer. Generally, social tax has to be paid once per month. In most countries, the amount of social tax must be decreased by the amount of personal income tax.

Or in other words, the more social tax paid, the higher the social security of the taxpayer; for example, the old-age pension depends on the amount of social tax paid.

The name of social tax is different in every country. For example, in the UK it is called “National Insurance,” in Ireland, “Pay Related Social Insurance (PRSI),” and in other countries, it is called “social insurance.”

The average social tax rate for the whole European Union is 34%. The tax rate is relatively low in Denmark due to its high personal income tax. Social tax in the Netherlands is integrated into income tax.

Table of social taxes for different European countries, showing the tax rate in per cent:

| № | Country | Tax rate (%) |

| 1 | 14.00 | |

| 2 | 14.75 | |

| 3 | 20.00 | |

| 4 | 25.94 | |

| 5 | 28.00 | |

| 6 | 28.81 | |

| 7 | 30.70 | |

| 8 | 30.98 | |

| 9 | 31.40 | |

| 10 | 31.42 | |

| 11 | 32.00 | |

| 12 | 33.00 | |

| 13 | 33.00 | |

| 14 | 34.00 | |

| 15 | 34.09 | |

| 16 | 34.75 | |

| 17 | 37.25 | |

| 18 | 38.20 | |

| 19 | 39.00 | |

| 20 | 39.95 | |

| 21 | 40.00 | |

| 22 | 40.06 | |

| 23 | 45.00 | |

| 24 | 45.50 | |

| 25 | 48.07 | |

| 26 | 48.60 | |

| 27 | 50.00 | |

| 28 | 50.00 |

These data highlight the diversity for social tax rates across European countries. The relatively low rates of Denmark and Ireland compare with the relatively high French and Italian rates.

Average salary in Europe 2023-2025

The following series of tables within the article on European Union taxation ranks European countries by average monthly salary once all taxes have been deducted. This figure represents the average net income received by employees. Yet, this is not very relevant because, in some countries, workers may get less take-home pay; yet, they will pay high taxes, which in turn may come back to them in the form of certain services from the state: free medicine, education, etc. In countries with liberal economies, income may be higher and taxes less. Nevertheless, citizens in these countries often pay a significant proportion of their income towards various goods and services that are free or highly subsidized in more socially sensitive economies. It must be emphasized that the current ranking of average wages takes into account only some of these factors. The numbers presented here reflect only the average nominal wage that the average citizen actually takes home – net pay. It is also to be taken into consideration that this ranking corresponds to the official net salary, and in some countries with a high level of shadow economy, real average salary can be higher.

The highest average incomes were recorded in Scandinavia and Switzerland, whereas the lowest salaries have been recorded in Eastern and South-Eastern European countries. Traditionally, the lowest salaries among EU countries have been those of Bulgaria and Romania.

Following is a list of European countries based on figures from the IMF, World Bank and national statistical agencies. All data are converted to euros at current exchange rates at time of publishing. Average salaries are given for both EU countries and other countries within Europe:

| № | Country | Average monthly salary, € |

| 1 | 4 902 | |

| 2 | 3 914 | |

| 3 | 3 795 | |

| 4 | 3 573 | |

| 5 | 3 221 | |

| 6 | 3 104 | |

| 7 | 3 041 | |

| 8 | 2 970 | |

| 9 | 2 791 | |

| 10 | 2 770 | |

| 11 | 2 509 | |

| 12 | 2 454 | |

| 13 | 2 442 | |

| 14 | 2 390 | |

| 15 | 2 152 | |

| 16 | 2 039 | |

| 17 | 1 752 | |

| 18 | 1 658 | |

| 19 | 1 363 | |

| 20 | 1 250 | |

| 21 | 1 214 | |

| 22 | 1 116 | |

| 23 | 1 110 | |

| 24 | 1 059 | |

| 25 | 1 050 | |

| 26 | 1 021 | |

| 27 | 1 002 | |

| 28 | 974 | |

| 29 | 950 | |

| 30 | 919 | |

| 31 | 785 | |

| 32 | 706 | |

| 33 | 665 |

In Europe, CGT means the tax charged on any profit made from disposing of assets such as shares, bonds, or real estate. The rates and conditions vary from country to country, reflecting different national policies and economic strategies for EU countries. In certain European states, it emerges as one of the vital sources of revenue, whereas in others, it may be reduced or not applied at all in specific cases.

The countries that have the highest rates of taxation on capital gains include:

High Capital Gains Tax Rates: The country of Denmark has one of the highest capital gains tax rates in the world and may reach as high as over 40%, depending on the amount and kind of investment.

France has similarly high rates, especially if social contributions are included in calculating capital gains tax. In those cases, the overall liability can be more than 30%. Ireland: The capital gain tax rate can also be as high as 33%.

The lowest capital gains tax rates include:

Czech Republic: Because of special capital gains, it has a minimum or even no tax at all.

Slovakia provides relatively low rates with some possibilities for tax planning. The capital gains tax rate in Estonia is connected with the income tax rate of 20%. Part of the capital gains are not taxed at all.

Some of the following characteristics of Europe’s capital gains tax are:

- Holding period: In a number of countries, the taxation rate depends on the period an asset is held. Generally, a considerably reduced rate is given to investments held for an extremely long time.

- Incentives and Exemptions: Some states give incentives to small businesses and retired persons, and some on reinvestment of sale proceeds in certain types of assets.

Particularly when planning your personal tax strategy, remember the differences in tax systems and regulations that exist throughout Europe, even within the EU. Yet, importantly, capital gains are treated differently in a lot of the individual countries of the European Union. Therefore, investors and asset owners should consider local conditions and regulations of the countries in which they are investing or holding assets, taking into account.

Taxation of capital gains is a multi-faceted and complex field throughout Europe. An investor may either account for local conditions and regulations or seek opportunities to optimize the tax position while investing in or owning assets. Depending on the country, the investment size, and the investor’s particular circumstances, an effective tax strategy may significantly reduce the overall tax burden.

Lowest VAT in Europe 2023-2025

Some entrepreneurs do their tax planning based on VAT rates, so we summarized the relevant information in a table: It is necessary to underline that the VAT in EU member states and ———– in other European countries differs.

The critical difference is that the legislation of VAT in EU countries is harmonized in accordance with the EU VAT Directive 2006/112/EC of 28 November 2006. This directive is based on the following principles:

- Value-added tax is charged for transactions involving a VAT payer in the territory of a member state and on imports of goods into the territory of the EU. It is important to note, however, that the import of goods from one member state of the EU to another member state of the EU is subjected to VAT in the country where the goods will be used.

- Country of the purchaser shall be considered to be a place of supply of goods in case of intra-EU sales. Import VAT becomes payable in case of supplies from outside the EU in the country where goods have been cleared and released into free circulation.

- The obligation to charge VAT arises when the purchaser receives the goods or services. A supplier’s issuing of an invoice does not constitute this moment.

- The standard VAT rate in EU countries is at least 15%, with no maximum limit. The current minimum VAT rate in the EU is 17% in Luxembourg, and the maximum is 27% in Hungary. Countries can apply two special reduced VAT rates to the limited list of goods and services according to the Directive. Their minimum should not be less than 5%, while this exception is given only to Spain, Italy, and Luxembourg.

- The Directive provides for cases where certain goods and services are completely exempt from VAT. In general, any export from an EU country, irrespective of the destination, is refundable in respect of previously paid VAT connected with the production of goods sent for export.

- VAT refund in the EU-the most extensive clause of the Directive, which provides for the possibility to refund in the country of registration VAT that was paid in another EU member state.

- Distance sales from the EU via the Internet or a catalog are subject to VAT in the country where the goods are sent. However, if such sales to a given country reach that country’s threshold, one needs to register oneself as a VAT payer. For example, in Belgium, such a threshold is 35,000 euros. Therefore, provided the volume of distance sales to Belgium exceeds the above limit, then the sending company should acquire a Belgian VAT number.

- With the EU, you can check the VAT number of any European company. This can be done through a special service on the official website of the EU by selecting the country where you received the VAT number and entering that number.

- Value Added Tax Number – a unique number assigned to a legal entity when registering as a value added tax payer. In EU countries it starts with two letters of the country code, the remaining symbols are digits and the number of digits may vary from country to country.

Current value added tax (VAT) rates in European countries

| Country | EU membership | Basic rate of VAT | Reduced VAT rate | Minimum threshold for registration as a VAT payer |

| Austria | Yes | 20% | 13%, 10%, 0% | Annual turnover from 30 000 EUR |

| Albania | No | 20% | 0% | Annual turnover from 5 000 000 lek (40 000 EUR) |

| Andorra | No | 4,5% | 9,5%, 1%, 0% | Compulsory registration |

| Belgium | Yes | 21% | 12%, 6%, 0% | Mandatory registration, but for distance selling the threshold is 35,000 EUR |

| Bulgaria | Yes | 20% | 9%, 0% | Annual turnover from BGN 50,000 (EUR 25,500), but other thresholds for some activities |

| Bosnia and Herzegovina | No | 17% | 0% | Annual turnover from 50,000 convertible marks (27,000 EUR) |

| UK | Yes | 20% | 5%, 0% | Annual turnover from £83,000 (95,000 EUR) |

| Hungary | Yes | 27% | 18%, 5%, 0% | Mandatory registration except for distance selling |

| Germany | Yes | 19% | 7%, 0% | Turnover for the previous year – from 17 500 EUR and expected turnover for the current year – from 50 000 EUR |

| Gibraltar | No | 0% | No | No |

| Greece | Yes | 24% | 13%, 6%, 0% | Annual turnover from 10 000 EUR |

| Denmark | Yes | 25% | 0% | Annual turnover from DKK 50,000 (EUR 6,700) |

| Ireland | Yes | 23% | 13,5%, 9%, 4,8%, 0% | Annual turnover of 75,000 EUR or more, of which 90 per cent is turnover from trading activities; otherwise the threshold for registration is 37,500 EUR |

| Iceland | No | 24% | 11%, 0% | Compulsory registration |

| Spain | Yes | 21% | 10%, 4%, 0% | Compulsory registration |

| Italy | Yes | 22% | 10%, 5%, 4%, 0% | Compulsory registration |

| Cyprus | Yes | 19% | 9%, 5%, 0% | Annual turnover from 15 600 EUR |

| Latvia | Yes | 21% | 12%, 5%, 0% | Annual turnover from 50 000 EUR |

| Lithuania | Yes | 21% | 9%, 5%, 0% | Annual turnover from 45 000 EUR |

| Liechtenstein | No | 8% | 3,8%, 2,5%, 0% | Annual turnover from 100,000 francs (86,700 EUR) |

| Luxembourg | Yes | 17% | 14%, 8%, 3%, 0% | Compulsory registration |

| Macedonia | No | 18% | No | Annual turnover from 1,000,000 denarii (16,600 EUR) |

| Malta | Yes | 18% | 7%, 5%, 0% | Compulsory registration |

| Moldavia | No | 20% | 8%, 0% | Annual turnover from 600 000 lei (30 300 EUR) |

| Netherlands | Yes | 21% | 6%, 0% | Compulsory registration |

| Norway | No | 25% | 15%, 12%, 0% | Annual turnover from NOK 50,000 (EUR 5,300) |

| Poland | Yes | 23% | 8%, 5%, 0% | Annual turnover from PLN 200,000 (EUR 46,700) |

| Portugal | Yes | 23% | 13%, 6%, 0% | Compulsory registration |

| Romania | Yes | 19% | 9%, 5%, 0% | Annual turnover from 65 000 EUR |

| Serbia | No | 20% | 10%, 0% | Annual turnover from 8,000,000 RSD (67,800 EUR) |

| Slovakia | Yes | 20% | 10%, 0% | Annual turnover from 49 790 EUR |

| Slovenia | Yes | 22% | 9,5%, 0% | Annual turnover from 50 000 EUR |

| Finland | Yes | 24% | 14%, 10%, 0% | Annual turnover from 10 000 EUR |

| France | Yes | 20% | 10%, 5,5%, 2,1%, 0% | Compulsory registration |

| Croatia | Yes | 25% | 13%, 5%, 0% | Annual turnover from 230,000 kuna (31,200 EUR) |

| Montenegro | No | 19% | 7%, 0% | Annual turnover from 18 000 EUR |

| Czech Republic | Yes | 21% | 15%, 10%, 0% | Annual turnover from CZK 1,000,000 (EUR 39,000) |

| Switzerland | No | 7,7% | 3,7%, 2,5%, 0% | Annual turnover from 100,000 francs (86,700 EUR) |

| Sweden | Yes | 25% | 12%, 6%, 0% | Compulsory registration |

| Estonia | Yes | 22% | 9%, 0% | Annual turnover from 40 000 EUR |

Tax residence in Europe – expat taxes

Tax residency in a low-tax jurisdiction in Europe offers the opportunity to significantly reduce the fiscal burden. However, before choosing a country for residency, it is recommended to familiarise yourself with the current income tax rates in European countries.

The most favourable conditions for individuals are provided in the following European countries:

| European country | Peculiarities of income tax accrual | Standard rate of income tax |

| Andorra | Tax residents are taxed on all worldwide income. There are no taxes on wealth, gift, inheritance, capital gains (except for capital gains from buying and selling property in Andorra). Since 2015, a progressive system of taxation was introduced (some of the lowest taxes in Europe): Up to 24.000 EUR-0% (for non-residents 10%); 24,001 – 40,000 EUR – 5%; from 40,001 EUR – 10%. In the case of married couples, income tax is levied on amounts exceeding 40,000 EUR at a rate of 10%. The same tax is imposed on interest from bank deposits, but only for amounts over 3,000 EUR. Regarding the sale of real estate, capital gains are subject to tax at a rate of 15%, though every year the rate decreases, and from the 13th year of ownership, the property can be sold without fiscal obligations. | 10% |

| Bulgaria | The fiscal obligations due by Bulgarian tax residents extend to worldwide income. The uniform income tax rate recorded in the country is among the lowest throughout Europe, being no more than 10%. In addition to the income tax, Bulgaria applies state insurance contributions: social and health insurance: social insurance – 24.7-25.4%, of which 14.12-14.82% is to be paid by the employer, 10.58% by the employee; health insurance – 8%, of which 4.8% is to be covered by the employer, 3.2% by the employee. No capital gains tax exists, but there is a tax on property. This makes Bulgaria the lowest taxed country in Europe, due to its income tax of 10%. | 10% |

| Hungary | This European country levies an income tax rate of 15%. Hungary also enforces 13% for the social tax and 18.5% on the social security contribution. For this European country, the general rate for inheritance and gift tax is 18%, while it uses a favorable housing tax rate of 9%. It does not tax donations among direct relatives. | 15% |

| Gibraltar | Where the rate of income tax, of course depends on which system chosen. Surcharge or gross income, so in allowance system, tax is paid on income minus allowances and the rates are: first 4,000 pounds – 16%, next 12,000 pounds – 19%, after that-41%. Gross income system: first 10,000 pounds – 8%; next 7,000 pounds-22%; after that up to 25,000 pounds-30%. Then the tax rate for income over £25,000: the first £17,000 – 18%; next £8,000 – 21%, next £15,000 – 27%, next £65,000 – 30%, and anything over that – 27%. Payments for social security in Gibraltar are also imposed at a rate of 10% of the employee’s gross salary, minimum £12.10 and maximum £36.30 a week; 20% of the gross income of the employer, minimum £28.00 and maximum £50.00 a week; and a similar charge of 20% of a self-employed individual’s gross income, minimum £25.00 and maximum £50.00 a week. No such tax liability exists: a consumption tax such as VAT; a wealth tax; inheritance tax; death duty; tax on dividends; tax on gifts, and no social security contributions. It is to be noted that an income of £ 11,450 does not attract any income tax. Besides, the country also applies a variety of deductions that reduce the fiscal burden and create conditions for Gibraltar to retain its status of the territory with the lowest taxes in Europe for a long time to come. | between 8 per cent and 30 per cent |

| Cyprus | Cyprus is also one of the jurisdictions with the lowest corporate tax rates in Europe-12.5%. Tax residents in the Republic pay annual income tax on a progressive scale: up to 19,500 EUR-0%, from 19,501 to 28,000 EUR-20%, from 28,001 to 36,300 EUR-25%, from 36,301 to 60,000 EUR-30%, from 60,001 EUR-35%. Apart from the basic income tax in Cyprus, special defence contribution is withheld. It is withheld only on dividends-17%, interest-in most cases 30%, and rental income. However, special non dom status exonerates one from payment of taxes on dividends, on interest from deposits, on rental income, and the levy on defence. There is no tax on inheritance, immovable property, capital gains-except on property transactions, in Cyprus. Different incentives and deductions make this jurisdiction appealing in Europe. | 0 to 35% |

| Lithuania | In 2023, tax residents of Lithuania are subject to tax at a rate of 20% on income not exceeding 101,094 EUR per calendar year and 32% on everything exceeding this amount in respect of income from employment, payments to members of the management or supervisory board, income received under copyright contracts, received from the company that is also the employer of the given person, income under a civil law contract received by the manager of a small partnership not being its member. Dividends are also taxed at a rate of 15%, but the law provides for preferential treatment in respect of certain companies. There is no capital gains tax in this European country, there is no withholding of inheritance tax from close relatives, there is no gift tax or luxury tax. Social contribution of Lithuania amounts to 19.5%, including health insurance. | 20% to 32% |

| Liechtenstein | Liechtenstein has a very faithful, progressive income tax system, making the Principality practically the lowest in Europe. Annual income exempt from income tax includes: the income of a natural person is CHF 15,000, that of a single parent is CHF 22,500, and for a married couple, it is CHF 30,000. The highest income tax rate is 8%, imposed on income of more than CHF 200,000 per year for a single person, more than CHF 300,000 per year for a single parent, and more than CHF 400,000 per year for married couples. Still, one has to consider that this Principality in Europe has a communal tax represented by a surcharge ranging from 150% to 180% to the national income tax. The decision to increase the fiscal burden is made every year by the local government. Provided that there is a communal tax, the effective burden on personal income increases from 2.5% up to 22.4%. There are no inheritance, estate or gift taxes in Principality. On the contrary, there are capital gains tax – 3 – 24% depending on amount – and social contributions: 4.7% pension contribution, and 0.5% unemployment insurance. | 1 to 8 per cent |

| Slovakia | Current income tax rates: the tax base exceeding the subsistence minimum by 176.8 times (i.e. up to 38 553.01 EUR) is taxed at the rate of 19%, everything more – 25%; dividends – 7%; capital gains – 19%. There are no local taxes on personal income in this European country. | 19%/25% |

| Montenegro | Residents pay tax on worldwide income from any source, non-residents – only on income related to a permanent establishment in Montenegro, as well as on royalties, interest, and from the rental of local immovable property. From 1 January 2022, this European country has a progressive taxation scale: up to 700 EUR (gross) – no tax; from 701 to 1,000 – 9%; from 1,001 – 15%. Entrepreneurs pay tax at the following rates: from 8,400.01 to 12,000 EUR – 9%; from 12,000.01 EUR – 15%. A few years ago, the 9% income tax rate was the lowest in Europe, and the progressive scale leveled this advantage, but Montenegro continues to be an attractive jurisdiction for tax residency. | 9%/15% |

| Czech Republic | Since 2021, the Czech Republic has introduced a progressive taxation system for personal income: up to CZK 1,867,728 (~78,420 EUR) – 15%; anything above that – 23%. The income tax rate of 15% corresponds to the European average. | 15%/23% |

| Switzerland | In Switzerland, the income tax withholding is at three levels: federal, cantonal, and municipal. Federal income tax is progressive in the country, ranging between 0.77% and 11.5% above CHF 769,700. Still, each canton and municipality is entitled to its way of deriving the income tax rate from such a broad base. So in some parts of the country, taxes for the residents are not that high. This has resulted in an effective tax burden of 22.22 per cent on personal income in the Canton of Zug, 23.82 per cent in Appenzell-Innerrhoden, and 24.3 per cent in Obwalden, while in the Canton of Geneva, it reaches as high as 44.75 per cent. | from 22.22% |

| Estonia | As in most other European countries, in Estonia residents pay taxes on all income, while non-residents pay taxes only on profits earned in the country. The standard income tax rate is 20% | 20% |

How to obtain tax residency in Europe

In order to pay low taxes in Europe, it is necessary to obtain residency status in the desired country. In most cases, to become a tax resident, it is necessary to fulfil a number of conditions, including living in the country for at least 183 days during the year. However, it should be noted that in some countries the requirements are more stringent, and it is possible to obtain favourable tax residency in Europe even earlier.

| Country | Options for obtaining tax residency in Europe |

| Andorra | Residence exceeding 183 days in a year. Business centre in the country. |

| Bulgaria | In order to be considered a tax resident of Bulgaria, an individual must have a permanent address in the country and reside there for a minimum of 183 days within a 12-month period. Additionally, the individual must have a centre of vital interests in Bulgaria, such as a family, property, job, or business. |

| Hungary | Staying in Hungary for at least 183 days in a calendar year. |

| Gibraltar | A residence of at least 183 days in any tax year, and more than 300 days in the aggregate over three consecutive assessment years. |

| Cyprus | The minimum period that the house is available for is 183 days in aggregate. Please note that the day of departure is not counted as a day of residence, while the day of arrival is. Furthermore, if one arrives and departs in Cyprus, it would count as one day. The 60-day rule is applicable provided the following preconditions of the individual are met: does not reside in any other state for more than 183 days; is not a tax resident of other states; resides in Cyprus for more than 60 days; has economic interests (business, housing) in Cyprus. |

| Latvia | An individual may become a tax resident of this European country if they fulfil any of the following criteria: 1. They are registered as a resident in Latvia. 2. They have stayed in Latvia for more than 183 days in any 12-month period. |

| Lithuania | Please confirm whether the person concerned lived in this European country during the period indicated for taxation purposes, showing personal, social, or economic interests in Lithuania. The person has spent at least 183 days in Lithuania during the tax period. A person who has stayed in Lithuania for a period or periods that, when put together, amounts to more than 280 days in consecutive tax periods if the period of such stay totaled 90 days or more in any such tax period. Any natural person who is a Lithuanian citizen but does not correspond to the criteria stated above and who is paid under a labor contract or a contract which under its content corresponds to a labor contract, or whose expenses of residence abroad are covered from the State or municipal budget of the Republic of Lithuania. |

| Liechtenstein | Possession of a residence permit. Staying in the territory of the country for more than 6 months continuously, excluding short breaks. |

| Slovakia | Being physically present in Slovakia for 183 or more days in a calendar year |

| Montenegro | To qualify, individuals must: 1. Spend at least 183 days in Montenegro. 2. Have a permanent residence. 3. Have their centre of activity in Montenegro. |

| Czech Republic | Staying more than 183 days in a calendar year. Permanent residence in the Czech Republic (permanent address). |

| Switzerland | By Swiss domestic tax legislation, an individual is deemed a tax resident if they: 1. Have a permanent place of residence and a center of vital interest in Switzerland. 2. Intend to engage in gainful activity in Switzerland for a consecutive period (excluding short-term absences) of at least 30 days. 3. Intend to remain in Switzerland without engaging in gainful activity for a consecutive period (excluding short-term absences) of at least 90 days. |

| Estonia | If the stay in Estonia in any 12-month period exceeds 183 days |

It is quite difficult to choose on your own the country in Europe which offers the best tax residency, as you are bound to study the corporate and tax legislation of the country you are interested in rather thoroughly. So, it would be far easier to ask for help from lawyers and tax consultants operating in Regulated United Europe.

Accordingly, Regulated United Europe lawyers would recommend considering the following criteria when choosing a country to start a business:

Facility of starting and operating a business. In addition to the tax rate, remote management of the company is a concern, as well as how much it would cost to maintain. If your area of business requires licenses or permits from the state, you will want to carefully consider this issue before opening a company.

Taxation. The main issue for both you and your company as owners are individuals depends on whether you plan to reside in the country where you open your business or only intend to set up a legal entity and manage it remotely. In the first case, taxation for individuals is important for you; in the second case, it is only corporate taxes.

Human capital. The list of countries that would fit the bill can vary greatly depending on the business of the company – if you need a highly qualified labour force with good English language skills to carry out your activities, then the countries with the lowest wages in the EU are not the right option for you.

Level of salary. As in the point above, the most important role is taken by the area of the company’s activity – if the area of your business presupposes employment of a large number of low-skilled labour, you should first refer to the countries with the lowest wages of the European Union.

Countries in Europe that have the lowest tax

The Estonian model of taxation is unique among European countries, probably the most favorable for entrepreneurs and investors; it presupposes nondistortion of the process by taxing only the profit distribution, and it can be said to have obvious advantages in business growth and development. In the present paper, we would like to discuss Estonia as a leader among European countries providing the most favorable conditions to companies in respect of taxation.

Characteristics of the Estonian Tax System

The Estonian taxation system stands apart from all other countries by its corporate profits, which are only taxed in instances of distribution of the profit. Profits invested or reinvested in the company are not taxed, thereby encouraging reinvestment and rapid enterprise growth. It encourages companies to grow and develop innovative activities while it is now becoming one of the most promising jurisdictions for doing business in Europe.

Benefits of Estonian tax model for business

- Encouraging reinvestment. Since it does not provide for tax on retained profit, companies effectively can boost their capital with reinvestments. This is one of the main driving forces behind sustainable growth.

- Transparency and simplicity: The Estonian tax system is characterized by a high degree of transparency and simplicity. All this decreases administrative barriers and compliance costs.

- International business support. Due to Estonia’s well-developed digital infrastructure and the possibility to manage business online with the help of its unique system called e-Residency, many favorable conditions are created for international companies to be happy with their decision to choose this country as a destination for their endeavors.

- Tax incentives for a startup company. Having provided a number of tax incentives and support for the establishment of start-ups, it is actually one of the best platforms in Europe for innovative entrepreneurship.

It forms a leader in Europe on the Estonian scene regarding favourable taxation for business. A special Estonian tax system encouraging reinvestment and innovation, transparency, and ease of administration, together with strong support for international and innovative businesses, form an ideal environment for a company to develop and expand its business in Estonia. All these factors turn the country into an attractive point on the European map for entrepreneurs who try to find the maximum of efficiency in their business and look for a tax structure that would be optimal.

Lowest Income Taxes in Europe

Excluding the search for optimal conditions to work and live in, Europe represents a mosaic of diverse tax systems. It is among European states that Estonia became an outsider for its tax policy, offering some of the most favorable conditions for citizens. Below follows a closer look at why it is Estonia leading in Europe regarding favorable personal income taxation.

Peculiarities of Income Tax in Estonia

One of the most loyal progressive personal income tax rates in Europe is used in Estonia. The personal income tax is 20 per cent, though due to the wide possibilities offered by the tax deduction system, the real tax rate is one of the lowest in Europe.

Strengths of Estonian tax environment

- Understandability and transparency. The Estonian tax system has a high degree of comprehensibility and transparency. Ease of declaring and payment decreases the administrative burden on taxpayers.

- Tax benefits and deductions. Speaking about the individual taxpayers, Estonia provides quite a wide range of tax-free allowance and deductions that significantly reduce the taxable income and thus the amount of tax payable.

- Incentivizing investments: Due to the Estonian tax system’s peculiarity, there is no taxation levied on reinvested profit, which would encourage investments and is one way of benefiting capital growth.

- Digitalization of processes: Estonia is considered a leader in the world in digitalizing public services, including tax administration. It provides for electronic income declaration to simplify this process as much as possible.

While most European states put noticeably higher income tax rates and at the same time have more complicated taxation and administration systems, Estonia creates more attractive conditions for people. This not only reduces the financial burden on taxpayers but also provides favorable conditions to attract highly qualified specialists and investors in the country.

Estonia is proof that even within the frames of the modern European economy, it is possible to create a tax system that would favor business development and attract foreign specialists. The combination of low tax rates with simplicity and transparency of taxation makes Estonia one of the most attractive countries in Europe for living and working. Thus, Estonia is the leader in terms of favourable personal income taxation not only throughout Europe but also can be viewed as a successful example for many countries on the international level.

Lowest taxes in Europe for business

Nowadays, a country may be chosen based on its tax policy for business implementation. Europe with different tax systems gives an entrepreneur numerous opportunities to optimize his or her tax liabilities. In this context, Estonia belongs to those countries which have some of the most favorable tax systems in Europe for business by offering special conditions for developing companies and attracting investments.

Peculiarities of the Estonian tax system

Estonia introduces a new concept of corporate income taxation, which is paid only in the case when the profit is distributed as dividends. The corporate tax constitutes 20 per cent, but until the payment of the dividends is performed, company’s profit can be subject to reinvestment being tax-free. Due to this, the given approach motivates business to grow and develop as the capital may be efficiently utilized and multiplied.

Business advantages

- Incentivising reinvestment: due to the fact that the system defers taxation of the profits to the moment of their distribution, it encourages companies to reinvest their earnings in business and accelerates development and expansion.

- Simplicity and transparency: high simplicity and transparency are typical for the Estonian tax system, which decreases the administrative burden of a company and the risk of tax disputes.

- Support for innovation: Estonia actively supports innovative projects and startups by offering tax incentives and several support programmes for them, which turns the country attractive for technology companies.

- Digital economy. Thanks to the developed e-government infrastructure, Estonia offers unique opportunities to conduct business in a digital environment, making a lot of procedures easier and more accessible.

Comparison with other European countries

Among other European countries that have more traditional and often heavy approaches to taxation, Estonia has some undeniable advantages in doing business. This places Estonia among the top destinations for investors and businesses looking for a spot to invest in with regard to effective tax planning and optimization of liabilities.

Estonia is among the most striking European countries when it comes to attracting attention in terms of taxation with regard to entrepreneurs. The innovative approach to taxation, support for reinvestment, ease of administration, and focus on digitalization create a very favorable environment for the development of companies of all sizes. Thus, Estonia guarantees not only some of the lowest taxes in Europe for businesses but also it is a prime example of how state tax policy can drive economic growth and innovation.

Lowest taxes for freelancers in Europe

In the globalised world and in the development of the digital economy, freelancing is turning into one of the most popular forms of employment. Europe, with its diverse tax systems, offers freelancers ample opportunities. On the other hand, when choosing a country to register an activity, it is important to take into account not only the amount of taxes but also the convenience of doing business. In this context, Estonia is the most attractive jurisdiction for freelancers due to its favourable tax policy and developed e-government infrastructure.

Peculiarities of taxation of freelancers in Estonia

Within Estonia, freelancers have the option to conduct their activities under the e-Residency system. It provides a means not only for smoother procedures in business management but also for optimizing tax burdens. The income tax of individuals is 20 percent, with various exemptions and deductions to ease the burden of taxation.

Benefits for freelancers

- Simplicity and accessibility. Registering and managing a business is as easy and accessible through e-Residency as anywhere in the world for freelancers from different corners of the world.

- Tax optimisation. The Estonian tax system is very friendly, enabling possibilities of tax optimization, including several exemptions and deductions applicable to the income of freelancers.

- Government support. The Estonian government does much to support freelancers and entrepreneurs by offering various support and training programs.

- Digital infrastructure. Thanks to a highly developed digital infrastructure, freelancers can efficiently manage their business, communicate with clients and access government services online.

Comparison with other European countries

Compared to other European countries, Estonia offers some of the most favourable conditions for freelancers. Low tax rate, possibility of tax optimisation, as well as convenience and ease of doing business make Estonia an attractive jurisdiction for international freelancers.

Choosing Estonia as a jurisdiction at the time of registration of a freelancer’s activity opens not only possibilities for optimization of tax liabilities but also access to the most convenient and effective system for carrying out business management. The benefits of the Estonian tax system, together with the developed digital infrastructure of this country, turn it into one of the most attractive countries in Europe for freelancers who seek to maximize efficiency and minimize administrative barriers when running their business.

Which EU country is best to choose for tax residence

Choosing a country of tax residence is one of the most important decisions that every international entrepreneur and investor needs to make. Within the European Union, there are numerous jurisdictions with their own certain tax regime which offers different advantages. However, when it comes to choosing tax residency, it is not only a question of the tax rate but also of the general policy of taxes, stability of the economic environment, and ease of doing business. In this context, Estonia is one of the most attractive countries for tax residency in the EU.

Main advantages of Estonia

- Progressive taxation exists. Estonian corporate income tax can be paid only in one case: when an enterprise distributes dividends. Thus, companies can reinvest their profits without additional tax burdens on them or their owners.

- Simplicity and transparency are in place. The Estonian tax system is characterized by a high level of transparency and predictability, which minimizes risks for businesses and eases the planning of tax liabilities in general.

- Digital economy and e-Residency. Estonia is one of the most advanced countries in the world in terms of the digitalisation of public services. The e-Residency programme provides an opportunity to run the businesses online from anywhere in the world, which is especially appealing for international entrepreneurship.

Comparing to Other EU Countries

While Other EU countries—Ireland or Cyprus, for example—offer attractive tax regimes for businesses, this is an unbeatable combination in Estonia: low taxes, digitization of processes, and stability in the business climate. The Estonian tax environment is simple and clear-cut, unlike other jurisdictions where low taxes are combined with complex administration or uncertain tax laws.

Choosing Estonia as a country of tax residency, entrepreneurs and investors get optimal effective tax planning in the stable and predictable jurisdiction. The innovative tax system, combined with the advanced digital infrastructure and the ability to enter the European market, makes Estonia one of the most attractive countries for tax residency in the European Union.

EU countries with the lowest import taxes

Import duties are among the most important trade policy tools that influence economic relationships among countries. Inside the EU, tariffs and duties are harmonized for all members of the customs union, but due to numerous trade agreements and economic zones, some countries and territories offer special conditions when importing goods. In this article, we will look at which EU countries can boast the lowest import duties and what benefits this can provide to international entrepreneurs.

EU and Import Duties: The Big Picture

The European Union levies the Common Tariff Rate on goods imported from outside of the union. However, through various trade treaties, items originating from specific countries can be imported at lower rates or even duty-free. Within the EU itself, there are free economic zones and territories with special taxation regimes that may also offer lucrative conditions for imports.

Countries with the Most Favorable Conditions

- The Netherlands. Having a favorable geographical position, together with the port in Rotterdam as one of the biggest in the world, creates optimal conditions in the Netherlands for importing and further re-export. The state actively uses its logistical advantages by offering customs clearance with the simplified procedure and special economic zones.

- Belgium. Belgium also enjoys the same logistical advantage because of its port, housed in Antwerp. There, customs are known to be quite efficient, and the channels of accelerated import processing are well developed.

- Luxembourg. This country doesn’t have any seaports, but still it offers lots of attractive conditions for imports due to very favorable tax legislation and a high level of logistics infrastructure development.

- Malta. Malta provides special conditions in case of importation of goods, especially for the services and technology sector, by view of policy to attract foreign investment and develop economy.

EU trade agreements with third countries ensure low import duties for European businesses. Where these agreements are between the countries participating, a substantially reduced rate or even complete waiver from duty may be extended to specific categories of goods.

Which country to choose for importation of goods into the European Union depends on many factors, including logistics and customs procedures, as well as tax policy. For instance, the Netherlands, Belgium, Luxembourg, and Malta can be included in the category of attractive jurisdictions in terms of import duty and may provide substantial benefits for international entrepreneurs. However, while choosing a tax strategy, a holistic approach has to be considered by analyzing all the associated costs and likely benefits of trading in the country selected.

Tax comparison Europe

Tax policies vary widely across Europe, making the continent attractive to international investors in certain jurisdictions depending on their tax rates and regulatory environment. In this article, we will look at the countries with the highest and lowest tax rates in Europe to help investors and entrepreneurs make informed choices when planning their business operations.

High-tax countries

- Denmark. Denmark is often singled out as having one of the highest levels of taxation in the world. The standard income tax rate for individuals can reach up to 55.9%, including all municipal and state levies. This is due to the high level of social guarantees and quality of life.

- Sweden. Sweden’s taxes are also high, with a top personal income tax rate of about 52 per cent. As in Denmark, high taxes go to finance extensive social protection and public services.

- Belgium. Belgium has one of the highest taxation rates in the EU, with a top personal income tax rate of up to 50%. The tax system in Belgium is complex, with many local and regional taxes increasing the overall tax burden.

Low-tax countries

- Bulgaria. Bulgaria Bulgaria offers one of the lowest tax rates in the European Union, with a flat rate of corporate tax and personal income tax of 10%. This makes the country attractive for foreign investors and business immigration.

- Ireland. Ireland is known for its corporate tax rate of 12.5%, which is one of the lowest in Europe. This has contributed to Ireland becoming a significant financial hub, attracting many international companies, especially from the high-tech sector.

- Cyprus. Cyprus offers a corporate tax rate of 12.5% and a number of tax incentives for foreign investors, making it a popular choice for international business. In addition, Cyprus has an advantageous programme for investors who can take advantage of special tax treatment of dividends and interest.

The choice of a country to do business in Europe depends significantly on the tax policy and economic environment. High-tax jurisdictions tend to offer high levels of social protection and developed infrastructure, while low-tax jurisdictions attract businesses with favourable tax rates and less bureaucracy. It is important to carefully analyse all aspects before deciding where to incorporate a company to ensure the best fit between tax strategy and business objectives.

Taxes optimization in Europe

A study conducted by Organisation for Economic Co-operation and Development bears witness that corporate taxes are the most destructive to economic growth in Europe, whereas personal income tax and consumption tax are less destructive. The same goes with property taxes: they have the least contribution to deterring a country’s economic growth. The competitive and neutral tax code contributes to the country’s sustainable economic growth and attracts foreign investment, and simultaneously collects sufficient funds in the treasury for state needs.

The Estonian tax rating is most attractive in Europe already for the tenth year. First, the 20 per cent corporate income tax rate is paid only by distributed profits. Second, Estonia boasts a flat 20 per cent personal income tax rate not applied to personal dividend income. Third, property tax applies only to the value of land but not to real estate or capital. Finally, the country has a territorial tax system that excludes from its domestic tax 100% of foreign profits earned by domestic corporations.

European Tax Competitiveness Index

- Estonia

- Switzerland

- Czech Republic

- Luxembourg

- Lithuania

Overview of best ranking EU countries regarding tax competitiveness

Estonia

Estonia

- For one decade now, Estonia has been ranked number 1 in the International Tax Competitiveness Index.

- There is only tax on distributed profits under the Estonia corporate income tax system, and thus companies can reinvest their profit without paying any taxes.

- Property taxes are only levied on the value of the land.

Switzerland

Switzerland

- Switzerland has above-average reimbursement conditions for investment in machinery, buildings, and intangible assets.

- Switzerland boasts 102 tax treaties, which is quite an impressive number, and no CFC (controlled foreign corporations) rules – the latter are designed to block corporations from shifting pre-tax profits from a high-tax country to a low-tax country by utilizing forms of income that can be easily shifted round.

Czech Republic

Czech Republic

- The corporate rate of 19 per cent below OECD average 23.6 per cent.

- High threshold for obtaining a VAT number.

- The Czech Republic also has a territorial tax system that only exempts both dividends and capital gains earned from other European countries, and also has an extensive network of tax treaties.

Luxembourg

Luxembourg

- Capital gains taxation is exempted when any asset, such as shares, has been held for at least six months, hence encouraging long-term savings.

Lithuania

Lithuania

- Corporate tax rate: 15 per cent, which is considerably lower than the EU average.

- Labour taxes are lower than the average in the EU.

Least competitive tax systems in Europe

Italy has the second least competitive tax system in the OECD. The Italian tax system includes a number of distortionary property taxes, such as: i) a separate levies on the sale of real estate; ii) other real estate financial transactions; and iii) a wealth tax on individual assets. The high standard VAT rate of 22 per cent is complemented by one of the fifth narrowest consumption tax bases in the OECD.

The economies that rank with Italy at the bottom of the European tax competitiveness ranking – France, Portugal, Poland, and Spain – commonly impose relatively high marginal corporate income tax rates or have multiple layers of tax rules. All five countries that are ranked at the bottom have aggregate corporate tax rates above the EU average.

Ireland ranks poorly in the ranking despite a relatively low corporate tax rate. This is due to the high level of personal income and dividend taxation, but also because of the relatively narrow VAT base. The five lowest ranked countries have abnormally high corporate income tax rates in a range from 25.825 per cent up to 35 per cent. Unusually high top income tax thresholds well above average income are found for four of the five lowest-ranked countries. Of these, the highest aggregate corporate income tax rate is 31.5 per cent in Portugal. Portugal also levies one of the highest top personal income tax rates at 53% in addition to further taxes.

The lowest maximum corporate income tax rates in the OECD are found in Hungary at 9 per cent, Ireland at 12.5 per cent and Lithuania at 15 per cent. No such tax is levied in Estonia.

Loss relief rules: carry forwards and carry backs

Hungary, Poland and Slovakia have the most severe restrictions on the carry-forward of company losses (next year): carry-forwards are not allowed and carry-forwards are not only limited to five years, but also limited to 50 per cent of taxable income. In 2023, only the Estonian and the Latvian systems consciously have no limits on loss carryforwards.

Capital allowance: machinery, buildings and intangible assets

For instance, Estonia and Latvia permit 100 per cent of the present value of capital investments to be written off, since their corporate tax applies only to distributed profits and thus is determined by cash flow.

Portugal, Luxembourg, Germany and France apply income tax to all or part of their corporate income tax base.

Most countries tax personal income using two approaches. First, countries impose income taxes and payroll taxes on income from work. The structure of those taxes can affect people’s choices of whether to work, to work additional part-time jobs, or whether a second family breadwinner will work. Second, people are taxed on their savings through the imposition of taxes on capital gains and dividends. In most cases, these taxes represent a second tier of corporate income taxes and could have an impact on savings and investment decisions. High capital gains and dividend taxes may lower the total savings and investments in a country.

The income tax system in most countries has a progressive tax structure where earn more income, they fall into a higher tax bracket. The top statutory personal income tax rate applies to all income above a cut-off level.

The total statutory personal income tax rate including employee social contributions is highest in Slovenia at 67.5 per cent while Estonia has the lowest rate at 21.6 per cent.

Along with wage income, individual income tax systems in a large number of countries tax investment income through the taxation of capital gains and dividends.

Capital gains generally arise when an individual purchases an asset – usually corporate stock – in one period and then sells it in another period at a gain. A dividend is an after-tax payment to the individual from corporate profits.

Capital gains taxes and personal dividend taxes represent a double taxation of corporate profits and thereby further increase the tax burden on capital. When a corporation realizes a profit, it first faces the corporate income tax. The after-tax profit can then typically go one of two ways. The corporation can retain the after-tax profit. That raises the value of the business and thereby its stock price. The shareholders then sell the stock and receive capital gains, which requires them to pay tax on that gain. Another option is that a corporation distributes after-tax profits to shareholders through dividends. Shareholders who receive dividends then pay dividend tax on that income.

Example:

If a company earns $1 million of taxable income with a 20 per cent corporate income tax rate, there would remain $800,000 to reinvest in the company, thereby increasing the value of the stock, or to pay dividends. The shareholder may then be subject to an additional 20 per cent tax on the gain from the sale of the stock or on the company’s dividends. In effect, the system taxes business profits at 36 percent. An individual who expects that an investment will yield a 10 percent real return may realize a mere 6.4 percent profit after tax.

VAT/sales tax exemption threshold

Most OECD countries offer thresholds above which firms must pay VAT/sales tax. Where a firm’s annual income is beneath the threshold, it is not obligated to enter the VAT system. This means that small businesses – contrary to those above the threshold – do not charge VAT on commodities sold to final consumers, but at the same time cannot recover a VAT refund on the amount paid for business expenses. While relieving very small businesses from the burden of the tax saves administrative and compliance costs, needlessly high thresholds are distorting in that they tend to benefit small enterprises at the expense of larger firms.

Property tax

Property taxes are government imposition on an individual’s or entity’s assets or estates. The collections and frequency depend on the class of estate tax. Inheritance tax for instance is imposed once a person dies and his or her estate flows into the hands of heir correspondingly. Estate taxes come in fixed periods, which for most countries is annually, and their assessment has been dependent on the value of assessable property such as land and real estate. Apart from land tax the rest of the estate taxes augment economic distortions and bring adverse long-run impact on economy and its productivity.

Property taxes

Many countries also impose estate taxes on a person’s wealth. These come as inheritance or succession taxes, which are imposed either on a person’s estate at death or on assets transferred from the deceased’s estate to the heirs, or as a recurring tax on a person’s wealth. Inheritance and inheritance taxes restrict resources available for investment or production and decrease incentives to save and invest. This decrease in investment goes against economic growth. Additionally, these taxes – especially inheritance and inheritance tax – can be avoided through certain planning techniques, making the tax an inefficient and unnecessarily complex source of government revenue.

Inheritance and gift taxes are significant burdens on the taxpayer, while at the same time producing very scant revenues for the state. Inheritance, inheritance and gift taxes in OECD countries generated an average of 0.15 per cent of GDP in tax revenue, with the highest amount collected only 0.74 per cent of GDP in France, despite the fact that this tax may go as high as 60 per cent in some cases.

European countries with no inheritance, inheritance or gift tax: Austria, Estonia, Israel, Latvia, Norway, Slovakia and Sweden.

Property transfer taxes

Property transfer taxes are taxes on the transfer of real estate, land improvements, machinery from one person or company to another. In the Czech Republic, Estonia, Lithuania and Slovakia there are no property transfer taxes.

Withholding taxes on dividends, interest and royalties to foreign investors

The withholding rates are the highest in Switzerland, which withholds 35 per cent on dividend or interest payments by Swiss companies to foreign entities or individuals. There is no taxation of dividends and interests in Estonia, Hungary and Latvia.

Royalties – On royalties also, Belgium calls for firms to withhold the maximum amount, 30 per cent. Hungary, Latvia, Luxembourg, Hungary, the Netherlands, Norway, Sweden and Switzerland have no requirement for firms to withhold any amount of royalties for purposes of tax withholding.

Also, lawyers from Regulated United Europe provide legal services for obtaining a crypto license in Europe.

FREQUENTLY ASKED QUESTIONS

Countries with the easiest start-up process in Europe

Countries in Europe with the easiest company start-up process typically include Estonia, the UK and Ireland. Estonia is known for its innovative e-Residency system, which allows foreigners to easily register and operate a business entirely online. The UK and Ireland attract with their ease of company registration, transparent tax regime and relatively low start-up costs. All these countries offer a favourable business environment that supports innovation and entrepreneurship with foreign participation.

Which countries have the lowest tax burden for companies in Europe?

In Europe, the countries with the lowest corporate tax burden typically include Ireland, Bulgaria, Cyprus, Estonia, Hungary and Cyprus. These jurisdictions offer relatively low corporate taxes, making them attractive to international businesses.

Which countries in Europe receive the most taxes from individuals?

In Europe, the largest amount of taxes from individuals is usually collected in countries with high levels of social security and progressive tax systems, such as Sweden, Denmark, Finland and Belgium. These countries have high personal income tax rates, especially for high income earners.

The highest income tax rate in Europe?

The highest income tax rate in Europe is usually found in Scandinavian countries such as Sweden and Denmark, where it can exceed 50%. These countries are known for their high taxes and extensive social programmes for citizens.

Lowest income tax in Europe?

The lowest income tax rate in Europe is usually found in Bulgaria, where it is 10% for individuals. This makes the country one of the most attractive in Europe in terms of tax burden on the income of tax resident citizens.

What is the most profitable country in Europe to start an IT company?

Starting an IT company is often considered the most profitable in Ireland because of its low corporate tax rate, skilled professionals and favourable investment environment. Estonia is also attractive for IT businesses due to its innovative e-Residency system and simplified tax system.

In which European countries is cryptocurrency recognised on a national level?

In Europe, countries that have recognised cryptocurrency on a national level include Switzerland, Malta and Estonia. Switzerland is known as one of the centres of cryptocurrency and blockchain innovation, Malta is actively working on the creation of a "Blockchain Island", and Estonia is one of the first countries to offer blockchain solutions at the state level and create a favourable environment for crypto-business.

Which country has the most favourable conditions for opening a forex company in Europe?

Cyprus is often considered one of the most favourable countries to start a forex company in Europe due to its attractive tax policies, EU membership and respected regulator, the Cyprus Securities and Exchange Commission (CySEC). CySEC offers a recognised and well-regulated environment that attracts many forex brokers.

Which country has favourable conditions for starting an online gambling company in Europe?

Malta is considered one of the most favourable countries to start an online gambling company in Europe due to its prestigious regulator

(MGA), its attractive tax system and the fact that it is part of the EU, giving access to the entire European market.

In which European country is it easiest to open a bank account for a foreign-owned company?

Lithuania is considered one of the most favourable countries in Europe for opening a bank account for a foreign-owned company. This is due to its developed financial infrastructure, flexible approach to international businesses and simple account opening procedures for foreign investors.

In which countries in Europe may a company not have a single employee?

In Europe, in countries such as the UK and Estonia, a company can officially exist without hiring employees, especially if it uses external services to manage day-to-day operations and has only one owner.

In which European countries is company ownership data publicly available?

In Europe, company ownership data is publicly available in countries such as the UK, where Companies House publishes ownership information, and Estonia, known for its transparent business system. Open access to company ownership data is important for ensuring business transparency, combating money laundering, tax evasion and corruption, and building investor and partner confidence.

In which European countries is company ownership data hidden and not publicly available?

In Europe, there are different levels of transparency and confidentiality of company ownership data depending on the legislation of each country. Most countries in the European Union require disclosure of beneficial ownership information as part of measures to combat money laundering and terrorist financing. However, the extent to which this information is available to the public may vary.

Countries with limited access to company ownership data:

- Luxembourg: Although beneficial ownership information must be provided to the register, access to it may be restricted.

- Malta: Malta requires disclosure of ownership information, but access to this data may be restricted to the public.

- Cyprus: In the past Cyprus has been known as a highly confidential jurisdiction, but recent legislative changes are aimed at improving transparency.

RUE customer support team

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

OÜ

Registration number:

14153440

Anno: 16.11.2016

Phone: +372 56 966 260

Email: [email protected]

Address: Laeva 2, Tallinn, 10111, Estonia

UAB

Registration number: 304377400

Anno: 30.08.2016

Phone: +370 6949 5456

Email: [email protected]

Address: Lvovo g. 25 – 702, 7th floor, Vilnius, 09320, Lithuania

Registration number:

08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00, Prague

Sp. z o.o

Registration number: 38421992700000

Anno: 28.08.2019

Email: [email protected]

Address: Twarda 18, 15th floor, Warsaw, 00-824, Poland