Crypto regulation in Lithuania 2026

Since 2020 year Lithuania appeared in the TOP of the most friendly countries for cryptocurrency companies. The country has created the corresponding legal environment for crypto business. Such activities are strictly controlled and regulated with the only purpose of avoiding the slightest signs of money laundering and terrorist financing. But getting permission and getting involved into cryptocurrency exchange or cryptocurrency wallet maintenance services is quite possible. If You are ready for transparent business, but without losses of advantages welcome to Lithuania!

Lithuania cryptocurrency regulation 2026

COST OF CRYPTOCURRENCY LICENSE

|

PACKAGE «COMPANY & CRYPTO License IN LITHUANIA» |

9,900 EUR |

- Establishment or purchase of a ready-made company

- Assistance in registration of share capital (EUR 125,000)

- Preparation of legal company documents

- Assistance in director employment/KYC/AML officer and information State Social Insurance Fund

- Lease of legal address at Vilnius Business Centre for 1 year

- Review of the business model and the structure of the Cryptocurrency Company

- Assistance in opening a bank account for cryptocurrency companies

- Procedural Rules and KYC/AML Company Procedures

- Preparation of notifications, forms and supporting documents for submission to FCIS and Business Regests of Lithuania

- Paying company registration government fees

- Paying government crypto license fees

- General counselling (5 hours)

Changes in the regulation of cryptocurrency companies in Lithuania in 2022/2023

The Lithuanian government has started fighting the risks of money laundering by adjusting the regulation in relation to the cryptocurrency market. The new legislative amendments will bring changes in anti-money laundering and countering financing of terrorism policy of companies in the cryptocurrency sphere: the procedure of identifying customers will change, and completely anonymous accounts will be forbidden.

The government of Lithuania has decided to amend the AML/CTF Law in order to add more transparency to the development of its cryptocurrency sector. According to the draft designed by the Lithuanian Ministry of Finance and the central bank, amendments will make the regulations on virtual currency exchanges and custodial wallets of virtual currency money operators in Lithuania more detailed.

While the crypto market is growing very fast and while new products are being developed, the attention of regulatory authorities should be focused on the issues of risk management, particularly those risks related to AML. In line with the considerations above, active steps have been taken in Lithuania to strengthen the regulation of the crypto market, preparing it for further changes at the EU level. “The main goal is to ensure more transparency of this sector, more effective prevention of money laundering and terrorist financing, and more effective management of other risks,” Finance Minister Gintara Skaistė said while presenting the project at a government meeting.

Legislative changes would introduce more detailed rules on customer identification and prohibit the opening of anonymous accounts. This new rule will increase the requirements for crypto exchange operators—from January 1, 2023, they will be obliged to increase their authorized capital to at least 125 thousand euros. Also included among the new requirements of crypto companies in Lithuania is a requirement for there to be a senior manager who will have to be a permanent resident of the Republic of Lithuania. This amendment is directed at improving communication with supervisory authorities and closer communicational relations with the local market.

The bill also provides that as from 1 February 2023, Registrų Centras shall publicly disclose the list of companies operating as a virtual currency exchange operator and a virtual currency depository wallet operator, whereby more significant transparency of the market of cryptocurrency service providers will be ensured.

Above requirements shall therefore come into force for new companies with effect from November 2022 and for already registered companies with effect from December 2022.

List of major changes in legislation

- According to the amendments to the law, it will be possible to obtain a single cryptocurrency license in Lithuania. The Commercial Register (Registrų Centras) will be the supervisory authority to comply with formal requirements (deposit of initial capital, presence of a local AML manager in the structure of the company, etc.).

- The minimum authorized capital of a cryptocurrency company will be increased to 125,000 EUR.

- Instead of MLRO and a non-local AML manager, VASP will be required to have a local AML manager (working only in a single cryptocurrency company).

- In accordance with the amended legislation, increased requirements for the reputation of the director and UBO will be applied.

Original wording of changes in the law are here.

Regulation of cryptocurrency activity in Lithuania

Thanks to a number of steps taken by the Government, Lithuania has become a European center for fintech business. In particular, the capital of this state, the city of Vilnius, hosts both fintech-startups and large international financial companies. Among the reasons for the attractiveness of the jurisdiction for such activities are business-oriented legislation, relatively low costs of registration, licensing, and maintenance of firms.

To all of these advantages, starting from 2020 was added one more—the establishment of clear and transparent rules for receiving a license for virtual currency without burdening them with bureaucratic procedures and financial requirements.

Note! The attractiveness of Lithuania increases against the background of unpleasant changes in Estonian legislation concerning the licensing of crypto-exchange activities, which were introduced in 2020-2021. Among them, there was an increase in the minimum authorized capital of crypto companies and the mandatory relocation of the control center to Estonia.

Moreover, the head of the Money Laundering Data Bureau (RAB) announced the possible revocation of the crypto licenses issued earlier. Thus, Estonia is rapidly losing its virtual currency-friendly status.

Important! Due to these facts, Lithuania becomes one of the few jurisdictions in the EU, where you can legally perform transactions with cryptocurrency and conduct fully crypto business.

Reminder: Notice that it is in Lithuania where the world’s largest cryptocurrency exchange, Binance, is licensed and provides services to Europe.

How is crypto activity regulated in Lithuania?

- The regulatory powers in this area are possessed by the Financial Crimes Investigation Service.

- The concept of a «crypto license» in relation to Lithuania is used conditionally, since in fact a special license is issued for the provision of services in the sphere of virtual currencies, not a license.

- The receipt of such authorizations occurs within the so-called notification procedure – the crypto company submits a notification in the form of a statement that it intends to perform the relevant activity. The application is accompanied by a package of necessary documentation.

- Verifying the conformity with the legislation and issuing the permits is at the discretion of FCIS.

Note: The Central Bank of Lithuania insists on the separation of traditional financial and cryptocurrency activities. But traditional market players are allowed to have virtual assets in circulation.

Advantages

Fast project implementation time

Possibility to purchase an off-the-shelf solution

Possibility of a fully remote solution

No obligation to have an office

Types of licenses to work with cryptocurrencies in Lithuania

Entrepreneurs are given a choice of two types of cryptocurrency authorization. It is also possible to get both licenses at once.

Virtual currency exchange service provider.

The «Virtual Currency Exchange Operator» authorization provides the legal basis for the work of the exchanger, that is, the provision of such exchange services with the receipt of a commission:

- One virtual currency to another

- Fiat money for cryptocurrency

- Fiat cryptocurrencies

The service provider maintains cryptocurrencies in customized wallets.

The «Virtual Currency Deposit Operator» license offers services on the creation of encrypted keys for clients for security purposes, as well as transfer of cryptocurrency to other persons.

Taxation of cryptocurrency activities

- Income tax (WHT, corporate tax) in Lithuania is 15%.

- Small enterprises with up to 10 employees, having gross annual income of up to €300,000, can be taxed at a reduced rate of 0-5%.

- Taxation of cryptocurrency transactions depends on their nature. There is no direct tax if the token was bought or sold by analogy with other currency, securities, or investments.

- Dividend tax is levied on the distributed profit and amounts to 15%.

- Services provided by the crypto exchanger are exempt from Value Added Tax.

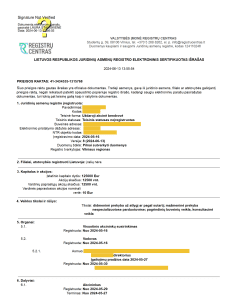

Example of a Lithuanian crypto company certificate

Field of activity – Depozitinių virtualiųjų valiutų piniginių operatorius, Virtualiųjų valiutų keityklos operatorius

Company requirements for getting a crypto license in 2026

To file an application to the FCIS and get permission to conduct crypto activity, the following prerequisites need to be fulfilled:

- Registration of a legal entity in Lithuania as UAB (LLC)

- At least 1 shareholder and at least 1 director (can be a shareholder)

- To have an office in the country (the use of a virtual office is allowed)

- The minimum authorized capital of such a company should be at least 2,500 EUR

- Board members and final beneficiaries must correspond to the requirements of an immaculate business reputation, as well as prove the absence of a criminal record

- The company must have an AML/KYC compliance officer appointed

Required documents list

The same care should be taken in the preparation of the company’s documentation as when collecting documents for individuals involved in this business – ultimate beneficiaries, directors, shareholders, members of the board. In order to reduce risks of mistakes, the process of preparation of the documentation is better entrusted to specialists of «Lavrange».

In the list of documents for individuals:

Notarized copies of the passports of the countries of residence

Confirmation of current address – utility bill not older than three months or bank statement not older than three months

Power of Attorney (PoA) when business registration and licensing is carried out remotely

CV or link to the public business profile in social networks (e.g. Linkedin) – confirmation of education and professional experience of all project participants

Apostille certificate of absence of criminal record not older than three months

In the list of documents for a legal entity:

Charter and other corporate documents

Agreement of all directors

Confirmation of opening a bank account in Lithuania accordingly

Detailed description of the company’s activities-business model and business plan-link to the website

The Procedure of Registration of Cryptocurrency Activity in Lithuania

You can register the company and obtain the appropriate crypto permission from FCIS both by arriving in Vilnius accompanied by our representative and completely remotely by proxy to our specialist.

| Step | Description |

|---|---|

| Business Model Development | Development of a company business model with the lists of operations to be performed. |

| Company Name and Legal Address | Searching and confirming a unique name of the crypto company, selection of a legal address. |

| Power of Attorney | Notarial power of attorney for the representative of the company. |

| Constituent Documents | Registration of the constituent documents and registration forms. |

| Documentation Gathering | Gathering of documentation for individuals involved in the activities of the company, according to the requirements of the State regulator. |

| Company Registration | Registration of the company and opening of a bank account for it. |

| Notification to FCIS | Draft and send the notification to the FCIS about receiving special permission for crypto business. An application of this category is generally processed within one month. |

Note: During the licensing process, the regulator has the right to demand other information. That is, a detailed description of the activities of the crypto company. The permission can be given only when all conditions are met and in consideration of the total amount of information requested.

Crypto regulation in Lithuania

| Period for consideration |

up to 1 month | Annual fee for supervision | No |

| State fee for application |

No | Local staff member | Required |

| Required share capital | 125,000 € | Physical office | No |

| Corporate income tax | 5 – 15% | Accounting audit | No |

Regulations of crypto-currency company activity in Lithuania

Therefore, crypto-company activity aimed at preventing money laundering and financing criminal purposes is to be subjected to a very strict framework of rules that first of all presupposes implementation of the corresponding internal control policy and procedures regarding the assessment of risks of the company’s activity as prescribed by the regulator. Besides, external monitoring by competent authorities is provided.

Important! Among the main areas of internal and external control are the following:

Obligatory due diligence measures: identification and verification of all potential customers in accordance with AML/KYC rules, as well as checking individual transactions of current clients in case of exceeding the established limit of 15,000 euros or equivalent amount in other currency, or presence of other criteria of signaling. Customer data storage possibly to be transferred to the supervisory authority upon request;

Regular reporting to FCIS; response in due time to the current queries about the activity of the company.

Establishing the position of an AML specialist-the Compliance Officer-responsible for the implementation of such policy to counter the legalization of proceeds of crime; the appointment to this position must be agreed upon with the FCIS.

Attention! The change in the structural structure of the crypto company after getting FCIS permission is subjected to the registration, at which the full package of documents should be provided.

Please note! There have been no special requirements yet presented for a cryptocurrency company with respect to accounting and tax reporting. Accounting shall be performed according to the standards adopted for other companies in Lithuania.

POD specialist tasks:

- To participate in the development, implementation, and maintenance of AML policies in the company;

- To participate in the elaboration of a risk assessment system for products and services as well as for customers;

- Information collection and analysis on suspicious transactions having signs of money laundering and with possible elements of other fraud;

- Record-keeping for high-risk customers;

- The regular interaction with the board of directors and financial bodies;

- Communicating with representatives of the FCIS and reporting to this regulator;

- Filing suspicious activity notifications with supervisory authorities, in particular in case of suspected money laundering;

- The development of training for the company’s personnel for counteraction to legalization of the proceeds of crime, especially in contact with clients.

Requirements for AML specialist:

- Live in Lithuania

- Profile education

- Professional experience and impeccable business reputation

How should a customer be identified and verified-a natural or legal person?

- Clearly identify: whether the customer acts on his own behalf or represents the interests of another person (in the latter case, the person must be identified);

- Collect information on the ownership structure, business management, client’s objectives;

- Cross-check the personal data of end-beneficiaries, shareholders, board members from independent sources;

- Study the client’s business relationship;

- Constantly review and update information and documents for clients with whom we already have cooperation;

- Not to cooperate or to immediately terminate cooperation on obtaining relevant information from:

-

- Against whom international sanctions are applied;

- Who previously were suspected of laundering criminal money and financing terrorism;

- Who are politically exposed persons;

- Which are residents of jurisdictions where appropriate measures under the CCP are not applied.

In what case is a customer subject to identification?

For a business relationship, pending, in case of random exchange or cryptocurrency transactions, if the amount reaches or exceeds 1,000 euros;

There is a suspicion that the information previously obtained about the customer or the person to whom funds are transferred is not reliable or incomplete;

Suspicion of a money laundering or terrorist financing operation or transaction.

Cost and terms of obtaining crypto license in Lithuania

Important! Self-filing of documents most likely will result in: the best option – a delay in the start of the crypto project, the worst option – a refusal to provide permission due to the applicant’s mistakes.

Meanwhile, the average turnkey processing time in Lithuania takes from 1 to 2 months. We are talking about the passage of all stages: from the moment of the company registration and the opening of an account, to receiving a license.

AML/KYC General Policy for Crypto Companies

To get the special permission from FCIS regarding the provision of services related to the exchange and storage of cryptocurrency, the applicant company needs to be prepared with: a) criteria for assessing the risk of customers and individual transactions; b) KYC documentation (know your client) /AML (anti-money laundering criteria); c) procedural rules.

Procedural security measures include:

- Classification of risks

- Risk assessment

- Application of due diligence measures

- Control of the origin of funds and transactions

- Internal audit and fulfillment of obligations to report suspicious transactions to the regulator

Among the documentation on AML/KYC:

- Description of high-risk transactions, including those related to communication and location of clients-establishing the requirements and procedures for conducting and monitoring such transactions

- Description of operations with lower risk-setting requirements and procedures for them

- This could include how transaction and customer data are to be stored, and it also includes any regulatory reporting requirements concerning reporting suspicious transactions or transactions to the regulatory body itself.

Lithuania

Capital |

Population |

Currency |

GDP |

| Vilnius | 1,357,739 | EUR | $24,032 |

Registration of a crypto company in Lithuania

Due to the last changes in legislation, Lithuania can be considered as the most budgetary and affordable option for the registration of a crypto company among the EU countries. If Estonia used to be such an option, it is not like that anymore. First, more means would have to be invested in the registration of crypto businesses in Estonia: increased requirements to the minimum amount of authorized capital. The second aspect is that the organization of the activities of such companies has become more complicated: it has become obligatory to move the centre of business management to Estonia.

Important! Given the prospects of doing crypto business in Europe, Lithuania can reasonably be considered an excellent option among jurisdictions for the registration of the company.

Lithuanian advantages for crypto business:

- Friendly attitude towards crypto assets and related activities;

- Clear and understandable conditions for obtaining special permissions (crypto licenses) for the provision of services related to the exchange and storage of cryptocurrencies;

- The legislative regulation of cryptocurrencies is more flexible than that of neighbour Estonia;

- A possibility of registering a company, registering a corporate account and remotely obtaining a licence;

- An acceptable corporate tax rate comparing to other EU jurisdictions is 15%;

- The country in recent years possesses the status of a fintech business centre;

- There are no residency requirements for the company’s directors and shareholders;

- Practically zero bureaucratic expenses for the registration of a business by a non-resident;

- Relatively low expenses, both for the very procedure of registration of the company and for its further maintenance;

- To create conditions for entrepreneurs to start working with crypto projects as soon as possible when the market conditions are favorable.

The Lithuanian Financial Crime Investigation Service monitors the activities of crypto-wallet operators and cryptocurrency service providers. One and the very same business may be authorized for both types of crypto activities, and on average, less than one month is needed to get authorization.

Permission for providing services of cryptocurrency and/or wallet has to be obtained by incorporating, first of all, a limited liability company UAB in the country. The minimum authorized capital required is €2,500. The process of establishing a company can be completed without physical visit; it usually takes about ten working days to obtain the necessary originals. A typical interaction begins with the analysis of the target business model, the structure of shareholders, the biography of the CEO, which allows us to make a list of the necessary documents for an effective registration process.

Law of the Republic of Lithuania on the Prevention of Money Laundering and Financing of Terrorism (hereinafter – Law on the Prevention of Money Laundering and Terrorist Financing) binds PWA to follow the requirements of POD, including such as customer identification and authentication, monitoring and suspension of transactions, reporting to authorities, etc. Thus, for the valid commencement of cryptocurrency-related activities, it is preferable to have an internal POD officer, preferably local, who will report correctly to FCIS.

The practical challenge to be resolved by all VASP is, of course, how to establish viable banking relationships which would ensure seamless transitions for the customers between the FIAT currencies and the cryptocurrency. On this point, Lithuania is also a friendly jurisdiction, having almost 300 fintech companies in its ecosystem ready to offer modern and advanced financial solutions for blockchain-oriented businesses.

While the crypto market is developing so rapidly in search of competitive advantage, VASP shall seek innovative, customer-friendly, and sustainable solutions for the offering of products. While crypto services cannot be qualified as financial services in the direct sense of this word, in general, some products provided by VASP may bear characteristics similar to conventional financial products and as such may be licensable. By combining the developed infrastructure for the licensing of financial services and in light of the approach by the Bank of Lithuania, such digital business is able to scale its business activity successfully by acquiring additional licenses (e.g., EMI, PI, financial broker).

List of legal persons operating as a virtual currency exchange operator in Lithuania.

ICO/STO and other capital raising modes in Lithuania

In 2017, the Bank of Lithuania has presented its approach to virtual assets and initial coin offerings, updated in 2019. Although the approach of the oversight body described therein is quite neutral, the basic principles of the regulatory regime are present. For example, depending on the type of supply, the ICOs can be either exempt from regulatory measures or be subject to the requirements that apply to securities offering, crowdfunding, collective investment, or investment services. In addition, the Bank of Lithuania has published recommendations on security token offering, which, with a view to the characteristics of the tokens offered-that is, payment, utility, and security-offers a more detailed approach as regards the regulatory requirements. As most of these recommendations deal primarily with ICO and STO.

Taxation of Cryptocurrency Activities

Generally speaking, there are two main taxes that enterprises shall consider from a taxation perspective: corporate income tax («CPN») and value added tax («VAT»). Both of these taxes can be collected under certain conditions, and the tax regime generally depends on the kind of actions taken. For example, income received from cryptocurrency exchanges and security tokens are exempt from VAT, while other activities provided by cryptocurrency exchanges—for example, getting some kind of referral fee from other platforms—might be subject to taxation in some cases. VESP profits are subject to the CPN rate of 15%; this is cut down to almost a few percent, thanks to the application of special tax credits for R&D activities or investment projects regarding software. MDO/IEO/ILO, CIT obligations depend on the type of issued tokens—funds raised in exchange for:

- securities tokens are not taxed by CIT,

- service tokens are equal to advance payments which are taxable not at the time of issuance of tokens and fundraising but when the actual service is provided by the platform in exchange for service tokens, and

- other forms of tokens are taxable upon receipt of funds.

Since there might be several variants of business, there might also be quite plenty of variants of taxation. That’s why we strongly advise conducting a profound tax assessment before the very beginning of work.

Lawyers of our company are always happy to answer all your questions about obtaining a cryptocurrency license in Lithuania and also accompany your company through the whole licensing process.

Establish a Crypto Company in Lithuania

If you are on a quest for crypto-friendly jurisdiction, then Lithuania is surely the right choice, because it’s not only eager to be responsive to the fast evolution of the cryptocurrency market but easily possible to start a business in Lithuania. This Baltic country is 11th on the list of 2020 Ease of Doing Business Ranking.

In addition, Lithuania is already in 6th place in the International Tax Competitiveness Index ranking, which presupposes low tax burdens on business investment and a sufficiently high level of neutrality due to its well-structured framework of tax codes. Besides, the Central Bank of Lithuania, being a regulator of Lithuanian crypto companies, created such a policy that allows them to successfully grow and develop.

If you are a foreign national willing to establish a crypto company in Lithuania, in addition to favorable conditions, you will have equal rights, regardless of your citizenship status.

The advantages of the business environment in Lithuania are as follows:

- Probably the fastest procedure of company registration within the EU, that saves your money and time.

- The world’s fastest, most reliable internet empowers your crypto business to flourish in a secure, productive, and flexible atmosphere. 4th place in the International Cybersecurity Index ranks and 5th in CEE by mobile download speed (Mbps).

- A pool of multilingual, motivated, and highly-qualified talents willing to drive innovative businesses forward.

- The ease of paying your taxes with the Lithuanian government gives you peace of mind that is so much needed to develop your business successfully.

For AML/CFT purposes, all crypto companies are seriously overseen by the Lithuanian Financial Crime Investigation Service (FCIS). Its almost impeccable performance is recognized in the global AML Basel Index, with a rank of 9th among the lowest-risk jurisdictions.

Legal Business Structure for Crypto Activities

First of all, one has to establish a Private Limited Liability Company-UAB regarding crypto licensing. Suffice it to say, it refers to the legal form of business organization, issuing unquoted shares. It got this name because its owners are not personally liable if the company could not cover the obligations. This means that, in the event of business failure, the shareholders incur a loss only to the extent of the assets provided to the company, and no personal assets of theirs are touched.

If you consider your crypto activities to be of higher risk, this type of a company is for you. It can be established by a representative or online using templates and founding documents through the self-service system of the State Enterprise Centre of Registers.

The main factors to consider before embarking on the company formation process:

- Company name: Unique, compliant, and may be reserved with the State Enterprise Centre of Registers prior to setting up, by completion of form JAR-5.

- It is set up by one or several natural and/or legal persons; the number of shareholders is not limited.

- The owners and directors of the company need not be permanent residents of Lithuania.

- Minimum share capital – 2,500 EUR and at least 25% must be paid up, which implies that each shareholder has to make a payment of at least 25% of the nominal value of all his subscribed shares and the sum of the total excess of the nominal value of subscribed shares.

- The in-kind contribution, intended to partially pay for the company’s shares, must be pre-valued by an independent property appraiser before the signing of the company’s founding agreement.

- The most important decisions, by shareholders, are taken through voting – each share has one vote and a person who has acquired the biggest number of shares has the biggest influence on voting at the general meeting of shareholders.

- The second precondition, therefore, requires the company’s owners and directors to undergo background checks due to a lack of criminal records. The owners and directors of the company must also provide proof of proper education and enough experience in order to run a company. Crypto companies need to develop and implement internal AML/CFT policies and procedures, such as CDD and KYC.

- It is also a must to appoint a qualified AML Compliance Officer, which can be a board member, too, who would be responsible for the observance of AML regulations, internal policies, and reporting to FCIS. Annual audits are mandatory when the company exceeds at least two of the following amounts: total assets – 1.8 mill. EUR, sales – 3.5 mill. EUR, and an average number of employees – 50.

A share disposition allows access to more funds and transfer of or exit from the business. In order to acquire more funds, a company can issue new shares, upon the acquisition of which the shareholders pay a certain sum of money. If such a company is profitable, its shareholders can receive the profit earned by the company through dividends or by receiving a salary, in which case certain taxes will have to be paid.

What You Need to Do

In general, setting up a new Private Limited Liability Company (UAB) in Lithuania is relatively easy and quick, provided you have all the necessary documents ready for the incorporation process. This means that it is only a question of a few days until your new company is registered and a new corporate bank account is opened to allow you to apply immediately for a crypto license.

Steps of opening a Private Limited Liability Company (UAB) for crypto activities:

- Prepare the Memorandum of Association along with the Articles of Association.

- Reserve a temporary company name via the State Enterprise Centre of Registers.

- Obtain a business address in Lithuania.

- Open an accumulative bank account.

- Transfer share capital to the bank account.

- Notarise the founding documents at a registered notary’s office—the notary has to confirm the accuracy of the data entered in the application of registration, compliance of the Articles of Association with the requirements of the law, the fact that the company may be registered;

- Register the company at the State Enterprise Centre of Registers;

- Convert the accumulative bank account into a settlement account.

- Online registration of the company, receive an e-signature.

- Registration with the State Tax Inspectorate and the State Social Insurance Fund.

- Following the registering a crypto company, a filing an application for a crypto license with the Bank of Lithuania.

As it is provided in Art. 4 of Law on Companies, Articles of Association shall be prepared and should include the following information:

- Company name

- Type of the legal form of the company

- Address of the registered office of the company

- The purpose of the company, including the type of its activity

- The amount of its authorized capital expressed

- The number of shares and their type, their nominal value and clearly defined rights they grant to its holder

- Powers of the general meeting of shareholders, the procedure of calling the meeting

- Other bodies of the company, their powers, the procedures of electing or removing from office; The procedure of publishing the notices of the company, including specific public channels; Ways of presenting the company’s documents and other information to shareholders; Decision-making procedures in regard to opening branches and representative offices, and appointment or removal of the heads of the company’s branches and representative offices.

- Operating procedure of the Articles of Association of the company

- Company’s duration period – in case the company is established as a company of limited duration

- Date of signing of the Articles of Association

There are two types of licenses issued for crypto activity in Lithuania:

- Crypto Wallet Exchange Licence which enables licence holders to manage crypto wallets possessed by their customers

- Crypto Exchange Licence which entitles the licence holders to provide exchange services between cryptocurrency and fiat currency in either direction, as well as exchange among different types of cryptocurrency.

Provided that all the necessary stakeholders are verified and the documentation is prepared with due care, it takes less than one month to finalize the process of authorization of crypto activities. Our team here at Regulated United Europe (RUE) can take care of this with you. After a successful application, you will receive a license issued by the State Enterprise Centre of Registers, and you can start performing crypto activities.

The two applications – company registration and licensing – must be submitted with supporting documents in the Lithuanian language. If you need a certified translator, we can arrange it for you.

Taxation of Crypto Companies in Lithuania

By now, you must have already envisaged the successful operation of your crypto company. Without doubt, one of the major factors you would want to look into is an efficient tax planning strategy. You would like to be aware of major tax obligations and special allowances and incentives available to crypto companies, in spite of the lack of separate regulation in crypto taxation in Lithuania.

The State Tax Inspectorate explains that the taxation of cryptocurrency exchange and wallet services does regard the mining, initial coin offering, buying, selling, mediation, and settlement in such currencies of products or services bought and/or sold as taxable operations.

To make life easier, the State Tax Inspectorate published its explanation of crypto tax treatment and how general taxation rules are applied. For the purpose of tax treatment, virtual currency is treated as an instrument that features characteristics similar to Bitcoin, Ethereum, Ripple, and Litecoin. Nevertheless, such a definition isn’t directly set and might include various tokens.

Depending on the nature of your crypto activities, your company might be responsible for the following taxes:

- CIT (Corporate Income Tax): 15%

- VAT (Value Added Tax): 21%

- SSI (State Social Insurance): from 21%

- WHT (Withholding Tax): 15%

Corporate Income Tax

The Lithuanian Corporate Income Tax is among the lowest in the EU and is imposed on revenues gained by the Lithuanian crypto companies. Depending on the residence status of a company, tax is imposed either on worldwide income or income sourced in Lithuania. A company is considered a tax resident of Lithuania if it is incorporated according to Lithuanian law.

Resident crypto companies will be required to pay Corporate Income Tax on all the income, both sourced inside and outside of Lithuania. Whereas, normally speaking, non-resident crypto companies will pay their tax only in respect of the income derived in Lithuania, which in their case may also be derived through permanent establishments located in Lithuania.

According to this provision, income derived from economic activity carried out by a Lithuanian tax resident through its permanent establishments located in one of the EEA countries or a country with which Lithuania has concluded an agreement on elimination of double taxation is not subject to tax if such income is related to the same type of tax in these countries.

Within the frame of this Corporate Income Tax application, following the characteristics of transactions and their economic consequences, cryptocurrencies are viewed as short-term assets which may be available for the payment of products or services or for sale.

Companies whose average number of employees does not exceed 10 persons during a tax period and the income for the tax period does not exceed 300,000 EUR shall be subject to corporate income tax at the rate of 0% for the first tax period and at the rate of 5% for all subsequent tax periods, unless otherwise provided for by the Law on Corporate Income Tax.

Value Added Tax

Generally speaking, a crypto company is obliged to register as a VAT payer if it supplies taxable products or services in Lithuania, and when its taxable annual turnover has exceeded 45,000 EUR.

For VAT purposes, the definition of cryptocurrencies is not dependent upon the Bank of Lithuania. In this context, they are defined as an alternative means of payment and, therefore, are subject to the rules applicable to fiat money. All transactions involving cryptocurrencies are considered financial transactions.

Based on the current law, the following rules apply in respect of cryptocurrencies:

- Revenues received from the supply of cryptocurrency exchange services are not subject to VAT, inasmuch as it is analogous to the treatment of fiat money.

- Tokens supplied within an initial coin offering (ICO) are not subject to tax with VAT, since the process, in itself, equates to the supply of shares.

- Mining does not imply imposition of VAT, except in such a case where there is a relationship of supplier-client when a miner is paid for products or services supplied within Lithuania.

- Sales of crypto-related services: e.g., paid referral of other platforms.

If a crypto company hires employees, it is bound to pay the State Social Insurance, and thereby also a part of payroll taxes. For instance, an employee is not allowed to start before he or she is registered in the Social Security Tax Office on a 1-SD form. That is devised to notify the authority about the commencement of one’s personal income, which shall be made no later than one day in advance of the employment.

Support for Crypto Startups in Lithuania

Once your crypto company is established and licensed, you shall ensure that all the legal requirements remain met, and you can skilfully navigate the regulations while constantly innovating. There are several governmental and non-governmental organisations that can support your efforts. The Lithuanian bank plans to foster, accelerate and effectively supervise crypto-related activities in Lithuania by creating a blockchain-based regulatory sandbox called LBChain, allowing firms to test their business solutions by offering regulatory and technological infrastructure in a controlled environment.

You can also reach out to Blockchain Centre Vilnius – a global network-based organization that unites top leaders, innovators, and experienced enthusiasts who help companies bring their products and services to the blockchain space.

If you have decided to open a crypto company in Lithuania, our experienced and dynamic team of Regulated United Europe (RUE) will provide comprehensive legal advice on company formation, licensing, taxation, as well as professional financial accounting services to set the stage for your success. Contact our experts today for a tailored consultation.

Besides that, we have a virtual office facility that dispels the need for expensive office leases, equipment, and personnel. This is a competitive advantage for small businesses that do not mind creating a professional image with such physical office functions as a business address, meeting facilities, and reception, while managing to cut costs and retain the benefits of working remotely. Apply for our virtual office today.

“Lithuania is regulated and is a safe place to start your crypto-related business there. With years of experience, Lithuania has developed a high reputation and worldwide recognition of their license, so it is a good pick for a reputable jurisdiction. I would be happy to assist you in starting your crypto business there.”

FREQUENTLY ASKED QUESTIONS

What makes Lithuania a good place to start a cryptocurrency business?

Crypto businesses can operate legally in the country thanks to the country’s legal framework. In order to prevent money laundering and terrorist financing, such activities are strictly regulated and controlled. The possibility of getting permission and getting involved in cryptocurrency exchanges or cryptocurrency wallet maintenance is not impossible.

In recent years, what changes have taken place in the industry?

- In Lithuania, there will be the possibility of obtaining a single cryptocurrency license as a result of the amendments to the law. In case of formal requirements (deposit of initial capital, presence of a local AML manager, etc.), the Commercial Register (Registro Centras) will be the supervisory authority.

- An increase to 125,000 EUR will be made to the minimum amount of capital a cryptocurrency company must have.

- It will be necessary for VASP to have a local AML manager (working only for one cryptocurrency company) instead of a MLRO and a non-local AML manager.

- Following the amendment to the legislation, the director and UBO will be subject to increased reputational requirements.

In Lithuania, who is responsible for regulating crypto activity?

A regulatory authority in this area is the Financial Crimes Investigation Service (FCIS).

Do crypto licenses come in different types?

- Providing services for the exchange of virtual currencies.

Providing such exchange services for a commission is the purpose of the “Virtual Currency Exchange Operator” authorization:

- The exchange of one virtual currency for another

- Cryptocurrency exchanged for fiat money

- Cryptocurrencies for fiat money

- Custom wallets are used by the service provider to store cryptocurrency.

Permits issued to “Virtual Currency Deposit Operators” permit clients to create encrypted keys for security reasons, and transfer cryptocurrency to third parties.

Lithuanian crypto taxation basics: what is it?

- In Lithuania, corporate income tax (WHT) is 15%.

- A reduced rate of 0-5% may apply to small firms with up to 10 employees and gross annual incomes up to €300,000.

- It depends on the nature of the transaction whether cryptocurrency transactions are taxed. By analogy with currency, securities or investments, the token does not incur a direct tax.

- Taxes on dividends are imposed at 15% on distributed profits.

- VAT is not applicable to crypto exchanger services.

What requirements must be met?

- A UAB (limited liability company) is the legal form of registering a legal entity in Lithuania.

- Shareholders and directors (may also be shareholders);

- It is permissible to have a virtual office in the country;

- Such a company must have a minimum authorized capital of EUR 2,500;

- There must be an impeccable business reputation among board members and final beneficiaries, as well as no criminal record;

- There must be a compliance officer for AML/KYC in place at the company.

How about the anti-money laundering policies?

Crypto companies must follow strict rules to prevent money laundering and the financing of criminal activity.Initially, we are talking about implementing internal control policies and procedures, assessing the risks associated with the company’s activities in accordance with the regulator’s requirements. It is also envisaged that the competent authorities will monitor the process externally.

Are there any plans to tax net wealth?

Taxes based on market value are a common cantonal tax imposed on cryptocurrencies, such as the Net Wealth Tax. There are major differences between cantons due to their local rates and collection systems. Tax bands are determined by factors such as residence permit type, marital status, and annual income, for example, in Zurich. A single taxpayer who earns less than 77,000 CHF (approx. 77,800 EUR) is not subject to paying the tax, but can be required to pay up to 5,584 CHF (approx. 5,640 EUR) if their income exceeds 3,158,000 CHF (approx. 3,191,000 EUR). For married couples, the thresholds are slightly higher.

Can you tell me what the capital gains tax rate is?

Capital Gains Tax is imposed on profits from selling or trading crypto by self-employed crypto traders and businesses at a rate of up to 7.8%. Personal wealth assets are exempt from the tax.

Does accounting have any specific requirements?

Cryptocurrency firms are not subject to special accounting and tax reporting requirements. Companies in Lithuania should conduct accounting according to the same standards.

Are there any AML documents I need to present?

Of course, you can. Below are a few of them.

- Establishing requirements and procedures for conducting and monitoring high-risk transactions, including transactions involving communication and location of clients

- Establishing procedures and requirements for operations with lower risk

- Data storage for transaction and customer information

- Reporting suspicious transactions or transactions to the regulatory body is a regulatory requirement

Lithuania has many advantages when it comes to crypto activity. What are those advantages?

Among the many, a few stand out.

- Attitudes toward crypto assets and related activities that are friendly;

- For providing services related to the exchange and storage of cryptocurrencies, there must be clear and understandable conditions for obtaining special permissions (crypto licenses);

- In comparison to neighboring Estonia, the regulatory framework for cryptocurrencies is more flexible;

- Creating a corporate account, registering a company, and obtaining a license remotely;

- In comparison with other EU jurisdictions, it has an acceptable corporate tax rate (15%);

Getting your crypto business registered in Lithuania: where to begin?

To qualify for a Lithuanian crypto licence, which you cannot operate without, you must form a Private Limited Liability Company (UAB). Shares of the company aren’t traded on a stock exchange because it’s a legal business structure. Unfulfilled company obligations are not personally liable for its shareholders. As a result, a failure of the company would only expose the shareholders’ personal assets to risk.

Additional information

Additional services for Lithuania

RUE customer support team

RUE (Regulated United Europe) customer support team complies with high standards and requirements of the clients. Customer support is the most complex field of coverage within any business industry and operations, that is why depending on how the customer support completes their job, depends not only on the result of the back office, but of the whole project itself. Considering the feedback received from the high number of clients of RUE from all across the world, we constantly work on and improve the provided feedback and the customer support service on a daily basis.

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

Registration number:

14153440

Anno: 16.11.2016

Phone: +372 56 966 260

Email: [email protected]

Address: Laeva 2, Tallinn, 10111, Estonia

Registration number: 304377400

Anno: 30.08.2016

Phone: +370 6949 5456

Email: [email protected]

Address: Lvovo g. 25 – 702, 7th floor, Vilnius, 09320, Lithuania

Registration number:

08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00, Prague

Registration number: 38421992700000

Anno: 28.08.2019

Email: [email protected]

Address: Twarda 18, 15th floor, Warsaw, 00-824, Poland

Please leave your request

The RUE team understands the importance of continuous assessment and professional advice from experienced legal experts, as the success and final outcome of your project and business largely depend on informed legal strategy and timely decisions. Please complete the contact form on our website, and we guarantee that a qualified specialist will provide you with professional feedback and initial guidance within 24 hours.