Crypto License in the UK

With a strong legal framework, access to a global financial market, and a reputation for innovation, obtaining a crypto license in the UK sets your business on the path to success. Whether you’re launching a new crypto project or expanding your existing operations, our comprehensive package ensures seamless company formation and licensing to meet all regulatory requirements.

Launch Your Business Legally and get UK Crypto License with Our Full-Service Package

- Full turnkey company formation

- Corporate documents

- VASP License application assistance

- Procedural Documents (AML/KYC Policies, Custody service agreement, etc.)

- Registered Office for 1 year

- Analysis of the existing documents, website, structure

Crypto License in UK

As cryptocurrency has changed, the businesses engaging in cryptocurrency have to follow harsh, handed-down regulations from the European Union. The majority of the attention of such regulations relates to Anti-Money Laundering, Prevention of Terrorist Financing, and illegal financial activities. Everything You Need to Know for Getting a Crypto License in the UK — The Ultimate Guide.

Activities Requiring FCA Crypto Authorization:

- The exchange of cryptocurrencies for fiat currencies and vice versa;

- The exchange of one cryptocurrency for another;

- The provision of cryptocurrency Automated Telling Machines;

- The provision of custodian wallet providers;

- The provision or facilitation of peer-to-peer cryptocurrency exchanges;

- Engaging in any initial coin offering activity.

Also, businesses that are already registered or authorized by the Financial Conduct Authority for other services — including e-money institutions or payment services — are obliged to also register in cases where crypto asset activities are additionally offered.

Advantages

Crypto Legislation in the UK

Cryptocurrency firms in the UK are subject to the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (MLRs). This act prescribes the requirements for those businesses that are vulnerable to money laundering and places great importance on the customer due diligence measures that the FCA implements to counter money laundering and financial crimes.

UK-based crypto asset companies must comply with the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (the MLRs) which sets out obligations of private sector companies exposed to the risks of money laundering. It includes requirements for the application of customer due diligence measures which the FCA is authorised to enforce and monitor with the aim to combat money-laundering and financing of illegal activities via cryptocurrency businesses.

The following cryptoasset business activities are within scope of the MLRs:

This includes cryptoasset automated teller machines (ATMs) and peer-to-peer providers; Issuers of new cryptoassets, such as Initial Coin Offerings (ICOs) or Initial Exchange Offerings-this applies to companies providing one or more of the following services (including where the companies do so as creators or issuers of any of the cryptoassets involved, when providing such services).

- Exchanging, or arranging or making arrangements with a view to the exchange of, cryptoassets for fiat money or fiat money for cryptoassets

- Exchanging, or arranging or making arrangements with a view to the exchange of one cryptoasset for another

- Operating a machine which utilises automated processes to exchange cryptoassets for fiat money or fiat money for cryptoassets

- Firms who provide services to safeguard, or to safeguard and administer

- Cryptoassets on behalf of its customers

- Private crypto keys on behalf of its customers for the purposes of holding, storing and transferring cryptoassets in case such services are provided

For sustaining compliance, cryptoasset firms must:

- Undertake thorough AML/CFT risk assessments about clients, countries of operation, transactions, and products/ services.

- Adopt adequate AML/CFT policies, systems, and controls, considering the operational complexities.

- Have an appropriately qualified AML/CFT compliance officer who shall be responsible for adherence to laws.

- Training of the staff: AML/CFT policies and procedures shall be provided, which are followed by monitoring. Monitoring of the transactions on a continuous basis should be done to maintain a readiness for reporting suspicious activities with SARs. Compliance with CDD and KYC shall be followed by setting up workflows. Identify PEPs and requirements related thereto.

- Provide an appropriate record-keeping and data protection system that ensures data protection of personal data and compliance for AML/CFT reporting. Internal audit functions shall be developed that shall review compliance effectiveness on a regular basis.

New legislation is to be introduced this year for the purpose of reducing economic crime. It’s also supposed to reduce bureaucracy and establish a new competitive taxation system which crypto businesses will be given a chance to benefit from.

Crypto Licensing Process in the UK

To comply with AML/CFT regulations set out in Regulations 8 and 9 of the MLRs, all crypto companies must register with the FCA prior to starting their economic activities in the UK. The FCA makes a decision on complete applications within three months and, if an application is successful, issues a Part 4A Permission to carry out regulated activities. If an application is incomplete, the decision-making process might take up to 12 months and it’s usually a rejection due to withheld or false information.

When applying for registration, you shall take the following advice into consideration:

- Prepare by reviewing online registration forms and the latest information available on the FCA’s website

- Complete your application duly and thoroughly by fully answering every question on the application form and by providing all mandatory information (any omission will result in further information requests to your company, causing delays and continued failure to provide requested information will likely lead to the rejection of your application)

- Provide up-to-date, specific information and documents which are fit for purpose

The department of Innovative Pathways can support the application process by explaining the complexities of the regulations, including the implications for cryptoasset business models.

FCA Application Process

-

An applicant settles an application fee:

- 2,000 GBP (approx. 2350 EUR) if the company’s income is less than 250,000 GBP (approx. 294,000 EUR)

- 10,000 GBP (approx. 12,000 EUR) if the company’s income is greater than 250,000 GBP (approx. 294,000 EUR)

- An applicant submits a completed application form via Connect

- The FCA assigns a case officer and starts assessing the application

- The applicant provides any additional information or evidence as per the case officer’s request

- The FCA checks the application against various databases and information held by other regulatory agencies in the UK or overseas

- The FCA assesses the crypto business, considering whether it meets the minimum threshold conditions (which depend on the complexity of the business) described in the Handbook

- The FCA makes a decision on the application and issues a Part 4A Permission if the application is successful

- The FCA confirms the decision in writing, including a Scope of Permission which states what type of regulated activities are authorised, start date and limitations of the permission

- Upon authorisation, the Financial Services Register will be updated automatically

An application can be withdrawn during the authorisation process, in which case the application fee isn’t refunded. The applicants usually pull out when they’re unable to provide all the required information or due to missed legal deadlines.

If an application is rejected, the FCA will explain the reason for their decision and will refund the application fee. It’s possible to resubmit the application.

In addition to the authorisation application fee, authorised companies also have to pay a periodic fee which is calculated by applying a particular formula (involving application fee, company’s evaluation and calendar months) and communicated by the FCA in each individual case. In the first year, authorised companies have to pay only a proportion of the fee (based on the number of months remaining in the fee-year).

The FCA may suspend or cancel the registration of a crypto company at any time after registration if it doesn’t meet the requirements of the regulations.

Information Required to Register a Crypto Business in the UK

To successfully onboard, the following key information and documents are required:

A comprehensive business plan covering:

- Business objectives, target customers, employee structure, governance, and financial projections

- Evidence of adequate financial and non-financial resources

- Transaction volume, value, client details, pricing, and main lines of income and expenses

- Budget forecasts and financials for the first three financial years

- Marketing plan, including customer description and distribution channels

A detailed programme of operations that outlines the specified cryptoasset activities the business will engage in.

Description of the company’s organizational structure, including:

- A corporate structure chart

- Relevant outsourcing arrangements (the FCA may request a copy of any outsourcing contract)

Details of the IT systems the company will use for its economic activities, including IT security policies and procedures.

Directors and managers must prove they possess a good reputation, appropriate knowledge, and experience for their roles.

Provide details of governance structures and internal control mechanisms, including:

- Money laundering and counter-terrorism financing (AML/CFT) measures

- A framework for risk assessment specific to the company’s activities

- Staff training material

- Business-wide risk assessment and mitigation policies

A detailed programme of operations that outlines the specified cryptoasset activities the business will engage in.

Provide documentation of customer onboarding agreements and processes, including:

- Customer due diligence (CDD) and enhanced due diligence (EDD) procedures

- Transaction monitoring procedures

- Record-keeping and recording procedures

Provide documentation of customer onboarding agreements and processes, including:

- Customer due diligence (CDD) and enhanced due diligence (EDD) procedures

- Transaction monitoring procedures

- Record-keeping and recording procedures

Under the AML/CFT laws, individuals involved in the business must pass a fit and proper test, as required by Regulation 58A of the Money Laundering Regulations (MLRs). This test applies to:

- Partners, directors, and board members

- Nominated officers for regulatory compliance

- Beneficial owners (those owning over 25% of shares or voting rights)

- Any person in a position of similar influence

The purpose of these documents is to ensure compliance with AML/CFT legislation, demonstrating the applicant’s readiness to function responsibly in the market.

Capital

London

Population

67,791,400

Currency

GBP

GDP

$47,318

Crypto regulation in the UK overview

| Period for consideration | 9 months | Annual fee for supervision | No |

| State fee for application | from 2,350 EUR | Local staff member | No |

| Required share capital | No | Physical office | Required |

| Corporate income tax | 19% | Accounting audit | Required |

How to Open a Crypto Company in the UK

Before applying for registration with the Financial Conduct Authority (FCA), it is essential to incorporate a company in the UK. One of the most common business structures is a Private Limited Company (Ltd), which offers benefits such as personal asset protection, tax planning options, and a professional image. Setting up a UK-based company can also be done from abroad.

- No minimum share capital requirements

- At least one shareholder and one director are required (can be the same person and a non-resident of the UK)

To be eligible for FCA registration, the crypto company must meet these criteria:

- Be incorporated in the UK

- Have a physical office in the UK (PO boxes are not accepted)

- Open a bank account for operational and crypto transactions

- Record-keeping at the registered business address or office for all transaction-related payments

- Comply with Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) regulations

The crypto company must appoint an officer responsible for AML/CFT compliance. This officer will:

- Manage compliance policies, procedures, and controls concerning AML and terrorist financing

- Act as the nominated officer under the Proceeds of Crime Act 2002

- Hold relevant knowledge, experience, and training

- Have independence and access to resources necessary for carrying out compliance responsibilities

Steps for Opening a Private Limited Company in the UK

- Choose a unique company name (must include “Limited” or “Ltd”)

- Appoint directors and, if desired, a company secretary

- Select shareholders or guarantors

- Identify individuals with significant control of the company (e.g., holding a controlling vote)

- Draft the Memorandum and Articles of Association

- Determine the extent of company bookkeeping records

- Register the company with Companies House (include registered address, SIC code, etc.)

- Set up the company with HMRC for Corporation Tax

- Apply to the FCA for cryptoasset authorisation

Crypto Tax in the UK

While a thorough crypto regulatory framework is yet to emerge in the UK, Her Majesty’s Revenue and Customs (HMRC), the UK’s tax authority, has already published the Cryptoassets Manual, where all the crypto-related tax liabilities are explained within the structure of the existing legislation. Read more here Crypto Tax in the UK.

If you’re planning to register your crypto company with the FCA in the UK, our experienced and dynamic team of Regulated United Europe (RUE) is here to help. We offer comprehensive advice on crypto company formation, crypto license, accounting and taxation and guarantee efficiency, confidentiality as well as meticulous attention to every detail that impacts your business success. Contact us now to receive a personalised offer.

Also, lawyers from Regulated United Europe provide legal support for crypto projects and help with adaptation to MICA regulations.

How to Balance Compliance and Opportunity: Getting a Crypto Exchange License in the UK, 2026

The United Kingdom stands out as a global financial powerhouse, making it a highly attractive landscape for cryptocurrency businesses. With its regulated environment, emphasis on compliance, and strategic advantages, the UK is an ideal destination for crypto companies looking to launch or scale. Here’s an overview of the key aspects of obtaining a crypto exchange license in the UK.

The UK’s Financial Conduct Authority (FCA) is the main regulatory body overseeing crypto-related activities. The integration of crypto assets into the Money Laundering, Terrorist Financing, and Transfer of Funds (Information on the Payer) Regulations 2017 requires the FCA to:

- Apply strict anti-money laundering (AML) regulations to crypto exchange operators

- Require registration for crypto exchanges to improve transparency and securit

This regulation brings greater consumer protection and contributes to preventing financial crimes within the crypto sector.

The UK offers various license types tailored to different crypto industry services:

- Crypto Exchange License: Permits businesses to operate exchanges between fiat and crypto or between different cryptocurrencies.

- Crypto Broker License: Enables entities to resell crypto on behalf of clients.

- Crypto Trading License: Allows direct trading in digital assets.

- VASP License: Permits virtual asset service providers to offer a broader range of services in the crypto industry.

The UK offers various license types tailored to different crypto industry services:

- Crypto Exchange License: Permits businesses to operate exchanges between fiat and crypto or between different cryptocurrencies.

- Crypto Broker License: Enables entities to resell crypto on behalf of clients.

- Crypto Trading License: Allows direct trading in digital assets.

- VASP License: Permits virtual asset service providers to offer a broader range of services in the crypto industry.

The cost of obtaining a crypto exchange license in the UK varies depending on the type of license and activity scope. Although potentially costly, for businesses aiming to operate within the regulated UK market, it represents a meaningful investment.

There are several strategic benefits to obtaining a crypto license in the UK:

- Enhanced business legitimacy in a trusted regulatory environment

- Access to a vibrant and extensive financial market

- Investor and customer confidence due to FCA-regulated compliance

This regulatory confidence is invaluable for any crypto business’s growth and sustainability.

Key challenges in obtaining a crypto license in the UK include:

- A complex regulatory framework

- High compliance standards set by the FCA

Businesses need to remain agile and stay updated on regulatory changes to maintain their licenses.

With a sophisticated financial services sector and a large potential customer base, the UK market offers considerable opportunity for crypto businesses. While the costs of a crypto license in the UK are not the lowest, the strategic advantages and long-term benefits make it a worthwhile investment.

For faster market entry, businesses may consider purchasing an existing crypto exchange license in the UK. This approach requires thorough due diligence to ensure compliance with current regulations and alignment with business objectives.

As the UK continues to refine its crypto regulatory framework, obtaining a crypto exchange license is a strategic step for businesses aiming to leverage the market’s advanced opportunities. Compliance not only minimizes risks but also bolsters the company’s reputation, laying a solid foundation for success in the global crypto market.

Crypto License in the UK 2026

As the popularity and adoption of cryptocurrencies continue to rise, the UK is actively developing regulatory mechanisms to manage this evolving sector of the economy. The requirement for a license to conduct cryptocurrency transactions has emerged as a vital tool to ensure that the circulation of digital assets adheres to rules that are transparent, secure, and legally compliant. Notably, several changes are anticipated in the UK cryptocurrency market in 2026.

Overview of Regulatory Environment

The UK has historically been a leader in financial innovation, which extends to its approach to cryptocurrency regulation. Currently, the Financial Conduct Authority (FCA) serves as the supervisory body for the cryptocurrency industry, mandating that all operators within virtual currency markets obtain a license.

Licensing Requirements

In 2025, to obtain a license to operate cryptocurrency activities, companies must meet the following criteria:

- AML/CFT Compliance: Every cryptocurrency business must implement systems and procedures to effectively identify and mitigate risks associated with money laundering and terrorist financing.

- Capital Requirements: Minimum capital requirements must be established to ensure financial stability on the platform.

- Management Team Qualification: Members of the management team must possess qualifications that enable them to effectively manage cryptocurrency operations.

- Transparency: Firms are required to provide customers with comprehensive details regarding services, fees, and the risks associated with using cryptocurrency for transactions.

Procedure of Obtaining a License

The application process for obtaining a crypto license involves several stages:

- Application Submission: Companies submit the necessary documentation along with proof of eligibility.

- FCA Review: A thorough review of the submitted information is conducted, assessing both management capabilities and financial condition.

- License Decision: The FCA will either grant or deny the license based on its evaluation.

Starting in 2025, obtaining a license for cryptocurrency activities will be mandatory for any company wishing to operate in this field. The licensing process is expected to enforce strong regulatory compliance, providing additional protections for users and the overall economic system. The effectiveness of this measure can be gauged by its potential to foster a sound and secure environment for the continued development of cryptocurrency technologies and services.

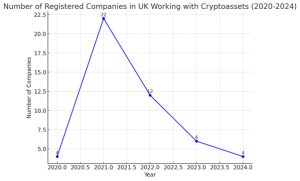

Number of registered companies in UK working with cryptoassets

UK Crypto License 2026

On 11 September 2025, the UK government introduced draft legislation that includes provisions on digital assets, proposing to recognize these assets as personal property within the legal framework of England and Wales. This significant change affords digital assets, such as cryptocurrencies, NFTs, and carbon credits, the same legal protections as traditional forms of personal property.

A key provision in the bill states that an object, whether physical or electronic, is not excluded from the category of personal property solely because the information is intangible or exists in electronic form. This initiative was developed in response to a report by the Digital Assets Law Commission, commissioned by the Department of Justice in 2023, to address the legal recognition of digital assets.

The Law Commission found that while common law in England and Wales has proven flexible regarding personal property rights over digital assets, legal uncertainty remains. This ambiguity has hindered legislative development and does not meet the expectations of market participants, especially concerning disputes and third-party interventions.

In response, the Law Commission proposed statutory law reform aimed at clarifying that personal property rights extend to digital assets, thus eliminating legal uncertainties that affect owners’ rights in the digital economy.

The bill currently before Parliament will expand the classification of property to include a new category: ‘thing (including a thing that is digital or electronic in nature).’ This expansion relates to existing categories:

-

- Things in possession: Such as cars and money.

- Things in circulation: Including shares and debentures.

Crucially, the bill specifies that an object does not require physical possession or direct economic activity to qualify as personal property. This provision legally acknowledges crypto-tokens as digital assets capable of being subjects of personal property rights.

The Bill aims to enhance legal protections for digital asset owners, addressing issues such as:

- Coercive Measures Against Fraud and Theft: Owners can utilize legal mechanisms to protect their interests in cases of fraud or theft, including legal action for asset recovery.

- Rights in Disputes: The Bill extends legal tools, such as injunctions to freeze assets, to prevent mismanagement of digital assets during disputes.

- Inclusion in Bankruptcy Proceedings: Digital assets can be part of the estate in bankruptcy proceedings, ensuring they receive similar treatment as other property types.

This legislative change aims to provide clarity and stability in the treatment of digital assets, enhancing owners’ rights in the digital economy. By acknowledging digital assets legally, the UK aims to strengthen its position as a global leader in crypto-assets, attract investment, and ensure the legal system keeps pace with technological advancements.

Furthermore, the bill highlights a commitment from the UK government to adapt legislation to the evolving landscape of digital assets, reflecting a strategic focus on regulating this rapidly changing sector.

The Law Commission’s report made further recommendations to improve the legal infrastructure surrounding digital assets:

- Reform of Collateral Agreements: To provide legal certainty regarding the pledging of digital assets.

- Establishment of an Expert Industry Group: A panel to provide technical and legal advice on complex issues related to digital assets.

The key changes introduced by the bill include:

- Legal recognition of Bitcoin and other digital assets as personal property.

- Enhanced legal certainty and protection for digital asset owners against fraud and disputes.

- A commitment to maintaining the UK’s leadership in technology and digital asset markets.

The introduction of the Property Bill marks a pivotal step in UK law, formally recognizing digital assets as personal property for the first time. This legislative progress positions the UK as a frontrunner in establishing a clear legal framework for digital assets, instilling confidence in the market and fostering growth within the cryptocurrency sector.

Taxation of Cryptocurrency in the UK 2026

In 2026, the taxation of cryptocurrency in the UK remains primarily governed by capital gains tax (CGT) and income tax. The details are as follows:

CGT applies when cryptocurrency assets are disposed of—sold, exchanged, or used for purchases. The tax on gains ranges from 10% to 20%, depending on the gain’s size and the taxpayer’s income level. For the 2025/2026 tax year, the non-taxable allowance will reduce to £3,000.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Income tax applies when cryptocurrencies are received as payment for services or through mining. The income is classified as employment income, taxed at rates between 20% and 45%, depending on the individual’s total income.

Inheritance tax applies to estates valued over £325,000, including cryptocurrencies. The value of cryptocurrencies is assessed at their market value at the time of death.

- CGT applies to gains exceeding the non-taxable limit of £3,000 for the 2025/2026 tax year.

- Income from cryptocurrencies is subject to income tax based on total income levels.

- Other taxes, including VAT and inheritance tax, may apply depending on the transaction circumstances.

Overall, UK taxpayers must comply with tax obligations related to cryptocurrency assets, which are treated similarly to other investment instruments under current tax legislation. Awareness of the tax implications of cryptocurrency transactions is crucial to avoid potential penalties.

“I specialize in guiding you through the latest developments in the business landscape and optimizing your project to align with the newest laws and regulations in the United Kingdom. Don’t hesitate – get in touch with me today, and let’s initiate the process for your success in the UK.”

FREQUENTLY ASKED QUESTIONS

Yes, but formally it is not called a license.

Individuals wishing to partake in business-related crypto activities in the UK are obliged to register with the Financial Conduct Authority (FCA).

Once the FCA grants authorization, registered crypto service providers may take part in the following activities:

- Safeguarding and/or administer clients’ crypto assets

- Offering crypto to crypto and fiat to crypto exchanges

- ICO and ITO

If the application is complete and the FCA does not request any further information of documents, the decision will be delivered within 6 months from the application date. However, this is often not the case. If the FCA asks for further information, the applicant must submit it within 3 months.

Yes, but the director of a crypto company ik the UK must formally reside in the country.

Opening a bank account is not a formal requirement for establishing a crypto company in the UK. However, having one is highly recommended.

There is no formal requirement for the minimum authorised capital amount.

As it is not a formal license but rather an authorization, it does not have an expiration date.

In order to register as a virtual asset service provider in the UK, the applicant must fulfil the following criteria:

- Have an established company in the UK with a local office

- Maintain all records related to transactions that have been made under the license in the place of business

- Hire a director and an anti-money laundering officer that fulfil the formal requirements (necessary professional background and knowledge, clean criminal record etc.)

- Gather all the reports and documents that are necessary for the application.

There are a few solid reasons why it is worth establishing and running a crypto company in the UK. To begin with, the UK is a highly trusted regulatory framework in Europe that supports crypto trade. From a more general perspective, the UK is also a Fintech hub, providing a dynamic environment that’s full of networking and development opportunities. Finally, the process of registering with the FSA is rather straightforward, allowing applicants to ensure a streamlined and smooth application if the necessary information is collected thoroughly.

No. The director must be a resident of the UK. In addition, the company must have a local office.

UK crypto companies must hire a competent AML officer and establish a detailed and clear AML policy.

In order to receive authorisation from the FSA, applicants must fulfil the necessary conditions. Consequently, difficulties may arise if the information submitted to the FSA doesn’t match the requirements or is otherwise insufficient. Further difficulties may arise if the applicant fails to establish a comprehensive risk management network and policies that depend on the estimated size and complexity of the crypto business.

Additional services for UK

RUE customer support team

RUE (Regulated United Europe) customer support team complies with high standards and requirements of the clients. Customer support is the most complex field of coverage within any business industry and operations, that is why depending on how the customer support completes their job, depends not only on the result of the back office, but of the whole project itself. Considering the feedback received from the high number of clients of RUE from all across the world, we constantly work on and improve the provided feedback and the customer support service on a daily basis.

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

Registration number:

14153440

Anno: 16.11.2016

Phone: +372 56 966 260

Email: [email protected]

Address: Laeva 2, Tallinn, 10111, Estonia

Registration number: 304377400

Anno: 30.08.2016

Phone: +370 6949 5456

Email: [email protected]

Address: Lvovo g. 25 – 702, 7th floor, Vilnius, 09320, Lithuania

Registration number:

08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00, Prague

Registration number: 38421992700000

Anno: 28.08.2019

Email: [email protected]

Address: Twarda 18, 15th floor, Warsaw, 00-824, Poland

Please leave your request

The RUE team understands the importance of continuous assessment and professional advice from experienced legal experts, as the success and final outcome of your project and business largely depend on informed legal strategy and timely decisions. Please complete the contact form on our website, and we guarantee that a qualified specialist will provide you with professional feedback and initial guidance within 24 hours.