Crypto License in Saudi Arabia 2025

The Kingdom of Saudi Arabia is forcefully making a claim as one of the forerunners in the revolution of cryptocurrencies. The SAMA has embarked on strict control of cryptocurrency transactions, emphasizing formulation and adherence to the regulatory framework with the aim of striking a balance between the encouragement of innovation and the protection of the rights and interests of investors and consumers.

The Kingdom of Saudi Arabia is forcefully making a claim as one of the forerunners in the revolution of cryptocurrencies. The SAMA has embarked on strict control of cryptocurrency transactions, emphasizing formulation and adherence to the regulatory framework with the aim of striking a balance between the encouragement of innovation and the protection of the rights and interests of investors and consumers.

One step toward such a regulatory climate was when a high-ranking Saudi Arabian religious leader issued a fatwa confirming that operations with Bitcoin and other cryptocurrencies correspond to the principles of Sharia. That was a serious religious legal act that influenced the modification in the legal position of the Kingdom regarding cryptocurrencies.

Meanwhile, SAMA is heavily involved in CBDC capability analysis and testing in its further integration with the country’s current financial system. This line of work shows that the Saudi Arabian state wants not only to follow new technological realities but also to create conditions for the effective introduction and use of these technologies in the national economy.

The Government of Saudi Arabia is very interested in the DeFi sector and, therefore, has become one of the most active countries in the MENA region on decentralized exchanges. Such a G20 economy, with a population of over 30 million people-approximately 63% of whom are under the age of 30 years-benefits from its demography and boosts innovation in financial technology. Youth, more open to novelty, are active in creating and applying new financial products and services.

Besides, the interest in Altcoins in the Kingdom is way higher than in the rest of the world. This can signal a much higher risk tolerance and diversity in investment assets among the residents. The current state of affairs serves as a witness to the fact that the Kingdom seeks not only to become a participant in the global financial market but also an active builder of the new economic reality, in which digital assets will play a key role.

Virtual assets in the Kingdom of Saudi Arabia

Virtual assets have been in a state of legal limbo in the Kingdom of Saudi Arabia. The policy enacted by the government regulator back in 2018 barred banking institutions from cryptocurrency trades. It branded virtual cryptocurrency trading as unlawful. Still, in practice, there were no legal sanctions for conducting digital asset operations, which installed legal ambiguity in these markets.

Such legal grey areas may well just deter investors keen to participate in the crypto market of the Kingdom. Meanwhile, assets such as NFTs are not within the ambit of existing prohibitions and hence a more favored way of investing in digital assets.

To date, no active policy and legislation development that is aimed at regulating the digital assets market has been pursued by the Kingdom. It will likely follow the suit of other regional players very soon, which actively develop the legal basis to frame this market. Considering the high level of technological awareness and curiosity among the country’s youth, one may expect that quite soon some regulatory measures will be introduced aimed at legalizing this sector of cryptocurrencies and other virtual assets, along with its stabilization. Here, it will play for the benefit of the Kingdom, making it more solid in the arena of digital finances around the world and attracting new investments to the economy.

Indeed, the financial sector of the Kingdom of Saudi Arabia shows steady interest in blockchain technology by implementing it avidly in practically all spheres of financial activities. The warnings from the Saudi Arabia Monetary Agency and Capital Market Authority that trading in bitcoin is risky and not protected by the state against losses associated with virtual currencies have been overlooked, yet the implementation of blockchain applications goes on.

In its turn, major trends of blockchain technology adoption in the financial sphere are the increase in efficiency, security, and transparency of the financial processes. Financing of supply chains, systems of identity verification, and cross-border payments will be the most relevant practical applications of blockchain technology. All those measures, in turn, are targeted at reducing the operational risk and increasing control over financial flows.

Along with these local projects, SAMA cooperates with UAECB on the development of different projects related to centralized cryptocurrencies, such as the CBDC for the Central Bank of the Saudi Rial and the cross-border project “Aber”. This also shows not only the pursuit of stronger international financial cooperation but also readiness for the adoption of modern financial novelties with the purpose of making the general performance of financial activity in the region more stable and reliable.

Therefore, blockchain technologies will not only contribute to but also catalyze the change in the financial sector of the Kingdom by opening wide opportunities for the development and cooperation of the national economy in a globalized environment. Considering the dynamic growth observed in its financial industry, the Kingdom of Saudi Arabia cautiously addresses the regulation of particular kinds of FinTech business-most notably, cryptocurrencies and crowd funding.

Following is a snapshot of the highlights of the current regulatory climate:

| Category | Details |

|---|---|

| Cryptocurrencies | The Saudi Arabian Monetary Authority (SAMA) does not recognize cryptocurrencies as legal tender. As a result, cryptocurrency exchanges and services facilitating cryptocurrency transactions are not officially authorized within the Kingdom.

SAMA is, however, engaging in dialogue with industry leaders such as Binance, as well as with other national regulators, including the Ministry of Communications and Information Technology (MCIT), to develop a regulatory framework for digital currencies. |

| Crowdfunding Platforms | Debt-based crowdfunding platforms are regulated by SAMA to ensure compliance with financial norms and standards.

Equity-based crowdfunding platforms fall under the regulation of the Capital Market Authority (CMA), allowing investors to receive company shares in exchange for contributions. Donation- and reward-based crowdfunding platforms are allowed to operate legally, as long as they adhere to specific rules and secure the necessary licenses and approvals. |

| Dynamic Regulation | The fintech regulatory framework in Saudi Arabia is highly adaptive and variable, requiring market participants to stay informed about legislative and regulatory updates continuously. |

The regulation of the fintech sector in Saudi Arabia aims to balance innovative development with the need to protect the interests of financial market participants, while ensuring stability and transparency in business operations in the country.

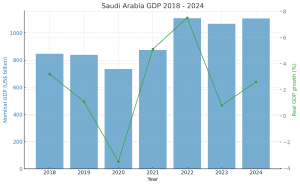

Saudi Arabia GDP

Vision 2030 program

The most ambitious goals of the Vision 2030 program initiated by the Kingdom of Saudi Arabia involve decreasing the reliance of the economy on the oil sector and diversification. Among the most interesting areas, it is possible to highlight the transformation of the country’s financial system through the development of the fintech sector and increasing the share of cashless transactions in the economy. The Kingdom thus aims for 2030 to reach 70% of cashless transactions, showing focused interest in strategic orientations for financial technologies.

The Fintech Strategy was unveiled in May 2022 as the fourth major pillar of the Vision 2030 program, aimed at equipping Saudi Arabia to become a global fintech hub and attract entrepreneurs from both their country and the rest of the world. In pursuit of innovative technologies and entrepreneurship, the following initiatives have been launched by the government: first, the Fintech Saudi Initiative has targeted new and small businesses in this sector.

As far as tax policy is concerned, the Government of Saudi Arabia announced that in 2023, new special zones will be established in addition to the currently existing economic cities. The new zones and cities will fall under a special tax regime and shall be regulated by the Economic Cities and Special Zones Authority – ECZA. Also, with the consultations on the draft new tax legislations currently underway, tax benefits are still in the development phase, and the enactment timing is not determined yet.

These initiatives are an indication that financial innovative technologies will be developed and scaled under better conditions while strengthening economic sovereignty through reduced dependence of traditional sectors.

Although there are no specific legislative acts directly against cryptocurrencies or crypto assets, the Kingdom of Saudi Arabia is very cautious with regard to regulating this sector. The Saudi Arabian Monetary Authority has not recognized cryptocurrencies as legal tender; hence, this effectively excludes the legal operation of cryptocurrency exchanges within the country.

Key aspects of the current approach to cryptocurrencies:

| Topic | Details |

|---|---|

| Negotiations with Industry Leaders | SAMA is actively engaged in discussions with major players in the crypto industry, including large exchanges like Binance. These negotiations explore a potential regulatory framework for digital currencies, which could indicate future regulations in this sector. |

| Collaboration with National Regulators | SAMA collaborates with other regulatory bodies, such as the Ministry of Communications and Information Technology (MCIT), indicating a comprehensive approach to cryptocurrency regulation. |

| Memorandum of Understanding with Sandbox | A recent memorandum of understanding between the Saudi Digital Government Authority (DGA) and the metaverse platform Sandbox underscores Saudi Arabia’s interest in emerging technologies. This agreement boosted the SAND token price, reflecting positive market sentiment. |

| Prospects for Future Regulation | Given the ongoing negotiations and international agreements, it is anticipated that Saudi Arabia will create a robust regulatory environment for cryptocurrencies. New legislation affecting the crypto industry is expected by 2025, potentially accelerating its growth in the region. |

This approach allows Saudi Arabia to stay at the forefront of technological progress, supporting innovation while ensuring consumer protection and financial system stability.

RUE customer support team

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

OÜ

Registration number:

14153440

Anno: 16.11.2016

Phone: +372 56 966 260

Email: [email protected]

Address: Laeva 2, Tallinn, 10111, Estonia

UAB

Registration number: 304377400

Anno: 30.08.2016

Phone: +370 6949 5456

Email: [email protected]

Address: Lvovo g. 25 – 702, 7th floor, Vilnius, 09320, Lithuania

Registration number:

08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00, Prague

Sp. z o.o

Registration number: 38421992700000

Anno: 28.08.2019

Email: [email protected]

Address: Twarda 18, 15th floor, Warsaw, 00-824, Poland