Crypto License in Lithuania 2025

VASP license / CASP license in Lithuania

The Lithuanian government officially allows the conduct and regulation of crypto business, making it one of the few European Union member states where legal financial transactions with cryptocurrency are possible. Virtual currencies can be used with FIAT—traditional financial services—and electronic money—so-called e-money—by permission of the Lithuanian government.

Licensing related to Virtual Currencies in Lithuania is provided in two forms:

An exchange license for cryptocurrencies: such a license allows companies to exchange cryptocurrency for capital or for another cryptocurrency and receive some commission for the provided service.

Custodian license for crypto wallets: licensed companies are allowed to manage cryptocurrency wallets, including the generation and storage of encrypted client keys.

Lithuania crypto license

Lithuania is recognized as one of the leading jurisdictions for obtaining a Crypto license in Lithuania, enabling companies to operate legally in the virtual asset market. Many industry experts also refer to this regulatory framework as a CASP license in Lithuania or a VASP license in Lithuania. While the terms CASP (Crypto Asset Service Provider) and VASP (Virtual Asset Service Provider) originate from different regulatory and legal sources, they both denote the same comprehensive licensing process. This robust and transparent system ensures full compliance with AML/KYC requirements and provides a secure foundation for crypto businesses aiming to expand across Europe.

|

PACKAGE «COMPANY & CRYPTO License IN LITHUANIA» |

9,900 EUR |

- The establishment of a company or the purchase of one that is already established

- A EUR 125,000 contribution to the registration of the share capital

- Preparation of legal documents for companies

- Assistance with state social insurance fund employment/KYC/AML officer and information

- For one year, Vilnius Business Centre will be the legal address

- An analysis of the Cryptocurrency Company’s business model and structure

- Company KYC/AML procedures and procedural rules

- Submission of notifications to Lithuanian FCIS and Business Registers

- Fees for registering a company with the government

- License fees for government-issued cryptography

- Five hours of general counselling

Additional Services

| 1,500 EUR | |

| 2,000 EUR | |

| 400 EUR |

General regulations

In this process, the authority may ask for more information about or a detailed description of the activities that will be carried out by the crypto company. When all the data is collected and complete, a license may be issued.

Changes in the structure of a virtual firm after receiving a license should be performed only after the date of the license, in order to mark it correctly in the system with a full portfolio of documents. Changes must be done as regards addresses: owner, board members, beneficiaries, employees.

Lithuanian Business Register provides the license application form for cryptography and is subordinated to FCIS. It is a department in the Lithuanian Police and Border Police Department with a very distinctive function. For more information about Lithuania’s rules concerning cryptography, see below.

Order V-5 of January 2020, about money laundering and terrorism financing, applies to virtual currency businesses.

LICENSING PROCEDURE

To get a Virtual Currency License, the UABs need to be incorporated in Lithuania. The minimum authorized capital of the company shall be at least 2500 euros. There would not be any requirement to visit Lithuania by proxy or use the electronic card of the Lithuanian resident for creation of crypto company. The company may be created fully remotely.

- The structures of cryptocurrencies do need at least one member. The latter can be both an owner and a board member.

- He is also employed by AML, a crypto company.

- Officer/Official in Charge of Combating Money Laundering and Financing of Terrorism

- No requirement to be established in Lithuania is set for such an officer/official. He or she is simply expected to have some experience in the industry and enjoy a good reputation.

The licensed business shall thoroughly assess the owner of every visitor and delve deep to transfer its merits by applying AML/KYC rules. AML/KYC rules may be consulted with by the FCIS supervisory authority.

List of legal entities operating as a virtual currency exchange operator in Lithuania.

What are CASP and VASP Licenses in Lithuania?

A CASP license in Lithuania and a VASP license in Lithuania are alternative terms used in various regulatory documents to describe the same type of license issued to cryptocurrency service providers. The term CASP (Crypto Asset Service Provider) is often used in one set of legal texts, while VASP (Virtual Asset Service Provider) appears in others. Despite this variation in terminology, both licenses impose identical requirements, including strict adherence to AML/KYC standards, robust cybersecurity measures, and comprehensive financial transparency. This regulatory consistency ensures that businesses benefit from a secure operational framework, no matter which term is used in a given source.

Requirements for the company

Companies of any service provided within the field of virtual currency activities should do the following:

- Implement customer due diligence and verification;

- Provide regulators with access to customer information;

- The company needs to have an internal control system and a procedure for risk assessment;

- Compliance with KYC/AML means there is a compliance officer

- A notification to be sent to the Financial Crime Investigation Service – FCIS.

There are also requirements that board members and owners of the company should not have any criminal records or reputations that may be questioned.

No physical presence is needed for crypto company owners and board members if foreigners/non-residents of Lithuania want to conduct crypto activities legally while being abroad.

It is necessary to submit the following documents when applying for a cryptocurrency license in Lithuania:

All participants’ passports must be apostilled

The CVs of all participants in the project

It is important that the board has a good reputation in the business world (no criminal record)

As part of the application process, an AML officer must prove that they have a good reputation in business and do not have any criminal records, as well as provide documentation regarding relevant education, skills, and experience

KYC/AML officers can be replaced by third-party suppliers with whom a collaboration agreement has been reached

Owners/board members of the company do not have any restrictions based on their country of residence.

The KYC/AML procedures, procedural rules, and business plan

Advantages

Implementation of projects quickly

A ready-to-use solution is available

Fully remote solutions are possible

There is no requirement to have an office

Companies of any service provided within the field of virtual currency activities should do the following:

- Implement customer due diligence and verification;

- Provide regulators with access to customer information;

- The company needs to have an internal control system and a procedure for risk assessment;

- Compliance with KYC/AML means there is a compliance officer

- A notification to be sent to the Financial Crime Investigation Service – FCIS.

There are also requirements that board members and owners of the company should not have any criminal records or reputations that may be questioned.

No physical presence is needed for crypto company owners and board members if foreigners/non-residents of Lithuania want to conduct crypto activities legally while being abroad.

Lithuania

Capital |

Population |

Currency |

GDP |

| Vilnius | 2,801,000 | EUR | $24,032 |

Documents needed

In order to review and prepare an application for a cryptocurrency license, the following documentation will be required:

- A valid passport copy from the country of origin

- In the case of a remote start-up and license application, a power of attorney (PoA) is required

- The business model of the company and a detailed description of its activities

- Crypto license participants’ CVs/summaries of experience and education

- Address of website that will offer cryptocurrency services

- A copy of the criminal record of an owner, board member, final beneficiary (UBO) or AML officer (not older than 3 months)

Example of a Lithuanian crypto company certificate

Field of activity – Depozitinių virtualiųjų valiutų piniginių operatorius, Virtualiųjų valiutų keityklos operatorius

REPORTING REQUIREMENTS

To report to the tax authorities, the cryptocurrency company does not have any special requirements. Lithuanian companies must provide accounting in the same way as other companies. Crypto companies do not need to report to regulators, but FCIS is always able to make prescriptions and requests about their activities. Essentially, the FCIS requires that crypto projects comply with AML/KYC requirements, such as collecting client data from crypto projects and making it available to the regulator upon request.

TAXATION OF VIRTUAL CURRENCY COMPANIES IN LITHUANIA

- VAT does not apply to crypto exchange services.

- VAT is required on cryptocurrency offers

- There is a 15% tax on cryptocurrency benefits. Taxes are applied to small businesses with less than 10 employees and turnovers below 300,000 euros.

- Dividends paid on income are taxed at 15%.

Depending on the type of crypto activity, taxes vary. Taxes are not imposed on tokens acquired through exchange, nesting, or any other means.

Crypto company registration in Lithuania

Registration of a crypto company in Lithuania in 2025 is a very promising direction for those entrepreneurs who would like to deal with blockchain technology and digital assets. Lithuania appeals with its good regulatory climate, clearly tuned legislation, and openness to novelties. In this article, the key points relevant to the process of registering a cryptocurrency company in this country are presented: what requirements are imposed on the founders, how much authorized capital is required, and other important points.

Founder’s requirements

Any cryptocurrency company in Lithuania can be registered both by individuals and legal entities that must not necessarily be the country’s residents. Nevertheless, founders and managers of such companies are to have a perfect business reputation for successful passing the very license issuance procedure and satisfying all the requirements of local legislation. What is more, AML and KYC checks may be needed.

Amount of authorized capital

Minimum amount of authorized capital with the purpose to register a cryptocurrency company in Lithuania is EUR 125,000. Note that such funds are supposed to be deposited into the account of the company before the latter starts its activity. This capital can be spent on covering start-up costs and investing in business development.

Licensing of cryptocurrency activities

To provide such activities in Lithuania, the undertaking is obliged to obtain the relevant license issued by the Lithuanian Anti-Money Laundering Centre. There are mainly two types of licenses:

- License for Cryptocurrency Exchange: A license to entitle an undertaking to exchange cryptocurrencies for fiat money and vice versa; also, exchange cryptocurrencies for a cryptocurrency.

- License for Cryptocurrency Wallets: Such a license allows an undertaking to store and manage keys to the Cryptocurrencies on behalf of a client.

Application form and a set of documents confirming the conformity of the company with Lithuanian legislation, including AML/KYC requirements.

Tax regulation

General regulation of taxation applies to cryptocurrency companies in Lithuania. The corporate income tax is at a rate of 15 per cent with a reduced rate of 0-5 per cent in the case of small businesses whose annual revenues are less than 300,000 euros. VAT and other tax aspects have to be considered while transacting with cryptocurrency.

By registering a cryptocurrency company in Lithuania, one opens unparalleled opportunities to break into the European digital asset market. The country allows an attractive regulative and tax environment for crypto businesses; however, success in this area requires plans to be made with due care and in compliance with all legal and regulative requirements in the country. Businessmen are encouraged to examine these areas with local lawyers and financiers to ensure complete compliance and optimize their operations in Lithuania.

Crypto exchange license in Lithuania

A crypto exchange license in Lithuania allows a company to work in various fields of activity with digital assets and offer extensive services related to cryptocurrencies. Lithuania, due to its progressive regulatory policy and openness to innovation, attracts many entrepreneurs who would like to conduct business with cryptocurrencies for the European market. In this post, let’s look at the main points of getting a crypto exchange license in Lithuania, what services are provided to a company with such a license, the reporting requirements, and the benefits of it.

Services that a crypto exchange licence holder can offer

A company that has obtained a crypto exchange license from Lithuania can offer a wide range of services, which include:

- Trading pairs: Exchanging one cryptocurrency for fiat money or other cryptocurrency.

- Custodial services: For the safekeeping of clients’ cryptocurrency assets, highly secure.

- ICO/STO: The organization and performance of initial coin offering or tokenized securities for companies.

- Providing APIs to developers: Providing APIs for integration with other services and applications.

Work with Clients

Having the license of a crypto exchange, the company will be entitled to operate with both private investors and corporate clients to provide them with access to the trading platform for such assets, as well as additional services associated with investments in digital assets. The big work with the clients is the observance of AML and KYC compliance; hence, detailed identification and verification of clients are needed.

By obtaining a Crypto license in Lithuania – whether it is referred to as a CASP license or a VASP license – companies demonstrate their commitment to maintaining the highest standards of security and regulatory compliance, thereby enhancing investor confidence.

Reporting requirements

Companies operating with cryptocurrencies under an in-possession cryptocurrency exchange licence are obliged to comply with reporting requirements of the regulator, including reporting related to financial transactions, management reports, and also AML/KYC activity. The requirements ensure the transparency of operations of a company, together with protection of interests of clients.

Benefits of crypto exchange licence in Lithuania

- Regulatory clarity: Lithuania offers a clear and understandable regulatory environment for cryptocurrency companies that minimize legal risks.

- Access to the European market: Under this license, the company gets access to the wider market in the European Union.

- Prestige and credibility: With a license, the confidence of clients and partners would increase and add more weight to the reputation of the company internationally.

- Growth and scale: Licensed operations allow the company to expand its services and attract more clients.

The license of a crypto exchange in Lithuania requires an extended approach to the preparation of documentation, meeting regulatory requirements, and assuring high standards of security and transparency of operations. Benefits accompanying this process will counterbalance all the challenges related to the licensing process, hence this is an important step towards successful development in the cryptocurrency and blockchain industry. Following the right approach and fulfilling all the requirements, the company would not only be able to get a foothold in the market but also considerably expand its capabilities and scope of activities.

How to obtain a crypto trading license in Lithuania?

Over the last couple of years, Lithuania became one of the most attractive jurisdictions for cryptocurrency companies because of its innovative regulatory policy and openness towards financial technology. That means that the transparency of the process of receiving a cryptocurrency trading license in this country and relative simplicity make Lithuania an extremely favourable place for start-ups and international companies seeking to develop their operations within the European Union. In this article, we review the step-by-step process of obtaining the relevant license in detail, requirements to founders, and the time frame for setting up the company.

The process to secure a Crypto license in Lithuania is identical to obtaining a CASP license in Lithuania or a VASP license in Lithuania, ensuring compliance with all legal and regulatory requirements.

Step 1. Preparatory phase

First, it would be required to consider in detail the regulatory requirements of Lithuania regarding cryptocurrency companies. It means it is necessary to be acknowledged with legislation, which regulates cryptocurrency activities, AML, and requirements for KYC procedures.

Step 2. Registration of a legal entity

A registered legal entity in Lithuania is a prerequisite for getting the license. The procedure involves choosing the company’s name, legal address, elaborating on the articles of association, and registration in the Lithuanian Register of Legal Entities.

Step 3. Preparation and submitting the documents

At this stage, the company should prepare and send to the Lithuanian Securities Market Commission a package of documents that prove compliance with regulatory requirements. Among them are the main ones:

Business plan, which describes the business model, sources of revenues, and structure of management; AML and KYC policy, proving the measures against money laundering and terrorist financing.

Evidence of professional suitability of founders and key personnel, which should provide biographies and documents confirming experience in the financial sector.

Step 4. To wait for the regulator’s decision

After the submission of all required documents, the Lithuanian Securities Market Commission will review them. This process may take from several weeks to several months, depending on how complete and qualitative the submitted documentation was.

Requirements to founders

Business reputation: The founders and key employees shall have a flawless business reputation and not have any criminal records, especially those about financial crimes.

Financial strength: It has to be proven that the company has adequate capital for starting and maintaining the activity.

Professional Experience: It is a must that previous experience in finance is held, as well as an understanding of the cryptocurrency market.

Timing of Company Incorporation

The general procedure of preparation of documents to getting a license takes from 1 to 6 months, depending on the complexity of the documentation and the speed of consideration of the application by the regulator.

Obtaining a cryptocurrency trading license in Lithuania is a very promising opportunity for companies willing to work in the European market. The probability of getting a license increases if the company follows the steps and requirements stated above. The process is worth going through with full responsibility and paying much attention to details, because qualitative preparation and completeness of documentation play a key role in a positive decision by the regulator.

Securing Your Gateway to Europe: The Crypto Exchange License in Lithuania 2025

While the rise of the cryptocurrency industry booms all over the world, Lithuania as a country has emerged to become the gateway to the vast European market for crypto businesses. This article is a full guide on how to get a crypto exchange license in Lithuania. It covers everything from the beneficial regulatory climate of the country to the general procedure of licensing to the strategic advantages that Lithuania will accord your crypto business as its base.

Crypto Licensing Framework in Lithuania

The governments in Lithuania, through the Bank of Lithuania, have created a very progressive regulatory environment for digital currencies with an underlying framework of EU financial regulations. There are several options for crypto licenses, depending on what aspect of the cryptocurrency business:

- Crypto exchange license in Lithuania: Crypto-to-fiat and crypto-to-crypto exchange services can be provided.

- Crypto broker license in Lithuania: Brokerage of crypto transactions can be operated.

- Crypto-trading license in Lithuania: For those businesses which directly deal in crypto trading activities.

- VASP crypto license in Lithuania: In case of Virtual Asset Service Providers, it encompasses a wide array of services from wallet providers to the issuance of ICOs.

Crypto-licensing Eligibility and Requirements

This means that, in order to get a license, an applicant has to meet high demands regarding effective AML/KYC procedures, proof of operational capability, and a clear business plan. One more highly important demand is to show strong IT security from cyber threats.

Cost Analysis for Obtaining Crypto License in Lithuania

The crypto exchange license cost in Lithuania is competitive when compared to other EU countries, and the licensing process is relatively straightforward; thus, Lithuania is an economically attractive jurisdiction for crypto businesses.

Advantages of a Crypto License in Lithuania

Obtaining a crypto license in Lithuania has a number of key benefits for companies, such as access to the entire EU market under regulatory compliance, increased credibility, and potentially great growth and scalability.

Investment Opportunities in the Crypto Market of Lithuania

Lithuania is accessible not only due to its regulatory but also economic environment-it provides potentially lower operational costs. Accessibility to the cheapest crypto license in Lithuania makes it a destination for both startups and established firms willing to maximize their investment efficiency.

How to Manage a Sale and Transfer of Crypto License

One can also accelerate market entry by acquiring an existing crypto exchange license presently on sale in Lithuania. In any case, due diligence and a proper understanding of the legal frameworks involved are necessary pre-transaction requirements.

Conclusion: Lithuania has all the ingredients to make any crypto business wish to establish or extend its operations in Europe. From a friendly regulatory regime to competitive costs and strategic market access, a crypto exchange license in Lithuania is one sure step toward a vantage position within the global crypto economy.

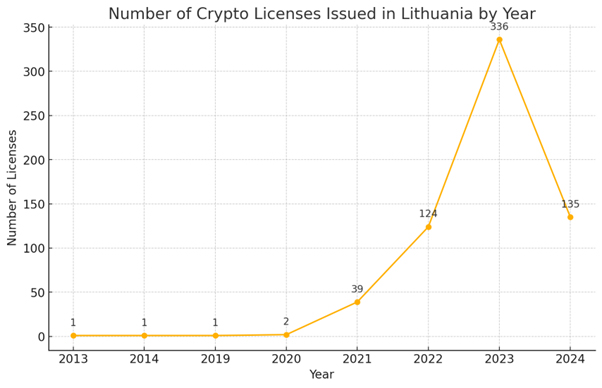

As of 24.10.2025, there are 640 entities in Lithuania that have been granted permission to provide crypto services: cryptocurrency storage service and cryptocurrency exchange service.

It follows the table of Crypto-licences distribution in Lithuania, divided by year:

Obtaining a crypto license in Lithuania by year

Crypto license in Lithuania 2025

Improved requirements for operators of the Virtual Currency Exchange Platforms and operators of Virtual Currency Depository Wallets confirm their equity capital. While still under new regulation, there is a prescription that those operators shall check their capital level in order for them to be assured of their compliance with the requirements prescribed by regular reviews. This is not only in ensuring the operators are financially stable, thus reliable, but also secures the interest of their customers. The measures aimed at strengthening user confidence in the institutional participants of the virtual currency market increase the transparency of their activities.

Operators shall provide appropriate documentary evidence of own funds sufficient to cover any shortfall in the level of required own funds within the time limits laid down by the regulator. Failure to observe the requirements above may be subject to administrative penalties, including fines and restrictions on further activity.

On 1 August 2025, amendments to Article 25(6) of the Law of the Republic of Lithuania on the Prevention of Money Laundering and Terrorist Financing regarding the requirements for legal entities registered in the Republic of Lithuania that operate or intend to operate as virtual currency exchange operators and/or virtual currency deposit wallet operators came into effect. Following amendments are binding on such a legal entity to:

- If the legal person is registered in the form of a joint stock company or a closed joint stock company:

- a) register and fully pay capital at least in the amount of EUR 125,000 and to maintain permanent capital at the aforementioned amount;

- b) ensure that the funds making up the authorized capital are transferred to an account with a credit institution of the Republic of Lithuania or to an account with a credit institution of the European Union Member State that has a branch in the Republic of Lithuania.

For legal entities of other legal forms, established in the Republic of Lithuania, as well as branches of legal entities of the European Union Member States or foreign countries:

- A guarantee document should be provided to cover the entire period of activity in the amount of at least EUR 100,000 for one customer’s claim for damages and for the amount of EUR 500,000 for all customers’ claims for damages per year, issued by an insurance company or a financial institution.

These changes seek to enhance the control over the activities of Virtual Currency Operators and strengthen their level of financial responsibility toward their customers in general, thus helping in efforts to combat money laundering and the financing of terrorism.

The novelty brought amendments to the Law of the Republic of Lithuania on the Prevention of Money Laundering and Terrorist Financing; an obligation active was imposed on natural persons who acted as operators of virtual currency exchange and/or operators of virtual currency deposit wallets. The innovation, on the one hand, requires such persons who have initiated their activities before 31 July 2025 and who continue to practice from 1 August 2025, to declare to the relevant authority prior to 31 August 2025 that as of 1 August of the same year they satisfy the statutory equity capital requirement, which should amount to at least EUR 125,000.

In particular in this regard, natural persons have to provide the competent authority with proof of statutory equity capital. Such proof has to be furnished in a form as provided for by the authority in such a way as to be able to verify the adequacy of one’s financial resources and, consequently, the statutory requirements concerning financial reliability and stability.

The latter serves to enhance financial transparency and accountability of VC operators, adding to the protection of the rights of consumers and hindering financial risks within the system of AML/CFT.

Under the Law of the Republic of Lithuania on the Prevention of Money Laundering and Terrorist Financing, each legal entity that acts as a virtual currency operator is obliged to identify by themselves and submit to the Authority those documents that duly prove that the company meets legal requirements. This is explained by the fact that the law does not provide for a clearly defined list of such documents.

Among the documents most relevant to prove compliance with the legal requirement of having equity capital of at least EUR 125,000 are the following:

- interim reports of the financial statements for the first half of the financial year 2025 that have been registered at VM Registration Centre;

- extracts from the General Ledger entries current on or after 30 June 2025, taken out from the accounting software used by a bank;

- monthly cash inventory report of the company for June-July 2025.

A bank statement confirming that the cash balance as at 1 August 2025 is at least €125,000.

Legal entities should also note that the submission to the Office of solely financial statements or evidence of the formation of the company’s authorised capital of €125,000 cannot be considered as sufficient proof that the legal requirements are met.

Attention should be drawn to the fact that virtual currency operators who, by 31 August 2025, do not provide sufficient proof that, as of 1 August 2025, they maintain equity capital continuously in the sum laid down shall be deprived of a right to further continue their activity within the Republic of Lithuania as of 1 September 2025. Emphasis is placed on the stringency of legal requirements and the need for strict compliance to ensure legality in the course of virtual currency activity.

The Lithuanian government feels the risks associated with crypto-assets are rising and has thus been strengthening the regulatory positions of companies operating within this area in the country. The chiefs of the Bank of Lithuania, Ministries of Interior and Finance, along with FCIS, categorically insist on the tightening of control over cryptocurrency-related activities, pointing out that without relevant measures the country will face its reputation as a reliable and stable jurisdiction being lost. Such a move might have very negative consequences for the national financial system, investment attractiveness, and international position of Lithuanian fintech companies.

This will strengthen the regulatory requirements for a highly transparent and secure cryptoasset market and this, in turn, could contribute to increasing confidence in the Lithuanian financial system, domestic and foreign investors alike. It will also reduce the risks related to money laundering and the financing of terrorism, strengthening Lithuania’s position internationally as a country that meets high standards of financial security.

While crypto-asset activities are innovative, they can be related to such risks as money laundering and fraudulent schemes. The Bank of Lithuania regularly informs consumers, financial market participants, and institutions of control about such risks, pointing to the necessity of strengthening controls in this sphere.

Due to the threats identified, Lithuania plans further strengthening of the legal regulation of the crypto-asset market. With active participation of experts in this field and submission of legislative proposals, specific measures are to be developed and implemented, which will make the legal environment more strict and supervise providers of crypto-asset services.

More strict regulation will, in turn, enable financial institutions to better detect transactions that may be suspicious of money laundering and terrorist financing. More detail in the information provided to the FNTT will facilitate rapid responses and investigations that, again, will help prevent further offenses. The success of the measures proposed below depends to a large extent on the close co-operation and co-ordination of all the supervisory bodies.

The Ministry of Finance of Lithuania has prepared several legislative amendments and submitted them for co-ordination with other state institutions in advance of the relevant European Cryptoasset Markets Regulation requirements coming into force in 2025: The aim of these amendments is to introduce new operational requirements for cryptoasset service providers and to secure a much higher level of licensing.

The proposed changes are intended to create an enabling environment for the sustainable development of the cryptocurrency sector through the incorporation of such into the country-wide fintech ecosystem. The measures are also expected to increase transparency of operations and set higher quality standards in this area. It will help clean up the market and underline companies with sustainable business models, which will be able to work in the new environment without substantial difficulties. The inability of some players to meet the requirements may mean that they have to review their operations or leave the market altogether.

Such an approach not only works for financial stability but also protects consumers’ interests and reduces probable financial losses and fraud connected with cryptoassets. It will further strengthen the position of Lithuania as one of the leading fintech innovation hubs in the EU.

After last year’s and this year’s inspections carried out against virtual currency operators, competent authorities imposed fines on twelve companies. These ranged from 2,700-220,000 euro fines, and warnings were given to two other companies. In 2023, the total amount of fines imposed for violations under the AML Law reached almost half a million euros. Such statistics show that some companies in the virtual currency sector continue to neglect the mandatory measures for preventing money laundering, which shows further and stronger regulatory measures with respect to that.

It also corroborates the status quo regarding regulatory compliance and the need for operators of virtual currencies to put in place an effective system of internal controls enabling them to forestall financial crimes. This involves fines, and the need to increase education and guidance of companies about compliance issues. Stability of this sector and control of the built-up risks remain in the focus of regulators.

Over the last years, Lithuania has become one of the most active centres of cryptoasset sector development within the European Union. Growth dynamics of the number of cryptoasset companies have noticeably increased: while in 2020 there were just 9, by the end of 2022 their number reached as many as 850. Considering, however, that the risks are growing, the Bank of Lithuania, the Ministry of Finance, and the Financial Service for Combating Economic Crimes decided to tighten the legislative framework. As such, certain amendments were made in 2022 to the Law on Prevention of Money Laundering and Terrorist Financing.

Due to these changes, as early as the beginning of 2023, the number decreased to 200. However, after the market got accustomed to the new conditions, the number began growing and constitutes 540 companies now. By the number of registered companies in the field of virtual currency, Lithuania holds second place in the EU, leaving behind only Poland.

However, the practice demonstrates that the cryptoasset market of Lithuania still has considerable challenges on the road to maturity and full compliance with the regulatory requirements. That is particularly true in regard to the reluctance of companies to report suspicious money transactions to the FSTT; it underlines the necessity to continue tightening controls and increasing the responsibility of market participants.

The findings also indicate further strengthening of regulatory measures and controls to ensure the stability and transparency of the cryptoasset market, the building of confidence in the use of cryptoassets among the general public, and protection of the financial system against money laundering and terrorist financing risks.

The Government of the Republic of Lithuania is taking a further active step in tightening the regulation in the crypto-asset market, with a view to reducing the risks of money laundering, terrorist financing, and fraud, as well as circumvention of international sanctions. The Government adopted a new package of measures that have been jointly drafted by the Bank of Lithuania in cooperation with the Ministry of the Interior, the Ministry of Finance, and other ministries. These include further strengthening the control over cryptoasset service providers and a further widening of FSTT’s powers.

Regulation in this area is only going to get tougher, while inter-institutional co-operation and information sharing will be further developed to enhance the effectiveness of controls.

The next section refers to how MiCA, the pan-European in-force market implementation regulation, would take effect on 30 December, with a transition period until 1 July 2026, allowing the adaptation of the market and the service providers to the new requirements. However, bearing in mind the high risks of the cryptoasset market, Lithuania has decided not to apply this transition period and thus to start implementing the requirements of MiCA from 2025 onwards. The decision underlines the country’s desire to adjust its national legislation to European standards as soon as possible, and to enhance the security measures in the cryptoasset market.

This will provide the position of Lithuania as a leader in the regulation of cryptoassets within Europe and protect the financial market from possible threats and build confidence in this rapidly growing sector.

This change in the regulation of cryptoassets is a serious step toward strengthening the financial security and consumer protection at the level of the whole European Union. The introduction of uniform requirements for the licensing and supervision of providers of cryptoasset services means that this fast-growing sector will fall under much stricter control.

Entrusted with the task of licensing participants in the cryptoasset market, the Bank of Lithuania, together with the Financial Service for Combating Economic Crimes, will observe the observance of requirements laid down by laws related in particular to anti-money laundering and combating terrorist financing. In this respect, the relevant approach highlights the need to reinforce security measures and improve the quality of services, a relevant element in the granting of a licence.

In turn, only those companies that demonstrate strict compliance with these requirements and secure a high quality in the provision of their services will be enabled to qualify for a license. The approach will therefore serve not only to improve the level of consumer protection and strengthen the integration of cryptoassets into the financial system but also to increase confidence in the cryptocurrency sector as a whole. It further reduces the risks of potential usage of cryptoassets in illegal transactions according to the arrangement of combating financial crimes.

The Bank of Lithuania actively participates in the process of informing and preparing legal entities that operate or intend to operate in the provision of cryptoasset services for the entry into force of the Markets in Cryptoassets Regulation of the European Union (hereinafter – MiCA). In this respect, the Bank of Lithuania has published a letter via which it has stated the main expectations and requirements for companies in advance regarding the implementation of MiCA.

In its letter, the Bank of Lithuania points to the following:

- It is necessary that legal persons take note of the content of MiCA and start implementing its requirements, especially those concerning licensing, operational security, consumer protection, and anti-money laundering measures.

- Pre-implementation preparation: Companies should not waste any more time and start pre-implementation preparation, in order to ensure that complete and full implementation of the regulation is done from the date of formal implementation thereof. Auditing on internal policies and updating of risk management systems should be initiated, and investment in training of staff should be done for the same purpose.

- Active collaboration with regulators means the Bank of Lithuania believes in active participation by companies in respect to regulators and will provide wide scope for transparency, hence prompt resolution of emerging issues.

This letter is part of a wider effort undertaken by the Bank of Lithuania in pursuit of stability and security of the financial system within the context of a rapidly developing cryptoasset market. In this respect, the Bank of Lithuania seeks to bolster confidence among all the stakeholders that Lithuania will further remain an attractive and reliable jurisdiction for innovation in the financial sector, one that actively implements European best practices.

The cryptoasset market of the European Union will move to a whole new level when the MiCA Regulation comes into full force on 30 December 2025. This turns it into a sector which is regulated and supervised as a fully-fledged part of the financial market, including the introduction of licensing for all its participants.

Key aspects of regulation under MiCA:

- Licensing: The licensing of all crypto-asset service providers ensures their compliance to be in operation.

- Governance and transparency: The MiCA regulation puts high measures of governance on firms, including the protection of clients’ assets, conflict-of-interest policies.

- Preparing for change: Companies will be required to take steps to adapt their operations to the new requirements; this includes reviewing and enhancing internal rules and procedures.

The Bank of Lithuania, in its letter, points out that despite the higher regulation, the risks of money laundering, terrorist financing, fraud, and other crimes remain high. For that reason, preparation by cryptoasset service providers is deemed essential in view of the entry into force of the new regulations by actively working to enhance their risk management and control systems.

The Bank of Lithuania calls on service providers to be more active in teamwork with regulators and to participate in education and raising-awareness programs in order to get a full understanding of all issues related to the new regulation. Only this way will cryptoasset transactions become even more secure, and that would contribute to building confidence in the sector-not only within Lithuania but throughout the European Union.

The Bank of Lithuania is very outspoken about what it expects from applicants who will provide crypto-asset services to show maturity and competence in managing the risks associated with this type of activity. This is a welldeserved expectation that allows only those operators who can guarantee a high level of security and reliability in their operations to enter the market.

Main criteria to be considered by the Bank of Lithuania while licensing:

- Shareholder structure and reputation: In this case, the review will cover the ownership structure of shareholders and their repute to ensure they are financially sound and reliable.

- Fumus originis-or the transparency of the source of funds: The Bank of Lithuania will need assurance regarding the purity of source of capital being invested for financing the activities to block illegalities in attracting investments.

- Qualification and reputation of managers: A great deal of importance will be attached to professional qualities and personal reputation of managerial personnel.

- Sustainability of operations: Applicants will be expected to demonstrate how they can ensure the sustainability, safety, and soundness of the operation of systems, including the existence of an effective internal control system and risk management systems.

- Independence of operation: It is relevant that the applicant is not a shell entity and does not outsource significant parts of its operation, and its control functions are outsourced to third parties that cannot ensure an adequate level of control.

These measures will contribute to mitigating risks linked to crypto-assets and increasing confidence in the sector as a whole. This letter also expresses the concern of the Bank of Lithuania regarding compliance with the said requirements, pointing out that compliance will be treated as one of the priorities when granting a right to operate in this sphere.

Bank of Lithuania — the new regulator of Lithuanian crypto companies

As of 1 January 2025, Bank of Lithuania will be the regulator of Lithuanian crypto companies.

Bank of Lithuania has published information with regard to applications for new and existing MiCA licences by January 2025:

- The disclosure requirement and a plan, which shall be in line with the GAP analysis, shall be included in a very specific and personalized whitepaper by all VASP companies registered in Lithuania. The Bank of Lithuania shall elaborate in detail on VASP companies’ compliance with CASP standards in line with DORA regulations.

- The update of ICT risk management, incident reporting, resilience testing, third-party management, and so on is to be performed according to corporate documents, and it should satisfy the requirements of the Bank of Lithuani.

- Any crypto asset, as well as any transfer of money in FIAT, is implemented with the use of a ‘move rule’ in order to follow all protocols present for any crypto transaction.

The enterprise-wide risk assessment should also be at a new level, supplemented by the updated NRA-based methodology. The changes in the ANK-and financial-policies and audits against Bank of Lithuania requirements are also called for. - The Bank of Lithuania stands ready to attract to its market only such crypto-asset providers that would have extensive experience. Candidates need to perform profound research on what the legal requirements and expectations of the Bank of Lithuania are, publicly available in advance and prior to filing applications for licensing. Their operations must be compliant with the highest standards.

- The activity of crypto-asset service providers is covered by the Markets in Crypto-asset Regulation of the European Union; it prescribes that shareholders and managers must be of good repute, possess adequate financial resources, and have an appropriate management organization that is experienced and competent. This will be a focus of attention in the licensing process.

- This would include, for investments in cryptoasset sector activities, proof of the origin of the funds with which such an activity is to be financed, including documentation of the investor’s business history and financial scheme. It will also be important that the management structure of complex groups of companies be described as clearly as possible, and where necessary, this structure be simplified with a view to ensuring transparency and credibility.

The Bank of Lithuania will carefully scrutinize the preparedness of candidates in the cryptoasset market for activity in a safe and secure manner, which means not only profound knowledge of the legal framework but also actual skills in risk management. Service providers will be obliged to provide clear proof that their activities will be stable and effective.

The Bank of Lithuania shall not issue licences to one-day companies, those that fail to provide the requested information or provide incomplete and/or inaccurate information. It is recommended that service providers already operating in the market apply for licensing only after thorough self-assessment for compliance with the requirements as well as assessment of the realistic possibility of obtaining a licence. It also brings to the forefront how licensed participants should, at all times during their operations, strictly comply with the established regulations.

Ultimately, whether you refer to it as a Crypto license, CASP license, or VASP license in Lithuania, the consistent regulatory framework provides a robust foundation for your crypto business to thrive in the European market.

“As an experienced legal professional with a deep understanding of the nuances surrounding legal entities registration in Lithuania, I am committed to providing you with thorough and up-to-date insights to support your endeavours. My dedication extends to ensuring that you receive relevant and accessible information to navigate the regulatory framework and effectively progress with your projects in Lithuania.”

FREQUENTLY ASKED QUESTIONS

What is the process for getting a crypto license in Lithuania?

The following requirements must be met by applicants in order to obtain a crypto license in Lithuania:

- Lithuanian company establishment and registration

- A minimum of one employee is required for the company

- The company must have an employee who has good knowledge of KYC and security regulations

- A Lithuanian address is required for the company

- KYC procedures must be established by the company

- It is the company’s responsibility to provide the supervisory body with regular reports about its activities and security.

Can Lithuanian companies engage in crypto activities without contacting the local tax authority?

That’s right. In addition to corporate taxes, crypto companies are subject to other taxes as well. State Tax Inspectorate under the Ministry of Finance of the Republic of Lithuania is responsible for reporting their income and collecting taxes.

How does Lithuania's crypto license work?

Client keys may be issued to customers by authorized holders of crypto storage wallet licences, and client wallets may be held on their behalf by custodial wallet holders. Exchange services between virtual currencies and fiat currencies may be offered by holders of a Crypto exchange licence for a fee. A virtual currency may also be exchanged for another. It is possible for a virtual asset service provider to obtain both crypto licenses in Lithuania if it intends to offer both types of services.

Is getting a license a long process?

It takes 30 days to obtain a crypto licence in Lithuania. Occasionally, the process may be delayed due to missing documents.

Crypto companies can be owned by non-Lithuanian residents?

That’s right. While visiting Lithuania for a limited period of time, you can set up a crypto company via a notary or complete the process entirely remotely. Nevertheless, a trustee must be located in Lithuania who would act on the founder’s behalf.

A Lithuanian crypto company can have members who are not Lithuanian residents on its board?

In fact, yes.

Can a license be obtained without a bank account?

It is possible to open a bank account after obtaining a license.

Can a virtual currency service provider operate with a minimum authorized capital?

Virtual currency service providers must have a minimum authorized capital of 2500 Euros.

What is the duration of a crypto-license?

In Lithuania, cryptocurrency licenses are issued indefinitely

Cryptocurrencies can be deposited as authorized capital?

Crypto payments aren’t allowed yet, but some financial service providers are developing more flexible policies. In the future, this option may be introduced.

A crypto company's charter capital is paid in in what way?

A deposit of authorized capital in Euros (EUR) is required from applicants.

If you want to open a company and obtain a crypto-license in Lithuania, when do you have to deposit capital?

In order to establish a company in Lithuania, applicants must deposit minimum authorized capital. A company cannot be registered with the local authorities without completing this step.

What are the benefits of getting a crypto license in Lithuania?

The country of Lithuania implements technical developments very quickly, and offers excellent conditions for those who want to establish a business and obtain a crypto license. A few of the main benefits are as follows:

- It is possible to complete the entire process remotely

- Capitalization requirements are low

- In just 30 days, the process can be completed

- There is a 15 percent corporate tax rate, which is lower than those found in many other EU countries.

Cryptocurrency companies in Lithuania are audited?

In fact, yes. Lithuanian Financial Crime Investigation Service (FCIS) supervises holders of both types of crypto licences.

Are there any measures in place in Lithuania to prevent money laundering and the financing of terrorism?

The internal processes of every crypto company should be monitored by a security expert who ensures that all relevant regulations are followed. Lithuanian Financial Crime Investigation Service (FCIS) supervises and audits all crypto companies.

Are there any difficulties in obtaining a crypto license in Lithuania?

A trustee must be appointed on behalf of non-residents to establish a company in Lithuania on a remote basis. If a non-resident wishes to do it themselves, they must be present in the country and find a notary who can assist them.

Can a Lithuanian crypto company open a bank account?

According to a recent change, those who want to establish a company in Lithuania are no longer restricted to local banks. Companies can also open accounts in credit unions and digital banks. A full list of banks and financial institutions that companies can open accounts in is compiled and updated by the Bank of Lithuania.

Purchase of Ready Made Licensed VASP in Lithuania

Purchasing a ready-made licensed VASP (Virtual Asset Service Provider) company in Lithuania is an effective way to quickly enter the European cryptocurrency market, however, by the end of 2024, Lithuania has a number of government requirements that must be taken into account. One of the key requirements is the presence of at least 125,000 euros of non-burnable balance in the bank account of the acquired crypto company. This condition is due to the need to guarantee the financial stability and reliability of the company, as well as the ability to quickly respond to the requests and requirements of the regulator.

This requirement is in the context of ensuring sufficient capital to cover all operational risks associated with the business of providing virtual asset services. The presence of this account balance also helps maintain the trust of clients and partners, as it indicates the financial reliability and stability of the company.

The acquisition of a licensed VASP company in Lithuania requires careful preparation and understanding of the local regulatory landscape. It is necessary to conduct a full legal and financial due diligence in order to fully assess the condition of the company, its obligations, history of operations, and compliance with all regulatory requirements. This includes reviewing licenses, contracts, financial transaction history and account status.

It is also important to pay attention to the company’s infrastructure, the availability of qualified personnel and technical solutions that have been implemented in the company. All this together allows us to assess the company’s potential for further development and integration into the buyer’s existing business model.

VASP license in Lithuania 2025

Lithuania, previously considered one of the most favorable European jurisdictions for cryptocurrency companies (as of October 24, 2024, more than 640 crypto licenses had been received), in the second half of 2024 significantly tightened regulatory requirements for the activities of companies working with virtual assets. As a result of tightening regulatory requirements, more than half of the issued licenses have already been revoked, which was a significant blow to the cryptocurrency sector in the country.

The changes in regulatory policy reflect a pan-European trend towards greater oversight of the virtual asset market to improve transparency and combat financial crimes such as money laundering and terrorist financing. Lithuanian authorities have strengthened licensing requirements, introducing more stringent checks for compliance with international standards and local legislation.

The key point of the innovations was the introduction of a mandatory requirement for the company to have managers and key employees permanently residing in Lithuania. This condition is intended to ensure closer contact and interaction with Lithuanian regulatory authorities and simplify the process of supervision of the activities of companies.

In addition, the requirements for the initial capital of companies and the size of financial guarantees have been significantly increased, which must now confirm the financial stability and ability of the companies to cover potential operational risks - to have a non-burnable balance in the company’s bank account of at least 125,000 euros. These measures are aimed at strengthening the financial security of clients and reducing risks for the cryptocurrency market as a whole.

In response to increased regulatory requirements, many cryptocurrency companies either decided to restructure and bring their activities into compliance with the new rules, or were forced to leave the Lithuanian market, which led to the revocation of a significant number of licenses. This has created new challenges for the sector, but has also created opportunities for companies that can adapt to the changing regulatory landscape.

The tightening of requirements in Lithuania is part of a general trend towards increased control over cryptocurrency transactions in Europe and reflects the country's desire to strengthen its reputation as a reliable jurisdiction for financial innovation while ensuring a high level of transparency and security in the circulation of virtual assets.

Additional services for Lithuania

RUE customer support team

“Hi, if you are looking to start your project, or you still have some concerns, you can definitely reach out to me for comprehensive assistance. Contact me and let’s start your business venture.”

“Hello, I’m Sheyla, ready to help with your business ventures in Europe and beyond. Whether in international markets or exploring opportunities abroad, I offer guidance and support. Feel free to contact me!”

“Hello, my name is Diana and I specialise in assisting clients in many questions. Contact me and I will be able to provide you efficient support in your request.”

“Hello, my name is Polina. I will be happy to provide you with the necessary information to launch your project in the chosen jurisdiction – contact me for more information!”

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

Registration number: 08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00 Prague

Registration number: 304377400

Anno: 30.08.2016

Phone: +370 6949 5456

Email: [email protected]

Address: Lvovo g. 25 – 702, 7th floor, Vilnius,

09320, Lithuania

Sp. z o.o

Registration number: 38421992700000

Anno: 28.08.2019

Email: [email protected]

Address: Twarda 18, 15th floor, Warsaw, 00-824, Poland

Europe OÜ

Registration number: 14153440

Anno: 16.11.2016

Phone: +372 56 966 260

Email: [email protected]

Address: Laeva 2, Tallinn, 10111, Estonia