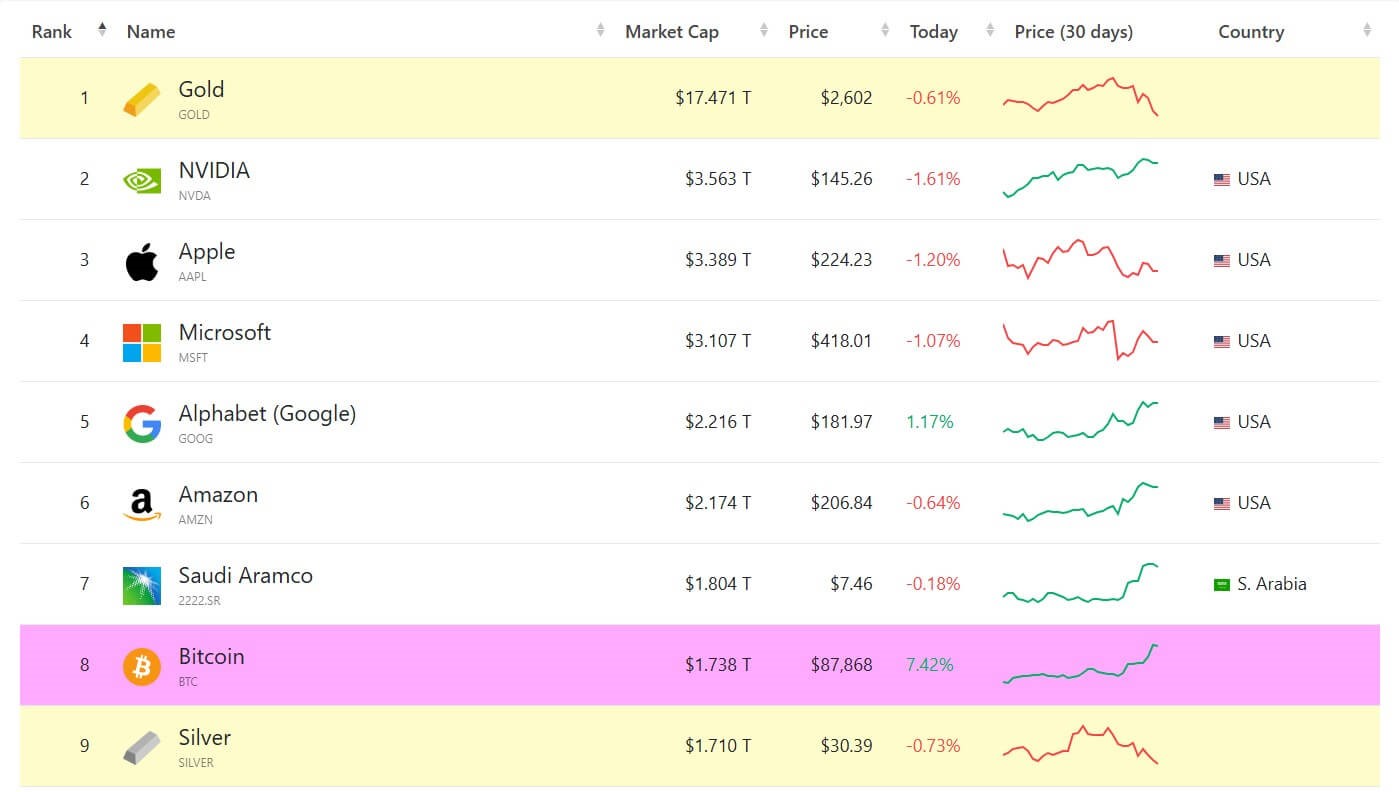

On November 12, 2024, the value of one bitcoin once again exceeded the value of 1 kg of gold, and its market capitalisation exceeds the value of silver.

Now, at the time of writing (17.12.2024) bitcoin is valued at around $2.1 trillion and is the seventh largest asset in the world, ahead of silver with a market capitalisation of $1.7 trillion. Meanwhile, gold remains the world’s leading asset with a commanding market capitalisation of $17.9 trillion.

Recently, there have been increasingly positive signs that the US may create a strategic Bitcoin reserve – the crypto industry’s most important policy for the Trump administration. Senator Cynthia Lummis, who proposed the National Bitcoin Reserve Act, said the bill could get bipartisan support within the first 100 days if people support it.

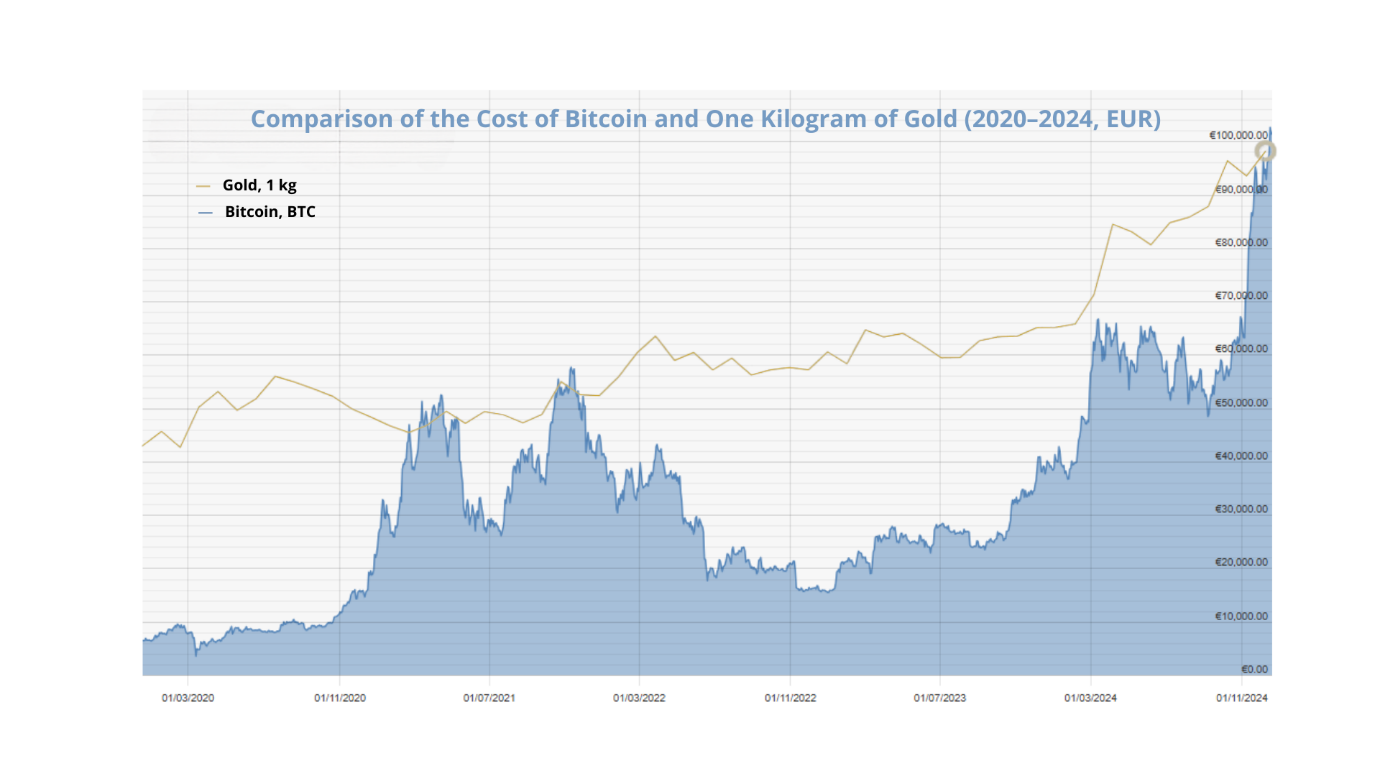

How asset prices have changed:

– In early 2011, the value of one bitcoin was less than one US dollar, while the value of one kilogram of gold was around $40,000.

– In December 2017, bitcoin reached its all-time high at the time, surpassing $20,000 per coin. At that time, the value of one kilogram of gold was about $40,000.

– In March 2020, during the COVID-19 pandemic, bitcoin and gold showed similar dynamics: both assets dropped significantly in value. Bitcoin dropped to around $5,000 per coin, while the value of a kilogram of gold fell to around $50,000.

– However, since the beginning of 2021, bitcoin has been on an active rise, reaching new all-time highs and exceeding $60,000 per coin. At the same time, the value of a kilogram of gold remained relatively stable at around $50,000.

– In November 2024, the value of one bitcoin and one kilogram of gold equalised, reflecting the evolution of digital and traditional assets in the financial market.

This development challenges traditional perceptions of the value of gold as a reserve asset, highlighting the growing confidence in cryptocurrencies and their perceived protection against inflation and geopolitical risks.

Key Observations:

- Gold:

- Stability: The gold price has risen gradually, with small fluctuations, reflecting its role as a protective asset.

- From 2014 to 2024, the value of gold in euros increased from €30,710 to €81,353, an increase of approximately 165% over 10 years.

- Particularly sharp growth was seen from 2019 to 2020 during a period of economic instability.

- Bitcoin:

- High volatility: The bitcoin price has shown sharp spikes and drops, reflecting its speculative nature.

- From 2014 to 2024, the value of one bitcoin has increased from €346 to €102,299, an exponential growth of 29.428%.

- The most notable jumps occurred in 2017 (rising to €17,791) and in 2020-2021, when bitcoin peaked at over €48,000.

A comparative analysis:

| Year | Gold (€/kg) | Bitcoin (€/BTC) | Note |

|---|---|---|---|

| 2014 | 30,710 | 346 | Stable gold, cheap bitcoin |

| 2017 | 34,000 | 17,791 | Bitcoin surge |

| 2020 | 50,000 | 19,438 | The beginning of a new growth in cryptocurrencies |

| 2024 | 81,353 | 102,299 | Bitcoin sets a record once again |

- Gold’s rise has been steady and predictable, highlighting its role as a safe haven in times of economic instability.

- Bitcoin has shown much higher returns, but with extreme volatility. It is seen as a speculative asset and “digital gold”.

- In moments of economic crisis (e.g. the 2020 pandemic), both assets have shown growth, confirming their attractiveness to investors during volatile periods.

Comparing bitcoin to gold

Comparing bitcoin to gold first became popular among crypto-enthusiasts and investors in the early 2010s. The exact date and authorship of this comparison are not always unambiguous, but some key moments in the history of bitcoin and its perception as “digital gold” stand out:

- 2010 – Start of “digital gold” as a concept

- One of the first known references to comparing bitcoin to gold can be traced back to 2010, when Hal Finney, a well-known cryptographer and one of the first members of the bitcoin network, wrote in his posts that bitcoin could become a digital analogue to gold due to its limited supply and decentralised nature.

Quote by Hal Finney (2010):

“Imagine that Bitcoin is a base metal as scarce as gold but with the following properties: it is easy to transport and can be sent through the internet.”

- 2011 – Comparison in the crypto community

- In 2011, when the price of bitcoin first surpassed $1, there were more articles and discussions about bitcoin’s similarities to gold.

- The community on forums such as Bitcointalk and Reddit have been actively discussing the idea that bitcoin could become “digital gold” because:

- It has a limited issue of 21 million coins.

- Not subject to inflation like gold.

- Easy to store and transfer.

- 2013 – Reinforcing analogy in media

- As the price of bitcoin rose to $1,000 in 2013, the term “digital gold” began to be used en masse by journalists and financial analysts.

- In particular, Cameron and Tyler Winklevoss (Winklevoss twins), prominent investors and early supporters of bitcoin, have publicly stated that bitcoin is the equivalent of gold for the digital age.

- Analogy at the institutional level – After 2017

- In 2017, during another rally in the crypto market, major investors and financial companies started referring to bitcoin as a “store of value”, similar to gold.

- Example: Barry Silbert, founder of Grayscale, has actively used this comparison to promote bitcoin trusts as an alternative to physical gold.

While it is impossible to attribute the comparison of bitcoin to gold to one person, it was Hal Finney and early bitcoin enthusiasts who laid the groundwork for the idea of “digital gold” around 2010. By 2013, the comparison had become an enduring trend in the crypto community and media, and by 2017, it was generally accepted at an institutional level.

Overview of the position of cryptocurrencies Bitcoin and Ethereum among the most expensive assets by market capitalisation as of 17.12.2024

- Bitcoin (BTC)

- Rank: 7th

- Market capitalisation: $2.114 trillion

- Bitcoin continues to lead among cryptocurrencies and is among the top 10 assets by capitalisation. Its popularity as “digital gold” strengthens its position at the level of the world’s largest assets.

- Ethereum (ETH)

- Rank: 21st

- Market capitalisation: $484.38 billion

- Ethereum remains the second largest cryptocurrency, well behind Bitcoin, but retains an important role due to its smart contracts and decentralised application ecosystem.

As such, Bitcoin and Ethereum hold key positions among global assets, outperforming many publicly traded companies and traditional assets such as silver and some stock indices.

Comparison with traditional assets

Against traditional assets such as precious metals, large corporate stocks and commodities, Bitcoin and Ethereum retain a marked advantage:

| Asset | Position | Market Capitalisation |

|---|---|---|

| Gold | 1 | $14.5 trillion |

| Apple (AAPL) | 2 | $3.2 trillion |

| Microsoft | 3 | $3.1 trillion |

| Bitcoin (BTC) | 7 | $1.2-2.1 trillion |

| Silver | 8 | ~$1.4 trillion |

| Saudi Aramco | 6 | ~$2 trillion |

| Ethereum (ETH) | 21 | ~$500bn |

- Bitcoin (BTC) holds steady in the top 10 global assets by market capitalisation, competing with major companies and precious metals.

- Ethereum (ETH) retains its status as the second cryptocurrency in the world and is among the top 25 assets, overtaking many large corporations.

- The continued growth of cryptocurrencies will depend on:

- Introducing new technologies and network improvements (e.g., Ethereum 2.0).

- Institutional interest and regulatory framework.

- Recognising cryptocurrencies as savings and financial instruments.

Thus, cryptocurrencies, especially Bitcoin and Ethereum, have already taken a significant place in the global financial system, approaching traditional assets such as gold and major stocks. Also, with the positive dynamics of changes in the value of major cryptocurrencies, it makes sense to consider obtaining a crypto licence in Europe for your crypto project.

Assets with the largest capitalisation

RUE customer support team

RUE (Regulated United Europe) customer support team complies with high standards and requirements of the clients. Customer support is the most complex field of coverage within any business industry and operations, that is why depending on how the customer support completes their job, depends not only on the result of the back office, but of the whole project itself. Considering the feedback received from the high number of clients of RUE from all across the world, we constantly work on and improve the provided feedback and the customer support service on a daily basis.

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

Registration number:

14153440

Anno: 16.11.2016

Phone: +372 56 966 260

Email: [email protected]

Address: Laeva 2, Tallinn, 10111, Estonia

Registration number: 304377400

Anno: 30.08.2016

Phone: +370 6949 5456

Email: [email protected]

Address: Lvovo g. 25 – 702, 7th floor, Vilnius, 09320, Lithuania

Registration number:

08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00, Prague

Registration number: 38421992700000

Anno: 28.08.2019

Email: [email protected]

Address: Twarda 18, 15th floor, Warsaw, 00-824, Poland

Please leave your request

The RUE team understands the importance of continuous assessment and professional advice from experienced legal experts, as the success and final outcome of your project and business largely depend on informed legal strategy and timely decisions. Please complete the contact form on our website, and we guarantee that a qualified specialist will provide you with professional feedback and initial guidance within 24 hours.