Client reviews are a key tool for evaluating a company’s and its team’s effectiveness. With over a decade’s experience in corporate and legal services, Regulated United Europe‘s specialists have repeatedly found that client feedback confirms a high level of professionalism and helps identify areas for growth.

The company has accumulated an impressive number of reviews from clients across Europe and beyond, most of which highlight the competence, transparency, efficiency and personalised approach of RUE’s staff. This has been made possible thanks to the company’s consistent policy of focusing on quality, ethics and long-term partnerships.

Feedback is of strategic importance to the Regulated United Europe team. It enables the company to evaluate client satisfaction with the services provided, the efficiency of internal processes, the accuracy of communication and the quality of client support. Every review is regarded as an opportunity to improve work methods, optimise processes and implement new solutions that meet the demands of today’s market.

RUE views communication with clients as a two-way process based on trust and mutual respect. The company is open to constructive suggestions and values any comments aimed at improving the quality of service. This approach helps to maintain high professional standards, strengthen the company’s reputation and establish itself as a reliable partner for international clients seeking legal, tax and regulatory support in Europe.

This is why the Regulated United Europe team is continually enhancing its internal quality control system, striving to ensure that every service, consultation or project inspires confidence and satisfaction, and encourages clients to recommend the company to others.

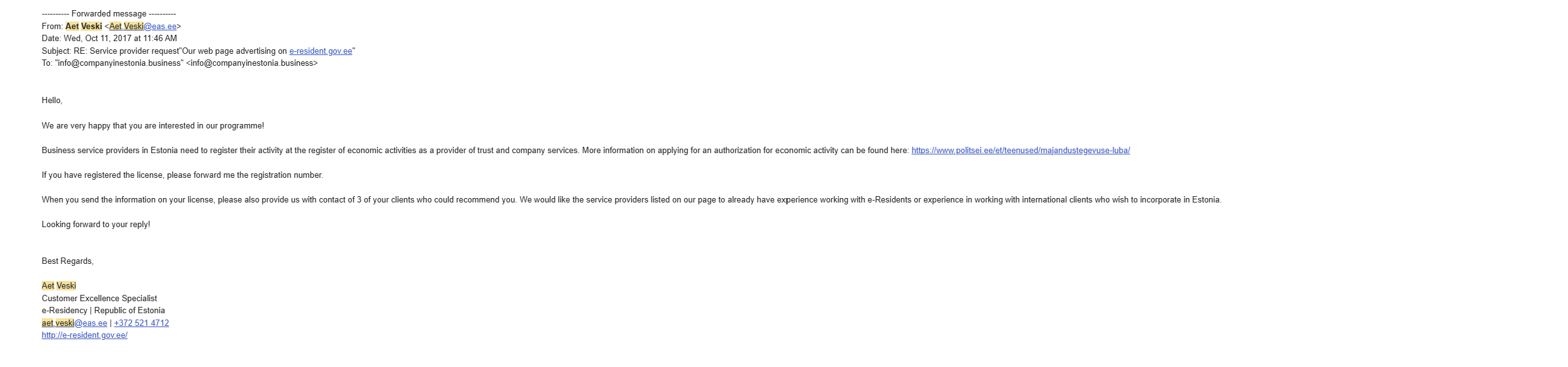

Below are some reviews from our partners and clients:

RUE customer support team

RUE (Regulated United Europe) customer support team complies with high standards and requirements of the clients. Customer support is the most complex field of coverage within any business industry and operations, that is why depending on how the customer support completes their job, depends not only on the result of the back office, but of the whole project itself. Considering the feedback received from the high number of clients of RUE from all across the world, we constantly work on and improve the provided feedback and the customer support service on a daily basis.

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

Registration number:

14153440

Anno: 16.11.2016

Phone: +372 56 966 260

Email: [email protected]

Address: Laeva 2, Tallinn, 10111, Estonia

Registration number: 304377400

Anno: 30.08.2016

Phone: +370 6949 5456

Email: [email protected]

Address: Lvovo g. 25 – 702, 7th floor, Vilnius, 09320, Lithuania

Registration number:

08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00, Prague

Registration number: 38421992700000

Anno: 28.08.2019

Email: [email protected]

Address: Twarda 18, 15th floor, Warsaw, 00-824, Poland

Please leave your request

The RUE team understands the importance of continuous assessment and professional advice from experienced legal experts, as the success and final outcome of your project and business largely depend on informed legal strategy and timely decisions. Please complete the contact form on our website, and we guarantee that a qualified specialist will provide you with professional feedback and initial guidance within 24 hours.