The Philippines has demonstrated considerable interest in cryptocurrencies, reflected not only in everyday use but also in government regulatory action. The analysis of the legal environment and prospects of cryptocurrencies in the country will give a profile of the cryptocurrency market of the Philippines.

Market overview

The Philippines is a leader in the adoption of cryptocurrency in Southeast Asia. According to various studies, a remarkably large share of inhabitants of this country actively use cryptocurrencies for transfers, investments, and even everyday purchases. This is largely connected with a high level of mobile connectivity, the development of online banking, and there being no banking infrastructure in far-flung areas.

Regulatory environment

The government of the Philippines became very cautious about virtual currencies and had been working on a proper regulatory system that would best protect users against possible risks and ensure stability in the financial system. In 2017, Bangko Sentral ng Pilipinas began to license cryptocurrency exchanges as “remittance and transfer companies” for better control over crypto asset transactions. Anti-money laundering and anti-terrorist financing measures were introduced.

Use of cryptocurrencies

Cryptocurrencies in the Philippines are utilized for speculative investment and regular financial transactions. Examples of these are as follows:

- Remittances: The Philippines has a large number of migrant workers, and the use of cryptocurrencies aims to reduce remittances costs and make the process simpler.

- Payment for Goods and Services: More and more local businesses and companies nowadays gradually accept cryptocurrencies as an additional means to pay for services.

How to have innovation and regulatory measures balanced remains the big challenge in view that needs to be met in the Philippines. Issues like the volatility characteristics of cryptocurrencies, fraud risks, and possible uses of crypto-assets for illicit activities call for regulatory attention.

Development prospects

With further development of technological infrastructure and additional legal clarity, there is a place for cryptocurrencies to play an increasingly large role within the Philippine economy. Innovation in blockchain technology and a growing number of educational programs focused on teaching cryptocurrencies are extending the crypto-economy and embedding it more into traditional financial systems.

The Philippines, indeed, showed very broad perspectives for the growth and integration of cryptocurrencies into the national economy. Further improvement in the regulatory environment, of course, and enhanced public awareness can better promote the development and adoption of cryptocurrencies at every level of the country’s economic activity.

Is crypto legal in Philippines?

Is crypto legal in Philippines? Cryptocurrencies in particular have gained significant popularity in the Philippines and present an uphill task for any government in terms of regulating their use while simultaneously providing legal clarity to the users/investors. The paper tabulates the legislation regulating cryptocurrencies in the Philippines and analyses the implication of such legislation on the future of the crypto industry in the country.

| Legal Status of Cryptocurrencies | The Philippines was among the first countries in Southeast Asia to actively regulate cryptocurrency activities. In 2017, Bangko Sentral ng Pilipinas (BSP) issued regulations classifying cryptocurrency exchanges as currency exchange companies, requiring them to register with the BSP and implement AML and KYC measures. |

| Regulatory Framework | Under Circular No. 944, the BSP requires all cryptocurrency exchange operators to register as operators of a payment system. They must provide quarterly reports on their activities, including transactions and user data, to enhance transaction transparency and protect users from fraud. |

| Taxation | The taxation of cryptocurrency in the Philippines remains unregulated, leading to uncertainty about how income from cryptocurrencies should be declared. Generally, the tax code states that any profit derived by citizens is subject to taxation, which would include cryptocurrency trading proceeds. |

| Using Cryptocurrencies in Everyday Life | Cryptocurrencies are not considered legal tender for settling debts in the Philippines and are not widely used for purchasing goods and services. However, they can be utilized for private transactions and investments, making them a popular tool for capital preservation and accumulation. |

| Development Prospects | The Philippine government is keen on further regulating the crypto market, which may lead to the introduction of new laws and enhancements to the existing legal framework. This could promote the growth of the crypto industry and build confidence in cryptocurrencies as financial instruments. |

In the Philippines, cryptocurrencies are in their relatively stable legal position; therefore, their use is relatively safe and transparent. The outlook for the crypto industry in the Philippines seems promising, especially if the government further develops and refines a regulatory framework that cultivates growth and innovation in this area.

Crypto adoption in Philippines

The Philippines is currently one of the leading countries in Southeast Asia regarding the adaptation of cryptocurrencies. In large part, it is a consequence of the strong support from the government side and very innovative efforts in the financial sphere. The current review deals with the state of cryptocurrencies in the Philippines, main drivers of popularization, and main challenges and opportunities for further development.

| Active Regulation as a Basis for Growth | Active regulation is crucial for growth. In the Philippines, regulators have worked to create an encouraging legal environment for digital currencies. Licensing exchange platforms and introducing anti-money laundering and counter-terrorist financing regulations provide stability and transparency, enhancing consumer protection and promoting further investments. |

| Greater Use of Cryptocurrencies | In the Philippines, cryptocurrencies are used not only for investing and speculative trading but also for payments and money transfers. This is particularly true for migrant workers sending remittances from abroad. Companies like Coins.ph utilize digital currencies for mobile payments and remittances, making transactions more inclusive and less expensive than traditional banking systems. |

| Innovations and Start-ups | The Philippines is active in creating blockchain and crypto startups. Government support for such projects, along with private investment, fosters the emergence of new products and services that integrate cryptocurrencies into everyday economic activities. |

| Problems and Challenges | Despite progress, several challenges remain in adapting cryptocurrencies. Concerns include volatility, fraudulent activities, scalability issues with blockchain technology, and the need for greater awareness and education about cryptocurrencies among the population. |

| Prospects | The future development of cryptocurrencies in the Philippines will depend on various factors, including global economic trends and innovations in blockchain technology. Strengthening regulatory measures while supporting innovation and protecting consumer rights will contribute to a more stable and secure cryptocurrency market. |

The Philippines continue to be on the active path of adopting cryptocurrencies, which promises perspectives not only for economic growth but also for better financial services for the general public. Despite the challenges, the potential of cryptocurrencies remains high, and support from regulators and innovative companies continues to open up new opportunities for their use.

Best crypto exchange in Philippines

With the interest in cryptocurrencies growing rapidly within the Philippines, choosing a reliable and efficient cryptocurrency exchange becomes a key aspect for traders and investors. In the following paper, we will present an overview of the leading cryptocurrency exchanges available on the Philippine market, describing their features, advantages, and disadvantages.

Criteria for selecting an exchange

- Security: two-factor authentication, cold storage, etc.

- Liquidity: the volume of trading is high to maintain stable prices and to be able to sell/buy quickly.

- User Interface: intuitive interfaces for both newbies and professional traders.

- Commissions: trading and withdrawal commissions.

- Customer Support: speed and quality of customer support.

Best cryptocurrency exchanges in Philippines

| Top Cryptocurrency Exchanges in the Philippines | Description |

| Coins.ph | One of the pioneering and leading cryptocurrency websites in the Philippines, offering buying and selling of cryptocurrencies along with financial services like money transfers, bill payments, and mobile commerce. It is accessible and user-friendly, making it suitable for beginners. |

| PDAX – Philippine Digital Asset Exchange | A licensed exchange that enables direct pairing of crypto assets with the Philippine peso, facilitating easier buying and selling for local users. Supports major cryptocurrencies like Bitcoin, Ethereum, and Ripple with competitive commissions. |

| Binance | An international exchange that offers a wide variety of cryptocurrencies, low commissions, and advanced trading tools, attracting sophisticated investors. Provides services for staking, futures, and margin trading. |

| eToro | Primarily known for trading stocks and currencies, eToro also offers cryptocurrency trading. Its unique social trading feature allows users to copy the moves of professional traders, making it accessible for beginners. |

The best cryptocurrency exchange for users in the Philippines really depends on individual needs and experience level. Coins.ph or PDAX would be good for a complete novice or for those who are looking for simple solutions to buy and sell cryptocurrencies. If you wish to maximize strategies with more trades for higher profits, Binance and eToro fit for the purpose. In any case, one should make a double-focused choice regarding the present needs and future plans and, of course, having scrutinized conditions of trading and security.

Best crypto app in Philippines

Due to the growth in the number of people in the Philippines that have started using virtual currencies, the need for mobile applications, which would work with crypto assets efficiently, is getting bigger. In this article, we would like to present the best cryptocurrency applications presently available in the Philippine market, ranked by functionality, usability, and security.

Due to the growth in the number of people in the Philippines that have started using virtual currencies, the need for mobile applications, which would work with crypto assets efficiently, is getting bigger. In this article, we would like to present the best cryptocurrency applications presently available in the Philippine market, ranked by functionality, usability, and security.

Criteria for the evaluation of cryptocurrency applications

Security: multi-factor authentication enabled by default, encryption of data, other security measures available.

User Interface: Clean, intuitive interface, support for local languages.

Functionality: Support for a wide range of cryptocurrencies, integration with exchanges, portfolio tracking and analytics capabilities.

Speed and stability: Application performance in transaction execution and reliability under high load conditions.

User reviews and support: Positive reviews and efficient customer service.

Best cryptocurrency apps in the Philippines

| Top Cryptocurrency Apps in the Philippines | Description |

| Coins.ph | Among the most used applications in the Philippines, Coins.ph enables buying, selling, and transferring multiple cryptocurrencies. It offers payments and money transfer services, making it an all-encompassing tool for financial transactions. |

| PDAX | Philippine Digital Asset Exchange offers an app that allows direct trading of cryptocurrencies with Philippine peso pairing, ensuring ease of use, security, and a user-friendly experience in the local market. |

| Binance | As the leading cryptocurrency app globally, Binance provides users in the Philippines access to a vast array of trading pairs and advanced trading tools, along with ultra-high performance and serious multilevel security. |

| eToro | While better known for stock and currency trading, eToro’s cryptocurrency features are noteworthy, offering an easy-to-navigate user interface and a social trading feature that allows users to copy successful traders’ strategies upon sign-up. |

The choice of the best cryptocurrency mobile application depends on personal preferences, as well as requirements related to security and functionality. This will make Coins.ph and PDAX apt for those looking at localized solutions with seamless access to buying and selling of digital assets. For advanced users, Binance and eToro will give access to more global features and advanced trading tools. Whichever your choice might be, it always makes much sense that every app, as far as possible, needs feedback from other users and adequate security measures for your assets.

Tax on crypto in Philippines

Due to the gaining popularity of cryptocurrencies in the Philippines, income taxation derived from their purchase, sale, and exchange becomes a relevant issue. The Philippine government is trying to adapt its tax laws to new realities of a digital economy to ensure just taxation and control of this dynamic field.

Existing legislation

For the Philippines, cryptocurrencies, under the National Tax Code, fall under general tax obligations for income derived from these transactions. Income, including capital gains, from cryptocurrency trading must be declared and subjected to personal or corporate income tax.

The income derived from the sale of cryptocurrencies in the Philippines is considered capital gains. However, the tax rate on these capital gains depends upon the length of time the asset has been held. In particular:

- Short-term capital gains (assets sold within one year of acquisition) are taxed at ordinary income tax rates.

- Tax relief or lower rates may kick in for assets held for a period of more than one year.

Value added tax

The imposition of VAT on cryptocurrency transactions is similarly a very contentious issue as virtual currencies are not deemed as legal tenders in the Philippines. However, subject to proper interpretation, the exchange services of cryptocurrency could be saddled with VAT under the existing law.

Tax planning and accounting

Accurate documentation of all cryptocurrency transactions, with a record of the date of purchase and sale, volumes transacted, their prices, and income received, will help traders and investors in performing effective tax accounting. This will evade potential tax violations and minimize the extent of tax liabilities through financial instruments and legitimate deductions.

Taxation of cryptocurrencies in the Philippines largely remains in a state of flux and continues to adjust, along with the development of the economy and technology. It will be necessary for all market participants to get acquainted with the latest changes in legislation and regulatory practice. Work with qualified tax advisors and accountants can assure observation of tax obligations and optimization of tax burden.

How to buy crypto in Philippines

The Philippines is increasingly becoming one of the active markets in Asia with respect to the use and trading of cryptocurrencies. This guide gives in-depth information on how one can buy cryptocurrencies in the Philippines, including how to choose a platform, how to register and transact, and how to cover security and tax regulations.

| Steps to Buying Cryptocurrency in the Philippines | Description |

| Step 1: Choosing a Cryptocurrency Platform | Choose a reliable and regulated exchange. Popular options include: Coins.ph: One of the first exchanges licensed by Bangko Sentral ng Pilipinas, offering a basic interface for buying, selling, and storing cryptocurrencies. PDAX (Philippine Digital Asset Exchange): Licensed under BSP, offering a wide variety of cryptocurrency options and direct trade pairing with the Philippine peso. Binance: An international platform that provides access to a wide range of cryptocurrencies and numerous trading tools. |

| Step 2: Registration of the Account and its Verification | Register your account by completing the following steps: Basic data entry: first and last name, email, and password. Confirmation of email address and phone number. KYC (Know Your Customer) procedure, including photo ID and proof of residence if necessary. |

| Step 3: Deposit of Funds | To start investing in cryptocurrency, refill your balance through bank transfer, e-wallets, or payment terminals. Some exchanges allow purchasing cryptocurrencies directly with credit or debit cards. |

| Step 4: Buying Cryptocurrency | With your account funded, proceed to buy cryptocurrencies by: Choosing a cryptocurrency to buy. Defining the purchase volume. Executing a buy order at the current market price or setting a limit order at your desired price. |

| Step 5: Cryptocurrency Storage | For asset security, transfer cryptocurrencies from an exchange wallet to a personal wallet: Hot wallets: Convenient for frequent transactions but less secure. Cold wallets: Very secure and suitable for long-term storage, ideal for holding large amounts for extended periods. |

Buying cryptocurrency in the Philippines requires proper selection of the exchange, precise verification, and elaboration of the security strategy. Settling upon a correctly selected exchange and ways of keeping cryptocurrencies given traders and investors can manage their digital assets effectively and make full use of opportunities that are opening up from the crypto market.

Crypto mining in Philippines

This is the continuous mining of cryptocurrency in the Philippines, as more technology-savvy investors and entrepreneurs get lured by its promising output in a new economic niche. However, much like other countries, there are various technical, economic, and regulatory hurdles clouding cryptocurrency mining operations. The article highlights the state of cryptocurrency mining in the Philippines today; analyzes the major challenges; and discusses ways in which the sector could develop in the future.

Present state of cryptocurrency mining

In the Philippines, like in other countries of high temperatures, there is a problem coupled with the cooling equipment. High temperatures can cut the efficiency of mining farms and raise the cost of electricity. Besides, in the Philippines, the cost of electricity is comparatively high, which adds to operating costs and eats into potential mining profits.

Regulatory environment

Cryptocurrencies in the Philippines fall under the Bangko Sentral ng Pilipinas, which desires to extend financial laws and regulations to cryptocurrencies. However, specific regulations with regard to cryptocurrency mining have not been fully defined, hence leaving a legal uncertainty for miners.

Desafios

High Energy Costs: Electricity is expensive, one of the main challenges that miners face, specifically in the Philippines.

Climatic conditions: Tropical climates require additional investment in cooling systems.

Regulatory risks: Lack of clear-cut rules may serve as a barrier for the development of mining and attracting investments.

Technological barriers: The need for constant updating of equipment due to rapid technological development so as not to lose competitiveness.

Perspectivas de Desarrollo

There is a prospect for cryptocurrency mining in the Philippines, which can be materialized provided the following conditions are present:

Lower energy costs: the use of renewable sources such as solar or wind power are among the options that could reduce energy costs.

Improved regulatory environment: Transparent and stable rules attract more investors to the industry.

Training and human resource development: professional skills development for blockchain technology and mining will bring a business to greater efficiency and innovations.

The industry is at its infancy stage in the Philippines, and this mainly depends on several key aspects: the changes within the regulating environment and the technological processes. Improvement to the mining environment may hold the key to increasing its share of the country’s economy and also in improving the level of technological maturity of the Philippines.

Best crypto wallet in Philippines

Among the important keys in managing crypto assets here in the Philippines is choosing a reliable cryptocurrency wallet. This article will give you an overview of the best wallets available in the Philippine market, analyzing their functionality, security, and usability.

Criteria for choosing a wallet

In choosing a cryptocurrency wallet, consider the following:

- Protection of private keys, multi-level authentication, regular security updates.

- UI/UX: Intuitive and accessible design, support for mobile devices.

- Currency Support: Great number of supported cryptocurrencies and tokens.

- Features and functions: Additional features such as currency exchange, staking and integration with other services.

Best cryptocurrency wallets for users from the Philippines

| Popular Cryptocurrency Wallets | Description |

| Coins.ph Wallet | Description: Coins.ph is one of the most popular cryptocurrency wallets in the Philippines that also functions as a mobile banking service. Advantages: Supports multiple cryptocurrencies, including Bitcoin, Ethereum, and Ripple, and is easy to operate due to integration with the Philippine banking system for easy deposits and withdrawals. Security: Features multi-factor authentication and complies with local regulatory requirements. |

| Coinbase Wallet | Description: This wallet is highly recognized internationally and offers top-notch security along with a wide variety of cryptocurrencies. Advantages: High usability, strong security, and effective private key management. Security: Keys are stored on a user’s device, with backup options and the ability to lock access with biometrics. |

| Trust Wallet | Description: An open-source mobile wallet supporting a vast array of cryptocurrencies and tokens based on various blockchains. Benefits: Supports many blockchains, including Ethereum and Binance Smart Chain, ease of use, staking capabilities, and access to decentralized applications. Security: Keys are stored on the user’s device with data encryption. |

| Metamask | Description: A popular wallet for interacting with Ethereum and applications built on it. Pros: Can be integrated into web applications, easy to use as a browser extension, supports ERC-20 tokens and NFTs. Security: Enables multi-factor authentication and allows users to manage their keys. |

Your choice of cryptocurrency wallet in the Philippines shall be dictated by your specific needs that concern security, ease, and functionality. Among others, Coins.ph, Coinbase Wallet, Trust Wallet, and Metamask are just but a few options to serve such a wide array of needs; from basic, day-to-day transactions to the most complex functionalities incorporating smart contracts and decentralized applications. And it is worth mentioning that one should regularly reassess their solutions in light of the emerging trends in cryptocurrency markets and changing technological landscapes.

Philippines crypto license 2025

In the context of the rapid development of financial technologies and their integration into commercial operations, the Government of the Philippines demonstrates active support for innovative fintech projects. The changes in the country’s fintech sector in recent years are epitomized by the shift from traditional money transfers to the rapidly developing digital banks, e-wallets, and electronic money operations. As a result, a number of fintech companies have begun implementing products that modify the traditional value chain in the banking sector, enabling direct interaction between financial institutions and customers. The COVID-19 pandemic in 2020 and 2021 accelerated the transition to cashless and digital payments.

In the context of the rapid development of financial technologies and their integration into commercial operations, the Government of the Philippines demonstrates active support for innovative fintech projects. The changes in the country’s fintech sector in recent years are epitomized by the shift from traditional money transfers to the rapidly developing digital banks, e-wallets, and electronic money operations. As a result, a number of fintech companies have begun implementing products that modify the traditional value chain in the banking sector, enabling direct interaction between financial institutions and customers. The COVID-19 pandemic in 2020 and 2021 accelerated the transition to cashless and digital payments.

Based on these premises, the regulatory bodies of the Philippines, including Bangko Sentral ng Pilipinas (BSP), which serves as the country’s central bank, have adopted a number of regulatory acts related to virtual assets and introduced new licenses for digital banks, coordinating the development of an instant payments system and QR code fast-response standards. Additionally, the Securities and Exchange Commission (SEC) has developed a draft of rules for Initial Coin Offerings (ICO), which provides for the issuance of tokens in exchange for fiat money, other cryptocurrencies, or assets.

Furthermore, the Insurance Commission (IC), which is responsible for regulating the activities of insurance and pre-insurance companies, as well as medical services, has introduced a regulatory sandbox framework designed to support innovations, test new technologies, products, and services in real-world conditions before their mass launch.

At the legislative level, the Philippines is also making steps toward creating an extensive regulatory framework for the fintech sector. Senate Bill No. 184, presented in 2022, aims to delineate regulatory powers, under which BSP becomes the leading body for regulating electronic money, while SEC takes on the role of regulating virtual assets. This bill is currently under review by the Senate Committee.

According to Emilio B. Aquino, Chairman of the Philippine Securities and Exchange Commission (SEC), a regulatory framework for regulating cryptocurrency operations in the country is planned to be introduced in the second half of 2024 or early 2025. He stated that SEC is actively working on creating a regulatory framework aimed at strengthening the protection of investors and market participants engaged in cryptocurrency trading.

The upcoming regulatory initiative focuses on coordination with global technology leaders, such as Apple and Google, to ensure compliance with regulatory requirements within the Philippines. It is noted that following recent actions to tighten control over the operations of the Binance cryptocurrency exchange, the SEC expects these companies to take prompt action to remove the exchange’s apps from their digital stores, in accordance with SEC rulings that mandate the presence of an appropriate license to operate within this jurisdiction.

Aquino emphasizes that, despite the possibility of circumventing restrictions through the use of virtual private networks (VPNs), the measures being taken are crucial to demonstrating the regulator’s determination in matters of oversight and control. In the context of international requirements and increasing risks, such as the collapse of FTX, the need for regulation of cryptocurrency exchanges has become even more pressing.

To commence operations in the Philippines, cryptocurrency exchanges must obtain permits in accordance with Republic Act No. 8799, which will ensure the legitimacy of their activities and the protection of Filipino citizens’ interests. This regulation is part of the SEC’s strategy to strengthen the stability and transparency of the country’s financial sector.

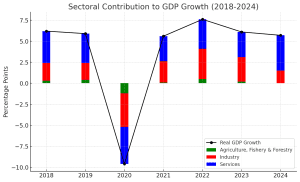

Sectoral contribution to GDP growth

VASP license Philippines

The Central Bank of the Philippines (BSP) is actively supporting the development of the virtual asset market by providing regulatory support to virtual asset service providers (VASPs) and financial institutions interested in issuing stablecoins that comply with established regulatory requirements. On May 9 of this year, Coins.ph, a VASP based in the Philippines, announced that it had received approval from the BSP to launch a pilot project for the PHPC stablecoin, which will be backed by the Philippine peso. This pilot project is being implemented within the framework of the BSP regulatory sandbox. The main goal of this initiative is to evaluate the functionality of PHPC and analyze its potential impact on the country’s financial stability.

According to Coins.ph, the PHPC stablecoin will be pegged 1:1 to the Philippine peso and supported by cash and cash equivalents held in bank accounts in the country. This key requirement is aimed at ensuring the rights of PHPC holders to redemption in accordance with regulatory provisions.

Within the BSP regulatory sandbox, Coins.ph will have the opportunity to demonstrate the use of PHPC in various financial operations, including money transfers, cryptocurrency exchanges, and its use as collateral in DeFi applications. Such cooperation with the regulator will not only allow for the practical application of PHPC but also ensure that all operations comply with BSP requirements for consumer protection, anti-money laundering, counter-terrorism financing, data protection, and other legal and regulatory standards.

If the PHPC stablecoin pilot project is deemed successful, Coins.ph may receive official approval from the Central Bank of the Philippines (BSP) to expand its distribution to the broader consumer market. This step will be a significant milestone in the development of financial technologies and the introduction of digital assets into the country’s economy, highlighting the considerable potential of stablecoins to enhance the efficiency of payment systems.

These events in the Philippines are unfolding against the backdrop of a global trend of tightening regulatory measures concerning stablecoins. Financial regulators worldwide are paying increased attention to the development and implementation of rules for stablecoins, aiming to ensure that their issuers adequately address key risks. Major risks include consumer protection, the prevention of financial crimes, and the maintenance of financial stability.

This approach is driven not only by the widespread adoption of stablecoin technology and its potential in payments and remittances but also by the need to adapt regulatory frameworks to new challenges arising from the dynamic development of digital finance. The importance of timely regulation of stablecoins is emphasized by their ability to influence the financial system, which requires a cautious approach to ensuring their stability and reliability as a means of payment.

In the Philippines, cryptocurrency regulation is in a stage of development and adaptation to the rapidly changing conditions of the digital asset market. While cryptocurrencies are not recognized as legal tender, they are legally used in commercial and financial operations within the country. This reflects a progressive and pragmatic approach to cryptocurrencies, supported by government authorities through the issuance of licenses to cryptocurrency exchanges and service providers, as well as active engagement in the development of the crypto community and its activities.

Regulatory Institutions and Framework

The central regulator for cryptocurrencies in the Philippines is the Banko Sentral ng Pilipinas (BSP). BSP actively develops and updates guidelines related to virtual currencies to adapt the existing financial system to the new realities of the digital economy. These efforts are aimed at ensuring the security of financial operations, protecting consumer rights, and preventing financial crimes associated with the use of virtual currencies.

The Securities and Exchange Commission of the Philippines (SEC) also plays a key role in cryptocurrency regulation. The SEC is responsible for developing and implementing rules that govern the use of cryptocurrencies as investment instruments, including oversight of initial coin offerings (ICOs) and the activities of cryptocurrency exchanges.

The Future of Cryptocurrency Regulation in the Philippines

In light of global trends and the increasing use of digital currencies, the Philippines will continue to adapt its regulatory framework to meet international standards and best practices. It is expected that future regulations will be more comprehensive and focused on enhancing the transparency of cryptocurrency operations, strengthening measures to combat money laundering and terrorism financing, and protecting investors and users of cryptocurrency services.

Given the rapid development of the cryptocurrency sector and its potential for financial innovation, the Philippines aims to position itself as a leader in the regional and global implementation and regulation of digital assets.

In the Philippines, all legal entities and individuals operating cryptocurrency exchanges are required to register with the Banko Sentral ng Pilipinas (BSP) and comply with established operational standards. These standards include developing and applying risk management techniques, as well as implementing customer identification procedures (KYC), which is a key element in protecting the country’s financial system from potential abuses and financial crimes.

The Securities and Exchange Commission of the Philippines (SEC) also contributes to cryptocurrency regulation, particularly in terms of initial coin offerings (ICOs) and their use in investment schemes. To legalize operations with cryptocurrencies, exchanges must obtain a virtual asset service provider (VASP) license. Additionally, to provide additional services such as electronic money transfers and operations with e-money, relevant licenses are required, including licenses for electronic money issuers (EMI) and remittance companies (RTC).

Recently, BSP expanded its authority in the cryptocurrency sector by adapting its rules to market changes. This is demonstrated by the issuance of the first license for advanced electronic payment and financial services (EPFS) to Coins.ph, which was previously granted only to traditional banks.

Anti-money laundering (AML) remains one of the main challenges in the cryptocurrency industry, especially given significant improvements in KYC processes. In the Philippines, where there is no national identification card, companies must be able to effectively identify the identities of customers using various documents from all 82 provinces of the country, adding additional complexities to the identification process.

Cryptocurrency tax in the Philippines

The Philippine government has introduced a capital gains tax on cryptocurrency transactions, setting a rate of up to 15%. This tax applies to income derived from the sale, exchange of cryptocurrencies, as well as purchases made using them. This approach is aimed at regulating and taxing the rapidly growing cryptocurrency market while maintaining financial stability.

Philippine residents who own or trade cryptocurrencies are required to report capital gains when filing their annual tax returns. In cases where cryptocurrency is used for short-term resale, it may be classified as inventory, and income from such activity could be subject to a value-added tax (VAT) at a rate of 12%, if the turnover exceeds the established threshold.

For cryptocurrencies held for long-term investment purposes, such assets are considered capital assets and are subject to regular income tax if profit is realized from their sale or exchange.

Regulators such as the Securities and Exchange Commission (SEC) demonstrate a deep understanding of the crypto space and a commitment to developing reliable and informed regulatory frameworks. The collaboration with the Legal Center of the University of the Philippines (UPLC) to develop guidelines for digital assets highlights the commitment to transparency and involving the public in the rule-making process. This inclusive approach ensures that the crypto community and businesses actively participate in shaping the regulatory framework in the Philippines, promoting their acceptance and compliance.

RUE customer support team

RUE (Regulated United Europe) customer support team complies with high standards and requirements of the clients. Customer support is the most complex field of coverage within any business industry and operations, that is why depending on how the customer support completes their job, depends not only on the result of the back office, but of the whole project itself. Considering the feedback received from the high number of clients of RUE from all across the world, we constantly work on and improve the provided feedback and the customer support service on a daily basis.

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

Registration number:

14153440

Anno: 16.11.2016

Phone: +372 56 966 260

Email: [email protected]

Address: Laeva 2, Tallinn, 10111, Estonia

Registration number: 304377400

Anno: 30.08.2016

Phone: +370 6949 5456

Email: [email protected]

Address: Lvovo g. 25 – 702, 7th floor, Vilnius, 09320, Lithuania

Registration number:

08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00, Prague

Registration number: 38421992700000

Anno: 28.08.2019

Email: [email protected]

Address: Twarda 18, 15th floor, Warsaw, 00-824, Poland

Please leave your request

The RUE team understands the importance of continuous assessment and professional advice from experienced legal experts, as the success and final outcome of your project and business largely depend on informed legal strategy and timely decisions. Please complete the contact form on our website, and we guarantee that a qualified specialist will provide you with professional feedback and initial guidance within 24 hours.