Crypto License in Slovakia 2025

In Slovakia, crypto activities are to a certain extent harmonized with EU legislation, thus requiring a license mainly for the purpose of AML/CFT compliance. Whereas the national authorities have acknowledged the importance of this innovative technology, and they even managed to shed some light on crypto taxation, at the moment they prefer a liberal approach toward crypto regulation, which in simple terms means that a thorough crypto regulatory framework is not going to be deployed anytime soon.

This unregulated status notwithstanding, Slovak jurisdiction holds a number of competitive advantages that attract crypto-businesses willing to obtain a license in one of the European jurisdictions. The paper has provided an overview of how one can become a licensed crypto business in Slovakia if he intends to leverage the country’s low costs of establishing a company, competitive and business-friendly tax regime, nominee directors, and shareholders’ services. It has also described the absence of restrictions with regard to foreign property and employees, in addition to the highest level of productivity in Central and Eastern Europe.

The Slovak Financial Intelligence Agency has implemented the AML/CFT regulations to the extent that it has even developed and applied stringent controls on cryptocurrency transactions. It exercises rigid control over crypto companies and is authorized to request relevant reports containing detailed customer information with a view to helping to build confidence in the Slovak crypto companies.

The main task of the National Bank of Slovakia is to maintain stability in monetary policy and supervision over participants of the Slovak financial market. Though authorities are presently not entitled to regulate providers of crypto-assets by an authorization issuance, even in a case when the activity in question with cryptocurrencies is carried out using traditional forms of payment-for example, being exchanged for real money-he acknowledged different types of crypto assets.

NBS defines cryptocurrencies as: “Cryptocurrencies are currencies or other types of digital assets, based on cryptography, decentralized, and often using some form of blockchain technology.” Other terms include electronic coins or tokens. Mining is defined herein as the “process of creating crypto assets.”.

Cryptocurrency License in Slovakia

Cost of cryptocurrency license

|

PACKAGE «COMPANY & CRYPTO LICENsE IN SLOVAKIA» |

- Setting up of the company with preparation of all legal documents and power of attorney for 1 year

- Review of the business model and the structure of the Cryptocurrency Company

- General counselling (5 hours)

- Obtaining Crypto license

- AML, KYC policy, terms of service

- State fees

- Notary fees

- Attorney fees

- Contact person throughout process

- Assistance in opening a bank account for cryptocurrency companies

| Legal Services for Crypto Projects | 1,500 EUR |

The following types of crypto assets are distinguished:

- Virtual currencies can only be a certain medium of exchange for fiat currencies and other virtual currencies or a certain medium for payment against goods and services, and no rights attached thereto. Utility tokens – could be utilized for future purchase of services or products provided by the issuer of markers.

- The investment markers can provide rights to the holder to take part in the management process, or to assets received by the issuer of the tokens-future profits.As the Basel Capital Accord defines, ICO is a method of alternative financing, in other words-a novelty way of attraction of capital from the state to finance certain projects of individual individuals. Basically, what happens is that the issuance of electronic coins and tokens takes place and then is offered to the general public against fiat money or virtual assets. Most transactions take place over the internet.In the recent past, NBS has developed a regulatory system whose main focus is to drive innovation across the nation. This is in the line of carrying out tests on novel products and providing the necessary avenue for collaboration between the market players and other institutions of interest. The stakeholder database addresses this through the provision of contacts of some firms under the regulation of NBS.Features and innovations, knowledge of the applicable regulatory framework, and benefits for customers — only the Slovak commercial system can apply on the NBS website in case it is desirable to test some new crypto product or service in a controlled environment or just be advised on a specific issue.Blockchain Slovakia is another organization created to support the development of firms whose business models are based on blockchain technology, including cryptocurrencies. It enables cooperation among researchers and developers, entrepreneurs, regulators, and investors in developing technical, legal, and regulatory solutions.

Advantages

Low cost of setting up the company

Cryptoassets are not considered as financial instruments or securities

Fast project implementation time

Possibility to buy an off-the-shelf solution

CRYPTO LEGISLATION IN SLOVAKIA

The law applied by the NBS does not define or regulate crypto assets and related economic activities, as a rule, unless they are covered by any other regulatory framework developed for the financial market.

Therefore, the NBS and other national authorities refer to EU and national legislation with a view to deciding whether each individual commercial case may fall within the definition of electronic money, financial instruments or other regulated units. However, activities falling under the heading of cryptography do not come under the heading of the existing types of authorizations granted by the NBS—for example, license to trade in foreign currency or permit to issue electronic money.

NBS also refers to a report issued by the European Banking Authority—one that discusses crypto assets against the background of EU legislation. The EU does not have full-fledged regulation of crypto business so far, but the authorities believe that in some respects, existing legislation of financial markets is already applied. If crypto assets fall within the definition of electronic money, for instance, the Second Payment Services Directive should be considered.

A report published in 2019 by the European Securities and Markets Authority identified features and functions of virtual assets and their possible classification.

According to ESMA, to the extent that crypto assets were financial instruments, the following EU law applied to crypto-asset issuers and service providers:

- Directive 2014/65/EU

- Prospectus regulation

- The Market Abuse Directive

- Short-sale regulation

- Central Securities Depository Regulation

- Final Settlement Directive

On the other hand, crypto-assets are deemed not to be treated as a financial instrument or security under Act 566/2001 on securities and investment services under Slovak legislation. If you have any questions about how EU and national legislation interacts, please do not hesitate to contact our lawyers for individual consultations.

Although many aspects of regulation have yet to be clarified, you can already be sure that the EU AML/CFT legislation on crypto enterprises has been transposed into the national legislation of Slovakia. The last three EU directives adopted by the member country are the Fourth Anti-Money Laundering Directive (AMLD4), the Fifth Anti-Money Laundering Directive (AMLD5), and the Sixth Anti-Money Laundering Directive (AMLD6). They have developed a clear legal definition of crypto assets, besides establishing a regulatory framework for companies performing cryptography-related economic activities.

Besides all the above, the EU authorities have recently agreed on new anti-money laundering rules concerning crypto operations that are supposed to bring more transparency but not hamper innovation. As per the new rules, the identity of the customer has to be checked, whatever the size of the transaction may be, for any transaction between two regulated digital wallet providers. On the other hand, the unoccupied private purses will remain out of the scope.

In the light of AML/CFT rules, crypto companies are obligated to adhere to the following principles:

- Determine the nature and complexity of crypto operations and types of clients regarding the relevant rules. Also, develop and implement policies and procedures to manage risks concerning money-laundering and the financing of terrorism.

- Ensure that staff are appropriately trained and can negotiate legislation pertaining to money-laundering, the financing of terrorism and the protection of data relating to the mitigation of financial crime as well as the identification of customers and circumstances, high risk.

- Design and implement CDD and KYC policies that assure customer identification throughout the business relationship.

- Provide internal processes for the identification of political players.

- Ongoing monitoring of operations in accordance with principles of risk assessment.

- Reporting suspicious transactions and customers to the competent authorities for the purpose of the national Law 297/2008 on the Prevention of the Legalization of the Proceeds of Crime and the Financing of Terrorism (Slovak AML Act).

Compliance with the rules of AML/CFT is the guarantee of stability for the crypto business. There have been cases when bank accounts of Slovak crypto companies were closed because of non-conformity with the legislation on combating money laundering and financing of terrorism. One should not forget that the local police have access to information about cryptocurrency firms and can take very strict measures.

Crypto regulation in Slovakia overview

| Period for consideration |

4-6 weeks | Annual fee for supervision | No |

| State fee for application |

15 EUR | Local staff member | No |

| Required share capital | 5,000 EUR |

Physical office | Required |

| Corporate income tax | 21% | Accounting audit | Required |

TYPES OF CRYPTO LICENSES IN SLOVAKIA

All entrepreneurs who plan to provide either cryptocurrency services—involving cryptocurrencies and fiat money—or crypto wallet services either in or from within Slovakia shall, before starting such a business in Slovakia, register with the Trade Licensing Bureau as crypto-related economic activities are deemed a regulated trade, under Law No. 279/2020 Coll. amending Law No.

Depending on the type of crypto activity, the Trade Licensing Authority grants the following licenses:

- A license for Crypto Exchange Services for firms that provide services in the trading of cryptocurrency against other cryptocurrencies, fiat money, and other kinds of assets, including related equipment such as crypto ATMs;

- A license for Wallet Services for firms that offer the safekeeping and/or administration of cryptographic secrets or private crypto keys on behalf of their clients, or the safekeeping and/or administration and the transfer of crypto assets.

Since the crypto transactions in question are classified as regulated transactions, besides general conditions—when carrying out such a regulated transaction, one has to be at least 18 years old, and there has to be proof of legal capacity, not having a criminal record—the crypto-entrepreneur would also have to fulfill educational and other requirements according to financial market participants. Examples include the introduction of internal AML/CFT policy and data protection models. Professional competence for regulated industries will be set in line with rules set under Schedule 2 of the Trade Licensing Act.

EU/EEA nationals or foreign entrepreneurs residing within the EU/EEA who do not meet the condition of professional competence required for participation in regulated trade, such as activities of cryptocurrency development; the Trade Licensing Act and other relevant Slovak legislation give the right to demand from the Ministry of Interior of the Slovak Republic to recognize his/her knowledge and competencies, evidenced by certificates of competence, diplomas, and/or other documents, certified by extradition in another member state according to the relevant Slovak legislation. The recognition of a non-Slovak qualification can be done within as long as three months.

CRYPTO LICENSING PROCESS IN SLOVAKIA

The entire process of licensing usually takes four to six weeks, and the Trade Licensing Authority issues a license within three working days provided necessary information and documentation are correct. Any modification to the structure or activities of the Licensee should be given to that authority’s notice. Documents reflecting this change should be filed with the proper authorities within 15 days from the date of its introduction.

Key steps for obtaining a regulated trade license for your crypto activities in Slovakia include the following:

- Establish a company with a legal address in Slovakia.

- Notify the Trade Licensing Office about an intention to start a crypto business in Slovakia either at the office of the region where your permanent stay is recorded or, if you are not a permanent resident, in a region where the business is registered.

- State fees: pay through the e-tax stamp, in cash, or by bank transfer—5 EUR in case of unregulated trades and 15 EUR in case of regulated ones.

- Application, in the Slovak language, is to be submitted either in one of the local offices of the Trade Licensing Office having a place in the locality of your residence or online through the Central Public Administration Portal.

Documents to be attached:

- Application form

- Articles of Association and other corporate documents

- Document confirming premises obtained for the registered office in Slovakia—a virtual office can be used; it shall be either a lease agreement with the explicit statement of business purpose or written consent of the owner of the property, signed by a notary.

- Document confirming permanent residence of company founders and directors

- Proof of relevant professional competence enabling founders and senior management to conduct crypto activity

- Certificates from the General Prosecutor’s Office or by the competent authorities of the home country, proving that founders and senior management haven’t been sentenced for committing an economic crime or another crime in relation to the intended business activities; it must not be issued earlier than 90 days ago.

All the documents must be translated into Slovak language by a translator certified by the Ministry of Justice of the Slovak Republic. If you need such a service, we’ll be happy to arrange it for you.

HOW TO OPEN A CRYPTO COMPANY IN SLOVAKIA

For the purpose of obtaining a crypto license in Slovakia, it shall be necessary to incorporate a local company, which will be governed by the Commercial Code. There was no citizenship requirement and foreigners stood under the same regulations and had the same benefits as Slovak citizens.

Private limited companies are one of the most common types of legal entity which can be incorporated easily within 3 to 4 weeks’ time if all the required documents are prepared quite in advance.

Requirements to a private joint-stock company:

Unique company name (it is recommended to prepare three versions)

Minimum equity – EUR 5,000 (full payment at the time of registration is optional)

Director living in Slovakia or another EU country

1-50 shareholders

Local corporate bank account (requires up to two weeks to open)

DOCUMENTS REQUIRED TO ESTABLISH A PRIVATE LIMITED LIABILITY COMPANY IN SLOVAKIA

The following documents are required in order to establish a private limited liability company in Slovakia:

- Copies of identity cards (passports) of founders, directors, and beneficiaries

- Confirmation of permanent residence of the founders and directors—either utility bills or a document issued by the competent authorities

- Articles of association

- Either a registration act (in the case of a single founder) or a memorandum of association (in the case of multiple founders)

- Detailed business plan, including structure and operation principles, and financial information

- Certificate of criminal record issued by the relevant authorities

- Diploma of secondary education and document confirming the availability of other qualifications needed for conducting the crypto business

- Apostille power of attorney (in case the company is registered by another person)

MAIN STEPS TO SET UP A PRIVATE LIMITED LIABILITY COMPANY

The main steps to be taken for setting up a private limited liability company are:

- Check availability and reservation of the name of the chosen company in the Trade Register.

- Apply for a crypto license at the Trade Licensing Office.

- Filing of all documents with the commercial register.

- Tax registration.

- Notification to the health insurance of your choice and the Social Insurance Agency within eight days after the commencement of the crypto business.

Upon successful registration in the Trade Register, an electronic mailbox will be automatically created at the Central Government portal – www.slovensko.sk. The directors of a company will be obliged to communicate in electronic form with the national authorities and also to send electronic messages and notices.

You can immediately start your crypto activities once the Trade Register issues the certificate of registration.

CRYPTO TAXATION IN SLOVAKIA

All Slovak companies involved in crypto-related economic activities have to be registered with the tax authorities that collect taxes in Slovakia. Like any other company, they are allowed to choose either a standard tax year that coincides with a calendar year or another 12-month period.

The following taxes are compulsory for Slovak crypto companies:

- Corporate Income Tax (CIT) – 21%

- Value Added Tax (VAT) – 20%

- Withholding Tax (GSP) – 0%-35%

- Social Security Contributions (SCP) – 25.2%

- Health Insurance Contributions (CHF) – 10%

The tax regime of cryptocurrencies was elaborated in a guide released by the Ministry of Finance (MoF) back in 2018. According to the authorities, income gained from cryptocurrencies is taxable, and any sort of transfer related to cryptocurrencies is considered a taxable transfer. For instance, the exchange of virtual currency for other virtual currency or for goods and services is regarded as a taxable transfer.

For taxation purposes, cryptocurrencies that are not fiat money are considered short-term financial assets, valued at the current market price at the time of the transaction.

The Ministry of Finance has also amended the Act on Tax Administration and the Act on Income Taxes, providing the definition of virtual currencies in the category of other revenues, alongside new regulations governing the taxation of income obtained from the sale of virtual currency.

Taxed as Income

The following activities have been taxed as income:

- Exchanging virtual currencies for other types of virtual currencies

- Exchanging virtual currencies for the provision of services

- Exchanging virtual currencies for assets

- Providing paper storage services

Under the amended Income Tax Act, some crypto transactions are excluded from the tax base, specifically income acquired from virtual currencies obtained through mining during the tax period of their use. It shall be included in the tax base of the tax period when virtual currencies are sold.

The Income Tax Act governs tax expenditure on virtual currencies, which may be utilized as a tax expense to calculate the total value of the entry price of the virtual currencies sold, up to the amount of revenues from their sales. The entrance price refers to the price at purchase, in case it was purchased, and the real value in cases of exchanging virtual currencies for other virtual currencies.

Among the many other advantages, there are numerous tax benefits for Slovak crypto companies. For instance, an R&D discount of 200% could be utilized to the extent that R&D project expenditures can be deducted from the tax base twice.

There are close to 70 international agreements for the avoidance of double taxation in Slovakia, which allow resident taxpayers to safeguard their income against double taxation in various countries.

Slovakia

Capital |

Population |

Currency |

GDP |

| Bratislava | 5,460,185 | EUR | $20,565 |

ACCOUNTING AND AUDIT REQUIREMENTS OF CRYPTO COMPANIES

The Accounting Act defines which entities are obliged to audit their books of account.

Auditing is compulsory for entities that meet at least two of the following criteria:

- Total assets more than EUR 1 million

- Net turnover exceeds EUR 2 million

- Average number of staff more than 30

In 2018, the Accounting Act was revised to create accounting regulations specifically for virtual currencies and companies involved in economic activities related to cryptography. Among the new obligations is the conversion of virtual currencies to euros on the accounting day.

Additionally, the Accounting Act has included a Licensing Act that provides regulations regarding the method of estimating what is referred to as the real value of virtual currencies. The real value of virtual currency means the market price on the day of valuation and must be determined by the accounting company through the selected public market of virtual currencies. Throughout the reporting period, the same method for determining the real value of the processed virtual currencies should be consistently used by the company.

If you want to get a cryptography license in Slovakia, our team of experienced and dedicated lawyers will be happy to assist you in this process. We are well prepared to offer company creation and crypto licensing services as well as to consult you on taxation matters. In addition, if you need accounting services or virtual office, we will be happy to help. Contact us now to book a personalized consultation.

Gateway to Innovation: Securing a Crypto Exchange License in Slovakia 2025

As the cryptocurrency industry continues to evolve, Slovakia is emerging as a promising location for crypto businesses looking to expand in the European market. This article provides a detailed guide on obtaining a crypto exchange license in Slovakia, offering insights into the regulatory framework, the application process, and the strategic advantages of securing a license in this jurisdiction.

Regulatory Landscape for Crypto Exchanges in Slovakia

In Slovakia, the regulatory framework for cryptocurrencies is overseen by the National Bank of Slovakia (NBS) and aligns with European Union financial regulations. Businesses seeking to operate legally must comply with stringent anti-money laundering (AML) and counter-terrorism financing (CTF) measures.

Types of Crypto Licenses in Slovakia

Slovakia offers various types of licenses to cater to different aspects of the cryptocurrency business:

- Crypto exchange license in Slovakia: Permits the operation of platforms that facilitate the exchange of cryptocurrencies for fiat currencies and vice versa.

- Crypto broker license in Slovakia: Allows entities to broker transactions between buyers and sellers.

- Crypto trading license in Slovakia: For businesses directly engaged in the buying and selling of cryptocurrencies.

- VASP crypto license in Slovakia: Aimed at providers of virtual asset services beyond simple exchange functions.

Application Procedure for a Crypto License in Slovakia

The entire documentation that needs to be filed for a crypto license in Slovakia includes a business plan, AML policy, proof of financial stability, and more. Firms must guarantee the cybersecurity measures that will serve as protection for consumer data and assets.

Crypto Licensing: Economic Aspects

The cost of a crypto exchange license in Slovakia is competitive within the Central European region, making it very appealing for both startups and established firms. These costs should be factored into the strategic financial planning of companies.

Benefits of Acquiring a Crypto License in Slovakia

Obtaining a crypto license enhances a company’s credibility and facilitates interaction with global financial systems with fewer obstacles. Additionally, it offers legal protection and opens up further opportunities in the expansive EU cryptocurrency market.

Crypto Market Opportunities for Investments in Slovakia

The Slovak crypto market shows promising growth potential, especially given the low cost of a crypto license in Slovakia. This advantage can help entrepreneurs enter the field with relatively low initial costs.

Acquiring an Existing License

For those seeking a quicker route to market, acquiring an existing crypto exchange license for sale in Slovakia may be a more prudent choice. This requires thorough due diligence to ensure that the license meets all current regulatory requirements.

In a country like Slovakia, which is still refining its approach to regulating cryptocurrencies, obtaining a crypto exchange license is a crucial step for any business wishing to establish a legitimate and competitive presence in the European crypto market. This can be achieved through careful planning and adherence to regulatory standards, enabling enterprises to navigate this dynamic sector effectively.

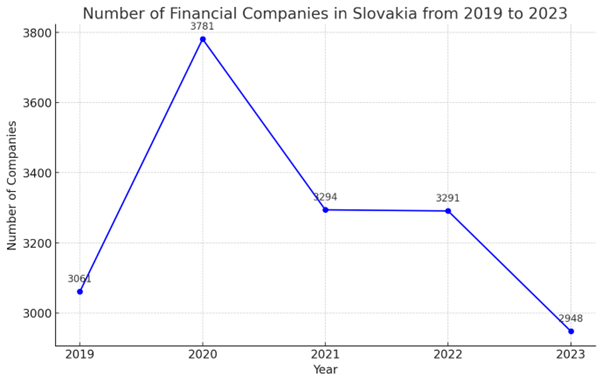

Number of financial companies in Slovakia

Crypto License in Slovakia 2025

Tightening the Regulatory Framework for Cryptoasset Transactions: Innovative Approaches in Legislation

In line with the contemporary trend in the regulation of cryptocurrencies, the Parliament adopted a legislative act that set new vectors in the sphere of digital asset turnover. The bill that received approval from MPs provided for the introduction of special permits for the transactions with cryptocurrencies, underlining that this branch cannot avoid the regulation within the Slovak Republic.

In a nutshell, it is based on those very principles developed under Markets in Cryptoassets Regulation aimed at the harmonization of European Union rules concerning crypto-currency trading. This bill targets the mandatory licensing of traders and enhanced supervision of these activities, putting the quality and security of the financial transactions in this sphere under control.

So far, the Slovakian legislation has failed to insert into the legal framework specific norms regulating the public offering of cryptoassets and their inclusion in trading platforms, keeping a significant part of related services out of the rigid legal framework. Innovations of the law mean the radical change in approach: now, every company operating in cryptoasset-related services will be obliged to undergo a licensing procedure through the National Bank of Slovakia.

Adaptation of the Regulatory Framework of the Slovak Republic to the Requirements of the European Union Regarding Regulating Cryptoassets

The NBS is a competent authority entitled to allow the public offering and trading of active tokens and the servicing of cryptoassets. Within the framework of powers given by the MiCA regulation, the NBS is authorized to impose sanctions for violation of established rules against violators, which seriously increases the degree of responsibility of participants in this market.

The Slovak Ministry of Finance is actively working on drafting domestic legal acts; some of these will be expected by this year’s middle, while others will enter into force by the end of this year. The National Bank of Slovakia will be the supervisory authority to this financial sector.

Taxation of Income from Cryptocurrencies (Virtual Currencies) in Slovakia in 2025

Conceived for 2025 is new legislation in Slovakia regarding the taxation of income from cryptocurrency transactions. This further develops due to the MiCA regulation adopted by the European Union, with the purpose of harmonized and complete rules in the field of cryptoassets.

According to the Minister, some of the measures should start their application this year, while the full force of the rest is due at the beginning of next year.

How to Account for Revenues and Expenses Related to Virtual Currencies in Slovakia?

To book revenues and expenses arising from virtual currencies accurately, the laws regarding taxation in Slovakia should be followed as closely as possible. Income from the sale of cryptocurrencies is recognized when the sale is against cash consideration or is bartered for other assets, services, or other cryptocurrencies.

The identical value of a virtual currency should be valued with the same market value method throughout a calendar or fiscal year for consistency and equitability in tax accounting.

Following the Determination of Fair Market Value for Cryptocurrencies

The income tax for cryptocurrency income would be determined by deducting expenses directly related and attributable to the derivation of such income. Such expenses include, among other things, the purchase price of the cryptocurrency, the electricity costs related to mining cryptocurrencies, or the fair value of exchanging the cryptocurrency for property or services.

Taxation of Cryptocurrencies in Slovakia for Individuals 2025

Within the framework of Article 8 of the Income Tax Act, income tax is to be charged in 2025 on the transactions of virtual currencies carried out by individuals in Slovakia. The gains realized upon sale represent other income that should be declared in the tax return of type B individuals.

Taxes on Cryptocurrencies for Legal Entities in Slovakia 2025

Starting in 2025, income from cryptocurrency transactions will be subject to taxation from the accounting and tax records of legal entities and individual entrepreneurs in Slovakia. This includes all types of accounting, such as simple, double, and tax accounting, and covers the option to use fixed costs.

For tax purposes, in determining the cost, the original value of a cryptocurrency acquired through purchase is its purchase price. In the case where the acquisition of such cryptocurrency was purchased against another virtual currency, the acquisition cost is determined as the fair value at the acquisition date.

“I have expertise in providing guidance to navigate starting a business in Slovakia, providing insights, optimizing projects for compliance with current regulations. Reach out to me today to initiate the journey for your business success in Slovakia.”

FREQUENTLY ASKED QUESTIONS

Does Slovakia grant a license for crypto activities?

Yes. Slovakia grants two types of crypto license depending on the scope of activities that a crypto company is intending to conduct.

How do I get a crypto license in Slovakia?

The first step towards obtaining a crypto license in Slovakia is to establish a crypto company. This procedure is done in collaboration with the Trade Register. Once the company’s certificate of registration is obtained, the company may apply for a crypto license with the Trade Licensing Office.

What are the activities of the crypto license in Slovakia?

When it comes to crypto licensing in Slovakia, there are two types of licenses. The choice between the two depends on the scope of business activities that a crypto company is intending to conduct. The first type of license authorizes e-wallet services, and the second type authorizes crypto exchange operations. The full scope of regulated crypto activities in Slovakia includes:

- Creation of digital coins and the use of blockchain technology

- Cryptocurrency exchange services related to crypto currencies

- Financial consulting services offered to those interested in investing in crypto currencies

- Crowdfunding platforms through which funds can be raised through the sale of cryptocurrency

- Initial coin offerings (ICOs) which raise capital through crypto currencies

- Establishing a network of crypto ATM

How long does it take to get a license?

The total duration of the process can be split into three parts:

- The process of opening a bank account is expected to take at least 2 weeks

- The process of company formation is expected to take around 3-4 weeks

- The procedure of obtaining a crypto license may take around 4-6 weeks

Can non-residents of Slovakia own a crypto company?

Yes. However, the director of a Slovakian crypto company must be a resident in either Slovakia or another EU Member State.

Can non-residents of Slovakia be part of the board of a Slovakian crypto company?

Yes, as long as they are residents of another EU Member State.

Is it necessary to have a banking account to obtain a license?

Yes. Opening a corporate bank account is a prerequisite for establishing a cryptocurrency company in Slovakia. The process of opening a bank account should be expected to last at least two weeks.

What is the minimum authorized capital for a virtual currency service provider?

Irrespective of the type of crypto license that a crypto company aims to obtain, the minimum authorized capital is 5000 euros.

Is it possible to deposit authorized capital in crypto currency?

No. The National Bank of Slovakia does not recognize cryptocurrencies as valid means for current operations.

How is the charter capital of a crypto company paid in?

It must be deposited to the bank account of a crypto company.

When do you need to deposit capital to open a company and obtain a crypto-license in Slovakia?

It is not necessary to deposit the required minimum authorized capital at the moment of the company's registration. This step can be completed at a later time.

What does a crypto company need to apply for a cryptographic license in Slovakia?

In order to successfully apply for a crypto license in Slovakia, a crypto company must complete the following steps first:

- Set up AML/KYC polices required for their crypto oriented activity and company type.

- Appoint a director and AML officer that are residents either in Slovakia or another EU Member State.

- Prepare a clear and detailed business plan.

- Submit the application and register with the Trade Licensing Office.

Why should you get a crypto license in Slovakia?

There are multiple advantages that crypto license holders in Slovakia can benefit from. Firstly, crypto companies that file their taxes correctly may receive a major tax reduction. Financing opportunities are available as well for growth projects. Secondly, Slovenia allows 100% foreign ownership – something that many other EU countries are limiting at the moment. There are no restrictions for foreign employees in Slovakian crypto companies, either.

Are Slovakian crypto currency companies audited?

When it comes to crypto regulations, Slovakia stands out by enforcing strict requirements to regulate crypto businesses. Slovakia allows full disclosure of corporate information to strengthen security protocols and oversight. As a result, all cryptocurrency businesses are subject to regular checks and identification.

Can the director of a crypto company be a non-resident of Slovakia?

Yes. In that case, however, the director of a crypto company should be a resident in an EU member state.

What measures to prevent money-laundering and the financing of terrorism are in place in Slovakia?

Regulatory bodies and tax authorities have full access to information regarding crypto activities and may perform regular checks/audits on crypto license holders in Slovakia. There are further AML/KYC regulations that apply, but they depend both on the type of business and the crypto license that it owns.

What difficulties may arise in obtaining a crypto license in Slovakia?

Slovakia is one of the European countries that don’t prohibit crypto currencies but maintain very strict measures on crypto activities and crypto businesses that operate in the country. In Slovakia, these measures are initiated and enforced by the Financial Intelligence Unit. Given such a strict regulatory framework, violation of local regulations can have tough consequences. This is reflected in the history of crypto businesses that have been suspended or completely closed down due to regulatory violation in the past.

Where can I open a bank account for a Slovakian crypto company?

Crypto businesses in Slovakia are required to open a bank account with a local bank.

Additional services for Slovakia

RUE customer support team

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

OÜ

Registration number:

14153440

Anno: 16.11.2016

Phone: +372 56 966 260

Email: [email protected]

Address: Laeva 2, Tallinn, 10111, Estonia

UAB

Registration number: 304377400

Anno: 30.08.2016

Phone: +370 6949 5456

Email: [email protected]

Address: Lvovo g. 25 – 702, 7th floor, Vilnius, 09320, Lithuania

Registration number:

08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00, Prague

Sp. z o.o

Registration number: 38421992700000

Anno: 28.08.2019

Email: [email protected]

Address: Twarda 18, 15th floor, Warsaw, 00-824, Poland