Seychelles cryptocurrency license 2025

In the digital economy era, cryptocurrencies are taking their place in the world financial system. Seychelles is developing its position as a main international financial centre and provides a very transparent legal and, at the same time, effective mechanism of licensing for crypto companies. Below you will find a detailed description of the procedures and advantages of getting a cryptocurrency license in Seychelles.

Legal framework

The Seychelles government has created a friendly environment for cryptocurrency companies by introducing a well-defined legal framework that enables legal protection and fosters innovation. The licensing of cryptocurrency transactions is under the Securities Act and supervised by the Seychelles Securities Authority to make sure international standards of transparency and financial security are met.

Benefits of Licensing

- International recognition: A license from Seychelles confirms legitimacy in the international arena and helps to build trust in your business with your customers and partners.

- Favourable tax climate: Seychelles has a law that foresees a competitive tax structure, allowing for the optimization of tax liabilities.

- Speedy registration procedure: The system of licensure within Seychelles is fast and efficient; you are allowed to begin your operation in the shortest period of time.

- Access to international financial markets: The license opens good opportunities for work with international banks and financial institutions.

Procedure for obtaining a license

The procedure for obtaining a cryptocurrency license in Seychelles is rather simple: one needs to submit an application, provide a full set of documents, and pass a compliance check. It can be divided into several stages:

| Step | Details |

|---|---|

| Documentation Preparation | The writing of the business plan, AML/KYC policies, and company legal documents is underway. This step includes the preparation of required documents and files for submission. |

| Application | A license application, along with the prepared documents, is to be submitted to the Seychelles Securities Commission. |

| Review and Assessment | The Commission conducts a detailed review of the submitted materials and assesses the qualifications of the applicant. |

| License Issuance | Once all steps are satisfactorily completed and relevant fees are paid, the license is issued to the applicant. |

Obtaining a cryptocurrency licence in Seychelles represents a strategically advantageous move for companies willing to expand their presence in international markets. A transparent legal framework, competitive conditions of taxation, and an effective system of licensure make Seychelles the state of choice for a cryptocurrency business.

|

PACKAGE «COMPANY & CRYPTO LICENSE IN SEYCHELLES» |

65, 000 EUR |

- Consulting on relevant legislation and assisting with legal entity registration

- Review and filing of Securities Dealer License application documents

- Assistance in organization of the licensee and liaising with regulator

- Securities Dealer License Application/Securities Dealer Representative License Application

- Legal Advisor Consent

- Company secretarial, registrar office/agent for the first year

- Guidelines for submitting all required documents and certificates

- Tax Registration

- Government fees

- Assistance in opening a Corporate Bank Account

Crypto company registration in Seychelles

In the field of digital innovations, Seychelles occupies a special niche as an attractive hub for conducting cryptocurrency businesses by invitingly boasting favorable regulatory environments that encourage growth and development in digital assets. Incorporating a Seychelles cryptocurrency company opens up international markets and offers a number of strategic advantages.

Legal framework

First, there is familiarity with the Seychelles regulatory environment in relation to cryptocurrency transactions. While welcoming innovation, Seychelles’ laws attach much importance to AML/CFT aspects. This is where one may want to do some extra homework regarding the requirements within the law and regulation for setting up a fully compliant enterprise.

Selecting the appropriate form of business organization

Proper entity selection is extremely important to function effectively and optimize taxation. In Seychelles, the most popular type of entity chosen by a cryptocurrency business entity is an International Business Company (IBC), given its flexibility, privacy, and tax benefits.

Preparation and submission of necessary documents

The incorporation of an IBC in Seychelles includes filing several documents, namely articles of association and documents related to the appointment of directors and shareholders. A proper and detailed business plan will also be required, especially when it comes to seeking external funding or dealing with banking and financial institutions.

Registration with regulatory authorities

After that, when all the documents are prepared, they must be submitted to the FSA – Seychelles authority in charge of the registration and licensing of cryptocurrency companies. Depending on the type of activities, some businesses will also require a special license.

Opening a corporate bank account

Opening a corporate bank account is required in order to operate a cryptocurrency company in Seychelles, hence taking care of its finances. The problem is that many banks are rather cautious with regard to cryptocurrency transactions, so this may not be easy; hence, the process should be begun early enough.

Compliance with ongoing regulatory and tax obligations

After incorporation, entrepreneurs have to observe all ongoing regulatory and tax obligations, such as filing annual reports and remaining compliant with policies on AML/CFT.

The registration of a cryptocurrency company in Seychelles becomes a strategic step for the perspective of entrepreneurs who look forward to maximizing their businesses in digital assets. In fact, following each step described here and assuring compliance with local regulatory requirements will be an effective way to get started with international success.

Republic of Seychelles

Capital |

Population |

Currency |

GDP |

| Victoria | 100,060 | Seychellois rupee (SCR) | $41,828 |

Crypto legislation in Seychelles Seychelles has become a hotbed of interest from the global cryptocurrency community because of its friendly, progressive approach to regulating digital assets. Open to innovation and an active desire to provide all the conditions for the comfortable growth of the sector, in general, Seychelles legislation shows a balance between encouragement for industry development and investor protection.

Regulator frame

The state regulates the Seychelles Crypto Industry with a plethora of relevant laws and regulators, including the Financial Services Authority of Seychelles. This is the main role of the FSA: licensing and supervising cryptocurrency firms to international standards of transparency and AML.

Licensing of Cryptocurrency Activities

One of the important features of Seychelles’ cryptocurrency legislation includes the licensing of certain activities related to cryptocurrencies, namely operations of cryptocurrency exchange, custodial services, and other kinds of services dealing with digital assets. The licensing introduces high standards of security and integrity among market players.

AML/CFT requirements – compliance

Anti-money laundering and counter-terrorist financing are believed to be of the highest priority in Seychelles. Cryptocurrencies are also bound to introduce fully functional AML/CFT systems, including denomination of customers’ identification procedures-KYC, monitoring of transactions, reporting of suspicious activity, etc.

Protection of Investors

Seychelles’ legislation also seeks to protect investors’ rights and interests by enforcing the principle of transparency of transactions, information disclosure, and fair trading practices. This includes disclosure of the risks associated with the investment in cryptocurrencies and that an investor is duly informed.

Taxation

In the case of Seychelles, its position in respect of the taxation of cryptocurrency transactions presents a relatively favorable environment, focusing on further growth and development of this sector. Entrepreneurs should pay attention to tax aspects of their activities and be in accordance with tax obligations.

Continuous compliance with regulatory requirements

Regulatory compliance is an ongoing process. It hence calls for the concerned companies that deal in cryptocurrency to conduct periodic audits of their operations and policies to ensure that continuous compliance is pursued in Seychelles, where the regulatory landscape keeps changing dynamically.

Cryptocurrency legislation in Seychelles has been geared toward creating an enabling environment for innovating and integrating financial technologies while insisting on investor protection and adherence to international standards. Understanding this legislation and observing its strict prescription allows not only the successful conduct of business in Seychelles but also the building of confidence and security within the general cryptocurrency sector.

Crypto exchange licence Seychelles

During the era of the hot cryptocurrency market, Seychelles is a very unique location due to its friendly climate for cryptocurrency exchange organizations because of its progressive regulatory approach and strategic way of looking at digital finance. The license for crypto exchange opens the ways of international markets to the enterprise with great accruable benefits. The following are brief details about obtaining a Cryptocurrency License in Seychelles:

| Step | Details |

|---|---|

| Insight into the Regulatory Environment | Develop a deep understanding of the regulatory landscape for cryptocurrency in Seychelles. Familiarize yourself with the Financial Services Authority of Seychelles (FSA), the key licensing and supervisory body, and their requirements, including AML and KYC policies. |

| Business Plan Development | Prepare a comprehensive business plan that includes your business model, goals, risk management strategies, and operational processes. The plan should demonstrate market knowledge, including competitor analysis, target audience, and marketing strategies, as it is a critical document for your application. |

| Documentation Preparation and Submission | Gather and submit all required documents to the FSA, including company legal documents, your business plan, AML/KYC policies, management and ownership information, and details on technical infrastructure and security. Ensure compliance with FSA’s documentation standards. |

| Conformity Assessment and Verification | The FSA will assess your firm’s suitability, potentially requesting additional information, holding management meetings, or conducting audits. It’s crucial to be transparent and responsive to any FSA inquiries. |

| Licensing and Commencing Business | Upon successful assessment and application approval, the FSA will issue a license for your cryptocurrency exchange, allowing you to operate in Seychelles. Ensure ongoing compliance with regulatory standards, prioritizing security and transparency. |

Obtaining a cryptocurrency exchange license in Seychelles is a challenging, complicated process that is highly sensitive to planning preparation and interaction with regulators. With the appropriate approach, by paying attention to all the important nuances, such a process may open your business to the international cryptocurrency market and just lay the bedrock for growth and success in such a dynamic industry of digital assets.

Crypto trading licence Seychelles

Most entrepreneurs pursue global diversification and expansion within the Seychelles cryptocurrency market. The region provides an attractive regulatory platform for cryptocurrency trading – a combination of strict standards with openness to innovation. Carefully planned, a license for cryptocurrency trading in Seychelles may be obtained by following a number of regulatory requirements.

Deep understanding of the regulatory environment

Understanding the regulatory environment in Seychelles is a paramount first step toward attaining a license to trade cryptocurrency. This is by virtue of coming to terms with all requirements and expectations that the FSA shall use in regulating cryptocurrency transactions in these islands. With attention to the details and a profound understanding of the applying rules and regulations, success in the licensing process should ensue.

Licence type selection

There are several types of cryptocurrency trading licences for various kinds of activities in Seychelles. Decide which licence will best correspond to your business goals and needs: whether your business needs a licence as a cryptocurrency exchange, broker, or custodial services licence. If you carefully choose the type of licence, then you will be able to concentrate on the relevant aspects of preparation and submission of documents.

Preparation of the needed documentation

Putting together a full package of documents to be filed along with your application for a license. This will involve but not be limited to the following: comprehensive business plan, AML/CFT policy, ownership and management information, and a detailed description of the technical and security aspects of your platform. Preparation of high-quality and full documentation significantly increases the chances of success.

Application and Communication with FSA

Submit your licence application with all required documents to the FSA. After the same has been submitted, be prepared for active engagement with the regulator through responding to other enquiries, interviews, and all other follow-up information that might be requested.

Opening of corporate bank accounts

After licensure, the next step will be opening corporate bank accounts for the cryptocurrency trading platform. Choosing crypto-friendly banks and presenting a full package of corporate documents are going to be the main keys to completion of this step.

Starting operation

With license in hand, bank accounts opened, you can now start operations. Needless to say, for the continued success of your cryptocurrency business in Seychelles, it is necessary that one continues inertia with full compliance with all regulatory requirements and maintains the highest operational standards.

Obtaining a license for cryptocurrency trading in Seychelles opens entrepreneurs to quite a promising and dynamic market. Thus, following all the steps above and not disregarding the need for your careful preparation, you will manage to successfully register your crypto trading platform and begin your activities in the international arena.

How to get a crypto license in Seychelles?

Seychelles is a jurisdiction of choice to start a cryptocurrency business because of its progressive regulatory policy, which is open to financial technology innovation. Understanding how to acquire a Seychelles cryptocurrency license is thus all-important for any successful entry into this fast-growing sector. The following is the process one must go through in order to achieve this:

| Step | Details |

|---|---|

| Study of the Regulatory Environment | Understand the regulatory framework of the Seychelles FSA. Familiarize yourself with current laws, guidelines, and compliance requirements for cryptocurrency activities to ensure your business is fully aligned with regulations. |

| Determining License Type | Identify the type of license that fits your business model, such as for exchanges, custodial services, or other cryptocurrency operations. Ensure you understand all specific requirements for the chosen license type. |

| Preparation of Business Plan and Documentation | Draft a comprehensive business plan detailing the business model, management, operations, and security protocols. Prepare all required legal documents, AML/CFT policies, and information about the management team. |

| Application to the FSA | Submit your complete license application to the FSA, ensuring that it includes all required documents and meets FSA guidelines. |

| Engagement with FSA and Follow-up Requests | After submission, the FSA may request additional information or clarifications. Promptly responding to these requests helps expedite the licensing process. |

| Licensing and Commencing Operations | Once the license is approved, you are authorized to begin operations. Maintain compliance with regulatory standards to support sustainable and secure business growth. |

Obtaining a cryptocurrency license in Seychelles requires the utmost care in planning, preparation, and a strategic approach. The following steps will help the entrepreneurs launch and grow their cryptocurrency business in this jurisdiction by paying attention to each stage for maximum utilization of the opportunities available.

Seychelles – main information

Seychelles is an archipelago and island country in the Indian Ocean with known spectacle scenery, luxurious beaches, and rich cultural heritage.

| Parameter | Information |

| The five biggest cities | 1. Victoria

2. Anse Royale 3. Bovalon 4. Anse Boileau 5. Cascade |

| State language | English, French, Seychellois Creole. |

| Time zone | Seychelles is in the UTC+4 time zone. |

| Calling code | +248 |

| Domain zone | .sc |

Notes:

- Cities: In the strict, fullest definition of the term, Seychelles does not have an official claim to any “cities.” Aside from Victoria, classed as both the only city and capital, other settlements are similar to towns or communes.

- Official Language: The main reasons for the three official languages that Seychelles has – English, French, and Seychellois Creole – reflect historical influence and cultural diversity associated with the archipelago.

- Time zone: Seychelles uses one zone for the whole archipelago and does not change, considering summer or winter time.

- Calling code and domain zone: The calling code of Seychelles and the top-level national domain show how special this island country is.

Advantages of Seychelles crypto license

This has made Seychelles one of the most attractive jurisdictions for crypto businesses, which allows corporations to pursue manifold benefits and advantages in this line of work. Recognition by the world financial community and strategic regulation have created very good conditions for developing projects in the field of cryptocurrency.

Regulatory clarity and support for innovation

The Seychelles offers clear regulations and a stable legal environment regarding cryptocurrency transactions. The Seychelles FSA is working tirelessly to give credence to clear rules and regulations that support innovation while providing investor protection. In this respect, the jurisdiction should attract more entrepreneurs seeking a reliable platform for locating their cryptocurrency projects.

Favorable taxation

One of the biggest advantages Seychelles can boast about is its tax policy. Due to its status as an IBC, companies holding a cryptocurrency license will be exempt from local taxes payable on profits, capital gains, and dividends, making Seychelles a highly sought-after jurisdiction for international cryptocurrency businesses from a tax efficiency standpoint.

International recognition

Obtaining a cryptocurrency license in Seychelles enhances the reputation of your company on an international level. This goes beyond instilling confidence in customers and partners, also easing the process of opening bank accounts and cooperating with international financial institutions.

Attracting global markets

A license in Seychelles is a key to international markets. Firms holding this license can conduct business globally and serve customers worldwide. This is particularly valuable for cryptocurrency exchanges and other platforms aiming to expand their user base and trading volume.

Speed and efficiency of the procedure for obtaining a license

Unlike other jurisdictions, in Seychelles, the entire process concerning a cryptocurrency license can be quite effective and fast. If a company is well-prepared and adheres to all norms, it can obtain a license quickly and begin operations with minimal delay.

Obtaining a cryptocurrency license in Seychelles has several advantages, indicating potential growth for entrepreneurs in the digital asset space. From regulatory support and tax incentives to international recognition and access to global markets, these features position Seychelles as an ideal platform to grow and build a cryptocurrency business. In that respect, the licensing process should be approached with due care to fully capitalize on the opportunities available.

The Benefits of a Crypto License in Seychelles

Seychelles, with its supportive legislation and openness to innovation, has emerged as a leading center for cryptocurrency businesses. A Seychelles cryptocurrency license opens doors to numerous strategic opportunities, significantly contributing to business growth and scalability on a global scale.

- Regulatory support and stability: Seychelles has established clear and transparent regulations for crypto companies. The regulated activities allow a company to operate in a legally stable environment, minimizing the risk of unexpected regulatory changes. This facilitates long-term planning and development.

- Improving trust and reputation: Moreover, regulated activities foster trust and reputation, making a Seychelles license a crucial marker of credibility and transparency to customers, partners, and regulators. It enhances a business’s credibility, broadening access to banking and financial services and enhancing international reputation.

- Access to international markets: With a Seychelles license, cryptocurrency companies can more easily expand beyond national borders and attract customers and investors worldwide. This opportunity for growth and scaling helps companies become truly global.

- Tax benefits: A key advantage for cryptocurrency businesses in Seychelles is tax efficiency. Leveraging incentives like reduced or zero corporate tax rates minimizes the tax burden, especially for international businesses engaged in cryptocurrency operations.

- An investment magnet: Licensed cryptocurrency activity in Seychelles can attract investors seeking reliable and regulated channels for investment. This will bring in much-needed capital and funding for expansion and innovation.

- Operational efficiency: A cryptocurrency license in Seychelles simplifies establishing business relationships with banks, payment systems, and other financial institutions, facilitating smoother operational processes and enhancing overall efficiency.

Acquiring a cryptocurrency license in Seychelles offers numerous strategic benefits, including regulatory support, tax incentives, enhanced reputation, and international market access. These advantages provide a competitive edge in the fast-evolving cryptocurrency industry.

Overview of Crypto-Regulation in Seychelles

The Seychelles have emerged as one of the essential international centers for cryptocurrency business, owing to their strategic approach toward the regulation of digital assets. It combines flexibility and clarity in such a way that creates a stimulating environment for innovation and growth of the cryptocurrency industry. The article will provide a holistic overview of Seychelles regulations on Cryptocurrencies, discussing its key features and ways in which it offers a conducive environment to businesses in this sector.

The Regulatory Body and the Legislative Framework

The central figure in the regulation of cryptocurrencies in Seychelles is the Financial Services Authority of Seychelles, which has the powers to license, supervise and regulate activities within the jurisdiction involving cryptocurrencies. The FSA operates under several pieces of legislation including the International Business Companies Act and the Securities Act, which provide the legal framework for conducting transactions in cryptocurrencies and related financial instruments.

Licensing of Cryptocurrency Activities

One of the most salient features of Seychelles’ cryptocurrency regulation is the issuance of licenses for those dealing in cryptocurrencies, any form of cryptocurrency exchange, and other forms of crypto-related activities. The licensing process requires companies to demonstrate the competency to meet high standards in AML/CFT, cybersecurity, and consumer protection.

Conformity with International Standards

Seychelles is very active in cooperation with international organizations and adherence to international standards that regulate virtual currencies. This means signing commitments to adhere to the FATF recommendations and other initiatives at an international level concerning digital asset regulation. This ensures Seychelles’ high level of trust and legitimacy in conducting cryptocurrency transactions internationally.

Tax Policy

Local cryptocurrency companies enjoy favorable tax conditions: the so-called International Business Companies are even exempt from income tax. Thus, Seychelles is an appealing jurisdiction for international cryptocurrency transactions.

Investor Protection and Transparency

Regulation in Seychelles also seeks to protect investors by imposing obligations of transparency and fair dealing. Virtual currency platforms must provide clear terms of use, risks, and recourse procedures, creating a safe and secure marketplace.

In Seychelles, the regulatory balance allows for innovation and growth while maintaining a high degree of investor protection and adherence to international standards. This regulatory framework offers an excellent environment for cryptocurrency companies looking for a strategic platform for scaling up their business internationally.

Types of Applications for Crypto License in Seychelles

Today, Seychelles has become one of the most progressive jurisdictions, particularly with the rapid development of digital finance. Obtaining the relevant license is critical for launching and operating cryptocurrency platforms, and it all starts with the application process. Below is an overview of the different types of applications, each aligned with various operating models for cryptocurrency businesses:

| License Type | Description |

|---|---|

| Cryptocurrency Exchange License | This license is for organizations wishing to provide cryptocurrency exchange services, enabling users to buy, sell, and trade digital currencies. It ensures competence in managing technical systems, safeguarding assets, and complying with regulations. |

| License to Conduct an ICO | Required for companies fundraising through an Initial Coin Offering (ICO). The application must include a detailed description of the project, business model, risks, and plans for fund distribution. |

| License for Custodial Services | This license applies to firms offering custodial services for third-party crypto assets, requiring companies to demonstrate high-level security and protection for customer assets. |

| License for Payment Services Using Cryptocurrencies | For companies processing cryptocurrency-based payments or offering payment solutions. The application must include payment infrastructure details, anti-money laundering measures, and transaction security. |

| Comprehensive License | A comprehensive license covers multiple services mentioned above under one regulatory framework, suitable for companies involved in a variety of cryptocurrency activities. |

Understanding the requirements for each license type is crucial for obtaining a cryptocurrency license in Seychelles. Proper preparation and knowledge of regulatory expectations simplify the licensing process. With a detailed plan, entrepreneurs can leverage the favorable digital finance environment in Seychelles to explore new opportunities in innovation and growth.

How to Obtain a Crypto License in Seychelles

Seychelles is one of the most progressive countries for fintech regulation, making it an attractive jurisdiction for cryptocurrency businesses. A cryptocurrency license issued in Seychelles opens international markets and allows businesses to operate transparently in a well-regulated environment. The following are major steps to obtaining a cryptocurrency license in Seychelles:

In-depth Analysis of the Regulatory Environment

The first step is to understand Seychelles’ regulatory environment. The Financial Services Authority (FSA) oversees virtual currency transactions, and entrepreneurs must understand its legislation, including licensing, AML/CFT policies, and consumer protection measures.

Determination of License Requirements

Depending on the business type, such as cryptocurrency exchange or custodial services, relevant license requirements will differ. Each license type has prerequisites related to corporate structure, minimum capital, and security policies.

Preparation and Submission of Documentation

Once license requirements are defined, the next step is preparing documentation, including a business plan, AML/CFT compliance proof, legal documents, and ownership information. All documents must meet the FSA’s standards.

Application to FSA

With a complete documentation set, apply to the FSA for a cryptocurrency license. The application must reflect the business’s full activity, and all documents must comply with regulatory standards.

Interaction with the FSA

After submitting an application, there may be interactions with the FSA, potentially involving additional information, meetings, or business plan adjustments per the FSA’s recommendations.

Licensing Approval and Commencement of Business

Once the FSA grants a license, the business can commence operations in Seychelles, assuming ongoing compliance with regulatory requirements.

Obtaining a cryptocurrency license in Seychelles requires careful planning and preparation. By understanding the requirements and applying a strategic approach, entrepreneurs can leverage this innovation-friendly jurisdiction to launch and scale their cryptocurrency businesses confidently.

Types of Crypto Licenses in Seychelles

Seychelles, with its transparent and supportive regulatory environment, is a leading center for cryptocurrency innovation. Obtaining the appropriate cryptocurrency license is essential for compliance and success in this jurisdiction. Here’s an outline of the main types of cryptocurrency licenses in Seychelles:

| License Type | Description |

|---|---|

| License for Operating a Cryptocurrency Exchange | This license is for companies operating an online trading platform where users can buy, sell, and exchange various cryptocurrencies. Applicants must comply with AML requirements and KYC procedures, provide a business plan, and demonstrate robust technological and security infrastructures. |

| Custodial Services License | Companies providing custodial services for crypto assets on behalf of clients need this license. It focuses on asset custody security, requiring firms to guarantee the protection and integrity of client funds. |

| ICO License | Required for companies planning to conduct an Initial Coin Offering (ICO) to raise funds. The application includes comprehensive project disclosures, risk assessments, team information, and plans for the use of raised funds. |

| License for Payment Services | This license is required for companies offering payment solutions and processing cryptocurrency transactions. The focus is on ensuring payment reliability and maintaining data security for users. |

| Comprehensive License | Businesses involved in multiple cryptocurrency-related activities can apply for a comprehensive license, which covers a range of services under one regulatory framework. |

Obtaining a Seychelles cryptocurrency license offers substantial business opportunities through lawful operations in an attractive fintech jurisdiction. Carefully preparing the required documentation can ensure a successful licensing process. Strategic planning in Seychelles helps expand a business into the global market.

Steps to start a crypto business in Seychelles

They can be initiated in Seychelles, subsequent to strategic planning, followed by adherence to regulatory requirements and integration of technology. This tiny island nation, with its progressive view on digital finances, forms fertile ground for entrepreneurs willing to plunge headfirst into this fast-growth area of cryptocurrencies.

| Criterion | Details |

|---|---|

| Detailed market study | Deep analysis of the cryptocurrency market in Seychelles, including demand assessment, customer segmentation, and competition analysis. Tools like SWOT analysis for positioning your business. |

| Develop a solid business plan | Creating a detailed business plan that includes a business model, value proposition, marketing strategies, operations plan, and financial projections. It should also identify how blockchain will be utilized in your crypto business. |

| Compliance with regulatory requirements | Complying with Seychelles’ laws on digital assets, including FSA registration and AML/KYC policies. Seek legal experts with experience in Seychelles’ cryptocurrency regulations for guidance. |

| Securing funding | Determining capital requirements and researching funding options, such as venture capital, angel investors, or crowdfunding platforms interested in crypto projects. |

| Opening bank accounts | Building relationships with crypto-friendly banks in Seychelles. It’s essential to find a bank that understands your crypto business model and supports secure transactions. |

| Passionate about the development of the technology stack | Choosing the right blockchain platform, designing or purchasing secure wallets for digital asset storage, and implementing strong security measures against cyber threats. You may need to develop or outsource to blockchain developers. |

| Launch marketing and branding | A marketing strategy to increase brand awareness and attract customers. The strategy should include digital marketing, social media engagement, content marketing, and working with cryptocurrency influencers. |

| Continuous compliance and innovation | Adapting to changes in the cryptocurrency regulatory landscape. Keeping up with new regulations and maintaining compliance procedures, while innovating to meet market and technological advancements. |

| Networking and cooperation | Engaging with the global and Seychelles crypto community. Networking with other crypto businesses, attending blockchain events, and building strategic partnerships to enhance your business reputation and open up further opportunities. |

| Customer service orientation | Providing exceptional customer service as a differentiator in the crypto industry. Implementing a responsive support system for addressing customer queries, feedback, and technical issues promptly to build trust and loyalty. |

Setting up a crypto business in Seychelles is a very popular venture that requires the junction of technological innovation with strategic business planning. By closely adhering to the aforementioned steps and adjusting to the dynamism of cryptocurrency markets, entrepreneurs will be well-placed to make their mark on this exciting industry. Let me reiterate: succeeding in the crypto business is not about the launch but sustainability through constant innovation, compliance with regulatory frameworks, and unmatched customer service.

Procedure for obtaining crypto license in Seychelles

Obtaining a crypto license is one of the most relevant procedures a business can undertake with the aim of legalizing its operation in Seychelles. Many entrepreneurs are lured by Seychelles because of its good regulatory environment and the prevalence of clear conditions for conducting a crypto business. In the article at hand, we will take a closer look at the procedure related to obtaining a crypto license in Seychelles, turning particular attention to the main steps and requirements.

Preparing study of the regulatory requirements

Before proceeding with the licensing process, it would be of essence to have an understanding of the legal and regulatory environment under which cryptocurrency activities are exercised in Seychelles. It is also needed to understand the recent changes in legislative requirements, as well as the licensing conditions, including the AML and KYC requirements.

Determining the licence type

Identifying what license is required for your business will be a second step. According to the nature, which may vary in cryptocurrency exchange, wallet provision among others such as Initial Coin Offering, and other such services of a cryptocurrency business in Seychelles, there might be different licenses. Each type of license has varying requirements and conditions.

Preparation of documentation

The licensing application involves the preparation and subsequent submission of documents. This usually involves preparation of the business plan, proof of compliance with AML/KYC requirements, information on owners and directors of the company, and proof of the company’s registered office in Seychelles. All documents need to be carefully checked for compliance with the local requirements.

Registration of a legal entity

For a cryptocurrency license, there has to be a registration of a company in Seychelles. The registration itself involves choosing the legal form of the company, filing the incorporation documents, and payment of the government fee. It is highly advised to seek the services of a local legal agent to facilitate the process.

Filing an application for a license

When the documents are ready and the company is registered, a license application needs to be filled out and submitted to the relevant regulatory body of Seychelles-the FSA. The application should be fully complemented with all the documents and proof of due compliance with the requirements by the regulators.

Verification process

Once the application goes through, the FSA will begin to vet an applicant against regulatory and legal requirements. This may include additional requests for information, interviews with management, and checking of the business model for its sustainability and compliance with AML/KYC standards.

Obtaining a licence

Following the inspection, if the decision is positive, the regulator will issue a license to carry out cryptocurrency activities. Note that the license can be issued with certain conditions and specifications that the licensee should agree to for transparency and security of the operation.

Compliance maintenance

Obtaining the license is not a point but a continuum, since the company would have to continue observing the regulatory requirements of periodic reporting and transaction monitoring. Similarly, policies and procedures ought to be reviewed from time to time to reflect changes in legislation as well as regulatory practice.

The Seychelles cryptocurrency license is issued in a very planned manner, keeping in mind all the minute details regarding the local regulatory requirements. If these steps are followed, then your cryptocurrency business will be legalized, and also it will have a strong foundation for its sustainable development and expansion in the international market.

How to obtain a crypto trading license in Seychelles

Obtaining a license for cryptocurrency trading in Seychelles is a very important and, at the same time, compulsory step toward undertaking legal cryptocurrency activity for companies in this island jurisdiction. Considering that the Seychelles have such an innovative regulatory environment and are open to innovation, the country offers great conditions to develop a cryptocurrency business-of any kind, including trading. Below is a step-by-step action plan on how to obtain a cryptocurrency trading license using business language.

| Step | Details |

|---|---|

| Inquiry into Regulatory Requirements | First, one needs to sufficiently develop a good understanding of the regulatory environment in Seychelles. This includes understanding current laws and regulations for cryptocurrency activity, as well as anti-money laundering (AML) and Know Your Customer (KYC) requirements. Consulting local legal professionals specializing in cryptocurrency regulation is recommended. |

| Choosing the License Type | Identify which class of license is most consistent with your business model. This could include a crypto exchange license, custodial service license, or another special license, each with its own set of requirements and conditions. |

| Preparation of Documents | Prepare a documentation package that includes your business plan, financial projections, AML/KYC compliance documentation, and information about company managers and business owners. Ensure all documents comply with local legal and regulatory requirements. |

| Registration of Company | Your company must be registered in Seychelles. Choose the legal type of company, file the incorporation documents, and pay the registration fees. When registering, specify that cryptocurrency trading is part of the business activities. |

| How to Apply for a License | Once your documentation package is prepared, apply for a license with the Seychelles Financial Services Authority (FSA) or another relevant body. Ensure that all documents are submitted in full and correctly. |

| Passing the Inspection | Your company and management will undergo a regulatory review. During this stage, the business plan and financial stability may be audited, particularly in relation to AML/KYC compliance. Be prepared to respond to any requests for further information or clarification. |

| Licensing | Once the review is completed and your application is approved, you will be granted a license to trade in cryptocurrency. This license gives you legal authority to conduct cryptocurrency-related activities in Seychelles under the specified terms and conditions. |

| Ongoing Compliance with Regulations | Obtaining the license is just the beginning. You must continue to perform internal audits, report as required, and update your policies in line with regulatory changes. Maintain transparent communication with the regulator to avoid any legal issues. |

Obtaining a license for cryptocurrency trading in Seychelles is a delicate task of preparation and understanding of the regulatory environment. If you follow the steps above and maintain high standards of your business, then you will be able to launch and grow your crypto project in Seychelles with benefits of this jurisdiction.

Taxation of Virtual Currency Companies in Seychelles

Taxation of the virtual currency firm in Seychelles is the most topical issue in regard to financial planning and management for a business in the jurisdiction. Seychelles attracts many firms of digital currencies with its congenial business climate – relatively lower burden of taxation and ease in company registration.

Basics of taxation in Seychelles

Seychelles is one such attractive location, offering, among many features, a nil corporate income tax rate on income derived outside that jurisdiction. This, therefore, makes Seychelles attractive for virtual currency trading companies desiring to minimize their respective tax burdens.

Taxation of income from virtual currencies

Generally speaking, Seychelles-registered virtual currency companies operating as IBCs are exempt from paying income tax on their profits sourced outside the country. At the same time, one should point out that such companies also have to fully comply with all reporting requirements as well as with AML/KYC rules and regulations.

VAT and other taxes

International business companies do not pay any corporate tax in Seychelles, but for goods and services sold or consumed within the country, the state may charge Value Added Tax. Currently, the VAT rate is 15 per cent. Virtual currency companies charging services to local residents or businesses must consider this while setting prices and when conducting their bookkeeping.

Reporting and compliance

Even though Seychelles companies are tax-exempt, they have to maintain accounting records and present annual accounts. This will help in bringing transparency into their financial transactions apart from helping the company come up to international standards. The companies operating in virtual currencies are advised to pay close attention to changes that might occur in tax legislation or international reporting requirements to avoid possible tax consequences.

Tax Liabilities Planning

It would, therefore, be appropriate to formulate a dedicated tax planning approach to maximize this advantage for virtual currency organizations based in Seychelles. In this respect, it will be fundamental to identify the most appropriate structure of the firm, determine jurisdictions where its constituent units are best incorporated and invested, and make use of available international treaties that eliminate double taxation of profits.

This makes Seychelles an attractive jurisdiction from the point of view of tax for entrepreneurs dealing with digital assets and international investors into virtual currency companies. A great deal of caution should be exercised in ensuring that there is sufficient planning and management of tax liabilities while at the same time observing all the requirements of regulations and reporting to make a viable and legitimate business in Seychelles.

Tax rates in Seychelles

Seychelles possesses an attractive tax regime for both local and foreign companies, particularly with respect to offshore business structures. The summary below describes the major tax rates applied to companies incorporated in Seychelles.

| Tax indicator | Tax rate for local companies | Tax rate for IBC* |

| Income tax | 25% | 0% |

| Tax on dividends | 0% | 0% |

| Value added tax (VAT) | 15% | Not applicable |

| Capital gains tax | No charge | No charge |

| Licence fee | Variable, depends on the type of business | $100 a year |

| Personal income tax (wages and salaries) | Up to 15 per cent | Not applicable |

Offshore Seychelles companies are the forms of IBCs, generally used by international business and investment, and also obtain some advantages in tax.

Strong points:

- Income tax: For a resident company, it is imposed on 25 percent income tax, while international business companies will get out of the ambit of income tax.

- VAT: Value Added Tax charged on all goods and services sold or provided in Seychelles at the rate of 15%.

- Licence fee: The annual licence fee paid by international business companies is normally $100.

- Taxation of dividends: No tax is payable on dividends either by the company paying the dividend or the person receiving it.

Seychelles continues to be an attractive jurisdiction to international enterprises with its offshore tax advantages combined with a simplified company registration process, but it also needs to adhere to international norms on transparency and sharing of tax information. In general, readers are advised to seek fresh information and guidance from tax specialists who can confirm that international norms and laws are being followed.

Crypto-tax in Seychelles

At the moment, taxation of cryptocurrency is one of the biggest issues in Seychelles for many digital asset entrepreneurs and investors. With its appealing policy concerning taxation and open-mindedness for innovations, Seychelles creates favorable conditions for the development of cryptocurrency business.

| Topic | Details |

|---|---|

| General Seychelles Tax Environment | Seychelles offers a favorable tax regime for International Business Companies (IBCs), where profits earned outside the country are not taxed. This makes it an attractive jurisdiction for cryptocurrency and blockchain companies. |

| Taxation of Cryptocurrency Companies | Cryptocurrency companies that are IBCs in Seychelles are not subject to corporate income tax, provided their income is generated outside Seychelles. However, compliance with regulatory requirements, such as AML and KYC policies, is mandatory. |

| Tax Liabilities | Although IBCs are not subject to income tax, other taxes may apply, such as Value Added Tax (VAT) on domestic transactions. In Seychelles, the VAT rate is 15%. |

| Reporting and Tax Compliance | IBC companies must adhere to specific reporting and governance requirements to maintain their tax status. This includes keeping current accounting records that must be filed with relevant regulatory authorities. |

| Tax Planning | Effective tax planning is crucial for cryptocurrency companies. This involves structuring the company and optimizing tax liabilities to ensure operational efficiency. Legal and tax advice should be sought to develop the best strategy. |

| International Co-operation | Seychelles participates in international tax and financial transparency cooperation. Companies must comply with international standards, which may include the exchange of tax information as part of efforts to combat tax evasion. |

Taxation in Seychelles offers multiple possibilities for optimization and expansion of a business related to digital assets. With a low tax burden and an appealing regulatory environment, Seychelles is an attractive jurisdiction for an international cryptocurrency project. At the same time, successful operations in Seychelles require careful planning and strict compliance with all the requirements of the tax and regulatory regimes.

Seychelles: How to Establish a Crypto Business in 2025 – A Step-by-Step Guide to Licensing

With its friendly regulatory regime, Seychelles has become one of the hotspots for crypto businesses on the world map and emerged as an attractive financial center. Below is a detailed review of the peculiarities of obtaining a strong crypto exchange license in Seychelles and a look into the regulatory framework, application process, and benefits accruable from this jurisdiction.

Regulatory Environment for Crypto Exchanges in Seychelles

The Financial Services Authority of Seychelles represents the competent body in terms of oversight and regulation relevant to the cryptocurrency sector. The Authority has implemented a regulatory framework that allows innovation, enabling the conduct of all crypto-related activities within a secure and compliant environment. This, in turn, makes such a regulatory background of paramount importance for the protection of investors and the integrity of the financial market.

Types of Crypto Licenses in Seychelles

Seychelles has different types of licenses for the wide range of needs that arise in the crypto industry:

| License Type | Details |

|---|---|

| Crypto Exchange License | Granted for the right to provide services for the exchange of cryptocurrency against any other cryptocurrency or fiat currency. |

| Crypto Broker License | Used by enterprises intermediating between crypto buyers and sellers. |

| Crypto Trading License | This license type is for companies that directly buy and sell digital assets. |

| VASP Crypto License | This license targets providers offering a broader range of services associated with virtual assets. |

Cryptocurrency License Application Process

The crypto licensing in Seychelles is issued through a very elaborate application process that involves very comprehensive business plans, proof of compliance with AML/CFT regulations, and evidence of stringent security measures for customer assets. The FSA scrutinizes every applicant to ensure that businesses comply with the high bar set for operating in the financial space.

Cost of Crypto Licensing in Seychelles

Its cost is competitive enough to attract many offshore businesses desiring reliability with some regulation. While the cost for acquiring a crypto exchange license might be high in Seychelles, the advantage that is derivable in the long term from operating a company in a place like Seychelles cancels out such costs. If one is into such business, it is worth considering.

Benefits of Acquiring a Crypto License in Seychelles

Obtaining a crypto license in Seychelles gives a substantial advantage; it opens access to fast-growing world markets and increases the confidence level among clients and investors. Furthermore, compliance with Seychelles’s regulatory standards will surely help companies lay a good foundation for their business to be viable and secure.

Complications That May Arise During the Licensing Process

The main challenges include adhering to strict regulatory requirements imposed by the FSA and navigating the competitive international crypto market. However, with proper strategic planning and compliance, such challenges can be well averted.

Market Opportunities in Seychelles

It is an excellent opportunity for Seychelles in this crypto world, as the government of Seychelles comes forward to assure full support and assistance for a successful digital asset industry. Potential for growth, combined with probable advantages like offering the cheapest crypto license in Seychelles, makes it an extremely attractive destination for both startups and established crypto enterprises.

While the crypto space is at a very nascent stage of development, the island nation of Seychelles is building a name for itself in the global market. Acquiring a Seychelles crypto exchange license provides an assurance of regulatory compliance while also offering a great chance for businesses to maximize potential opportunities in the relatively new cryptocurrency world market. It is definitely possible to sustain this lucrative business if the strategy is proper and if all regulatory compliances are followed.

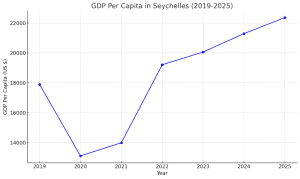

GDP per capita of Seychelles from 2019 to 2025

Seychelles crypto license 2025

In July 2025, the government of the Seychelles introduced a new bill aimed at enhancing regulatory control over the virtual asset sector. This move was in response to the increasing risks related to money laundering and terrorism financing associated with the rapidly developing digital asset industry.

The bill proposes the creation of a licensing system for organizations dealing with virtual assets, including conducting Initial Coin Offerings (ICO) and trading non-fungible tokens (NFT). These measures are aimed at increasing transparency of operations and strengthening consumer protection.

The bill places particular emphasis on expanding the powers of the Financial Services Authority (FSA), which will have enhanced abilities to conduct inspections, investigations, and take action against organizations violating established rules. This includes the ability to suspend or revoke licenses for virtual asset service providers.

The bill also contains provisions requiring the registration of ICO and NFT promoters, which will serve as an additional guarantee to protect investors from fraudulent schemes. The document emphasizes that any activities in the virtual asset sector without proper registration or licensing will be considered illegal.

Additionally, the bill provides for significant fines and criminal liability for violations of the law, highlighting the seriousness of the government’s intentions in regulating the digital market.

These changes are aimed at strengthening the legal framework and creating conditions for the safe and controlled development of the virtual asset market, ensuring protection for both market participants and ordinary consumers.

In conclusion, the adoption of this bill marks a new era in the regulation of digital assets in the Seychelles, establishing strict frameworks for virtual asset operations and providing the government with the necessary tools to combat financial crimes in this rapidly evolving sector.

In recent years, the global cryptocurrency and virtual asset market has seen significant fluctuations and changes driven by both technological progress and shifts in legislative frameworks. The Seychelles, aiming to maintain its position as a hub for financial innovations, has introduced new legislative initiatives to regulate virtual assets and related services.

Definition and Classification of Virtual Assets

According to the Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) law of 2020, a virtual asset is defined as a digital representation of value that can be traded or transferred and can be used for payments or investments. However, in the proposed Virtual Asset Service Providers (VASP) bill, this definition is expanded to cover a broad range of assets and exclusions.

Legislation

After a series of consultations and discussions, the Seychelles introduced the VASP bill, which regulates the activities of companies working with virtual assets. This law imposes strict licensing requirements, introduces AML/CFT obligations, establishes consumer protection measures, and sets cybersecurity standards.

Regulation and Supervision

The primary regulatory body responsible for licensing and overseeing virtual asset activities is the Seychelles Financial Services Authority (FSA). The FSA ensures compliance with AML/CFT requirements while maintaining the alignment of local operations with international best practices.

Fines and Sanctions

The VASP bill provides for severe penalties for violations of the law, including large monetary fines and long prison sentences. These measures underscore the Seychelles’ commitment to creating a transparent and secure environment for working with virtual assets.

Prospects and Benefits

The implementation of the VASP law opens new opportunities for business in the Seychelles by offering legal clarity and a stable regulatory environment. This attracts new investments and fosters the development of innovative financial technologies on the islands.

The Seychelles continues to strengthen its position as a leading center for financial innovation, adapting its legislation to the changing conditions of the global virtual asset market. The introduction of the VASP law is a significant step in supporting the legality, security, and innovation in the cryptocurrency and virtual asset sector.

After conducting a National Risk Assessment in 2021, which identified significant risks of money laundering and terrorism financing related to virtual assets, the Seychelles recognized the need to implement strict regulatory measures. The Financial Action Task Force (FATF) insists that jurisdictions actively assess and mitigate financial crime risks, especially those associated with new technologies, according to FATF Recommendation 15 on new technologies.

The introduced VASP bill in the Seychelles reflects the country’s commitment to effectively managing these risks. The VASP bill establishes a licensing system for certain virtual asset products and services, including wallet providers, exchanges, brokers, and investment providers. Such regulation ensures that only authorized entities can operate in the Seychelles, providing protection against unauthorized activities. Key licensing criteria include capital requirements, solvency, insurance, cybersecurity measures, prudential and market requirements, audit requirements, as well as the evaluation of the professional suitability and integrity of directors and senior officers.

To ensure transparency and accountability, the bill introduces specific requirements for the content that VASPs must comply with in order to provide their services in or from the Seychelles. ICO and NFT organizers must also register, ensuring transparency and accountability in these innovative financial sectors. The VASP bill prohibits the promotion or provision of virtual asset products and services without proper authorization, thereby preventing fraud and misuse. The operation of mining enterprises, mixers, tumblers, and validators is also prohibited.

To enhance oversight, the bill provides for increased monitoring through inspections and investigations for compliance, as well as actions against online VASPs claiming to be regulated in the Seychelles. To ensure adherence to high standards of integrity, special measures have been introduced to monitor and reduce risks related to AML/CFT and other financial crimes.

The Financial Services Authority (FSA) has been designated as the regulatory authority responsible for ensuring compliance with the VASP legislation. The FSA is authorized to conduct inspections and investigations into non-compliance, issue and revoke licenses, register ICO and NFT promoters, issue guidelines and directives for compliance, request information, and take enforcement actions.

An important aspect of the VASP bill is its focus on consumer protection and education. By raising awareness of fraud and the misuse of virtual assets, the VASP bill helps protect consumers from illegal activities. It prescribes adequate protection for victims of such activities and encourages responsible innovation and use of technology in the virtual asset space.

To ensure smooth integration, the VASP bill includes amendments to relevant laws such as the Anti-Money Laundering and Countering the Financing of Terrorism Act 2020, the Financial Services Authority Act 2013, the International Business Companies Act 2016, and the Financial Services Consumer Protection Act 2022. These amendments align existing laws with the new regulatory framework for virtual assets, improving overall regulatory coherence.

When the VASP bill comes into force, all entities providing virtual asset services must apply to the FSA for a license or authorization as a virtual asset promoter by December 31, 2025. Meanwhile, the entity may continue its business operations until its license application is approved or rejected, or until the registrar grants permission for the issuance of an ICO or NFT, and such a decision must be communicated to the applicant in writing by the FSA.

These steps reflect the Seychelles’ commitment to creating a secure, transparent, and innovative virtual asset ecosystem. The VASP bill not only addresses current financial crime risks but also lays the foundation for sustainable growth and consumer trust in the growing virtual asset sector, while supporting technological innovation with reliable regulatory oversight.

RUE customer support team

“Hi, if you are looking to start your project, or you still have some concerns, you can definitely reach out to me for comprehensive assistance. Contact me and let’s start your business venture.”

“Hello, I’m Sheyla, ready to help with your business ventures in Europe and beyond. Whether in international markets or exploring opportunities abroad, I offer guidance and support. Feel free to contact me!”

“Hello, my name is Diana and I specialise in assisting clients in many questions. Contact me and I will be able to provide you efficient support in your request.”

“Hello, my name is Polina. I will be happy to provide you with the necessary information to launch your project in the chosen jurisdiction – contact me for more information!”

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

Registration number: 08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00 Prague

Registration number: 304377400

Anno: 30.08.2016

Phone: +370 6949 5456

Email: [email protected]

Address: Lvovo g. 25 – 702, 7th floor, Vilnius,

09320, Lithuania

Sp. z o.o

Registration number: 38421992700000

Anno: 28.08.2019

Email: [email protected]

Address: Twarda 18, 15th floor, Warsaw, 00-824, Poland

Europe OÜ

Registration number: 14153440

Anno: 16.11.2016

Phone: +372 56 966 260

Email: [email protected]

Address: Laeva 2, Tallinn, 10111, Estonia