Crypto License in Gibraltar 2025

The crypto license, or DLT Provider’s license, is issued by the Gibraltar Financial Services Commission (GFSC), which is also responsible for overall supervision of crypto market participants. The very important purpose of the license is to comply with AML/CFT rules.

A number of organizations have been set up to support the development of crypto and other blockchain-based products and services that can be enjoyed by licensed crypto businesses. These include NTiE, the New Technologies in Education group set up by the government in partnership with the University of Gibraltar and a number of leading crypto businesses. The group will provide technology-related education, an element that may serve as a driving force behind any business orientated to innovation.

Gibraltar crypto license

|

PACKAGE «COMPANY & CRYPTO LICENSE IN Gibraltar» |

- Incorporating a Gibraltar company to operate the cryptocurrency exchange and to apply for the DLT Provider License.

- Registering the company with the Employment Service in Gibraltar. Opening vacancies for employees.

- Drawing up employment contracts and employee handbook.

- Review of commercial leases for business premises and other property-related work.

- Review of the business plan, suggestions for changes and improvements, and writing the legal and regulatory parts.

- Advising on financial projections and capital adequacy requirements.

- Drawing up corporate governance policy together with other associated policies.

- Drawing up risk management policy and risk register.

- Drawing up anti-financial crime policy.

- Drawing up anti-bribery and anti-corruption policy.

- Drawing up customer due diligence measures policy.

- Providing a risk assessment methodology.

- Drawing up data protection policy.

- Drawing up terms of use for customers of the exchange.

- Drawing up privacy and cookie policies.

- Assistance with the completion of the GFSC application forms (initial and full application).

- Accompanying the applicant to the presentation to be given to GFSC as a part of the application process.

- Assistance with opening a Gibraltar bank account.

| Legal Services for Crypto Projects | 1,500 EUR |

Crypto Legislation in Gibraltar

In 2018, Gibraltar was one of the first jurisdictions that tried to bring clarity into the governance of crypto activities when the national authorities enforced the Distributed Ledger Technology Framework-the DLT Framework-that contained licensing requirements for crypto and other blockchain-based businesses. Today, the country is further developing legislation toward the integrity of crypto businesses and the adoption of blockchain-based products and services.

One of the significant laws regulating the activity of DLT is the Financial Services Act. It has, until recent times, nine regulatory principles. It has now been extended by the 10th Regulatory Principle for Digital Ledger Technology aimed at avoiding insider trading and manipulation of price information. According to this principle, any DLT providers should conduct their economic activity in a way that will not damage the integrity of the market.

Under the Financial Services Act, license of a DLT Provider means a license granted under section 8 of this Act to carry out the controlled activity of providing distributed ledge technology services.

The following crypto activities are under the DLT Framework in Gibraltar:

- Exchange between Virtual Assets and Fiat Money

- Exchange between Virtual Assets

- Transfer of Virtual Assets

- Administration of Virtual Assets or Instruments allowing control of Virtual Assets

- Participation in and provision of financial services related to an issuer’s offer and/or sale of a virtual asset

Licensed crypto businesses must conduct their business in conformity with the following regulatory principles:

- Conduct their business with integrity and treat customers fairly

- Pay due regard to the interest and needs of each and all the customers and communicate with them in a way which is fair, clear and not misleading

- Maintain adequate financial and non-financial resources

- Undertake and manage its own business with a capability of carrying risk assessment and management and undertake it with due skill, care, and diligence.

- Make provision for effective schemes in the interest of the protection of customer assets and money in those particular circumstances where a crypto firm is responsible for customers’ assets and money.

- Have effective corporate governance arrangements in place.

- Ensure that all the systems and security access protocols are maintained to appropriate high standards.

- Having arrangements to prevent, detect and disclose the risk of financial crime in general, and money laundering and terrorist financing in particular.

- Having the ability to be resilient and to have contingency arrangements for orderly solvent winding up of the business

- Having arrangements to counteract insider trading and information and price manipulation

Although Gibraltar left the EU along with the UK, its AML regulations remain harmonised with the EU’s Fifth Anti-Money Laundering Directive (AMLD5) and Sixth Anti-Money Laundering Directive (AMLD6) which means that Gibraltar’s DLT businesses must comply with such requirements as proven competence of the senior management as well as implementation of KYC procedures and other internal policies designed to identify and mitigate risks related to customers and countries of operation.

At the national level, AML/CFT obligations are reflected in the Proceeds of Crime Act (POCA) and the Guidance Notes issued under POCA on Control Systems to prevent the use of the financial system for money laundering, terrorist financing and other financial crimes.

Advantages

Cryptocurrency regulation at national level from 2018

All cryptocurrency transactions are regulated by EU law

Flexible and beneficial taxation system

Credit opportunities for crypto start-ups

Crypto Licensing Process in Gibraltar

The crypto licensing process in Gibraltar is well-regulated, transparent, and smooth but may be costly, as the state duty varies from 11,800 to 35,000 EUR, depending on the type of licensable activities. A quality application is processed in about three months.

The following steps are included in the application process:

- Pre-application engagement

- Initial application assessment

- Full application and presentation

Pre-Application Engagement

During the pre-application engagement phase, a crypto company is invited to contact the GFSC. For example, at the very least, applicants are supposed to contact GFSC’s Risk and Innovation department about their application proposal and discuss their business model and the type of proposed economic activities. In such consultations, it can further be confirmed by the authority if activities performed fall within the scope of the DLT Framework. Only those firms that actually use DLT to transmit or store value belonging to someone else should proceed with the second step in the application process.

Pre-Assessment of Application

At this stage, the applicant must submit to GFSC an initial application assessment request, including a non-refundable application assessment fee of 2,000 GBP, or approximately 2,347 EUR, along with the relevant documents. This is usually the period when GFSC makes an assessment of the complexity in terms of the products or services proposed and the business model, and also identifies the potential risks.

In a period of two weeks, the Risk and Innovation team provides an initial assessment and categorizes the applicant in line with inherent risks and the complexity of the proposed business model and activities.

In assessing the inherent risk and complexity of any proposed business model and activities, regard will be had to:

- The manner in which the company intends to make use of the distributed ledger technology

- The use of smart contracts and all the pertaining complexities

- Whether the firm intends to hold or control customer investments

- The type of customers that the firm is likely to deal with, e.g. retail, sophisticated or professional investors

- Volume and complexity of products and services offered

- The extent to which there will be cross-border contacts with other regulatory regimes when providing other investment services and activities

- Investment-related risk and complexity issues, if the firm intends to provide investment services or activities

- Outsourcing of activities to third-party operatives and the materiality of such activities

- The complexity of the organisation’s structure

- The extent of the intended activities

- Susceptibility of the business to money laundering and financing of terrorism

- Whether the business model and its products or services have already been used successfully

Upon preliminary review of such an application, the applicant is given a notice of initial assessment that includes certain steps the applicant must comply with before making an application for the license of a DLT Provider. This typically will include a list of required documents and the payment of a full application fee as prescribed. At this stage, an expected annual fee is also told to the applicant. Upon the satisfaction of the requirements of this notice, the company is in a position to apply for the DLT Provider’s license.

Any material changes to an applicant’s business model will be required to be pre-approved by the GFSC, who will also consider whether the complexity categorization of the company should be changed.

Full application and presentation

A full application must include information about the competence of the founders and directors, a business plan, financial projections and evidence of compliance with the applicable regulations.

Each founder and director of the company must supply the following documents:

Notarised copy of an identity document

Notarised copy of proof of residence (e.g. utility bills)

Certified bank statement

Two professional letters of recommendation

Confirmation of source of funds

Notarised proof of the absence of criminal record

CV that includes previous places of work

Notarised copies of diplomas of education

It is a fixed initial application fee, and the full application fee depends on the business complexity and the category of the DLT Provider assigned during the initial application stage.

The following are the fees:

- Complexity Category 1: 10,000 GBP (approximately 11,600 EUR)

- Complexity Category 2: 20,000 GBP (approximately 23,200 EUR)

- Complexity Category 3: 30,000 GBP (approximately 34,800 EUR)

Once an applicant has submitted a full application and paid the relevant fees, he or she will be invited to give a presentation to the GFSC. Any particular elements that the presentation should cover, deriving from the nature and complexity of the proposed business, are advised at the time of consideration of an initial application.

Typically, this should address the following:

- Overview of the senior management, including relevant skills and experience to operate the business

- Business plan, including structure of the company, products and services, target market, strategy, etc.

- Financial projections

- Evidence of company’s capability to meet the regulatory principles

It is presented to the Risk and Innovation team, as well as people from the Panel of Experts and other GFSC decision makers. The purpose of this is to reduce the time it takes to understand the nature of the business, assess the company’s compliance with the regulations, and consequently speed up the application process.

The license of a DLT Provider can be granted by the authority only on sufficient proof being provided by an applicant that they will comply with the regulatory principles. The authority has to justify its decision by communicating guidelines on how to apply the principles of regulation and criteria considered to determine if the applicant is capable of complying with those principles.

A fully licensed DLT Service provider will also have to pay the stipulated annual fees, depending on business complexity and inherent risks. Such a company shall also always comply with the regulatory principles and shall notify the GFSC about internal changes or events that may affect compliance of the regulations.

Annual fees are as follows:

- Complexity Category 1: 10,000 GBP (approximately 11,600 EUR)

- Category 2 complexity: 20,000 GBP (approximately 23,200 EUR)

- Category 3 complexity: 30,000 GBP (approximately 34,800 EUR)

How to Open a Crypto Company in Gibraltar

To apply for the DLT Provider’s license, a company has to be incorporated in Gibraltar. One of the most common legal business structures is a Private Limited Liability Company, which may be set up within a week by one or more foreigners upon its registration with the Gibraltar Companies House. Statutory capital depends upon the contents of a business plan.

Required documents:

- Articles of Association

- A detailed business plan, including financial projections for the forthcoming period

- Proof of identity/passport or other of founders and directors

- Proof of residential address – bank statement or utility bills received within the last three months

- A power of attorney – if the company is set up remotely

Requirements for a Private Limited Liability Company willing to be involved in the activity related to DLT:

- Have at least one shareholder of any nationality and without any residence requirement

- Appoint at least one director who must have impeccable reputation and actively participate in the commercial activities of the company – no residence requirements

- Open a corporate bank account in a local bank

- At least hire two employees in Gibraltar – one of them must be a key staff member other than the director

- Company secretary

- Publish a business website

- Have an operating platform

- Must have a registered office in Gibraltar

If the documents are not in English, they need to be accompanied by a notarised translation. Should you need a certified translator, we’ll be more than happy to assist you.

Crypto regulation in Gibgaltar overview

| Period for consideration |

6 months | Annual fee for supervision | from €11,800 |

| State fee for application |

from 11,800 EUR | Local staff member | At least 2 |

| Required share capital | 24,000 EUR | Physical office | Required |

| Corporate income tax | 12.5% | Accounting audit | Required |

Crypto Tax in Gibraltar

In Gibraltar, no crypto-specific tax has been imposed, but all crypto companies are obliged to follow general principles of taxation, and in most cases, pay general taxes which are collected and administered by the Income Tax Office. The tax year runs from 1st of July to the 30th of June.

You will be pleased to know that neither capital gains, nor dividends, nor sales, nor gifts, nor wealth are taxed. VAT also doesn’t form any part of the taxation system of the country.

The following is a general list of taxes that are usually imposed on crypto companies:

- Corporation Tax (CT) — 12.5%

- Social Insurance (SI) — 20%

- Stamp Duty (SD) — 0-3% in respect of real estate or 10 GBP — about 12 EUR per share

The nature of economic activities and residence status on which the company is based will be relevant in determining the Gibraltar tax treatment. A company will be treated as a tax-resident in Gibraltar if it is managed and controlled, that is making corporate level decisions, from Gibraltar or from outside Gibraltar by persons who are permanent residents of Gibraltar.

The parent legislation that governs Corporation Tax is the Income Tax Act 2010, which provides that the tax is chargeable on profits that accrue in and arise in Gibraltar. This means that income-earning economic activities are considered for profiling under Corporation Tax only if these activities are principally undertaken in Gibraltar.

A Crypto company whose income derives from an underlying activity, which is subject to licensing under the DLT Framework or, even when licensed in another country, has availed of passporting rights into Gibraltar, will be considered a company whose profits derive from income accrued in and sourced in Gibraltar.

If one is not sure whether or not the crypto activities are chargeable for Corporation Tax, then the professional team of Regulated United Europe will be more than happy to provide a consultation tailored to one’s particular case.

Crypto businesses may qualify for the following capital allowances:

- A first year allowance for plant and machinery, of up to 60,000 GBP (approx. 69,600 EUR) of purchase or – in case of higher costs – 50% of expenditure in the period is fully deductible

- Computer equipment, of up to 100,000 GBP (approx. 116,000 EUR) of purchase or – in case of higher costs – 50% of the expenditure in the period is fully deductible

- A pool allowance of 25% annually on a reducing balance basis

Under the Social Security Insurance Act Amendment Of Contributions Order 2021, all crypto firms registered in Gibraltar must pay weekly Social Insurance contributions, regardless of where their staff are based, provided they are registered with the local Employment Service. The contributions are from 28 GBP (approximately 33 EUR) per week to a maximum of 50 GBP (approximately 58 EUR) per week.

Exemption from the Social Insurance is available under the following conditions:

- When the employee is also employed elsewhere in Gibraltar and their contributions are fully paid by another employer;

- When the employee holds a valid A1 certificate issued by another EEA country where their contributions are paid.

For example, the credit for a start-up that has up to 20 employees may get up to 100 GBP (approximately 116 EUR) per employee for the first year in relation to the Social Insurance. This credit may also be claimed by small businesses with a total of up to ten employees.

Another aspect of support for new businesses is the employment incentive, in which an additional deduction will be given based on 50% of the fixed salary cost for new employees joining from 1 July 2021. Employee incentives such as bonuses, overtime, and various allowances are not included in this scheme.

Expenditure incurred by employees on training to obtain a qualification relevant to the job is deductible as an expense against the profits of an undertaking at a rate of 150%.

Stamp Duty is payable on the transfer or sale of any immovable property situated in Gibraltar or shares in a company owning real estate situated in Gibraltar on an amount based upon the market value of the property.

The rates of Stamp Duty vary in accordance with the property’s value. Here is the main breakdown in this regard:

- If the value of the property does not exceed 200,000 GBP (approx. 235,000 EUR) – 0%

- If the value of the property exceeds 200,000 GBP (approx. 235,000 EUR) but does not exceed 350,000 GBP (approx. 411,700 EUR) – 2% on the first 250,000 GBP (approx. 294,000 EUR) and 5.5% on the balance

- If the property is valued more than 350,000 GBP (approx. 411,700 EUR) – 3% on the first 350,000 GBP (approx. 411,700 EUR) and 3.5% on the balance

Currently, Gibraltar has only one international agreement on the elimination of double taxation which is signed with the UK. On the other hand, crypto companies can avail themselves of tax relief available to those liable to pay Corporation Tax under the Income Tax Act 2010 but who can satisfy the Income Tax Office that they have paid or are liable to pay income taxes in any other jurisdiction on the same profits or gains.

It has also signed a number of tax information exchange agreements to date, so as to allow for the possibility of putting into place the principle of transparency in cross-border taxation; its model was developed by the Organisation for Economic Cooperation and Development.

Reporting and Auditing Requirements

According to the Income Tax Act, companies with annual gross income of 1,25 mill. GBP (approx. 1,45 mill. EUR) or more are required to file their tax returns along with audited accounts. If the annual gross income is less than 1,25 mill. GBP (approx. 1,45 mill. EUR), the returns must be submitted along with accounts accompanied by an independent accountant’s report.

Small companies don’t require auditing. A company qualifies as a small company if two of the following amounts aren’t exceeded:

- Annual turnover – 10,2 mill. GBP (approx. 11,8 mill. EUR)

- Total assets – 5,1 mill. GBP (approx. 5,9 mill. EUR)

- Average number of employees – 50

If you intend to run your crypto business in Gibraltar, highly qualified and experienced consultants of Regulated United Europe (RUE) will be delighted to assist you. We very well understand and closely monitor crypto-related legislation in Gibraltar and thus can guide you through the process of establishing a company and obtaining a crypto license. Moreover, we’re more than happy to help you with financial accounting and reporting. Book a personalised consultation now to start your journey in one of the friendliest crypto jurisdictions.

Gibraltar

Capital |

Population |

Currency |

GDP |

| Gibraltar | 34,003 | GIP | £50,941 |

Embracing Regulation: How to Get a Crypto Exchange License in Gibraltar 2025

Gibraltar is globally renowned for creating an enabling regulatory environment for blockchain and cryptocurrency operations. It has turned out to be one of the most attractive jurisdictions because of its ability to provide companies with such an advanced legal framework. The following paper will closely look at obtaining a crypto exchange license in Gibraltar, considering the regulatory landscape, the process of application, and multiple advantages of acting within this well-regulated environment.

Crypto Exchanges: Gibraltar Regulatory Framework

The Gibraltar Financial Services Commission has implemented a robust framework for companies trading with DLT. As one of the most forward-thinking countries when it comes to crypto regulation, Gibraltar was one of the first to establish a bespoke DLT regulatory regime from which each type of crypto license, including those for trading and brokerage, has emerged.

Types of Crypto Licenses in Gibraltar

It comes in different licensing variants, which cater to the various requirements of the crypto world. Some of these are as follows:

- Gibraltar Crypto Exchange License: It helps a corporation to operate any kind of platform where trading of cryptocurrency against fiat is enabled.

- Gibraltar Crypto Broker License: The license allows a company to act as a broker in crypto trades.

- Gibraltar Crypto Trading License: This license is for those particular companies that are actually trading in virtual or digital assets.

- VASP crypto license in Gibraltar: For Virtual Asset Service Providers dealing in a wider range of services.

Application Process for Crypto License

The application process in Gibraltar is highly detailed, with the intention of ensuring that all businesses maintain the highest possible levels of security and transparency. Applicants will be required to demonstrate not just financial stability but also to implement robust governance structures, risk management systems, and customer protection.

Crypto Licensing Costs in Gibraltar

The cost for the crypto exchange license in Gibraltar is competitive, highlighting the commitment of the jurisdiction to hosting a successful digital financial market. An applicant should be prepared to meet the direct licensing cost as well as continuous compliance costs.

Advantages of Getting a Crypto License in Gibraltar

Operating with a crypto license in Gibraltar offers quite a number of benefits, such as extra credibility, offering entry to the largest growing global market, and making sure any kind of business is operating in a country with regulation standards met at an international level. This may help foster global partnerships and gain customer trust.

Licensing Process Challenges

While friendly and supportive, the Gibraltar environment for crypto businesses requires firms to go through strict compliance checks during their setting up and operation standards. This will be very important in ensuring that regulatory changes are kept at bay, and adapting to global financial regulations in evolution.

Investment Opportunities in Gibraltar’s Crypto Market

Of course, Gibraltar is a place that’s good for investments, especially appealing with the cheapest crypto license in Gibraltar compared to all other European jurisdictions. The fiscal policy and strategic location of this territory also confer extra advantages on every crypto business in its desire to spread its operations across Europe and beyond.

Market Entry Strategies

A Crypto exchange license for sale in Gibraltar can be a lucrative shortcut to market for those in a hurry. It requires very careful due diligence, however, to ensure that the license will suit the strategic needs of the business and will also be fully compliant with the relevant regulatory requirements.

With Gibraltar continuing to set the pace in regulatory innovation, the ability to obtain a crypto exchange license in Gibraltar gives any business intent on leveraging some of the wide-ranging opportunities in crypto and blockchain markets a strategic differentiator. Conformity to the Gibraltar regulatory environment will equate to compliance, enhanced marketability, and lead positioning in the global digital economy.

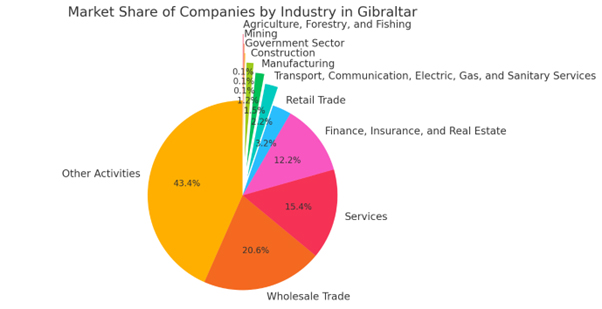

Market share in Gibraltar

Crypto License in Gibraltar 2025

Key aspects of regulating cryptocurrencies and VASP companies in Gibraltar:

- Government Attitudes and Definitions: The government in Gibraltar is very friendly and encouraging towards cryptocurrencies and blockchain technology. It actively works to develop a very friendly regulatory environment for all kinds of businesses with connections to cryptocurrency. An example could be the recent introduction of Financial Services Regulation known as Distributed Ledger Technology, or DLT, which made Gibraltar the very first jurisdiction that can boast a clear regulatory framework for companies operating in this area.

- Cryptocurrency Regulation: In the span of a few years, Gibraltar has become a player in the DLT industry and made a reputation for itself as a jurisdiction friendly toward blockchain technology. DLT regulations mean the regulation of companies storing/transmitting value on behalf of others, in other words, using blockchain for cryptocurrencies.

- Taxation: No capital gains tax, no value added tax, and no source tax in Gibraltar. Corporation tax is 12.5% of profit accrued or earned in Gibraltar.

- Remittances Laws and Anti-Money Laundering Requirements: Anti-money laundering directives have been added to Gibraltar law and apply to all relevant financial businesses, including DLT firms. Such firms are required to perform adequate customer due diligence and to pursue ongoing monitoring and risk assessment.

- Pre-licensing and Ownership Requirements: A company must be licensed by the GFSC under the DLT regulations, provided it is engaged in the business of providing a service related to the custody or transfer of digital assets belonging to another person.

The Gibraltar Financial Services Commission is very instrumental in ensuring the implementation of regulations concerning cryptocurrency companies. To this end, in 2017, Gibraltar became the first country in the world to enact specific legislation to regulate the business of firms operating in blockchain and distributed ledger technology. The rules were added to the Proceeds of Crime Act 2015, with the incoming of virtual assets transfer rules in 2021, which started on the 22nd of March 2021. This rule gave businesses in Gibraltar a period of 18 months before these new requirements were in full force on 22 September 2022.

Crypto-Asset Regulation: The GFSC keeps a register of financial businesses that derive income or capital gains from selling tokenised assets or trading in virtual assets resulting from commercial activities. The principal legislative requirements for their activities are located in the Proceeds of Crime Act and related legislation 2021.

Gibraltar has also been able to extend a number of innovative solutions in the crypto-asset space, including:

- VASPs and VAAPs;

- DLT licences;

- Cryptocurrency asset-based funds.

Financial services in Gibraltar are subject to the control of the Financial Services Act 2019 and connected regulations constituting laws and regulations applicable to the financial markets, fiduciary services and securities registration. The mentioned Act defines ‘regulated activity’ as transactions which meet special criteria and are provided in frames of a relevant business process.

Any company conducting business in or outside Gibraltar from 1 January 2018, relying on the use of a DLT for the purposes of storing or transferring value, must obtain authorisation from the GFSC. This obviously does not cover activities already regulated under other legislation and such activities will thus remain subject to the existing regulatory framework.

MiCA en Gibraltar

The regulator in Gibraltar, despite Brexit and the country leaving the European Union, has remained peremptory to principles of international cryptocurrency regulation. While MiCA regulation—that is, the direct application of EU Cryptoasset Markets Regulation—does not apply in Gibraltar’s jurisdiction, the local regulator is actively trying to ensure that local regulations are comparable with the expected requirements by MiCA, especially for those companies who intend to or would want to operate within the EU.

Certain steps being taken by the Gibraltar regulator in order to ensure compliance or compatibility with MiCA include:

- Revision of Existing Legislation: The country of Gibraltar is actively adapting its laws and regulations to meet international standards in order to be compatible with MiCA. This includes licensing requirements, anti-money laundering measures, and Know Your Customer policies that need clarification.

- Co-operation with International Regulators: The regulator of Gibraltar proactively co-operates with other international bodies for the sharing of experience and best practices that relate to the regulation of cryptocurrencies.

- Technical Support and Consultancy: Gibraltar provides technical support and consultancy services to companies operating within and outside the EU to ensure their complete compliance with both local and prospective European regulation.

- Licensing-Twofold Approach: Many companies seize the opportunity to create a strategy operating in both Gibraltar and the EU because it allows them to best meet diverse requirements from regulators and penetrate more markets.

- Public Discussions and Legislative Updates: The regulator regularly holds public hearings and discussions in order to involve the respective feedback and suggestions from the very stakeholders, further developing the principle of flexibility and efficiency in the regulatory environment.

All these actions will provide an even more friendly climate for crypto-business and will raise the level of transparency and trust among both investors and users, which are essential for the stable and successful development of this industry within a global economy.

Gibraltar currently also regulates the cryptocurrency market to ensure a minimum compliance with relevant anti-money laundering and anti-terrorist financing laws, in addition to making licensing requirements for various cryptoasset activities. Sales of tokens, which are not securities, have to be registered as Virtual Asset Service Provider (VASP) with the GFSC. Similarly, any activity involving an exchange between virtual assets and money, as well as an exchange between different types of virtual assets, shall be duly registered with the GFSC. Similarly, any organization that stores or transfers crypto-assets belonging to customers needs to sign up and obtain a license with GFSC to use DLT. Depending on the terms of the loan agreement, borrowing and lending is also done in accordance with regulation and may be licensed, if the process involves the transfer of rights to assets. The yield and staking services may also be considered participation in a collective investment scheme or alternative investment fund and therefore require proper registration and adherence to GFSC regulations. The activities in relation to Proof-of-Stake consensus mechanisms may also be required to register if they involve the custody or management of crypto-assets of third parties and, therefore, fall under the regime of a DLT licence.

In the case of NFTs, they are not treated as ‘virtual assets’ in the proper sense of the word because of their unique nature and also not designed to serve as a means of payment. This is also the reason why many activities connected with NFTs, depending on their characteristics and purpose, will not be under the regulation of virtual asset standards. Such assessment has to be made on a case-by-case basis; some transactions involving non-fungible tokens should be duly registered or licensed. Professional legal advice would be highly recommended based on the requirement of each activity, to be perfectly in compliance.

One important way in which offshore companies are used in Gibraltar is to provide services to local clients, but there are various significant limitations upon how such activity needs to be structured so as to avoid legal liability under local legislation. The key requirement is that offshore companies must not carry on business ‘in or from Gibraltar’ pursuant to section 8(1) of the Financial Services Act.

The concept of ‘reverse solicitation’ in Gibraltar allows local customers to initiate contact on their own with offshore companies. That is, a Gibraltar client contacts, on its own initiative, an offshore company without the need for such an offshore company to actively promote its services within Gibraltar. Examples of such referrals would be where a client gains access to information about a company either through a website or recommendations from third parties unconnected to the offshore business.

It is crucial that the offshore business does not have a physical presence in Gibraltar, and does not visit Gibraltar to negotiate or enter into contracts. Any direct marketing to Gibraltar residents may be considered by the GFSC as constituting an effective economic connection with Gibraltar. This may mean, amongst others, that the activities of the offshore company will fall within the ambit of local regulation; this might then extend to include the application of the Financial Services Act and/or DLT provisions.

Against this background, offshore companies are strongly advised to exercise due care about their activities and avoid any practices likely to create an impression of active marketing or targeting of customers in Gibraltar, since such may imply regulatory interference and potential legal sanctions.

Setting up a cryptoasset business and obtaining the relevant licence in Gibraltar is a multi-step process, which is very time-consuming and requires a great amount of attention to detail. In January 2025, the GFSC introduced a staged application process that seeks to provide a more structured, understandable licensing process. In the first step, which takes as long as five months, the regulator reviews the applicant firm’s business model, major employees, and its capital needs. In contrast, the second and third steps each take only up to two months. The entire process, therefore, can take as long as nine months depending on the nature and complexity of the application and when sufficient information is available.

To begin with, the application fee costs £2,500. Besides this fee, other costs associated with legal and professional fees are also expected to be met by an applicant. The wide-ranging license categories cost between £10,000 and £30,000 plus VAT, depending on the complexity and the risk classification of the business under consideration by the GFSC. These include initial assessment fees and final fees upon licensure.

This makes Gibraltar an attractive place because it provides a very stable legal and tax environment for crypto businesses. Since 2018, the country had an extremely robust DLT regulatory framework. Additionally, the VASP registration system secures a high level of AML and KYC checks, which are necessary for interacting with traditional financial institutions. All of this creates a very favorable environment for the growth and development of cryptoasset businesses in Gibraltar.

“Renowned for its political stability, advantageous tax structure, and robust privacy laws, Gibraltar provides an ideal setting for business incorporation. Given my specialization in this area, I am well-equipped to assist. Please do not hesitate to contact us for additional information.”

FREQUENTLY ASKED QUESTIONS

Does Gibraltar grant a license for crypto activities?

Yes. In Gibraltar, a crypto licence is formally titles the Distributed Ledger Technology (DLT) licence. Following the application process and careful consideration, it is issued to crypto service providers by the Financial Services Commission.

How do I get a crypto license in Gibraltar?

All DLT licence holders in Gibraltar are regulated by the Gibraltar Financial Services Commission. To obtain the Distributed Ledger Technology (DLT) licence, crypto companies must complete the following steps first:

- Establish a company in Gibraltar

- Rent (or purchase) a locally based office space for business operations

- Hire local personnel

- Provide a report of services that the company intends to offer in the first few months

- Implement anti-money laundering policies

- Prove the absence of criminal records for all participants

- Draft and submit a detailed business plan

What are the activities of the crypto license in Gibraltar?

DLT licence holders are authorized to provide the following services:

- Exchange between virtual assets and fiat currencies;

- Exchange between one or more forms of virtual assets;

- Transfer of virtual assets;

- Safekeeping and/or administration of virtual assets or instruments enabling control over virtual assets;

- Participation in and provision of financial services related to an issuer’s offer and/or sale of a virtual asset.

How long does it take to get a license?

The application process itself (gathering information, filing reports etc.) is expected to last up to 3-4 months. Once the application is submitted, the evaluation phase may take 2-6 months. The complete amount of time required to obtain a DTL license is between 5 and 12 months.

Can non-residents of Gibraltar own a crypto company?

Yes. There are no residency or nationality requirements associated with the ownership of a crypto company in Gibraltar.

Can non-residents of Gibraltar be part of the board of a Gibraltar crypto company?

Yes. Crypto companies in Gibraltar must have at least one, but no more than 50 shareholders. They are not subject to any nationality or residency restrictions.

Is it necessary to have a banking account to obtain a license?

Yes. Opening a bank account is a necessary step for incorporating a company in Gibraltar.

What is the minimum authorized capital for a virtual currency service provider?

Minimum authorized capital depends on the type of company. Private Limited Liability Company (LLC) – 100 GBP (approx. 117 EUR). However, this number may change depending on the crypto business model. Public Limited Liability Company (PLC) – 20,500 GBP (approx. 24,000 EUR). However, this number may change depending on the crypto business model.

For how long is a crypto-license issued?

DTL licences in Gibraltar must be renewed on an annual basis.

Is it possible to deposit authorized capital in cryptocurrency?

No. Cryptocurrency is not seen as a legal tender in Gibraltar.

How is the charter capital of a crypto company paid in?

It must be deposited to the bank account of a crypto company.

What does a crypto company need to apply for a cryptographic license in Gibraltar?

In order to obtain a DTL license, crypto companies in Gibraltar must complete the following steps:

- Fill out ant prepare the application form

- Review and amend their white papers and other policy documents that must be submitted alongside the application form

- Open a bank account

- Apply for a DTL licence with the Gibraltar Financial Services Commission.

Why you should get a crypto license in Gibraltar?

Gibraltar is a leading jurisdiction for blockchain companies, setting an international example through a legal and regulatory regime that embraces the growth of blockchain technology.

From a technical point of view, it is also relatively easy to form a company in Gibraltar. Besides, the country allows full foreign ownership, inviting international companies and founders to position their business in the country.

As a third point, Gibraltar is a relatively low tax jurisdiction, applying a corporate income tax rate of 12,5% to companies who are registered there.

Are Gibraltar cryptocurrency companies audited?

Yes. DTL license holders in Gibraltar are subject to a mandatory annual audit.

Can the director of a crypto company be a non-resident of Gibraltar?

It depends on the type of legal entity that is decided upon incorporation. Whether the company must have a minimum of one or two directors, there is a formal requirement is have at least one director who is a local resident.

When are measures to prevent money-laundering and the financing of terrorism applied in Gibraltar?

These measures are generally applicable to companies in Gibraltar. Generally speaking, crypto companies are expected to observe the rules for market integrity.

What difficulties may arise in obtaining a crypto license in Gibraltar?

First of all the application process may be rather complex. The national regulator is known to be extremely thorough in their evaluation, which may extend the duration of the application process significantly.

Where can I open a bank account for a Gibraltar crypto company?

Every company in Gibraltar must open a corporate bank account with the Gibraltar Bank as part of the incorporation process.

Is cryptocurrency legal in Gibraltar?

Yes, cryptocurrency is legal in Gibraltar. Still, the jurisdiction of Gibraltar has implemented a very proactive and progressive approach toward the regulation of the crypto industry. On January 1, 2018, it had issued the DLT Framework that regulates the business of the firms operating in or from Gibraltar, using DLT for storing or transferring assets belonging to others. It also lays out a set of measures that will guarantee transparency, security, and adherence to the relevant regulations, hence making Gibraltar one of the top-ranked jurisdictions for crypto businesses.

Does Gibraltar have any AML regulations with respect to cryptocurrency transactions?

Yes, it does. For example, such rules have been embedded within the Distributed Ledger Framework that was put in place by Gibraltar itself. Among the nine fundamental principles in the framework, one insists that the DLT provider shall provide effective systems and controls for preventing, detecting, and disclosing financial crime risk, including money laundering and terrorist financing.

In this respect, the GFSC has prepared and issued detailed guidance to help DLT providers interpret and apply such principles correctly in practice. Such guidance is based on POCA provisions, which include guidance on how controls should be organized to prevent financial system abuse for money-laundering and terrorist financing purposes.

A DLT provider of Gibraltar will, therefore, have strict financial obligations for crime, which further cements the idea that the jurisdiction is committed to making sure a high level of safety and security is maintained within the crypto industry.

Who is the Regulator of Cryptocurrency in Gibraltar?

There are two major regulatory bodies in Gibraltar governing Cryptocurrencies. These are the following: the Gibraltar Financial Services Commission, GFSC, and Gibraltar Financial Intelligence Unit, GFIU.

GFSC regulates and supervises DLT activities like digital currencies. This body outlines the standards and directives that each crypto asset company should adhere to, so that transparency, safety, and compliance with regulations are ensured.

In return, GFIU also has an important role in the anti-money-laundering system. This organization analyzes and disseminates STRs provided by Virtual Asset Service Providers. The GFIU analyzes these reports and coordinates with other regulatory and law enforcement agencies if necessary.

In this respect, the GFSC and the GFIU, taken together, provide a literally all-encompassing oversight for the cryptocurrency industry in Gibraltar due to thorough risk control, which allows the industry to develop in a legally clean environment.

Are there licensing or registration requirements for VASPs in Gibraltar?

Yes, there is clarity in terms of licensing and registration for VASPs in Gibraltar, particularly those using distributed ledger technology (DLT). In Gibraltar, all firms operating DLT-related activities and providing cryptocurrency services are required to obtain a license from the GFSC.

Applications are made to the GFSC, where firms must be in a position to satisfy a number of regulatory requirements, including but not limited to AML measures, capital requirements, and risk management regarding client asset protection. Licensing involves not only a review of the business model and operational processes of an entity but also a review of the qualifications of key personnel.

Indeed, as of November 2024, only ten companies registered in Gibraltar are licensed for crypto services-a sure evidence that GFSC takes a very fine-grained, stringent approach to the regulation of this fast-changing industry and ensures there is a high level of transparency and safety in cryptocurrency transactions in Gibraltar.

Additional services for Gibraltar

RUE customer support team

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

OÜ

Registration number:

14153440

Anno: 16.11.2016

Phone: +372 56 966 260

Email: [email protected]

Address: Laeva 2, Tallinn, 10111, Estonia

UAB

Registration number: 304377400

Anno: 30.08.2016

Phone: +370 6949 5456

Email: [email protected]

Address: Lvovo g. 25 – 702, 7th floor, Vilnius, 09320, Lithuania

Registration number:

08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00, Prague

Sp. z o.o

Registration number: 38421992700000

Anno: 28.08.2019

Email: [email protected]

Address: Twarda 18, 15th floor, Warsaw, 00-824, Poland