Crypto License in El Salvador 2026

El Salvador has ushered in a new era in the global financial ecosystem by becoming the first country in the world to officially adopt bitcoin as legal tender. This move just underlines the El Salvador government’s ambition to play a leading role in the cryptocurrency industry by establishing an enabling environment for blockchain technology development and broadly for cryptocurrency transactions. In this article, we would like to raise several issues concerning key questions of obtaining a Cryptocurrency license in El Salvador, its benefits, and procedures.

Legal Basis

The Salvadoran government has developed an extensive legal and regulatory framework governing the use of cryptocurrencies, including bitcoin. The legal regime not only provided for the use of cryptocurrencies as means of payment but also introduced the requirements for cryptocurrency transactions, including AML/CFT measures and KYC-procedures.

Strong Points of Licensing in El Salvador

- Innovative legal environment: With the adoption of bitcoin as legal tender coupled with the creation of an appropriate regulatory framework, El Salvador is considered one of the most innovative countries when it comes to cryptocurrencies.

- Market access: The license allows business incorporation that enables activities within El Salvador’s borders, meaning companies can operate legally in El Salvador and access new markets and consumers.

- Financial incentives: El Salvador offers a host of incentives for crypto companies, including tax breaks and government support in providing infrastructure.

- International recognition: Getting a license in El Salvador enhances the prestige of the company globally, being on the front line in this respect of legalization of cryptocurrencies.

How to Obtain a License

Obtaining a cryptocurrency license in El Salvador involves some preparation and serious application with the intention of fulfilling all regulatory requirements:

| Step | Details |

|---|---|

| Preparation of Documentation | The company should be ready with a complete set of documents: a business plan, AML/CFT compliance documents, KYC policy, and confirmation of the legal registration of the company. |

| Application | The application for such a license should be submitted to a regulator in El Salvador and supported with all required documents. |

| Application Review | The regulator will review the submitted documentation to verify whether the company can follow the very requirements of the regulations. |

| Licensing | After successfully completing the steps required and the payment of the license fee, the license is issued to the company for it to conduct its operations officially in El Salvador. |

On its part, the adoption of bitcoin as a form of official means of payment in El Salvador has opened up opportunities for unique exposure for the companies developing and integrating cryptocurrency in the global financial system. Getting a cryptocurrency license in El Salvador means acquiring an innovative legal environment and, at the same time, showcasing a company fully committed to high standards of transparency and accountability. This sets up all the factors that make El Salvador stand out as an attractive jurisdiction for leading players in the cryptocurrency market who want to expand their presence globally, take part in creating the future of the digital economy, and enjoy an innovative legal environment.

Crypto company registration in El Salvador

The problem of registering a cryptocurrency company in El Salvador has become particularly relevant in the context of the official adoption of bitcoin as legal tender by this country—the first such case in history. Such progressiveness opened new horizons for entrepreneurs and investors in digital currencies. Further, in the article, we will review the main aspects and procedures of registering a cryptocurrency company in El Salvador.

Understanding the Legislative Framework

It means that, in the first place, before actually starting a registration procedure, it is necessary to perform a profound study of the El Salvador legislation concerning cryptocurrencies and blockchain technologies. In particular, it will be necessary to pay special attention to the so-called Bitcoin Law, as well as other regulative documents defining the legal status of cryptocurrency circulation in this country. It is recommended to use the services of a legal consultant specialised in the field of cryptocurrency legislation of El Salvador, which would provide consultancy and take all measures necessary for full compliance.

Selection of Legal Form of Company

The proper choice of the legal form is among the very important steps in the process of registration. In El Salvador, the most used forms for the cryptocurrency company are: Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L.) and Joint Stock Company – Sociedad Anónima – S.A.). All of these forms have their peculiarities, minimum authorized capital, and management structure that should be considered when making a decision.

Procedure for Registration

Registration of a cryptocurrency company in El Salvador involves several simple actions:

- Pre-coordinating and filing the documents of incorporation: First of all, it is required to prepare the statute as well as other documents of incorporation, reflecting the main points of activities, its legal address, information about founders and directors.

- Registration in the National Registry: When all the documents are ready, registration shall be made in the National Registry of El Salvador by filing the documents of incorporation and paying the respective government fees.

- Obtaining a Tax Identification Number (NIT): Every company, by law in El Salvador, should obtain the tax identification number for following up on the tax obligations and maintaining the records in that direction.

- Registration with the Ministry of Finance: In order to operate legally and pay all its taxes, a company has to be registered with the Ministry of Finance of the Republic of El Salvador.

Compliance with Regulatory and Tax Requirements

Once the company is incorporated, various regulatory and tax requirements must be followed under Salvadoran law. The most recurrent are maintaining accounting records, preparation and filing of periodic tax returns, and compliance with AML/CFT regulations.

In this regard, it is possible to claim that the registration of a cryptocurrency company in El Salvador allows entrepreneurs-innovators and investors to create their business in a relatively new and friendly environment for cryptocurrency. Along with this, huge attention should be paid to the process of registration for the ability of the firm to work fruitfully and long-term in the international digital asset market.

El Salvador

Capital |

Population |

Currency |

GDP |

| San Salvador | 9,282,410 | USD; since 2001 BTC; since September 2021 |

$11,717 |

Crypto Legislation of El Salvador

In June 2021, El Salvador became the first country in the world to officially declare bitcoin as legal tender. It drew the interest of the international business community and investors in cryptocurrencies into the country; it was, therefore, a new turn of events in the history of digital asset legislation. Below, we look at some of the salient points in the crypto legislation of El Salvador.

Bitcoin Law

The Bitcoin Law is the basic legal instrument that governs the use of cryptocurrencies in El Salvador. According to the Bitcoin Law, besides the U.S. dollar, bitcoin is a legal tender and thus legally authorizes conducting transactions in cryptocurrencies.

Strong Provision of the Bitcoin Law

- Legality of Bitcoin: This law recognizes bitcoin as a form of legal tender in El Salvador; therefore, any transaction can be performed with it like any other traditional currency.

- Forced acceptance: Any economic agent shall be forced to accept the Bitcoin form of payment for goods and services, where the technological infrastructure allows it for him/her.

- Exchange and Conversion: The Government of the Republic guarantees, through the creation of a special fund in its Administration, the possibility of immediate and automatic convertibility to US dollars.

Regulatory Infrastructure

El Salvador began establishing the necessary regulatory and technological framework to give effect to the Bitcoin Law and to allow its proper functioning. This includes the creation of special platforms for the exchange and storage of cryptocurrencies, as well as legislation with respect to the exchange of cryptocurrencies and their use as a means of payment.

Taxation

From a taxation perspective, in El Salvador, such a type of bitcoin transaction is VAT-exempt; therefore, the usage of the digital currency had been very attractive to local and foreign investors. Other aspects regarding the taxation of transactions in cryptocurrencies remain to be specified in further regulatory documents.

The Future of Cryptocurrency Legislation

The Salvadoran government said it wants to develop the legislative and infrastructural framework to support the sector of cryptocurrency further, through the creation of a full cryptocurrencies ecosystem, possibly even introducing some sort of regulation that protects investors and users of cryptocurrency services.

The Bitcoin Law passed in El Salvador, the ambition to become one of the leading countries in cryptocurrency regulation, presents new opportunities in the development of the digital economy and the attraction of international investments. Meanwhile, complete integration of cryptocurrencies into the country’s economy will require far-reaching work on building a regulatory, technological, and fiscal infrastructure that could ensure sustainable and secure use of digital assets.

Crypto Exchange License in El Salvador

Having a cryptocurrency exchange license obtained in El Salvador is, therefore, of vital importance for those businesses willing to legalize and extend their activity within the borders of this innovative cryptocurrency-intensive economy. Since adopting bitcoin as a legal form of tender, El Salvador has gained a certain status in the world, turning it into a focus for companies specializing in this form of currency from all over the globe. In this article, we’ll investigate, from a business perspective, how one goes about getting a license to operate a cryptocurrency exchange in El Salvador.

| Step | Details |

|---|---|

| Study of the Legislative Framework | The first step for possible operators of cryptocurrency exchanges is a deep understanding of Salvadoran cryptocurrency legislation. The Bitcoin Law and connected regulations set the legal framework for operating cryptocurrency exchanges, including licensing requirements, operations, and security regarding AML/CFT policies. |

| Choice of Legal Form of the Company | Determining the proper legal form of business is critical. In El Salvador, cryptocurrency exchanges could be registered as a limited liability company (S.R.L.) or Joint Stock Company (S.A.) depending on the structure and business needs. The type of legal form adopted will have an impact on the management structure, taxation, and obligations towards shareholders. |

| License Application | The licensing application is based on the preparation and filing of a suite of documents that prove compliance by the company with legal requirements of El Salvador. The main documents are: Constituent documents of the company; Evidence of capital requirements compliance; Business plan, including a risk model and measures that may be taken for risk minimization; AML/CFT Policies; Information on the key persons of the company – officers, shareholders, and others – and their qualifications. Customer data and funds should be highly protected in these exchanges; it should also include cybersecurity systems. This will involve the development of security policies, encryption systems, and periodic audits concerning security. |

| Tax Planning | Tax planning and the identification of the future tax obligations of the company in El Salvador is really a very important moment in the licensing process. Under the Bitcoin Law, there are certain exemptions, but apart from it, the company shall be obliged to comply with the national tax system—through possible income taxes and VAT. |

| Final Stages of Licensing | On receipt of all the required documents, the concerned regulatory authorities in El Salvador go through the application. A license is then issued for operating a cryptocurrency exchange—a green light to commence operations within the country. |

The license of a cryptocurrency exchange in El Salvador should be excellently planned in advance. It would require much knowledge in the field of local legislation and regulatory requirements. A license obtained may signal opening the gate to participating in one of the most innovative cryptocurrency markets in the world and offer an enormous potential for growth and development.

Crypto Trading License in El Salvador

Obtaining a cryptocurrency trading license in El Salvador is the pivotal point for companies willing to extend their digital asset businesses across borders within the country. The introduction of bitcoin as legal tender in the country underlines the commitment of El Salvador to innovation in the financial sphere and creates a good omen for the beginning of bitcoin market development. In this respect, let’s discuss the most interesting peculiarities of getting a crypto trading license in El Salvador.

Legislative Research

It is of the utmost importance to explore the current law of El Salvador about cryptocurrency and blockchain before filing an application for a license. More specifically, you will get acquainted with the Bitcoin Law and other regulatory acts that provide explanations of the conditions under which cryptocurrency activities should take place in this country. In this way, it will be easier for you to prepare a full set of documents and observe all the conditions so that you can obtain a license.

Choosing the Legal Form of the Business

Determining the legal form of a business is one of the most important aspects of the whole registration and licensing process. In El Salvador, several types of a legal entity can be opted for, such as S.R.L. or limited liability company and S.A., abbreviated for the joint stock company. It is recommended to base such a decision on the analysis of the business model of the company, its structure, and particular capital and management needs.

Business Planning

For the application for a license, an in-depth business plan has to be developed that contains the company’s objectives, strategy for development, market analysis, financial model, and measures of compliance that also include AML policy and procedures of KYC. The business plan should indicate the model for risk management and approaches from the company with respect to assurance in security and protection of customer data.

Application Submission Supported by Relevant Documents

For this, an application needs to be forwarded to the concerned regulatory authority in El Salvador with a complete set of incorporation documents attached, a business plan, proof of compliance with capital requirements, details of key employees and their qualifications, and documents proving the compliance with AML/KYC policies.

Operational Requirements Compliance

This is the very start of the crypto exchange’s activity in El Salvador, and it involves obtaining a license. A company should ensure complete compliance with regulatory requirements, including cybersecurity measures for customer information, AML/KYC compliance, and periodic reporting to regulators.

El Salvador’s cryptocurrency trading license issuance process requires much thought and great awareness of the local law and regulatory requirements in great detail. It gives it the opportunity to develop its activity within one of the most progressive cryptocurrency markets. To this respect, it is crucial to underline that besides having a license, it is highly important to maintain high operating standards, proper regulatory conformation, and security of assets and customer data at all times.

El Salvador – main information

| Parameter | Information |

| The five biggest cities | San Salvador (capital) Santa Ana San Miguel Mexicanos Soyapango |

| State language | Spanish |

| Time zone | Central Standard Time (CST), UTC-6 |

| Calling code | +503 |

| Domain zone | .sv |

How to Get a Crypto License in El Salvador?

After El Salvador adopted bitcoin as legal tender, receiving a licence for conducting cryptocurrency activity became an urgent task for many international and local entrepreneurs. This, on one hand, opened completely new horizons and possibilities of doing business; on the other hand, particular requirements and obligations have been established. In the article below, we’ll take a closer look at how to obtain a cryptocurrency licence in El Salvador from the business point of view.

After El Salvador adopted bitcoin as legal tender, receiving a licence for conducting cryptocurrency activity became an urgent task for many international and local entrepreneurs. This, on one hand, opened completely new horizons and possibilities of doing business; on the other hand, particular requirements and obligations have been established. In the article below, we’ll take a closer look at how to obtain a cryptocurrency licence in El Salvador from the business point of view.

Study the Legislation

The first basic step deepens the research into the Legislation of El Salvador regarding Cryptocurrencies. It is relevant to be aware of the Bitcoin Law, among others, that establish needs regarding cryptocurrency transactions, AML policies, and KYC, among others, when developing this type of business.

Legal Form of Business Selection

So, in order to obtain a license, it is necessary to first indicate what legal form the company will take. In this respect, in El Salvador, cryptocurrency companies can be registered both as limited liability companies and joint-stock companies. The very type of these depends on the scale of the business, planned management structure, and financial performance.

Preparation of documentation

The second phase will involve the preparation of all required documents for the submission of the license application. Typically, a package of documents should include:

- Constituent documents of the company;

- A business plan, which also includes the description of a business model, financial plan, and AML/KYC compliance strategy;

- Proof of adequate authorized capital;

- Information on the managers and owners of the business;

- Policies and procedures that guarantee transaction security and customer data protection.

Company registration

First of all, the very process of licensing is official incorporation of a company in El Salvador. It is based on filing of Articles of Incorporation with the relevant government authority, after paying applicable government fees and identification number as taxpayer.

Licence application

After the company was incorporated, and all relevant documents were prepared, an application for a cryptocurrency licence would be forwarded to the regulatory authority in El Salvador. The application and supporting documents have to be fully compliant.

Observance of requirements on the part of regulatory framework

Licensing means an initial stage of responsible activity in the crypto market. The company should strictly follow all regulatory requirements on auditing, reporting, and policy updates from time to time according to changes in the legislation.

Obtaining a license for cryptocurrency activity in El Salvador is a multi-step process that includes legislation study, extensive preparation, and strict compliance with regulatory requirements. The successful passage of this procedure opens access for a company to one of the most promising cryptocurrency markets, increases the confidence of clients and partners, and raises the prestige and competitiveness of the business in the international arena.

Advantages of El Salvador crypto license

Obtaining a cryptocurrency license in El Salvador gives several crucial advantages to enterprises that strengthen their position in the global market of digital assets. El Salvador became the first country that legally recognized bitcoin as legal tender and opened new opportunities for cryptocurrency business development and growth. In the present article, we will consider in detail the major advantages of a cryptocurrency license in El Salvador from a business perspective.

- Legislative support and legal clarity: Probably the most important advantage for those obtaining a cryptocurrency license in El Salvador would be the extensive legal support and clarity provided by the authorities on legislative issues with respect to the cryptocurrency industry. The Bitcoin Law and the regulatory framework laid out therein comprehensively establish rules and conditions whereby enterprises can work-legally and safely, which means more stability in business operations.

- Access to a Growing Market: Licensing in El Salvador opens access to the growing cryptocurrency market in Latin America; that gives a chance for companies to attract new customers and partners, extend their geography, and participate in innovative projects of the country.

- Tax incentives: This is due to the very favorable tax conditions that El Salvador can offer to cryptocurrency companies regarding VAT exemption on their transactions, and possibly corporate tax incentives. This means the business has higher financial efficiency, while its tax burden is optimized.

- Improvement of Business Reputation: A license obtained in the jurisdiction which officially recognizes cryptocurrencies makes a great difference to the international good standing of the company. That would reflect the commitment of the business towards high standards of regulation, transparency, and security of operations, building trust with clients and investors alike.

- International Attraction of Investments: A license from El Salvador will serve as a very big incentive, which attracts international investment to this country. The licensed companies of jurisdictions with a developed cryptocurrency ecosystem are usually welcomed by investors and partners, which greatly facilitates the search for project financing or the development of new ones.

- Innovation ecosystem: A license from El Salvador opens up active creation and support for the establishment of startups in an ecosystem of innovation in the realms of cryptocurrencies and blockchain, along with the elaboration of technologies. At the same time, licensed companies are given the right to take part in this process-to work together with public and private organizations-so that it would be possible to contribute to the digital economy of the country.

Indeed, a cryptocurrency license in El Salvador is the real treasure for every company operating in the field of digital assets. It means legal clarity and government support, access to a promising market increases business reputation and attracts investment. The innovative ecosystem with tax incentives such a license in El Salvador can be the key for a successful and sustainable cryptocurrency business.

Advantages of crypto license in El Salvador

In June 2021, El Salvador became the very first country in the world to make history by adopting bitcoin as legal tender officially. The move further confirmed the status of El Salvador as an innovative leader in the sphere of financial technology and has opened up new possibilities for the rest of the world in using cryptocurrencies for business purposes. This article discusses the key benefits of obtaining a cryptocurrency licence in El Salvador and its effect on global business.

- Legal certainty and stability: Legal tender for bitcoin creates the legal certainty required by cryptocurrency investors and businesses. Licensing cryptocurrency transactions in El Salvador legalizes all aspects of their operations, building trust among both foreign and local investors by minimizing the risks of regulatory claims and ensuring a business-friendly environment.

- Tax incentives: El Salvador has offered various tax incentives to cryptocurrency companies, including exemption from income tax for foreign investors. These incentives will further make the country a very attractive jurisdiction for both startups and established cryptocurrency companies looking to optimise their tax burdens.

- Access to international markets: A crypto license in El Salvador opens wide doors for international business and access to worldwide markets. Companies, therefore, can conduct their business in a country that supports innovation in digital currencies, enabling them to grow and expand internationally.

- Promotion of innovations and technologies: El Salvador actively promotes blockchain technology and cryptocurrency innovation. Licensing companies in the field encourages research and development, fosters the adoption of new technologies, and supports the ecosystem of digital currencies in the country.

- Improvement in financial inclusiveness: El Salvador is now trying harder to overcome traditional banking obstacles through the adoption of cryptocurrencies to achieve higher levels of financial inclusion. This, in turn, will translate into digital payment opportunities for businesses and will extend their customer reach into the unbanked population.

Licensing of cryptocurrency transactions opens new perspectives for global businesses in El Salvador, giving legal stability, tax incentives, access to international markets, supporting innovation, and creating conditions for increasing financial inclusion. Guided by bitcoin as a legal tender, El Salvador is at the forefront of the integration of digital currencies into the economy, opening up unique opportunities for companies willing to grow in this dynamically changing field.

Crypto Regulation Overview of El Salvador

The recognition of Bitcoin as legal tender, thanks to the historic decision made by El Salvador last June 2021, has obliged the country to create, little by little, a regulatory framework for this new cryptocurrency market. The decision catalyzed many changes in the financial infrastructure of the country and propels El Salvador into pole position with regard to innovation in digital currencies. This article has endeavored to give a general overview of the recent situation of cryptocurrency regulation in El Salvador and its implication on the business community.

Legal framework and legislation

El Salvador has legislated several laws and regulations regarding the use of digital cryptocurrencies within the country. Central to the general regulation structure is the Bitcoin Law, which simply legalizes the use of Bitcoin as a medium of exchange and simultaneously establishes a system for the integration of digital currencies into the national economic system. Moreover, this law compels all commercial enterprises to accept bitcoin for payment in goods and services, provided that it is technically feasible.

Regulation and supervision

With the aim of regulating the cryptocurrency market, stipulating its transparency and security, El Salvador established specific supervisory bodies. Such bodies license cryptocurrency exchanges, providers of services for storing cryptocurrencies, and other participants in this market. They also define conditions that need to be complied with in terms of accounting, combating money laundering, and terrorist financing in the cryptocurrency market.

Tax aspects

Despite the general progressiveness of the approach to regulating cryptocurrency, the position regarding its taxation in El Salvador is not particularly out of the ordinary. The principle is that Bitcoin transactions are VAT-liable, although there are some tax incentives for foreign investors; one such incentive is an exemption from income tax on cryptocurrency investments.

Support for innovation

The Salvadoran government is proactive in supporting innovation and technology development in cryptocurrencies, even offering special economic zones for technology companies. That would include infrastructure for startups operating in this area, easier access to finance, and tax breaks.

Impact on business

This regulation of cryptocurrency in El Salvador opens up new vistas for businesses operating both locally and abroad. Simplification of the procedures concerning payments, access to new financial tools and markets, and even tax incentives are among the main reasons which help enterprises grow and develop in the country.

The Republic of El Salvador strengthens its position as a hub of innovation in cryptocurrencies and creates a favorable legal and regulatory environment that contributes to the development of the digital economy. These measures contribute not only to economic growth internally but also to gaining interest from the international business community, allowing it to turn the country into an attractive platform for investment in digital technologies and cryptocurrencies.

Crypto license application types in El Salvador

By its adoption as a form of legal tender, El Salvador became the trendsetter in this form of regulation of cryptocurrencies. With this, the country had not only raised its flag in the global arena of digital innovation but had also brought about different kinds of licensing that were specialized in various transactions involving cryptocurrencies. In this article, we will closely examine the types of crypto license applications in El Salvador, their characteristics, and their contribution to the business environment.

| License Type | Description |

|---|---|

| Licence for operations with cryptocurrencies | Such a license is provided for those companies that are engaged in the purchase, sale, and exchange of cryptocurrencies. This license will provide companies with the right to officially trade in El Salvador and provide customers with safe and secure transactions. |

| Licence for custodial services | Custody services, in other words, storages of cryptocurrencies, need special attention in regards to security and protection of clients’ assets. In a custodial license, quite specific presumptions are placed on the custody infrastructure and on the management and control of customer funds. |

| Licence for cryptocurrency exchanges | Cryptocurrency exchanges are key players in the digital asset ecosystem since they are utilizing platforms that enable the exchange of cryptocurrencies. In that respect, such exchanges are expected to obtain a special license which upon issuance would indicate their compliance with regulatory requirements, security, as well as transparency issues. |

| Licence to carry out an ICO (Initial Coin Offering) | Initial Coin Offerings are one of the most popular capital-raising activities in the cryptocurrency market. The license for El Salvador’s ICO requires the organizers to follow the rules concerning disclosure and investor protection, thus guaranteeing that the process is transparent and intact. |

| Blockchain-based financial services license | Everything is covered, from a big area of financial services, going from payment systems and fund transfers to blockchain-based lending. The main purpose of such licensing is to stir innovation and the development of new financial products within the country. |

The different types of cryptocurrency licenses in El Salvador just prove how much the country wants to support both innovation and the safe development of the digital economy. For those companies willing to carry out their activity within the cryptocurrency field in El Salvador, performing detailed research on the needs of each type of license, with full compliance with them, is highly recommended for receiving a work permit. This approach not only legalizes and regulates the crypto sector but also allows new perspectives to open for growing and developing companies in this highly active field.

How to get a crypto license in El Salvador?

Since the official recognition of bitcoin as legal tender, El Salvador enjoyed a special position in the world economy; it is a hotbed of cryptocurrency novelties. Such a license is required for those companies that want to conduct activity related to digital assets in this country. Below, you will learn how to obtain a cryptocurrency license in El Salvador—a step-by-step guide adapted for businesses.

Type of License Determination

The first consideration one should make is the determination of the type of crypto license that fits their business model best. There are various types of licenses available: licenses for conducting cryptocurrency transactions, providing custodial services, conducting operations of cryptocurrency exchanges, and the issuance of the mentioned ICOs, as well as blockchain-based financial services. Therefore, it would be all-important to choose the right type of license in view of a successful journey through the licensing process.

Preparation of Documentation

To obtain a crypto license, the company needs to prepare and file a number of documents. Among them are:

- Constituent documents of the company;

- A detailed description of the business model;

- KYC and AML policies and procedures;

- Evidence of technical infrastructure’s compliance with safety requirements;

- Financial statements and plans;

- Biographies of executives and key employees.

Filing an Application

When all the necessary supporting documentation is prepared, it is time to file the application for a license with the competent regulator in El Salvador. All documents need to be complete, accurate, and compliant.

Evaluation procedure

After the application is filed, the assessment process commences, wherein the regulator verifies the documents submitted and may ask for further information. Meetings with the representatives of the company may be held at this stage to clarify certain aspects of the business model or risk management processes.

Licensure

After the assessment procedure has been finished and upon the adoption of the positive decision of the regulatory body, the company obtains a crypto license that permits its official work in the sector of cryptocurrency in El Salvador. Bear in mind that the license can provide certain conditions and limitations, keeping which means the possibility of further work.

The whole process of obtaining a license to deal in cryptocurrency requires great preparation and attention to detail. The license, once obtained, will give the company access to the growing market of cryptocurrency and be an opportunity for a business enterprise to take part in the innovation economy of the country. This guide aims to ensure that if properly followed, all requirements are complied with, allowing a business to integrate successfully into El Salvador’s ecosystem of cryptocurrencies, enabling it to develop the digital economy and expand its presence on a worldwide basis.

Crypto License Types Available in El Salvador

With its status, El Salvador became the first country to officially adopt bitcoin as a form of legal tender—openly beginning a new chapter in the history of the digital economy. Such a step underlined an essential role that cryptocurrencies had already begun to play in the modern financial sphere and called for regulators to develop clear rules and regulations regarding licensing cryptocurrency activities. Such is the subject of our article: a closer look at the types of crypto licenses available within El Salvador, their characteristics, and also the requirements for businesses.

| License Type | Description |

|---|---|

| Licence for operations with cryptocurrencies (Cryptocurrency Operator) | This kind of licence is designed for organizations that involve buying, selling, exchanging, and other forms of operations with cryptocurrency. Operators of cryptocurrencies can perform services for both physical persons and legal entities, acting as a bridge between the exchange market and the market of digital assets. Companies applying for such a licence need to confirm their financial strength, robust security systems, and AML/KYC politics. |

| Custodial service licence – Cryptocurrency Custodian | Custodial services imply storing cryptocurrency assets belonging to customers. Obtaining a license for custodial services requires a very high level of security regarding the storage of assets by the company, along with elaborating measures to avoid data theft and loss. Cryptocurrency custodians play an important role in securing the assets of their customers, who want to have access. |

| Cryptocurrency exchanges license – Cryptocurrency trading platform | The license for the cryptocurrency exchange shall be obtained by such cryptocurrency exchanges that offer to provide a platform for trading of cryptocurrencies. It has to be demonstrated that such an organization follows open operations, fair trading practices, and protection of interests of traders. The exchanges shall follow mechanisms for dispute resolution, AML/KYC policy, and systems to prevent frauds. |

| License to conduct ICO – Initial Coin Offering Platform | The hottest way to raise investment for a cryptocurrency project is via an Initial Coin Offering. An ICO license is a recognition given to platforms which support new projects by offering them tools to fundraise. Such kind of platforms will be obliged to support the transparency of projects, protection of rights of investors, legality of projects. |

| Blockchain-based financial services license | This license category is targeted at financial service companies at the crossroads of blockchain technology—transfers, payments, and lending. To get the license, it is necessary that an enterprise prove the transparency of its activity, correspondence to the requirements for prevention of money laundering and terrorist financing, and also protection of customers’ data and funds. |

It is important to highlight that most of the numerous multiple cryptocurrency licenses available in El Salvador show the commitment of the country to establish a favorable and regulated environment for the development of the cryptocurrency economy. This is something important, and further on, it will be necessary for entrepreneurs and companies interested in activities related to this subject to study carefully the requirements of each license type and then prepare the corresponding documentation so that the procedure for obtaining the license is successful. Such an approach will ensure the legality and transparency of the business process and create perfect conditions for further innovation and growth within the dynamically developing digital economy of El Salvador.

How to Open a Crypto Business in El Salvador: Step-by-Step Guide

The recognition of bitcoin as legal tender made El Salvador the hope of cryptocurrency innovation on the world scene. Starting a crypto business in El Salvador has a lot to do with unparalleled opportunities for growth and development under new economic conditions. The following is a step-to-step guide to launching a cryptocurrency business, taking into account the needs of the business.

Market research and business modeling

Before the very beginning of activity, it is highly required to elaborate on the crypto business with deep market research regarding demand, competitors, potential clients, and legislation requirements. Based on that research, a relevant business model should be designed, allowing a particular cryptocurrency market in El Salvador.

To choose a legal form and to register a company

Hence, it is vital to select the appropriate legal form of business from the very beginning because it is crucial for its further successful development and growth. In El Salvador, one has quite a wide range of options: joint stock companies – S.A. de C.V. or limited liability ones – S. de R.L. Having decided on the form, one should register the company with relevant government authorities.

Obtain a crypto license

Licensing is required to conduct a cryptocurrency business in El Salvador. For this purpose, a package of documents must be prepared and submitted, proving that such a business meets AML/KYC standards, among other requirements. Licensing requirements will be studied in detail and complied with accordingly.

Organising the financial infrastructure

A sound financial infrastructure—which also includes bank accounts, payment systems, and capital management—forms the backbone of any successful crypto business. In this regard, a relationship should be established with banks and/or payment providers willing to work with cryptocurrency companies.

Technology Solution Development and Implementation

A technology platform forms part of the core of any crypto business, whether it’s a cryptocurrency exchange, wallet, or a particular payment service. It could take a considerable amount of time and resources to develop an appropriate, secure, and user-friendly technological solution. Besides, such development involves qualified specialists.

Customer engagement and marketing

A well-articulated marketing strategy and reflective customer engagement methodologies are quite crucial to a crypto business. The detailed plan shall be developed for marketing and advertisement activities aimed at brand awareness and attracting the target audience.

Compliance and risk management

The only way to develop a crypto business in the long-term perspective is to ensure continuous regulatory compliance and active risk management. The rapid changes in legislation have to be constantly monitored, company policies and procedures updated in time, and professional measures taken to minimize risks of an operational, financial, and reputational nature.

Setting up a crypto business in El Salvador is a very unique opportunity for those entrepreneurs and investors who look forward to leveraging an advanced cryptocurrency economy. In fact, by following the above steps and giving due consideration to strategy and operational detail, one can ideally establish and grow a cryptocurrency business in this progressive jurisdiction.

Steps to obtain crypto license in El Salvador

Since the day when bitcoin was officially recognized as legal tender, El Salvador has been in the front rank for cryptocurrency, offering a new wave of opportunities for businesses that are innovative. A crypto license is a key factor for any company desiring to operate legally in the digital asset space. We will detail below how one may obtain the relevant cryptocurrency license to be able to successfully start and operate a crypto business in El Salvador.

| Step | Description |

|---|---|

| Preliminary Analysis and Preparation | Before commencing the licensing process, companies should research the crypto law of El Salvador and choose a suitable license type for their business model. They should also undergo a legal and financial audit to ensure compliance with the country’s requirements. |

| Selection of the Type of Crypto License | Crypto licenses come in various types: exchanges, custodial services, payment systems, and other cryptocurrency-related activities. Each type has its own set of conditions and requirements for successful issuance. |

| Preparing and submitting documents | To obtain the license, companies must prepare and submit a package of documents, including: Statutes of the company; A detailed business model description; AML/KYC compliance programs and procedures; Details about key personnel and founders; Proof of financial stability and security of the applied technology. |

| Verification and due diligence | Once the application and documents are submitted, regulatory authorities in El Salvador review them. They may request additional information to verify compliance with safety regulations and the financial stability of the company. |

| Paying fees and obtaining a license | After the assessment is complete and all requirements are met, the company must pay the required license fees. Once paid, the company will receive an official cryptocurrency license to operate legally in El Salvador. |

| Ongoing Compliance | Obtaining the license does not eliminate the company’s obligations. They must maintain ongoing compliance, including periodic reporting, financial transparency, and adherence to AML/KYC policies to keep the license valid. |

Obtaining a cryptocurrency license in El Salvador requires a lot of preparation, attention to detail, and knowledge of local regulations. Such a complicated procedure opens enormous opportunities for crypto businesses in case of its successful completion, giving them the legal framework for conducting digital asset transactions in the country’s innovation economy. In fact, if these steps are followed with due attention to the regulatory requirements, a successful integration into the fast-growing crypto market of El Salvador can be done by the companies.

How to get a crypto trading license in El Salvador

El Salvador, the moment it adopted bitcoin as legal tender, turned into a hotbed of cryptocurrency innovation in the world. In fact, entering this blossoming field makes getting a cryptocurrency trading licence the first and foremost step an entrepreneur or corporation should take. In this article, we look from a strategic and business point of view at the possibility of obtaining a cryptocurrency trading license in El Salvador.

Research the regulatory environment

Before one even applies for a license, one must know what the regulations are in El Salvador regarding cryptocurrencies. Among other things, one has to understand what the Bitcoin Law is and its implications, as well as other legislation which regulates how cryptocurrency transactions would be conducted within that country. For that, one can recruit the services of a legal practitioner specializing in the regulation of cryptocurrencies.

Choose license type

It is very important to determine the type of cryptocurrency license that will best suit your business model. This may include those involved in cryptocurrency exchanges, custodial services, and cryptocurrency-based payment systems, among others. For cryptocurrency trading, a license for a cryptocurrency exchange most probably will be required.

Preparation of the Business Plan and Documentation

A core element of the application is the comprehensive business plan, which shall comprise a description of the business model, a risk management strategy, AML and KYC policies, along with security and data protection measures. It will be pertinent to draft a set of company incorporation and legal documents.

Submitting an application and liaising with regulators

Once all the required documents are ready, the application must be sent to the appropriate regulator in El Salvador. This phase will entail personal presentations, filing further documentation and answering questions from the regulator. The process should be characterised by frank and constructive contact with the regulators.

Awaiting a decision and applying for licence

Having filed the application, it is expected that the company should await a decision on the part of the regulator. The real time of processing the application depends on how voluminous the documents presented are and also depends on the workload of the regulator himself. In case of a positive decision, one obtains a licence to trade cryptocurrencies-the green light for the beginning of activity in El Salvador.

Respecting ongoing commitments

Licensing does not necessarily mean the responsibilities to the regulator are at an end. The licensed companies are expected to report regularly on their activities, observe regulatory requirements, and ensure high standards of security and data protection.

Needless to say, preparation, proper understanding of the regulatory landscape, and active engagement with the relevant regulators play a crucial role in securing a crypto trading license in El Salvador. Although cumbersome, once the licence is granted, this opens one’s gate to a wider world of possibilities to conduct a crypto business in probably one of the most innovative countries in the world. Just like any other serious business, it is vital to approach the process as responsibly and with due care as possible to ensure its success and sustainability in El Salvador.

Taxation of virtual currency companies in El Salvador

El Salvador is a country with a unique position in the world that has aggressively integrated cryptographic currencies into its economy by announcing Bitcoin as legal tender. New opportunities have opened for companies operating with virtual currencies, yet certain requirements have been imposed on their taxation. This paper will look at some of the key elements of the taxation mechanism for Virtual Currency Companies in El Salvador and review both opportunities and liabilities.

General principles on taxation

In El Salvador, income derived from cryptocurrency transactions shall be subject to tax treatment like any other traditional financial transaction. This would mean that companies will have to declare their revenues and expenses on cryptocurrency transactions as charges and credits for income tax purposes.

Income tax

Companies resident in El Salvador whose activities consist of the trading of virtual currencies are required to pay income tax at the general rate. The main element that needs highlighting concerns the correct identification of the income realization moment, and corresponding deductible expenses, considering the crypto assets highly volatility nature.

VAT

Whether value-added tax applies to cryptocurrency transactions in El Salvador is still an open issue, since cryptocurrencies are considered a means of payment and cannot be qualified as goods or services. However, services linked to cryptocurrencies – provided by an enterprise, for example, purchase/sale platforms – may be considered subject to VAT in respect to the performance of such services.

Capital additions

This is also levied on the capital gain that comes about from the sale of cryptocurrencies invested in El Salvador. Therefore, accounting for an enterprise should be closely monitoring the acquisition and selling cost of the cryptoassets to ensure correct calculation of tax obligations.

Repatriation of Profits

Another important issue for foreign companies operating in the field of cryptocurrency in El Salvador is the repatriation of profits. In general, conditions for the repatriation of capital in El Salvador are quite liberal. However, such companies would also have to check if any tax implications arise for them back home.

Planning and compliance

Effective tax planning, put together with stringent tax compliance, is one of the elements that create the magic behind making a cryptocurrency business thrive in El Salvador. It is recommended that the companies keep all of their cryptocurrency transactions in detail and consult with tax professionals on a regular basis to optimally assess their tax liabilities.

Taxation of virtual currency companies in El Salvador is a multilayered and dynamic field. Being updated with changes in legislation and regulatory practices is indispensable for anyone willing to be compliant and perform at the best of their tax obligations. In this respect, proper behavior concerning taxation would enable every company to fully realize the potential of El Salvador as a hotbed of cryptocurrency innovation and, with it, the growth and development of their business in the new economic reality.

El Salvador’s tax system offers different rates for companies operating in the country. Here is an overview of the main tax rates for companies in El Salvador:

| Tax indicator | Tax rate |

| Corporate income tax | 30% |

| Value added tax (VAT) | 13% |

| Tax on transactions with securities | 20% on income from the sale of securities by foreign persons |

| Personal income tax | Between 10% and 30%, depending on income level |

| Municipal tax | 1% to 3% of net income, depending on the municipality |

| Property tax | Varies depending on the value and location of the property |

Key highlights

- Corporate Income Tax: A company is obliged to pay 30% of the net profit derived after deducting allowable expenses and depreciation.

- Value Added Tax (VAT): It has a general rate of 13 percent on most goods and services.

- Personal income tax: The scale, being progressive, therefore varies from 10% – 30% depending on the level of income.

- Municipal tax: This tax also has to be paid by the firms for which the amount that is to be paid depends upon the discretion of the municipality where it lays.

Crypto tax in El Salvador

On the other hand, this is El Salvador, which was the first country in the world to declare Bitcoin as a legal tender, and hence opened new horizons for the cryptocurrency market. This move has underlined not only the significance of cryptocurrencies in the world economy, but another very serious issue: the taxation of cryptocurrency assets. In this article, we touch on the key aspects of cryptocurrency taxation in El Salvador, with a view to entrepreneurs and investors in pursuit of maximizing profits while following all tax obligations.

General principles of cryptocurrency taxation

Despite the innovation El Salvador has adopted with respect to cryptocurrencies, it has implemented fairly traditional approaches to taxing cryptoassets. It is worth noting that cryptocurrency transactions are not tax-free and are declarable for local law purposes.

Impuesto sobre la renta

Just like most countries in the world, income tax is the main act of tax that cryptocurrencies are subjected to in El Salvador. Profits from cryptocurrency deals, like trading and mining, among other activities, should be subjected to normal tax rates both for individual and corporate taxpayers. But definitely, its peculiarities relating to volatility require a very serious accounting and documentation of all those transactions in order to correctly calculate the arising tax liabilities.

Capital Additions

Another type of tax that may be applied on investments made on cryptocurrencies includes those transactions that result in the realization of capital gains. A significant issue related to this matter is establishing at what time the capital gains are effective and at what tax base. Determination of capital gain fully relies on the keen observance of the selling and purchasing prices of the securities by investors.

VAT and other taxes

Due to the very uniqueness of the market, the situation concerning the evaluation of VAT of cryptocurrency transactions is still a point of specialized legal research in El Salvador. It is recommended that consulting of tax professionals be performed with the aim of establishing potential VAT and other tax liabilities in respect of property transfer tax or value-added tax on the provision of services related to cryptocurrency.

Tax planning and compliance

In this way, the most effective carrying out of tax planning and compliance strategies will provide opportunities to optimize the tax burden and avoid tax risks. Large companies and individual investors alike need to show extra attention to accounting and documentation of all cryptocurrency transactions using professional accounting and tax services that will guarantee proper reporting and observance of all relevant tax requirements.

Taxation of cryptocurrencies in El Salvador is a very complex matter to deal with; it requires full knowledge and attention to every detail. If there is an appropriate approach toward tax planning and compliance strategies, then entrepreneurs and investors would be in a position to comply with the law but at the same time optimize their tax liabilities, which contributes to growth and business success within the Salvadoran cryptocurrency ecosystem.

Embracing Cryptocurrency Innovation: Securing a Crypto Exchange License in El Salvador 2025.

El Salvador made headlines globally by becoming the first country to adopt Bitcoin as legal tender, marking a significant milestone in the acceptance and integration of cryptocurrencies into a national economy. This guide delves into the specifics of obtaining a crypto exchange license in Salvador, highlighting the regulatory environment, application process, and advantages of securing a license in this pioneering market.

Regulatory Framework for Crypto Exchanges in El Salvador

Following the historic Bitcoin Law, El Salvador has been developing a regulatory framework that facilitates the operation of crypto-related businesses while ensuring financial stability and compliance with international standards. The government and financial regulators are actively working to provide clear guidelines that support the growth of the cryptocurrency sector.

Types of Crypto Licenses in El Salvador

El Salvador offers a variety of crypto licenses to cater to different aspects of the digital asset industry:

- Crypto exchange license in Salvador: Allows companies to operate platforms where users can exchange cryptocurrencies and fiat currencies.

- Crypto broker license in Salvador: Enables businesses to facilitate crypto transactions on behalf of their clients.

- Crypto trading license in Salvador: For firms directly engaged in the buying and selling of digital assets.

- VASP crypto license in Salvador: Intended for virtual asset service providers offering a broad range of services.

Application Process for a Crypto License

Applying for a license for crypto exchange in El Salvador involves submitting detailed documentation to demonstrate compliance with local and international regulatory standards, including robust AML and CFT protocols. The process is designed to ensure that only financially sound and responsible businesses are permitted to operate.

Cost of Crypto Licensing in El Salvador

The crypto exchange license in Salvador cost is designed to be competitive to attract international crypto businesses to the country. The government’s pro-crypto stance is expected to maintain relatively low licensing fees to encourage innovation and investment in the sector.

Benefits of Acquiring a Crypto License in El Salvador

Operating with an El Salvador crypto license offers substantial advantages, including access to a growing market of crypto-friendly consumers and businesses. Additionally, regulatory compliance provides enhanced credibility and trust with global financial partners.

Challenges in the Licensing Process

The main challenges include adapting to an evolving regulatory framework and managing the operational demands of a rigorous compliance environment. However, the unique position of El Salvador as a crypto-forward nation provides significant opportunities for businesses willing to navigate these initial hurdles.

Market Opportunities in El Salvador

El Salvador’s commitment to integrating cryptocurrency into its economy opens up vast opportunities for innovative business models and services. The potential for growth, combined with incentives such as the cheapest crypto license in Salvador, makes it an attractive destination for crypto entrepreneurs and established companies looking to expand into new markets.

As El Salvador continues to lead in regulatory innovation, obtaining a crypto exchange license in Salvador represents a strategic move for businesses aiming to leverage the extensive opportunities within the emerging cryptocurrency landscape. With strategic planning and a commitment to compliance, businesses can successfully navigate this exciting and dynamic sector.

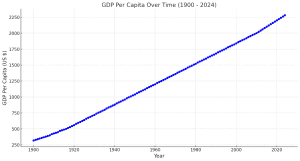

El Salvador GDP per capita from 1900 to 2025

El Salvador crypto license 2025

El Salvador is actively promoting and deepening its commitment to the digital economy, showcasing its achievements and experience in developing regulations that foster a favorable environment for the regulation of cryptocurrencies and other digital assets on the international stage.

In the first 300 days since Juan Carlos Reyes took office as President of the National Commission on Digital Assets (CNAD), El Salvador has made a noticeable impact in 2025, ranking among the leaders in the Americas in terms of digital environment regulation. The country received a high rating of 9.2 in the 2025 Crypto Asset Regulation Report, highlighting the effectiveness and success of CNAD’s work.

This success confirms the significance of the efforts made by CNAD in developing and overseeing the implementation of regulations for digital assets in El Salvador. The Commission aims to create a qualified team of regulators capable of developing and implementing world-class standards in the cryptocurrency ecosystem.

The National Commission on Digital Assets of El Salvador (CNAD) is unique, being the first and only independent organization in the world whose powers include regulating and overseeing the country’s digital asset market. The primary tasks of CNAD include monitoring compliance with the Digital Asset Issuance Law, developing regulations for cryptocurrency usage, tokenization, and other digital financial instruments, as well as overseeing market participants’ compliance with current laws to ensure investment security, stability, transparency, and market safety.

“I am pleased to announce that the National Assembly has approved significant amendments to the legislation governing the activities of the National Commission on Digital Assets (CNAD), thus expanding our powers to regulate companies working with Bitcoin (BTC) in our country,” informed Juan Carlos Reyes, President of the Commission.

As a result, CNAD is now empowered to control the activities of companies in the Bitcoin and other crypto-assets sectors within the country, including conducting risk analysis developed by specialists with a solid understanding of technology and the market, as Reyes emphasized.

With the introduction of a new regulatory model, which will take effect in the coming weeks, El Salvador is establishing a registration requirement for Bitcoin service providers, including exchanges, custodians, and payment systems. These organizations are required to implement standards to prevent money laundering, protect client assets, and ensure cybersecurity.

The initiative, initially proposed by Minister of Economy María Luisa Hayem, introduces new obligations for cryptocurrency platforms through the National Commission on Digital Assets. This includes adopting a set of risk management policies and adhering to technical standards established by CNAD, according to recommendations from the Financial Action Task Force (FATF), including the so-called “Travel Rule” and other regulations to prevent crimes in the cryptocurrency sector.

Representatives of the National Commission on Digital Assets (CNAD) claim that the changes are motivated by a desire to increase efficiency. During the discussion of the bill in the legislative chamber, CNAD Director Miguel Serafín emphasized that the proposed amendments are purely pragmatic. He highlighted the importance of the new policy designed for cryptocurrency services, aimed at protecting client assets.

The reforms also include requirements for maintaining detailed accounting records that reflect the financial condition of providers and provide accurate data on conducted transactions. Furthermore, CNAD is granted the right to take preventive actions to maintain the stability of the Bitcoin and other digital asset ecosystems, based on technical reports. Additionally, a ban is introduced on conducting transactions with digital assets without proper authorization from the main regulator.

During the debates in the National Assembly, lawmakers emphasized that these initiatives are aimed at achieving an ambitious goal – making El Salvador an attractive platform for new markets. “This will contribute to economic growth, creating jobs for the population and opening opportunities for Salvadorans and foreign investors to invest in the country’s economy,” noted the politicians.

These regulatory measures are designed to strengthen El Salvador’s leadership in the digital assets sector in the region, creating a regulatory environment that promotes innovation and attracts investment, as lawmakers emphasize.

The reform of the legal framework for the digital asset industry in El Salvador is taking place at a critical moment. Special attention has been drawn to this process by the Director of Communications at the International Monetary Fund (IMF), Julie Kozak, who emphasized that Bitcoin remains a “key element” in negotiations for an agreement with El Salvador. This underscores the strategic importance and timeliness of the reforms in the context of international financial relations.

RUE customer support team

RUE (Regulated United Europe) customer support team complies with high standards and requirements of the clients. Customer support is the most complex field of coverage within any business industry and operations, that is why depending on how the customer support completes their job, depends not only on the result of the back office, but of the whole project itself. Considering the feedback received from the high number of clients of RUE from all across the world, we constantly work on and improve the provided feedback and the customer support service on a daily basis.

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

Registration number:

14153440

Anno: 16.11.2016

Phone: +372 56 966 260

Email: [email protected]

Address: Laeva 2, Tallinn, 10111, Estonia

Registration number: 304377400

Anno: 30.08.2016

Phone: +370 6949 5456

Email: [email protected]

Address: Lvovo g. 25 – 702, 7th floor, Vilnius, 09320, Lithuania

Registration number:

08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00, Prague

Registration number: 38421992700000

Anno: 28.08.2019

Email: [email protected]

Address: Twarda 18, 15th floor, Warsaw, 00-824, Poland

Please leave your request

The RUE team understands the importance of continuous assessment and professional advice from experienced legal experts, as the success and final outcome of your project and business largely depend on informed legal strategy and timely decisions. Please complete the contact form on our website, and we guarantee that a qualified specialist will provide you with professional feedback and initial guidance within 24 hours.