Cayman Islands Crypto License 2025

On 25 May 2020, the legislative arm of the government of the Cayman Islands enacted the Virtual Asset (Service Providers) Law, 2020 (“VASP Law”). The law delineates the activities that constitute virtual asset business in the Cayman Islands and provides for the requirements for licensing and registration for any person offering virtual asset services. The VASP Law is primarily purposed to ensure that the Cayman Islands meet global regulatory standards on consumers’ protection and address all recommendations on virtual assets that were set by the Financial Action Task Force. This shall guarantee a proper, sound, and modern framework for the regulation of virtual asset businesses in the Cayman Islands.

|

PACKAGE «COMPANY & CRYPTO License IN THE CAYMAN ISLANDS» |

25,900 EUR |

- Full turnkey company formation

- Name Availability Check,

- Document Preparation and Filing,

- Company incorporation process,

- Government fee for incorporation

- Company Secretarial service for 1 year,

- Registered Agent

- Legal Address for 1 year

- Set of the corporate documents

- VASP License application assistance

- Set of policies for license application

Benefits

The Cayman Islands are a British Overseas Territory in the Caribbean Sea. In recent years, this territory has become one of the trending destinations for those interested in cryptocurrency-related ventures. Some of the major benefits listed hereafter are as follows:

- Friendly Atmosphere for Regulation

- Stable Political and Economic Climate

- Banking Services Accessible

- Recognition Globally

- Tax Neutrality

- Full Foreign Ownership

- Minimum Requirements of Incorporation and Corporate Management

Requirements

To operate a cryptocurrency business in the Cayman Islands, one needs to obtain crypto licensing from the CIMA. This license acts as an assurance that all AML and CTF regulations are followed; this is a way of regulating the industry. The following shall be the minimum requirements for licensing a cryptocurrency company in the Cayman Islands:

- Notarised passport copies for all members

- Notarised address proof copies for all members

- Business plan

- Source of Funds: Information like current job designation, name of the company, nature of business, countries of operation, and number of years of service – where a bio-data would do

- Confirmation Letter of Business Activity

- AML Manual of the KYC/AML which delineates the policies and procedures of AML compliance

- Policies including Information Security, Private Key Storage, and Cybersecurity Programme

- Appointing a Local AML Officer

- Local Registered Office

Cayman Islands

Capital |

Population |

Currency |

GDP |

| George Town | 68,136 | The Cayman Islands Dollar | 86,568.77 KYD |

Establishing a Cryptocurrency Company in the Cayman Islands

The regulatory environment of the Cayman Islands is stable and predictable, together with a well-established banking system and favorable tax regime. The following are the main steps for launching a cryptocurrency business in the Cayman Islands.

Incorporation:

The first step is the incorporation of the business, and this could be in the form of LLC or exempted company. One important requirement is that it must be physically present through a registered office within the same jurisdiction.

Banking Services:

Once a cryptocurrency license has been obtained from the Cayman Islands, the business becomes part of the well-developed banking sector. Business people in the crypto industry can choose from a variety of banking services derived from a number of international banks operating within the jurisdiction.

Cryptocurrency License Application:

Those interested in operating in the cryptocurrency space in the Cayman Islands first need to obtain a crypto license from CIMA. The preconditions are very strict, including putting forward a very detailed business plan, introducing effective systems and controls against tax avoidance and terrorism financing, and satisfying ‘fit and proper’ criteria. Secondly, there should be at least minimum capital for a firm as set by CIMA.

Compliance:

The Cayman crypto businesses should operate in accordance with the AML and CTF regulations. This includes also identifying and verifying customers, procedures for monitoring transactions, and filing suspicious activities reports to the authorities.

Cayman Crypto License: Process and Timeline

| Stage | Description |

|---|---|

| Preliminary Documents Gathering | Three Names of Companies in order of preference

Copies of passports for all shareholders and directors Utility bills of all shareholders and directors CVs of shareholders and directors Business model of the company/Business plan Confirmation of Source of Funds Confirmation Letter of Business Activity |

| Company Incorporation | Company incorporation

Preparing corporate documents Establish accounting services |

| Licensing | Determination of correct licence type

Collation of all documentation relevant to the application Licence Application to the Regulator – CIMA Communication with the regulator |

| Corporate Account Opening | Profiling of the most suitable Banks/EMIs by comparing the risk appetite of the Bank with that of the Client, based on previously prepared AML policies

Collecting all the required documents from the Client’s side to initiate the process: flow of funds, source of wealth, description of the purpose of opening an account, key partners, company website, utility bill, etc. Guide the Client’s company through the whole account-opening process |

The Licensing Process: Peculiarities and Stages

With this, CIMA assumes responsibility for crypto assets, which Cayman Islands legislation refers to as “virtual assets.” The legal entity licensing framework is, at the same time, fairly uncomplicated. Those involved in the crypto arena in the Cayman Islands are referred to as VASPs, with the applicable law being the VASPA Act, 2020, as amended in 2022. A crypto license may be obtained in a series of successive steps.

Preparation of Documents

The Regulator considers an application for the crypto license only when it is filled with the following documents:

- Constituent Papers: Charter, certificate of registration, as well as other relevant copies.

- Duplicate Financial Statements: Financial reports for the certain reporting period, confirming the economic reliability and the capability of fulfilling obligations.

- Business Plan: A document which in wide ranges describes the structure of the company, its activities, business strategy, possible risks, and forecasts.

- Technological Documentation: Information on the used platform and means of security for crypto activities.

- Competency and Professionalism Proof: Certificates proving the competency and skills of directors and officers.

Further, CIMA requires a police certificate from the applicant’s state of residence, a letter of good standing by a prior in-country banking regulator of the applicant’s home country, and other documents.

Licensing Application Filing

A license application can be made online through REEFS by a prospective licensee. Applicants also have to submit the AML/CFT form, available on the website of REEFS. Payment of the registration fee results in the issuance of a license.

Then the Regulator thoroughly reviews the documents submitted at the application review stage: it scrutinizes the security system, evaluates the business strategy presented, verifies the professionalism and the criminal record of the management team, and only then does CIMA make the final verdict.

Legal Entity Structure for Obtaining a Crypto License

At the stage of registration, entrepreneurs who want to conduct cryptocurrency activity in the Cayman Islands can use several options for the legal form of organization. The choice of one form or another will be determined by the business goal, a number of participants, and the dimension of their responsibility. We advise choosing only with the involvement of specialists from our law firm, which takes into consideration all factors, including the client’s preferences.

Limited Liability Company – LLC

The most popular business form for non-resident businessmen due to the following characteristics of this type of business organizations:

- The limited liability of the owners when the company has a financial problem saves personal property and assets of the owners.

- Less complexity in the management – effective power and control distribution among participants according to the number of shares of the authorized capital provides transparency and effectiveness.

- Enhanced confidentiality, as information about owners and directors remains in the private domain.

Considerations for a Joint-Stock Company

Considered a lucrative alternative to an LLC, a joint-stock company presents distinctive internal structuring and control aspects:

- A more complex management structure involving shareholders and a board of directors elected to directly oversee the company.

- The opportunity to attract capital from outside investors by issuing shares creates favorable conditions for expansion.

- Financial transparency is higher, though information about the owners as private individuals is not disclosed. The focus is on presenting the financial information of the company.

Distinguishing Features of Partnerships and Other Entities

Depending on the specific purposes pursued by acquiring a crypto license in the Cayman Islands, other types of business entities can be preferable:

- Partnership: A partnership is based on an agreement for mutual management and ownership, and it’s formed by at least two people. Especially convenient for asset management in the cryptocurrency field.

- Joint Venture: Comprising companies providing resources for a particular venture, joint ventures are best used for specific projects, like startups.

- Funds and Variable Capital Structures: A specific kind of SPV would be in a position to accurately fulfill the given needs of the firm.

Issues within the Licensing Process

Although the procedure for licensing is not complex, still, a variety of factors can make it all complicated:

- Lack of Ability to Prove Financial Soundness: Unable to prove the aspect of financial soundness may lead to a license denial that may further result in issues.

- Papers can have a lot to do with legal documentation, and any mistake in one can lead to rejection of licenses.

- The verification procedure by the regulating authorities can be pretty long-drawn, especially in the case when there is insufficient documentation provided or questions regarding the technological equipment of the company pop up.

- Changes to cryptocurrency legislation on a regular basis translate to an on-time update to policies and corporate procedures.

- Government antitrust requirements that rule out the monopolization of markets can be challenging for a cryptocurrency firm.

- Our lawyers are good at cryptocurrency licenses and hence can handle such challenges while reducing the associated risks.

Regulation of Cryptocurrency Entities

Companies operating in the digital or virtual asset sector are supposed to get licensure among others for the operation of a crypto exchange. Relevant laws that regulate various activities in the field of cryptocurrency within the jurisdiction include:

“On Virtual Assets” (On Service Providers): It identifies the requirement of a cryptocurrency exchange license, imposed on those who provide services of virtual asset custody or/and operating of crypto trading platform.

Foreign Account Tax Compliance Act (FATCA): Applies to US citizen licensing, where companies controlled by US citizens/residents are required to report on financial account information to the US Internal Revenue Service-IRS.

AML (Anti-Money Laundering): A requirement that firms engaged in relevant cryptocurrency activities comply with anti-money laundering regulations.

More importantly, when incorporating a legal entity, one must comply with the requirements set out by the Companies Act. As an example, the crypto company must be registered and have a registered office in the Cayman Islands, with a registered agent.

CIMA

The Cayman Islands Monetary Authority has the responsibility of overseeing both the financial and cryptocurrency sectors of the country. The licensing requirements by this regulator for persons offering services by using virtual assets in the Cayman Islands are relatively lenient. Such persons are treated as virtual assets service providers, and their activities are regulated by the Virtual Assets Law of 2020.

CIMA regulates the issue of a license to the following entities amongst others:

- crypto-exchange

- The platforms on which crypto assets are stored and traded.

- Crypto-brokerage companies performing the functions of an intermediary.

- Crypto funds.

- DeFi and ICO projects.

Why Regulated United Europe?

Although the license to operate a cryptocurrency business in the Cayman Islands is comparatively easy to obtain, it is necessary for anyone considering this option to seek the advice of highly qualified lawyers with experience in this field. Such specialization is provided by the RUE Law Firm. Due to our support, you can legally start a cryptocurrency business right away. Our experts analyze literally every detail: included legal risks, enabling you to make an informed decision. Later on, our team works effectively at getting the crypto license and provides detailed support throughout the whole licensure process, increasing the chance for a successful application approval.

Crypto Company Registration in the Cayman Islands

The Cayman Islands have, for a long period, been known as one of the best financial hubs in the world because of their stability, favorable taxation policy, and modern approach to innovation in fintech, including cryptocurrencies. Some of the major benefits accruing from the registration of a crypto company in the Cayman Islands include international recognition, favorable taxation environment, and having access to a variety of advanced financial services. Below are the key steps and considerations for those contemplating incorporation of a cryptocurrency company in the Cayman Islands.

| Step | Description |

|---|---|

| Legal Entity | Choose an appropriate legal structure for your cryptocurrency company, such as exempt companies, limited partnerships, or segregated portfolio companies, based on your business model and investment strategy. |

| Preparation of Documents | Prepare and present necessary documents such as the memorandum of association, articles of association, details of directors and shareholders to the registration authority for company registration. |

| Registration of the Company | Submit an application to the Registrar of Companies in the Cayman Islands for company registration after preparing all required documents. It can be facilitated by an attorney or consultant. |

| Licensing | Apply for a licence depending on the nature of your cryptocurrency operation, such as for cryptocurrency exchanges or virtual asset services, and comply with specific licensing requirements. |

| Banking and Financial Services | Open a bank account and secure other financial services for managing company funds and operations, including specialized services tailored for cryptocurrency companies. |

| Compliance with Requirements of Regulator | Ensure full compliance with local and international regulatory requirements, making necessary adjustments to internal policies and procedures as needed. |

Therefore, the registration of a crypto company in the Cayman Islands will be a strategic step to bring huge dividends to investors and entrepreneurs who seek to maximize their digital asset potential. Careful planning in all respects using the foregoing steps will surely promise the successful creation and international growth of your cryptocurrency business.

Crypto legislation in Cayman Islands

Over the years, the Cayman Islands have earned a good reputation as one of the most significant financial centers in the world and have managed to create an enabling environment for the development of cryptocurrency businesses. Efficient and progressive legislation has established a platform that allows innovative developments and growth in the digital asset industry to attract entrepreneurs and investors from around the world. Key aspects of cryptocurrency legislation in the Cayman Islands are discussed in this article, very important for an entrepreneur to know if he intends to operate in this jurisdiction or expand into it.

Over the years, the Cayman Islands have earned a good reputation as one of the most significant financial centers in the world and have managed to create an enabling environment for the development of cryptocurrency businesses. Efficient and progressive legislation has established a platform that allows innovative developments and growth in the digital asset industry to attract entrepreneurs and investors from around the world. Key aspects of cryptocurrency legislation in the Cayman Islands are discussed in this article, very important for an entrepreneur to know if he intends to operate in this jurisdiction or expand into it.

Regulatory body

The principal regulator that is responsible for the regulation of cryptocurrency transactions in the Cayman Islands, is the Cayman Islands Financial Services Authority (CIMA). Pursuant to local legislation, CIMA is expected to oversee financial services with a view to provide stability to the financial markets and to protect consumers.

Legislative framework

Islands’ cryptocurrency legislation includes several key acts, which are targeted at the regulation and licensing of activities related to virtual assets:

- Virtual Asset Service Providers Act: VASP Law – The law articulates the basis for which the Virtual asset service provider will be registered and licensed, hence incorporating cryptocurrency exchanges as custodial services among other cryptocurrency entities.

- Anti-Money Laundering Act – The AML Regulations have certain obligations on firms dealing in cryptocurrency to put in place proper customer identification and transaction monitoring mechanisms to deter money laundering and terrorist financing activities.

These laws and regulations give a clear legal framework to the transactions with cryptocurrency, thus building up a secure and transparent environment for investors and entrepreneurs.

Licensing and compliance

To conduct any cryptocurrency activity in the Cayman Islands, a company needs to get the relevant licence from CIMA. Licensing would involve considering the business model, financial strength, company governance, and risk management and regulatory compliance systems.

Benefits for cryptocurrency businesses

Benefits accruing to the crypto companies coming to the Cayman Islands include:

- Tax incentives – no direct taxes, such as income tax, capital tax, or export of capital tax;

- International recognition – status as a reliable and stable jurisdiction helps to inspire confidence in clients and partners alike;

- Progressive regulation – legislation adapted to innovations in the sphere of digital assets provides legal clarity and supports business development.

During the last period, the Cayman Islands have been consolidating their position as one of the main bases for cryptocurrency businesses by allowing friendly legislation, sound supervision, and favorable taxation conditions. The Cayman Islands is an ideal destination for those companies willing to find a reliable and regulated jurisdiction to develop their projects based on cryptocurrencies, joining innovative regulation and international business focus.

Cayman Islands – main information

| Parameter | Information |

| The five biggest cities | Georgetown (capital West Bay Spots Boddentown Estherne-Bodden Town. |

| State language | English |

| Time zone | The time zone of the Cayman Islands is Eastern Time (EST), UTC-5. |

| Calling code | +1-345 |

| Domain zone | .ky |

Crypto Licence Exchange Cayman Islands

In this respect, the Cayman Islands have managed to turn themselves into one of the popular jurisdictions for the registration and licensure of a crypto exchange, due to their favorable regulatory environment and tax regime. The procedure for a cryptocurrency exchange license in the Cayman Islands is effectively prepared and governed by a number of regulatory requirements that have to be followed with great caution. This article outlines the key features and steps involved in getting a license as a crypto exchange.

| Step | Description |

|---|---|

| Understand the Regulatory Environment | Familiarize yourself with the regulatory framework of the Cayman Islands, particularly the Virtual Asset Service Provider (VASP) Law, which governs cryptocurrency exchange operations. |

| Business Modelling | Prepare a detailed business model, describing the services offered by your exchange, transaction volumes, target audience, security measures, and anti-money laundering (AML) and counter-terrorist financing (CFT) policies. |

| Company Registration | Incorporate your company in the Cayman Islands. The company’s legal structure should align with your business model and strategic objectives. |

| Preparation and Submission of Licence Documents | Prepare and submit key documents for the license application, including the business model, risk management policies, AML/CFT measures, and information about key management and operational personnel. |

| Evaluation and Approval | The Cayman Islands Financial Services Authority (CIMA) will review your application, which may include follow-up questions or requests for additional information. If successful, your company will be granted a license to operate a cryptocurrency exchange. |

| Ongoing Compliance with Regulatory Requirements | After obtaining a license, your company must continue to comply with regulatory requirements, including regular updates to risk management and AML/CFT policies, as well as submitting reports to CIMA. |

It is a very sensitive process, requiring vast planning, attention to the tiniest detail, and the fulfillment of every need for licensure by the authorities. Owing to its very appealing regulatory, fiscal, and business climate, the Cayman Islands provide unrivaled perspectives for cryptocurrency exchanges to develop and flourish. The correct approach and in full conformity with the law can enable your digital exchange to be successfully launched and expanded in this highly regarded jurisdiction.

Crypto Trading Licence Cayman Islands

This means that the Cayman Islands have gradually emerged as one of the important international hubs for cryptocurrency business, especially given their conducive regulatory and tax environments. The grant of a cryptocurrency trading license represents a major milestone toward compliance by companies desirous of doing business in this jurisdiction in conformity with local laws and regulations.

Understanding the Regulatory Environment

The first step in the process that a financial company must undertake to get a cryptocurrency trading licence is proper research into the regulatory environment of the Cayman Islands. Legislation governing cryptocurrency transactions is controlled by the CIMA, or the Cayman Islands Financial Services Authority, which determines norms of licensure and principles of supervision.

Licence Selection

Depending on the nature of your business, you may be required to obtain one of various forms of licence under Cayman Islands law. The most relevant are virtual asset service provider licences, which cover a host of different activities in relation to cryptocurrency.

Preparation for Application Submission

Preparing for a license requires thorough work, including, among others, the writing out and documenting of all internal policies and procedures, like AML measures and KYC procedures, and a description of the business model in detail with services. An application by a license applicant reaches the end. It is then submitted with all the required documents and supporting materials to CIMA after careful preparation. All data should be presented accurately and in full to avoid rejection or delay of the review process.

Requirements Post-Registration

Along with the licence granted to trade cryptocurrency in the Cayman Islands, several post-registration obligations are imposed on the company in question, such as reporting, maintaining regulatory compliance, and operation transparency.

A licence to trade cryptocurrency in the Cayman Islands can be somewhat complex but is still manageable for those companies seeking to engage in activities related to cryptocurrencies within one of the most attractive jurisdictions in the world. A license is obtained only when there is strict adherence to regulatory requirements and professional preparation of the application. In this aspect, it is important to make professional use of legal and advisory agencies specializing in offering their services on financial regulation in the Cayman Islands, for ensuring that all requirements are complied with and the licensing process is streamlined accordingly.

How to Get a Crypto License in Cayman Islands?

The Cayman Islands represent an international financial centre with sound, progressive legislation; thus, they are a jurisdiction of great opportunity for cryptocurrency companies. Setting up a cryptocurrency license in this country is a well-thought-out process and is fully compliant with the requirements of regulators.

| Step | Description |

|---|---|

| Determination of the Licence Type | Identify the appropriate license category based on the nature of your cryptocurrency transactions, such as trading, custodial services, or other virtual asset services, as different licenses are issued for each type of activity. |

| Preparation of Documentation | Prepare necessary documents for licensing, which may include a business plan, financial projections, AML/CFT compliance evidence, security and data retention policies, and details about the management team. |

| Registration of Company in the Cayman Islands | Incorporate your company in the Cayman Islands as a prerequisite for applying for a cryptocurrency business license. |

| Applying for a Licence | Submit the complete application for a license to the Cayman Islands Monetary Authority (CIMA), which may involve additional information or clarifications during the process. |

| Ongoing Compliance with Regulatory Requirements | Ensure continuous compliance with all relevant regulations, including AML/CFT, data security, and customer protection, through regular audits and reporting to maintain the license. |

A license for doing cryptocurrency business in the Cayman Islands opens doors for companies to the international financial community and provides many substantial advantages associated with doing business in this jurisdiction. Upon successful license obtainment, the focus should be on careful planning, strict compliance with regulatory requirements, and professional documentation. Specialized legal and advisory agencies could significantly simplify this process for their clients and ensure compliance with all required needs.

Cayman Islands Cryptocurrency License Benefits

The Cayman Islands – featuring an enabling investment climate, coupled with modern and growing legislation on financial services – have more in store for benefits that companies active in cryptocurrency businesses can avail. A license in the Cayman Islands opens up access to the world finance market and a range of strategic advantages.

Best Regulatory Environment

The regulatory environment in which cryptocurrency transactions come into play within the Cayman Islands is one of the best anywhere in the world, and, for all intents and purposes, quite transparent and clearly understood. The existence of a regulatory body in the name of the Cayman Islands Financial Services Authority, or CIMA for short, has always ensured stability and strength in terms of the institutional framework as far as cryptocurrencies are concerned.

International Recognition

An internationally known and respected license obtained in the Cayman Islands will instill much more confidence in clients and partners alike. Opening a number of global markets and investors to a company, this sort of international recognition would thus make facilitating business growth and expansion easier.

There Is No Direct Taxation

One of the most important features that make the Cayman Islands attractive is the complete lack of direct taxation for companies, including income tax, income tax, and capital gains tax. All this makes the jurisdiction very popular among cryptocurrency firms in quest of financial efficiency from all sides.

Data Protection and Privacy

It holds privacy and data protection with regard to the Cayman Islands on a high pedestal, affording the company quite a high level of data protection. This will entail extra security for customer data and transactions, yet another important aspect that any cryptocurrency business would have. This would give extra security in transactions and customer data, which is an important aspect for cryptocurrency businesses.

Flexibility and Innovation

The regulatory environment of the Cayman Islands is flexible and open to innovation, with an ability for companies to adapt in rapidly changing market conditions and evolve in light of the most advanced technological trends. Licensing for cryptocurrency activities marks an important underpinning of the Cayman Islands’ commitment to innovative, progressive business.

Obtaining a cryptocurrency license in the Cayman Islands offers unparalleled strategic competitive advantages as a result of gaining international recognition and no direct taxation, high privacy, and support for innovation. These make the Cayman Islands one of the most appealing jurisdictions whereby a cryptocurrency business can easily grow and thrive in the international arena with ease.

Benefits of crypto license in Cayman islands

One of the most recognizable and established jurisdictions when it comes to international financial services is the Cayman Islands. For a cryptocurrency company, they offer substantial advantages, especially concerning obtaining a cryptocurrency license, which opens wide perspectives of business dealing with digital assets. The following are key advantages that make the Cayman Islands a very favorable jurisdiction to incorporate and operate a cryptocurrency company:

Progressive regulation

The most developed regulative environment for cryptocurrency activities is present in the Cayman Islands. In its turn, local legislation enacts a legal ground for dealing with digital assets, providing legal clarity and stability to cryptocurrency companies. Indeed, progressive regulations stimulating innovations and development provide an enabling environment for businesses to grow and expand.

International recognition and reputation

A license obtained within the Cayman Islands enjoys a high level of trust and recognition in the international business community. It gives access to world markets and investments, thus making companies more attractive to international partners and clients.

Tax advantages

The absence of direct taxation is one of the main reasons this jurisdiction should be so attractive for crypto companies. There is no income, capital gains, or capital withdrawal tax in the Cayman Islands, which, therefore, allows companies to minimize their tax burden and increase their profit as much as possible.

Transparency and Conformity with International Standards

The Cayman Islands have fully implemented the international standards of AML/CFT. A license for activity of cryptocurrency means compliance with such a high level and helps to enhance the reputation and credibility of the company.

Flexibility to support innovation

The regulatory environment of the Cayman Islands is flexible and open to new business models and technological innovation. This would ensure that cryptocurrency companies develop innovative products and services, yet remain within the ambit of regulatory requirements.

Obtaining a cryptocurrency license in the Cayman Islands provides a set of strategic advantages to companies, which include progressive regulation, international recognition, tax benefits, high levels of transparency, and support for innovation. All these factors make the Cayman Islands one of the most desirable jurisdictions to register and develop a cryptocurrency business with the purpose of its further sustainable growth and expansion globally.

Overview of crypto regulation in Cayman islands

The Cayman Islands have long since been an established international finance hub; however, today they are making big strides in establishing a friendly regulatory environment for companies involved in cryptography. It is especially appealing to digital asset entrepreneurs and investors due to the clear-cut and progressive regulation. Below is an overview of the critical features of cryptocurrency regulation in the Cayman Islands that explains the keystones and guides businesses.

Regulator frame

Meanwhile, the central body that regulates cryptocurrency turnover is CIMA. The legislative base regulating virtual assets is presented by a number of important documents—the main ones being the Virtual Assets Act, also known as VASA, and corresponding regulations—these are meant to provide transparency for cryptocurrency transactions and protection for investors and consumers.

Licensing of activities

The main aspects of the regulation of cryptocurrency in the Cayman Islands pertain to licensing for activities with virtual assets, which cover the following cases: operation of a cryptocurrency exchange, provision of custodial services, and offerings of tokenised products and services. Companies receive a licence subject to strict conditions, including AML/KYC compliance.

Advantages of the regulatory environment

The benefits that cryptocurrency firms will have from the regulatory environment in the Cayman Islands include, among others:

- International recognition and reputation: Licenses offered by CIMA enjoy a very high degree of credibility amongst the international business community.

- Transparency and legal clarity: Jurisprudence and regulatory requirements and procedures provide legal clarity to cryptocurrency transactions.

- Tax incentives: The Cayman Islands offer no direct taxation for digital asset companies.

The regulatory framework for the Cayman Islands, therefore, strikes a balance between stringent oversight and incentivizing innovation to provide an atmosphere that is conducive to the carrying out of businesses in this area. Companies willing to perform business functions within the given jurisdiction stand to benefit in many ways, primarily through clear and essential insight into the different aspects of licensing and regulatory requirements at their disposal. The Cayman Islands remain committed to further developing this position as a global centre of importance for the cryptocurrency industry, thereby providing a sound and attractive platform for companies to achieve international growth and innovation.

Crypto-license application types in Cayman islands

The Cayman Islands are reported to be an international hub of financial innovation, in which development the development of the cryptocurrency sector took a special place. The jurisdiction has created favorable conditions for companies dealing with digital assets, which positions Cayman as one of the most popular destinations to obtain a cryptocurrency license.

Introduction to the Regulatory Environment

It regulates virtual currencies through the Cayman Islands Financial Services Authority, which is in charge of setting and monitoring standards of operation. The Virtual Asset Law, known as VASA, among other regulations, covers the precondition and regulations around the licensing and regulation of digital asset companies.

Types of Statements

| Licence Type | Description |

|---|---|

| Virtual Asset Service Provider (VASP) Licence | For companies involved in the intermediation, exchange, custody, or administration of cryptocurrencies and other virtual assets. The application must include detailed business models, security measures, and AML/KYC policies. |

| Cryptocurrency Exchange Licence | Required for businesses operating cryptocurrency exchanges. The application should include information on technological infrastructure, algorithms for transaction matching, and measures for user protection and transparency. |

| Licence for Custodial Services | For firms offering cryptocurrency asset custody or management services. The application should cover asset storage procedures, security measures, and data access protocols. |

| Digital Asset Fund Registration | For funds investing in cryptocurrencies or virtual assets. Registration applications should include an investment strategy, governance structure, and risk policies. |

Application Process

The application process starts with the preparation and submission of documents confirming compliance of the company with the set requirements. Other important steps within an application process are the detailed development of a business plan, confirmation of compliance with AML/KYC security measures and policies, and payment of applicable fees. It should be duly noted that a successful application requires thorough preparation and clarity on the requirements of the regulation.

Obtaining a cryptocurrency license in the Cayman Islands is a strategically crucial step toward exploiting market opportunities for digital actives. Success in this process requires a clear understanding of the different types of applications and their respective licensing requirements. Success here comes from employing the right approach along with competent preparation, where companies are able to pass through the regulatory landscape of the Cayman toward sustainable growth and development within the industry.

Crypto license in Cayman Islands: how to get it?

The Cayman Islands have one of the best investment climates and one of the most up-to-date legislative frameworks for regulating financial services. All this produces a unique set of conditions due to which cryptocurrency companies can grow and develop their business with the maximum payback. Getting a cryptocurrency license is a significant step toward ensuring that the activities of a company are in full compliance with the laws and regulations in force in this jurisdiction.

| Step | Description |

|---|---|

| Determining the Type of License Required | The applicant must first identify the appropriate class of license based on the nature of the proposed cryptocurrency activity. Different licenses, such as virtual asset licenses, cryptocurrency exchanges, and custodial services, may have different requirements. |

| Preparing the Business Plan and Documentation | Applicants must prepare a detailed business plan and gather supporting documents, including corporate records, proof of financial stability, and information on management and ownership. The business plan should outline services, objectives, security measures, and AML/CFT compliance. |

| Incorporation of the Company in the Cayman Islands | The company must be incorporated in the Cayman Islands. This involves choosing a legal structure and submitting the necessary documents to the Registrar of Companies to obtain legal recognition and status in the jurisdiction. |

| Application for Licence | After incorporating the company and preparing the necessary documents, the applicant can submit a formal license application to the Cayman Islands Monetary Authority (CIMA), ensuring all guidelines and requirements are met for a successful application. |

| Awaiting Decision and Compliance with Post-Registration Requirements | Once the application is submitted, CIMA will review the materials and may request additional information. If the application is approved, the company will receive its cryptocurrency license and must comply with ongoing reporting and AML/CFT obligations. |

Acquiring a cryptocurrency license in the Cayman Islands involves a number of activities, which require serious planning and great attention to detail, with strict adherence to the requirements at hand. Still, international recognition, favorable tax conditions, and a stable regulatory environment make licensing in this jurisdiction well worth such investment in time and resources for those companies willing to operate at the forefront of the crypto-currency market.

Types of crypto licenses in Cayman islands

The Cayman Islands represent one of the most important financial centres in the world, and these islands are very appealing both to entrepreneurs and investors due to their very appealing tax climate, economic stability, and very proactive regulations regarding digital assets. The paper will provide a necessary overview of the types of licensing available in this jurisdiction for firms seeking to conduct cryptocurrency-related activities within the Cayman Islands.

Virtual Asset Service Provider (VASP) Licence

Cayman Islands law allows for a license for a virtual asset service provider-in other words, any company conducting or attempting to conduct business providing a range of services related to exchanges of virtual assets for traditional currencies, the transfer of virtual assets, and offering wallet and custodial services for customers. Obtaining a VASP license means, in turn, that an enterprise should correspond to very high regulatory requirements, including AML/CFT.

Licence of cryptocurrency exchange

This license category is for those providing services related to cryptocurrency trading, including exchange for traditional money or between various cryptocurrencies. Safety and transparency of operation, regarding protection of users, is a high standard imposed on the cryptocurrency exchanges operating in the Cayman Islands, together with proper regulatory compliance.

Licence for custodial services

All the companies which store and manage cryptocurrencies on behalf of customers need to get the appropriate licence, including cryptocurrency wallet key storage and any other service associated with storing, etc. The requirements for getting such a licence concern the proof of the reliability of the storage technologies used and the level of protection of clients’ assets.

Licence for Digital Asset Funds

Funds investing into cryptocurrencies and other forms of virtual assets are also regulated in the Cayman Islands. A digital asset fund licence applies to a proposed entity that raises funds for the purpose of investing in digital assets for the benefit of third parties. The structuring, risk management and reporting requirements outlined also apply to such funds.

With this in mind, the Cayman Islands have an attractive regulatory environment for cryptocurrency firms. For this reason, it continuously appeals to many individuals from all over the world. This leads to the understanding that a very vital aspect of company development in this jurisdiction is awareness of different license types and requirements that are to be applied to various kinds of cryptocurrency activity. A responsible approach to the licensing process and strict adherence to regulatory standards ensure that your business will be able to further develop in the Cayman Islands, as one of the most favourable locations for cryptoinnovation.

How to start a crypto business in Cayman islands

With its friendly regulatory environment, modern legislation, and tax incentives, the Cayman Islands is fast becoming a hub for international cryptocurrency investors and entrepreneurs alike. Opening a cryptocurrency firm in this state is subject to specific local regulatory requirements that need serious attention at the planning stage. The steps below will guide an entrepreneur through the successful launch of their business in the Cayman Islands.

| Step | Description |

|---|---|

| Regulatory Environment Analysis | Understanding the regulatory environment in the Cayman Islands is crucial. This includes familiarizing oneself with the Virtual Assets Act (VASA) and other relevant regulations to ensure compliance with licensing and operational requirements. |

| Selection of Appropriate Business Model | The success of the business relies on selecting a business model that aligns with market conditions and regulatory requirements. Defining services, target audiences, and monetization strategies clearly is vital for the business’s growth. |

| Company Registration | The company must be properly incorporated under local Cayman law. This involves choosing a legal form, filing a memorandum of association, and fulfilling all registration requirements to qualify for a license. |

| A Licence | Depending on the cryptocurrency activity, one or more specific licenses may be required. The application involves submitting detailed documentation to demonstrate that the business meets regulatory and operational standards. |

| Develop Compliance Procedures | Developing effective compliance procedures, including Anti-Money Laundering (AML) and Know Your Customer (KYC) policies, is crucial for meeting regulatory standards and minimizing legal risks. |

| Establishing Banking and Financial Linkages | Establishing connections with appropriate banks and financial institutions is key. These partnerships ensure the operational efficiency of the cryptocurrency business and compliance with international standards for cryptocurrency transactions. |

| Launch and Marketing | Once the above steps are completed, launching and marketing the business is essential. A strong marketing strategy will help attract customers and establish a recognizable brand in the global cryptocurrency market. |

Opening a crypto company in the Cayman Islands calls for an intelligent approach and understanding of the field, from a regulatory point of view, with complete adherence to laws and regulations. Yet, as one of the few countries boasting crystal-clear legislation for cryptocurrencies, the Cayman Islands open unparalleled opportunities for crypto companies to expand and develop on the international scene.

Crypto license obtainment procedure in Cayman Islands

The Cayman Islands have emerged as one of the most popular destinations for cryptocurrency firms in recent times, given the friendly investment climate coupled with an approach to keep their regulatory environment fresh regarding the changing dimensions of financial innovation. This article reviews key procedures and steps necessary for the issuance of a cryptocurrency license in the Cayman Islands and shall, therefore, equip entrepreneurs and investors with the ability to set up and operate a business enterprise within its precincts successfully.

Understand the regulatory environment

The first and foremost step towards the process of licensing is to understand the regulatory landscape in the Cayman Islands. To this end, one needs to closely study the Virtual Assets Act, popularly known as VASA, among other prevailing regulations that have stipulated boundary requirements for companies dealing in cryptocurrency. This will therefore create a clear vision in terms of licensing requirements and regulatory compliance obligations.

Type of licence

Depending on the nature of your business, you could fall under one of several license categories under Cayman law. You need to tell whether your business needs to be licensed as a Virtual Asset Service Provider, cryptocurrency exchange, custodial or other specialized license. Each license category has different requirements and is issued with regard to distinct activities.

Preparation and Filing of Documents

Once the license class has been determined, the next big step involves the preparation of documents. These include a business plan, proof of adherence to anti-money laundering and counter-terrorist financing policy, information on key employees and founders, and detailed descriptions of internal procedures and security systems. Of course, all these documents must be very clear and complete to hasten the application process.

Filing the Application with the Financial Services Authority

Once all the documents are ready, the license application is filed with the Cayman Islands Financial Services Authority – CIMA. The duration and intensity of the review process will depend on the type of license applied for. During this period, CIMA may ask for additional information to supplement some information.

Meeting post-registration requirements

Licensing is just the beginning of your life as a licensed cryptocurrency company in the Cayman Islands, and will revert to ongoing compliance with all regulatory requirements, which include periodic reporting and adherence to policies related to AML/CFT. Regular reviews of policies and procedures would go a long way in sustaining a compliant and successful business, given the ever-changing nature of regulatory requirements.

Obtaining a cryptocurrency license in the Cayman Islands has to be well-planned with regard to documentation and deep knowledge of the local regulatory environment. The obtained license offers a gateway to legal and efficient cryptocurrency activity, access to a promising and fast-growing market of digital assets. If taken properly, together with observance of regulatory prescriptions, the Cayman Islands may become just that very important component in your strategy for business growth related to cryptocurrencies.

How to get a crypto trading license in Cayman islands

The Cayman Islands, having a very friendly regulatory and tax environment, provide enormous opportunities for businesses dealing in cryptocurrencies. Acquiring a license to trade in cryptocurrency is a great way to operate legally and offer services in this beautiful archipelago.

| Step | Description |

|---|---|

| Determine Whether You Need a License | The first step is to understand the prerequisites set by the Cayman Islands Financial Services Authority (CIMA). Identify the appropriate license category based on your business model and operations, ensuring compliance with AML, KYC policies, and other regulations. |

| Preparing Documentation | Once the license type is identified, compile necessary documentation such as a business plan, financial projections, detailed risk management policies, and proof of key management personnel’s competence and reliability. |

| Legal Entity Incorporation | Before applying for a license, your company must be registered in the Cayman Islands. Submit the relevant documents to the registration authority and pay the necessary registration fees. |

| Application to CIMA | Submit the application to CIMA for a cryptocurrency trading license, along with the required documents that demonstrate compliance with all regulations. CIMA may request additional information or clarification during this process. |

| Licence Fees Payment | Once the application is approved, pay the license fees, which vary based on the type of license and the size of the business. This is the final step toward obtaining the license. |

| Satisfaction of Standing Regulatory Obligations | Obtaining a license is only the first step. The company must continue to comply with regulations by submitting periodic reports to CIMA, updating its AML/KYC policies regularly, and maintaining ongoing adherence to all regulatory requirements. |

The whole process of a cryptocurrency trading license obtaining in the Cayman Islands presupposes careful planning, thorough preparation, and strict adherence to the local laws and regulations. Operating a regulated cryptocurrency business within the territory comes with significant benefits, mainly international recognition and favorable conditions on taxation; hence, it will be all worth the effort it requires. If properly addressed with support in the appropriate measure, your company will be able to reach the objective of being licensed in this jurisdiction and lay a sound foundation for the conduct of a successful cryptocurrency business in the Cayman Islands.

Taxation of Virtual Currency Companies in the Cayman Islands

The Cayman Islands have been one of the most favorite destinations for international businesses, including virtual currencies. Attractive tax policy and progressive regulation-encouragingly create a very good environment for companies dealing in cryptocurrencies and other virtual assets. This article discusses the taxation system applicable in the Cayman Islands to such companies and the salient features of the same to be considered while proposing a business in this jurisdiction.

Basic Principles of Taxation

One of the most attractive features of the Cayman Islands is that it does not levy direct taxes. As a result, there are no income taxes, corporate taxes, capital gains taxes, any tax on dividends, interests or royalties, and inheritance or gift taxes. This applies to both local and international businesses, including trading and investing in virtual currencies.

Licence and Registration Fees

There are no direct taxes in the Cayman Islands, although there are license and registration fees from businesses operating within the jurisdiction. All such license and registration fees vary according to the type of business involved and may also change with increasing regulatory requirements. For cryptocurrency firms, this might involve the cost of obtaining and renewing a Virtual Asset Service Provider license.

Reporting and Regulatory Compliance

Even though there is no direct taxation, the companies that incorporate in the Cayman Islands still have to follow certain reporting and compliance requirements. This means compliance in financial reporting and meeting international AML and KYC standards. The endorsement of no income tax for companies in the Cayman Islands should not be misunderstood to mean freedom from any tax obligations whatsoever by the Company, especially under the respective tax laws of any country of its presence or operation.

International Co-operation

The Cayman Islands actively co-operates with international regulators and adheres to international standards with respect to taxation and financial reporting, including remaining committed to participating in tax information exchange initiatives such as the Agreement on Mutual Administrative Assistance in Tax Matters and the EOIR standard.

The unique treatment crafted for cryptocurrency firms in the Cayman Islands does include some very attractive tax and regulatory policies. Together with international recognition, the lack of direct taxation creates an extremely suitable environment within which it would be beneficial to grow a global digital asset business. However, one needs to ensure that all considerations with respect to business are taken care of regarding licensing requirements and registration fees while paying due respect to obligations related to international standards and regulations.

Cayman Islands tax rates

The tax system in the Cayman Islands is attractive for business. Low rates and a great deal of incentives are provided for international companies on the islands. Therefore, here are the major tax rates of the Cayman Islands:

| Tax indicator | Tax rate |

| Corporate income tax | Absent |

| Value added tax (VAT) | Absent |

| Personal income tax | Absent |

| Annual licence fee | Depends on the type of company and the size of its assets, but typically between $700 and $5,000 |

Important points:

- Company tax: Income tax is not levied within the Cayman Islands; therefore, companies are not taxed in the islands.

- VAT: The Cayman Islands also do not impose charges on VAT, making it all the more attractive to international enterprise owners.

- Personal income tax: There is no personal income tax, which again makes the islands appealing to international professionals and investors.

- Annual license fee: Instead of levying income taxes or VAT, companies in the Cayman Islands are required to pay an annual license fee based upon the type and size of the company concerned.

Crypto tax in Cayman Islands

The Cayman Islands have gained much attention in recent years due to their exclusive conditions, which allowed the cryptocurrency business to grow rapidly. Absence of direct taxation already makes this archipelago one of the most popular destinations both for crypto companies and investors. In this vein, the below will provide a review of the tax environment of the Cayman Islands within a cryptocurrency context that highlights key attention points when doing business or investing in this jurisdiction.

Basics of Taxation in the Cayman Islands: From the perspective of fiscal policy, it is one of the main reasons why the Cayman Islands has attracted cryptocurrency inflows from around the world. The islands do not charge corporate income tax, capital gains tax, and taxes on dividends, interest, or royalties. This provides a great benefit to cryptocurrency companies, since they can optimize their level of tax burden by increasing their net profits.

Registration and Licence Fees: While the burden of direct taxes does not arise, the companies based in the Cayman Islands bear the burden of paying registration and licensing fees, whose amounts depend on the kind and scale of operations. For the cryptocurrency firms, these could differ given the specifics of their operations and what might be expected of them in terms of licensure.

Adherence to international standards

Notably, the Cayman Islands is committed to meeting the international standards of transparency and co-operation in tax affairs and have initiated various tax information exchange initiatives while maintaining adherence to Organisation for Economic Co-operation and Development standards. It is well advised for the cryptocurrency companies to consider the above-mentioned points while creating plans and structures and developing their operations and compliance programmes.

Planning and structuring

It is prudent for a cryptocurrency company to carefully plan and structure its operations in the Cayman Islands with a view to optimizing its tax burden and ensuring compliance with applicable regulatory laws. This may involve choosing an appropriate corporate structure, putting in place effective internal control policies, and adherence to principles of business transparency.

The Cayman Islands remain one of the world’s leading centres for cryptocurrency businesses, offering favorable terms of taxation and continuing to meet high standards of regulatory transparency. A cryptocurrency enterprise can secure full merit of the benefits provided by the jurisdiction in furtherance of stated business objectives and maximum profitability, subject only to the proper planning in a strategic manner. Attention to detail and observance of international and local regulatory requirements during the process are necessary.

Securing a Crypto Exchange License in the Cayman Islands 2025: A Gateway to Global Opportunities

The Cayman Islands are renowned not only for their scenic beauty but also as a pivotal financial centre, particularly appealing for cryptocurrency enterprises seeking a favourable regulatory environment. This detailed guide explores the crucial aspects of obtaining a crypto exchange license in the Cayman Islands, highlighting the regulatory framework, application process, and the distinct advantages of launching a crypto business in this jurisdiction.

Regulatory Environment for Crypto Exchanges in the Cayman Islands

The Cayman Islands Monetary Authority (CIMA) regulates the local cryptocurrency market, ensuring that all entities operate in compliance with international financial standards. The introduction of the Virtual Asset (Service Providers) Law has further streamlined the process, defining clear pathways for those looking to establish crypto services in the islands.

Types of Crypto Licenses in the Cayman Islands

The Cayman Islands offer various licenses to cater to different needs within the crypto industry:

- Crypto exchange license in Cayman Islands: Allows businesses to offer exchange services between cryptocurrencies and fiat currencies.

- Crypto broker license in Cayman Islands: Permits companies to facilitate crypto transactions on behalf of clients.

- Crypto trading license in Cayman Islands: For businesses that engage directly in the buying and selling of digital assets.

- VASP crypto license in Cayman Islands: Aimed at providers who offer a broader range of crypto services.

Applying for a Crypto License in the Cayman Islands

The application process is stringent, requiring thorough documentation including business plans, compliance procedures, and proof of financial stability. Applicants must demonstrate their ability to adhere to AML/CFT regulations and show robust security measures to protect their operations and clients.

Cost Implications of Licensing

The crypto exchange license in Cayman Islands cost can vary significantly based on the scope of business activities and the specific regulatory requirements to be met. While initial costs may be substantial, the long-term benefits of operating in a regulatory-compliant and financially sound environment can outweigh these expenses.

Advantages of Holding a Crypto License in the Cayman Islands

Securing a license in the Cayman Islands offers businesses not only regulatory clarity but also access to a global network of financial markets. The jurisdiction is recognized worldwide for its strong adherence to legal and regulatory standards, enhancing business credibility and investor confidence.

Challenges in the Licensing Process

Applicants may face challenges related to adapting to regulatory changes and managing compliance costs. However, with proper planning and expert advice, these hurdles can be effectively navigated.

Market Opportunities in the Cayman Islands

The Cayman Islands provide substantial market opportunities, highlighted by competitive aspects such as the cheapest crypto license in the Cayman Islands. These opportunities, combined with the islands’ reputation as a financial hub, make it an attractive location for crypto startups and established firms alike.

Purchasing an Existing License

For businesses seeking a faster market entry, purchasing an existing crypto exchange licensein the Cayman Islands for sale might be a viable option. This approach requires thorough due diligence to ensure that the license meets all current regulatory standards and aligns with business objectives.

The Cayman Islands continue to be at the forefront of financial innovation, providing a robust framework for those looking to enter the crypto market. By securing a crypto exchange license in the Cayman Islands, businesses can leverage the jurisdiction’s strategic advantages to access international markets, ensuring compliance and success in the burgeoning global cryptocurrency landscape.

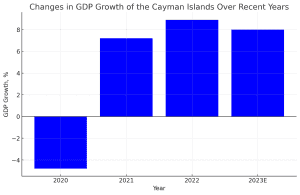

Changes in Cayman Islands GDP growth

Cayman islands crypto license 2025

The Cayman Islands, rated among the leading financial centers around the world, boast an innovative and attractive business destination. It has a stable society, sound political system with close judicial and legislative ties with the United Kingdom, unique selling propositions such as tax neutrality, expert services, and a moderate regulatory regime, specializing in servicing complex and institutional investors.

This coalescence of appealing features has made the Cayman Islands a jurisdiction of choice for financial structures in relation to fintech, including, among others, different investment vehicles in digital assets, cryptocurrency exchanges, initial coin and token offerings, and the issuance of decentralized finance protocols and networks.

The Cayman Islands government, through CIMA, recognizes, as do bodies like Cayman Finance and the Cayman Islands Blockchain Foundation, that fintech and digital assets are critical to further develop this sector. In parallel, however, the authorities also seek a proper balance between innovative expansion and adherence to high standards of financial integrity and transparency, particularly apposite in a digital asset regulating context.

In May 2020, the Cayman Islands enacted the Virtual Assets (Service Providers) Act, as amended in 2025, hereinafter referred to as the “VASP Act”. Implementation of this legislation was premised upon new international standards related to anti-money laundering adopted by the Financial Action Task Force (FATF). The VASP Act provides for the regulation of virtual asset services conducted within the Cayman Islands.

The VASP Act is implemented in two phases: one comprises AML rules, under which the virtual asset service providers will have to register themselves, while the second phase pertains to licensing and other regulatory issues. First phase has started and now all eyes are on the second phase.

In particular, the Ministry of Financial Services and Commerce of the Cayman Islands, on 13 February 2025, issued a draft bill for the Virtual Assets (Service Providers) Amendment Act 2025, along with associated proposals and consultation materials for discussing the proposed amendments to the legislation. Basically, the draft bill introduces requirements as to the minimum number of directors for the VASPs, revises the criteria necessary for the appointment and removal of key officers, and gives better clarity to the definition of terms such as “Operator” and “Convertible Virtual Asset.” It also rationalizes the fee structure for applicants of VASPs, removes obsolete provisions, improves terminology, and aligns audit-related requirements with other regulatory laws.

Public consultations on this issue closed in April 2025, and the actual second phase of the implementation of the law is expected soon.

This regulatory environment bolsters further the position of the Cayman Islands as a jurisdiction of choice for firms operating in the virtual asset space. It provides the necessary flexibility and predictability for the market participants to conduct their activities in this sector, with full assurance that the standard of compliance set internationally is respected in the Cayman Islands.

According to the VASP Act, a “virtual asset” is a digital representation of value that can be digitally traded or transferred and which falls into one of the following categories: for a payment or investment purposes. To begin with, it excludes any digital representation of fiat currencies and “virtual tokens of services.” This latter term means the digital values that cannot be transferred or exchanged with third parties and that are intended exclusively to provide access to an application or service, or to perform a function directly by the owner of the digital representation of value.

The Virtual Asset Rules have provided continuing clarity to the provisions under the VASP Law on the issue of registration, collection of fees, and issuance of virtual assets since October 2020. These rules allow further understanding and clarity for all parties in the trade and management of virtual assets within the Cayman Islands.

Crypto regulation in Cayman islands

The regulation of cryptocurrencies and digital assets in the Cayman Islands is governed by the VASP Act, which establishes the legal framework for virtual assets and sets rules for businesses providing services in this field. Virtual assets used by individuals for personal purposes generally fall outside strict regulation.

According to this law, all Virtual Asset Service Providers (VASPs) must be registered or licensed by the Cayman Islands Monetary Authority (CIMA), obtain a registration exemption, or hold a sandbox license. These organizations offer their services on a commercial basis or as part of business operations.

The virtual asset services subject to regulation include:

- Exchange of virtual assets for fiat currencies.

- Exchange between different forms of convertible virtual assets.

- Transfer of virtual assets.

- Storage services for virtual assets, including the activities related to the safekeeping or administration of virtual assets, allowing the holder to control their assets.

- Participation in financial services related to the issuance or sale of virtual assets, as well as providing similar services.

Therefore, the law of the Cayman Islands aims at establishing a certain and more orderly legal framework as concerns the regulation of the virtual asset market, so that it would become transparent and subject to the highest possible standards in terms of cryptocurrency activities.

The activities that are not covered by the specific services listed in the VASP Act and any other activities of digital assets remain caught under different forms of regulation in the Cayman Islands, although not bespoke for digital assets. Examples include the Securities Investment Business Act (SIBA), the Money Services Law, and Anti-Money Laundering (AML) standards.

These activities likely to amount to virtual asset services include the issuance of virtual assets, the provision of financial services related to the issuance or sale of a virtual asset, and the transfer of virtual assets when undertaken in the Cayman Islands by a legal person for or on behalf of others in the course of business. These activities will be subject to licensing or registration with CIMA under the VASP Act.

In this regard, a multi-tiered approach to regulating digital assets was implemented in the Cayman Islands, both in terms of specialized and general legal frameworks capable of comprehensively managing and overseeing the broad range of activities in this field. It guarantees compliance with locally and internationally accepted standards for transparency and equity in the market’s functioning with respect to digital assets.

The current position under the VASP Act in the Cayman Islands is that any issuance of virtual assets must be pre-approved by the Cayman Islands Monetary Authority. The term “issuance” in this context refers to an act of offering created virtual assets to the public in return for fiat currencies, other forms of virtual assets, or any other form of consideration. The term “public” has not been defined within the meaning of the law and would need, therefore, to be considered broadly when interpreting issuances.

There are, however, some critical differences between public and private sales under the VASP Regulations. A private sale would generally be defined by an absence of public advertising and few buyers purchasing any assets under a private agreement. It is possible that such private sales do not come within the purview of registration under the VASP Act. Additionally, the sale of tokens whose purpose is to grant rights to services or applications only and transfers without consideration, such as “airdrops,” are exempt from the requirement for approval.

Second, it is specified that direct issuances of virtual assets are subject to a certain maximum threshold, which has not been set at the time of writing this article. However, this threshold shall not apply if the issuance is via one or more virtual asset trading platforms or by way of regulated persons, in case such platforms are licensed under the VASP Act or are regulated in a low-risk jurisdiction. This indicates that the Cayman Islands are keen on adhering to the set international standards of virtual asset regulation and, at the same time, affording room for flexibility and market access to innovative financial products.

“Establishing a business in the Cayman Islands is a streamlined process, indicative of its welcoming business environment. As a specialist in this field, I am well-equipped to assist you. Feel free to reach out for more information or guidance.”

FREQUENTLY ASKED QUESTIONS

What makes the Cayman Islands a good place to start a cryptocurrency business?

The Cayman Islands is an attractive jurisdiction for cryptocurrency businesses due to its stable political and economic environment, low taxes, access to banking services and high level of privacy. In addition, it has a transparent and clear regulatory framework for dealing with cryptoassets, providing legal clarity and protection for companies and their customers.

What changes have taken place in the crypto sphere in the Cayman Islands in recent years?

Until 2023, the Cayman Islands has introduced the Virtual Assets Law (May 2020), which sets out a framework for cryptocurrency businesses. The legislation aims to comply with global standards including privacy, CTF, AML and KYC policies. This ensures the secure conduct of financial activities with assets and strengthens the Cayman Islands' position as an attractive jurisdiction for cryptocurrency companies.

Who in the Cayman Islands is responsible for regulating cryptocurrency activity?

In the Cayman Islands, cryptocurrency activity is regulated by the Cayman Islands Financial Services Authority (CIMA). CIMA is responsible for issuing various types of licences for cryptocurrency exchanges, crypto-banks, crypto-brokers and other companies dealing with crypto-assets

Are there different types of cryptolicences in the Cayman Islands?

Yes, there are different types of crypto licences in the Cayman Islands provided by the Financial Services Authority (CIMA). These include licences for crypto exchanges, crypto banks, crypto brokers and crypto funds. This provides comprehensive regulation of various aspects of cryptocurrency activity, from trading platforms to storage and transfers of cryptoassets.

Cryptocurrency taxation basics in the Cayman Islands: what is it?

The Cayman Islands are known for their loyal tax regime, including with regard to cryptocurrency activities. They do not levy income tax, corporate tax, capital gains tax or value added tax on cryptocurrency companies, making them an attractive place to do business in this area. However, companies must comply with local laws, including adherence to AML/CFT policies.

What requirements must be met in the Cayman Islands when starting crypto activities?

In the Cayman Islands, starting a crypto business requires company registration, development and implementation of AML/KYC policies, a minimum share capital of $100,000, an office in the islands, appointment of a director to comply with regulatory requirements, establishment of anti-money laundering and counter-terrorist financing systems, payment of an annual licence fee and passing a CIMA inspection.

What is the capital gains tax rate in the Cayman Islands?

There is no capital gains tax in the Cayman Islands. This is one of the reasons why this jurisdiction is attractive to investors and companies dealing with cryptocurrencies and other types of assets.

Are there accounting requirements in the Cayman Islands?

There are accounting and financial reporting requirements for companies in the Cayman Islands, but these may vary depending on the type of organisation and its activities. Companies are required to maintain records and documentation that reflect their financial transactions in sufficient detail to enable an accurate determination of their financial position. However, the Cayman Islands has no income tax or corporation tax, which reduces accounting requirements compared to some other jurisdictions.

Are there any KYC/AML documents in the Cayman Islands that I need to provide?

Yes, the Cayman Islands requires KYC/AML documents when registering a company and starting crypto activities. These documents typically include proof of identity of founders and directors, proof of address, a detailed business plan and information demonstrating the source of funds. It may also be necessary to appoint a local AML compliance officer and develop AML/KYC policies.

Registering a crypto business in the Cayman Islands: where to start?

To start registering a crypto business in the Cayman Islands, you should begin by registering your company in the jurisdiction, developing and implementing AML/KYC policies, appointing an AML officer, and possibly selecting a local representative. You will also need to develop a detailed business plan and confirm the source of your finances. You can then apply for the appropriate licence from a regulator such as CIMA, meeting all documentation and compliance requirements.

Additional services for Cayman Islands

RUE customer support team

“Hi, if you are looking to start your project, or you still have some concerns, you can definitely reach out to me for comprehensive assistance. Contact me and let’s start your business venture.”

“Hello, I’m Sheyla, ready to help with your business ventures in Europe and beyond. Whether in international markets or exploring opportunities abroad, I offer guidance and support. Feel free to contact me!”

“Hello, my name is Diana and I specialise in assisting clients in many questions. Contact me and I will be able to provide you efficient support in your request.”

“Hello, my name is Polina. I will be happy to provide you with the necessary information to launch your project in the chosen jurisdiction – contact me for more information!”

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

Registration number: 08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00 Prague

Registration number: 304377400

Anno: 30.08.2016