BVI Crypto license 2025

The British Virgin Islands (BVI) offer a crypto-friendly regulatory environment, tax advantages, and a clear licensing framework for blockchain and digital asset businesses.

Launch Your Business Legally and get BVI Crypto License with Our Full-Service Package

- Full turnkey company formation

- Corporate documents

- VASP License application assistance

- Procedural Documents (AML/KYC Policies, Custody service agreement, etc.)

- Registered Office for 1 year

- Analysis of the existing documents, website, structure

Crypto License in BVI

Lying in the heart of the Caribbean, BVI has emerged over the years as a beacon for entrepreneurs and investors. Renowned for their picturesque landscapes, tax-neutral policies, and a sound financial framework, BVI has emerged as one of the preferred destinations for businessmen and investors alike. In this paper, we explore the varied opportunities and advantages that make BVI the ideal choice for a business firm.

According to the VASP Act, the term ‘virtual asset’ means any digital representation of value that can be electronically traded or transferred and that can be used for investment or payment purposes, provided certain preconditions are met. This broad definition clearly encompasses a wide variety of cryptocurrency assets, including non-fungible tokens.

Advantages – British Virgin Islands Crypto License

Under the VASP Act, a business entity may apply for regulation as a VASP for the following activities not limited to: providing services of virtual assets; offering custody and custody-related services of virtual assets; and conducting an exchange of virtual assets.

Businesses seeking a license for a cryptocurrency in the British Virgin Islands must satisfy certain regulatory conditions developed by the BVI Financial Services Commission (FSC). These requirements are designed in such a way as to make businesses of the crypto industry comply with the local laws and BVI cryptocurrency regulations so that the business proceeds in a responsible and sustainable manner. A license for crypto exchange in the BVI is mainly subject to the following conditions:

It should be duly incorporated in the BVI and have some physical presence within the jurisdiction of the BVI, including an office maintained or a registered agent appointed in the BVI.

All directors, officers, and shareholders of the proposed business will be subject to a fit and proper test with a view to ascertain whether a person holding such a position is fit and proper.

The business is required to provide a comprehensive business plan that covers proposed activities, products or services, the market intended for, and a growth strategy.

A business should follow proper policies and procedures that should help in abiding by the AML/CTF requirements, including the appointment of a compliance officer responsible for ensuring all aspects of this AML/CTF policy are complied with.

The businesses should be in a position to undertake activities within the crypto industry with adequate financial resources and a minimum level of capitalization as prescribed by the FSC.

The businesses have to demonstrate appropriate technological infrastructure and security measures considered necessary for the protection of customers’ assets and personal data.

The business should have professional insurance to protect themselves and the clients by covering losses resulting from negligence, error, or omission. A company is also required to appoint an auditor.

The companies should maintain a written risk assessment document detailing the risks that may impact the VASP. The document shall identify how the threats are identified, measured, assessed, monitored, controlled and reported.

Documentary and Information Requirements

An applicant for a BVI VASP license is bound to provide the following information and complete the application form, where relevant, with documentary support provided. This includes:

Payers who wish to conduct the activity of Virtual Assets Custody Service or who provide services as a Virtual Assets Exchange, under the definition set out in the VASP Act, have to provide more detailed information and assurances to the FSC. These are meant to attest that the VASP is capable of safeguarding the assets of clients effectively, aside from the increased risks of money laundering and terrorist financing. These would also ensure that the relevant regulatory requirements are complied with, aside from offering greater overall security in terms of the virtual asset services provided by the particular entity.

Capital

Road Town

Capital

Road Town

Capital

Road Town

Capital

Road Town

It is a tax-neutral jurisdiction; this means that the income made out of the mother jurisdiction neither attracts corporate, income, nor capital gains taxes. In relation, it is an attractive location for companies seeking to set up business operations in this country.

Although the BVI does not impose direct taxes, there are certain fees that could be of relevance for business. For instance, they would have to pay some annual fees connected to the maintenance of their BVI company and the renewal of their crypto license with the BVI Financial Services Commission.

On top of that, the incorporated companies who are located outside the BVI may be obliged to pay income tax in their native place. For instance, a cryptocurrency business that provides services to customers based in the United States might be considered liable for tax in that jurisdiction, depending on the nature of activities it undertakes.

It is crucial, then, that businesses in the BVI consult with a tax professional to ensure that the entities are in compliance with all applicable tax laws and regulations. This would likely involve both local and foreign-based tax professionals, depending on where the head office of the firm is located.

Application Fees:

The application fees payable in respect of the registration application of a VASP under the VASP Act, as prescribed in the Guidelines and outlined below:

Reporting Requirements:

As noted above, virtual BVI companies providing asset services are considered to be conducting “relevant business” for the purposes of the AML Regulation and are, therefore, required to comply with the BVI anti-money laundering/counter-terrorism financing/financial crime statutory regime. This inter alia includes compliance with Travel Rules, reporting suspicions of money laundering and/or other criminal conduct to the Commission and/or the British Virgin Islands Financial Investigation Agency, as appropriate.

In that direction, OECD issued the final version of the Crypto-Asset Reporting Framework or CARF, along with the updated version of 2023 on CRS. It instituted a standard cross-border reporting system that would allow for the exchange of information related to crypto-asset trading. To this effect, this article predicts an amendment in the BVI’s CRS legislation framework to bring it in line with the suggestions as per CARF.

Continuing Requirements:

Several continuing requirements could be prescribed for a VASP including:

Any person offering virtual asset benefits without registering under the VASP Act can be convicted and liable to a fine of not more than US$ 100,000 and/or to imprisonment for a term of not more than 5 years. Where any director, partner or other senior officer has knowingly authorized, permitted or acquiesced in that offence that person may also be liable to the same penalty.

BVI Crypto-Currency and ICOs:

Over the past two years, substantial amounts have been raised through initial coin offers for cryptocurrencies, tokens, and other forms of blockchain-based assets. Offshore financial centers, such as the British Virgin Islands, have actively pursued the opportunity to participate in this capital-raising phenomenon. The result is a growing demand for the use of BVI companies as ICO issuer vehicles. While there has been equal interest coming in from other offshore jurisdictions, setting up an ICO via a BVI company has its relative advantages that make the BVI just about ideal for ICO launches. This has therefore seen some of the most successful launches within the last 12 months.

ICO:

Another alternative way to raise outside capital is through an ICO. Unlike a classic IPO, wherein investors receive a security that represents a claim on the issuer or its consolidated group, in an ICO, investors change cash for a newly issued cryptocurrency on a blockchain platform.

The digital asset usually is made up of a credit or token used to spend on items on the platform or related business being financed by the ICO. Instead, most investors do not use these “utility tokens” to buy anything in the application but instead hold the tokens in anticipation that the success of the underlying enterprise—where the new utility token is the primary unit of exchange—will drive up the utility token’s relative cash value. The supply follows increasing demand for the tokens to realize value within the application, and for their potential acceptance as a wider medium of exchange.

Regulators generally do not regard most utility tokens as an “investment” or a “security.” For that reason, such tokens are not subject to a variety of regulations and restrictions that normally apply to public debt or equity issued by a company. This exemption is because a token’s value is derived from the demand for the token itself and not from any return or repayment stemming from an underlying business operated by the issuer. Thus, ICO provides a fast and cost-effective way for early-stage businesses, startup companies, and technology entrepreneurs to raise significant amounts of money—particularly where traditional access to capital markets is not available.

ICOs and Existing BVI Securities and Financial Services Regulation:

Although it is generally accepted that a standard ICO would not be restricted or heavily regulated by the existing BVI financial services law, the current state of this law and the guidance provided should be taken into consideration for any proposed ICO to properly structure and avoid triggering restrictions and obstacles that may not otherwise apply.

The following provisions apply in respect to an ICO and regarding BVI financial services laws:

Crypto Regulation in British Virgin Island

| Category | Details |

|---|---|

| Period for consideration | From 6 months |

| Annual fee for supervision | No |

| State fee for application | 10,000 USD |

| Local staff member | No |

| Required share capital | No |

| Physical office | No |

| Corporate income tax | 0% |

| Accounting audit | No |

BVI Crypto Exchanges:

The operation of investment exchanges is regulated by SIBA, but its scope is limited to items classified as “investments” under SIBA. So operating an exchange for tokens classified as utility tokens and exempt from the scope of the legislation discussed above is not a regulated activity, provided nothing that falls within the definition of an “investment” is used as a medium of exchange for such utility tokens.

As such, the trading of utility tokens against other utility tokens, fiat money, or stable coins would not be a regulated activity. Conversely, the trading of utility tokens against a token which resembles an investment would most likely be within the purview of the regulation.

British Virgin Islands Financial Services Regulatory Sandbox:

Recently, the BVI enacted the Financial Services, Regulatory Sandbox, Rules 2020, for those instances either where a token is likely to be regulated under either SIBA or FMSA, or under other laws or where an exchange would involve the trading of “investments” under the Regulations.

These Rules introduce a “regulatory sandbox” in which innovative fintech businesses can operate, provided they adhere to a clearly defined business strategy and serve a limited (pre-determined) number of clients. In that way, an activity can be “sandboxed” even if a token is deemed to fall under financial regulation, without full compliance with BVI financial services regulation during the technology evaluation period.

Cryptocurrency British Virgin Islands Regulated Activities:

In general, if a virtual asset or a product relating to virtual assets constitutes an “investment” under SIBA, a BVI company will be required to be licensed in order to carry on certain activities relating to that investment.

The types of “investments” under SIBA include:

| Type | Investment Detail |

|---|---|

| Shares, etc. | Includes shares, interests in a partnership, or fund interests. |

| Debentures, etc. | Covers debentures, debenture stock, loan stock, bonds, certificates of deposit, and other instruments creating indebtedness. Excludes instruments related to agreements for paying money for goods or services, as well as cheques, bills of exchange, banker drafts, or letters of credit. |

| Instruments giving entitlement to shares, debentures | Relates to warrants or other documents entitling the holder to acquire investments. |

| Certificates of investment | Certificates granting proprietary or contractual rights transferable without the consent of the registered holder. |

| Options | Includes options on selling or buying any investment or currency, including options on palladium, platinum, gold, or silver. |

| Futures | Futures contracts for investment purposes (traded or expressed for trading on an investment exchange), excluding those entered for commercial non-investment purposes. |

| Contracts for differences | Rights under a contract aimed at profits or loss avoidance based on fluctuations in property value, indices, or prices—excluding delivery arrangements of the related property. |

| Long-term insurance contracts | Contracts for long-term insurance or rights/interests in any investments. |

| Rights and interest in investments | Rights to or interests in any investment. |

| Specified investments | Anything designated as an investment by relevant regulations. |

It is important to note that for the purposes of SIBA, cash and real estate are not considered to be investments. For example, a virtual asset transaction that qualifies as a “contract for differences” would be considered an “investment” for the purposes of SIBA under the above definition.

Investment business for the purposes of SIBA includes the following activities:

With the British Virgin Islands offering a blend of tropical beauty, financial advantages, and a progressive business environment, they stand to order for entrepreneurs. From the new crypto industry to the establishment of any other traditional business, the BVI offers that perfect blend of opportunities and advantages which set the stage for success. Give in to the charm of the Caribbean-sealed business environment of the BVI, where innovation meets tranquility and success is unlimited.

Crypto Company Registration in BVI

Registration of a cryptocurrency company in the British Virgin Islands is considered one of the most attractive options for every entrepreneur and investor willing to maximize benefits from this jurisdiction. It has favorable tax regulations, privacy, and a relatively simple registration procedure that make BVI one of the preferred locations for launching a crypto company.

Before actually starting the registration process, it is very important to understand the regulatory landscape of BVI with respect to Cryptocurrencies. While the tax laws can be friendly, there is some form of regulation and certain duties that have to be followed, including those concerning transparency and AML.

Consequently, choosing the correct legal form of a cryptocurrency company is very important. The most common forms in the BVI include LLCs and IBCs. Each form has different advantages and characteristics, depending on the business plan and goals.

The steps towards incorporating a company in the BVI require the preparation and filing of certain documents, including the Memorandum of Association and Articles of Association, among others. You also have to find a registered agent in the BVI that will be your representative in the Islands officially.

All the companies incorporated in the BVI shall further comply with local and international anti-money laundering and Customer Due Diligence standards, such as disclosing the company’s ultimate owners, directors, and beneficiaries, and verifying sources of funding.

Furthermore, it may be quite cumbersome to open a bank account for the cryptocurrency company in the BVI due to the fact that many of the BVI banks either refuse to work with this line of activity or impose much stricter KYC and AML requirements onto them. Many are left with no choice but to use the services of specialized financial advisors or legal entities offering services that include, among others, maintaining business relations with banking institutions in this country.

Taxation incentives for cryptocurrency companies in the British Virgin Islands include no taxation of profits, capital gains, dividends, and interest paid by a company. Nevertheless, even considering such a favorable tax position, companies are obliged to maintain records concerning their financial activity and to file annual reports in accordance with applicable local legislation. It should be underlined that the BVI adopted an economic substance regime, where certain types of companies are supposed to show substantive economic activity on the islands.

In this respect, BVI introduced economic presence rules in 2019, which, depending on the underlying activity, could be relevant for a cryptocurrency firm also. This requires companies to show that they are managed and controlled from the BVI and their principal activities are conducted from the islands. In relation to this requirement, documentation of economic presence should be on islands, including qualified personnel, financial outlays, and a physical office.

Once a company has been successfully incorporated in the BVI, it is necessary to comply at all times with the applicable regulatory and tax requirements, updating incorporation documents, keeping and maintaining financial records, and compliance with international anti-money laundering and counter-terrorist financing standards.

To conclude, the advantages of registering a cryptocurrency company in the British Virgin Islands will include favorable tax regulations and privacy. However, without thorough preparation in respect to local legislation and regulations, subsequent observance of the regulatory requirements, it would be rather difficult to further implement and conduct business for a long period. Preparation with regards to incorporation, selection of an appropriate legal structure, AML/KYC compliance, and planning of economic activity in view of economic presence rules shall attract special attention. Companies may also have to seek professional assistance from specialists familiar with doing business in the BVI to ensure successful registration and operation in the jurisdiction successfully.

Selection of Registered Agent and Office

In order to make this inclusions of crypto company into BVI, one needs to select an agent registered within the islands and also an office. Such a registered agent will be able to act as local representative for the firm and provide liaison with local regulators by filing documents and annual reports with them. Having a physical office may also be a requirement in order to prove economic presence according to local legal requirements.

Development of Internal Policies and Procedures

Operators of cryptocurrency businesses should develop and implement internal policies and procedures in respect of regulatory requirements regarding AML and KYC compliance. These policies should be specific to the peculiarities of the cryptocurrency operation and provide for effective management and control of financial transactions.

Establishing Contact with Banks and Financial Institutions

This may include opening bank accounts, which could be a problem for many traditional banks that are extremely cautious about co-operating with businesses in this industry. It would be advisable to do some preliminary research and possibly seek the help of specialised financial advisors to find a bank or financial institution open for co-operation with cryptocurrency companies.

Ongoing Compliance & Monitoring

After incorporation, a company should continue being compliant with all relevant laws and regulations, including annual updates of registration information and financial reporting. It is very important to internally monitor operations and transactions on a continuing basis in order to avoid not only regulatory violations but also to manage risks.

Registration of a cryptocurrency company in the British Virgin Islands is not at all straightforward and requires much forethought by individuals that have knowledge of local legislation and licensing. In addition, the regulatory environment is supportive of businesses, offering all kinds of tax incentives and confidentiality. Indeed, the right approach and preparation mean that the BVI can represent an important jurisdiction for the further growth and development of your cryptocurrency business through the provision of a secure platform for further international expansion and innovation in digital assets.

Also, in this respect, it is relevant to mention corporate structure and internal culture of compliance, since cryptocurrencies are a regulated and closely monitored industry. Any building of effective risk management and compliance systems suitable for your business and your regulatory requirements will not only legally protect the company but also its reputation as a reliable and responsible market participant.

With BVI, involvement in the ecosystem of cryptocurrency activity and industry associations will provide you with an avenue to contribute to the expansion of your professional network through experience, expertise, and knowledge sharing with other companies. It also helps raise awareness of your brand, educates you on the latest trends and regulatory changes, and takes advantage of opportunities to grow your cryptocurrency venture.

Finally, it is important to point out that, notwithstanding all the advantages, conducting a cryptocurrency business in BVI presupposes the strict observance of ethical standards and best practices in the given industry. In this respect, transparency of your operations, sincerity of your discourses with clients and investors, responsible treatment of assets, and data protection must form one, two, three cornerstones of your company.

With the proper approach and compliance, overall, the British Virgin Islands can offer unique opportunities for your cryptocurrency business to grow and thrive, opening up full potential in innovative technology on a global scale.

Information about British Virgin Islands (BVI)

| Parameter | Information |

|---|---|

| The five biggest cities | Road Town (capital), Spaniestown, Anegada, Virgin Gorda, Joost van Dijk |

| State language | English |

| Time zone | UTC-4 |

| Calling code | +1-284 |

| Domain zone | .vg |

Crypto legislation in BVI

British Virgin Islands over the past years have positioned themselves as one of the major international financial centers, offering extremely favorable legal and tax environment for international investments, which, of course includes investment in cryptocurrencies. The Government of the BVI has drafted cryptocurrency legislation to strike a balance between making the British Virgin Islands welcoming to innovative technology companies while setting the appropriate level of regulation and protection.

By and large, the cryptocurrency activity in the British Virgin Islands is regulated by the already existing legislation relating to investment business, companies, and anti-money laundering. While specific cryptocurrency legislation is still under development, the basic principles and requirements are already outlined quite clearly.

The BVI follows the Companies Act 2004 and the Investment Business Act for the regulation of activities in the field of digital assets. These Acts provide the regulatory framework around the incorporation and conduction of business, including the licensing of those people who wish to provide an investment service or product. In case one intends to operate a cryptocurrency business in the BVI, he will be required to follow such requirements.

Anti-money laundering and counter-terrorist financing are serious issues in the BVI. Cryptocurrency companies are required to have in place proper AML/CFT procedures, including performing Know Your Customer checks, monitoring transactions, and reporting suspicious transactions.

As such, the fast growth of the Digital Asset Market also compelled BVI to make an adaptation in its regulatory approach to its unique features. That would be fashioning new rules and guidelines that protect both investors while simultaneously encouraging fintech innovations.

Improvement of BVI crypto legislation is in tune with international standards and guidelines, for example, writing special rules regarding the conduct of ICOs, trading of cryptocurrencies, keeping digital assets, and blockchain. Such a balanced regulatory environment would have further stimulated growth and innovation and at the same time provided an adequate level of protection for the market participants.

The following are some of the key advantages to doing business in the British Virgin Islands: its tax policy. Companies incorporated in the BVI are generally exempt from taxes on profits, dividends, interest, and royalties. Thus, it can be expected that the BVI will turn out to be an attractive jurisdiction for cryptocurrency companies, particularly the ones looking to maximize their international tax advantages.

Despite all the advantages mentioned above, the cryptocurrency companies in BVI have a number of issues that challenge their operationalization. It involves opening bank accounts, taking into consideration the cautiousness of most banks regarding cryptocurrency transactions, and trying to follow international anti-money laundering standards. It is therefore very important to make proper preparations, and even seek help from specialized financial and legal consultants when necessary.

Establishing a cryptocurrency company in the British Virgin Islands allows the conduct of favorable tax policies and the most liberal legislation. On the other hand, the ability to work in this jurisdiction means profound knowledge of the current condition of the local regulatory environment and readiness for further adaptation to its changes. If chosen and supported correctly, the BVI may become a crucial chain in your strategy to develop your cryptographic business globally.

Crypto exchange licence BVI

Obtaining a cryptocurrency exchange license in the British Virgin Islands is considered one of the strategic steps for companies eager to operate within this progressive yet regulated jurisdiction. Unique opportunities for the growth and development of cryptocurrency business are provided due to favorable tax policy and flexible regulation.

Introductory Part of BVI Regulation Environment

First of all, it is relevant to understand the general regulatory environment of the BVI and how it applies to cryptocurrency exchanges. While the BVI has not at the date of writing introduced specific legislation relating directly to cryptocurrency exchanges, such exchanges are required to comply with general AML and KYC legislation and, depending on their activities, licensing issues. The following section describes the general steps for obtaining a licence:

It is a pretty demanding process, considering the preparation, attention to detail, and deep understanding of the local regulatory landscape that it takes for one to ultimately get a license from the British Virgin Islands for a crypto exchange. It is through this process that one gets a chance to operate his business in one of the most attractive jurisdictions concerning cryptocurrency business. Meanwhile, in the same breathe, it has to be emphasized that business has to be conducted at high parameters and in full observance of regulatory prescriptions to ensure longevity in the market. In this respect, it would be worth resorting to the expertise of professional legal and financial consultants in order to have the best possible result for all stages of registration and further operation of a cryptocurrency exchange in the British Virgin Islands.

| Step | Details |

|---|---|

| Preliminary Research and Consultation | The first thing is preliminary research of the regulatory requirements, sometimes with the advice of a professional. You must familiarize yourself with the regulatory requirements your business falls under or if there is a special license required to operate a cryptocurrency exchange. Professional advice is recommended. |

| Choosing the Right Legal Structure | Selecting the appropriate legal structure for your cryptocurrency exchange is crucial. For example, BVI often adopts the IBC structure due to its flexibility and tax benefits. |

| Creation of Internal Policies and Procedures | Establish internal policies and procedures to meet AML/KYC requirements. This includes customer identification, transaction monitoring, and reporting suspicious activity. |

| Application for a Licence Being Filed | After choosing the legal form and drafting AML/KYC policies, file the license application. The application should describe the business, AML/KYC policies, key personnel, financial projections, technology infrastructure, security systems, and adherence to international standards. |

| Communication with Licensing Authorities | After submitting the license application, establish communication with licensing authorities. Respond promptly to any requests for additional information, amendments, or clarifications to expedite the process. |

| Licensure – How to Obtain and Retain | Upon obtaining the license, ensure compliance with all conditions, such as periodic reporting and disclosures. Continued compliance with regulatory frameworks and operational care ensures the sustainability and reputation of your cryptocurrency exchange. |

Crypto trading licence BVI

Obtaining a cryptocurrency trading license in the British Virgin Islands is one of the most crucial steps for companies willing to conduct activities related to their cryptocurrency trades in the BVI. The BVI has become home for many international investors and companies doing cryptocurrency transactions due to its very friendly regulatory and tax environment for cryptocurrency transactions. Furthermore, it is worth conducting a study of the regulatory environment.

Regulatory Environment Study

First and foremost, deep knowledge of BVI regulations with respect to cryptocurrencies should be acquired. Overall, BVI is a relatively loosely regulated jurisdiction, but there are certain laws and requirements that should be met in relation to cryptocurrency trades, especially concerning AML/KYC. By studying such requirements, you will have a good overview of which licenses might be needed for your specific business.

Choice of Legal Structure

Choosing the right legal structure is critical to the successful incorporation and further operation of a company. The BVI is widely popular for its IBCs due to their flexibility, confidentiality, and tax advantages. A decision on choosing a structure should be based on current and future needs of your business.

AML and KYC Policies Development

The draft and implementation of the AML and KYC policies shall be done based on international standards before the application for a license is submitted. This point is of utmost importance regarding the prevention of cryptocurrency platforms from being used for money laundering or terrorist financing. Policies shall include the processes for identification and verification of customers, monitoring of transactions, and suspicious transaction reporting.

Submission of an Application for a Licence

After the preparation of all the documents and development of relevant policies, one will proceed with an application for a license. The application must provide full details of the company, give a description of the business model, and show evidence of compliance with AML and KYC policies. On certain requests by the regulator, other additional documents may be required.

Waiting for a Decision and Interaction with the Regulator

Once the application is filed, a company has to wait until the regulator has approved its application. During this period, it may be required to answer further questions and provide additional information to regulators. At times, effective communication and rapid response with each request from the regulators may be the key to getting the license.

Ongoing Compliance with the Licence Conditions

Obtaining a license is just the beginning. The company needs not only to obtain a license but also to keep it and successfully conduct business in the BVI by continuing to observe any relevant regulatory requirements, including the AML/KYC regulations, together with the conditions provided in the license. Regular policy and procedure updates, coupled with internal reviews and audits, will be instrumental in preventing violations that may occur and the sanctions resulting from these.

Products and Services Development in Line with the Licence

A cryptocurrency trading license outlines the premise upon which a company is permitted to develop its products and offer its services. Of course, any new products and services must be within the conditions of the license and the regulatory requirements outlined by the BVI. This may be conceivable with additional consultation with the regulator or their legal advisors when devising innovative solutions or introducing new technologies.

Interaction with the Financial Sector

Any cryptocurrency exchange, in order to operate effectively, would have to interface with the financial world through banks and systems of payment. While the BVI has a good climate for cryptocurrency transactions, opening bank accounts and the execution of fiat currency-related transactions may take more effort and approval.

The journey towards a BVI cryptocurrency trading license involves a lot of preparation, significant insight into the regulatory requirements, and extensive communication with regulators. Lastly, compliance with regulatory rules and license conditions and the ability to adapt to an ever-changing regulatory landscape forms a good foundation for long-term growth and success in this dynamic and innovative area. The BVI remains one of the more attractive jurisdictions for cryptocurrency exchanges, offering an enabling environment to develop business with access to international financial markets.

How to Get a Crypto License in BVI?

Obtaining a cryptocurrency business license in the British Virgin Islands is considered a great achievement for companies willing to develop their operations in a jurisdiction with a beneficial business environment. The road to getting a license consists of pre-planning, application, and then approval by the regulator in several steps. The following are the major steps toward successful acquisition of a BVI cryptocurrency license, focusing on key business aspects.

| Step | Details |

|---|---|

| Understand the Business Model – Understand Whether Any License Is Required | Before licensing, it is important to assess the business model and the activities your cryptocurrency business will conduct. This helps identify which regulatory categories apply and determine the required license. Special focus should be placed on AML and KYC requirements of the BVI, mandatory for all financial transactions. |

| Docketing and Filing | Prepare a set of documents, including a business model description, financial plan, details about beneficial owners, directors, senior management, and AML/KYC policies. Confirmation of compliance with international security standards for technology and software may also be needed. |

| Choosing a Registered Agent in the BVI | BVI registration requires a registered agent to represent the company and assist with local compliance. Selecting an experienced and reliable agent can ease the licensing process and support ongoing operations. |

| Filing the Application and Liaising with the Regulator | Once documents are ready and a registered agent is selected, file the application with the relevant BVI regulator. Maintain open communication with the regulator, and be prepared to provide additional information or clarifications as requested. |

| Compliance with Conditions of a Licence and the Commencement of Operations | Upon obtaining the license, ensure compliance with all regulatory conditions, such as regular reporting and maintaining AML/KYC policies. This ensures legal compliance and builds credibility with clients and partners. |

Continuous Monitoring and Adaptation of Changes in the Regulatory Environment

The crypto-market is rapidly developing, and respective requirements may alter. It is relevant to continuously monitor changes in BVI legislation and international standards to adapt your activities in a due timely manner and avoid respective risks. Further, regular internal policies and procedures update and internal audits shall help comply with high standards and regulatory requirements.

Cooperation with Professionals

Because the whole process of acquiring a BVI cryptocurrency licence is very complex and specific, it is highly advisable to have good collaboration with professional legal and financial advice in this jurisdiction. Professional advice and support will substantially ease the licensing procedure and reduce potential risks.

Advantages of BVI crypto license

Obtaining a cryptocurrency business license in the British Virgin Islands is considered one of the strategic decisions for any digital asset company, offering considerable advantages. The jurisdiction of the British Virgin Islands is quite attractive to both international investors and entrepreneurs because it has heavy tax policies, a very high level of privacy, and relatively smooth regulatory procedures.

Obtaining a cryptocurrency license in the British Virgin Islands provides companies not only with a legal framework of doing business but also with a number of strategic advantages: a favorable tax environment, simplified regulatory procedures, a high level of privacy and protection, international recognition, and ample opportunities for innovation. All these combined create a stimulating environment for the growth and development of cryptocurrency businesses.

One thing should be kept in mind, though: following all the regulatory requirements is not enough to get and retain a license; there is also a need for active risk management, compliance with AML/KYC policy, and data protection. What is more, companies will have to be ready to change themselves according to changes that take place in the regulative environment to further their business in the best way and meet international standards.

In this regard, it is advisable that one consult a competent legal and financial expert who would assist at all stages of the licensing process and through the subsequent operation of the business. This will not only enhance your prospects of securing a license but also contribute to the success and sustainability of the enterprise in the BVI.

Benefits of crypto license in BVI

A BVI crypto license can be a great addition to your firm, opening the doors towards access to the global digital asset market and becoming the starting point of a long-lasting growth and success position. Obtaining a cryptocurrency license in the British Virgin Islands provides a wide range of advantages for a company, placing this jurisdiction as one of the favorite places for both registration and operation of a cryptocurrency business. Indeed, their reputation as a trusted international financial centre, besides a specialized approach to cryptocurrency regulation, places the BVI in a very favorable environment for growing and innovative businesses.

- Tax Advantages:

Another great advantage of doing a cryptocurrency business in BVI is the favorable tax climate. Generally speaking, a BVI-licensed cryptocurrency company will be exempted from income taxes, capital gains taxes, dividends, and interest. This enables a firm to retain maximum revenue and attracts further reinvestment for growth.

- Regulatory Clarity and Stability:

What is more, the BVI offer a quite clearly regulated environment where cryptocurrency companies can be established, with much-needed legal clarity and stability. Indeed, a license issued in this country confirms compliance with international standards and local legislation, which means increasing investors’, customers’, and partners’ confidence.

- Building Better Reputation and Trust:

On the other hand, licensing by BVI is some sort of seal as far as the quality and trust of cryptocurrency companies are concerned. It actually assures the commitment of the company to the standards followed in terms of transparency and accountability, which again is crucial for gaining users and attracting investment in the industry of cryptocurrency, wherein trust plays a major role.

- Access to International Markets:

A license from the BVI gives more international market access and partnership opportunities for companies; this means more ease in the expansion of business beyond one jurisdiction. This will create a good avenue for business scaling, attracting foreign investors, and developing global partnerships.

- Attractiveness to Talent and Investors:

A cryptocurrency license in the BVI supports a company’s status as an attractive employer and a reliable partner for investors. Stability, combined with the progressive approach of the jurisdiction towards innovations, attracts highly qualified professionals and experienced investors interested in the industry of cryptocurrency and blockchain technologies.

- Freedom for Doing Business:

The BVI license allows companies to have considerable flexibility in choosing their business models and development strategies. Under legal support and clear regulation, companies can innovate with new products and services in a more liberal manner, adapting to the ever-changing market requirements and customer preferences.

- Intellectual Property Protection:

Indeed, the BVI has a strong system for the protection of intellectual property, something very essential for the growth of companies that are now developing software and technologies in various innovations involving virtual currencies. In this respect, it is an ideal environment to invest in research and development since such innovations are safe from misuse.

- Affordability:

In comparison with other jurisdictions, the BVI license may also be cheaper from the very outset, but also through the operation of such a license, including meeting the regulatory requirements that apply. This enables start-ups and emerging companies to use their resources more effectively.

- Easy Access to Banking Services:

While access to banking can indeed be difficult for cryptocurrency firms, a BVI licence increases the possibility of successfully opening bank accounts and gaining access to other financial services by way of increased trust and reputation that a licence brings.

A license in the Cryptocurrency in the British Virgin Islands offers a wide range of strategic benefits, such as tax advantage, regulation clarity, international recognition, intellectual property protection, and scalability. These make the BVI an attractive jurisdiction for entrepreneurs and investors looking to capitalize on the opportunities offered by the global cryptocurrency and blockchain market.

Crypto Regulation Overview in BVI

The British Virgin Islands are gradually gaining their reputation as one of the preferred places for the registration and operation of a cryptocurrency business due to their very progressive and flexible regulatory policy. This jurisdiction combines regulatory clarity with operational flexibility in an exceptional manner that turns out an attractive base for both startups and established companies in the field of cryptocurrencies.

The BVI regulatory environment can be described as open to innovation, with a wish to create a favorable environment for this industry’s development while ensuring a high level of transparency and security for all market participants.

Currently, there is no special legislation in the BVI that strictly regulates activities related to cryptocurrency, such as cryptocurrency exchanges and ICOs. A cryptocurrency firm, however, will be required to adhere to general AML/CFT legislation as well as legislation concerning offshore companies.

The AML/CFT strict policies, including customer due diligence and transaction monitoring, should be implemented in BVI cryptocurrency firms. This is highly meant to ensure trust and security in the industry, apart from minimizing the risk of using cryptocurrencies in illicit activities.

One of the key benefits of conducting a cryptocurrency business within the BVI relates to the extent of its tax policy. Generally speaking, companies are exempt from direct taxes in the BVI. This makes the jurisdiction fairly appealing to cryptocurrency businesses with international interests. Companies should pay close attention to how they manage their tax liabilities in other jurisdictions, particularly if they conduct business or have customers located outside of the BVI.

The BVI remains committed to improving its regulatory regime with respect to the use of cryptocurrencies and blockchain projects. This would include, where appropriate, more specialized regulation and requirements relating to cryptocurrency exchanges, ICO platforms, and digital asset custody with a view to providing a high level of investor protection while ensuring the integrity of the financial system.

The BVI is also working actively with international organizations and regulators in harmonizing its regulatory standards to meet international requirements. This is indicative of the commitment of the islands towards ensuring that business in cryptocurrency attracted on the islands is conducted transparently and is accountable at an international level.

In addition, the regulatory environment within the BVI was so constituted to favor innovation and the emergence of new technologies in finance. For this reason, it would be a very excellent ecosystem to test and launch new products and services into the global market, with startups and technology companies using the BVI as the base from which to expand internationally.

The fact that crypto companies of the BVI enjoy extremely high ownership and privacy protection, which is extremely important in an area where the protection of intellectual property and personal data plays a leading role. Regulators of the jurisdiction of BVI recognize the importance of data protection and provide mechanisms to protect data in accordance with international standards.

Crypto License Application Types in BVI

The British Virgin Islands do their best to consider the global trend of balancing innovation with investor protection within the regulation of the cryptocurrency business. These different types of license applications reflect the specific nature of the operation and services that various companies provide in the context of cryptocurrency activities. The main types of applications for a cryptocurrency license for BVI will be considered below, in view of the key aspects and requirements of each.

| License Type | Details |

|---|---|

| License for Cryptocurrency Operations | This license is for companies that directly buy, sell, and exchange cryptocurrencies. It requires strict implementation of AML/CFT policies, an effective risk management system, and strong customer data protection and confidentiality. |

| License to Operate a Cryptocurrency Exchange | To establish and operate a cryptocurrency exchange in the BVI, a specific license is required. The application must include a detailed description of the technological infrastructure, liquidity policy, and mechanisms for resolving customer disputes and complaints. The platform must meet criteria for security, transparency, and customer protection. |

| License for Custodial Services | Companies offering custodial services to store and manage clients’ cryptocurrency assets must obtain this license. The application should describe the storage systems, measures for protecting against theft or loss, and AML/CFT policies including customer identification and verification procedures. |

| License for ICO and Tokenization of Assets | For tokenization and Initial Coin Offerings (ICOs), a special permit is required. The application must outline the fundraising objectives, the nature of the tokens, the rights and obligations of investors, and measures to protect investor interests. A clear governance structure and financial management plan are critical components. |

The procedure for acquiring a crypto license in the British Virgin Islands does not mean that the company complies with local and international AML/CFT requirements but also describes in detail the business: structure, goals, mechanisms of protection, and risk management strategies. In any case, typical for the application is the elaboration and providing of full, accurate, and transparent information about the business of the applicant.

This process is, therefore, indispensable, since a license provides not only a legal ground for operation in the digital asset space but also becomes a kind of landmark of reliability and transparency for the company to its customers, partners, and regulators. Obtaining a license increases the credibility of the company at the international level and opens wider opportunities for access to banking and financial services, as well as for the development of business generally.

A company applying for a cryptocurrency BVI license will do well to consider carefully the requirements and conditions imposed by the regulator and ensure that its operations at all times align completely with such a requirement. Consideration must also be given, not least, to changes in the regulatory environment, as the digital asset field is literally developing day by day.

Preparation of a license application: The relevant experience of legal and advisory firms in cryptocurrency regulation at the BVI is valuable in the licensing application process. The professionals will be better equipped to advise and assist during the application process, and subsequently with the regulator thereafter, which will significantly ease the process of obtaining a license and avoid possible complications.

How to Obtain a Cryptocurrency License in BVI?

Generation of a cryptocurrency business license in the British Virgin Islands becomes a meaningful step towards legalization of operations for companies within one of the most attractive jurisdictions for such a sector as crypto. The process for getting a license requires careful planning and a strategic approach to documentation, along with painstaking care in regulatory compliance.

| Step | Details |

|---|---|

| Business Planning | Draft and prepare a detailed business plan including the nature of the business, management structure, risk strategies, AML and KYC procedures, and financial forecast. It should clearly show how the company plans to comply with both local and international regulations and standards. |

| Legal Form Selection | Choose the appropriate legal structure. The most common structures in the BVI are International Business Company (IBC) and Limited Liability Company (LLC). The chosen structure should align with the business model and strategic objectives. |

| Registration of the Company on the BVI | Register the company in the BVI through a registered agent before applying for a license. This step involves submitting certain documents to ensure the company complies with local legal requirements. |

| AML/KYC Policies Development | Develop and implement effective Anti-Money Laundering (AML) and Know Your Customer (KYC) policies. These policies must meet both BVI laws and international standards, ensuring measures against financial crime. |

| Filing an Application for a Licence | Submit the application for a license, including all necessary documents like the business plan, confirmation of AML/KYC policy compliance, and management qualifications, through a registered agent. |

| Application Evaluation and Approval | The BVI regulators will review the application and business model. They may request additional information or clarification, and it is crucial to respond quickly and fully to ensure a successful approval process. |

| Issuance of Licence | Once the application is approved, the company is granted the license to engage in cryptocurrency activities. This formalizes the commencement of operations as described in the Business Plan and provides the legal foundation for activities in the jurisdiction. |

| Ongoing Compliance with Regulatory Requirements | After obtaining the license, companies must continuously comply with regulatory requirements, such as updating AML/KYC policies, submitting regular reports, and participating in inspections. Keeping up with legislative changes and adapting to new regulations is essential for maintaining trust and staying compliant. |

Obtaining a cryptocurrency license in the BVI requires competent and strategic preparation. In fact, it is a serious step that opens the door to access the international cryptocurrency market and opens such advantages for the company as tax efficiency and increased confidence of customers and partners in it. Successful conduction of a cryptocurrency business on the BVI, however, requires not only getting but also continuing regulatory compliance and adaptation to the invariable changeability of the regulatory landscape.

Types of crypto-licenses in BVI

The government of the British Virgin Islands, similar to other advanced cryptocurrency jurisdictions, has a few types of licenses that provide for the regulation of various aspects of digital asset activity. These licenses enable companies to legalize their operations and provide assurance of their adherence to high standards of security, transparency, and accountability.

This license is addressed to companies that are involved in buying, selling, exchanging, or making any other type of transaction with cryptocurrency and other digital assets. For this type of license, the applicant needs to demonstrate full compliance with AML/CFT politics, sufficient risk management system, and proper protection of customer data.

Designed for those platforms which provide the service to exchange cryptocurrencies between customers. Cryptocurrency exchanges must guarantee a high level of security of the transaction, follow AML/CFT politics, and also give full transparency of the transaction to the customer.

This license is granted to those organizations that provide custody or management services of crypto assets on behalf of their customers. The custody services have to ensure complete security for the stored assets and high standards of cybersecurity and data protection.

Also, in the case of an initial coin offering or any type of asset tokenization, the availability of a license is required, with a full description of the project, information about the token, rights and obligations of investors, measures of protection of their interests.

Other licenses may also be needed for specific financial services regarding cryptocurrency, like lending against crypto-assets, managing cryptocurrency portfolios, or any advisory services regarding investment in digital assets. These activities need close regulation in terms of the protection of clients’ interests and ensuring financial stability.

That is why such a great variety of different cryptocurrency licenses in the British Virgin Islands gives the opportunity for an entity to choose among them, depending on the business model and peculiarities of activity. Obtaining a license is one of the most significant steps toward legalization that does not give only regulating requirements but also increases customers and partners trust.

However, it is worth noticing that obtaining a license provides for preparation relevant documents and keeping to the regulations, and actually, it really implies the real need for effective internal policy and procedures for client interest protection and inhibition of financial crime. The companies shall prove a high level of responsibility, transparency, and reliability of their activities.

In order for the company to successfully pass the licensing process and further conduct business in the BVI, compliance with international standards of anti-money laundering and counter-terrorist financing is required, as well as guarantees of security and protection of customer data. This demands incessant attention to changes in legislation and regulatory practice, correcting business processes for new requirements.

Having a cryptocurrency BVI licence opens up many opportunities for companies to develop and scale their operations internationally. However, success in this respect is impossible without compliance not only formally but also with high business standards, without a focus on the protection of the rights and interests of clients, and without the active implementation of novelties and technological solutions.

Steps to start a crypto business in BVI

Establishing a cryptocurrency business in the BVI will be a very attractive opportunity for entrepreneurs and investors looking to benefit from one of the finest international financial service centers. The financial, tax, and business regulatory frameworks of the BVI offer a hospitable environment in which innovation and growth related to digital assets can flourish. The next sections summarize, in business terminology, the basic steps one will follow in setting up a cryptocurrency business in the BVI.

Setup of a cryptocurrency business in the BVI is complicated and strictly regulated; it, however, promises enormous opportunities for every innovative company that is active in this rapidly growing industry. Any business venture must be approached with a focus on thorough strategic planning, investing in technology and security, continuous improvement, and adaptation to the constantly changing regulation and market environments.

How to get a crypto license in BVI

The procedures for obtaining a cryptocurrency licence in the British Virgin Islands – BVI are the basic and first step of companies operating with cryptocurrencies within this country. Supported by the stability of its economy, supported by its privacy policy and regulation frameworks, plenty of businesses reside in the digital asset space. This attracts various businesses to its shores.

First of all, one needs to be in a position to take total cognizance of the regulatory framework of the BVI with respect to cryptocurrency activities. It needs to be accustomed to the Anti-Money Laundering Act, Anti-Terrorist Financing/CFT, and Know Your Customer/KYC requirements.

In order to apply for a cryptocurrency license, a business shall be registered in the British Virgin Islands, including selecting the proper legal form that would be an IBC and completing all conditions related to it.

A detailed business plan, as part of the licence application, shall elaborate on the nature of the cryptocurrency business, the revenue model, risk management strategies, AML/CFT and KYC procedures, and the long-term goals of the company.

A company should be able to prove that it maintains sufficient capital to support its operations. The amount of capital may vary depending on the licence type and operation volume.

After the preparation of the required documents, such as a business plan, company incorporation documents, proof of capital, and risk management policies, the company will submit an application to the regulator in BVI, which is the FSC.

This is where the FSC will go through every single document that has been submitted, and any other additional information that may be required, must also be made available. If all of the above are complete, then the FSC will issue the cryptocurrency licence, allowing one’s company to start its operational process in the British Virgin Islands.

Licensing was only the beginning of very involved processes of operational and regulatory compliance. The licensed firms would be required to report their activities periodically, have appropriate risk management systems put in place, and ensure that there is AML/CFT policy compliance. It would imply periodic updating of internal policies, procedures, and control systems to keep abreast of the prevailing regulatory environment in place and mitigate operational risks.

A cryptocurrency licence issued in the British Virgin Islands should keep books and records of all the financial transactions, and such books and records shall be subjected to auditing periodically. Auditing should be made by accredited audit firms for complete transparency, and the regulators and the customers can have faith in the operation of the company.

Data protection and privacy are crucial in the era of digitalization. The companies should make strict security measures to protect the confidentiality and customer data according to international standards and local BVI legislation regarding the protection of data.

The companies may be interested in the cooperation with other market players such as banks, payment systems, or technology solution providers in order to enhance their operational capabilities and the added value of the offered services. It is relevant to choose partners that meet high standards of safety and security, having a good reputation in the market.

How to get a crypto trading license in BVI

Obtaining a cryptocurrency trading license in the British Virgin Islands is considered one of the strategic steps to be made by a company willing to enhance its status in the digital asset market globally. The whole procedure will bring legitimacy to your activities and provide access to one of the most favorable regulatory regimes in the world.

Taxation of Virtual Currency Companies in BVI

The taxation of virtual currency companies in the British Virgin Islands represents an important aspect of financial planning and management for any business in this jurisdiction. Over the last decade or so, with the growing popularity of cryptocurrencies and other virtual assets, governments and regulators worldwide have established clear rules and regulations to regularize this area, including taxation.

Basic principles of taxation in the BVI

The British Virgin Islands traditionally have been considered one of the most favourable places to do business, including because of their attractive tax system. The main features of the taxation system in the BVI are the absence of income tax for companies that are not operating within the jurisdiction, as well as no capital gains tax, no dividend tax and no interest tax.

Taxation of virtual currencies businesses

Those virtual currencies businesses in the BVI whose activities are not conducted within the jurisdiction can benefit from many of the advantages afforded by BVI tax laws. This, of course does not mean there is any room for laxity on the part of such companies to adhere fully to requirements of the local legislation on the necessity to be registered, licensed appropriately and keep accounting records according to international standards.

Economic presence and taxation

In line with international anti-avoidance initiatives such as BEPS from the OECD, the BVI introduced economic presence rules. These require specified companies to show an actual economic presence within the jurisdiction. Translated into virtual currencies businesses, it may mean a requirement for management and key decisions to be made within the BVI and qualified personnel in the jurisdiction.

Compliance with FATCA and CRS

Those companies operating in or with virtual currencies in BVI have to consider also requirements about the US Foreign Account Tax Compliance Act – FATCA – and the CRS, promoted respectively by the US and the Organisation for Economic Co-operation and Development – OECD, both aimed at combating tax evasion through automatic exchange between nations. This means that for virtual currency companies domiciled in the BVI, registration is required with the relevant systems, and also compliance with reporting requirements is compulsory in respect of providing data of their international customers to the competent tax authorities.

Value Added Tax (VAT) and other indirect taxes

No VAT is payable in the BVI; nevertheless, virtual currency companies ought to consider and apply tax exposures on revenues booked within their host countries or countries where their customers are tax residents. Depending on the specific jurisdiction, the transactions of virtual currency might be subject to value-added tax or any other indirect taxes. Great caution should be exercised in planning and compliance in order for the risk of taxes to be minimized.

Planning and counselling

Full-value tax planning for the purpose of optimizing tax liabilities, while observing all relevant regulatory requirements, is recommended for companies in BVI dealing in virtual currencies. The inclusion of tax advice in the strategy allows an indication of the possibility of obtaining potential benefits in taxation and prevents unforeseen tax consequences. Qualified tax and legal advisors specializing in cryptocurrency activity and international taxation should be consulted with a view to ensuring that all requirements are met and that any existing tax burden is minimized.

Taxes in BVI

The British Virgin Islands are considered one of the most successful offshore financial centers in the world, offering an alluring environment for international business and investments. The BVI tax system is aimed at creating a favorable environment for offshore companies, due to which the islands are among the favorite sites of many international corporations and private investors.

Special Notes:

- Licence fee: All offshore companies registered in the BVI are supposed to pay the annual government licence fee. The exact amount of fee depends on the type of activity and thus may vary.

- Economic presence: As part of recent tax reforms, some companies in the BVI must show “actual economic presence” within the country. This may include having an adequate number of qualified employees on the islands with the necessary physical assets to perform actual operations.

Despite its renowned status as a tax haven, it has stringent conditions regarding transparency and compliance of BVI companies with international anti-money laundering and anti-terrorist financing standards. Also, a company should closely follow the changes of international tax regulations and react to them on time to keep its status

Tax Rates in BVI

| Parameter | Tax rate in BVI |

|---|---|

| Corporate income tax | 0% |

| Tax on dividends | 0% |

| Capital gains tax | 0% |

| Tax on income earned outside the BVI | 0% |

| Licence fee | Varies depending on the type and size of the company |

| VAT/Goods and Services Tax | No charge |

Crypto tax in BVI

Taxation of cryptocurrency in the British Virgin Islands is among the prime issues that businesses and investors alike need to consider when operating in the field of digital assets. It is very important for business success and optimization of tax liabilities to understand the BVI tax regime and how it applies to cryptocurrency transactions properly.

Basic principles of taxation in the BVI

The BVI has a favourable tax regime and no income tax, capital gains tax, dividend tax, or interest tax for companies that do not operate within the jurisdiction. Thus, the BVI is considered an excellent and appropriate place for international business and also for cryptocurrency companies.

Taxation of cryptocurrency

Cryptocurrency Compliance in BVI

Despite such a favourable tax climate, several tax aspects and obligations must be closely considered by and complied with cryptocurrency companies in the BVI:

- Registration and licensing: Companies conducting activities related to cryptocurrencies are to be registered by the BVI and, if required, licensed appropriately. While it is not a tax, accurate registration and licensing are key prerequisites to any legitimate business activity.

- Compliance with international standards: Companies should respect international reporting duties, which include FATCA and CRS, among others. Such duties require the disclosure of financial accounts and transactions for avoiding tax evasion.

- Governance and economic presence: Where the rules on economic presence are effective in the BVI, entities carrying out activities in scope, including certain cryptocurrency activities, will be required to have a substantive economic presence in the jurisdiction. This could include management and operational considerations for the BVI.

- Indirect taxes and duties: While no direct taxation is imposed on cryptocurrency in the BVI, there are certain indirect taxes and duties of which a company should be aware, which may apply to its transactions.

Tax Planning Strategies for Cryptocurrency Firms in BVI

Given the nature of the space at this time, effective tax planning strategies are very pertinent for cryptocurrency firms based in the BVI with the view to optimizing liabilities and discharging relevant regulatory obligations. Some of the main strategies in this regard will include:

- Deep understanding of the regulatory requirements: Acquiring updated knowledge of tax and regulatory requirements in the BVI is crucial for compliance with all the laws to avoid penalties or any tax consequences attached. This includes updating changes in economic presence rules and international reporting standards.

- Professional counseling: Companies can obtain valuable advice from professional tax and legal advisors regarding how to operate optimally in a complex regulatory environment, creating tax plans that fit the particular operating model. Consultation is very important in international taxation and compliance with reporting issues.

- Company structuring and operations: It may be decisive for effective structuring of the company and activities, such that taxation is at its optimum. It provides for the selection of the proper legal form of business and organization of the activities in such a manner that best meets the economic presence requirement with the least tax liabilities.

- Transparency and compliance: In times of high financial transparency, coupled with international information exchange, high levels of transparency and compliance are not only a duty but also a strategic asset. It builds a positive reputation and can lead to more favorable relationships with regulators and partners.

Taxation of cryptocurrency in the BVI offers a host of advantages for digital asset companies. On the flip side, careful planning and compliance are very much required to successfully run a business, letting optimization of tax liabilities factor in. The key components of success in this dynamic area are professional advisers, great understanding of the regulatory environment, and effective business structuring.

Finally, lawyers of the Regulated United Europe entity provide legal support for crypto projects and assist in adapting to the regulations according to MICA.

BVI Crypto Business Setup 2025: A Gateway to Licensing Success

The British Virgin Islands are increasingly recognized as one of the leading jurisdictions in the world when it comes to cryptocurrency businesses, having very friendly regulatory conditions and strategic global positioning. The following article is an essential guide to the obtaining of a crypto exchange license in BVI, going through the topic of the regulative framework, application process, and notable advantages connected with the status of a license holder in this jurisdiction.

Regulatory Framework in the BVI for Crypto Exchanges

The BVI Financial Services Commission is the main regulator for activities in cryptocurrency to make sure they meet international norms without stifling innovation. In the BVI, regulations have been drafted in such a way that would create a situation where crypto businesses are safe and strong with regard to global standards on anti-money laundering and financial terrorism.

Crypto License Types in the BVI

The BVI offers several crypto licenses, catering to various aspects of the digital asset industry:

- Crypto exchange license in BVI: Allows companies to operate platforms where users can exchange cryptocurrencies and fiat currencies.

- Crypto broker license in BVI: Permits companies to facilitate crypto transactions on behalf of their clients.

- Crypto trading license in BVI: For entities primarily engaged in buying and selling digital assets directly.

- VASP crypto license in BVI: Aimed at providers offering a range of services related to virtual assets.

Crypto Licensing Application Process in the BVI

The process for applying for a crypto license within the BVI is a very stringent one and comprises an elaborative documentation of the business model, proof of the implementation of the AML and KYC protocols, and evidence of strong security for customer assets’ protection.

Fee for Crypto Licensing in the BVI

Competitive Crypto Exchange License Cost: The cost of a crypto exchange license in the BVI is competitive-within the contexts, this offers tremendous value for money when compared with other jurisdictions. Accordingly, companies will need to be prepared to face initial and ongoing compliance costs but relatively lower overall expenses when looking at the BVI as a base.

Benefits of Acquiring a Crypto License in the BVI

Holding a BVI crypto license provides immense opportunities: tapping into one of the fastest-growing cryptocurrency markets in the world, gaining better credibility among clients and investors, and being able to clearly understand the legal framework, which gives an enterprise the confidence to work within a regulated environment—a prerequisite for its long-term growth.

Investment Opportunities in the BVI’s Crypto Market

The BVI provides a good spot for investment, considering the lucrative rates on investments. Sometimes, it is called the cheapest crypto license in BVI. This makes it attractive to startups and established businesses looking to diversify and extend their business processes into the world of cryptocurrency.

Buying a Ready Crypto License

This is an option when investors intend to have faster entry into the market with some offers to buy an already licensed crypto exchange in BVI for sale. In this case, one needs to pay great attention to due diligence in order for all regulatory requirements to be met and the license to comply with the business goals of the buyer.

The British Virgin Islands present one of the most captivating jurisdictions to conduct and expand business with the view to take advantage of the changing nature of the cryptocurrency industry, inter alia accompanied by a reputable and stable regulatory environment. A crypto exchange license in BVI would be but a guarantee of international standards and a warrant for successful positioning within the digital economy worldwide.

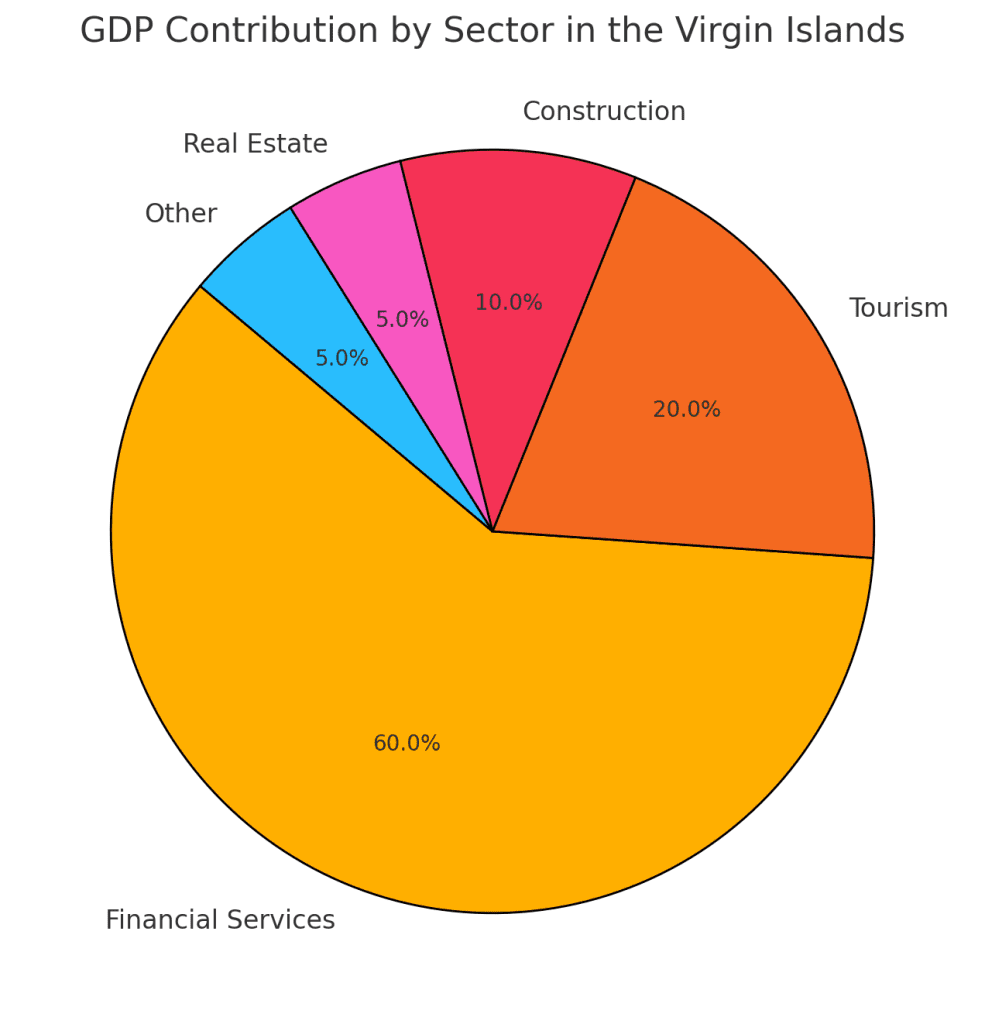

Distribution of GDP by major economic sectors of the British Virgin Islands

British Virgin Islands crypto license 2025

In 2022, the British Virgin Islands enacted the Virtual Assets Service Providers Act, 2022, and through this, the legal and regulatory framework of virtual asset transactions was established. The Act seeks to create a threshold that will determine whether VASPs will be registered and monitored for compliance with AML/CFT requirements. This is in pursuit of ensuring that the law protects clients’ interests and those of the general public in terms of safety in this trendily changing virtual asset market.

Registration Requirements

The law has put in place compulsory registration for all providers of virtual assets services, and under this regime, the providers will be obligated to provide a great deal of information on management, shareholders, auditors, a full business plan, and a risk assessment. The process of registration further places an obligation on these providers to promptly notify the BVI Financial Services Commission of any alteration affecting the information submitted. This enhances the transparency of the operations of companies and ascertains that data provided to the regulatory authority is accurate.

Key Responsibilities of VASP The law requires that virtual asset service providers must keep records and register all financial transactions and client information for the sake of traceability of all transactions and status of the company’s finances. AML/CFT requirements require providers to update client information and protect the assets, including identification and segregation appropriately. The requirement chases a minimal risk level concerning violations of the norms aiming to prevent money laundering and terrorism financing and an appropriate endowment of legal protection on the client’s part.

Requirements about Custody and Specific Activities of Exchange Service