Crypto License in Bulgaria 2026

Bulgaria is one of those jurisdictions where crypto businesses remain largely unregulated, except for anti-money laundering and counter-terrorist financing purposes. The Bulgarian National Bank (BNB) and the Financial Supervision Commission (FSC) monitor the situation and have taken a position in line with the European Central Bank. The government awaits the introduction of EU-wide regulations instead of building a national regulatory framework. Nevertheless, crypto businesses require a licence in Bulgaria from the National Revenue Agency (NRA) whose main role is to administer taxes and social security contributions, as well as collect other public and private state receivables.

In 2019, the Bulgarian Council of Ministers announced a national programme “Digital Bulgaria 2025” with the aim to promote smart, sustainable, and inclusive digital growth, including the adoption of such innovations as distributed ledger technology (DLT) and artificial intelligence, as well as the introduction of high standards for cybersecurity and interoperability. In the future, crypto entrepreneurs can expect higher demands for their products and services across public institutions and other significant areas. While the national government is only initiating talks about the adoption of cryptocurrencies, crypto entrepreneurs can avail themselves of the uncomplex licensing rules and the favourable tax regime.

|

PACKAGE «COMPANY & CRYPTO LICENSE IN BULGARIA» |

6,500 EUR |

- Establishment of a company with Power of Attorney

- Acquisition of a legal address for a year

- Registration of a company in accordance with law

- Apostilled and sworn translated set of documents of the company

- Shared capital account registration + assistance in contributing the capital

- Standard KYC/AML procedural rules

- State and notary fees

- Assistance in the employment of the KYC/AML officer and registration within tax authorities

- Application with the regulator for crypto activities

- General consultation

| Legal Services for Crypto Projects | 1,500 EUR |

The provision of the following services requires crypto authorisation from the Bulgarian supervising authority:

- Cryptoassets exchange into another type of cryptoasset

- Cryptoassets exchange into fiat money and vice versa

- Services of safeguarding private crypto keys on behalf of customers

- Services of holding, storing and transferring cryptoassets

At present, the government doesn’t offer any support through such testing programmes as regulatory sandboxes, although back in 2020 the country announced the plans to launch a Sofia Sandbox. Its purpose would be to provide a safe small–scale testing ground for new business models, which aren’t protected by regulations yet. This way the Bulgarian authorities will be able to monitor the developments and experimentations closely.

Crypto Legislation in Bulgaria

Since Bulgaria is a member of the EU, it’s obligated to transpose all crypto-related rules. Currently, the main law governing cryptocurrency businesses in Bulgaria is the Measures Against Money Laundering Act (MAMLA) which partially transposed the provisions of the 5th EU Anti-Money Laundering Directive (5AMLD), which introduced additional measures for the prevention of the use of the financial systems for the purposes of money laundering or terrorist financing.

In accordance with the 5AMLD, MAMLA introduced the concept of “virtual currencies” and defines them as a digital representation of value that isn’t issued or guaranteed by a central bank or a public body, isn’t necessarily related to legal tender, and has no legal status of currency, but is accepted by natural or legal persons as a means of exchange and can be transferred, stored and traded electronically. A crypto wallet provider who offers custodial services is defined as a natural or legal person, or other legal entity, providing services for the protection of private crypto keys on behalf of its customers for owning, storing, and transferring virtual currencies.

MAMLA obligates crypto businesses to engage in the following activities:

- Establish and carry out customer due diligence and know-your-customer procedures; where the former should be performed at simplified, advanced, or complex levels; complex due diligence is a standard and must be performed in the cases of transactions exceeding 30,000 BGN (approx. 15,000 EUR) regardless of whether that transaction is carried out in a single operation or several

- Record transactions by collecting and maintaining relevant information and documentation in relation to the identifications of customers, transactions, and related activities

- Assess risks of money laundering, terrorist financing, and other criminal financial activities by employing internal standardised procedures

- In the case of payments above 30,000 BGN (approx. 15,000 EUR) notify the Financial Intelligence Directorate of the State Agency for National Security

- Disclose information about suspicious customers, transactions, and other activities to the Financial Intelligence Directorate of the State Agency for National Security in accordance with the internal procedures

Crypto companies can choose to establish an AML/CFT compliance department or exercise other forms of internal control to meet legal obligations through their managing directors, managers, and representatives.

When it comes to licensing crypto-related services, the following activities don’t fall within the category of licensable payment service activities pursuant to the Payment Services and Payment Systems Act (PSPSA):

- Mining and trading in virtual currencies

- Financing through virtual currencies

- Mining and sale of virtual currencies

- Purchase and sale of machines and devices for mining virtual currencies

The Markets in Financial Instruments Act (MFIA) doesn’t recognise cryptoassets as financial instruments. Instead, they’re treated as commodities and their trades are regulated by the Obligations and Contracts Act and the Commerce Act. The main applicable rule is that the contract of a sale transaction obligates the seller to transfer the ownership of possession or a different right to the buyer for an agreed price. Pursuant to the Commerce Act, if a natural person purchases cryptocurrencies, their transfer isn’t considered a commercial transaction. Disputes regarding cryptoasset transactions are addressed in accordance with the General Claims Procedure instead of the Commercial Disputes Procedure under the Bulgarian Civil Procedure Code. In terms of consumer protections, the Consumer Protection Act is applicable only if cryptoassets aren’t acquired for investment purposes (i.e., trading for profit).

The Markets in Financial Instruments Act (MFIA) doesn’t recognise cryptoassets as financial instruments. Instead, they’re treated as commodities and their trades are regulated by the Obligations and Contracts Act and the Commerce Act. The main applicable rule is that the contract of a sale transaction obligates the seller to transfer the ownership of possession or a different right to the buyer for an agreed price. Pursuant to the Commerce Act, if a natural person purchases cryptocurrencies, their transfer isn’t considered a commercial transaction. Disputes regarding cryptoasset transactions are addressed in accordance with the General Claims Procedure instead of the Commercial Disputes Procedure under the Bulgarian Civil Procedure Code. In terms of consumer protections, the Consumer Protection Act is applicable only if cryptoassets aren’t acquired for investment purposes (i.e., trading for profit).

When it comes to promoting crypto-related activities, their advertising is allowed and not regulated. That said, it should comply with general relevant legislation, for instance, the Protection of Competition Act, which means misleading messages or comparative advertising causing damage to competitors is strictly prohibited for cryptoasset companies.

For the EU, the cryptocurrency industry is among the regulatory priorities and the authoritative institutions have been working tirelessly to introduce much-needed improvements which will set global standards and build trust in the industry. In 2022, the European Securities and Markets Authority (ESMA) introduced a pilot regime for market infrastructures based on distributed ledger technology (DLT Pilot Regime). It was originally published as part of the EU Digital Finance Package along with the proposal for a regulation on markets in crypto-assets (MiCAR), the aim of which is to support the development of digital finance and mitigate associated risks. The pilot is launching in March 2023 and is scheduled for review in 2026.

Essentially, the DLT Pilot Regime introduces an EU-wide regulatory sandbox that will enable safe experimentation with crypto technologies for companies willing to operate securities trading and settlement systems based on DLT. The participation may allow such companies to be exempt from certain EU regulations that might be disrupting the deployment of DLT in securities trading.

Furthermore, in 2022, the Economic and Monetary Affairs Committee approved the Markets in Crypto-Assets (MiCA) regulation for a vote by the European Parliament and the EU members which will clarify the existing regulations applicable to European Crypto Asset Service Providers (CASPs). MiCA’s framework seeks to combat crypto market abuse and manipulation, including insider trading. Key changes introduced by MiCA encompass such environmental responsibilities as an obligation for crypto businesses to publish the levels of their energy consumption on their business websites and share these data with national authorities.

Non-compliant CASPs will be monitored and thoroughly checked by the European Banking Authority (EBA) which will maintain a public register of such service providers. A non-compliant CASP is a crypto business whose parent company is registered in a country that is classified by the EU either as a third country posing high money laundering risks, or non-cooperative jurisdiction for tax purposes.

Another change introduced by MiCA is related to stricter regulations of stablecoins. Stablecoin issuers operating within the EU will be required to build up a sufficient liquid reserve with a 1:1 ratio, partly in the form of deposits. It will allow all stablecoin holders to be offered a claim by the issuer at any given time and free of charge. The European Banking Authority (EBA) will be responsible for the supervision of stablecoins.

CRYPTO REGULATION IN BULGARIA

| Period for consideration |

Up to 1 month | Annual fee for supervision | No |

| State fee for application |

25 EUR | Local staff member | No |

| Required share capital | from 1 € | Physical office | No |

| Corporate income tax | 10% | Accounting audit | No |

Why Choose a Bulgarian Crypto License

Bulgaria has no crypto-specific licence governing crypto-related economic activities and there are no particular restrictions or obligations, and companies can even accept pledging in cryptocurrencies as collateral for giving loans that don’t fall within any specific regulatory framework. That said, a licence is still required for most crypto-related businesses for AML/CFT purposes pursuant to MAMLA.

Cryptoasset exchanges and custodial wallet providers are obligated to register in the public register, which is maintained by the NRA, who’s also responsible for granting crypto authorisation. Upon registration, a company certificate is issued, which is an equivalent of a crypto license and is the only official document issued by the national authority allowing cryptoasset entrepreneurs to engage in crypto-related economic activities within the general regulatory framework. List of legal entities operating as a virtual currency exchange operator in Bulgaria.

The main features of a Bulgarian crypto license:

- No local staff is required

- Speedy application process

- The whole licensing application can be completed remotely

- No requirement for an AML/CFT compliance officer

- Low initial share capital requirements – from 2 BGN (approx. 1 EUR)

Requirements for Crypto License Applicants

Natural and legal persons from abroad are allowed to apply for crypto authorisation in Bulgaria as long as they’re able to demonstrate their capability to comply with AML/CFT regulations.

Pursuant to Art. 2, p. 2 of the Ordinance, the following information must be included in the crypto license application for a company:

- Name of the company

- Seat and address of management

- Address of correspondence

- Business email address

- Representatives entered into the Registry Agency

- Contact person (role, telephone number, and email address)

- Unique Unified Identification Code (UIC), also called BULSTAT Code, of the company obtained from the Commercial Register

- Details of the bank accounts opened in Bulgaria and abroad

- Description of the business website and software, including a mobile application, used to offer the planned crypto products and services

- Description of the intended crypto-related products and services

- List of countries where the crypto-related services are planned to be provided

- Information on whether the applicant is a company with cross-border activities or part of a cross-border enterprise (within the meaning of EU legislation)

Pursuant to Art. 2, p. 2 of the Ordinance, the following information must be included in the crypto license application for a sole proprietor:

- Name of the sole proprietor

- Permanent address

- Address of permanent residence

- Contact person (role, telephone number, email address)

- PIN/Personal Number of a Foreigner or official reference number from the NRA Registry

- Description of the business website and software, including a mobile application, used to offer the planned crypto products and services

- Description of the intended crypto-related products and services

- List of countries where the crypto-related services are planned to be provided

- Information on whether the applicant is engaged in cross-border activities or is part of a cross-border enterprise (within the meaning of EU legislation)

Crypto Licensing Process in Bulgaria

Compared to other European jurisdictions, the process of getting a crypto license in Bulgaria is rather simple. In accordance with Ordinance No. N-9 issued by the Ministry of Finance in August 2020, every application is processed prior to the commencement of crypto activities in Bulgaria.

Essential steps required to obtain a crypto license in Bulgaria:

- Register a company in Bulgaria

- Design internal AML/CFT procedures in line with the EU directives

- Prepare a description of the planned crypto services

- Pay the registration fee of 50 BGN (approx. 25 EUR) to the NRA

- Submit an online application form along with the required documentation

The application form is designed by the NRA and is available on their official website. Since it’s an electronic application form, it must be signed with a qualified electronic signature and contain the required information pursuant to Art. 2, p. 2 of the Ordinance.

Successful applicants whose services are defined by AML/CFT legislation, and who provide accurate information, and complete documentation, as well as settle the relevant application fee, are granted a Certificate of Registration within a month. It’s delivered in the form of an electronic document signed with a qualified electronic signature. Each successful applicant is notified of the issuance of the certificate by the NRA officials.

The NRA also supervises all changes in circumstances of the licensed businesses such as changed names, addresses, and any data related to the owners, directors, and representatives. A crypto-related service provider must notify the NRA of any changes so that the authority can update the register accordingly. The change of the information about their business website or the software for crypto-related services doesn’t incur additional fees.

ADVANTAGES

Implementation of projects quickly

A ready-to-use solution is available

Fully remote solutions are possible

There is no requirement to have an office

Open a Crypto Company in Bulgaria

The process of establishing a business in Bulgaria is fast and hassle-free. It normally takes up to two months to establish a new company in Bulgaria, which includes the preparation of documents and the registration of a new business. A new company can be registered within several days, provided that all the required documents are in order.

A ready-made company, by contrast, can be acquired within seven business days. Below we share the processes of establishing a new Bulgarian company but if you’re looking for a faster solution, please reach out to our well-experienced team who can as well consult you on acquiring a ready-made company.

The following legal types of business entities are available in Bulgaria:

- A Limited Liability Company, initial share capital – 2 BGN (approx. 1 EUR)

- A Closed Joint Stock Company, initial share capital – 50,000 BGN (approx. 25,600 EUR)

- An Open Joint Stock Company, initial share capital – 100,000 BGN (approx. 51,000 EUR)

- A Limited Partnership, initial capital – 4 BGN (approx. 2 EUR)

- A General Partnership, no capital requirements

- A Sole Proprietorship, initial capital – 2 BGN (approx. 1 EUR)

The most popular type of legal structure is a Limited Liability Company, which can be incorporated by any foreign natural or legal person pursuant to the Bulgarian Commercial Code.

Key requirements for a Limited Liability Company:

- A Bulgarian corporate bank account

- Possession of the minimum share capital, ready to be transferred to a Bulgarian bank account

- At least one shareholder

- At least one managing director (can be the same as the shareholder and a foreign citizen not residing in Bulgaria)

- Registered office in Bulgaria which will give a tax resident status (a virtual office will suffice)

A current account for a Bulgarian company can be opened in one of the local banks remotely if the entrepreneur signs a power of attorney, and provides the representatives with notarised required documentation. One of the conditions, as mentioned earlier, is the significant presence of the company in Bulgaria. If you wish to explore all the viable options and receive help in this area, please reach out to our friendly and efficient team who will propose a tailored solution in accordance with your individual needs.

The following documents are required:

- Photocopies of the passports of the owners and managing directors

- Notarised Articles of Association

- Memorandum of Association in the case of a sole shareholder

- The minutes of the shareholder’s meeting

- Notarised signature specimen and written consent by a company representative

- Bank statement showing deposited initial capital

- A certificate of the company name

Key steps of establishing a crypto company in Bulgaria:

- Reserve a compliant company name (subject to state fees)

- Prepare all the required documents (you’ll need a certified translation, notarisation, and apostillisation services which we can help you with)

- Open a temporary bank account for the share capital contribution

- Deposit the initial share capital to the Bulgarian corporate bank account opened in the name of the company

- Pay a registration fee of 55 BGN (approx. 28 EUR) to the Commercial Register of the Registry Agency

- Submit an application along with the receipt of the payment and the required documents to the Commercial Register of the Registry Agency

- Register as a VAT payer (it’s a mandatory step for Bulgarian companies that exceed 50,000 BGN (approx. 25,600 EUR) in a 12-month period)

- Register employees for social insurance purposes (social security contributions are mandatory in Bulgaria)

- Apply for a crypto license from the NRA

Bulgaria

Capital |

Population |

Currency |

GDP |

| Sofia | 6,520,314 | BGN | $12,505 |

Taxes on Crypto in Bulgaria

The NRA tax treatment of crypto assets follows the MAMLA definition, as well as the policies of the European Bank Authority, which recognizes natural and legal persons who are liable to pay tax. The standard allowances and exemptions apply, supplemented by crypto-specific rules imposed by the EU: for example, cryptocurrencies are outside the scope of VAT, as they already constitute a supply of financial services. Other crypto-related economic activities may be burdened with a VAT in the standard 20% rate.

Other standard tax rates in Bulgaria:

- Corporate Income Tax – 10%

- Individual Income Tax – 10%

- Social Security Contribution – 24,3% / 13,72% is payable by employers, and 10,58% is payable by employees/

- National Health Insurance – 8% / 4,8% is payable by employers and 3,2% is payable by the employees/

- Withholding Tax – 5% – on dividends distributed

Taxable the following types of income:

- Income from trading/exchange of cryptoassets

- Income from acquiring cryptoassets

- Income from mining cryptoassets

- Income from exchanging crypto assets for another type of crypto-assets

- Income arising from staking

Income arising from the trading or exchange of crypto-assets, it is considered income from the sale of financial assets and therefore the following rules are applicable.

- Taxable income from a sale or exchange of financial assets is the total of the realised profits within the taxable period, determined for each individual transaction, minus the total of the realised losses within the taxable period determined for each separate deal. The total of the net results of all the deals forms an annual taxable basis and should be declared in the annual tax return.

- The annual taxable base can be formed from the exchange of one crypto asset against another if the acquired one generates profit.

- No advance tax shall be due concerning crypto assets

- No special documents for transfer of rights or property are regulated and all relevant documents have to be archived for five years after due period of taxation.

- While trading activity is done by a company as a continuing activity, the apportionable costs might reduce the net taxable profit

- The unrealized profit arising from sale/exchange of financial assets give rise to taxation.

Income from acquiring or mining cryptoassets is deemed to be income arising from economic activities under the Income Taxes on Natural Persons Act. In the cases of acquisition, this may involve buying crypto mining equipment and afterwards selling the cryptoasset mined where the buying of crypto mining equipment and later on selling the mined cryptoasset is considered to amount to economic activity, and the taxable result is constituted under the Corporate Income Tax Act. When the mining or acquisition is made through a company, allocable costs can reduce the net taxable profit.

Staking is treated as an action that involves yielding income, but the Income Taxes on Natural Persons Act and the Corporate Income Tax Act do not specify it clearly. According to the National Accounting Standards, companies, at the moment of acquiring any crypto-asset, are under obligation to register it as an increase of the intangible assets and periodically revalue it on a fair or market value.

Accounting and Reporting

The Accountancy Act of 2015 and the Independent Financial Audit Act of 2016 governs accounting and reporting processes in Bulgaria. Since Bulgaria is an EU member, these laws are aligned with the directives and regulations of the EU. If a company is exempt from statutory audit, cryptoassets must still be reported in the annual financial statements.

Pursuant to the Accountancy Act, the following companies must audit their financial statements:

- Small companies that exceed at least two of the following parameters: 1) total assets – 2 mill. BGN (approx. 1 mill. EUR), 2) total revenue – 4 mill. BGN (approx. 2 mill. EUR), and 3) the average number of employees – 50

- Medium and large companies and public-interest entities (PIEs)

- Medium and large groups, and groups which include a PIE

- Joint Stock Companies and Limited Partnerships with shares, except for the cases when no activities are conducted throughout the year

- Consolidated financial statements and the financial statements of the companies included in the consolidation

Removal from the Public Registry

For various reasons a crypto authorisation entry can be removed from the Public Registry and consequently the electronic Certificate of Registration can be invalidated.

An entry into the NRA’s Public Register might be removed in the following cases:

- If requested individually for such reasons as the termination of cryptocurrency-related services, dissolution of legal persons, and proclaiming incapacity regime for natural persons

- If NRA determines that incomplete, misleading, or incorrect information was provided

- If competent authorities determine that a company violated AML/CFT laws and sanctions have been imposed

- Due to register entry removal of legal persons with the Commercial Register or BULSTAT Register at the Registry Agency

- Upon the death of the natural person who was a licence holder

If you wish to obtain a crypto license in Bulgaria and benefit from the relaxed licensing rules, as well as the very favourable taxation framework, our highly qualified and experienced consultants here at Regulated United Europe (RUE) will be delighted to equip you with the necessary knowledge that will help you lay your path to success. We very well understand and closely monitor crypto-related legislation in Bulgaria and the rest of the EU, and thus can guide you through establishing a company and obtaining a crypto license, including developing internal AML/CFT procedures. Moreover, we’re more than happy to assist you with financial accounting and tax optimisation. Book a personalised consultation now to start a new journey in the cryptocurrency industry.

Also, lawyers from Regulated United Europe provide legal services for obtaining a crypto license in Europe.

Navigating the Cryptocurrency Landscape in Bulgaria, 2026: A Guide to Obtaining a Crypto Exchange License

Bulgaria has become one of the most promising landscapes in the domain of cryptocurrency enterprises, further enhanced by its strategic location in Europe and the extensive ecosystem for growing acceptance of digital finance technologies. This article, therefore, considers in detail how one can obtain a crypto exchange license in Bulgaria, explaining the regulatory framework, the application process, and the benefits from obtaining a license.

Crypto Exchanges Regulatory Landscape in Bulgaria

The Bulgarian Financial Supervision Commission, or FSC, regulates activities involving cryptocurrencies in accordance with both national and European Union legislation. On a national level, this concept of regulation strives to balance providing fertile ground for innovation with considerable attention to security, transparency, and fighting financial crime.

Types of Crypto Licenses in Bulgaria

Bulgaria has different types of crypto licenses to address various aspects of the cryptocurrency market:

- Crypto exchange license in Bulgaria: This license allows the operation of a platform that connects buyers and sellers of cryptocurrencies.

- Crypto broker license in Bulgaria: This license allows an institution to act as an intermediary in crypto transactions.

- Crypto trading license in Bulgaria: Applies to those businesses where the trading of digital assets is concerned directly.

- VASP crypto license in Bulgaria: Applied to those service providers that offer a broader scope of crypto services.

Requirements for Obtaining Crypto License in Bulgaria

This involves the filing of lengthy documentation, such as comprehensive business plans, proof of compliance with anti-money laundering directives, and sufficient cybersecurity measures that would guarantee traders and investors are safe.

Cost of Crypto Licensing

The cost of a crypto exchange license in Bulgaria would, therefore, vary with the particular services falling within its ambit and the intricacy of the business model. Despite these costs, Bulgaria is known to offer one of the cheapest crypto licenses in Bulgaria. For this reason, it is an attractive location for startups and established businesses that aim to expand their operations in Europe.

Benefits of Holding a Crypto License in Bulgaria

Acquiring a crypto license in Bulgaria enhances credibility and opens wide European markets for companies under a regulated framework. Observance of regulatory compliance is an essential ingredient in attracting partnerships and winning the confidence of clients and investors alike.

Crypto Licensing Process Challenges

Due to the constant updating and amendment, the laws regulating digital currencies make it very difficult to master the regulatory environment. Businesses must be alert and adaptive to this dynamic environment to not only remain compliant but also to leverage changes in regulatory cover.

Investment Opportunities in Bulgaria’s Crypto Market

Bulgaria is a country that offers enormous investment opportunities for crypto markets, with an extremely friendly tax regime and an ecosystem really supportive of technology innovation. The growth potential is huge, to the extent that it turns Bulgaria into one of the most attractive options to start crypto business activities.

Buying an Already Existing Crypto License

While investors are in a hurry to enter the market, purchasing an already existing crypto exchange license in Bulgaria can be one of the options. This approach, however, requires very careful due diligence to ensure that the license will be fully compliant with all regulatory requirements and will serve the business objectives of the buyer.

While Bulgaria is still working on the development of the virtual currency regulatory framework, acquiring a crypto exchange license in Bulgaria opens up perspectives for the national market and the broader European financial space. Companies can navigate through this continuously changing and developing sector strategically with compliance, realize the opportunities opened up by the progressive approach of Bulgaria to regulate cryptocurrencies.

Crypto License in Bulgaria 2026

An enterprise already complying with some national rules in force before MiCA’s entry into force is allowed to continue its operations in the relevant EU Member State during the transition period. Such enterprises must, however, necessarily be licensed under the new regulation in order to continue their operations.

A really new approach is the passporting of licenses: the possibility given to crypto asset service providers to conduct their activities legally throughout the European Union without needing further national licensing in each country. This significantly simplifies further expansion into the European market and enhances integration and cooperation within the EU Digital Single Market.

It does, however, express an expectation for more specific guidance from the industry with regard to licence requirements in light of the new legislation. It should be underlined that in Bulgaria, a crypto-licence will be a prerequisite for the legal operation of crypto-assets after the end of the transition period. The opportunity created by the MiCA regulation, which includes passporting of services to operate within the EU and EEA, cannot be exploited by service providers who do not have such a licence.

Apart from that, there are serious differences between the Bulgarian draft law and the MiCA standards with regard to the time for processing and issuance of a licence. The draft allows the Financial Supervision Commission to process applications for up to six months, while MiCA puts the limits at 60 working days in the case of crypto-licences and up to 40 working days in the case of cryptoassets services licences.

These divergences can therefore raise some issues for the firms who want to obtain licenses as soon as possible to begin or carry on cryptoasset activities and, secondly, result in a higher risk of ‘silent refusals’ at a moment when a lack of response from the regulator within the required time is considered as refusal.

Response and preparedness by different stakeholders like banks, companies, and regulators are indeed one of the most important factors in bringing about new legislation. The introduction of new regulations also means that adaptation will have to be made by the banking sector, which will need to comply with both national and European requirements related to cryptoasset activities. It will be important to ensure that all stakeholders are well-informed and prepared for the upcoming changes that will pave the way for an easy transition and compliance with the new rules.

Indeed, digital assets and Web3 technologies for the most part are developing at an unbelievable speed, faster than the pace at which legislation can keep up. In any event, the adoption of MiCA places the European Union at the front line in devising an appropriate regulatory framework to underpin the very fast-growing digital technology industry, placing the EU at an advantage in the global race, including vis-à-vis the United States.

Indeed, in the Bulgarian context also, the first important step is the recognition of the existence of a category of digital assets beyond the legal framework. For example, the regulation of some types of NFTs as unique and non-interchangeable differs from the approach to the other, more standard levels of digital assets-fractional and interchangeable tokens-which are much more likely to fall under stricter regulation.

MiCA focuses on cryptoassets that are not classified as financial instruments and, therefore, excludes from its scope those assets that in substance would actually fall under existing financial regulations, such as the Markets in Financial Instruments Regulation. This division allows for a clear demarcation of the scope of application of various regulations, hence would grant an industry clearer guidelines on how to develop and apply innovative technologies.

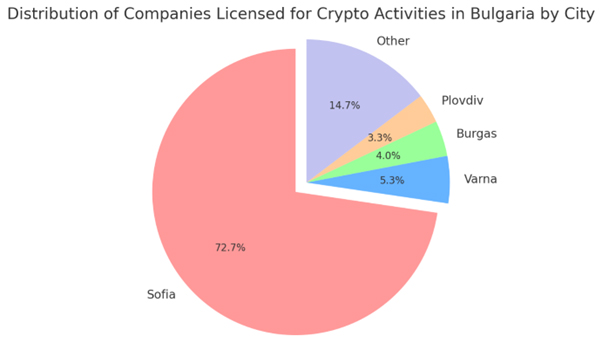

As of 24 October 2025, there are 150 companies registered in Bulgaria that are authorised to engage in crypto activities. These companies are registered in the following cities:

The majority are located in Sofia, comprising 72.7% of the total.

“Bulgaria has become a promising destination for entrepreneurs and businesses seeking a thriving environment for growth and success. If you’re considering starting your business in Bulgaria, contact me, and let’s explore your vision together.”

FREQUENTLY ASKED QUESTIONS

Do crypto activities require a licence in Bulgaria?

Currently, Bulgaria has no crypto-specific licence but nevertheless, every crypto company is still legally required to obtain general authorisation from the National Revenue Agency (NRA) before starting crypto-related economic activities in Bulgaria.

What’s the process of getting a crypto license in Bulgaria?

To obtain a Bulgarian crypto license, you should first establish a company in Bulgaria and launch a compliant business website along with a mobile application. It’s also required to prepare a description of the intended crypto activities and implement internal procedures to combat and prevent money laundering and terrorist financing activities. Lastly, you must submit an electronic application along with the required documents that back up your provided information.

Does Bulgaria impose crypto license registration fees?

Yes, the registration fee of 50 BGN (approx. 25 EUR) must be paid to the National Revenue Agency (NRA) which is among the lowest fees in Europe.

Can Bulgarian companies engage in crypto activities without notifying the national tax authority?

It’s mandatory to obtain authorisation from the National Revenue Agency (NRA) before accessing the Bulgarian market.

What crypto activities does Bulgaria’s crypto license permit?

Bulgarian crypto authorisation permits such activities as crypto exchanges (cryptocurrencies into other cryptocurrencies, as well as cryptocurrencies into fiat money and vice versa), crypto wallets and safeguarding of private keys, as well as services of holding, storing, and transferring cryptocurrencies.

How long does it take to get a crypto license in Bulgaria?

If all submitted documents are in order, a crypto business is included in the public register and granted a Certificate of Registration within one calendar month which is very efficient compared to many other European jurisdictions.

What information must be included in the application for a Bulgarian crypto license?

The National Revenue Agency (NRA) requires to include such company details as name, address, details of company representatives and Unique Unified Identification Code (UIC). It’s also mandatory to include a detailed description of the business model and intended crypto activities, as well as a list of countries where the business is planning to offer crypto products and services.

Can crypto companies be owned by non-residents of Bulgaria?

Yes. Bulgaria doesn’t have citizenship or residence requirements for crypto company founders.

What documents are required to open a cryptocurrency company in Bulgaria?

Notarised Articles of Association, a certificate of the company name, passport photocopies of company founders and directors, and a local bank statement showing deposited initial capital are among the key documents required to establish a cryptocurrency company in Bulgaria.

Can a Bulgarian crypto license be obtained without opening a local bank account?

No. A Bulgarian crypto license can be obtained by a Bulgarian company which can be established only if it has a Bulgarian bank account.

Can documents for a Bulgarian crypto company registration be submitted in English?

No. All Bulgarian company formation documents must be drafted and submitted in Bulgarian language and therefore you’ll most likely need to hire a certified translator in order to open a Bulgarian crypto company.

What are the benefits of getting a crypto license in Bulgaria?

The main benefits of obtaining Bulgarian crypto authorisation are optimal company formation and crypto authorisation processes which can be carried out remotely, as well as minimal requirements for initial capital, and no burdensome crypto license application and supervision fees. While the rules are more relaxed than in many other European jurisdictions, having a Bulgarian crypto licence can still open doors to the rest of the EU since Bulgaria is also its member country.

Are Bulgarian crypto companies audited?

Bulgarian crypto companies are generally subject to statutory audits. However, audit exemption applies to companies that don’t exceed at least two of the following parameters:

- Total assets – 2 mill. BGN (approx. 1 mill. EUR)

- Total revenue – 4 mill. BGN (approx. 2 mill. EUR)

- The average annual number of employees – 50

Can Bulgarian crypto companies have directors who are non-residents of Bulgaria?

Yes. Bulgaria doesn’t have citizenship or residence requirements for crypto company directors.

Does Bulgaria have any measures in place to prevent money laundering and the financing of terrorism?

Yes, Bulgaria monitors crypto companies for the purposes of anti-money laundering and counter-terrorist financing (AML/CFT). The main applicable law is the Measures Against Money Laundering Act (MAMLA) which has partially integrated the provisions of the EU’s 5th Anti-Money Laundering Directive (5AMLD).

Are there any challenges to obtaining a crypto license in Bulgaria?

The Bulgarian government doesn’t currently offer any support through such testing programmes as regulatory sandboxes which means that testing of crypto-related ideas isn’t facilitated and therefore it can be more difficult to navigate national regulations and ensure adherence to various security requirements which is imperative when obtaining a crypto license.

Can a Bulgarian crypto company open a bank account?

Yes. A Bulgarian crypto company generally can and must open a local bank account to deposit initial capital upon its formation.

Are crypto businesses taxed in Bulgaria?

Yes. All crypto businesses operating in or from Bulgaria are taxed in accordance with national and applicable EU legislation and therefore must register as taxpayers. Generally, they’re subject to Corporate Income Tax, VAT, Social Security Contributions, Withholding Tax, and other taxes.

Additional services for Bulgaria

RUE customer support team

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

OÜ

Registration number:

14153440

Anno: 16.11.2016

Phone: +372 56 966 260

Email: [email protected]

Address: Laeva 2, Tallinn, 10111, Estonia

UAB

Registration number: 304377400

Anno: 30.08.2016

Phone: +370 6949 5456

Email: [email protected]

Address: Lvovo g. 25 – 702, 7th floor, Vilnius, 09320, Lithuania

Registration number:

08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00, Prague

Sp. z o.o

Registration number: 38421992700000

Anno: 28.08.2019

Email: [email protected]

Address: Twarda 18, 15th floor, Warsaw, 00-824, Poland