Crypto License in Poland 2025

VASP license / CASP license in Poland

In 2014, the Polish authorities declined to recognise Bitcoin as a currency. However, they did classify contracts based on the base index as full-fledged financial instruments, subject to standard rules. Despite the lack of a legal definition, cryptocurrencies are not equated with fiat money, and are legally traded in Poland. Mining, the purchase, and the sale of crypto means are recognized as not prohibited activities.

Since November 2021, virtual asset turnover has become a regulated business in Poland. Companies engaged in such activities must register with the State in a separate register of cryptocurrency enterprises and obtain an appropriate licence. Entrepreneurs must comply with the registration requirements set out in Polish legislation.

Thus, due to the popularity of virtual currencies, the physical features of which are bitcoin ATMs, Poland has become a jurisdiction where the cryptocurrency business – mining, selling, and buying cryptocurrency assets – is regulated and controlled by national authorities.

Poland crypto license

Poland has become one of the most attractive jurisdictions for obtaining a Crypto license in Poland. Many industry experts also refer to this as a CASP license in Poland or a VASP license in Poland. Although these terms may appear in different regulatory documents, they are essentially synonymous and denote the same robust licensing process for crypto businesses. This unified approach ensures strict compliance with AML/KYC standards and provides companies with a transparent regulatory framework, enabling them to confidently enter the European market.

COST OF CRYPTOCURRENCY License in Poland

|

PACKAGE «COMPANY & CRYPTO LicenSe IN POLAND» |

7,900 EUR |

- Creation or purchase of a ready-made company in Poland

- Preparation of legal documents of the company

- Assistance in employment of director/KYC/AML employee and information of the State Social Insurance Fund

- Rent a legal address in the business centre for 1 year

- Overview of the business model and structure of the Cryptocurrency Company

- KYC/AML Procedural Rules and Procedures

- Preparation of notifications, forms and supporting documents for submission to the Chamber of Tax Administration of Katowice

- Payment of State Fees for Registration of a Company

- Payment of State Licensing Fees for Application for a Cryptocurrency License

- General consultation (5 hours)

GENERAL PROVISIONS

The Polish financial market is overseen by the Polish Financial Supervision Authority (AFM), which guarantees its smooth operation and growth. Additionally, the AFM formulates draft legislation to regulate the financial market.

The Polish financial market is overseen by the Polish Financial Supervision Authority (AFM), which guarantees its smooth operation and growth. Additionally, the AFM formulates draft legislation to regulate the financial market.

The cryptocurrency business is currently a separately regulated area, administered by the Tax Administration Chamber, which maintains a register of crypto activities, called the Register of Virtual Currencies.

The requirements for obtaining a cryptocurrency license and registration in a special registry apply to Polish companies providing the following services:

- Exchange of virtual currencies for fiat money (cryptocurrency exchangers, crypto-currency exchanges)

- Exchange virtual currencies for other virtual currencies

- Providing and maintaining accounts for virtual currencies (cryptocurrency wallets)

- Virtual currency exchange services (brokerage services)

The register of cryptocurrency companies will be controlled by the Ministry of Finance of Poland. This register was activated on November 1, 2021. Companies that have carried out activities in the field of virtual currencies in Poland before November 1 have an additional 6 months to adapt the business to new requirements and pass the licensing procedure.

Any new cryptocurrency companies registered in Poland after 1 November 2021 must complete a registration process with the relevant authority before commencing operations.

Crypto companies operating in Poland are supported by some authorities:

- Blockchain and New Technology Chamber of Commerce representing the interests of the industry in accordance with applicable Polish legislation;

- The Innovative Hub, where the Supervisory Authority consults with Fintech and also provides virtual sandboxes to support the development of new Fintech startups.

What is a CASP / VASP License in Poland?

“A CASP license in Poland and VASP license in Poland refer to licenses issued to Crypto Asset Service Providers or Virtual Asset Service Providers. Despite the difference in terminology—which often arises from historical and regional variations—the regulatory requirements remain identical. Both licenses enforce rigorous AML/KYC protocols, ensuring the security and transparency of cryptocurrency operations in Poland. In practice, whether you obtain a Crypto license, a CASP license, or a VASP license in Poland, the benefits and compliance standards are consistent.”

advantages

Fast project implementation time

Possibility to purchase an off-the-shelf solution

No share capital requirement

No obligatory local staff member

Additional Benefits of CASP/VASP Licenses

“In addition to the overall advantages of obtaining a Crypto license in Poland, having a CASP license in Poland or a VASP license in Poland sends a strong signal to investors and partners. These licenses confirm that your company adheres to a strict regulatory framework, which enhances your credibility in the market, facilitates smoother access to European financial systems, and ultimately, boosts investor confidence.

CRYPTO LICENSING PROCESS

Poland is part of the European area, and in addition to national regulations, EU regulations are considered in licensing. The country is part of the Schengen area, and the requirements of the European Union Directive will need to be met to enter the European market. Therefore, to issue a license for cryptocurrency exchange «with a perspective,» you will need:

To register a Polish company with «physical» office (nominal legal address is not enough) – non-residents will fit closed and open companies with limited liability, SP z.o.o and SA

Open a bank account and deposit the authorized capital – at the time of registration pay 100%

Recruit staff and directors with financial expertise and education

To prepare a business plan for several years in advance, documentation on technical and software tools used for exchange operations

Draw up AML/KYC compliance policies, internal registers, control regulations, etc.

Poland

Capital |

Population |

Currency |

GDP |

| Warsaw | 38,036,118 | PLN | $19,023 |

STAGES OF OBTAINING A CRYPTOCURRENCY license IN POLAND

1. Preparation and filing of documents for the registration of the company in Poland:

- Preparation of documents for registration remotely

- Payment of government fees related to the registration of a legal entity

- Preparation of primary declarations for the Inland Revenue Service and the registry of beneficiaries

- Legal address and mailbox rental for one year

2. Obtaining the Polish tax number PESEL

You need a Polish tax number to submit an electronic application via the ePUAP government service platform.This procedure includes:

- Translation of a certified copy of the director’s passport under the apostille (if the document is certified by a foreign notary and not by the Polish Consulate) into Polish.

- The courier sends the client a document confirming receipt of the PESEL tax number.

Deadline for receipt of PESEL – up to 30 days from the moment of submission by the client of the original documents, as well as translations.

- Application for a license, and registration of a company in the register of organizations working in the field of cryptocurrency:

The following steps need to be taken:

- Preparation of documents for inclusion in the register of organizations working in the field of cryptocurrency

- Payment of government fees

- AML procedure in Polish

The deadline for entering the Polish cryptocurrency into the register is 14 days from the moment the company director signs the statement via ePUAP. The deadline may be extended in case of system questions or a lack of important documents.

Crypto regulation in Poland

| Period for consideration |

up to 2 months | Annual fee for supervision | No |

| State fee for application |

133 € | Local staff member | No |

| Required share capital | 1,077 € | Physical office | No |

| Corporate income tax | 15% | Accounting audit | No |

REGISTRATION OF THE POLISH COMPANY IN THE REGISTER OF CRYPTO-CURRENCY COMPANIES

As mentioned, a company does not need to obtain a cryptocurrency license in Poland for legitimate cryptocurrency activities, but to register with the appropriate state business register.

The activities of Polish companies and persons involved in cryptocurrency are regulated by the Chamber of Tax Administration in Katowice, Poland.

Legal basis of the register of activities in the sphere of virtual currencies:

- Articles 129-129z of the Act of 1 March 2018 on combating money-laundering and the financing of terrorism.

- Resolution of the Minister of Finance, Funds and Regional Policy of 25 October 2021 on the appointment of a body of the National Tax Administration to perform the tasks of the body competent to maintain a register of activities in the field of virtual currencies.

- Resolution of the Minister of Finance, Funds and Regional Policy of 21 October 2021 on the filing of an application for registration in the register of activities in the sphere of virtual currencies and the notification of the suspension of this activity.

- Virtual currency activities are regulated and require registration in the registry.

List of companies and individuals who have received a cryptocurrency license in Poland

The law on the basis of which a cryptocurrency license is issued in Poland.

TAXATION OF A POLISH COMPANY

There is no special cryptocurrency tax, but crypto companies operating in Poland, depending on their legal structure, are liable to pay various already existing taxes, which in some cases can be saved, considering that Poland has double taxation agreements with more than 80 countries.

More information regarding taxation here.

Also, lawyers from Regulated United Europe provide legal support for crypto projects and help with adaptation to MICA regulations.

Unlocking the Potential of the Polish Crypto Market: A Guide to Crypto Exchange Licensing 2025

Poland stands as a promising frontier for the cryptocurrency industry, with a growing interest in blockchain technology and a favorable regulatory stance. This guide explores the process of obtaining a crypto exchange license in Poland, detailing the regulatory framework, application process, and the advantages of establishing a licensed operation in this dynamic market.

Regulatory Environment for Crypto Licensing in Poland

In Poland, the regulation of cryptocurrencies is managed by the Polish Financial Supervision Authority (KNF), which ensures that all crypto-related activities align with national and EU financial regulations. A crypto exchange license in Poland allows entities to legally trade and exchange cryptocurrencies, a critical step for operating within the Polish market.

Types of Crypto Licenses in Poland

The Polish regulatory framework offers several types of crypto licenses, each serving different operational needs:

- Crypto exchange license in Poland: For platforms that offer exchange services between cryptocurrencies and fiat currencies.

- Crypto broker license in Poland: Allows companies to act as intermediaries in crypto transactions.

- Crypto trading license in Poland: For businesses engaging directly in the buying and selling of digital assets.

- VASP crypto license in Poland: Aimed at providers of a variety of crypto services, including but not limited to exchange and wallet services.

Requirements and Eligibility for Obtaining a Crypto License

Applicants must meet stringent criteria, including robust AML and KYC protocols, sound financial health, and proven business models. Documentation such as business plans, financial forecasts, and security protocols is essential for approval.

Cost Implications of Crypto Licensing

The crypto exchange license in Poland cost can vary depending on the scope of business activities and the specific license type. It’s crucial for businesses to factor these costs into their financial planning, although Poland is known for having potentially lower costs compared to other EU countries.

Benefits of Acquiring a Crypto License in Poland

Holding a crypto license in Poland opens numerous doors, including enhanced credibility with customers and investors, compliance with European regulations, and access to a broad market within the EU.

Crypto Investment Climate in Poland

The Polish market offers an excellent environment for crypto investments. The country’s highly competitive licensing costs, often regarded as the cheapest in Poland for crypto businesses, coupled with its tech-savvy population, provide an ideal setting for growth and innovation within the crypto sector.

Market Entry Strategies

For those seeking to enter the market more expediently, purchasing an existing crypto exchange licence in Poland for sale may be a beneficial option. However, thorough due diligence is essential to ensure the licence meets the business’s specific needs and is compliant with all regulatory requirements.

In conclusion, as the Polish government continues to refine its approach to cryptocurrency regulation, securing a crypto exchange licence in Poland is an invaluable step for businesses aiming to capitalise on the opportunities within this emerging market. Companies can effectively navigate this exciting sector with proper preparation and understanding of the legal landscape.

Crypto License in Poland 2025

Since 2025, Polish regulation has introduced several changes in the cryptocurrency market that have directly affected entrepreneurs operating fixed cryptocurrency exchanges. Among them is the establishment of limits on cash transactions and new tax accounting rules. The article goes over the most important novelties and their consequences for the cryptocurrency industry.

1. Cash transaction limit in the crypto industry

The new cash limits will apply as of the beginning of 2025 in the case of transactions between an entrepreneur and a consumer. Entrepreneurs who conduct their business with cryptocurrency will have to take into consideration the limit on cash transactions at PLN 20,000, set for all types of cash transactions.

That would be a situation when a client purchases something with the use of 25,000 PLN. In the case of a cash payment, in such a shop or exchange office a corresponding obligation of revenue recognition—twice the amount of the payment in its entirety—would occur. In a situation when such transaction had taken place by bank account, such an obligation would not arise.

2. Double Revenue Recognition in Cryptocurrency Transactions

The described concept of double recognition of revenue means that the surplus of the limit of cash transaction of 20,000 PLN is subject to obligation showing of the whole value of such a transaction as revenue twice. The described provision embraces cryptocurrency transactions and may lead to additional tax burden of cryptocurrency exchangers and their customers.

In response, the National Bank of Poland drew attention to the provision’s analogy to the sanctions measures. Despite everything, the new regulation was passed and will come into force as of the beginning of 2025.

3. Interpretation of the new limits for the cryptocurrency exchanges

Where the customer of the Exchange makes a cash payment in an amount higher than PLN 20,000, the whole amount shall be recognized in the system twice. For example, in case of the transaction for PLN 25,000 – the full amount should be reported twice as an income and not only allegedly surplus above PLN 20,000. Fortunately, there is a possibility of curing such situations: if after the main cash transaction the customer gives back money in cash and then pays again by using his bank account, income can be recorded only once.

4. Cash transaction limits for B2B transactions

Business-to-business cash settlements between companies were limited up to PLN 15,000 until 2025. Starting from 2025, this limit has narrowed up to PLN 8,000, which might be treated as further restriction to cash use in extensive business-to-business transactions. However, this does not refer to transactions between cryptocurrency exchanges and their customers. In consequence, exchangers may still purchase a cryptocurrency for cash without any double revenue recognition or additional tax restrictions.

5. The main issues that should be considered during the performance of the activity of virtual currency exchanger

The entrepreneurs running their business in the cryptocurrency market in the year 2025 should pay close attention to new cash transaction limits and tax accounting provisions. It is important to note that the limit for cash transactions is PLN 20,000, which means every single transaction must be scrutinized with due care to avoid tax risk. It is also very important to consider customer identification rules if the transactions are over EUR 1,000 under AML procedures.

New regulatory changes in Poland, effective from 2025, influence both tax and legal aspects of dealing with cryptocurrencies. Further complications for entrepreneurs include limits on cash transactions and the need to recognize dual income. By following the rules and accepting new realities, entrepreneurs will manage to continue their activity with new regulations imposed.

The process to obtain a Crypto license in Poland is identical to obtaining a CASP license in Poland or a VASP license in Poland, ensuring a seamless regulatory experience.

Financing of purchase of the cryptocurrency mining equipment: opportunities and prospects in 2025

Cryptocurrency mining is a popular type of entrepreneurial activity, which at the same time involves rather substantial initial investment in equipment and infrastructure. With the purpose of successful entry into this business, it is worth exploring available opportunities for financing, which could partly cover the cost of purchasing cryptocurrency mining equipment. Available sources of finance for the sole proprietors and corporate entities as at 2025 are several. Let’s have a look at the key available options for financing the purchase of mining equipment.

1. Labour Bureau Funding

Government support through the Bureau of Labour is one of the most popular ways to obtain seed capital in order to buy mining equipment. Financing of such a nature is open to the registered unemployed and provides an opportunity to receive a subsidy to start a business.

Maximum aid intensity: The subsidy value is capped in 2025 for an amount higher than six average monthly remunerations in the economy, higher than PLN 43,000. This in practice will stand between 25,000 to 30,000 PLN, depending on the particular labour office for each region of Poland.

What subsidy can be used to pay for: Funds can be spent on equipment purchases like mining rigs consisting of ASICs or GPUs, software, cooling, and other necessary parts.

Limitations: Funds cannot be spent to pay ongoing expenses such as taxes, accounting, or marketing. Also, the subsidy is a one-time grant given only once.

2. European Union Grants

EU grants can also finance the start-up of a firm, including cryptocurrency-related ones. These have been divided into two parts: one-time support and temporary grants covering operational costs.

Grant size: In 2025, it will be possible to obtain about PLN 23,000 one-off support for starting a business and monthly support of between PLN 1,500 and PLN 2,500 for 6-12 months.

Advantages: The investor can use the subject finance to cover the expenses of equipment, power and cooling systems and other business ‘start-up’ expenses.

Application Procedure: Acquiring a grant includes consecutive steps: written recruitment, an interview with an advisor, training, preparation of a business plan. The whole process takes as long as 4 months.

3. Grants from PFRON for people with disabilities

Another possibility is the Foundation for the Social Inclusion of Persons with Disabilities, which also provides financing for business startups, including activities related to mining cryptocurrency.

Maximum amount: The subsidy can be up to PLN 100,000, which covers a great part of the initial costs of purchasing equipment.

On what can the subsidy be spent: this subsidy by PFRON could pay the mining rigs, cooling machinery, software, and other necessary components. It is also possible to cover the costs of advisory services, such as consulting services in legal or accounting matters.

4. Preferential loans granted at the start of an enterprise

The opportunity for soft loans in favor of startups, for those unable to get a subsidy or grant. This kind of financing is meant for both unemployed and students, by which you will be able to receive substantial amounts for the buying of equipment.

Maximum loan amount: The loan may reach the equivalent of 20 times the average monthly salary, which at the end of 2025 is about 140,000 PLN.

Benefits: The loan is issued for a period of up to 84 months, which is partially payable with a grace period of up to 12 months; the interest rate is much lower than commercial offers: from 0.68% to 1.7%, depending on the terms.

What is possible to be covered by the loan: this loan may cover all costs related to the mandatory equipment and installations, refrigeration systems, connection installations of the networks, rent of premises.

5. Subsidies of Local Action Groups

Local Action Groups — in short, LGDs subsidize the development of enterprises in rural areas. This type of subsidy is available for entrepreneurs registered in small towns and villages.

Subsidy rate: In 2025, this subsidy from the LGD can be as high as PLN 150,000, but such subsidizing may cover no more than 65% of the eligible costs.

Purposes of use: The financing can be utilized to acquire mining equipment, renovation, and construction works; marketing and promotion of the business.

Funding of mining equipment in 2025 may be issued within the framework of government subsidies and grants of the European Union and in the form of a soft startup loan. Which option to choose depends on your status—unemployed, student, or entrepreneur—and the volume of investment planned. To make a final decision, it is necessary to familiarize yourself in detail with the terms of each program and prepare a business plan that will convincingly demonstrate the future potential of your crypto business.

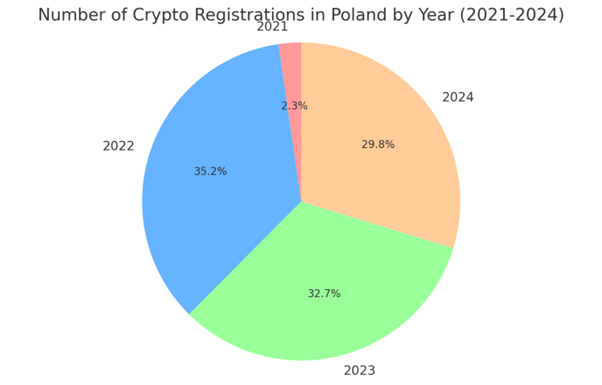

Companies and individuals who have a crypto activity permit/crypto license in Poland. In total, as of 22 October 2025, there are 1566 crypto registrations in Poland.

Whether you opt for a Crypto license, CASP license, or VASP license in Poland, our comprehensive solution ensures full compliance with Polish regulations, enabling your business to thrive in the European crypto market.

“Hi, are you looking to start your crypto project in Poland? Write to me and I will navigate you through all of the stages of applying for a VASP license in Poland.”

Whether you opt for a Crypto license, CASP license, or VASP license in Poland, our comprehensive solution ensures full compliance with Polish regulations, enabling your business to thrive in the European crypto market.

FREQUENTLY ASKED QUESTIONS

How do I get a crypto license in Poland?

In order to be registered as a virtual asset service provider in Poland, a company must complete the following process:

- Register a physical address (office) in Poland

- Submit copies of documents on behalf of company owners, directors and senior managers. They should reflect impeccable reputation and not show any convictions for violation or law.

- Deposit the minimum authorized capital

- Establish AML/KYC policies and set clear rules for risk management

- Identify and verify clients before setting up business relationships (or when a transaction exceeds a certain amount)

Is it necessary to contact the local tax authority in crypto activities on behalf of a Polish company?

Yes. Every company that operates in the country reports to the National Court Register (KRS, or Krajowy Rejestr Sądowy).

What are the activities of the crypto license in Poland?

The scope of business activities that a crypto company may provide in Poland is broad and formally defined as “activities in the field of virtual currencies”. These include:

- Exchanging between virtual currencies and fiat currencies

- Exchanging between virtual currencies

- Intermediating in the exchange referred to in point a or b

- Supporting user accounts in an electronic form

How long does it take to get a license in Poland?

Once all the application documents and reports are submitted by the applicant, the decision on whether to register the company as an official crypto service provider should be taken within a period of 14 days. However, in total the process of establishing and registering a crypto company in Poland may take around 2 months (with possible delays due to missing information or other disturbances).

Can non-residents of Poland own a crypto company?

Yes. Non-residents can successfully establish a crypto company in Poland.

Is it necessary to have a banking account to obtain a license?

Yes. A banking account is a necessary functional requirement for companies operating in Poland. This account must also be used for depositing the minimum capital requirement.

What is the minimum authorized capital for a virtual currency service provider?

Minimum authorized capital for registering a crypto company in Poland is 5000 PLN (around 1100 EUR).

Is it possible to deposit authorized capital in cryptocurrency?

No, applicants may only deposit the required amount in fiat currencies.

How is the charter capital of a crypto company paid in?

The applicant must deposit it into the bank account of the crypto company in question. The full amount must be deposited in a fiat currency.

When do you need to deposit capital to open a company and obtain a crypto-license in Poland?

This step must be completed prior to submitting an application for establishing a company in Poland. It is a necessary prerequisite for successful registration.

Why you should get a crypto license in Poland?

There are a few reasons why establishing and registering a crypto company in Poland is a strategically beneficial move. Firstly, Poland is a large domestic market that gives businesses instant access to a very broad audience. Furthermore, compared to estimated waiting times in other EU member states, opening a crypto business in Poland takes a short amount of time. It is also relatively simple in terms of the procedure itself, carrying less requirements than crypto licensing procedures in many other EU member states. Finally, Poland has signed bilateral agreements on the avoidance of double taxation with more than 84 countries. This situation offers a huge taxation advantage for international companies that intend to open a branch in Poland.

Are Polish cryptocurrency companies audited?

According to Polish law, crypto companies are currently not a part of the financial market. As a result, activities of crypto companies in the country are currently not subject to specific, financial supervision. Nevertheless, the Polish authorities may audit crypto companies over their provision of payment services, particularly their virtual currency exchange office.

Can the director of a crypto company be a non-resident of Poland?

Yes. Nevertheless, an annual board and management meeting is required.

What measures to prevent money-laundering and the financing of terrorism are in place in Poland?

All virtual asset service providers registered in Poland must perform several specific post-registration obligations established in Polish law. In particular, they must:

- Identify and assess money laundering and terrorist financing risks stemming from their business activities and set financial security measures in place

- Keep a record of user transactions

- Maintain a register of actions taken to prevent money laundering and terrorist financing under the AML/CTF law.

What difficulties may arise in obtaining a crypto license in Poland?

Although providing virtual asset services, as a business activity, is generally legal and permissible in Poland, the crypto asset market is unregulated. As a result, crypto companies may run into grey areas in crypto legislation.

Where can I open a bank account for a Polish crypto company?

According to Polish law, crypto companies don’t necessarily have to have a traditional bank account. Alternatively, companies may choose to open an account with a virtual bank or a payment system.

Additional services for Poland

RUE customer support team

“Hi, if you are looking to start your project, or you still have some concerns, you can definitely reach out to me for comprehensive assistance. Contact me and let’s start your business venture.”

“Hello, I’m Sheyla, ready to help with your business ventures in Europe and beyond. Whether in international markets or exploring opportunities abroad, I offer guidance and support. Feel free to contact me!”

“Hello, my name is Diana and I specialise in assisting clients in many questions. Contact me and I will be able to provide you efficient support in your request.”

“Hello, my name is Polina. I will be happy to provide you with the necessary information to launch your project in the chosen jurisdiction – contact me for more information!”

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

Registration number: 08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00 Prague

Registration number: 304377400

Anno: 30.08.2016

Phone: +370 6949 5456

Email: [email protected]

Address: Lvovo g. 25 – 702, 7th floor, Vilnius,

09320, Lithuania

Sp. z o.o

Registration number: 38421992700000

Anno: 28.08.2019

Email: [email protected]

Address: Twarda 18, 15th floor, Warsaw, 00-824, Poland

Europe OÜ

Registration number: 14153440

Anno: 16.11.2016

Phone: +372 56 966 260

Email: [email protected]

Address: Laeva 2, Tallinn, 10111, Estonia