DMCC stands for Dubai Multi Commodities Centre, a free economic zone in Dubai, United Arab Emirates, entrusted with trade in goods and services. It is considered one of the largest and fastest-expanding free economic zones anywhere on the globe, integrating international trade and enterprise.

DMCC was formed in the year 2002 to offer the best place for trading in many types of commodities such as gold, diamonds, tea, among others. The zone offers a set of business advantages: tax incentives, full foreign ownership of the company is allowed, with no requirement to have a local partner, state-of-the-art infrastructure and service.

Besides this, DMCC possesses a happening service and technology vertical, inclusive of IT and blockchain. With its good location and well-developed business infrastructure, the zone draws many international companies that seek to establish a base in the Middle East.

DMCC VASP Regulations 2025

The Dubai Government has empowered the world’s first autonomous regulatory authority of Virtual Assets that provided a world-leading complete legal framework of legislation, regulation, and supplementary rules. VARA is an authority established in March 2022 to regulate, supervise, and approve the virtual asset market across the Emirate of Dubai, including Special Developing Zones and Free Economic Zones, excluding the DIFC.

The Dubai Government has empowered the world’s first autonomous regulatory authority of Virtual Assets that provided a world-leading complete legal framework of legislation, regulation, and supplementary rules. VARA is an authority established in March 2022 to regulate, supervise, and approve the virtual asset market across the Emirate of Dubai, including Special Developing Zones and Free Economic Zones, excluding the DIFC.

Under the Virtual Assets and Related Activities Regulations 2023, the licensing regime of VARA includes the following broad range of virtual asset services: providing advice; broker-dealer activities; providing the custody of assets; exchange transactions; assistance on lending and borrowing; investment management and investment services; implementation of the funds transfer operations and settlement services. VARA stands for Virtual Assets Regulatory Authority.

The Virtual Assets Regulatory Authority, VARA, was established in Dubai with a mandate for the oversight of the virtual assets sector. Its main objectives would cover empowering market participants, increasing awareness of the products and transactions in the field, and fostering innovation in the industry. This authority executes regulation and supervision in all zones of Dubai for all types of activities related to virtual assets, which claims to be the world’s first dedicated global regulator for this area.

The Authority closely cooperates with the Dubai Department of Economy and Tourism and the Dubai Free Zones Authority, FZA, to introduce high standards in consumer protection and security within mainland Dubai and its free zones. It is such cooperation that develops the economy and finance of this emirate.

Dubai Law No. 4 of 2022

The law concerning the regulation of virtual assets in the Emirate of Dubai includes definitions and denominations with respect to virtual assets drafted in wide and adaptive format with a view to responding to changes in technology and to the virtual asset market itself. Thus, for the purposes of VARA, a virtual asset has been defined to be: “a digital representation of value which may be digitally traded, transferred or used for payment or investment purposes, and includes a virtual token as well as any other digital representation of value that is designated as a Virtual Asset.” In turn, it defines a virtual token as a digital representation of a set of rights available for offer and sale in digital form through a virtual asset platform.

These definitions extend the jurisdiction of VARA to areas beyond the traditionally regulated activities—such as trading cryptocurrency—and will allow VARA to develop specific rules regarding a wide range of virtual assets when they become created, such as NFTs and utility tokens.

Licensing Process

As per the law, any player who wants to operate virtual assets in Dubai needs to obtain a license as Virtual Asset Service Providers. The process leading to the licensure includes the following:

- Preliminary approval through application with disclosures provided by VARA, including required documentation such as a business plan, information on the beneficial owners and senior personnel management, and payment of the application fee.

- Obtaining the final approval and license from VASP after in-license and setup of firm operations, inclusive of additional documentation as required by VARA.

It is expected that the firms will cooperate fully with VARA by responding to all its inquiries and liaising with the licensing officer assigned to the applicant to establish a good relationship right from the early stages of the process. Once all the requirements from VARA are met, a VASP license will be issued to the firm, which permits it to conduct its business in accordance with the permission granted and the set regulations, renewable yearly along with payment of an annual supervision fee.

The company should also be listed on the register of Dubai Department of Economy and Tourism or the competent free zone, so that its operation is in full compliance with all rules and directives promulgated by VARA to ensure continued compliance with the requirements for licensing.

DIFC – Dubai International Financial Centre

The DIFC is the primary financial district in Dubai, United Arab Emirates; it was established with a goal to develop the economies in the region by providing financial services at an international level. Since its establishment in 2004, the DIFC has won confidence among international finance institutions through the rule of applying the principles of the English law in its legal system and/or court cases, hence assuring sound and transparent legal framework.

Salient advantages include no restriction on foreign ownership, complete exemption from income tax for up to 50 years, and full repatriation of capital and profit without any restriction. All this has created a very perfect business climate.

DIFC is home to the head offices of many international banks, investment funds, insurance and reassurance companies, and various financial institutions. This financial centre is actively developing such fields as Fintech, Islamic finance, investment, and asset management, thus turning it into one of the key financial centers not only in the Middle East but worldwide.

Digital Assets Law No. 2 of 2024

On 8 March 2024, independently of Dubai’s established regulatory regime, the Dubai International Financial Centre enacted Digital Assets Law No. 2 of 2024. It thus prescribes the legal nature of digital assets and the regulation of their control, transfer, and disposal by stakeholders. That is, according to Section 8, a “digital asset” means a virtual entity which exists through software and data generated by a network, is not attached to any given person or legal system, cannot be copied and used more than once by a predetermined group of persons.

Section 9 emphasizes that a digital asset is an intangible property and provides the definition of control of a digital asset and how ownership is transferred. This gives clarity to the legal nature of digital assets and allows for adequate regulation of recent technological developments, including blockchain and distributed ledgers.

Digital assets-related financial services, however, could be issued within the DIFC only by those entities that had acquired a licence from DFSA. It would require a preliminary informal review and an application with a full regulatory business plan, registration with the registry of the Company of DIFC, opening a bank account, and proof of capital and office space.

Due Diligence review of the DFSA application in detail would thus take 90-120 days. Initial feedback on this is provided within a fortnight. It needs to be followed assiduously with guidelines and timelines because delays at any level may happen. When the requirement is satisfactorily complete, the DFSA would grant a license to a Digital asset business to begin its operation.

SCA (Securities and Commodities Authority)

The UAE Securities and Commodities Authority is the prime regulator in the United Arab Emirates financial system. The main activities of SCA are focused on supervising and controlling both the securities and commodities markets of the UAE, next to regulating all types of transactions related to securities, as well as investment activities. The SCA was established to bring transparency and stability to the financial markets; furthermore, it is responsible for the protection of investors’ interests and the enforcement of all relevant laws and regulations.

Other main functions of the SCA include licensing, followed by routine supervision of financial institutes that undertake activities such as brokerage, asset management, and investment advisory. The Authority watches over the financial soundness of organisations, market activities, and follow-through on legal and regulatory requirements.

Also, the SCA participates in drafting new legislations with a view to improving the investment climate in the country. This harmonization and unification of regulatory standards are supposed to be done with other international and regional regulatory bodies with the aim of integrating the UAE into the global economic system for its further status as an international financial hub.

The UAE Securities and Commodity Authority, the SCA, has classified virtual assets into two broad ranges. Both shall have different approaches to regulations and regulatory frameworks. In this respect:

- Virtual Assets for Investment Purposes: regulated by the SCA. This is that range of virtual assets that are used mainly for investment purposes or the growth of investment.

- Virtual assets used for payment: which is under the regulation of the UAE Central Bank, except when such assets have been approved only by the Central Bank for use in virtual asset investment platforms.

The following types of assets and activities are exempt from the SCA’s regulations:

- Digital securities and digital commodity derivatives: Those instruments fall under other regulatory authorities or other law frameworks.

- Service tokens and NFTs, which are not for use as investments.

- The act of developing, deploying or using software for the purposes of mining, creating or extracting virtual assets.

- Loyalty programmes: These would usually not be regarded as virtual assets when used for investment or payment.

- Investing or paying with virtual assets whose value is determined by the SCA: This may be specially categorized and regulated by the SCA.

In addition, the SCA also issued regulations to complement existing UAE legislation on virtual assets through Cabinet Resolution No. 111 of 2022, SCA Rulebook 13/RM of 2021, and SCA Decision No. 26 (Chairman) of 2023. These Regulations would be applicable to all VASPs in the UAE, except for operators in financial free zones like the DIFC and ADGM. The main purpose will be strengthening the legal framework for the protection of the interests of market participants and stimulating innovative development of the industry.

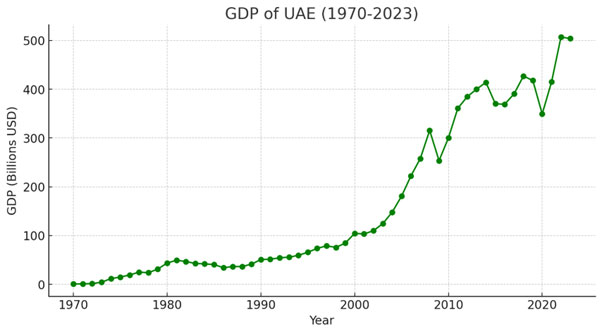

GDP of UAE

DUBAI REGULATION OF VIRTUAL ASSETS

DUBAI REGULATION OF VIRTUAL ASSETS

The regulatory regime for virtual assets is still in evolution as the government tries to establish Dubai as the leading regional and international centre for virtual assets and related services. Two years since its inception, VARA has really had remarkable success in raising awareness of Dubai’s advantages as a base in Virtual Asset Transactions, especially in Distributed Ledger and blockchain technologies.

The legal framework of Dubai has been generally supportive of innovation in virtual assets, mixing the overall friendly attitude towards new technologies with a strict touch of regulatory standards and, therefore, becoming one of the most attractive jurisdictions for VASPs when it comes to registration and further operation within this region. The fact that the DIFC has also adopted a Digital Assets Law certainly reinforces the ambition of Dubai to continuously improve and develop a legal framework that can keep pace with a rapidly changing world of digital assets.

The published VARA guidelines give an indication of those areas where VASPs must demonstrate continued regulatory compliance even after a license has been granted. These areas may concern operational efficiency, flexibility, transparency, professional conduct, and protection and preservation of the virtual assets that each business has. Furthermore, it pays attention to the protection of client rights, discipline in adherence to regulations, and access to services. The set of measures is applied towards sustaining the highest possible standards within the industry for the protection of market participants.

Custody of Virtual Assets in Dubai

Dubai emphasizes much on the security of the custody of the virtual assets, and this has been represented in the Regulatory Guidelines as well. The principles have been inculcating that high standards of due care should be followed in the valuation of the assets based on factors like current market conditions, volume, and the volatility of the asset. Also, the focus is on making the technologies and protocols applied transparent, the technology solutions used effectively, and an evaluation of the risks associated with the use of virtual assets.

The attempts at the regulation of the custody of virtual assets point to three general types of custody agreements:

- Custodial wallet: In this case, the licensed authority has total responsibility for the client assets and decision-making process related to custody and management of assets.

- Outsourced custodial wallet: In this case, the licensed authority will transfer all custody operations to external organizations, which would enable the usage of specific services with increased safety features of the assets.

- Non-custodial wallet: In this model, the client retains autonomous possession of their assets with the aid of all sorts of wallets, such as hardware, mobile, and desktop wallets. A form of custody like this would enable clients to self-manage access to their asset holdings themselves, integrate more personal responsibility, and, therefore, manage risks better.

Other long provisions of the guidelines address further aspects of virtual asset activities, such as those related to the obligations of brokers, dealers, financial advisers, and portfolio managers. This shall be the way to establish enabling and safe environments for all the participants of the virtual asset market, focusing on the responsibility and professionalism of managing and safe-keeping digital assets.

The Procedure for Getting a VASP License in Dubai

The obtaining process of the Virtual Asset Service Provider license is quite systematic in Dubai, and one needs to be cautious with the regulatory adherence. Herein, a more elaborative description of each stage of the process is presented: there is an Initial Approval phase, or in short, IA.

Application Form

The applicant is supposed to submit an application for initial disclosure to the DET or to the management of any of Dubai free zones save for DIFC. This involves submitting a business plan and information in regard to the beneficial ownership of the entity.

Supporting Documents

At the time of submitting the form, other documents may be required to supplement the form information when needed.

Initial Approval (IA)

The applicant shall pay the initial fees, usually 50% of the licence fee. The applicant will be granted initial approval known as IA, which will actually allow the firm to proceed to legal incorporation. Once the applicant has paid the fees and submitted the necessary documents, he or she is granted initial approval, which permits the firm to go ahead with legal incorporation and finalize the setup operational. At this stage, the firm is not yet authorized to begin virtual asset activities.

Step 2: VARA Licence

Pre-submission and preparation of documentation: once an IA has been granted, applicants will have to prepare and submit a host of further documentation to VARA. It would include policies and procedures in respect of corporate governance, risk management, technology solution, amongst others, that are so required by VARA.

Receipt of Feedback from VARA

VARA will look at the documents submitted and shall call for follow-up meetings, follow-up actions, and further documents.

Payment of Remaining Fees

The applicant pays the licence fees and the supervision fees for the first year.

VARA Licence

If an applicant meets all requirements and pays, in addition, all the prescribed fees and other charges, he is granted with VARA license under specified operating conditions, if necessary. This entails getting everything ready in detail and following the procedures set out by the regulators, allowing the acquisition of a licence to operate in the industry of virtual assets successfully.

RUE customer support team

RUE (Regulated United Europe) customer support team complies with high standards and requirements of the clients. Customer support is the most complex field of coverage within any business industry and operations, that is why depending on how the customer support completes their job, depends not only on the result of the back office, but of the whole project itself. Considering the feedback received from the high number of clients of RUE from all across the world, we constantly work on and improve the provided feedback and the customer support service on a daily basis.

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

Registration number:

14153440

Anno: 16.11.2016

Phone: +372 56 966 260

Email: [email protected]

Address: Laeva 2, Tallinn, 10111, Estonia

Registration number: 304377400

Anno: 30.08.2016

Phone: +370 6949 5456

Email: [email protected]

Address: Lvovo g. 25 – 702, 7th floor, Vilnius, 09320, Lithuania

Registration number:

08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00, Prague

Registration number: 38421992700000

Anno: 28.08.2019

Email: [email protected]

Address: Twarda 18, 15th floor, Warsaw, 00-824, Poland

Please leave your request

The RUE team understands the importance of continuous assessment and professional advice from experienced legal experts, as the success and final outcome of your project and business largely depend on informed legal strategy and timely decisions. Please complete the contact form on our website, and we guarantee that a qualified specialist will provide you with professional feedback and initial guidance within 24 hours.