Labuan crypto license 2025

Labuan, a small federal territorial area in Malaysia, is attracting the attention of digital asset entrepreneurs and investors due to its progressive regulation and favourable business climate. In particular, Labuan offers a unique opportunity for companies wishing to enter the world of cryptocurrency and blockchain technology through obtaining a Labuan Crypto License.

What is the Labuan Crypto License?

Labuan Crypto License is a licence issued to Labuan Financial Services Authority (LFSA) that allows companies to conduct various transactions with cryptocurrencies and digital assets. This can include exchanging cryptocurrency for fiat money, storing digital assets on behalf of clients, organising initial coin offerings (ICOs) and more.

Labuan Crypto License benefits for businesses

- Progressive Regulation: Labuan offers modern and progressive regulation for digital financial services, ensuring secure and transparent transactions.

- Global Platform: The licence gives you access to global markets and strengthens your company’s appeal to international investors and customers.

- Tax Advantages: Labuan offers generous tax incentives for companies operating in the digital financial services industry, making it an attractive place to do business.

- Supporting Innovation: Labuan Financial Services actively supports innovative projects and encourages the development of blockchain technology and cryptocurrencies in the region.

Steps to Obtaining a Labuan Crypto License

- Preparing a Business Plan: Develop a detailed business plan outlining the types of cryptocurrency transactions you plan to conduct, as well as your compliance strategy.

- Company Registration in Labuan: Register your company in Labuan and obtain the necessary licences and permits to start operating within the financial services industry.

- Applying for a Licence: Prepare and apply for a Labuan Crypto License through Labuan Financial Services, providing all required documents and information.

- Verification and Approval: Once the application is submitted, Labuan Financial Services will conduct a review of your company and application, and then make a decision on whether to issue a licence.

- Regulatory Compliance: Once licensed, be sure to comply with all regulatory requirements and safety standards set by Labuan Financial Services.

Labuan Crypto License is a key tool for companies wishing to enter the world of digital financial services. With it, you can gain access to global markets, build customer trust and maximise your business potential in the innovative field of cryptocurrencies and blockchain technologies

Labuan

Capital |

Population |

Currency |

GDP |

| Victoria | 95,120 | Malaysian ringgit (RM) (MYR) | $39,069 |

Crypto company registration in Labuan

Labuan, an international business and financial hub located in Malaysia, is attracting the attention of cryptocurrency startups and entrepreneurs looking to register their operations in a jurisdiction with a favourable tax regime, progressive regulation and strategic location in the Asia-Pacific region. In this article, we look at the key aspects of registering a cryptocurrency company in Labuan, highlighting its benefits, requirements and procedures necessary for a successful business launch.

Advantages of registering in Labuan

Tax benefits

Labuan offers competitive tax rates for cryptocurrency companies, including low corporate taxes and exemption from tax on foreign profits. This tax policy creates incentives for the growth and development of cryptocurrency projects.

Progressive regulation

Labuan’s regulatory environment is set up to support innovation in digital finance. Local authorities are actively developing and implementing a regulatory framework that facilitates cryptocurrency business while protecting the rights of investors and users.

Strategic location

Labuan is located in the heart of the Asia-Pacific region, providing convenient access to the fast-growing markets of Southeast Asia, China and India. This strategic advantage allows cryptocurrency companies to network internationally and expand their operations.

Registration requirements

Limited Liability Company

To register a cryptocurrency company in Labuan, it is necessary to form a company of limited liability (Labuan Company), which implies the presence of at least one shareholder (which can be an individual or a legal entity) and one director.

Local registered office

Companies are required to have a registered office in Labuan, which serves as the company’s registered office and a place to conduct official correspondence.

Licensing

Depending on the nature of a cryptocurrency company’s business, it may be required to obtain specialised licences, such as for digital asset transactions, trading or custodial services. The Labuan Financial Services Authority (LFSA) regulates the issuance of licences and sets requirements for the activities of financial technology companies, including cryptocurrencies.

Registration process

Cryptocurrency company registration in Labuan involves filing an application with the LFSA specifying the business model and plan of operations, proof of financial strength and compliance with AML/CFT requirements. The process also includes the preparation and filing of the company’s statutory documents, including the memorandum of association and articles of association.

Continuous compliance

Once incorporated, companies must maintain ongoing compliance with the LFSA’s regulatory requirements, including the filing of annual reports, financial statements and evidence of AML/CFT compliance. Companies are also required to inform the LFSA of any significant changes in business or management.

Benefits for crypto businesses

Registration in Labuan offers cryptocurrency companies a number of benefits, including:

- Tax optimisation: The ability to use a favourable tax regime to optimise tax liabilities.

- Building trust: Registration and licensing in a recognised jurisdiction builds confidence in the company among customers and investors.

- Market Expansion: Opportunity to access growing markets in Asia-Pacific and establish international partnerships.

Labuan is an attractive jurisdiction for cryptocurrency company incorporation due to its progressive regulatory environment, tax incentives and strategic location. Registration in Labuan can be the key to international growth and success for cryptocurrency startups and entrepreneurs seeking global opportunities and striving to innovate in the world of digital finance. However, potential applicants should consider the need for careful planning and preparation to meet all requirements and procedures set forth by Labuan Financial Services Authority.

Crypto legislation in Labuan

Labuan, strategically located in Malaysia, is actively building its image as one of the leading international centres for the cryptocurrency industry. With its progressive regulatory approach and liberal economic policies, Labuan is attracting the attention of the global crypto community. In this article, we will look at the key aspects of cryptocurrency legislation in Labuan, its impact on business and the main areas of focus for companies looking to develop their operations in this jurisdiction.

Basics of cryptocurrency regulation in Labuan

The Labuan Financial Services Authority (LFSA) is the key regulator responsible for the supervision and regulation of financial services, including cryptocurrency activities in the region. The LFSA has developed a comprehensive set of rules and regulations aimed at creating a safe and stable environment for investment and trading in digital assets.

Basic Regulatory Principles:

- Licensing: All cryptocurrency transactions in Labuan are subject to licensing by the LFSA. This includes cryptocurrency exchange activities, custodial services, ICOs and other digital asset transactions.

- AML/CFT Compliance: Companies are required to implement and comply with strict AML/CFT procedures that meet international standards.

- Investor protection: Legislation provides for measures to protect the rights and interests of investors, including transparency and disclosure requirements.

Impact of legislation on cryptocurrency business

Cryptocurrency legislation in Labuan provides a sustainable framework for business development, facilitating capital attraction and innovation. The LFSA’s licensing system and regulatory oversight increase confidence in the region as a safe and secure place to invest in cryptocurrencies.

Benefits to companies:

- Legal clarity: Clear regulation removes legal uncertainty, allowing companies to design their business models according to established rules.

- Global recognition: Registration and licensing in Labuan strengthens the company’s reputation internationally, opening access to new markets and opportunities to scale.

- Tax benefits: In addition to regulatory benefits, Labuan offers favourable tax conditions for cryptocurrency companies, making the jurisdiction even more attractive for businesses.

- Intellectual Property Protection: Labuan’s well-developed system of intellectual property rights protection facilitates innovation and development of new technologies in the cryptocurrency industry.

Implementation and challenges

Labuan faces a number of challenges in implementing cryptocurrency legislation, including the need to balance innovation and regulatory constraints, as well as ensuring compliance with international security and data protection standards. However, continually updating and adapting legislation to changing market conditions allows Labuan to remain at the forefront of cryptocurrency regulation.

The future of cryptocurrency legislation in Labuan

Given the rapid development of the cryptocurrency market and blockchain technology, Labuan continues to adapt and improve its legislation to support innovation while protecting the interests of all market participants. Possible areas of development include strengthening anti-money laundering measures, implementing standards for decentralised finance (DeFi) and incorporating the specificities of cryptocurrency assets into legislation.

Labuan’s cryptocurrency legislation creates a favourable environment for the development of the cryptocurrency industry by providing legal clarity, protecting investors and encouraging innovation. The advantages of registering and doing business in Labuan make this jurisdiction one of the most attractive for cryptocurrency companies in the international arena. The continuous improvement of the regulatory environment favours further growth and sustainable development of the cryptocurrency sector in Labuan.

Crypto exchange license Labuan

Labuan, Malaysia’s recognised international financial centre, is attracting increasing attention from the global cryptocurrency community due to its progressive approach to regulating financial technology, including cryptocurrency exchanges. Obtaining a cryptocurrency exchange licence in Labuan opens up significant opportunities for companies to grow and develop on the international stage. In this article, we will look at the key aspects of obtaining such a licence, its importance for businesses and the steps required to successfully navigate the regulatory process.

Labuan’s regulatory environment

The Labuan Financial Services Authority (LFSA) is responsible for the regulation and supervision of financial institutions in the jurisdiction, including cryptocurrency exchanges. The LFSA has developed a comprehensive regulatory framework aimed at creating a safe and transparent environment for trading digital assets, while fostering innovation and development in the cryptocurrency sector.

Benefits of a cryptocurrency exchange licence in Labuan:

- Legal clarity and stability: Clear regulation provides legal certainty for cryptocurrency transactions.

- International recognition: The licence from the LFSA strengthens the reputation of the cryptocurrency exchange and helps to attract users and investors on a global level.

- Tax benefits: Labuan’s attractive tax regime provides additional benefits for licensed cryptocurrency exchanges.

Requirements for obtaining a licence

Company registration in Labuan

Firstly, you need to register your company in Labuan, meeting all local corporate requirements and submitting a complete set of documents to the LFSA.

Proof of compliance

The company must demonstrate full compliance with international and local anti-money laundering (AML) and counter-terrorist financing (CFT) regulations, and provide a detailed business plan outlining the exchange’s operating model, security measures and user data protection.

Technological and operational standards

It is necessary to confirm the existence of a robust technological infrastructure capable of securing transactions and storing digital assets, and to demonstrate effective operational processes, including risk management systems and internal control procedures.

Qualified personnel

The company must ensure that it has qualified personnel with relevant knowledge and experience in financial technology, cryptocurrencies and regulatory compliance.

Process for obtaining a licence

Obtaining a cryptocurrency exchange licence in Labuan requires careful preparation and interaction with the LFSA. The process includes the following steps:

- Pre-consultation with the LFSA: It is recommended that pre-consultation with the regulator is undertaken to discuss the business model and licensing requirements.

- Submission of the application and required documents: The applicant provides a set of documents including a business plan, evidence of AML/CFT compliance, technology infrastructure information and team qualification data.

- Assessment of the LFSA application: The Regulator will carry out a thorough assessment of the material provided, may request further information or make suggestions for improvement.

- Issuing a licence: Upon successful completion of the assessment and confirmation of compliance with all requirements, the LFSA will issue a licence to operate a cryptocurrency exchange.

The Importance of Regulatory Compliance

Compliance with regulatory requirements plays a critical role in the successful launch and further operation of a cryptocurrency exchange. This not only ensures the legality of operations, but also builds trust among users and investors, which is a key factor in the growth and development of an exchange in a competitive market.

A cryptocurrency exchange licence in Labuan provides unique opportunities for businesses seeking to establish a meaningful place in the global cryptocurrency industry. With its progressive regulation, tax incentives and strategic location, Labuan acts as an attractive jurisdiction for cryptocurrency companies. However, success in obtaining a licence and developing operations is directly dependent on a thorough understanding of the regulatory requirements, as well as the company’s ability to ensure a high level of security, transparency and compliance with international standards.

Crypto trading license Labuan

Labuan, an international offshore financial centre in Malaysia, is actively shaping the environment for the cryptocurrency industry by offering a cryptocurrency trading licence. This licence opens the door for companies to access the global market for digital assets, while ensuring compliance with high regulatory and security standards. In this article, we look at the key aspects of the Labuan cryptocurrency trading licence, its impact on businesses and the steps required to obtain it.

Specifics of cryptocurrency regulation in Labuan

The Labuan Financial Services Authority (LFSA) is the primary regulator responsible for licensing and supervising the financial services industry, including cryptocurrencies. The LFSA has implemented a number of regulatory measures to support innovation while ensuring transparency, safety and investor protection.

Benefits of a cryptocurrency trading licence:

- Regulatory support: Obtaining a licence ensures legal protection and support from the LFSA, contributing to a favourable regulatory environment.

- International recognition: The licence builds trust with users and partners around the world, opening up new opportunities for international cooperation and capital raising.

- Tax incentives: Labuan offers favourable tax conditions for cryptocurrency companies, including low corporate taxes and exemption from tax on foreign profits.

Requirements for obtaining a licence

Company registration and structure

To begin with, it is necessary to establish a company in Labuan with an appropriate corporate structure and appoint a qualified management capable of ensuring the proper conduct of business.

Confirmation of conformity

The company must demonstrate its compliance with LFSA regulatory requirements, including anti-money laundering (AML) and counter-terrorist financing (CFT) regulations, and provide a detailed business plan outlining its operating model, risks and strategies to minimise them.

Technological infrastructure

Must provide evidence of a robust technology infrastructure and security systems in place to protect customer data and ensure secure transactions. Includes the use of advanced encryption, authentication and security protocols.

Team qualification

The company should have a team of professionals with proven expertise in cryptocurrencies, financial technology and regulatory compliance. This includes having lawyers, financial analysts and IT specialists on the team.

Procedure for obtaining a licence

Obtaining a cryptocurrency trading licence in Labuan requires the following steps:

- Document preparation and filing: Includes a set of company documents, business plan, evidence of AML/CFT compliance, information on technology infrastructure and team qualifications.

- LFSA review of the application: Once submitted, the LFSA carries out a detailed analysis of the information provided, assessing the company’s eligibility.

- Issuing a licence: If the LFSA successfully passes an inspection and confirms that all criteria are met, it will issue a licence to trade cryptocurrencies.

Importance of compliance with regulatory requirements

Compliance with regulatory requirements and security standards is a key aspect of a successful cryptocurrency exchange in Labuan. This not only ensures the legality of operations, but also increases trust from users and partners, contributing to sustainable growth and business development.

A cryptocurrency trading licence in Labuan provides unique opportunities for companies seeking to operate internationally in the digital asset space. Progressive regulation, tax incentives and support for innovation make Labuan an attractive jurisdiction for cryptocurrency exchanges. However, success in obtaining a licence and growing a business requires careful preparation, a thorough understanding of regulatory requirements and continued adherence to high standards of security and transparency of operations.

How to get a crypto license in Labuan?

Labuan, an international financial centre in Malaysia, has become an important hub for the global cryptocurrency industry, offering a favourable environment for companies dealing with digital assets. Obtaining a cryptocurrency licence in Labuan offers great opportunities for business development in a transparent regulatory environment. In this article, we present a step-by-step guide to obtaining a crypto license in Labuan based on the requirements of the Labuan Financial Services Authority (LFSA).

Step 1: Understanding the requirements of the LFSA

The first step is to look in detail at the LFSA’s requirements for cryptocurrency companies. This includes anti-money laundering (AML), counter-terrorist financing (CFT) regulations, risk management requirements, and technology security and data protection standards. Consultation with legal and financial experts specialising in cryptocurrency regulation is recommended.

Step 2: Registering a company in Labuan

To apply for a licence, your company must be registered in Labuan. The incorporation process involves choosing a corporate structure (e.g. limited liability company), preparing and filing articles of incorporation, and appointing directors and shareholders. It is important that the company structure meets the regulatory and operational requirements for conducting cryptocurrency activities.

Step 3: Preparing a business plan

The business plan should detail your business model, including the types of services offered, target market, risk management strategies, AML/CFT compliance measures, and technology and operational security plans. The business plan will be an important document when assessing your licence application.

Step 4: Proof of compliance with AML/CFT requirements

The company should provide evidence of the development and implementation of effective AML/CFT systems and procedures. This includes the existence of internal rules, the appointment of an AML/CFT compliance officer, and systems for customer identification and verification.

Step 5: Technology readiness and infrastructure

You must demonstrate that your infrastructure meets the high security standards required to protect customer data and secure transactions. This includes the use of strong crypto solutions, two-factor authentication systems, and data integrity and redundancy measures.

Step 6: Applying for a licence

Once all required documents have been prepared and LFSA compliance has been confirmed, the company can apply for a cryptocurrency licence. The application is submitted together with a full package of documents, including a business plan, proof of compliance with AML/CFT requirements, a description of the technological infrastructure, as well as information about the team and key persons.

Step 7: Assessing the LFSA application and obtaining a licence

Once an application has been submitted, the LFSA carries out a detailed analysis of the information provided to assess the company’s compliance with regulatory requirements. This process may include requests for additional information or clarifications. If the assessment is successful, the company is granted a cryptocurrency licence, allowing it to officially begin operating in Labuan’s jurisdiction.

Step 8: Continuous regulatory compliance

Obtaining a licence does not mean the end of the company’s obligations to the regulator. The company needs to continue to comply with all regulatory requirements, including filing regular LFSA reports, maintaining compliance with AML/CFT standards, and updating the regulator on any significant changes to the company’s operations or structure.

Obtaining a cryptocurrency licence in Labuan requires careful preparation and a thorough understanding of regulatory requirements. The licensing process underscores the company’s commitment to high standards of security, transparency and accountability to its customers. Successfully obtaining a licence opens the company’s doors to the international digital asset market, providing strategic opportunities for growth and development in the global cryptocurrency ecosystem.

Advantages of Labuan crypto license

Labuan, an international financial centre in Malaysia, has established itself as one of the leading jurisdictions for the cryptocurrency industry due to its progressive regulation and favourable tax climate. A cryptocurrency licence in Labuan provides a number of significant benefits for businesses looking to make the most of the digital economy. This article looks at the key aspects that make a licence in Labuan advantageous for cryptocurrency companies.

Tax benefits

One of the main advantages of Labuan is its favourable tax regime. Cryptocurrency companies licensed in Labuan can benefit from a low corporate tax rate as well as tax exemption on income earned from outside Malaysia. This creates an incentive for international business and investment in digital assets.

Regulatory support

The Labuan Financial Services Commission (LFSA) offers clear and balanced regulation of cryptocurrency activities, which provides legal protection for both companies and their customers. A transparent regulatory framework promotes a trusted environment for cryptocurrency transactions.

Access to international markets

A licence in Labuan gives companies access to a wide range of international markets due to the high level of trust and recognition enjoyed by this financial centre. This provides unique opportunities to expand business and attract investment from around the world.

Promoting innovation

The LFSA actively encourages innovation in financial technology and cryptocurrencies by offering a flexible regulatory environment for testing and introducing new products and services. Companies have the opportunity to develop and test innovative solutions in a supportive environment.

Simplicity and transparency of procedures

The process of obtaining a cryptocurrency licence in Labuan is transparent and relatively simple, reducing the administrative burden on companies. The LFSA provides clear guidance and support at all stages of the application and licence process, which helps to make the regulatory process faster and more efficient.

Building reputation and credibility

Obtaining a cryptocurrency licence in Labuan is perceived by the market as a sign of quality and reliability. It enhances the company’s reputation among customers, partners and investors by emphasising its commitment to high standards of security, transparency and regulatory compliance.

Advantages for international expansion

Labuan-licensed companies gain a significant advantage when entering new markets due to the recognition and credibility of the jurisdiction. This makes it easier to establish partnerships, raise capital and expand geographically.

Flexibility and adaptability of regulation

The LFSA demonstrates a flexible approach to regulating cryptocurrency activities, adapting quickly to industry changes and technological innovations. This creates conditions for long-term growth and development of the cryptocurrency business, allowing companies to remain at the forefront of technological progress.

Operational efficiency

Labuan offers cryptocurrency companies not only regulatory but also operational advantages, including an advanced business infrastructure, skilled labour and access to a wide range of professional services. This helps to optimise operational processes and reduce costs.

A cryptocurrency licence in Labuan is a valuable asset for any company seeking to take a leading position in the global digital asset market. The advantages offered by this jurisdiction, including tax benefits, regulatory support, access to international markets and operational efficiency, create a favourable environment for business growth and development. A key success factor is thorough preparation and strict compliance with regulatory requirements, which ultimately contributes to the company’s credibility and reputation in the eyes of the global cryptocurrency community.

Benefits of crypto license in Labuan

In recent years, Labuan, an offshore financial centre in Malaysia, has attracted increasing attention from cryptocurrency companies due to its progressive regulatory policies and favourable business climate. Obtaining a cryptocurrency licence in Labuan opens up a number of significant advantages for businesses, facilitating their growth and development on the international stage. In this article, we will look at the main benefits of a cryptocurrency licence in Labuan, using business language.

Favourable tax treatment

One of the key benefits of obtaining a cryptocurrency licence in Labuan is access to a favourable tax regime. Companies engaged in cryptocurrency activities in Labuan can take advantage of a low corporate tax rate and exemption from taxes on foreign income. This creates significant incentives for business development and investment attraction.

Legal defence and regulatory support

The Labuan Financial Services Commission (LFSA) provides a clear and balanced regulatory framework for cryptocurrency activities, protecting the interests of both companies and their customers. Obtaining a licence confirms a company’s compliance with international standards for transparency, security and anti-money laundering. This helps to build trust among partners and investors.

Access to international markets

Licensing in Labuan gives companies access to the broad international market for digital assets. The prestige of the jurisdiction and the high level of trust in licensed companies makes it easier to attract new clients and expand geographically.

Promoting innovation

The LFSA encourages innovation in cryptocurrencies and blockchain by offering flexible regulation to test and introduce new products and services. This creates a favourable environment for the development and implementation of innovative ideas and technologies.

Simplicity and transparency of licensing

The process of obtaining a cryptocurrency licence in Labuan is transparent and relatively simple, which greatly simplifies the administrative burden on companies. The LFSA provides clear guidance and support at all stages of the application and licensing process, which makes the licensing process quick and efficient. This accessibility and openness of the regulator makes Labuan an attractive choice for cryptocurrency startups and established companies seeking to legalise their operations.

Reputation building

Official licensing in Labuan not only improves a company’s perception among potential clients and partners, but also raises its status in the cryptocurrency industry. The LFSA licence serves as a sign of quality and reliability, confirming that the company operates in accordance with international standards and regulatory requirements.

Supporting growth and development

Obtaining a cryptocurrency licence in Labuan opens up new opportunities for business growth and scaling. Companies can enjoy all the benefits of an international financial centre, including access to skilled professionals, developed infrastructure and a global network of business contacts. This helps to increase the volume of transactions, expand the client base and strengthen competitiveness in the global market.

Obtaining a cryptocurrency licence in Labuan offers companies a number of strategic advantages, including tax benefits, regulatory support, access to international markets and reputation building. The transparent and relatively simple licensing process, as well as support for innovation and growth, make Labuan one of the most attractive jurisdictions for cryptocurrency companies. In an era where the cryptocurrency market continues to evolve and expand, licensing in Labuan represents a valuable step towards success and sustainability in the world of digital assets.

Overview of crypto regulation in Labuan

Labuan, Malaysia’s international offshore financial centre, has attracted the attention of the global cryptocurrency community due to its progressive approach to the regulation of digital assets. Labuan’s regulatory environment creates a favourable environment for the development and integration of cryptocurrency activities into the global financial system. In this article, let’s look at the key aspects of cryptocurrency regulation in Labuan and highlighted strategic business opportunities.

Regulatory authorities and licensing

The main regulator responsible for the supervision and regulation of financial services in Labuan, including cryptocurrency activities, is the Labuan Financial Services Authority (LFSA). The LFSA develops and implements the legal and regulatory framework governing cryptocurrency transactions, which ensures transparency, security and protection of the interests of market participants.

Licensing of activities

To operate a cryptocurrency business in Labuan, it is required to obtain the appropriate licence from the LFSA. The licensing process involves submitting a detailed business plan, proof of compliance with AML/CFT standards, information about the technology infrastructure and the qualifications of the team. Licences are issued for various activities including cryptocurrency exchanges, custodial services and ICO operations.

Tax regulation

Labuan offers an attractive tax regime for cryptocurrency companies, including low corporate taxes and exemption from tax on foreign-derived income. This tax policy favours attracting international investment and supporting innovative projects in digital assets.

Data protection and security

The LFSA is focused on ensuring high standards of security and data protection in the cryptocurrency industry. Regulatory requirements include the use of strong crypto methods, user identification and authentication systems, and measures to prevent data breaches and cyberattacks.

International co-operation

Labuan actively co-operates with international regulators and participates in global initiatives to regulate the cryptocurrency industry, which helps to create common standards and build international confidence in the jurisdiction. This cooperation includes information sharing, joint development of regulatory approaches and participation in international anti-money laundering and counter-terrorist financing programmes. This policy not only strengthens Labuan’s position as a reliable financial centre, but also provides companies operating in the jurisdiction with additional guarantees of stability and security.

Transparency and compliance with standards

The LFSA prioritises transparency and compliance with international standards in cryptocurrency activities. The regulator requires licensed companies to fully disclose information about their activities, including sources of funding, ownership structure and operational processes. This ensures a high level of investor and user confidence and promotes a healthy and competitive market environment.

Adaptation to new technologies

Labuan’s regulatory environment is characterised by a high degree of adaptability to new technologies and trends in the cryptocurrency industry. The LFSA is constantly updating and supplementing its regulatory framework to meet current challenges and support the innovative development of the industry. This creates conditions for the successful launch and development of cryptocurrency projects based on blockchain, decentralised finance (DeFi) and other advanced technologies.

Regulation of cryptocurrency activities in Labuan is a comprehensive and balanced approach that provides a favourable environment for the development of businesses in the field of digital assets. With a favourable tax regime, transparent regulatory policy, high standards of security and data protection, and active international cooperation, Labuan has established itself as one of the world’s leading jurisdictions for cryptocurrency companies. Obtaining a cryptocurrency licence in Labuan gives companies access to global markets and provides strategic opportunities for growth and scaling in the dynamic digital asset industry.

Labuan crypto license requirements

Labuan, recognised for its favourable business climate and progressive approach to regulating financial innovation, offers unique opportunities for cryptocurrency companies. The Labuan Financial Services Authority (LFSA) sets clear requirements for obtaining a cryptocurrency licence, ensuring high standards of transparency, security and reliability. In this article, let’s look at the key requirements and procedures for obtaining a crypto license in Labuan, using business language.

LFSA basic requirements

Legal structure and registration

To begin the licensing process, a company must be registered in Labuan. Labuan offers different legal structures such as limited liability company (LLC), public or private company. The choice of structure depends on the business model and planned activities of the company.

Detailed business plan

The LFSA requires the submission of a detailed business plan, including a description of the business model, revenue and cost projections, marketing strategy, information on key project participants, and a detailed risk analysis and mitigation measures.

Compliance with AML/CFT requirements

The company must demonstrate strict compliance with international and local anti-money laundering (AML) and counter-terrorist financing (CFT) standards. This includes having internal policies and procedures in place, designating a person responsible for AML/CFT compliance, and a system for customer identification and verification.

Technological infrastructure

A reliable and secure technological infrastructure for cryptocurrency transactions should be in place. This includes data storage and transmission systems, protection against unauthorised access, and measures to ensure data integrity and availability.

Qualifications and experience of the team

The LFSA assesses the qualifications and experience of the company’s management team and key individuals. Candidates are expected to have relevant education, professional experience in financial technology and knowledge of the specifics of working with cryptocurrencies.

Procedure for obtaining a licence

- Preliminary discussion with the LFSA: It is recommended that consultation with the regulator is undertaken to discuss details of the business plan and clarify licensing requirements.

- Application submission: After preparing all necessary documents, including the business plan and evidence of compliance with AML/CFT requirements, the company submits a formal licence application to the LFSA.

- Assessment of the application: the LFSA will carry out a detailed assessment of the submitted material, requesting further information or clarification where necessary.

- Verification and Audit: In some cases, an audit or third-party verification may be required to confirm compliance.

- Issuing a licence: After successfully completing all the steps and the application has been approved, the LFSA will issue a cryptocurrency licence.

Continuous compliance with regulatory requirements

Obtaining a licence is the beginning of a long-term regulatory compliance process. The company needs to report regularly on its activities, maintain high AML/CFT standards and undergo periodic inspections by the LFSA to confirm regulatory compliance.

A cryptocurrency licence in Labuan provides companies with a unique opportunity to operate in a regulated and protected environment, promoting sustainable development and business expansion internationally. The LFSA’s strict but fair licensing requirements underscore Labuan’s commitment to ensuring the cryptocurrency industry is safe, transparent and innovative. Thorough training and professional interaction with the regulator are key success factors in obtaining and maintaining a crypto license in this progressive jurisdiction.

How to get a crypto license in Labuan?

Labuan, recognised for its progressive regulatory policies in the financial services industry, presents significant opportunities for cryptocurrency companies. Obtaining a cryptocurrency licence in Labuan requires careful preparation and strategic planning. In this article, we offer a comprehensive guide outlining the key steps to obtaining a crypto license, using business language to understand and comply with Labuan Financial Services Authority (LFSA) requirements.

Step 1: Analysing LFSA requirements

The first and most important step is a detailed study and analysis of the LFSA requirements for obtaining a cryptocurrency licence. It is important to understand the eligibility criteria, key regulatory principles and mandatory conditions for applicants. This will help determine your business’ eligibility and identify possible barriers to licensing.

Step 2: Registering a company in Labuan

In order to apply for a crypto license, it is necessary to have a registered company in the Labuan jurisdiction. Registration involves selecting a suitable corporate structure, preparing incorporation documents and fulfilling all formal requirements set out by the LFSA.

Step 3: Develop a business plan

A detailed business plan is a prerequisite for obtaining a licence. The business plan should reflect the goals and strategies of your crypto business, including market analysis, marketing strategy, description of the operating model, security measures and AML/CFT compliance.

Step 4: Confirm compliance with AML/CFT requirements

Companies applying for a cryptocurrency licence must demonstrate strict compliance with anti-money laundering and counter-terrorist financing policies and procedures. This includes having effective customer identification, transaction monitoring and internal control systems in place.

Step 5: Technology readiness

Your infrastructure must meet the high standards of security and reliability set by the LFSA. A detailed description of the technology platform, encryption methods used, storage and data protection systems must be provided.

Step 6: Submission of the application and accompanying documents

Once you have prepared all the necessary documents and ensured that your business meets the LFSA requirements, the next step is to apply for a licence. The application should include a complete package of documents such as a business plan, evidence of AML/CFT compliance, a description of the technology platform, and CVs and certificates of qualification of key individuals in the company.

Step 7: LFSA assessment procedure

Once an application is submitted, the LFSA will evaluate the submitted materials to verify eligibility. This process may include additional requests for information, an audit of your business, interviews with key individuals and a review of your technology infrastructure. It is important to maintain open and constructive communication with the regulator throughout the assessment process.

Step 8: Obtaining a licence

Upon successful completion of the assessment procedure and confirmation of compliance with all requirements, the LFSA will issue a cryptocurrency licence. Obtaining a licence is a confirmation of the legality and reliability of your crypto-business, which opens up new opportunities for the development and scaling of activities.

Step 9: Continuous regulatory compliance

Obtaining a licence does not mean the end of a company’s obligations to the regulator. Licensed companies are required to submit regular reports on their activities, maintain high AML/CFT standards, and undergo periodic inspections by the LFSA to confirm compliance with regulatory requirements.

Obtaining a cryptocurrency licence in Labuan requires careful planning, thorough preparation and strict adherence to regulatory requirements. However, the effort involved in the licensing process pays off with access to an attractive regulatory, tax and business environment that is conducive to the development and growth of your cryptocurrency business. Strategic planning and a professional approach to the licensing process will be key to the successful launch and further development of your digital asset business on the international stage.

Table with tax rates in Labuan

| Type of tax/levy | Bid | Commentary |

| Corporate tax | 3% | Applies to multinational companies and companies doing business in Labuan |

| VAT rate | 0% | VAT is not applicable |

| Personal income tax | 0% | Income tax is not levied on residents and non-residents |

| Capital gains tax | 0% | Applies to capital investments and capital gains |

| Real estate transfer tax | 0% | There is no real estate transfer tax |

Please note that the tax system in Labuan is subject to change and it is advisable to consult official sources for up-to-date tax information.

Types of crypto licenses in Labuan

In recent years, Labuan has established itself as one of the key international hubs for cryptocurrency activity, offering companies a variety of licences that open up a wide range of opportunities in digital assets. The Labuan Financial Services Authority (LFSA) regulates the issuance of these licences, ensuring that they meet high international standards of security, transparency and reliability. In this article, we will look at the main types of cryptocurrency licences in Labuan and their key features.

Cryptocurrency Exchange Licence

This type of licence allows companies to organise and conduct cryptocurrency trading operations, including the exchange of one cryptocurrency for another, as well as cryptocurrency for fiat money. Licence holders must ensure that their activities comply with LFSA requirements, including AML/CFT, and demonstrate that they have a robust technology platform to conduct secure transactions.

Licence for Custodial Services

This licence is for companies that provide custody and management services for cryptocurrencies on behalf of clients. Custodial services include ensuring the security of cryptocurrency assets, including the use of cold wallets and other security methods. Licence holders must ensure a high level of custody security and compliance with regulatory standards.

Licence for ICO (Coin Offering)

Companies wishing to conduct an Initial Coin Offering (ICO) in Labuan must obtain the appropriate licence. This requires the submission of a detailed project description, including a business model, a plan for the use of the funds raised, information about the team and investor protection measures. The ICO licence allows companies to raise funding through the issuance and sale of digital tokens.

Licence for Operations with Fiat and Cryptocurrency Assets

This type of licence is intended for companies engaged in transfer and exchange transactions between fiat and cryptocurrency assets. Such transactions require strict compliance with regulatory requirements, including transaction monitoring and customer identification.

The diversity of cryptocurrency licences in Labuan reflects the jurisdiction’s commitment to creating a favourable environment for the development of all aspects of the cryptocurrency market. From trading platforms to custodial services and ICOs, Labuan offers a comprehensive approach to licensing, underlining its role as an attractive and reliable centre for cryptocurrency transactions.

Benefits of licensing in Labuan

Labuan licensing not only provides legal clarity and regulatory support for cryptocurrency companies, but also offers additional benefits such as:

- Tax incentives: Low tax rates and opportunities to optimise the tax burden.

- International recognition: The LFSA licence enhances the company’s reputation internationally, helping to attract clients and investors.

- Transparency and security: High standards in security and regulatory compliance enhance confidence in the company’s operations.

Steps to a successful licence

In order to successfully obtain a licence, companies are advised to:

- Carefully review the LFSA requirements for each licence type and ensure full compliance with them.

- Develop a detailed business plan that clearly describes the business model, market strategies, technology infrastructure and security measures.

- Prepare comprehensive documentation to demonstrate compliance with AML/CFT requirements and provide evidence of qualifications and experience of key team members.

- Engage in an open dialogue with the LFSA during the application process and review of your case to respond to any requests or comments from the regulator in a timely manner.

Labuan offers cryptocurrency companies a unique opportunity to grow their business in a stable, secure and innovation-supporting environment. Understanding and strictly adhering to licensing requirements is key to successfully operating in this progressive jurisdiction. Obtaining a cryptocurrency licence in Labuan opens new horizons for growth and international expansion, while ensuring a high level of trust from customers and partners.

Steps to start a crypto business in Labuan

Labuan, known for its favourable business environment and progressive financial services regulation, offers unique opportunities for startups and cryptocurrency companies. This guide provides a step-by-step plan for entrepreneurs looking to launch a cryptocurrency business in Labuan, focusing on the key aspects and requirements for a successful launch.

Step 1: Market research and business model development

Before starting any business, it is essential to conduct thorough market research to determine the needs of your target audience and analyse your competitors. Developing a clear and implementable business model that addresses these needs and sets your project apart from others is key to success. It is also important to determine what cryptocurrency services you will offer, whether it is trading, exchanges, custodial services or ICOs.

Step 2: Determining the legal structure and company registration

Choosing the right legal structure affects your company’s taxation, liability and managerial flexibility. In Labuan, you can choose between different forms of business organisation, including private or public company, partnership and others. Once you have chosen a structure, you should proceed to register your company with the Labuan Financial Services Commission (Labuan FSA), following all regulatory requirements.

Step 3: Develop a business plan

Preparing a detailed business plan is a requirement for obtaining a cryptocurrency license in Labuan. The business plan should include a description of your business model, market analysis, marketing and operational strategies, financial projections, and an AML/CFT compliance plan.

Step 4: Obtaining a cryptocurrency license

To operate a cryptocurrency business in Labuan, you must obtain the appropriate license from the Labuan FSA. The process of obtaining a licence involves submitting an application with all required documents, including a business plan, proof of financial strength and risk management strategies. It is important to pay special attention to security requirements and AML/CFT protocols.

Step 5: Establishment of technological infrastructure

The foundation of a successful cryptocurrency company is a robust technology infrastructure. This includes developing or selecting a suitable trading platform, security systems to protect assets and customer data, and solutions to ensure operational efficiency. It is important to invest in advanced encryption, authentication and cold storage technologies to ensure your services are safe and secure.

Step 6: Implement compliance and risk management policies

To comply with regulatory requirements and protect your business from financial risks, you need to develop and implement effective risk management systems and compliance policies. This includes establishing internal anti-money laundering (AML) policies, customer identification and verification (KYC) procedures, and monitoring and managing operational and market risks.

Step 7: Launching operational activities

After obtaining a license and completing all preparatory stages, it is possible to start operational activities. This includes activating the trading platform, starting to provide cryptocurrency services to customers and implementing a marketing strategy to attract users. It is also important to establish processes to continuously monitor transactions and ensure a high level of customer service.

Step 8: Continuous regulatory compliance

Running a cryptocurrency business requires constant monitoring and adaptation to changes in the regulatory environment. It is necessary to regularly update internal policies and procedures, ensure compliance with new regulatory requirements and maintain an open dialogue with the regulator. It is also important to conduct regular internal and external audits to verify the effectiveness of risk management and compliance systems.

Launching a cryptocurrency business in Labuan represents a promising opportunity for entrepreneurs and companies looking to innovate in the digital asset space. Careful planning, strict regulatory compliance and investment in security and technology are key to successfully launching and growing a business in this dynamic industry.

Procedures for obtaining crypto license in Labuan

Labuan, an offshore financial centre in Malaysia, has established itself as an attractive location for cryptocurrency companies due to its favourable tax climate and progressive regulatory approach. Obtaining a cryptocurrency licence in Labuan is a strategic move for companies looking to legalise their operations and expand their business internationally. This article provides a detailed guide to the procedures for obtaining a crypto license in Labuan, highlighting the key steps and requirements.

Step 1: Preliminary preparation

Analysing LFSA requirements

Before beginning the process, it is important to thoroughly research and analyse the regulatory requirements of the Labuan Financial Services Authority (LFSA) that apply to cryptocurrency activities. This includes understanding all aspects of licensing, including business model requirements, AML/CFT policies, technology infrastructure and team qualifications.

Business plan development

Creating a detailed business plan is a critical step that should reflect the strategic goals of your crypto business, outline your operating model, financial projections, and regulatory compliance plans.

Step 2: Registering a company in Labuan

To apply for a crypto license, your business must be officially registered in Labuan. Selecting a suitable corporate structure and successfully completing the registration process are prerequisites for further licensing.

Step 3: Compliance with AML/CFT requirements

A company should develop and implement comprehensive systems and procedures to combat money laundering and terrorist financing. This includes conducting customer due diligence, monitoring transactions and maintaining appropriate records.

Step 4: Applying for a license

Once all prerequisites have been met, the next step is to submit a licence application to the LFSA. The application should include all required documents such as a business plan, company registration documents, evidence of compliance with AML/CFT policies, a description of the technology infrastructure and information about the team. It is important to ensure that the application fully and accurately reflects your company’s operations and meets all regulatory requirements.

Step 5: Reviewing the LFSA application

Once an application has been submitted, the LFSA’s review process begins. During this period, the regulator may request additional information or clarification on the submitted materials. The review of the application includes assessing the information provided, checking eligibility and, in some cases, interviewing key members of the team. This stage requires patience and a willingness to respond quickly to any LFSA requests.

Step 6: Obtaining a licence

Upon successful completion of the review process and provided all requirements are met, the LFSA will issue a cryptocurrency licence. Obtaining a licence is key to officially authorising the commencement of cryptocurrency operations in Labuan’s jurisdiction. It is important to keep copies of all documents and licence for future proof of status.

Step 7: Continuous compliance with regulatory requirements

Obtaining a licence does not mean the end of your obligations to the regulator. The company needs to comply with regulatory requirements on an ongoing basis, including filing regular reports with the LFSA, keeping AML/CFT systems and procedures up to date and conducting regular internal reviews to ensure compliance. It is also important to monitor and adapt to changes in the regulatory environment to ensure continued compliance.

The process of obtaining a cryptocurrency licence in Labuan requires careful preparation and strict adherence to regulatory requirements. However, successfully completing the process offers significant opportunities for business growth and development in a favourable and supportive environment for innovation. By following this step-by-step guide, businesses can maximise their chances of successfully obtaining a licence and realising their international cryptocurrency potential.

How to get a crypto trading licence in Labuan

Labuan, an international financial centre in Malaysia, attracts cryptocurrency entrepreneurs with its favourable regulatory environment and tax incentives. Obtaining a cryptocurrency trading licence in Labuan is a strategic step for companies looking to expand their presence in the international digital asset market. In this article, we provide a detailed guide on how to obtain a cryptocurrency trading licence in Labuan using business language.

Step 1: Understanding Regulatory Requirements

The first step is to thoroughly review the regulatory requirements of the Labuan Financial Services Authority (LFSA) that apply to cryptocurrency activities. It is important to understand the obligations and conditions associated with obtaining a licence, including requirements for business model, AML/CFT policies, technology infrastructure and management staff.

Step 2: Company Registration in Labuan

To apply for a licence, your company must be registered in Labuan. The selection of a suitable corporate structure and the successful completion of registration are prerequisites for further licensing. During the incorporation process, attention should be given to determining the registered office, appointment of directors and shareholders.

Step 3: Preparing a Business Plan

Creating a detailed business plan is a requirement for obtaining a crypto license. The business plan should include a description of your business model, target market, marketing strategy, risk analysis, and a detailed plan for complying with AML/CFT policies and ensuring data and transaction security.

Step 4: Demonstrate Compliance with AML/CFT Requirements

The company must demonstrate its compliance with international and local AML/CFT standards. This includes developing internal policies, procedures and control systems to identify, monitor and report suspicious transactions.

Step 5: Technology Readiness

You must ensure that your technology platform and infrastructure meets the high security standards set by the LFSA. It is important to provide a detailed description of the cryptocurrency storage system, data encryption mechanisms, and security protocols used to protect against unauthorised access and cyber-attacks. Additionally, it should be demonstrated that robust solutions are in place to ensure business continuity and data recovery in the event of failures or attacks.

Step 6: Applying for a Licence

After preparing all the necessary documents and confirming that you are ready to meet the regulatory requirements, the next step is to submit a licence application to the LFSA. The application should include a complete package of documents, a business plan, proof of compliance with AML/CFT policies, a description of the technology platform and security systems, and information about the management team.

Step 7: LFSA Assessment and Approval

Once an application is submitted, the LFSA will conduct an assessment of the application, which may include requesting additional information, interviewing key individuals within the company and auditing the technology infrastructure. It is important to remain open to communication with the LFSA and to promptly provide all necessary data and documents to successfully complete the assessment process.

Step 8: Obtain a Licence and Start Operations

Upon successful completion of the assessment process and approval of the application, the LFSA will issue a cryptocurrency trading licence. With the licence in place, the company can officially start its operations in Labuan, launch its trading platform and offer its services to customers.

Step 9: Continuous Compliance with Regulatory Requirements

Obtaining a licence does not mean the end of obligations to the regulator. The Company must continue to comply with regulatory requirements, provide regular reporting to the LFSA, maintain up-to-date AML/CFT policies and ensure a high level of security of operations. Continued focus on compliance and regulation ensures the long-term success and sustainability of the business in the fast-paced world of cryptocurrencies.

The process of obtaining a cryptocurrency trading licence in Labuan requires careful preparation, strict compliance with regulatory requirements and active engagement with the LFSA. Successfully navigating this path will not only legalise your company’s operations, but also open up great opportunities for growth and development internationally.

Taxation of virtual currency companies in Labuan

In recent years, the world has witnessed an unprecedented explosion of interest in virtual currencies. This growth has attracted the attention of regulators and tax authorities around the world, including in Labuan, which is part of Malaysia and is known as an international offshore financial centre. In this article, we look at the key aspects of taxation of virtual currency companies in Labuan, using business language.

Fundamentals of Labuan’s tax regime

Labuan offers an attractive tax regime for International Business Companies (IBCs), including those involved in virtual currencies. The main advantages are a low corporate tax rate, no capital gains tax or dividend tax, and the possibility of obtaining a licence for financial activities related to virtual currencies.

Taxation of companies dealing with virtual currencies

Companies transacting virtual currencies in Labuan can benefit from a corporate tax rate of 3 per cent on net profits generated from their international operations. This offer makes Labuan one of the most attractive jurisdictions for cryptocurrency companies.

However, it is worth noting that in order to maintain transparency and comply with international standards, Labuan-registered companies dealing in virtual currencies must fulfil certain requirements. These include compliance with reporting and auditing regulations, as well as anti-money laundering (AML) and counter-terrorist financing (CFT) regulations.

Licensing and regulation

Activities related to virtual currencies in Labuan require a licence from the Labuan Financial Services Authority (LFSA). This includes the exchange of virtual currencies, digital asset transactions and other related financial services.

The LFSA sets strict requirements for licence applicants, including capital requirements, management requirements and internal control policies. This provides a high level of confidence and protection for both market participants and customers.

Tax incentives for investors and entrepreneurs

Labuan offers a number of tax incentives for investors and entrepreneurs in virtual currencies. In addition to a low corporate tax rate, there are income tax exemptions on dividends and interest earned from abroad, as well as capital gains tax exemptions for certain investments. These incentives make Labuan an attractive jurisdiction for international cryptocurrency businesses.

Transparency and compliance with international standards

Labuan is actively working to ensure that its financial system complies with international standards of transparency and co-operation in tax matters. Virtual currency companies are required to register with the relevant regulatory authorities and submit annual reports, which helps to build trust and confidence among the international investment community.

Labuan is an attractive jurisdiction for virtual currency companies due to its favourable tax regime, flexible regulations and commitment to international standards. However, success in this dynamic industry requires not only utilising tax and regulatory incentives, but also strict adherence to international financial transparency and reporting requirements.

In conclusion, companies wishing to develop their virtual currency business in Labuan should carefully evaluate both the opportunities and obligations under local laws and regulatory practices. Strategic planning and compliance are key to successful participation in this innovative and fast-growing field.

Crypto tax in Labuan

With the vibrant digital economy, cryptocurrencies have become a significant part of global financial transactions. Labuan, an international offshore financial centre owned by Malaysia, is a unique jurisdiction for cryptocurrency businesses due to its attractive tax policy and regulation. In this article, we will look at the main aspects of cryptocurrency taxation in Labuan, using business language.

Labuan’s general tax policy

Labuan offers an attractive tax regime for International Business Companies (IBCs), including those with cryptocurrency transactions. A key feature is the ability to choose between a flat tax of RM20,000 per annum or taxation at 3% of net profits. This flexibility allows companies to optimise their tax liabilities depending on the size and nature of their business.

Taxation of cryptocurrency transactions

The key point for cryptocurrency companies in Labuan is that income earned from trading and investing in cryptocurrencies is taxable under the chosen tax scheme. This includes profits from buying and selling cryptocurrencies, as well as income from mining and steaking.

Regulation and Licensing

An important aspect of running a cryptocurrency business in Labuan is the need to meet regulatory requirements. Companies wishing to conduct cryptocurrency transactions must obtain a licence from the Labuan Financial Services Commission (LFSA). This requirement emphasises the jurisdiction’s commitment to ensuring a high level of transparency and security in financial transactions.

Benefits for Investors

Labuan offers a number of tax incentives for cryptocurrency investors, including exemptions from taxes on dividends and interest received from abroad, as well as capital gains tax under certain conditions. These incentives make Labuan an attractive centre for international cryptocurrency investors and traders.

Challenges and Responsibilities

Despite the tax advantages, cryptocurrency companies operating in Labuan face a number of challenges and responsibilities. It is important to highlight that striving to comply with international standards on transparency and anti-money laundering (AML) and countering the financing of terrorism (CFT) is a key aspect to maintaining Labuan’s reputation as a trusted financial centre. Companies are required to implement appropriate procedures and controls to ensure compliance with these standards.

Transparency and Reporting

To build confidence in the cryptocurrency sector and maintain compliance with international requirements, cryptocurrency companies in Labuan are required to provide regular financial reporting. This includes submitting annual reports and audit reports to the Labuan Financial Services Commission (LFSA), which promotes a transparent and responsible business environment.

Compliance with International Norms

Labuan is actively working to comply with international tax and financial crime standards. Companies must recognise recent changes in international tax legislation and adapt their business models and internal procedures to meet these requirements. This includes complying with rules relating to beneficial owner disclosure and adhering to international tax information exchange standards.

Labuan is an attractive jurisdiction for cryptocurrency businesses due to its favourable tax regime, regulatory flexibility and commitment to meeting international standards. However, success in this area requires not only an understanding of the tax and regulatory advantages, but also strict adherence to rules and regulations aimed at ensuring transparency, security and sustainability of financial transactions. It is important for companies wishing to do business in Labuan to constantly monitor and adapt to changes in the regulatory environment to ensure long-term success and sustainability.

Securing a Crypto Exchange License in Labuan 2025: A Strategic Guide for Business Success

Labuan, located off the coast of Borneo in Malaysia, is rapidly gaining recognition as a significant player in the global fintech and cryptocurrency markets. This detailed guide explores the process of obtaining a crypto exchange license in Labuan, providing insights into the regulatory environment, application process, and the benefits of securing a license in this jurisdiction.

Regulatory Framework in Labuan for Crypto Exchanges

Labuan is governed by the Labuan Financial Services Authority (LFSA), which oversees financial services and ensures compliance with international standards. The jurisdiction has embraced the rise of digital currencies and blockchain technology by incorporating these innovations into its regulatory framework, primarily through the Labuan Financial Services and Securities Act. This legislation provides a clear and structured approach to licensing crypto businesses, ensuring transparency and security for both businesses and their clients.

Types of Crypto Licenses in Labuan

Labuan offers a variety of licenses tailored to service different aspects of the cryptocurrency market:

- Crypto exchange license in Labuan: Allows the operation of platforms that facilitate trading between cryptocurrencies and fiat currencies.

- Crypto broker license in Labuan: Permits companies to broker transactions on behalf of their clients.

- Crypto trading license in Labuan: For businesses directly engaged in the buying and selling of digital assets.

- VASP crypto license in Labuan: Intended for virtual asset service providers who offer a range of crypto-related services.

Application Process for a Crypto License

The application for a crypto license in Labuan involves rigorous checks to ensure that applicants meet the stringent requirements set by the LFSA, including adequate financial resources, a well-defined business plan, and robust anti-money laundering (AML) procedures. The process is designed to be transparent and efficient to facilitate the entry of new businesses into the market.

Cost of Crypto Licensing in Labuan

The crypto exchange license in Labuan cost is competitive, particularly when compared to other major financial centers. This cost-effectiveness, combined with a favorable tax regime, positions Labuan as an attractive location for crypto startups and established enterprises looking to expand their operations.

Benefits of Acquiring a Crypto License in Labuan

Securing a crypto license in Labuan offers businesses significant advantages, including access to a growing global market, enhanced credibility within the financial community, and compliance with international regulatory standards. These factors are crucial for businesses aiming to establish a long-term presence in the industry.

Challenges in the Licensing Process

While the licensing process in Labuan is streamlined, businesses may encounter challenges such as navigating the comprehensive regulatory requirements and adapting to evolving global crypto standards. Effective communication with the LFSA and continuous monitoring of regulatory developments are essential for overcoming these challenges.

Market Opportunities in Labuan

Labuan provides substantial market opportunities for crypto businesses, supported by its strategic geographic location and commitment to becoming a fintech hub. The potential for growth, combined with incentives like potentially offering the cheapest crypto license in Labuan, makes it an appealing destination for both emerging and established crypto businesses.

As the cryptocurrency sector continues to evolve, Labuan is positioning itself as a key player in the international market. Obtaining a crypto exchange license in Labuan not only ensures regulatory compliance but also offers significant strategic benefits that can enhance business growth and sustainability in the competitive global finance industry

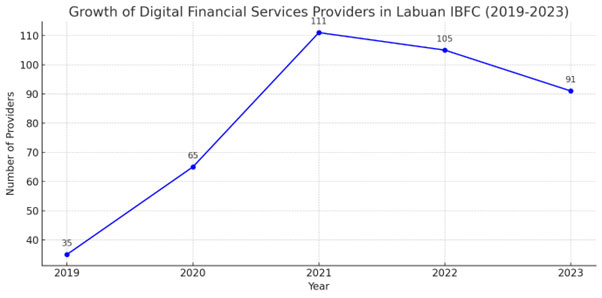

Cryptocurrency and digital financial services in Labuan IBFC from 2019 to 2023

Labuan Crypto Licence 2025

The 2025 Labuan IBFC Regulatory Plan outlines the key supervisory and AML/CFT policy priorities for the period. The plan is consistent with the strategic roadmap for 2022-2026 for Labuan IBFC and centers on international standards and changing market requirements.

Policy Development and Implementation

- The encouragement of sustainability: Introducing the tax taxonomy that classifies and aligns business activities with environmental, social, and sustainable objectives. This encourages shared efforts in sustainability.

- Strengthening the regulation of capital for Islamic banks: The broadening of the base of capital requirements and adequacy from conventional banks to Islamic banks and investment banks.

- Strengthening Regulation of Digital Currencies: The development of guidance on acceptable digital currencies for trading strengthens the rules for doing business using digital assets.

Improving Market Behaviour Requirements

The contract certainty guidelines for insurance and reinsurance extend the principles of contract certainty to insurance and takaful brokers. Further, reviewing compliance management policy updating provides the key control functions across sectors.

Enhancing AML/CFT Requirements

- AML/CFT Standards and Sanctions: Updates requirements covering customer due diligence, Suspicious Transaction Reporting, and screening against sanctions in light of latest FATF statements.

- Beneficial owner provisions: The Labuan entities and institutions that come in line, by beneficiary requirements with the revised FATF requirements.

- Red flag Indicators for Digital assets: Identification of suspicious activity in terms of virtual assets has made available more indicators for enhancing the procedures of filing suspicious activity reports.

Labuan IBFC

Labuan International Business and Financial Centre is developing digital financial services actively, turning it into a regulated yet business-friendly environment. This will also attract startups and established corporates looking at growth in Asia.

A Global Look at DFS

The COVID-19 accelerated this shift to digital services, and in the process, it saw phenomenal growth in the DFS sector. The transaction volume in the digital payments segment is projected to reach USD 1 trillion by 2025. DFS market in the Asia Pacific represents the fastest-growing market, creating considerable opportunities for Labuan IBFC.

Labuan IBFC’s Digital Platform

As one of the leading international financial centres, Labuan IBFC embraces innovative solutions in regulating DFS in such a way as to enable companies to adapt with a lot of ease to the changing requirements of markets. This includes:

- Digital banking: The first license for the first digital bank was approved in 2021.

- Cryptocurrencies and digital assets: Labuan IBFC issues licenses to trade in digital assets and the issuance of tokens.

- Regulatory Innovation: The regulatory measures include frameworks on cyber resilience and digital asset management.

Integration and Innovation

Labuan IBFC also fosters intense, wholesome competition that creates a continuum of innovation and supports new ideas for leapfrogging regional growth and development of the digital financial ecosystem. That is emphasized by the following:

- Collaboration: Strategic partnerships and joint initiatives with regulators and associations.

- Investor Attractiveness: The structures and solutions made available at Labuan IBFC, such as Waqf bases and Protected Cell Companies (PCCs), guarantee unique wealth management and investment opportunities.

Labuan IBFC is reinforcing its standing as a digital and innovative leading financial centre in the Asia Pacific. With a strategic location supported by strong regulatory support, innovative solutions make Labuan IBFC the ideal destination for digital financiers in pursuit of global growth and innovation.

RUE customer support team

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

OÜ

Registration number:

14153440

Anno: 16.11.2016

Phone: +372 56 966 260

Email: [email protected]

Address: Laeva 2, Tallinn, 10111, Estonia

UAB

Registration number: 304377400

Anno: 30.08.2016

Phone: +370 6949 5456

Email: [email protected]

Address: Lvovo g. 25 – 702, 7th floor, Vilnius, 09320, Lithuania

Registration number:

08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00, Prague

Sp. z o.o

Registration number: 38421992700000

Anno: 28.08.2019

Email: [email protected]

Address: Twarda 18, 15th floor, Warsaw, 00-824, Poland