Canada crypto license 2026

The ideal structure of incorporating a cryptocurrency transaction company in Canada should be founded on careful planning and a deep understanding of the legal framework. Being one of the far advanced countries in regulating cryptocurrency companies, Canada has laid down clear stipulations expected of any player operating such businesses. This article is a step-by-step guide to registering a cryptocurrency company in Canada using business language.

Defining the Business Structure

The first thing to consider is the choice of business form. The most commonly used business forms in Canada are: a sole proprietorship, partnership, and a corporation. Each of these structures has its own unique tax and legal features. Cryptocurrency companies most often choose the corporation form because of its advantages in terms of limited liability and investment opportunities.

Registering a Company Name

After choosing a type of business, you must register your company name. In Canada, the uniqueness of a name has to be searched against the relevant registration authorities to ensure that the name does not conflict with any pre-existing company. A name registration requires the filing of the appropriate forms and the payment of government fees.

Obtaining Necessary Licenses and Registrations

We have watched the Canadian government regulate cryptocurrency companies through a number of different authorities: the Canadian Securities Commission and the Financial Intelligence Service of Canada FINTRAC. In this case, depending on your line of business, this can include registering with FINTRAC as an MSB and-most importantly-maintaining records and reporting to prevent money laundering and terrorist financing.

Tax Accounting and Compliance with Tax Legislation

Cryptocurrency businesses need to account for any potential tax liabilities, including income tax and goods and services taxes or harmonized sales tax. Mainly, the system requires registering, though at times, depending on your annual turnover, it is voluntarily undertaken. The other important thing one may take note of is that such cryptocurrency transactions have implications regarding tax matters, especially regarding capital gains tax.

Develop Internal Policies and Procedures

Crypto companies in Canada are under the duty to establish and implement internal policies and procedures regarding the state regulator’s requirements and also industry best practices. This would include AML policies, Know Your Customer policies, and data security and privacy policies. These moves will not only help you stay within the confines of the law but also establish a sense of trust with your customers and partners in your business.

Protection of Intellectual Property

As the crypto industry is driven by innovation, intellectual property protection will become increasingly important. Consider trademark registration, the filing of patents for new technology developments, and copyright on new software code developed. The building of this strength for your company provides yet another avenue for licensing and commercialization opportunities.

Conformity to International Standards and Scale-up

This is very important for business growth in the field of cryptocurrencies in other jurisdictions. Of course, international lists of sanctions, various restrictions on cross-border transactions, and even specific cryptocurrency regulations will be seen in every country. If you adopt an international compliance strategy, you will be one step ahead of your competitors and avoid further legal risks.

In Canada, it is required to consider a number of legal, fiscal, and operational issues for the registration of a cryptocurrency company. To fulfill all the subsequent demands, one can be sure that a business will not only stay inside the frames of the law but will be commercially viable. The professional advice from lawyers and tax managers is necessary to render the cryptocurrency company fully compliant with Canadian and international legislation. In that way, you can focus on innovation and business growth with the assurance of its legal protection.

Crypto legislation in Canada

Canada continues to develop its position in regulating cryptocurrencies and blockchain technologies, hoping to strike a balance that encourages innovation and protects the interest of consumers. There are, however, some key information which both the cryptocurrency entrepreneur and investor should know about Canadian cryptocurrency legislation. This article provides an overview of Canadian cryptocurrency legislations in business terms.

Main Regulatory Organs

The key regulators of cryptocurrencies in Canada are the Securities Commission of Canada (CSA) and the Financial Intelligence Service of Canada, FINTRAC. The CSA regulates the securities market, investment activities connected with cryptocurrencies and tokens. FINTRAC is in charge of anti-money-laundering and counter-terrorist financing, thus regulating MSBs participating in cryptocurrency transactions.

Legislation and Regulation

In 2014, Canada was one of the world’s first countries to create legislation to control cryptocurrencies by bringing them within the ambit of the Anti-Money Laundering and Countering the Financing of Terrorism Act (PCMLTFA). This made it a must for crypto exchanges and wallet services to register with FINTRAC, the Financial Transactions and Reports Analysis Centre of Canada, as a money services business, MSB, ensuring that they conformed with AML/CFT requirements.

Since then, the CSA has put out a plethora of guidelines and clarification on the application of securities and investment laws on cryptocurrencies and all related products and services. This has entailed guidance on the issuance of initial coin offerings and initial token offerings, and also defining when such cryptocurrencies can be considered securities.

Compliance Obligations

It is in this regard that cryptocurrency dealing companies in Canada have to be most prudent concerning compliance requirements: registration with FINTRAC, establishment of systems and processes to forestall money laundering and terrorist financing, and adherence to rules on reporting and recording transactions. To restate what has been said above, companies must also ensure that their transactions are in conformity with local securities laws if their products or services can be identified as such.

Consumer Protection

Also, Canadian legislation concerning cryptocurrencies pays much attention to consumer protection. That is, the crypto companies have to ensure equal opportunities of trading, clarity of their offerings, and sufficient protection of user data and funds. In this respect, consumers should be provided with clear and complete information regarding the goods and services being offered as well as the risks associated with such.

Taxation of Cryptocurrencies

The taxation of cryptocurrencies also falls under regulation in Canada. The Canada Revenue Agency (CRA) views cryptocurrencies as commodities and, therefore, transactions with cryptocurrencies may be subject to capital gains tax or business income tax depending on the nature of the transaction. This means that companies and sole proprietors must keep records of their cryptocurrency transactions for tax purposes and report accordingly.

Development of Regulation

It will be noted that the legislation and regulation of cryptocurrency continue to develop in Canada, at the heart of new technological innovations and changing digital finance landscapes. For regulators, the trick is in the protection of investors, financial stability while continuing to encourage innovation and growth in both the cryptocurrency and blockchain sector.

Canada has become a destination of choice for cryptocurrency businesses in view of its holistic regulatory regime that promotes innovation while at the same time protecting consumer interest. It is crucial that companies operating in this space are cognizant of, and comply with, all applicable legal and regulatory requirements for their sustainable growth and risk minimization. For the above reasons, this report hereby recommends frequent consultation with professional legal and tax experts for updates on the current state of cryptocurrency law and regulation in Canada.

Canada

Capital |

Population |

Currency |

GDP |

| Ottawa | 40,769,890 | Canadian dollar ($) (CAD) | $59,813 |

Crypto Exchange License Canada

With the rapid development of the digital economy, cryptocurrency exchanges are among the vital participants in the digital asset ecosystem. Canada viewed this aspect seriously and established clear licensing and regulatory requirements for cryptocurrency exchanges. The paper discusses in detail the procedure of a cryptocurrency exchange license being issued in Canada by focusing on some key aspects concerning the business.

Understanding the Canadian Regulatory Landscape

Cryptocurrency exchanges, in this case, are considered MSBs in Canada, and as such, are required to register themselves with the Financial Intelligence Service of Canada or FINTRAC. This is a requirement established as part of anti-money laundering/combating the financing of terrorism activity with a view to ensuring that digital currency transactions remain at a high degree of transparency and security.

How to Obtain the License

| Step | Details |

|---|---|

| Registration in FINTRAC | Cryptocurrency exchanges operating in Canada must register as a Money Services Business (MSB) with FINTRAC. This registration requires filing information about the business source, owners, managers, and AML/CFT procedures. |

| Development of AML/CFT Policies | The development and implementation of an Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) policy are crucial for licensing. This includes Customer Identification and Verification (KYC), transaction monitoring, and reporting mechanisms for suspicious activities. |

| Observance of Requirements with the Securities Commission | Depending on the services provided, cryptocurrency exchanges may need to comply with the Canadian Securities Administrators (CSA) regulations. This includes ensuring compliance if the exchange deals with tokens classified as securities. |

| High Level of Safety | To obtain and maintain a license, exchanges must demonstrate high levels of security for user data and funds. This includes implementing cybersecurity measures and disaster recovery procedures. |

Benefits of Regulated Activities

There are several considerable benefits for cryptocurrency exchanges from operating within the Canadian regulatory framework and obtaining a license, including but not limited to the fact that:

- Customer Confidence: Licensing builds customer confidence since it means that an exchange operates at higher levels of regulation and security.

- Business Transparency: Regulation enforces high business transparency, especially for users and partners of the exchange.

- Banking Access: It is much easier to work with banks and financial institutions in Canada when registered as an MSB.

- Competitive Advantage: A licensed exchange is differentiated from several unregulated platforms in that it creates a secure and valid environment for its users to trade in.

Challenges and Recommendations

Notwithstanding the advantages, the licensing process itself may be a challenge and might require so much work to get it through. To simplify the process, cryptocurrency exchanges are advised to:

- Pre-application Preparation: Carefully go through all the requirements and ensure that you fully understand them before embarking on the application process.

- Expert Consultations: Avail the services of legal and consulting firms that specialise in the regulation of cryptocurrencies and financial technology.

- Technology Infrastructure: Make sure to invest in strong technology solutions that guarantee safety and AML/CFT.

- Continual Compliance: Design mechanisms for continuous monitoring on time with updates of internal policies and procedures whenever legislation changes.

A license to operate a virtual currency exchange in Canada is a very essential milestone to build a transparent and secure digital asset market under regulation. Compliance with regulatory requirements in Canada will go a long way toward ensuring security for users and investors, adding to the healthy development of the crypto industry. Of course, the burdens are there, but compared to the benefits that come from regulated operations, the costs and effort needed are outweighed, making an investment in compliance a strategically correct decision.

Crypto Trading License Canada

Assuming that the cryptocurrency industry is among those heavily scrutinized, a license for cryptocurrency trading is required to operate in Canada. The process ensures that applicable legal and regulatory requirements are met, protection for investors, and integrity in the financial system. This article provides in-depth information on how to get a cryptocurrency trading license in Canada using business language and focusing on the key aspects of the procedure.

Basics of Regulation

Canada is following the route of cooperation between different regulators, including the Financial Intelligence Service of Canada, also called FINTRAC, the Canadian Securities Commission, popularly known as CSA, and other regional authorities. Keeping in mind the continuation of cryptocurrency trading activities, one would have to comply with obligations pertaining to Anti-Money Laundering (AML) and Counter Financing Terrorism (CFT), in addition to investor protection requirements.

Process of Obtaining a License

| Step | Details |

|---|---|

| Determining MSB Status | The first step is to determine whether your business meets the definition of a Money Service Business (MSB) as defined by FINTRAC. If so, registration as an MSB and compliance with the AML/CFT regime is required. |

| Filing Application with CSA and Regional Authorities | If your business deals with cryptocurrency products that may be considered securities or derivatives, you must register with the CSA or relevant regional authorities. This includes additional documentation and regulatory requirements. |

| Prepare the Internal Policy and Procedures | Your business must design and implement internal policies and procedures covering AML/CFT, KYC, customer data protection, and transaction monitoring and reporting in line with regulatory requirements. |

| Technical Infrastructure and Security | A company must demonstrate robust security measures to protect customer data and assets. This includes encryption systems, multi-factor authentication, transaction monitoring, and disaster recovery plans. |

| Application and Submission of Documents | After meeting all requirements, submit an application with the relevant authorities (FINTRAC, CSA, or regional regulators) along with documentation proving compliance, including internal policies and security measures. |

| Verification and Approval Process | Regulators will review the application and may require further information. The approval process may take several weeks or months, depending on the complexity of the application and the workload of the regulators. |

Importance of Compliance with Regulatory Obligations

Licensing to trade cryptocurrencies in Canada is just the first step. For an entity to retain its license and continue to operate successfully, it will have to continue with all the regulatory requirements on a go-forward basis, including regular reporting, updating policies and procedures internally that are consistent with changes in legislation, and adhering to a high level of security and customer data protection.

Obtaining a license to trade in cryptocurrencies in Canada demands serious preparation and profound knowledge in regulatory matters. This is, after all, a license that confirms the fact that the company meets high standards of operation, security, and transparency that inspire confidence in users and regulators alike. Such a step will not only guarantee that it adheres to all the standards that assure the legitimacy of market activity but also be important for the emergence and existence of such organizations within the ever-changing panorama of cryptocurrencies.

Continuous Compliance and Adaptation to Change

At this point, it has to be underlined that the regulatory environment concerning cryptocurrencies in Canada and outside of it is in constant development. New legislative developments or changes within the existing regulations may require for cryptocurrency exchanges to adapt without delay and change their internal policies. This, in turn, requires a regular monitoring of the legal environment and an active dialogue with the regulators.

At this point, it has to be underlined that the regulatory environment concerning cryptocurrencies in Canada and outside of it is in constant development. New legislative developments or changes within the existing regulations may require for cryptocurrency exchanges to adapt without delay and change their internal policies. This, in turn, requires a regular monitoring of the legal environment and an active dialogue with the regulators.

Professional Advisory Services

Given that the regulative requirements are so complex and the cryptocurrency market is changing every day, it is highly advisable to seek professional advisors. Financial technology and crypto-specific law firms may provide the best consulting agencies to have great pieces of advice at each step in the licensing process, and further on in operational activities.

New Technologies Introduction

Technological innovation might be an important driver in a way to ensure that digital currency exchanges meet Canada’s regulatory expectations. Artificial intelligence for transaction monitoring, blockchain for increased data transparency and security, and automated Know Your Customer/Anti-Money Laundering top the leading ways of increasing efficiency in transactions while concurrently reducing their risks.

Encouraging Innovation and Investor Protection

Mainly, the protection of investors, maintenance of financial stability, and creation of an environment conducive to innovation and growth are the core intentions of regulatory oversight for the cryptocurrency exchanges in Canada. Understanding and adhering to all regulatory requirements denote commitment by the cryptocurrency exchanges to high standards of operation that contribute to the development of a healthy and sustainable cryptocurrency market in Canada.

Concluding Remarks

Obtaining a license to trade cryptocurrencies in Canada is notoriously burdensome and resource-consuming but forms an integral part of doing business with success. Complying with regulatory requirements, besides being at high operational levels, protects not only legally but also when developing trusted relations with customers and partners alike. In the long run, a commitment to being transparent and responsible translates into market comparative advantage, thus opening up new opportunities for growth and development.

Moreover, the regulatory environment is constantly updated based on new technological developments and changes in consumer behavior. Companies that are more proactive about monitoring these changes and adjust their strategies accordingly are those that are better equipped to meet a range of future challenges and seize emerging opportunities.

Strategy Planning and Continuous Learning

Accordingly, strategic planning and continuous learning are keys to successful navigation within Canada’s complex regulatory environment. Managers and employees will benefit by keeping themselves apprised with the latest trends in cryptocurrencies and blockchain through professional seminars, webinars, and conferences. Furthermore, formulating internal training and development programs is an important policy to enhance the competencies of the team members regarding regulatory compliance and risk management.

Cooperation with Regulators and Industry Organisations

The actual process of licensing and beyond can be greatly helped by developing positive relationships with regulators and taking an active role within industry associations. This can make the understanding and implementation of regulatory requirements easier to understand and implement, but equally important is the opportunity to share experiences, consider current challenges, and work out common approaches for the development of the industry.

The procedure for getting a license to trade cryptocurrency in Canada, though very complicated and challenging, is nevertheless realizable, provided all the features of its regulatory landscape and rigid adherence to compliance are well comprehended. Commitment to high standards of transparency, security, and accountability will help you through the licensing process and lay a bedrock for long-term success and sustainability in the dynamically changing world of digital finance.

How to get a crypto license in Canada?

An important prerequisite of operating in the context of this new evolving business industry in Canada is obtaining a cryptocurrency license. Acknowledging the potential and risk associated with the institution of cryptocurrencies, regulators have devised an overall licensing system to ensure that cryptocurrency transactions are transparently safe and secure. In the article below, we will elaborate on how to obtain a cryptocurrency license in a business-like manner in Canada.

| Step | Details |

|---|---|

| Activity Definition | Clearly define your cryptocurrency operations, which will determine the licenses and permits required. Activities include exchange operations, wallet services, ICO/IEO, mining, and advisory services. |

| MSB Registration | Register with FINTRAC as a Money Services Business (MSB). The application should provide comprehensive business details, ownership, management, and anti-money laundering/counter-terrorist financing (AML/CFT) policies. |

| AML/CFT Requirements | Develop and implement AML/CFT policies, including KYC, transaction monitoring, and staff training, as part of your compliance with regulatory requirements. |

| The Securities Commission Registration (Where Applicable) | If your business offers products or services considered securities, such as ICOs or IEOs, you must register with the CSA or regional authorities and provide additional documentation about investor protection and rights. |

| Preparation and Submission of Technical Documentation | Prepare technical documentation to demonstrate compliance with safety standards. This includes system architecture, data and user security measures, and disaster recovery plans, to be submitted to regulators. |

| Verification and Approval Process | Regulatory review of submitted documentation will begin. Additional information may be requested. The review duration depends on business complexity and documentation volume. Stay in close contact with regulators for clarification requests. |

| License Application and Acceptance | After passing all checks and receiving approval, your company will be granted a cryptocurrency license. Licensure is an ongoing process, requiring compliance with regular reporting and updates on internal policies and legislation. |

| Continuous Learning and Improvement | Maintain a culture of continuous learning to keep up with evolving regulatory requirements. Stay updated on changes in legislation, and engage with industry associations and market participants to share knowledge and best practices. |

Obtaining a cryptocurrency license in Canada requires serious preliminary preparation, attention to details, and deep knowledge of the requirements of legislation. But successful completion of the procedure opens access to one of the most developed financial markets in the world and enhances trust from your customers and partners, which in turn means the sustainable development of your business in the long term.

Advantages of Canada crypto license

Canada is a leading country in the world regarding the development and regulation of the cryptocurrency industry. The country has a very transparent and predictable regulatory environment that is quite attractive to investors and entrepreneurs alike, who may want to conduct activities in the digital currency industry. A Canadian cryptocurrency license opens the door to quite a number of significant business advantages. In the article below, we will point to the key points making the Canadian license highly valued.

- Legality and Trust: The main advantage of having a Canadian license is the legalization of activities before both local and foreign partners and clients. Thus, licensing presumes verification of a business regarding compliance with strict regulatory requirements about AML/CFT, enhancing credibility and reputation of a company in general.

- Access to Financial Services: Generally speaking, licensing allows crypto companies to have wider access to financial services, including banking, as many banks and financial institutions prefer to deal exclusively with regulated entities, which makes licensing a critical aspect in the assurance of operational efficiency within the business.

- Protection of Investors’ Rights: In Canada, cryptocurrency activity is regulated in protection of the rights of investors. Increased trust in licensed companies means a contribution to a stable and secure environment of investments. Companies should provide reliable and full information about their products and services, which may entail transparency and reduce the risk of financial losses for the investors.

- Raising Capital: This license opens new avenues for investment attraction within and outside Canada. International investors or partners are more attracted to regulated companies, so the processes of financing and business expansion will go easier.

- International Recognition: Canada is famous for its very strict but fair regulation of the financial market, including the crypto industry. A Canadian license for cryptocurrency activity may serve as a serious signal for international regulators and partners that your business meets high standards of operations, security, and transparency. This may contribute not only to the position of your company in the global arena but also ease the way to new markets and cooperation with foreign financial institutions.

- Enhanced Cybersecurity and Transparency: More importantly, huge measures by Canadian regulators with regard to cryptocurrency companies presuppose the implementation of strict measures of cybersecurity and customer data protection. Implementation of such requirements not only minimizes risks of cyberattack disclosure but also increases overall trust of users to the platform. Transparency of operations, which is guaranteed by a licence, further strengthens the position of the company as a reliable and responsible participant in the market.

- Ease of International Partnerships: Most countries require some sort of licensure for any incorporation into their system, so licensed cryptocurrency businesses usually have fewer barriers to forming international partnerships. This Canadian license will make due diligence easier on potential partners and customers alike, thus helping to facilitate agreements that may otherwise take a longer period. This keeps them at par with international standards.

- Compliance with International Standards: The aim in Canada when it comes to the regulation of cryptocurrency activity is to bring the country up to international standards and best practice. This would facilitate companies into other various jurisdictions with ease, and lighten the challenge of preparing for licence and permit requirements abroad.

Obtaining a Canadian cryptocurrency license is a great advantage for any enterprise in this field. Besides underlining the legitimacy and reliability of a business, licensing opens new opportunities for growth, investment, and international cooperation. Therefore, it’s important to approach this direction with full understanding of all requirements and a desire to meet the high standards set by Canadian regulators.

How to get a crypto license in Canada

Among the countries with advanced cryptocurrency legislation, Canada offers serious advantages for companies holding a cryptocurrency licence. That is not just a legal requirement but such a strategic advantage which can give serious weight to a company’s success in the fast-growing digital currency industry. In the article below, we will review key benefits provided by a cryptocurrency licence in Canada from a business perspective.

Building Trust of Clients and Partners

Licensing underlines the commitment of a company to high standards of security, transparency, and corporate responsibility. Most importantly, it greatly enhances the trust from customers and business partners in companies operating in industries where trust is an essential quality. Companies licensed by Canada are perceived as more trustworthy and stable; thus, their advantage lies in building stronger and more long-term relationships.

Legitimisation of Activities

Obtaining a license means the company meets all the requirements of Canadian law, which apart from legal protection legitimises the activities of the company internationally. Such an option opens wide horizons for cooperation with international financial institutions and regulators in other countries.

Attracting Investments

On the other hand, a license often makes companies more attractive to investors since a license is generally considered a virtual guarantee of business stability and reliability. This can make access easier to both private and institutional capital, raising the chances of growth and development opportunities open to the company.

Access to Banking and Financial Services

Having a license in a world where most of the banks and financial institutions are still sceptical about their cryptocurrencies, can give access to banking services way easier. That is very important for transactions which need high level of liquidity and access to international systems of payments.

International Compliance

Canada actively co-operates with international regulators and adheres to international standards in regulating financial services, to which those related to cryptocurrencies pertain. Being licensed here in Canada would add an extra layer of confidence in compliance with internationally recognized standards and regulatory requirements, ultimately making expansion internationally so much easier for the business.

Enhancing Cybersecurity

The application procedure involves a rather proactive analysis of the cybersecurity and data protection system. This, consequently, calls for the company to apply advanced technologies and best practices that will make sure customers’ information and funds are safe. Improved cybersecurity reduces the risk of losing or having data stolen but also increases general confidence in the corporation.

Drive Innovation and Growth

In other words, Canadian regulation strikes a balance between strict control and support for innovation. A licence allows companies to experiment with new products and services within a clearly defined regulatory framework, hence supporting innovative growth and enterprise development.

Operational Transparency

Indeed, various regulatory requirements-namely, financial reporting and transaction monitoring and record-keeping requirements-make operational transparency a premium for licensed cryptocurrency companies in Canada. This transparency will build trust with customers and business partners and will also drive tax and accounting compliance.

Regulatory Clarity

As such, these companies avoid legal uncertainty and risks related to unregulated activities in jurisdictions with clearly defined regulatory requirements. Canada’s regulatory clarity provides a great avenue through which companies can develop strategic plans for their operation and minimize associated risks due to regulatory changes.

In the fast-evolving crypto space and ever-changing regulations, getting a Canadian crypto license provides companies with certain strategic competitive advantages. It also reinforces not only the market position of a company but also serves as a very important basis for long-term healthy growth and success in the global crypto world.

Overview of crypto regulation in Canada

Canada has proved to be among the leading jurisdictions in this aspect, guaranteeing clarity and progressiveness toward digital asset transactions. The regulation covers everything from AML/CFT to consumer and investor protection. In the following article, we have been able to look at the overview of cryptocurrency regulation in Canada and point out its key points important for the business.

Key Regulators and Regulations

Some major regulatory bodies that monitor the use of cryptocurrency in the country are the Financial Intelligence Service of Canada, widely known as FINTRAC, and the Canadian Securities Commission, known as CSA. FINTRAC deals with AML/CFT issues, while the CSA takes care of securities-related transactions when cryptocurrencies are also involved.

In 2014, Canada was one of the very first countries in the world to provide legislation that regulated cryptocurrencies. This was through the amendment of the PCMLTFA to include virtual currencies. The implication is that any firm involved in the exchange or transfer of the cryptocurrency has to be registered as a Money Service Business and, correspondingly, to institute an AML/CFT compliance program.

Regulation of Cryptocurrency Exchanges

The crypto-exchanges operating in Canada would be required to register themselves as MSBs with FINTRAC and maintain stringent reporting and recording of the transactions. Apart from this, if any exchange offers trading in cryptocurrencies that come within the ambit of securities or derivatives, that too would have to be regulated by the respective laws provided by the CSA.

Investor Protection

CSA is working to develop and implement investor protection guidelines in the cryptocurrency space, to include transparency, disclosure, and risk management requirements. As such, these are measures to ensure that investors are aware of the risks associated with their investment and that appropriate protection is in place.

Innovation and Regulatory Sandboxes

Recognizing that innovation is vital to the economy, the regulators have created regulatory sandboxes in Canada, in which firms can test new products and services in a controlled environment without being subject to the full range of normal regulatory requirements. In this way, it enables startups and other innovative projects in cryptocurrency to take valuable feedback from the regulators and adapt their products and services according to the market requirements without violating any existing legislation.

Adherence to International Standards

Canada actively cooperates with international organizations, such as the Financial Action Task Force, so that the regulation of cryptocurrencies applies the rules according to international standards. Coherence in approaches from regulators also ensures that the best environment can be given to international businesses and investments.

The Future of Regulation

Canadian regulators continue to make improvements in the regulatory framework for digital currencies investors, innovators, and to prevent financial crimes. Future regulation will be in response to emerging technologies and market trends but still will maintain tough measures on consumer protection and financial stability.

This, in turn, strikes a balance in the regulatory approach toward cryptocurrency in Canada, ensuring innovation within the marketplace, but with safety and transparency. To conduct operations with success and growth in mind, companies in this area should be aware of and adhere to regulatory requirements. Active engagement with regulators, active participation in industry discussions, and attention to changes in regulations will enable firms to cope with the regulatory environment effectively and make the most of the opportunities offered by the cryptocurrency market in Canada.

Various types of applications for a crypto license in Canada

Regulations in respect to the crypto industry have been designed in Canada in order to provide safety, transparency, and security of transactions made using digital assets. A license obtained by the regulatory authorities is necessary for any kind of operation within the industry. Companies can prepare applications of different types depending on the kind of activity. Below, we will look at the main types of applications for a cryptocurrency license in Canada, highlighting key considerations that ought to be born in mind by a business. An overview of the registration:

| Step | Details |

|---|---|

| Money Service Business Registration | Any business exchanging cryptocurrencies for fiat, transferring cryptocurrencies, or providing wallet services must register with FINTRAC as an MSB. This includes providing detailed information on the business, owners, managers, and establishing AML/CFT compliance programs. |

| Application for a Securities Transaction Licence | Companies involved in the offering, sale, or trade of products considered securities (such as tokenized assets or ICOs) need a license from the CSA or provincial regulator, ensuring compliance with investor protection and regulatory standards. |

| Application for Registration as a Virtual Currency Dealer | Firms exchanging or transmitting virtual currencies must register as virtual currency dealers, a more rigorous registration than MSB, involving stricter AML/CFT responsibilities and enhanced consumer protection. |

| Specialised Statements for Regulatory Sandboxes | New cryptocurrency products or services can be tested in regulatory sandboxes. To enter, companies must show how their projects are innovative and could benefit the market. Sandboxes offer a chance to work with regulators to ensure products meet regulatory standards. |

| Applications for Special Permits and Licences | For cryptocurrency transactions not falling under general categories (e.g., new blockchain technologies or unique financial products), companies must apply for special permits or licenses, which are reviewed individually by regulators. |

| Preparation and Submission of Applications | Companies must prepare thoroughly before submitting any cryptocurrency license application. This includes: Understanding regulatory requirements: Familiarity with applicable laws and regulations is crucial. Developing internal policies: Policies for AML/CFT, data protection, and compliance must be documented and implemented. Demonstrating technical readiness: Companies must show their technology complies with safety and reliability standards. Seeking professional consultation: It’s recommended to consult lawyers and financial experts to ensure full regulatory compliance. |

It takes a lot of time and effort to obtain a cryptocurrency license in Canada; at the same time, it has its strategic advantages for companies. It establishes confidence with clients and other counterparties, opens up a full range of financial and banking services, allows international development of the business, and encourages innovation. The steps to know-how for applying for different types of licenses, to thorough preparation of applications for submissions, will be instrumental in the quick acquisition of the license and the extension of your business in the dynamically changing world of cryptocurrencies.

Proactive Compliance with Regulatory Change

Quick adaptability to the changes in the regulatory environment is indispensable for any successful cryptocurrency business in Canada. Regulators continue to work on developing and adapting regulations with a view to reflecting new technologies, together with evolving market behaviors and practices. Companies will need to review their operations and policies periodically to ensure that current requirements are met and potential fines and penalties are avoided.

International Standards Integration

Apart from the domestic requirements for compliance in Canada, international cryptocurrency regulatory standards also need to be obeyed while going international. Such fora and collaboration are likely to help companies stay abreast of global trends and global requirements and facilitate the development of universal solutions for compliance.

Corporate Transparency: A Must

Corporate transparency is among the significant parts in the process of obtaining and maintaining a cryptocurrency license. The regulators demand information regarding the owners, managers, financial condition, and operations of companies to be disclosed transparently. Improved corporate transparency enhances regulators’ trust as well as investor and customer confidence in the stability and reliability of an enterprise.

Obtaining a cryptocurrency license in Canada opens wide opportunities for new growth and development of an enterprise. In turn, it does need businesses to be eminently aware of the regulatory environment and committed to high standards of operation. The only way to be successful in such a dynamic field is with strategic planning, careful compliance, and proactive engagement with regulators. After all, adherence to regulatory standards reduces risks and paves ways for sustainable development and long-term success in the cryptocurrency industry.

How to get a crypto license in Canada?

Getting a cryptocurrency license in Canada is the very first key step for those businesses that want to operate within this fast-growing sector in accordance with the law. The process may look completely daunting due to vast regulatory requirements and proving your compliance to such high standards of security and transparency. Herein, we provide a step-by-step guide on how to go about the cryptocurrency licensing process in Canada.

| Step | Details |

|---|---|

| Determination of Activity Type | Clearly define the type of cryptocurrency activity, which will help in determining the necessary licenses. Activities may include cryptocurrency exchange transactions, wallet services, transfers, and ICOs or STOs. |

| Preparing for FINTRAC Registration | Register the company with FINTRAC as an MSB. This involves filing detailed information about the business, ownership, and managers, while confirming that policies to prevent money laundering and terrorist financing are in place. |

| Develop Internal Policies and Procedures | Develop and adopt internal policies addressing AML systems, KYC programs, data security policies, and risk management to ensure compliance with FINTRAC and other regulatory requirements. |

| Readiness of Technology for Safety | Ensure the enterprise has high-level technology solutions to protect customer data and assets. This includes encryption, multi-factor authentication, and other advanced security mechanisms. |

| Filing the Application | After preparing all required documents and systems, the company files a detailed application with FINTRAC and other relevant regulators, demonstrating the business operations and compliance measures in place. |

| Dealing with the Regulator | Licensing may involve clarification or further discussion with regulators. It’s essential to maintain an open and cooperative relationship to demonstrate a willingness to meet regulatory requirements. |

| Ongoing Monitoring and Compliance with Standing Requirements | Once licensed, businesses must continue to monitor their operations, ensure compliance with AML/CFT policies, report periodically to FINTRAC, and update internal policies in line with regulatory changes. |

| Development and Alteration | The cryptocurrency industry evolves rapidly. Companies must stay informed about new technologies, market changes, and regulatory shifts. Continuously investing in innovation and team training is essential for maintaining competitiveness and compliance. |

The process of obtaining a cryptocurrency license in Canada is pretty challenging with respect to thorough preparation, attention to details, and commitment to high levels of operation. Yet, having obtained a license opens new opportunities for the company to grow and develop in full accordance with laws within a regulated and secure environment. This, of course, offers protection by the law and also brings stability to the business. Furthermore, regulatory compliance and active communication with regulators help gain the trust of clients and partners, which is extremely important in achieving long-term success within the cryptocurrency industry.

Kinds of Crypto Licenses in Canada

Large segments of the world, including Canada, have taken the route of increased regulatory oversight by government agencies as a method of developing the cryptocurrency industry. Companies operating in this field consider understanding license types and requirements of acquisition as a key aspect of successful and legal operation. The article reviewed the main types of cryptocurrency licenses in Canada and described their characteristics and areas of application.

Large segments of the world, including Canada, have taken the route of increased regulatory oversight by government agencies as a method of developing the cryptocurrency industry. Companies operating in this field consider understanding license types and requirements of acquisition as a key aspect of successful and legal operation. The article reviewed the main types of cryptocurrency licenses in Canada and described their characteristics and areas of application.

Money Service Business (MSB) Licence

Firms which provide services such as exchanging cryptocurrencies for fiat money, transferring cryptocurrencies, or providing storage services related to these digital currencies are obliged to register with the Financial Intelligence Service of Canada as MSBs. If a firm registers itself as an MSB, this entails that such a firm is under obligations with respect to AML and CTF including record keeping for certain transactions and reporting.

Securities Transaction Licence

Where the activities of the company include dealing in cryptocurrency or any other related products that may be considered to be securities-issuances, such as tokens representing shares, interests, or other rights, such a company will fall under proper licensing with the CSA and/or provincial regulators. That, in turn, involves demonstrating compliance with specific standards that help protect investors.

Registration as a Virtual Currency Dealer

Recent changes in the regulations may also force some cryptocurrency firms to register themselves as virtual currency dealers. It is an entirely new requirement with the aim of extending the AML/CFT-related regulatory measures to more cryptocurrency transactions. The registration includes the imposition of tighter customer identification and transaction monitoring requirements.

Licenses for Regulatory Sandboxes

Canadian regulators encourage innovation in finance through regulatory sandbox programs, which allow companies to test new products and services in a controlled regulatory environment. Participation in such a program might be allowed on special application and approval by regulators, yet it provides an opportunity to get feedback and directly receive guidance from regulators on an innovative project to minimize risks and expedite the process of taking new technologies to market.

Special Licences and Permits

Companies could be obliged to obtain special licences or permits depending on the specific type of activity and technological features of cryptocurrency projects. Special licences or permits might concern those activities which involve special measures of security, protection of customers’ data, and specific settlement and transaction patterns. Such a necessity should be checked with regulators and legal counsel in advance, and all necessary documentation prepared accordingly.

Preparing for the Licensing Process

To obtain any form of cryptocurrency license in Canada successfully, the firms should prepare themselves to meet the requirements, thorough in nature such as:

- Internal Audit: Logic verification of the compliance of current operations, processes, and policies with regulatory requirements.

- Development and Strengthening of Compliance Policies: Including AML/CFT, KYC, Data Protection, and Information Security.

- Technology Training: Reliability and security should be assured in the systems of used technology, storage, and data transfer systems.

- SOPEP Regulatory Approaches: Preconsultation of the project and condition of licensing may make clearer in what ways expectations or requirements viewed by the supervisory authorities.

- Application Filing: An application package is to be prepared for submission to the correct regulatory authority by completing all applicable forms fully and accurately.

Obtaining a cryptocurrency license in Canada opens many opportunities for company development and expansion within the legal space that is being created. Key considerations that would help navigate the path of success through the process include preparation, deep knowledge of the regulatory requirement, and active engagement with regulators. Compliance with the regulatory standard strengthens a company’s position in the market and would contribute to the further sustainable and secure development of this sector as a whole.

Step to Setting Up a Crypto Business in Canada

Opening a cryptocurrency business is a very unique opportunity to take advantage of one of the most developed and regulated markets in the world. The successful development and growth of a business require clear understanding and due consideration of regulatory requirements, proper strategic planning, and following industry best practices. The following article includes a step-by-step guide to opening a cryptocurrency business in Canada.

| Step | Details |

|---|---|

| Defining the Business Model | Clearly define the cryptocurrency services your business will offer, such as exchanges, wallets, mining operations, ICO or STO platforms, advisory services, or related software development. |

| Understanding Regulatory Requirements | Understand the legislative and regulatory environment, including registration with FINTRAC as an MSB, implementing AML/CFT procedures, and recognizing licensing requirements for securities-related activities. |

| Write a Business Plan | Create a comprehensive business plan detailing your vision, goals, strategies, market analysis, financial projections, and an actionable plan. This document is also essential for attracting investors and partners. |

| Business Registration and Preparation of Corporate Structure | Choose the legal form for your business (e.g., sole proprietorship, partnership, corporation) and register with the appropriate authorities. Also, establish a clear organizational structure for your company. |

| Create Management and Operations Structure | Assemble a team with the necessary skills (IT professionals, lawyers, compliance experts, marketers). Develop operational processes such as software development, customer service management, and logistics. |

| Funding and Capital Management | Identify sources of seed capital, such as personal funds, business angel investments, venture capital, or crowdfunding. Develop a strategy for managing capital to maximize returns while minimizing risks. |

| Development and Implementation of Technological Solution | Develop a secure, scalable, and efficient technology platform for delivering your services or products. Ensure the platform is thoroughly tested before launch to ensure reliability. |

| Marketing and Customer Attraction | Develop a marketing strategy for customer attraction and retention. Use social media, content marketing, SEO, and customer service systems to build brand awareness and maintain customer loyalty. |

| Comply with Regulatory Requirements | Stay updated on regulatory changes and ensure continuous compliance. Regularly update internal policies, conduct audits, and train staff to ensure high levels of compliance. |

Opening a cryptocurrency company in Canada is not an easy but promising process, which requires a certain plan, development by strategy, and continuous adjustment to the changing regulatory field. Having prepared yourself for successful and long-lasting business in this fast-developing industry, you will definitely reach your aim with a good team of professionals supporting you.

Procedures for Obtaining Crypto License in Canada

Over the years, Canada has emerged as one of the world’s leading regulators in the field of cryptocurrencies and provides clarity on a very progressive regulatory regime applicable to companies dealing in digital assets. How a crypto license is obtained in Canada is quite a long procedure that requires serious preparation and profound knowledge of the regulatory demands. In this article, we will provide the detailed guide on how procedures for obtaining a licence of a cryptocurrency business in Canada should be performed.

Determine the Type of Licence Required

The first thing a business would want to do is to determine what kind of licence it requires for its operation. This would depend on the nature of the activities one intends to carry out. This could be in the form of:

- Registration as a MSB with FINTRAC for those companies that exchange cryptocurrencies for fiat money, transfer cryptocurrencies, and provide cryptocurrency wallet services.

- Securities license, in case of offering or trading cryptocurrencies or tokens, which could be conceived as securities.

- Internal Policies and Procedures: The internal policies and procedures must be designed and put in writing in order to comply with requirements for AML/CFT, including identification of customers’ criteria and monitoring of transactions.

Application Preparation and Submission

After internal policies and procedures have been drafted, the second phase involves preparation and submitting an application to the relevant regulatory authority with all ancillary documentation and evidence of conformance. In the case of MSBs, this means a registration process via FINTRAC’s portal, while for securities licenses, the mechanism is different because different requirements apply by various provincial regulators.

Verification Procedure

Afterwards, regulators may request additional information or clarification as part of the vetting process. A response to all requests and providing information as prescribed should be made promptly.

Obtaining the Licence and Complying with the Terms and Conditions

After the verification procedure is successfully completed, the company obtains a license to conduct cryptocurrency activities. It has to be underlined that a license is not the last step but the beginning of a new period in the life of the company, which requires strict observance of all regulatory conditions and obligations. This includes:

- Regular reporting to the relevant regulatory authorities.

- The revision and updating of internal policies and procedures with regard to changes in legislation and regulatory practice.

- Continuously monitoring the ongoing transactions for anti-money laundering and terrorist financing.

- Conduct periodical internal and external audits to validate compliance based on the requirements of a regulator.

Learn and Adapt Continuously

The regulatory environment in cryptocurrencies is changing very fast, and thus cryptocurrency companies need to understand how continuously to learn and adapt themselves to the coming requirements and best practices. Recommended:

- Regular training for the staff about the need for regulatory compliance and on the latest developments in legislation.

- Update yourself from the regulator on updates, guidance documents, updates in industry standards, and practices.

- Conferences and meetings in the industry where one can share their knowledge and experience with other market participants.

Developing Relationships with Regulators

Developing a transparent and helpful relationship with regulators can make the entire process of licensure and further compliance with regulatory requirements much easier. It includes the following:

- Openness and readiness for dialogue with the regulator.

- Discussion and active contribution to the development of regulatory policy and standards.

- Timely notification of regulators about changes in operations or management that may have an impact on compliance with regulatory requirements.

Obtaining a license for cryptocurrency activities in Canada is a serious preparation, rigorous following of regulatory requirements, and active interaction with regulatory authorities. If all procedures and steps are successfully completed, the company not only guarantees the legality of its activity but also significantly improves its image and the confidence of clients and partners.

Table with the main tax rates in Canada

| Type of tax | Bid | Commentary |

| Income tax (corporate tax) | Federal: 15 per cent Provincial: different rates for each province |

The overall corporate tax rate varies by province and can range from 25 per cent to 31 per cent |

| Value added tax (VAT) | Federal: 5 per cent Some provinces may have their own rates |

Certain goods and services may be exempt from VAT or subject to a zero rate |

| Personal income tax | Federal: 15% – 33% Provincial: different rates for each province |

Canada’s personal income tax is progressive, meaning the rate depends on the level of income |

| Capital gains tax | 50% of the individual income tax rate | In the case of the sale of capital assets, such as shares or real estate |

| Property tax | Various | Property tax rates can vary depending on the municipality and the value of the property |

How to Obtain a Crypto Trading License in Canada

Having a cryptocurrency trading license in Canada requires dealing with an extremely complex process of compliance with local regulations and standards. Notably, the licensing in Canada includes numerous steps that require cautious planning with consideration of the regulatory environment. Further follows the step-by-step explanation of the procedure needed for receiving a cryptocurrency trading license in Canada.

Understanding of regulatory requirements

To obtain a cryptocurrency trading licence, an organisation has to have crystal-clear ideas about the laws and regulations regarding cryptocurrencies in Canada. It has multiple regulatory bodies monitoring and regulating the transactions that are related to cryptocurrency; among them, most significant entities include securities commissions of each province or territory and anti-money laundering association FINTRAC.

FINTRAC registration

FINTRAC plays a major role in regulating cryptocurrency transactions in Canada. The companies offering services for the exchange and transfer of cryptocurrencies have to register with FINTRAC as Money Transaction Businesses. This will also include in-depth information about the business, owners, managers, and the procedure of operation.

Following KYC and AML policies

This shall come into effect for the obtaining of a license to sell by the development and implementation of the KYC and AML policies, which would reflect an overall approach on customer identification and verification, monitoring, and reporting suspicious transactions.

Data protection and cyber security

Companies should provide the highest level of data protection and cybersecurity regarding customer information and cryptocurrency transactions. They shall implement contemporary encryption technologies, perform periodic audits, and elaborate on incident response plans while going through licensing and license renewal processes.

Applying for a licence

When it is satisfied that it meets the foregoing requirements, what the company needs to do is to file an application for a licence with the relevant regulatory authority. Marnier said the application must be accompanied by all the supporting documents showing that it satisfies regulatory requirements, including in relation to defined extensive KYC and AML policy, proof of registration with FINTRAC, and documentation of cybersecurity and data protection measures.

Verification process

After the application, the actual verification begins, where the regulator checks the documents provided and asks for further information or clarification on some items. During this period, open and frank contact with the regulators is very essential for discussing the questions and remarks that are raised.

Issuance of licence

After successful completion of the verification process and confirmation of compliance with all requirements, the regulatory body issues a licence to trade in cryptocurrency. The license confirms the legitimacy and reliability of the company’s work in the field of cryptocurrencies, which is an important condition for the trust of clients and partners.

Observance of requirements

Licensing is not a terminal point, as companies must always be at a high state of regulatory compliance. This will entail periodical updating of policies and procedures, training of staff, and requirements with respect to reporting and monitoring of operations. Auditing by regulators may be done in order to certify the operations of licensed companies.

The license for the trading of cryptocurrency has to be carefully considered and demarcated at all points in time in Canada. From regulatory requirements to maintenance regarding cybersecurity and protection of data, all of these are salient features that lead an entity towards the successful obtainment and, thereafter, its sustainability of a license. In this regard, the license application process should not be considered an administrative obstacle but viewed as an opportunity to confirm their care for industry best practices and standards in further assurance of confidence and stability in cryptocurrency transactions.

Taxation of virtual currency companies in Canada

Taxation for virtual currency companies is a rather complicated issue in Canada, requiring deep knowledge not only of the country’s tax legislation but also of the peculiarities of the crypto economy. In this article, we prepared a detailed review of the main taxation issues that virtual currency companies are facing in Canada and ways to overcome those problems constructively.

| Topic | Details |

|---|---|

| Basic principles of taxation of virtual currencies | In Canada, virtual currencies such as bitcoin are considered commodities under the Tax Act. Transactions involving virtual currencies are subject to value-added tax (VAT) and potentially income and capital gains tax. |

| Value Added Tax | Businesses providing services or selling goods in exchange for cryptocurrency must record these transactions as subject to VAT. The underlying value of the virtual currency must be captured in Canadian dollars at the time of the transaction. |

| Income Tax | Companies involved in virtual currencies must report any gains or losses arising from such transactions for tax purposes. The realization of gains/losses from fluctuations in cryptocurrency value, due to exchange rates, can affect the after-tax position. |

| Taxation of Capital Gains | Capital gains taxes apply to the difference between the purchase and sale price of virtual currencies. In Canada, 50% of capital gains are taxable, so it is essential to track acquisition and disposal of cryptocurrencies carefully. |

| Deductions and Benefits | Tax deductions, such as for mining-related expenses, may apply. These can reduce taxable income, except for expenses like depreciation and electricity. |

| Accounting and Reporting | Cryptocurrency businesses must set up an accounting system to support tax compliance, record transactions in a ledger, convert the cryptocurrency value to Canadian dollars at the transaction time, and maintain complete documentation of expenses and income. |

| International Standards Compliance | International businesses must consider global taxation liabilities, including double taxation risks. Complying with international tax treaties and taking advantage of double taxation avoidance mechanisms is crucial to optimize taxation. |

| Risks and Challenges | The volatile nature of virtual currencies, coupled with a highly dynamic regulatory environment, makes it challenging to clearly identify tax events. Businesses should stay audit-ready with proper documentation and justification for their tax positions. |

Taxation for virtual currency companies in Canada requires an in-depth understanding not only of the cryptocurrency market but also of the intricacies of Canadian tax law. Proper management of tax liabilities helps ensure compliance with regulations and optimize the tax burden, thus contributing to better financial performance. Given the regulation that constantly changes, it is highly important to be aware of all recent changes in legislation and tax practices to gain full control over the mitigation of tax risks and opportunities effectively.

Crypto tax in Canada

Taxation of cryptocurrency transactions holds a special place in accounting and tax planning, both for individual investors and businesses alike, within the context of the rapidly changing cryptocurrency market. Specific reporting and taxation requirements regarding digital currencies have allowed the Canadian tax system to adapt to these new challenges. The article is designed to update business readers on key aspects related to the taxation of cryptocurrencies in Canada.

Taxation Classification of Cryptocurrencies

The Canada Revenue Agency (CRA) classifies cryptocurrencies as a form of taxable commodity. As such, most of the transactions conducted using cryptocurrencies are subjected to either a capital gain or an income tax treatment in nature; this also includes trading, exchanging, gifting, or the use of cryptocurrency in the purchase of goods and services.

Taxation of Capital Gains

After the sale of a cryptocurrency at profit, the difference between the base value – this is, the purchase price – and the sale price is considered a capital gain, and 50 per cent of this is taxable. Obviously, careful records are needed to keep track of all the dates and values in order to correctly calculate any resultant tax liabilities.

Mining and staking income

Income received from mining or staking of cryptocurrencies will relate to operating income and hence will be fully taxable. This means that an investor and firms engaged in this have to maintain adequate books and records that account for income and expenses from such activities so that taxes can be computed accurately.

Tax Planning and Accounting

Proper tax planning and accounting are required for any optimization of tax liabilities. Specialized cryptocurrency accounting software will aid in proper tracking of the value of the transaction; with the correct preparation of certain documentation, a tax return can be constituted.

Challenges and recommendations

While Canadian legislation provides a general framework on the taxation of cryptocurrencies, this fast-evolving market and technology come with some headaches. It is highly advisable that careful records of all cryptocurrency transactions be kept and tax professionals be consulted from time to time in order to be fully compliant with current tax requirements and avoid potential penalties due to incorrect reporting or payment of taxes.

Reporting of foreign assets

Where the cryptocurrencies are held on foreign exchanges, or in foreign wallets, Canadian residents whose foreign property has a total value of more than CAD$100,000 at any time in a year may have to report such property on Form T1135, Foreign Income Verification Statement. This is where proper consideration for location and valuation of one’s cryptocurrency assets come into play.

Payment of VAT and other taxes

Businesses using cryptocurrency for the supply of goods and services are required to treat VAT (GST/HST) in the same manner as other forms of payment. That means businesses would have to charge the proper tax rates and maintain records consistent with Canadian tax laws.

Legislative changes

Tax legislation will continue to evolve, but perhaps nowhere more so than in the cryptocurrency space where technology is moving quicker than the regulatory framework. It is crucial to stay abreast with the latest changes in legislation and regulatory practice as it develops, to ensure full compliance with tax obligations and reduce risk.

Taxation of cryptocurrencies in Canada is a multilayered challenge for investors and companies to not only be very informed about the tax rules but also to maintain strict accounting and reporting. Effective tax planning and tax discipline form an important ingredient in tax minimization and avoidance of potential penalties. Moreover, with the continuous regulatory change and volatility that characterizes the cryptocurrency market, consultations with qualified professionals – tax professionals and attorneys – can quite regularly provide that support one needs to wade through the complexities of tax planning and compliance.

Negotiating the Regulatory Environment: How to Obtain a Crypto Exchange License in Canada, 2025

As Canada boasts a stable economy and open regulatory policies, it is rapidly becoming the destination of choice for cryptocurrency businesses seeking to expand their operations. Below, readers will find an in-depth guide on how to obtain a crypto exchange license in Canada: what one needs to know in terms of regulatory requirements and advantages sought through licensure in this progressive jurisdiction.

Regulatory Framework of Crypto Exchanges in Canada

The primary regulatory body for crypto exchanges within the Canadian region is the Canadian Securities Administrators or CSA, and these are regulated by FINTRAC – mainly those issues that revolve around AML/CFT. With the revised PCMLTFA, crypto exchanges are required to register themselves as Money Service Businesses (MSB) and report and maintain records essentially required for purposes of Anti-Money Laundering and Counter-Terrorism Financing.

Types of Crypto License in Canada

Canada issues several licenses depending on what exactly the crypto business provides:

- Crypto exchange license in Canada: gives the right to execute trades between cryptocurrencies and also between a cryptocurrency and fiat.

- Crypto broker license in Canada: provides for acting as an intermediary in cryptocurrency deals.

- Crypto trading license in Canada: meant for an entity that directly buys and sells cryptocurrencies.

- VASP crypto license in Canada: In cases where the service providers will be able to offer a larger variety of services dealing with virtual assets.

Crypto Licence Application Process

The crypto licence application process in Canada follows a thorough provision of documents that will prove the prospecting agency’s compliance with the regulatory requirements on operational readiness, security measures, and commitment to the assurances of financial regulations. The application process is actually very strict; only those companies with staunch operational frameworks are approved.

Crypto License Cost in Canada

The strong crypto exchange license cost in Canada varies depending on the scope of operations and the specific regulatory requirements that the business needs to comply with. It is very important for businesses to budget not only the application process itself but also for the ongoing compliance costs needed in order to keep the license valid.

Crypto License Benefits in Canada

Having a Canadian crypto license brings several advantages: the ability to reach a vast and growing marketplace, the credibility effect among clients/investors, and assurance in case being in a sound regulatory environment is recognized worldwide. Businesses may face complications related to the complexity of the compliance requirements and the dynamic nature of international crypto regulations. However, with sufficient preparation and professional support, these complications can be successfully overcome.

Market Opportunities in Canada

The environment and politics have proven technologically friendly, making Canada an excellent opportunity for crypto businesses. While not offering the arguably cheapest crypto license in Canada, operating from such a respectable jurisdiction can often yield significant strategic advantages in return on investment.

As the world’s interest in cryptocurrencies increases by the day, Canada continues to be one of the best jurisdictions for a business to seek operation in a regulated framework. Owning a crypto exchange license in Canada means fulfilling part of the most stringent financial laws in the world; it is also a step towards successful business implementation in the ever-booming Canadian and world cryptocurrency markets.

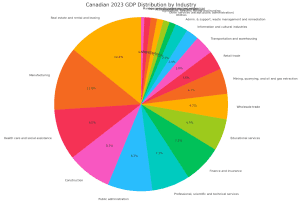

Canada’s GDP distribution in 2023

Canada crypto license 2025

Some of these jurisdictional limitations arise from the fact that the regulation of cryptocurrency in Canada is done at various levels of government and administrative management, depending on the particulars of the activity. Nevertheless, Canadian regulators are continuing to pursue a very transparent and innovative approach to regulation, exemplified, among other things, by the approval of cryptocurrency ETFs, the establishment of pragmatic legislation at the provincial securities market regulation level regarding oversight and compliance. What’s more, the cryptocurrency market in Canada appears to enter a new phase of maturity, supported by the strengthening of a legal framework and more consistent enforcement, coupled with decreased volatility that contributes to institutional investor interest in this asset class.

In January 2025, the CSA published a draft amendment to National Instrument 81-102 “Investment Funds,” adding further stringency to the conditions under which investment funds gain exposure to crypto assets. Provided the proposed changes are enacted, access to crypto assets would be provided only to alternative mutual funds and non-redeemable investment funds. In addition, amendments are proposed that will ban the use of crypto assets with derivatives and securities lending and REPOs. There are also proposed enhancements to the custody conditions regarding crypto assets, further reinforcing the current regulatory and controlling measures for the activity of funds in this market segment.

No single federal legislative framework regulates the securities market in Canada because each province has different autonomy in this respect and therefore has its own regulator enacting province-specific legislation. Nevertheless, the Canadian Securities Commission is taken as the coordinating or umbrella regulator and involves all the provincial securities commissions within its orbit. One of the most critical jobs of CSA is to carry on harmonizing the regulatory framework in securities at the national level. For example, the AMF in Quebec, and the Ontario Securities Commission, among others, are to follow notices provided by the CSA, and regulatory programs with respect to crypto assets, unless otherwise stated.

Crypto assets, such as Bitcoin, Ethereum, and Tether, are digital assets that are created using distributed ledger technology or blockchain. By this very technology, it does not suggest anything about the presence of a central managing body; hence, governance is carried out by users via decentralized cryptographic consensus mechanisms. Their functional features, structure, ways of governance, and legal aspects depend on the concrete crypto products. In view of the increasingly widespread trading of established crypto-assets, as well as the creation of new forms of such assets, and also in light of increased regulatory focus by securities market regulators, the legal categorization of crypto-assets is both a current and an important topic.

Over the years, due to the increased attention towards blockchain technologies and cryptocurrencies, Canadian regulators have attempted actively to keep abreast of events in adopting and elaborating legal frameworks with the management of this rapidly growing sector. The CSA has prepared a package of guidelines and recommendations along with other regulatory bodies addressed to market participants, which only testifies to the commitment of Canada to establishing a transparent and efficient regulatory regime.

Cryptocurrency regulation in Canada is mostly at the provincial level, where regulations of securities and derivatives require market players to follow rules laid down at the federal and the provincial levels. Moreover, the regulation of cryptocurrencies considers prospectuses, the registration of dealers, anti-money laundering, and antitrust measures.

Also, the distribution and sale of cryptocurrencies are regulated in Canada. The law provides for a private placement of digital assets without obligatory prospectus registration, opening additional possibilities for both investors and issuers. In its turn, this fact contributes to the active development of crypto funds and crypto asset ETFs, confirming the growing interest in this segment of the Canadian financial market.

Where tax is concerned, cryptocurrencies are treated by Canadian taxation authorities as commodities rather than normal currencies. So, every transaction made with the use of cryptocurrency is to be taxed in accordance with the nature of the transaction, whether it be income and/or capital gains and losses. One very important feature here is keeping and submitting records of all the transactions in cryptocurrencies that are called for when reporting your taxes.