Australia Crypto License 2026

Australia is in the first echelons in the crypto-licensing process, creating an unequivocal and organized legal framework for companies operating with digital assets. The main goals of licensing cryptocurrency in Australia are consumer protection, stability of the financial system, and reduction of money-laundering and terrorist financing risks. In this article, we touch on the main moments of obtaining a cryptocurrency license in Australia, which any entrepreneur desiring to enter the digital asset market of Australia should be aware of.

Understanding of Regulatory Requirements

It is highly advisable to give serious considerations first and foremost to the requirements brought about by the regulators, such as the ASIC amongst others, before undertaking the licensing process. In Australia, activities related to cryptocurrency are likely to fall under the application of the Financial Services Law, Anti-Money Laundering and Counter-Terrorist Financing Law among others.

Registration as a digital currency exchange service provider

One of the major steps toward compliance is registration with the Australian Financial Transaction Tracking and Analysis Reporting Commission (AUSTRAC) as a digital currency exchange service provider. The requirement applies to companies that provide cryptocurrency transactions. For a definition, this may include, amongst others, the provision of exchanging cryptocurrencies to and from fiat money and the provision of exchanging one cryptocurrency for another.

Preparing for licensing

The requirements that must be met for successful licensing include, inter alia:

- Appropriate systems and procedures to control AML/CTF risk.

- Management personnel that are reliable and have a good business reputation.

- Sufficient financial resources to support viable business operations.

- Safeguarding the assets of the clients.

Submission of application and documentation

In so far as your company has prepared your business for regulatory compliance, you are under the obligation to lodge an application with AUSTRAC and ASIC. The application process requires your company to attach all relevant documentation in support of your company’s compliance.

Application process

Upon receipt of the application, it will be comprehensively reviewed by the regulators with regard to the content and documentation. This may also be followed up by further requests for information, meetings with representatives of the firm concerned and sometimes on-site inspections. The length of time required to review an application will depend upon the complexity of the case, as well as the workload of the regulator at the time.

Licensee And Post-Licensee Period

The outcome of a successful application would mean the licensing of the firm to conduct activities related to cryptocurrency. Licensure, of course, does not imply an end to oversight by regulators. The company will have to continue being in compliance with the requirements of regulators: for example, filing regular reports and keeping to AML/CTF regulations.

Obtaining a cryptocurrency license in Australia requires serious preparation, taking into account careful attention to regulatory requirements. Such a step is at the heart of any company’s strategy that wants to operate within the law and protect customers. Success heavily depends on the quality of prior preparation and the capability of a company to prove that it meets high standards of regulation and risk management.

Crypto Company Incorporation in Australia

With its progressive approach to the regulation of cryptocurrencies and blockchain, Australia has become one of the favored destinations for entrepreneurs in digital assets. Establishing a cryptocurrency company in Australia begins with understanding and meeting the legal requirements set forth by local regulators. The simple step-by-step guide through registration below underlines key aspects and steps in the process of registering a cryptocurrency company in Australia.

Steps to Follow for Establishing a Cryptocurrency Company in Australia

| Step | Details |

|---|---|

| Form of Business Structure | The individual needs to determine the type of business to open. Options include sole proprietorship, partnership, company (Pty Ltd.), and trust. A company is recommended for cryptocurrency businesses as it offers limited liability and room for growth or investment. |

| Registering the company name | Choose a unique company name and register it with the Australian Securities and Investments Commission. Ensure the name meets all criteria set by ASIC before registration. |

| Register for an Australian Business Number (ABN) and register with ASIC | To operate in Australia, register for an ABN via the Australian Business Register website. After obtaining an ABN, register with ASIC by filing the required forms and paying the registration fee. ASIC will issue an ACN (Australian Company Number) upon successful registration. |

| Opening a bank account and setting up the accounting system | Open a corporate bank account to separate business and personal funds. Choose a bank that caters to cryptocurrency businesses and set up an accounting system for managing income, expenses, and tax liabilities. |

| AML/CTF Compliance | Register with AUSTRAC and establish Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) policies. Implement internal compliance programs and conduct customer due diligence. |

| Create a privacy and data protection policy | Adopt a privacy and data protection policy based on Australian legislation. This is crucial for building customer trust and ensuring legal compliance. |

Setting up a cryptocurrency company in Australia involves two main aspects: careful planning and attention to local legislation and regulatory requirements. The above steps will definitely ensure that your business gets off on the right foot in this dynamic and regulated environment. Keep in mind that it’s worth keeping pace with legal and financial consultants who are able to support your firm in achieving all current requirements and best practices.

Australia

Capital |

Population |

Currency |

GDP |

| Canberra | 27,117,800 | Australian dollar ($) (AUD) | $64,674 |

Crypto legislation in Australia

Australia is one of the world leaders in the adoption and regulation of cryptocurrencies and blockchain technology. The Australian government and regulators work proactively to provide a regular, very friendly legal environment for innovative technologies, including digital assets. In the article, we will consider the main aspects of Australia’s legislation that regulates the cryptocurrency market and its influence on business.

Key Regulatory Authorities

ASIC is the main regulator of Australia’s financial markets. It is tasked with the responsibility of making sure that financial services include coverage of financial markets, including cryptocurrency products and services. AUSTRAC is the AML/CFT regulator of the Australian Financial sector, which also covers cryptocurrency transactions.

Legislative framework

In 2017, Australia introduced several legislative changes to the Act to regulate cryptocurrency exchanges. Since that time, all operators providing services that convert cryptocurrencies to and from fiat money have been required to register with AUSTRAC and comply with all the requirements of AML and CFT. Such a move was an important step toward legalizing the cryptocurrency industry within the country and making digital asset transactions transparent.

Consumer protection

ASIC is active in ensuring consumer protection in cryptocurrency investments. The agency regularly warns and advises investors about the possible risks of investing in cryptocurrencies and initial coin offers. The regulator also attracts attention to compliance by companies with legislation regarding financial services and products.

Taxation of cryptocurrencies

In this respect, the Australian Taxation Office (ATO) classified digital currencies as properties. Consequently, cryptocurrency transactions are to be dutied. Their investors and players must declare income in tax return documents from virtual currency trading. The ATO monitors such tax law obligations by players in the cryptocurrency market.

The future of regulation

The Australian government has furthered improving the legislative framework in regard to cryptocurrency and blockchain technology, building upon its regulatory work. Any future regulation should foster innovation and further technology development while maintaining investor protection and financial system stability.

It concentrates on novel technologies development in a friendly atmosphere, at the same time providing high standards of consumer protection and holding financial stability. As for those cryptocurrency entrepreneurs and investors operating businesses in Australia, they should research not only local laws but also the required regulatory framework this country demands. Since its legislation is in constant improvement, that requires updates in knowledge and adapting strategies to correspond with any novel rule or regulation.

Crypto exchange license Australia

During the last years, Australia has been one of the most popular countries where the cryptocurrency segment has gained great development and actively created a legal framework for the regulation of digital assets. Among such regulative actions, one should point out the licensure of cryptocurrency exchange by authorities with the aim of bringing transparency to its activities and protection for investors. The following article will provide insight into how to obtain a license for a cryptocurrency exchange in Australia and outline the main actions and requirements.

| Step | Details |

|---|---|

| It’s about the regulatory environment | The first thing that an entrepreneur from any other jurisdiction needs to understand is local legislation and regulatory requirements even before trying to start a cryptocurrency exchange in Australia. The main regulators in this sphere are the Australian Securities and Investments Commission responsible for financial supervision, and the Australian Financial Transactions Tracking and Analysis Reporting Commission responsible for AML/CTF. |

| Registering and getting an ABN | The next step towards commencing your exchange operation in Australia is registration and the procurement of an Australian Business Number. This will involve determining what legal form the business will take, making the appropriate application before the ASIC, and getting the necessary documents of registration. |

| Registration with AUSTRAC | Next in line will be the registration of your cryptocurrency exchange with AUSTRAC as a digital currency exchange provider, including all sorts of detailed business information such as owners, managers, and descriptions of internal AML/CTF procedures. |

| Draft AML/CTF policies | One of the main preconditions for granting such a license to operate a Virtual Currency Exchange in Australia is designing and implementing effective policies and procedures for anti-money laundering and counter-terrorist financing. This means procedures of customer identification, monitoring of transactions, and reporting suspicious activity, including those connected with terrorism. |

| Technical and operational infrastructure | Besides, successful licensing requires high-level technical and operational security for further operations: developing a reliable trading platform, providing the secure storage of cryptocurrencies, protection of users’ data, etc. |

| Application Submission for Licensing | With all of these in place, you will be in a position to apply for licenses with ASIC. This may involve the actual submission of any number of documents that prove your exchange will meet certain standards or some form of an inspection process. |

The road to getting a cryptocurrency exchange license in Australia is one that calls for foresight and the need to cross numerous regulatory hurdles. The accessing of a license opens access not only to one of the most innovative and highly developed markets but brings an increase in user and investor confidence for your platform. Note that legal and regulatory compliance isn’t a line but rather a process, where maintenance requires being up-to-date regularly with new knowledge and its further adaptation to business processes.

Crypto trading license Australia

On the whole, Australia, which considers cryptocurrencies as some kind of new financial asset, does not waste time trying to create an enabling environment for the further development of the cryptocurrency market. In this respect, the regulation of crypto trading in the country has focused on investor protection and the transparency of transactions, making obtaining a cryptocurrency trading license a major step in business operation. In this article, we touch on the highlights of the process of getting a cryptocurrency trading license in Australia, indicate main steps, and provide some practical recommendations.

Analysing the Regulatory Landscape

Needless to say, the very foundation of the commencement of the licensing process would involve a thorough review of the regulatory requirements of both the ASIC and AUSTRAC. This will give an overview of the duties and responsibilities that are placed on licensed cryptocurrency exchanges and services.

Company Registration and Application for an ABN

A cryptocurrency business can be started in Australia by registering the company and obtaining an ABN through the selection of the appropriate legal structure for your business and registering it as such under the corporate law of Australia.

Registration with AUSTRAC

In other words, all cryptocurrency trading operators have to be registered as digital currency exchange providers with AUSTRAC. This is one step closer to strengthening AML/CFT measures along with regulatory compliances.

AML/CFT policy development and implementation

To obtain a license for cryptocurrency trading, one of the essential requirements is the proper development of an AML/CFT policy. This comprises drafting procedures regarding customer identifications, monitoring transactions, and reporting suspicious ones.

Technical training and safety

This means that license obtaining and subsequent operation concerning technical security issues of the trading platform is of especial importance. Core protection of customers’ data, safe storage of cryptocurrencies, and prevention of unauthorized access to the systems are at the core. Further additional requirements and prohibition rules concerning MiFIR – many of them addressing the issues related to high-frequency algorithmic trading.

Application for licence – submitting

Once the prerequisites are satisfied, the licensee might apply to ASIC for licensing. The preparation and lodgment of all the relevant documents with regard to compliance in business should be carefully done.

The application process for a license to trade in cryptocurrencies in Australia has to be meticulously carried out with much attention to regulatory demands, and most importantly, security is of high importance. In turn, successful licensing opens up one of the most dynamically developing markets and creates confidence in your platform on the part of customers. It is also worth mentioning that during the whole licensing process, it is highly advisable to cooperate closely with all kinds of legal and financial advisors who are experts in regulating this very kind of cryptocurrency. This will be just for ensuring that your business is fully compliant with Australian law.

How to get a crypto license in Australia?

Australia is actively developing the segment of digital finance, including cryptocurrencies, which creates a favorable environment for its further growth and development of innovation. Getting a cryptocurrency license is the most important step any entrepreneur wants to take within the frame of legislation in this segment in Australia. In this article, we give a step-by-step description of how to get the respective license, focusing on the most important aspects and demands of the process.

| Step | Details |

|---|---|

| Checking the Business Model and its Compliance with Cryptocurrency Legislation in Australia | Before the application is filed, it is an appropriate moment to take a closer look at the business model and check its compliance with the Cryptocurrency legislation of Australia; thus, all the regulatory requirements by the Australian Securities and Investments Commission (ASIC) and the Australian Financial Transaction Tracking and Analysis Reporting Commission (AUSTRAC), anti-money laundering law, and counter-terrorist financing are observed. |

| Business Registration and ABN | You will be obliged to register your business in Australia and get an Australian Business Number. These are the very first steps toward conducting any kind of business in the country, and crypto-related activities are no exception. |

| Registration with AUSTRAC | In Australia, all the crypto trading companies must register with AUSTRAC as providers of digital currency exchange services. This is also counted in the list of compliance requirements under AML/CFT law. To be more precise, the registration includes providing your business details ownership and management structure and a description of your internal AML/CFT procedures. |

| Develop and implement AML/CFT policies | Implementing policies and procedures that fulfill the requirements of AUSTRAC in matters concerning AML/CFT, including customer identification, transaction monitoring, and training of staff. |

| ASIC Application (where applicable) | Depending on your business, you may need to have an AFSL from ASIC. In summary, this would apply to firms who provide a broader array of financial services in connection with cryptocurrencies such as third-party trading and managing a portfolio of investments. |

| Ongoing compliance with regulatory requirements | The license is just the beginning of becoming a regulated cryptocurrency business in Australia; it will be important to ensure that there is ongoing compliance with all regulatory requirements that include report filings with AUSTRAC, adherence to AML/CFT policy, and any ASIC-specific requirements. |

Obtaining a cryptocurrency license in Australia requires careful preparation and attention to detail at every stage of the process. Compliance with regulatory requirements and operations are not only decisive for the successful obtaining of such a license but also for the long-term success of your business in the market. Consultation with legal and financial experts allows constant confirmation that everything is performed in compliance with applicable laws and regulations.

Perks of the Australia license

Australia, with its developed financial market and friendly legal climate, is one of the most attractive states where a cryptocurrency company can obtain a license to conduct relevant activity. Recently, the cryptocurrency regulation of Australia has become more systematic and this fact has contributed much to the rapid development and growth of the whole industry. So, below are the basic advantages of the cryptocurrency license in Australia:

Building customer confidence

One of the greatest crypto license advantages in Australia is that this builds trust with customers and investors. In other words, a license is some sort of proof that a company works under the conditions of local regulations and legislation, which makes it more credible and transparent in front of clients.

Legal clarity and stability

Australian regulators, such as ASIC, have put in place clear guidelines and requirements concerning cryptocurrency transactions. This legally clears the air of uncertainty and provides some degree of stability in terms of business operations for companies to reduce risks associated with regulatory uncertainty.

Access to banking services

Companies with a cryptocurrency licence issued in Australia have much better access to banking and various other financial services. Most banks, and a number of other financial institutions view a licensed company in a better light; therefore, opening bank accounts, securing loans, or simply performing various banking activities becomes so much easier.

International expansion opportunities

A license acquired from Australia can act as a good stepping stone to enter the international market. The regulators here cooperate with many other countries in the financial regulation sphere; hence, obtaining other licenses and conducting business operations in those jurisdictions is relatively easy.

Progressively sufficient legislation

Australia is proceeding with progressive and innovative cryptocurrency and blockchain legislation. This, in turn, provides a good environment for the development of new technologies and offerings, opening new opportunities for companies holding a virtual currency license.

Transparency and accountability

The regulation in Australia in terms of cryptocurrency transactions is so designed that a lot of transparency and accountability are preserved. Stringent reporting and monitoring with respect to transactions have to be followed by organizations, and this itself removes the chances of fraud and increases trust amongst users.

The Australian cryptocurrency license has multiple advantages, ranging from customer trust to legal certainty, better access to banking services, and international expansion. Overall, this makes Australia one of the most attractive locations for cryptocurrency companies willing to scale up and develop their international businesses.

Crypto license benefits in Australia

Australia is positioning itself as one of the leaders in cryptocurrency innovation in the world, offering a friendly environment and progressive regulation for cryptocurrency companies. Though an Australian cryptocurrency license may be hard to get, it provides several important advantages to businesses, which smooths its path toward sustainable growth and expansion on a global scale. This article will outline the key advantages that an Australia Cryptocurrency Licence offers to companies operating in this innovative field.

- Confidence to consumers and investors: In an environment where cryptocurrencies and blockchain projects need to establish trust with consumers and investors, an Australian cryptocurrency license serves as a seal of approval and an indicator of reliability and transparency for both customers and investors. It is a signal that this company adheres to the highest standards in terms of security, anti-fraud, and financial responsibility that are set forth by Australian regulators.

- Legal certainty and regulatory support: Obtaining a license means the clear understanding of the market rules for a company reduces legal risks and provides stability for long-term planning. The Australian Securities and Investments Commission, as a regulatory body in Australia, guides and supports licensed companies very comprehensively and helps to build up a healthy and competitive cryptocurrency ecosystem.

- Access to financial and banking services: Most of the companies with an Australian cryptocurrency license normally get easy banking and financial services in the region, a big advantage in the space where such access is fairly limited. This therefore would mean that operations can be simplified while capital management and operational efficiency is enhanced.

- Improved Global Scalability: With an Australia licence, expansion into other territories is a strong tool, as credibility and renown of a firm are raised, whereby the job of winning further licences in other territories would be much easier. To this end, having a licence in Australia offers strategic possibilities for companies seeking international development in many directions.

- More precisely, the Australian government and regulators actively promote innovation in fintech and cryptocurrency through considering opportunities for companies to develop and deploy their new technologies. Licensed organisations can be supported with their research and development and gain access to government funding programs.

- Transparency and compliance: The Australian licensing stipulates that cryptocurrency companies have to follow strict operations reporting with much transparency, coupled with sound financial reporting. This does not just deter financial crimes but also helps derive public confidence in cryptocurrency as a whole.

In a nutshell, an Australian cryptocurrency license opens the door to building trust, legal certainty, access to key financial services, global scaling opportunities, and active participation in the innovation ecosystem. All these factors combined provide a sound basis for growth and prosperity within the fast-developing industry of cryptocurrency.

Overview of Crypto Regulation in Australia

With its innovative approach to regulating FinTech, Australia is considered one of the leading nations that provide an enabling environment not only for both cryptocurrencies and blockchain technology but also for innovation in general. Over the past years, it has been capable of finding a very delicate balance between keeping pace with innovation and guarding the interests of investors while making sure the integrity of the financial markets is upheld. Below is a summary of some key issues related to cryptocurrency regulation in Australia, including key regulatory bodies, legislation, and licensing and compliance approaches.

Regulatory bodies and legislative initiatives

According to the material, the main regulator involved in regulating the cryptocurrency industry is the Australian Securities and Investments Commission-ASIC. It enforces corporate, market, and financial services legislation supposed to protect the investors, lenders, and consumers of Australia. Besides ASIC, another important regulator is the Australian Anti-Money Laundering and Terrorist Financing Authority, or in short, AUSTRAC. It requires that cryptocurrency exchange platforms and cryptocurrency custody providers register to comply with anti-money laundering and terrorist financing regulation.

Digital Currencies Law

The law that established the fundamental framework for regulating cryptocurrencies in Australia is the Digital Currencies Act 2017. It introduced the concept of registration and compliance required for exchanges dealing in cryptocurrencies. This would, in turn, allow AUSTRAC to monitor the transactions involving digital cryptocurrencies effectively to combat criminality and keep the market functioning within the rule of law.

Licensing and regulatory compliance

In Australia, cryptocurrency companies also fall under a number of different regulatory requirements involving licensing for certain activities. For example, any company engaged in the provision of investment advice regarding cryptocurrency or managing an investment portfolio with regard to the same should obtain an Australian Financial Services License. Furthermore, all licensed market participants will be required to follow strict Know Your Customer requirements and anti-money laundering legislation with the filing of regular reports to regulators.

Innovation and progressiveness

The country is also working on fostering innovation in fintech and cryptocurrencies—from establishing a regulatory sandbox that enables innovative fintech projects to “test their ideas in a controlled environment with the least possible regulatory burden” to fostering innovative solutions and technologies while maintaining consumer protection and the stability of the financial system.

The regulation of cryptocurrency in Australia strikes a balance between allowing innovation and protecting investors, while ensuring financial market integrity. Taken together, a progressive approach to licensing and compliance, with strong support for regulatory innovation, an environment supportive of cryptocurrency companies and their underlying technologies is created. Meanwhile, the Australian regulator continues to work on updating its regulation to include the constantly evolving landscape of digital finance and to solidify its status as an international leader when it comes to fintech and cryptocurrencies.

Australia – main information

| Parameter | Information |

| The five biggest cities | Sydney

Melbourne Brisbane Perth Adelaide |

| State language | English |

| Time zone | Australia is divided into several time zones, including:

AEST (UTC+10) ACST (UTC+9:30) AWST (UTC+8) |

| Calling code | +61 |

| Domain zone | .au |

Crypto License Application Types in Australia

In Australia, which features one of the most developed and innovative financial markets in the world, clear and progressive regulations have placed the cryptocurrency industry at the forefront. Due to the possibilities of the Australian market for different cryptocurrency businesses, each of those comes under a specific license type, therefore also corresponding to particular services being offered by the company. Below is an overview of the different cryptocurrency licence applications available within Australia, focusing on their special requirements and objectives.

Financial Services Licence (AFSL)

A license to deal in financial services is required for those firms operating financial products or services, such as providing investment advice, managing investment portfolios, and trading. This would cover a great raft of activities in the cryptocurrency space, from managing investment portfolios to providing cryptocurrency investment advice. To obtain an AFSL, firms must demonstrate that they can meet rigorous regulatory standards and obligations, including capital requirements, risk management procedures, and corporate governance.

Registration with AUSTRAC as a provider of cryptocurrency exchange services

In Australia, all businesses that deal in the trade of cryptocurrency to fiat and vice versa, or in one form of cryptocurrency to another, will have to register with AUSTRAC, the Australian Anti-Money Laundering and Terrorist Financing Authority. Such a registration imposes obligations regarding AML and CTF, and importantly, KYC. This would offer the necessary immunity against the potential criminal uses of cryptocurrencies, while at the same time ensuring safety and transparency of transactions.

Licence for operations with payment systems

Businesses offering services related to payment systems in the field of cryptocurrency, like cryptocurrency wallets and payment gateways, might be licensed for only these services. Such licenses ensure that the payment services will conform to the national standards of safety and efficiency, and in turn provide sufficient protection for the customers.

Licenses for blockchain technology providers

While blockchain technology providers that are not directly involved in financial services do not need to hold an AFSL, they risk falling within the need for another form of regulatory approval depending on the specific facts of their business model. For example, blockchain platform developers whose platforms allow for tokenized assets or for the creation of smart contracts representing a financial interest in a transaction will need to consider the regulatory implications of providing such services.

For any cryptocurrency company looking to set up business in Australia, understanding the types of licenses and regulatory requirements is basic for successful adaptation and growth in that country. With its progressive regulation clear, Australia provides a very good environment for innovation and growth within the industry of cryptocurrency, at the same time protecting investors and ensuring the integrity of the financial system. Those who stay up to speed with developments and proactively engage with regulators will be in the best position to capitalize on the opportunities presented by the Australian marketplace.

How to obtain a crypto license in Australia?

Obtaining a cryptocurrency license in Australia represents an essential step in any company’s development which wants to realize its activity legally within the frame of this dynamic developing market. The procedure for obtaining a license requires serious knowledge of all regulatory requirements and obligations, which are needed to be clearly followed. This article will develop the topic regarding a step-by-step guide to obtain a cryptocurrency license in Australia according to regulations and requirements from Australian regulators.

| Step | Details |

|---|---|

| Identifying the type of licence required | First, you need to understand what license your business has to obtain. This may be an Australian financial services license, depending on the type of services provided, or AUSTRAC registration if you provide cryptocurrency exchange services, or other licensing in respect of payment systems or blockchain technology. |

| Preparation of documents | Set up the documentation required for such registration, which usually includes a business plan, risk management policy and procedure, proof of KYC and AML, and information on key people in your company. All documentation should be complete and fully representative of the capability of your business to follow regulatory and operational expectations. |

| Application submission | Once these steps have been concluded and all the relevant documents are ready, a license application will be sent to the competent regulator. In the case of the AFSL, this would be the Australian Securities and Investments Commission (ASIC), and for the registration as a cryptocurrency exchange service provider, this will be the Australian Office of Anti-Money Laundering and Counter-Terrorist Financing (AUSTRAC). The application form should be fully and correctly filled out to avoid delays in the process. |

| Interaction with Regulators | Be promptly prepared for active interaction with regulators through and after filing by supplementing additional information and explanation of documents submitted, as well as being prepared for regulatory reviews and assessments. Efficient review will be made possible by active and open co-operation with the regulators. |

| Respecting ongoing commitments | Getting the license is only the beginning; to keep itself at par as a licensed cryptocurrency market participant, your company needs to be in a position of perpetual compliance with the regulatory requirements of updating policies and procedures, regular reporting, and AML/KYC compliance. |

Acquiring a license for cryptocurrency in Australia involves careful planning, preparation, and also engagement with regulators. Actually knowing the steps involved and their requirements is quite crucial in being able to negotiate through it. In this regard, by being committed to high standards of operational and regulatory compliance, the path opens up toward not only the successful licensure but even laying down a bedrock foundation for long-term success and growth in the country’s cryptocurrency industry.

Types of crypto licenses in Australia

In Australia’s regulatory landscape, therefore, there is a rather comprehensive license and registration package for these service providers whereby their respective cryptocurrency transactions could come in line with certain established standards of safety, transparency, and accountability. Such licenses and registrations preside over such areas as exchanges, financial services, and even the managing of payment and custody services. The following article delineates the key types of cryptocurrency licenses existing in Australia, pointing out their main characteristics and application in business practice.

Registration in AUSTRAC

It requires all cryptocurrency exchange platforms to register themselves as digital currency exchange providers. This is to stop the misuse of cryptocurrencies in money laundering and terrorist financing, where companies are required to strictly follow procedures on matters concerning KYC and AML.

Financial Services License (AFSL)

The Australian Securities and Investments Commission grants an Australian Financial Services Licence to companies trading financial services, the provision of cryptocurrency investment advice, investment portfolio management, and cryptocurrency derivatives transactions. With the obtaining of AFSL, the clients and investors can be confident that the company is meeting the high standards in terms of regulation and professionalism.

License for systems of payment services

Companies offering different payment methods, such as cryptocurrency wallets or payment gateways, may be required to acquire a license for the provision of payment services systems. This license regulates the facilitation of payment services in order to achieve a stable, effective, and secure system of payments; one that offers protection to the users and also guarantees compliance with the requirements of regulations.

Registration of cryptocurrency storage service providers

While Australia does not yet have a special license for cryptocurrency storage service providers, such as cryptocurrency wallets, such companies must register with AUSTRAC and implement the AML and KYC procedures. The more the cryptocurrency market develops, the more regulatory requirements are expected to change accordingly.

The Australian regulatory environment is favorable to the industry of cryptocurrency, while it also takes care of the interests of consumers and the integrity of the financial system. Understanding and compliance with the different licence types are critical success factors for companies which want to grow their cryptocurrency businesses in Australia. This means that with appropriate training and the engagement of regulators, they will be in the best position to capitalize on the opportunities this vast market has to offer and take further growth and innovation in such a vibrant industry.

Steps to start a crypto business in Australia

Opening a cryptocurrency business in Australia is a serious task that requires a lot of preparation and strict adherence to regulating authorities’ demands. The Australian financial market opens up certain opportunities with its high level of innovation and progressive regulation for cryptocurrency entrepreneurs. Thus, here are the steps you will have to make for opening your cryptocurrency business in Australia, considering business language and with a focus on regulatory compliance.

| Step | Details |

|---|---|

| Defining the Business Model | Clearly articulate your business model. This could include a range of streams under cryptocurrency: exchange platforms, crypto wallets, consulting services, or even developing your own cryptocurrency through an ICO. You should know what services you provide and how this fits into the current regulatory environment in Australia. |

| Company registration | Once you have identified a business model, you then formally establish the company in the country. This includes naming your company and also the kind of legal form that the company would take, such as private company, partnership, amongst others, with ASIC being the registering body. Another important aspect is considering the regulatory requirements such as obtaining an AFSL license, being registered with AUSTRAC, and complying with KYC and Anti-Money Laundering laws. Weighing these requirements against risks will make your business legal and protect it from potential issues. |

| Formulate a Business Plan and Strategy | Develop a sound business plan and marketing strategy crucial for success. This should include market analysis, financial projections, growth strategies, and a risk management plan. The marketing strategy will guide you in attracting and retaining customers and competing in the marketplace. |

| Establish banking and payment solutions | Set up solid banking and payment solutions for your cryptocurrency business. Many banks and financial institutions in Australia are skeptical of cryptocurrencies, so finding the right partners that are open to doing business with cryptocurrency companies is essential. |

| Launch and marketing | After meeting all regulatory requirements, you can launch. This involves developing a website, platform, or app and executing your marketing strategy to attract your first customers. |

Setting up a cryptocurrency business in Australia involves serious planning and strict adherence to regulations. From understanding the market and developing your strategy to registering and licensing your company, each step plays a crucial role in your successful and workable business. It provides a progressive regulatory environment that fosters innovation and opens new opportunities for entrepreneurs to grow and develop their businesses in the cryptocurrency industry.

Procedures for Obtaining Crypto License in Australia

Obtaining a license for a cryptocurrency in Australia is a big milestone for each business that is willing to enter one of the most regulated and innovative financial markets of the world. This requires great understanding and clarity about the regulatory requirements and steps involved in obtaining a cryptocurrency license in Australia.

Identification of the Type of License Required

It includes determining the type of license that your cryptocurrency business requires, and these may include:

- AUSTRAC registration for exchange platforms and cryptocurrency storage service providers.

- A Financial Services Licence (AFSL) – if your company gives financial advice, manages investments, or provides other financial product transactions, then finding out the right type of license that will work for your business is very important. If not, the proposed business will not be able to fit well into this particular regulatory requirement.

Preparing documentation

Next, the preparation and compilation of basic documentation will be required for an application in the form of a business plan, detailed description of the services you provide, AML and KYC policies and procedures, information regarding key persons within your organization. Your documentation must, of course, give evidence of the ability of the business to fulfill all requirements laid down by legal and operational parameters.

Submission of Application

When the paperwork is ready, lodge an application for a licence with the relevant regulator. In the case of an AFSL, this would be ASIC, and in respect of an AUSTRAC registration, this would be directly to AUSTRAC. Make sure the application is full and complete, and that any information might be available in order to expedite processing.

The review process

Once the application is submitted, it is considered to have entered the review process where regulators may request more information or clarification of any part of the application. It is therefore relevant that response from you to any request by regulators should be prompt and complete so as to ensure that your application is processed as quickly as possible.

Meeting additional requirements

Depending on the nature of your business and the detail of the application, you will also need to satisfy any other requirements, which can be for staff training, putting in place internal systems and controls to maintain compliance, and procedures for the ongoing monitoring of activities.

Issuance of licence and compliance

Upon successfully completing the review process and meeting all the requirements, you will be granted a license for cryptocurrency. Remember, acquiring a license is not the last step because your business further needs to stay in compliance with all regulatory and operational requirements, undertake periodic audits, and reporting in pursuance of regulatory requirements.

The process of obtaining a cryptocurrency license in Australia is all about paying attention, planning carefully, and following strict adherence to regulatory preconditions. The positive conclusion to the whole process will provide legitimacy to one’s business, hence building trust in customers and investors on a solid foundation for long-term success and growth in the crypto market.

How to get a crypto trading licence in Australia

A license to trade cryptocurrencies in Australia is a giant stride toward legal activity for companies involved in the said trade. The Australian market is highly regulated and thus transparent, providing a very stable and secure environment where cryptocurrency trading can safely take place. In order for it to be licensed, strict adherence to the regulatory rules and regulations as dictated by the financial regulators in Australia must be followed.

| Step | Details |

|---|---|

| Determining the License Type | The first step is determining the type of license required. For most cryptocurrency-related activities, including virtual currency trading, the company must obtain an Australian Financial Services License (AFSL) provided by the Australian Securities and Investments Commission (ASIC). |

| Preparing to Apply for AFSL | Preparation involves creating a range of corporate policies and procedures that meet ASIC’s requirements. This includes risk management policies, anti-money laundering (AML) and know-your-customer (KYC) procedures, as well as internal control and audit systems. |

| Making the Application | All necessary documents, such as business models, financial projections, key personnel details, and evidence of capability to meet licensing obligations, should be collated and submitted along with the AFSL application to ASIC. |

| ASIC Application Requests | ASIC may request additional information or clarifications during the application review. Prompt and complete responses to these requests are crucial for a timely review and decision. |

| Assessment and Issue of the Licence | Once ASIC reviews the application and is satisfied that the company meets all the requirements, it will grant the AFSL. This license signifies the company’s commitment to the highest standards of regulation and investor protection. |

| Ongoing Compliance | After obtaining the AFSL, the company is required to maintain continuous compliance through internal controls, audits, and regular reporting. Failure to comply can result in the revocation of the license and other legal consequences. |

The path to getting a cryptocurrency trading license in Australia requires a lot of time and commitment on the applicant’s part. However, successful completion of this process not only entitles one to operate in one of the most innovative and developed financial markets around the globe but also serves as an indication of the commitment of the business to high standards of operation and customers. With the right approach and careful planning, your company will be able to successfully integrate into the Australian cryptocurrency ecosystem and further catalyze growth and innovation in this exciting industry.

Taxation of virtual currency companies in Australia

Over the years, cryptocurrencies have become an integral part of international economic processes, and this fact could not but raise the need for changing national tax systems in response to the new realities. Being one of the developed economies with an advanced financial sector, Australia is actively working on embedding cryptocurrencies into its taxation system, thus providing transparency and predictability for companies operating virtual currencies. Taxation of cryptocurrency firms in Australia is based on an inclusive approach that considers novelty factors affecting the industry.

Basics of Cryptocurrency Taxation in Australia

The Australian Taxation Office does not consider cryptocurrencies as currency for taxation purposes but rather views them as property. This, therefore, means that most of the transactions dealing with cryptocurrencies come under the general tax rules that relate to investments and trading transactions.

Income tax

In Australia, cryptocurrency companies follow corporate tax treatment, just like any other firm. It works out the profit or loss by deducting the cost of acquisition against the sales proceeds of the cryptocurrencies. The cost in the audited accounts must be expressed in AUD currency, for which conversion must be applied with the appropriate exchange rate at the date of each transaction.

Goods and Services Tax (GST)

Before 1 July 2017, GST was applied to the sale of cryptocurrency; thus, in effect, double taxation was applied. After that date, however, cryptocurrencies were exempted from the application of GST, thus ruling out double taxation and further fuelling the industry for virtual currency in the country.

Capital Gains Tax (CGT)

Most cryptocurrency transactions are considered to be capital asset transactions, and hence, within the ambit of capital gains tax. This would suggest that whenever any cryptocurrency is realized above the acquisition cost, thereby giving rise to a tax liability, records for all the transactions in question should be kept in a very careful manner in order to correctly establish the incidence of capital gains or losses.

For taxation reporting, the cryptocurrency enterprises should maintain appropriate books of account related to all cryptocurrency transactions. It would contain the date of transaction, type of cryptocurrency, amount received in AUD, purpose for which the cryptocurrency was acquired, and cost of acquisition or disposal. Annual tax returns should reflect all relevant income and expenses associated with cryptocurrency transactions.

Any taxation of cryptocurrency companies in Australia depends on a profound understanding of the applicable tax rules and obligations imposed on the company concerned. In truth, tax laws are usually complex and in a state of flux, and therefore qualified professionals in tax should be consulted to ensure full compliance and optimization of tax liabilities by the cryptocurrency company. Proper management in the taxation area for activities based on cryptocurrencies enables not only regulatory compliance but also contributes to business development in this growing industry.

Taxes in Australia

In Australia, tax rates depend on the type of business conducted and the amount of its annual turnover. Below is a table of the main tax rates for companies at the moment according to free information:

| Company type | Annual turnover | Tax rate |

| Small and medium-sized enterprises (SMEs) | Up to $50 million AUD | 25% |

| Other companies | Over $50 million AUD | 30% |

Additional Comments:

- Small and Medium Enterprises (SMEs): If the annual turnover for SMEs is less than A$50 million, then the corporate tax rate from 1 July 2021 is 25%.

- Other companies: The entities whose annual turnover is above A$50 million are taxed at the standard rate of 30 per cent.

- Investment companies: Rates can be different depending on the type of investment activities for which the company exists. It is always wise to consult a tax professional for accurate information relevant to your situation.

Crypto tax in Australia

Taxation of cryptocurrencies in Australia is one of the most important aspects of financial management for investors and companies dealing in digital assets. The ATO actively works to adapt guidelines and policies in the ever-evolving cryptocurrency landscape in pursuit of clarity and fairness in the taxation of new asset classes. From a business perspective, understanding the resulting tax liabilities from cryptocurrencies is crucial in ensuring compliance and optimizing tax exposures.

Classification of Cryptocurrency for Tax Purposes

The ATO views cryptocurrency more as a form of property than as currency in the traditional sense. Transitionally, most cryptocurrency transactions will be classified as capital asset transactions and attract capital gains tax (CGT). On the other hand, various uses of cryptocurrencies—for example, trading or providing payment against goods and services—can also impact their tax liabilities.

Capital Gains Tax (CGT)

Gains from the sale of a cryptocurrency for more than its purchase price represent taxable capital gains. Investors and companies alike are required to keep thorough records of when they bought and sold with clearly listed purchase prices, sale prices, and exchange rates at the time of transaction for proper calculations of gain or loss. There are some incentives available, such as capital gains allowance for long-term investments over 12 months.

Taxation of Trading Transactions

The income and expenses derived from and related to the transactions should be treated as ordinary income and business expenses to the companies vigorously trading in cryptocurrencies. Profits on cryptocurrency trading can be charged to corporate income tax at standard rates.

GST and Cryptocurrencies

From 1 July 2017, a cryptocurrency transaction treated as an exchange for goods and services is exempt from GST, ending the double taxation problem that had been an issue affecting cryptocurrency consumers in Australia.

Reporting and Compliance against Tax Liabilities

It is utterly important for companies to present correct and timely tax reporting which truly reflects all the cryptocurrency transactions. The use of professional accounting software and consultation with tax specialists can also help in managing tax liabilities and reducing risks.

The taxation of cryptocurrency in Australia requires business enterprises to have appropriate understanding and application of the underlying tax laws and regulations. Given the complexity and rapidly changing nature of cryptocurrency tax legislation, it is highly recommended that professional tax advice be sought by the businesses to ensure full compliance with the legislation and effective tax planning. Prudent approach to cryptocurrency taxation will not only reduce tax liabilities but also contribute to sustainable development of business in this new and exciting industry.

Navigating the Cryptocurrency Regulatory Landscape in Australia 2025: A Comprehensive Guide to Licensing

Australia lies at the heart of clear regulatory frameworks and is basically leading the charge toward cryptocurrency and blockchain technologies. This paper shows, in a step-by-step manner, how one gets a crypto exchange license in Australia, with a focus on regulatory compliance and strategic benefits in having a license from this jurisdiction.

Regulatory Framework for Crypto Exchanges in Australia

Such activities fall under the purview of two key agencies: the Australian Securities and Investments Commission and the Australian Transaction Reports and Analysis Centre. Australia has an approach that focuses on compliance with the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 to ensure the crypto business is conducted with integrity and accountability, in a transparent manner. In turn, this facilitates consumer protection and sustainability within the financial system.

Types of Crypto Licenses in Australia

Australia has different crypto licenses to suit the various functionalities characterizing the crypto world, and these are as follows:

- Crypto exchange license in Australia: This license will enable an operator to provide services whereby a user can exchange their crypto with any fiat currency.

- Crypto broker license in Australia: This license allows any business to become intermediaries in between buyers and sellers of cryptocurrencies.

- Crypto trading license in Australia: It is targeted at those firms that are into direct buying and selling of the digital asset.

- VASP crypto license in Australia: It refers to the license required by the virtual asset service providers whose operation covers a wide area.

Obtaining a crypto license in Australia follows a very extensive application procedure, including comprehensive business plans with proof of adequate security measures and compliance with AML/CTF laws. The applicants need to show the ability to mitigate risks associated with money laundering and terrorism financing. The process is so comprehensive; only capable businesses that conform to the law can operate.

Cost of Crypto Licensing in Australia

The cost of a crypto exchange license in Australia is quite significant, considering the completeness in the regulatory process. It is, therefore, of essence that a prospective licensee considers not only the initial application fees but also compliance costs that will come afterward. In this regard, the integrity of operations and perpetuation of such licensure depend on ongoing compliance.

Operating under an Australian crypto license offers a host of advantages, including access to one of the most sophisticated financial markets in the world, credibility with customers and investors, and the assurance that its activities follow internationally recognized regulatory standards. All this is priceless in building trust and paving the way for global partnerships.

Challenges in the Licensing Process

Applicants’ challenges include handling adverse regulatory regimes and the high benchmark of operational transparency that the Australian authorities will expect. With proper planning and expert guidance, however, these need not become intractable problems.

Market Opportunities in Australia

The crypto market in Australia offers immense growth opportunities, besides boasting a tech-savvy consumer base and a government embracing financial technology innovation. On the downside, though, it may not be the cheapest crypto license in Australia; however, these strategic benefits that one gets with this market assure huge business growth and success.

The landscape of cryptocurrency is ever-changing around the world. In this case, Australia has risen as a standard setter in regulatory excellence. Obtaining a crypto exchange license in Australia means guaranteed compliance not just with stringent financial regulation but also prepares businesses for an extended range of opportunities in the prosperous Australian and global markets for cryptocurrencies. Businesses can be successful in this promising sector through strategic planning and adherence to strict compliance.

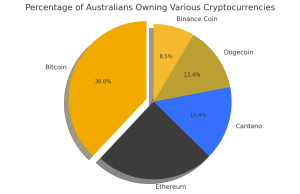

Percentage of Australians Owning Various Cryptocurrencies

Australia crypto license 2025

In Australia, the blockchain and cryptocurrency sector is experiencing active development, supported by the Commonwealth Government’s policy aimed at stimulating innovation in financial technologies. The regulatory environment in this area is evolving iteratively, being refined through a series of public consultations and government reviews covering cryptocurrencies, fintech, financial services, payment systems, and value storage regimes.

In 2022, the Australian Treasury initiated consultations on the development of a regulatory framework for secondary crypto asset service providers, proposing to adapt existing financial regulatory mechanisms to account for the specifics of crypto assets. However, the change in government led to the suspension of these initiatives and a shift towards new consultations, particularly focusing on token mapping.

On February 3, 2023, the Treasury published a consultation paper aimed at classifying the main activities and functions of crypto assets and their correlation with existing regulatory frameworks.

On March 29, 2023, opposition senator Andrew Bragg introduced the “Digital Assets Market Regulation Bill 2023,” which provides for the introduction of licensing for digital asset exchanges, custodial service providers, and stablecoin issuers, as well as disclosure obligations for central bank digital currency (CBDC) intermediaries in Australia. These measures aim to enhance market transparency and security, adapting the regulatory environment to the rapidly changing technological landscape.

On April 20, 2023, the Australian Attorney-General published proposals to reform the Anti-Money Laundering and Counter-Terrorism Financing Act 2006, proposing significant changes to the regulation of financial transactions in the context of terrorism and criminal activity threats. On May 2, 2025, second-round consultations were announced regarding these changes, underscoring the government’s ongoing interest in strengthening measures to combat illegal financial activity.

On June 7, 2023, the Treasury released a Strategic Plan for Reforming the Payment System, which includes updating the regulatory framework to improve operational efficiency and the security of payment processes. Within this context, two consultations were launched: the first aimed at modernizing the Payment Systems (Regulation) Act 1998, and the second at developing a new licensing system for payment service providers.

On October 11, 2023, as part of the mentioned strategic plan, a bill with an explanatory note for public discussion was introduced, proposing an extension of the scope of the Payment Systems Act and the introduction of new powers for the Minister.

On October 16, 2023, the Treasury began consultations on regulating the activities of digital asset intermediaries, requiring them to obtain an Australian financial services license and comply with enhanced regulatory requirements. The proposals are expected to become part of new legislation, which is set to be discussed in 2025.

On November 30, 2023, consultations were initiated on the introduction of mandatory industry codes for anti-fraud measures, focusing on the roles of the private sector, including banks and telecommunications companies, in strengthening security and transparency measures.

On December 8, 2023, the Treasury presented the second consultation paper on regulating payment service providers, proposing new requirements for prudential supervision, including obligations for large value storage entities and stablecoin issuers to ensure their obligations are backed by appropriate reserves.

This large-scale shift in regulatory policy has received support from key supervisory bodies, including the Australian Securities and Investments Commission (ASIC), which has intensified its efforts to ensure compliance with regulatory requirements in the cryptocurrency sector. The main focus is on combating unlicensed activities and behavior associated with risks to investors and consumers in the crypto industry. This course of action aligns with ASIC’s corporate plan for 2023–2027 and priorities for 2025, focusing on consumer protection and combating fraud. The adopted approach to regulation through enforcement underscores the need for legislative clarity.

On the other hand, the Reserve Bank of Australia (RBA), the country’s central bank, has not announced intentions to introduce retail CBDCs but is emphasizing the potential of wholesale CBDCs. Currently, the bank is conducting research with industry experts to assess potential use cases and economic benefits of CBDCs in Australia. These research efforts are synchronized with the Treasury’s initiatives to provide the RBA with expanded powers to regulate payment systems based on stablecoins, reflecting the country’s intention to integrate these digital assets into the core of its payment infrastructure.

Cryptocurrency regulation in Australia 2025

By 2025, Australia’s legal regulation of cryptocurrencies will be focused not so much on the nature of digital assets themselves, but on the operations involving them, including the processes of issuance and exchange, as well as activities related to cryptocurrencies. The Treasury, as the key regulatory body, continues to conduct consultations aimed at clarifying the characteristics of digital assets and adapting the regulatory frameworks for crypto asset service providers. This approach emphasizes risk management, focusing on centralized entities, while leaving aside issues related to individual assets or decentralized structures.

The Australian Securities and Investments Commission (ASIC) highlights that legislative obligations and regulatory requirements are technology-neutral and apply regardless of the technological platform used to provide regulated services. Despite the absence of specialized legislation directly addressing cryptocurrencies, these assets fall under the existing legal frameworks in accordance with Australian law.

ASIC’s regulatory guidance provides organizations with information on the legal status of crypto assets, describing how they are structured and what rights are attributed to them. This, in turn, defines the rules that companies must follow when working with these assets, contributing to the formation of a clear and consistent regulatory environment.

Cryptocurrencies classified as part of a collective investment product are recognized as financial products under the Corporations Act 2001. As such, they are subject to regulation under Australia’s established financial services regime. Additional details on the regulation of sales can be found in the relevant section.

In the field of lending, the activity related to cryptocurrencies is also expanding. In cases where this activity is covered by the National Consumer Credit Protection Act 2009, the relevant entities must have an Australian credit license or fall under exemptions from this requirement.

ASIC clarified its expectations regarding crypto assets included in the underlying assets of exchange-traded products and other investment products, as outlined in ASIC Information Sheet 230 (INFO 230). In this document, ASIC sets out requirements for market operators, retail fund operators, listing investment organizations, and holders of AFSL licenses working with crypto assets. Particular attention is given to the criteria for selecting crypto assets for investment products, including institutional investor support, the maturity of the spot market, and the regulation of derivative financial instruments related to crypto assets. As of October 2021, ASIC considered Bitcoin and Ether to meet these criteria. The document also provides recommendations on the storage of crypto assets and risk management systems.

Although Australia does not have specialized rules for blockchain or other distributed ledger technology (DLT), ASIC supports Information Sheet (INFO 219), which describes its approach to regulating DLT technologies. Companies using DLT to operate market infrastructure or provide financial or consumer credit services must comply with current licensing requirements and ensure adequate organizational and technological resources, as well as effective risk management. As DLT technology develops, new regulatory challenges and needs may arise.

Licensing of crypto companies in Australia

As part of the regulation of crypto asset activities in Australia, companies providing financial services are required to obtain a license from the Australian Financial Services License (AFSL) or qualify for an exemption from it. The legal status of crypto assets, which may be considered financial products, is determined based on ASIC Information Sheet 225 (INFO 225). According to ASIC, crypto assets with functional characteristics similar to existing financial products are subject to regulatory requirements concerning financial services.

ASIC further clarifies that the legal status of crypto assets depends on their structure and the associated rights, with the regulatory approach being applied broadly. Depending on their specifics, crypto assets may be classified as interests in managed investment schemes, securities, derivatives, or other financial products, each of which is regulated in accordance with AFSL requirements.

ASIC Information Sheet 225 provides comprehensive regulatory guidance for all participants in the crypto asset market. This includes issuers, intermediaries, miners, transaction handlers, exchange and trading platform operators, and crypto asset payment and trading service providers. Additionally, organizations providing crypto asset storage or wallet services must consider existing licensing requirements and compliance with financial conduct regulations.

Companies involved in crypto asset operations, considered as financial products, must adhere to the legislative requirements of the Corporations Act, which include disclosure obligations, registration, and licensing. Crypto asset exchange operators may also be required to obtain an Australian market license if they deal with assets classified as financial products. These measures are aimed at enhancing transparency and the security of financial transactions, increasing investor protection, and ensuring the stability of the financial market.

The Australian Treasury is actively involved in consultations regarding the proposed licensing regime for crypto asset service providers, highlighting the government’s commitment to creating a transparent and adaptive regulatory environment in this rapidly developing field. Additional information on this topic can be found in the “Government’s Attitude and Definition” section.

Moreover, the Australian Law Reform Commission (ALRC) conducted an extensive investigation aimed at simplifying and optimizing the country’s financial services regulatory framework. This investigation included an analysis of the use of definitions in the Corporations and Financial Services laws, as well as considering opportunities for restructuring and improving the laws. Based on the ALRC’s three interim reports, a final consolidated report titled “Fighting Complexity: Reforming Corporations and Financial Services Legislation” (ALRC Report 141) was published on January 18, 2025. This document contains 58 recommendations aimed at improving the legislative framework.

Although specific proposals concerning crypto assets were not the central theme in the final ALRC report, crypto asset regulation is recognized as an important public policy initiative. This highlights the recognition of the need to integrate this class of assets into improved legislation, reflecting a readiness to adapt to new economic realities and ensure effective regulation for the protection of market participants.

Cryptocurrency Taxation in Australia 2025

Cryptocurrency taxation in Australia continues to be a topic of debate, despite the efforts of the Australian Taxation Office (ATO) to clarify the application of tax laws to this type of asset. The ATO classifies cryptocurrency as an asset, a subject of retention or trade, rather than as money or foreign currency, according to recent amendments to the tax legislation.

The tax consequences for cryptocurrency holders depend on the purposes for which it is acquired or held. For taxpayers who are Australian tax residents, the following provisions may apply:

| Criterion | Details |

|---|---|

| Trading activity | If the taxpayer is engaged in a business related to the sale or exchange of cryptocurrency as part of their ordinary operations, such cryptocurrency is considered a trading asset. All income from the sale or exchange is subject to taxation, and losses may be accounted for in accordance with existing tax rules, including rules for “non-commercial losses.” |

| Determining business activity | Whether the taxpayer’s activity qualifies as a business is determined based on the actual nature of the activity. Key criteria include the intention to make a profit, the regularity and systematic nature of the activity, the presence of ongoing efforts, and the maintenance of business records. |

| Isolated transactions | Even if cryptocurrency was not acquired as part of regular commercial activity, income from occasional transactions intended for profit and included in a commercial operation or deal may also be subject to taxation. |

These clarifications from the ATO aim to create clearer and more predictable conditions for cryptocurrency market participants, which should help ensure compliance with tax laws and reduce disputes in this area.

In Australia, cryptocurrency that is not acquired or held for business purposes or for isolated profit-making transactions is considered an asset subject to capital gains tax (CGT). If such an asset is held by the taxpayer for more than 12 months, a CGT discount may apply upon its disposal, reducing the taxable base. However, if cryptocurrency is used as a personal-use asset and acquired for an amount less than 10,000 Australian dollars, the capital gain from its sale may not be taxable. This rule also applies to losses: losses from the sale of cryptocurrency classified as a personal-use asset are not considered for tax reporting purposes.

It should be noted that the cryptocurrency taxation policy in Australia may undergo changes in response to the development of cryptocurrency technologies and usage practices. For example, on March 21, 2022, the Australian government initiated a technical review of the taxation framework for digital assets by the Tax Board. Following consultations and analysis, the Tax Board presented its report on February 23, 2025, which included recommendations for the tax regime for digital assets and transactions.

These developments show that the government is actively seeking ways to adapt existing tax frameworks to new economic conditions brought about by the widespread adoption of digital assets. This underscores the importance of closely monitoring legislative and regulatory changes for individuals who hold or operate cryptocurrencies, to ensure compliance with tax requirements.

FREQUENTLY ASKED QUESTIONS

Is cryptocurrency legal in Australia?

Yes, cryptocurrency is legal in Australia. Bitcoin and other cryptocurrencies are officially recognized as property and have the status of legal tender, although their acceptance as a payment method remains at the discretion of individual merchants and companies. Cryptocurrencies can also be used for personal and business transactions, with users free to trade, spend, receive, and store these assets.

In 2017, cryptocurrencies and cryptocurrency exchanges were fully legalized in Australia, confirming their status as legitimate financial assets. Since then, the Australian government has continued to support the development of blockchain technology and related innovations across various sectors, including payment systems, crypto assets, lending, investing, and custodial services.

However, in 2018, legislative changes were introduced due to the growing need to combat money laundering and the financing of terrorism. In accordance with this, the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 was expanded to include digital currencies within the scope of AML (anti-money laundering) and CTF (counter-terrorism financing) measures. This required cryptocurrency exchanges and service providers to register with the Australian Transaction Reports and Analysis Centre (AUSTRAC) and comply with relevant tracking and reporting procedures, helping to ensure the transparency of transactions and prevent illegal activity.

Thus, cryptocurrencies are fully legal in Australia, but they are subject to certain levels of regulation to ensure their safe and transparent use.

Are there any AML rules in Australia regarding cryptocurrencies?

Yes, Australia has specific AML (anti-money laundering) and CTF (counter-terrorism financing) regulations for cryptocurrencies. These rules were introduced under the Anti-Money Laundering and Counter-Terrorism Financing Amendment Act 2017, which came into effect on April 3, 2018. Since then, digital currency exchanges in Australia are required to register with the Australian Transaction Reports and Analysis Centre (AUSTRAC), maintain customer records, implement AML/CTF compliance programs, and report suspicious and significant financial transactions.

AUSTRAC has also issued guidelines for digital currency exchanges to help them develop and implement effective anti-money laundering and counter-terrorism financing programs. These programs must include customer identification and verification, transaction monitoring, record-keeping, and staff training.

A key point is that the initial AML/CTF rules in Australia were limited to fiat-to-cryptocurrency exchanges and vice versa. However, starting from July 2021, the Department of Home Affairs and AUSTRAC recognized the need to expand these rules in accordance with the FATF 2019 standards, which require regulation of a broader range of cryptocurrency-related activities. This includes exchanges between different forms of cryptocurrency, cryptocurrency transfers on behalf of customers, safe custody and administration services for cryptocurrencies, as well as involvement in financial services related to cryptocurrency issuance (e.g., Initial Coin Offerings or ICOs).

Thus, the AML/CTF regulations in Australia aim to create a safe and transparent environment for the use and exchange of cryptocurrencies, including protection against illegal activities and ensuring compliance with the law.

Who regulates cryptocurrency in Australia?

In Australia, cryptocurrency regulation is overseen by several regulatory bodies, depending on the aspect of cryptocurrency-related activities. Here are some of the key agencies and their roles in this area:

- Australian Transaction Reports and Analysis Centre (AUSTRAC) – AUSTRAC plays a key role in regulating cryptocurrency exchanges in Australia, overseeing compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. All cryptocurrency exchange operators must register with AUSTRAC and adhere to strict customer identification and reporting requirements.

- Australian Securities and Investments Commission (ASIC) – ASIC regulates corporate, market, and financial services, ensuring compliance with securities and investment laws. This includes the regulation of cryptocurrency-related products and services, such as Initial Coin Offerings (ICOs) and crypto-asset products offered to retail investors.

- Australian Taxation Office (ATO) – The ATO regulates the tax aspects of cryptocurrency, including the taxation of cryptocurrency transactions. The ATO classifies cryptocurrencies as property for taxation purposes and establishes reporting and taxation rules for crypto-asset transactions.