MetaTrader4

The MetaTrader 4 platform, also known as MT4, is a popular electronic trading platform for retail foreign exchange speculators. MetaQuotes Software developed it in 2005, and it was released in 2006. Licensees provide the software to their clients through foreign exchange brokers. In addition to the client component, the software has a server component as well. Servers are operated by brokers, while client software is used by brokers’ customers to view live streaming prices, charts, place orders, and manage their accounts.

Users can use the client to create their own trading scripts and robots that automate trading. It is a Microsoft Windows-based application. A successor, MetaTrader 5, was released by MetaQuotes in 2010. It was slow to take off and most brokers continued to use MT4 as of April 2013. Although MetaTrader 4 does not have an official Mac OS version, some brokers offer custom versions.

Besides supporting Android, iOS, and Windows mobile, Metatrader is also available for mobile devices.

Here are a few historical highlights

MetaQuotes Software, the company that developed MetaTrader, had released numerous versions starting in 2002. The most recent version of MetaTrader was released in 2005 and was significantly enhanced.

In the period between 2007 and 2010, brokers began offering MT4 as an alternative to their existing trading software as MT4 popularity increased among traders and third-party scripts and advisors improved.

The first MT5 live account was launched by InstaForex in September 2010 after a significantly re-coded MetaTrader 5 was released into public beta testing in October 2009. MQL4 was completely rewritten in 2013 and 2014, ultimately reaching MQL5. A unified MetaEditor is being used for MQL4 and MQL5 with the 600 build.

The most popular Forex trading platform in the world in September 2019 was MetaTrader 4, despite MT5’s introduction in 2009.

MetaTrader 4 and MetaTrader 5 platforms (App Store and Android Play Store) were reported to be removed from Apple’s App Store on September 24, 2022. While the company’s representative claimed that the removal was based on non-compliance with the App Store Review Guidelines, it was actually related to Western sanctions targeting Russia, where MetaQuotes is based.

Following the company’s changes to both the MT4 and MT5 iOS apps, both of them were once more available on the App Store on March 6, 2023.

Characteristics

There is no doubt that MetaTrader 4 offers a comprehensive trading platform. Online trading is possible with all the necessary instruments.

You can trade online depending on your broker:

- Stocks (such as Apple, Google, and Microsoft).

- Indexes (such as the S&P 500).

- There are various currency pairs available, such as EUR/USD, GBP/USD, USD/JPY, and others.

- There are several commodities (Gold, Silver, Oil, to name a few).

- You can download free historical data with MetaTrader 4, as well as see current prices. Charts can be opened in different time frames to gain a better understanding of the trend, and indicators can be added to perform technical analysis.

MetaTrader 4 provides trading signals that can be subscribed to for automatic trading of what other traders are doing.

Among the most powerful features of MetaTrader 4 is the ability to customize it as desired. By using the MQL language, you can write scripts to carry out specific actions, create custom indicators if the existing ones don’t meet your needs, build expert advisors to automate tasks or even trade automatically without your supervision. This can be done using MetaEditor.

Components

There are several components included in the complete MetaTrader 4 package:

- It is the client part of MetaTrader 4 that you are using. Free demo accounts are provided by brokerages for real-time online trading and practice trading. Providing real-time technical analysis, charts, and trade operations. Users can program trading strategies, indicators, and signals using the internal C-like programming language. Each indicator can be customized further, with 50 basic indicators included. There are versions of the software for Windows 98/2000/XP/Vista/7. There are some reports of success using Wine for the client terminal on Linux and WineBottler for the client terminal on Mac.

- Trading accounts can be controlled via mobile devices such as mobile phones and PDAs using MetaTrader 4 Mobile. The application runs on Windows Pocket PC 2002/Mobile 2003, iOS, and Android devices.

- In MetaTrader 4 Server, the server part is at the core of the system. Provides users with the ability to perform trade operations, display warrants, and execute them. Record and maintain archival records, send price quotes and news broadcasts. The service is offered as a subscription. There is no separate interface for this product.

- Server settings can be managed remotely using MetaTrader 4 Administrator.

- Account management and trade inquiries can be handled with MetaTrader 4 Manager.

- An intermediary between MetaTrader 4 and the client terminal is MetaTrader 4 Data Center. The main server is not overloaded with price quote sending.

Disadvantages

In terms of bells and whistles, MetaTrader 4 has almost all that most other trading platforms have to offer. The system does have some drawbacks, however. In general, MT4 doesn’t execute trades as fast as some other platforms, which is a central complaint. In cases where you cannot afford to waste time and need high-frequency trading, you may need to look elsewhere.

Despite the comprehensive interface, it’s not always easy to figure out how to use all the features. The lack of live customer support further aggravates this problem. You should work with a brokerage that charges minimal fees, even though the platform is free.

What makes MetaTrader 4 different from other trading platforms

MetaTrader 4 provides a lot of features compared to its competitors. In fact, most industry standards are provided by it.Furthermore, its coding language allows for automatic trades. The advantages of MetaTrader 4 surpass those of Robinhood, for instance.

The price of MetaTrader 4 cannot be compared with other platforms, however. Downloading and installing it are free, but you need a brokerage account to use it for real. The fees you will pay will also vary depending on the firm you choose.

Metatrader 5

MetaQuotes released MetaTrader 5 five years after the launch of MetaTrader 4 in 2005. Forex trading on MT4 was designed to be an all-in-one platform. A number of new features were added to MT5 along with the introduction of more instruments.

Why is MetaTrader 5 different from MetaTrader 4?

Aspects of asset trading

MT4 is a powerful platform for FX traders of all skill levels, providing access to multiple currencies and CFDs from the same place. There are still some limitations with MT5, but it is also suitable for non-Forex traders. There are over 500 markets available on MT5, covering a larger area than MT4.

Analyses of technical aspects

Technical analysis can be done with both MT4 and MT5. However, MT5 has increased the number of built-in technical indicators from 30 to 38. Analytical objects have also been increased – 44 as opposed to 31 in MT4. The economic calendar incorporated in MT5 is another useful addition. Major country data releases and financial market news are provided to traders through this service.

Dates and times

The MT4 platform has 9 timeframes (M1, M5, M15, M30, H1, H4, D1, W1, and MN). Additionally to the ones in MT4, MT5 includes the following: M2, M3, M4, M6, M10, M12, M20, H2, H3, H6, H8, and H12.

Objects with graphics

With MT4 and MT5, you can choose from 31 and 44 graphics objects, respectively. As the chart grew, more tools were needed to mark patterns, areas, and levels.

Languages for programming

MetaQuotes Language 4 (MQL4) is used by MT4 and MetaQuotes Language 5 (MQL5) is used by MT5. MQL4 cannot run on MQ5, which can be a problem for traders upgrading from MT4 to MT5. MQL4 is considered a simpler language by many traders. MQL5 has superior backtesting capabilities and is more efficient at modifying scripts and creating them.

CFD TRADING

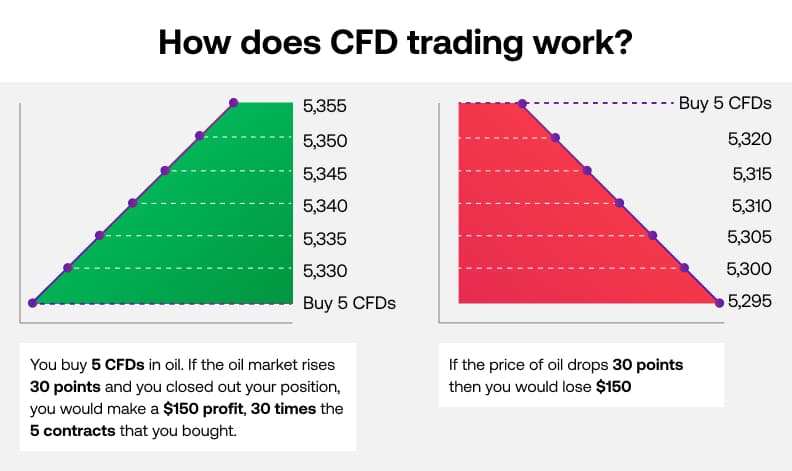

When a buyer and a seller have a contract for differences (CFD), the buyer must pay the seller the difference between the current value and the asset’s value at the time of the contract.

Without owning the underlying assets, CFDs allow investors and traders to profit from price movements. It does not consider the underlying value of the asset when calculating the value of a CFD; it only considers the price change between entry and exit.

There is no stock exchange, forex, commodity, or futures exchange involved in this process. Clients and brokers enter into a contract directly between them. Over the past decade, CFD trading has gained enormous popularity due to several major advantages.

Highlights

- An investor and a CFD broker enter into an agreement to exchange the difference between the open and close value of a financial product.

- The investor in a CFD does not actually own the underlying asset, but instead receives revenue when the asset’s price changes.

- CFDs have a number of advantages, including the ability to go long or short on the underlying asset at a lower cost than buying it outright.

- When an investor enters a CFD, their initial position is immediately reduced by the spread, which reduces their initial position.

- The industry is also subject to weak regulation, a shortage of liquidity, and the need to maintain a margin sufficient to protect against losses.

How it works

Financial markets are simulated by CFD contracts. With these contracts, you can go long as well as short, leveraged, and hedged, just like you would with the underlying market.

You select how many contracts to buy or sell instead of how much of a particular asset you want to invest in – like 100 HSBC shares.

In the event that the market moves in your favor, you will profit from your position. In the event that it moves against you, it will incur a loss. The profit or loss you made when you closed the position is realized when you sold the contracts you bought at the beginning. The size of your position and the movement of the market determine your return from a trade, just like traditional investing. The difference between the price of 100 HSBC CFDs when bought at 400p and the price when sold at 450p is (100 x 50p) £50. The loss you would incur if you sold them for 350p instead would be £50.

Trading tips

You’ll need to follow a few steps, but we’ve outlined them for you to make it easier. You can trade CFDs online by following these steps.

Creating a trading account is the first step

Choosing a CFD broker is the first step. It could be a live account where you deposit money and move it around the financial markets, or it could be a demo account where you practice your skills with virtual currencies and learn the software.

CFD Trading Platforms can be downloaded here

In order to trade CFDs online, you must first choose the best CFD trading platform. Brokers must also take this into consideration when choosing their services.

The CFD trading platform you use does not have to be designed specifically for trading CFDs. Trading CFDs is possible through your broker’s platform if they offer them.

Trading with Admirals involves MetaTrader 4 and MetaTrader 5, two of the most popular platforms in the trading world.Native Trading is also offered, which has been designed specifically to be user-friendly for beginners.

You’re ready to make your first trade!

Making your first trade on a live or demo account is one of the most exciting steps in learning how to trade CFDs. The steps are as follows:

- Log in to the Admirals Dashboard after opening an account with Trade.MT4 or Trade.MT5

- You can open Native Trading by clicking ‘Trade’ after finding your account details

Advantages

CFDs are now better understood, but why are traders using them? Trading CFDs has the advantage of being easily accessible to beginners, unlike many other types of trading. Nevertheless, people trade CFDs for a variety of reasons.

Before turning our attention to the risks associated with CFD trading, we will highlight some of the most important benefits of CFD trading.

Leverage for CFDs

Leverage is a major benefit of CFDs, which allows you to take on larger positions with smaller deposits.

Your broker, your location, and the instrument you are trading will determine how much leverage you are able to use with CFDs. The Admirals CFD trading platform, for instance, offers leverage up to 1:30 for UK-based retail traders. How does this affect us?

Essentially, you can access a $30 position for every $1 you have in your account if you have a leverage ratio of 1:30. In other words, if you want to open a position worth $1,500 and you have leverage of 1:30, you would have to deposit $50 to open the position.

The same potential profits and losses can be accessed with a relatively small deposit as with a larger position size. While CFD leverage can increase profits as well as losses, it needs to be used carefully.

Short-term and long-term trading

Traditional investing has the disadvantage of usually making money only when the markets are rising. With CFDs, however, you can trade long and short, allowing you to take advantage of rising and falling prices simultaneously.

Markets that are widely tradable

Due to their derivative nature, CFDs can represent a wide variety of markets. With a single CFD trading platform, traders can access thousands of financial markets (like Admirals).

These are just some of the markets where CFDs can be traded:

- Foreign exchange

- Market capitalization

- The commodity market

- ETFs (exchange-traded funds)

Opening and closing times

A CFD also reflects the trading hours of the underlying asset, along with its price. Regardless of the time of day, there is always something to trade during the week.

The following are some popular CFD trading hours:

- Daily, weekly, 24 hour access to forex CFDs

- Five days a week, 24 hours a day, index CFDs

- 24/7 commodity CFDs: 5 days a week, 24 hours a day

- CFDs on shares are available during the trading hours of the relevant stock exchange

Trading CFDs with risk management

Traders should manage their risk carefully when trading CFDs since they are leveraged. Stop losses and take profits are two key tools for controlling risk on each trade.

The take profit order, also known as the limit order, automatically closes your position when you reach a certain profit level. By doing so, they assist you in sticking to your plan when winning positions may entice you to hold onto them, despite the risk of a reversal.

Stop losses also close positions automatically when they reach a specified loss level. Your total risk is reduced when you use them. If your market ‘gaps’ over your stop loss, standard stop losses are not 100 percent effective.

You should upgrade to a guaranteed stop if you want to ensure your position closes when you reach your stop level.

PAMM Account

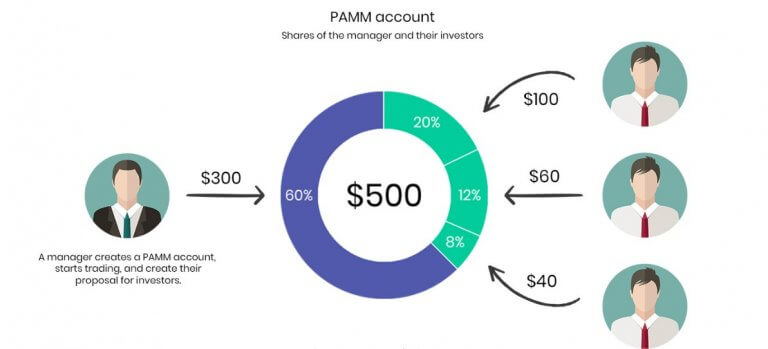

Occasionally referred to as percent allocation money management, the percent allocation management module, is a software application used primarily by foreign exchange brokers (forex) that allows clients to assign money to a specific trader managing their account on the basis of a limited power of attorney.

An unlimited number of managed accounts can be managed simultaneously by the trader on one trading platform through a PAMM solution. Every managed account in PAMM has a different ratio based on its deposit size. The results of a trader’s activity (profits and losses) are allocated among managed accounts based on the ratio.

Currency trading and other forms of arbitrage are typically profitable within very narrow margins, allowing more money to be put into play with the risk being spread among several investors.

What is the procedure

Investment accounts that provide access to a professional money manager or trader without requiring investors to actively manage their investments.

By signing up with a forex broker, the investor opens a PAMM account

A PAMM account can be opened through an online forex broker, so the first step for an investor is to open an account.

Funds are deposited by the investor

PAMM trading accounts are opened by investors who deposit funds into them. PAMM accounts are accessible to a wider range of investors with low minimum deposits, which vary by broker.

Choosing an account manager or trader is the investor’s responsibility

When the investor deposits his or her funds, they can choose a trader or a team of traders to manage their assets. A manager appointed to manage investments is known as an account manager.

It is important for the investor to carefully consider the performance history, investment strategy, fees, and other factors when selecting an Investment Manager for a PAMM account.

Investors’ investment objectives and risk tolerance should align with a trader’s track record and investment approach.

Traders manage investments

Investors entrust the trader to manage their investments once he or she has been appointed as the Investment Manager.The same PAMM Manager can be appointed by several investors. In addition to managing several PAMM accounts at once, the investment manager can also manage a variety of investment strategies at the same time.

A forex market investment involves pooling funds from several investors in order to generate profits.

Performance fees are charged by the Investment Manager who manages the investment. As a percentage of the investment’s potential return, this amount is typically calculated.

There is a distribution of profits and losses

PAMM accounts are divided proportionately among investors according to their investments.

A performance fee is paid to the trader as the Investment Manager. Additionally, the trader’s share of profits is proportionately increased.

It is the same distribution of losses among investors if the investments generate losses. Losses do not trigger performance fees.

Depending on the overall trading strategy, profits or losses are distributed at the end of the trading round, which can last for days, weeks, or even months.

A new round of forex trades is then initiated by the Investment Manager. PAMM works in this way.

Advantages

By pooling funds into a PAMM Account, the account manager can trade with a larger volume and thus potentially earn a higher return. A PAMM Account’s rating reflects the manager’s positive trading results, which in turn acts as an advertisement for the account. Investors deposit funds into the manager’s account, and the manager’s positive trading outcomes contribute to the PAMM Account rating.

As the manager trades, profits are generated that attract additional investments, allowing the manager to trade more funds on behalf of investors.

Traders (or money managers) and investors are part of the PAMM Account structure. By investing in PAMM Accounts, investors without the time or skills to trade on their own can profit from trading without trading on their own.

A PAMM account, then, is a management account in which funds are entrusted to the manager. In addition to managing their own capital, the managers manage others’ money, which is a very experienced and professional process.

In the Manager’s Proposal, the agreement between the manager and investors is established. This agreement is the basis for investors’ consent to take on a risk by making their funds available to selected managers. It also specifies the fee that will be charged for the services that the service manager provides. Money or a percentage may be involved.

Opening an account is the first step in the process, and the initial investment is the manager’s capital: a non-withdrawable amount that secures the manager’s interest. This capital is not allowed to be removed since it assures prospective investors that the account will be managed responsibly. It is advertised that the account’s activity is being monitored and that certain conditions are being offered.

Profits are also indicated. Because they do not participate in any trading activities, brokers advertise the account in ratings on their websites without taking responsibility for any losses or profits.

The manager and investors split the profits at the end of each trading period. As well as distributing funds, the broker can act as a regulator in instances where managers misbehave.

The PAMM Account offers a lot of benefits to both investors and managers. In a manager’s proposal, you can set the percentage of the investor’s profit that you will receive if you are successful trading and acting as a manager. The managers determine the conditions, the extent of control over the trade terms, the trade period, and the method of distribution of profits. These are the conditions that must be met by investors.

There are also advantages for investors. In the first place, effective managers have a high level of trading professionalism.A PAMM Account can also be withdrawn at any time if the results and the trading style of the manager are unsatisfactory to investors.

Diversifying investments across a number of accounts can reduce risk for the investor.

Disadvantages

- Each PAMM account is subject to the conditions set by its manager. Besides limiting the amount and number of participants, he can also limit the amount available for input.

- A PAMM account requires additional software and a sophisticated risk management system. Brokers’ work is somewhat complicated by this, but investors and managers don’t care.

An overview

There is an increasing number of legitimate PAMM accounts in the online trading industry. Investing in a PAMM Forex account involves providing funds to an account manager or trader who then uses these funds to trade in the financial markets. Both parties receive a percentage of profits earned through the account.

Since the trader bonds their own capital with the client’s money, it provides considerable assurance to investors that their funds are safe.

This makes it unlikely that the trader would invest recklessly.

It is still important to choose a broker that is regulated by a reputable authority like CySec or FCA so that your funds are protected. Legitimate PAMM brokers are required to comply with standards and regulations set by these institutions.

Forex Brokers with PAMM Accounts in 2023

It can be challenging for newcomers to the market to choose which forex PAMM account to choose. We have compiled a list of the best forex brokers that offer this investment service at a low cost and with a high level of safety.

- AvaTrade – Overall Best Forex Broker for PAMM Accounts

- Pepperstone – One of the Best PAMM Brokers for Experienced Traders

- Capital.com – Popular Forex Broker Offering Automated Trading Through MT4

- OANDA – Best PAMM Account with Strict Regulation

- BDSwiss – Top Alternative to PAMM Accounts with 17,000 Partner Traders

- BlackBull Markets – Widely-Used FX Broker with ECN Account

- FxPro – Respected Forex Broker Offering MAM Account for Professionals

- FP Markets – Dedicated PAMM/MAM Accounts with ECN Trading

- RoboForex – Popular PAMM Account with Low Minimum Investment

Prop Firm

An individual trader, or retail trader, can obtain capital and resources from a retail prop firm, also called a retail proprietary trading firm. Retail prop firms offer proprietary trading capital and other support services to retail traders rather than the traditional commercial prop firms that cater to professional traders and institutional investors.

A retail prop firm typically allocates a portion of its capital to individual traders as part of its business model. Stock, options, futures, and foreign exchange markets are all traded on by these traders, who are also known as prop traders.

Retail prop firms have the following key features:

- The allocation of capital is an important part of the retail prop business, as it allows traders to execute trades and potentially profit from the financial markets by using trading capital from the firm. A large capital base can be traded by traders who have been allocated capital, which allows them to trade with a larger capital base than they had originally invested.

- Reduction of trading risk: Retail brokers often absorb a substantial amount of trading risk, protecting traders from substantial losses. As a result of this risk-sharing arrangement, traders are not overburdened with financial risk and can concentrate on their trading strategies.

- The retail property business offers traders a variety of support services and resources, such as trading platforms, market data, research tools, educational materials, and mentoring programs. In addition to enhancing traders’ skills and knowledge, these resources will also help them improve their overall performance in the trading market.

- Commission or profit-sharing structure: Retail prop firms often adopt commission or profit-sharing structures in exchange for capital and resources. Prop firms are compensated for providing capital and support by receiving a portion of the traders’ profits.

An institution that operates as a proprietary trader invests for direct market gains rather than earning commissions on behalf of clients.

A financial institution engages in prop trading if it chooses instead to profit from market activity instead of thin-margin commissions generated from client trading activity. There are many types of proprietary trading, including stocks, bonds, commodities, currencies, and other instruments.

The use of proprietary trading by financial firms or commercial banks is expected to enable them to earn a greater return than index investing, bond yield appreciation, and other investments.

Highlights

- Rather than using client funds, financial institutions conduct proprietary trading with their own capital.

- In addition to trading index arbitrage, global macro trading, statistical arbitrage, merger arbitrage, fundamental analysis, volatility arbitrage, and technical analysis, proprietary traders can also execute a variety of market strategies.

- To obscure activities that promote corporate self-interest, large financial institutions intentionally obscure details on proprietary vs. non proprietary trading operations

How does it work

- The work of a prop firm can be summarized in a variety of ways. An overview of the process is given below:

- Prop firms provide an evaluation program to traders who want to receive funds from them. The industry standard is 30 or 60 days. Traders are required to trade on a simulator account during this period in accordance with regulations and risk management guidelines.

- Trading for prop companies requires traders to meet certain requirements, such as hitting profit targets, limiting drawdowns, and following risk management guidelines.

- Traders who succeed in the evaluation process will be given a funded account by the prop firm. Depending on the program chosen, traders can retain a portion of their profits on their account, and their account size will vary.

- Regulating traders: Prop firms impose strict trading regulations and risk management standards on traders that receive their funds. As a result of these regulations, both the company and the trader are protected from risk.

- Prop firms assess a one-time fee for the evaluation program depending on the size of the account the trader seeks.The platform, data feeds, and other services are further paid for by a monthly subscription fee.

How to get started

Comparing platforms is a good idea, so do your research

To find the prop trading firm that best suits your needs, you should do your homework and compare different firms before even considering joining one. Several factors should be taken into consideration, including trading platforms, minimum capital requirements, fees, and customer service.

Consult a firm for a free consultation

Getting a more detailed look at a prop trading firm’s products and services is important before you sign up. It will allow you to get to know the team behind the platform and confirm that it is a good fit for your needs.

Ask a prop company the following questions during your initial meeting:

- Are they able to provide you with what you need?

- Can you tell me about the training or mentoring you provide?

- Can you access the newest technologies and analytics tools?

- Do they provide trading software?

You can make an informed decision about which prop trading firm to join by asking the right questions.

Mentorship and training are available

Traders who are new to trading can be greatly benefited by training from experienced traders. As a prop trader, you’ll be able to learn the ropes and gain valuable insight by taking advantage of the mentorship and training provided by a prop trading company.

Identify your area of expertise

Would you consider yourself a Forex trader? An expert in cryptography? Is trading commodities more appealing to you? Success as a prop trader depends on knowing your specialty. Over time, you will become more proficient at trading that asset class by specializing in it.

Your trading strategy should be planned

Developing a trading strategy before trading with a proprietary trading firm is essential. Among the things that need to be taken into account are risk management parameters, such as stop-losses and take-profits, as well as entry and exit strategies. Optimizing your trades and maximizing profitability over time is easier when you plan ahead.

In addition to staying disciplined when things don’t go your way, planning your trading strategies in advance can help you avoid emotional trading phenomena like trading FOMO as well.

Let’s get started!

The hardest part of trading is getting started once you’ve signed up with a prop trading firm and received the necessary training. Don’t rush things and keep taking small steps. Your profit will steadily increase while your risk is minimized as a result.

Aspects to consider

Prop trading has the advantage of generating huge profits. Unlike brokers who earn commissions and other types of rewards, proprietary traders earn 100% of the firm’s income. The investment opportunities available to proprietary traders are also expanded.

Businesses can benefit from these features

The maximum amount of revenue is made available to banks and financial institutions. To make profits even higher, they may not even recruit traders.

Proprietary trading also offers the flexibility of using assets in different ways. As a result, banks can start buying securities for speculative purposes and later sell them to their customers, stockpiling securities for future sale. In order to facilitate the short sale of assets, assets can be provided as loans.

The result is that companies have the potential to become major market forces, especially when dealing with specific assets or assets that are highly specialized. Some of those securities can be liquidated by the company using its capacity.

The pros of trading

A proprietary trader has access to advanced technology and expanded capital compared to other traders. Through it, thousands of trades can be executed simultaneously using any strategy, including automated approaches.

Prop traders can make high-frequency trading more efficient by utilizing sophisticated trading platforms across a variety of financial markets. Strategies developed by proprietary traders can be tested, run, and improved with all the tools necessary.

Interactions with conflicting interests

A bank’s interests may conflict with those of its customers in a variety of ways due to proprietary trading.

Due to the importance of investment banks in mergers and acquisitions, traders have the potential to use inside information for merger arbitrage (though it is prohibited). Chinese walls are required between trading and investment banking divisions at investment banks; however, they have come under scrutiny recently, particularly in light of the Enron scandal. In 2007, the Australian Securities & Investments Commission brought charges against Citigroup alleging a conflict of interest.

Potential front running can also cause conflicts of interest, which can result in significantly higher trading costs for buy-side clients. The practice of front running per se is illegal, but brokers who operate proprietary trading desks may gain an advantage over their clients under certain circumstances.

Aspects of risk

The risk of trading with a prop firm is generally much higher than that of trading with a traditional broker. The reason is that prop firms aren’t typically protected by the same regulations as traditional brokers. Prop firms often require their traders to deposit significant amounts as collateral, which can be lost if they fail.

Finally, many prop firms require their traders to sign away their right to sue if they are unhappy with how their accounts are handled. Traders with prop firms are exposed to more risk than traders with traditional brokers due to all of these factors.

Understanding the risks associated with prop firms is essential if you plan to trade with them. Ensure you know what will be expected of you as a client, and never hesitate to ask questions if you don’t understand something.

If you are looking to start Forex trading or expand your Forex trading activities and obtain a Forex license, our team at Regulated United Europe will be happy to assist you in registering a Forex company and applying for a Forex license. We can also confidently guide you through the process of finding a viable forex license to sell and purchasing a turnkey solution in no time.

RUE customer support team

“Hi, if you are looking to start your project, or you still have some concerns, you can definitely reach out to me for comprehensive assistance. Contact me and let’s start your business venture.”

“Hello, I’m Sheyla, ready to help with your business ventures in Europe and beyond. Whether in international markets or exploring opportunities abroad, I offer guidance and support. Feel free to contact me!”

“Hello, my name is Diana and I specialise in assisting clients in many questions. Contact me and I will be able to provide you efficient support in your request.”

“Hello, my name is Polina. I will be happy to provide you with the necessary information to launch your project in the chosen jurisdiction – contact me for more information!”

CONTACT US

At the moment, the main services of our company are legal and compliance solutions for FinTech projects. Our offices are located in Vilnius, Prague, and Warsaw. The legal team can assist with legal analysis, project structuring, and legal regulation.

Registration number: 304377400

Anno: 30.08.2016

Phone: +370 661 75988

Email: [email protected]

Address: Lvovo g. 25 – 702, 7th floor, Vilnius,

09320, Lithuania

Registration number: 38421992700000

Anno: 28.08.2019

Phone: +48 50 633 5087

Email: [email protected]

Address: Twarda 18, 15th floor, Warsaw, 00-824, Poland

Registration number: 14153440–

Anno: 16.11.2016

Phone: +372 56 966 260

Email: [email protected]

Address: Laeva 2, Tallinn, 10111, Estonia

Registration number: 08620563

Anno: 21.10.2019

Phone: +420 775 524 175

Email: [email protected]

Address: Na Perštýně 342/1, Staré Město, 110 00 Prague